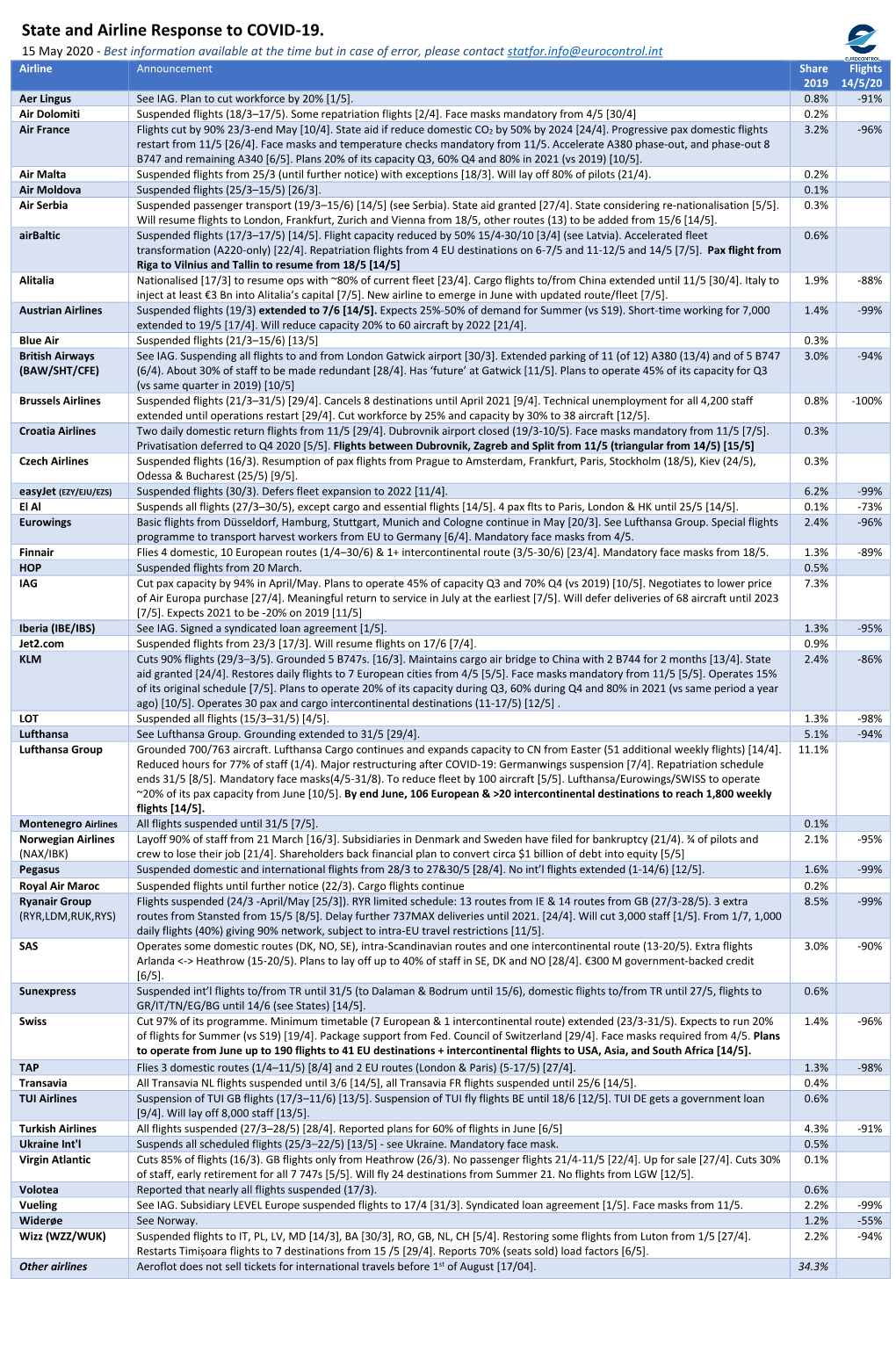

State and Airline Response to COVID-19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Mediterranean | Montenegro

THE MEDITERRANEAN | MONTENEGRO BASE ADDRESS Šuranj b.b. Kotor 85330 GPS POSITION: 42° 25.3931' / 18° 46.1982' E OPENING HOURS: 8am – 10pm BASE MAP BASE CONTACTS If you need support while on your charter, contact the base immediately using the contact details in this guide. Please contact your booking agent for all requests prior to your charter. BASE MANAGER & CUSTOMER SERVICE: Name: Goran Grbovic Phone: +382 67440999 Email: [email protected] / [email protected] BASE FACILITIES ☒ Electricity ☐ Luggage storage ☒ Water ☐ Restaurant ☐ Toilets ☒ Bar ☐ Showers ☒ Supermarket / Grocery store ☒ Laundry ☒ ATM ☐ Swimming pool ☒ Post Office ☐ Wi-Fi BASE INFORMATION LICENSE Sailing license required: ☒ Yes ☐ No PAYMENT The base can accept: ☒ Visa ☒ MasterCard ☐ Amex ☒ Cash EMBARKATION TIME Embarkation is on Saturday. YACHT BRIEFING All briefings are conducted on the chartered yacht and will take 40-60 minutes, depending on yacht size and crew experience. The team will give a detailed walk-through of your yacht’s technical equipment, information about safe and accurate navigation, including the yacht’s navigational instruments, as well as mooring, anchorage and itinerary help. The safety briefing introduces the safety equipment and your yacht’s general inventory. STOP OVERS For all DYC charters starting and/or ending in Kotor, a stopover on the last day of the charter is free of charge at the marina. DISEMBARKATION TIME Disembarkation is by Saturday 9am at the latest. All boats have to return to base on Friday and spend the last night in the marina. To assist in making checkout as smooth as possible, we ask that you arrive back at the base the evening before disembarkation. -

Montenegro Your New Favorite Destination

Montenegro your new favorite destination Join us in seeing magnificent Montenegro and all of its charming ways: Immerse in the turquoise waters of the Boka Bay, stunning views wherever one turns and the history yet to be discovered. Feel the marks of the mighty Roman Empire, a laid back culture as a clear mark of the Venetians and very tangible architectural marks of Austro-Hungarian Empire. Feel the beet that Ottoman culture and witness the rise of small yet modern, vibrant and dynamic Montenegro which is the mighty unity of all the culture explained before. Enjoy the soothing greenery of the Montenegrin mountains, depth of the deepest Canyon of Europe or even one of the handful virgin rainforests in Europe. The rest of stunning facts in terms of nature, cuisine, culture and are up to you do discover without compromising the luxury brought to you renowned Regent Hotels & Resorts. Montenegro lifestyle Regent Porto Montenegro team is proud to bring you closer to Montenegro, a country with a deceiving history, sensational beauty and secretive self. Enjoy the must visit sights whilst staying with us. Boka Bay Book a private tour for exploring an amazing Boka Bay! A long winding inlet 27 kilometers long, Boka Bay is one of the most beautiful bays in the world, protected by high mountains and flourishing with Mediterranean vegetation. Do not miss on visiting UNESCO protected Perast and Kotor which captivate with the uprecendant beauty and charm. Discover Boka either with Frauscher boats or with elegant 41 m wooden boat. Historic tours Feel the beat of the historic navy battles Do not miss on the Roman mosaics in Risan or numerous historic sites from the Venetian or even Ottoman empire. -

Network Operations Plan

Network Operations Plan COVID – Business continuity plans Edition: 1.14 Edition date: 20-04-2020 Classification: Green Reference nr: EUROCONTROL Network Management Directorate DOCUMENT CONTROL Document Title Network Operations Plan Document Subtitle COVID – Business continuity plans Document Reference Edition Number 1.14 Edition Validity Date 20-04-2020 Classification Green Status Proposed Issue Author(s) Razvan Bucuriou (NMD/ACD) Contact Person(s) Razvan Bucuroiu (NMD/ACD) Edition Number: 1.14 Edition Validity Date: 20-04-2020 Classification: Green Page: i Page Validity Date: 20-04-2020 EUROCONTROL Network Management Directorate EDITION HISTORY Edition No. Validity Date Reason Sections Affected 1.0 23/03/2020 All 1.1 25/03/2020 Updates to ACC and airport plans 3 and 4 1.2 26/03/2020 Updates to ACC and airport plans 3 and 4 1.3 27/03/2020 Updates to ACC and airport plans 3 and 4 1.4 30/03/2020 Updates to ACC and airport plans 3 and 4 1.5 31/03/2020 Updates to ACC and airport plans 3 and 4 1.6 01/04/2020 Updates to ACC and airport plans 3 and 4 1.7 03/04/2020 Updates to ACC and airport plans 3 and 4 1.8 06/04/2020 Updates to ACC and airport plans 3 and 4 1.9 07/04/2020 Updates to ACC and airport plans 3 and 4 1.10 08/04/2020 Updates to airport plans 4 1.11 10/04/2020 Updates to ACC and airport plans 3 and 4 1.12 14/04/2020 Updates to ACC and airport plans 3 and 4 1.13 16/04/2020 Updates to ACC and airport plans 3 and 4 1.14 20/04/2020 Updates to airport plans 4 Edition Number: 1.14 Edition Validity Date: 20-04-2020 Classification: Green Page: ii Page Validity Date: 20-04-2020 EUROCONTROL Network Management Directorate TABLE OF CONTENT DOCUMENT CONTROL ..................................................................................................I EDITION HISTORY.........................................................................................................II CHECKLIST ................................................................................................................ -

Prof. Dr.Sc. Vesna PUSIĆ Prva Potpredsjednica Vlade RH I Ministrica Vanjskih I Europskih Poslova Trg N.Š

EUROPEAN COMMISSION Brussels, 11.02.2014 C(2014) 940 final PUBLIC VERSION This document is made available for information purposes only. Subject: State aid No SA.38168 (2014/N), ex. SA.37108 (PN/2013) – Croatia Dubrovnik Airport Development Madam, 1 PROCEDURE (1) By electronic notification dated 14 January 2014, the Croatian authorities notified to the European Commission a measure concerning the renovation and development of the Dubrovnik Airport. The measure was registered under the state aid case number SA.38168. (2) By letter dated 15 January 2014 and registered with the Commission services on 17 January 2014, the Croatian authorities provided a language waiver whereby the adoption of this decision in the English language is accepted. 2 DESCRIPTION OF THE MEASURE 2.1 Dubrovnik Airport (3) Dubrovnik Airport is situated 25 kilometres from the city of Dubrovnik, in Dubrovnik & Neretva County. The airport mainly serves the South side of the Republic of Croatia (i. e. 5 towns, 17 municipalities and 230 settlements comprising around 130.000 inhabitants). It is the only Croatian airport in the South part of the country with international connections. Prof. dr.sc. Vesna PUSIĆ Prva potpredsjednica Vlade RH i ministrica vanjskih i europskih poslova Trg N.Š. Zrinskog 7-8, 10000 Zagreb REPUBLIKA HRVATSKA Commission européenne, B-1049 Bruxelles – Belgique Europese Commissie, B-1049 Brussel – België Telefon: 00-32 (0) 2 299 11.11. (4) Dubrovnik Airport is owned and operated by Dubrovnik Airport Ltd, a limited liability company fully owned by the Croatian State1. (5) Over the last decade, traffic at Dubrovnik airport has been rising to around 1.5 million passengers in 2013, with average annual growth rates at 1.4% for domestic passengers and 1.9% for foreign passengers. -

Peter Wiener Steer CV

Peter Wiener Associate I am a Business Consultant with over 30 years’ commercial experience across the Qualifications aviation, rail and telecommunications sectors. I started my career at British Kingston University Master in Business Administration Airways, where I spent 11 years in a number of roles including Operational (MBA) Research, Pricing and Cargo. Following nearly five years in mobile 1992 Lancaster University telecommunications, I returned to my transport roots, this time as a consultant, MSc Operational Research where I have developed a portfolio of work in the rail industry to complement my 1985 continuing involvement in aviation. I undertake projects ranging from broad Oxford University BA Physics and Philosophy strategic studies, to detailed technical analyses across the aviation and rail 1984 industries, including both policy and transaction studies. Previous experience Professional membership includes the following: Association for Project Management APMP • Jacobs Consultancy 2001-2006 Associate Director Languages • Sonera Zed 2000-2001 Director Of Commercial Solutions French Good German Intermediate • CO Global Communications 1997-2000 Manager Revenue Management Spanish Basic • British Airways 1985-1996 English Native o Network Optimisation Manager, BA World Cargo Years of Experience o Pricing Development Manager 16 Client side o Senior Operational Research Analyst 15 Consultancy Relevant skills Aviation consultancy: Peter’s experience includes the development and review of traffic projections, aeronautical revenues and operating costs, on behalf of developers, lenders or vendors for a number of major airport transactions including: London Stansted, London Gatwick, Brazil (Sao Paulo, Brasilia, Rio de Janeiro, Belo Horizonte), Sendai (Japan), Hochtief AirPort assets including Athens, St. Petersburg, Dakar, Rome, Brussels, Budapest, Delhi/Mumbai, Madagascar, Montenegro, Nairobi, Bugesera (Rwanda) and Milan, as well as developing traffic forecasts for the Berlin airport system, Manchester and Birmingham Airports. -

In Montenegro Invest

ISBN 978-9940-662-04-2 COBISS.CG-ID 26095376 EDITION 2015 INVEST IN MONTENEGRO What Should You Know About Montenegro? Jovana Tomasevica 2A 81000 Podgorica Montenegro Phone/Fax: (+382 20) 203 140 203 141 202 910 202 911 www.mipa.co.me [email protected] Frequently Asked Questions What Should You Know About Montenegro? INVEST IN MONTENEGRO 2015 111 Frequently Asked Questions This publication is product of The Montenegrin Investment Promotion Agency (MIPA) INVEST IN MONTENEGRO 2015 Dear Reader The aim of this publication is to provide you simple and straightforward answers to the most frequently asked questions about Montenegro. We expect, of course, that you will have many more questions. Montenegrin Investment Promotion Agency (MIPA) is at your disposal for additional questions, arising from the reading of this publication. We hope it will contribute to your better understanding of the overall situation in Montenegro, and help you in establishing your business. We believe it is important to get your attention to several general facts about Montenegro: . Geographically strategic position of Montenegro in Europe . Montenegro is in process of negotiation for joining the European Union (EU) . Montenegro is first on the list of candidates for the full membership into NATO; . We treat foreigners and domestic ones equally with regard to investments; . For majority of the countries visas are not required; . The euro is official currency since 2001 . One of the most competitive corporate tax regimes in Europe There are many more factors which can have a positive effect in the starting stage of your business. These positive factors are described, along with this publication, in our other two publications, named ‘Country Report’ and ’11 Reasons to invest in Montenegro’. -

Analysis of the Multimodal Mobility System in the Dubrovnik Airport

LAirA Landside Airport Accessibility Report no.2: Analysis of Multimodal Mobility in FUA Towards Dubrovnik Airport January 2018 Zračna luka Dubrovnik d.o.o., Dobrota 24, Močići, CLIENT 20213 Čilipi, Croatia Mobilita Evolva d.o.o. – Froudeova 5, 10 020 Zagreb, Croatia CONSULTANT DOCUMENT Report no. 2 - FINAL TYPE STUDY Una Vidović, mag. ing. arch. DIRECTOR Una Vidović, mag. ing. arch. EXPERT TEAM Expert Team Leader – LEADER architect Božo Cicvarić, mag. ing. traff. Expert Team Member - traffic engineer Klara Mahmić, mag. geogr. Expert Team Member - Masters degree in geography (GIS expert) PARTICIPATED Tomislav Vešligaj, mag. ing. traff. IN STUDY Expert Team Member - DEVELOPMENT traffic engineer Alen Tursunović, mag. ing. traff. Expert Team Member - traffic engineer Viktor Jozić, mag. ing. traff. Expert Team Member - traffic engineer DIRECTOR Una Vidović, PhD. Architect. TABLE OF CONTENTS 1. INTRODUCTION .............................................................................................................. 1 2. DUBROVNIK – NERETVA COUNTY (FUA) ................................................................ 2 2.1. SIZE ............................................................................................................................. 2 2.2. POPULATION ............................................................................................................ 3 2.3. KONAVLE MUNICIPALITY .................................................................................... 5 3. DUBROVNIK AIRPORT ................................................................................................. -

Impacts of Arsenal Brownfield Regeneration on Urban Development of Tivat in Montenegro

sustainability Article Impacts of Arsenal Brownfield Regeneration on Urban Development of Tivat in Montenegro: From Industrial Settlement to Center of Nautical Tourism Ema Alihodži´cJašarovi´c,Svetlana Perovi´c* and Sanja Paunovi´cŽari´c Faculty of Architecture, University of Montenegro, 81000 Podgorica, Montenegro; [email protected] (E.A.J.); [email protected] (S.P.Ž.) * Correspondence: [email protected]; Tel.: +382-69-385190 Abstract: This study investigated the main aspects and consequences of urban regeneration in the context of sustainable development, using the example of the town of Tivat, whose radical urban transformation was initiated in the post-referendum transition period after 2006, when decision-making policies created a new environment for development. The focus of the research was the impact of the Arsenal brownfield regeneration on the urban development of Tivat in Montenegro, following its decades-long transformations from industrial settlements (military shipyard) to the “new town” of Porto Montenegro (the center of nautical tourism), which is 10 km away from the UNESCO World Heritage site in Kotor, which had a strong influence on the development of Tivat. The theoretical and empirical research was focused on three aspects of sustainability. This study identifies key parameters that indicate the specific causes and consequences of the urban transformations, as well as impacts of nautical tourism on the development of a particular tourist destination with accompanying sustainability factors. The urban regeneration of Tivat, as an example of an urban laboratory in the Mediterranean, Citation: Alihodži´cJašarovi´c,E.; can be used for comparative measurements of the success of the brownfield process of regeneration of Perovi´c,S.; Paunovi´cŽari´c,S. -

IZVJEŠTAJ O RADU AGENCIJE ZA CIVILNO VAZDUHOPLOVSTVO Za 2013

IZVJEŠTAJ O RADU AGENCIJE ZA CIVILNO VAZDUHOPLOVSTVO za 2013. godinu I UVOD Pravni osnov za izradu Izvještaja o radu Agencije za civilno vazduhoplovstvo za 2013. godinu sadržan je u Zakonu o vazdušnom saobraćaju („Službeni list CG“, br. 30/12), koji je stupio na snagu 16. juna 2012. godine. Odredbom ĉlana 13 stav 2 navedenog zakona propisano je da Agencija priprema godišnji izvještaj o radu i godišnji finansijski izvještaj za prethodnu godinu, koje usvaja Vlada Crne Gore, na predlog Savjeta Agencije. U skladu sa stavom 8 istog ĉlana Zakona o vazdušnom saobraćaju, navedene izvještaje, sa izvještajem nezavisnog ovlašćenog revizora, Agencija dostavlja Vladi Crne Gore do 30. juna tekuće za prethodnu godinu. II PRAVNI POLOŢAJ I ORGANI AGENCIJE Ĉlanom 5 Zakona o vazdušnom saobraćaju regulisan je pravni položaj Agencije za civilno vazduhoplovstvo Crne Gore, kojim je propisano da je Agencija nezavisno pravno lice koje vrši javna ovlašćenja u skladu sa zakonom, da je osniva Vlada Crne Gore, da je samostalna u obavljanju poslova iz svoje nadležnosti i da za svoj rad odgovara Vladi. Organi Agencije su Savjet Agencije i direktor Agencije. III NADLEŢNOST I UNUTRAŠNJA ORGANIZACIJA AGENCIJE a) Nadleţnost Odredbama Zakona o vazdušnom saobraćaju ureĊeni su uslovi za obavljanje vazdušnog saobraćaja u vazdušnom prostoru Crne Gore, uslovi za sigurnost i bezbjednost vazdušnog saobraćaja, upravljanje vazdušnim saobraćajem i druga pitanja od znaĉaja za vazdušni saobraćaj. Istovremeno odredbama ovog zakona propisani su pravni položaj, nadležnost i poslovanje -

List of Airports

IATA ICAO NAME OF THE AIRPORT COUNTRY 1 TIA LATI Tirana International Airport Albania 2 GRZ LOWG Graz Airport Austria 3 INN LOWI Innsbruck Airport Austria 4 LNZ LOWL Blue Danube Airport Linz Austria 5 VIE LOWW Vienna Airport Austria 6 BRU EBBR Brussels Airport Belgium 7 LGG EBLG Liege Airport Belgium 8 ANR EBAW Anvers Airport Belgium 9 CRL EBCI Charleroi Airport Belgium 10 OST EBOS Ostend/Brugge International Airport Belgium 11 BNX LQBK Banja Luka International Airport Bosnia & Herzegowina 12 OMO LQMO Mostar International Airport Bosnia & Herzegowina 13 BOJ LBBG Burgas International Airport Bulgaria 14 SOF LBSF Sofia International Airport Bulgaria 15 VAR LBWN Varna Airport Bulgaria 16 ZAG LDZA Zagreb Airport Croatia 17 DBV LDDU Dubrovnik Airport Croatia 18 PUY LDPL Pula Airport Croatia 19 SPU LDSP Split Airport Croatia 20 ZAD LDZD Zadar Airport Croatia 21 PFO LCPH Paphos Airport Cyprus 22 LCA LCLK Larnaca Airport Cyprus 23 PRG LKPR Praha Airport Czech Republic 24 OSR LKMT Mosnov/Ostrava Airport Czech Republic 25 CPH EKCH Copenhagen Airport Denmark 26 BLL EKBI Billund Airport Denmark 27 TLL EETN Tallinn Airport Estonia 28 LPP EFLP Lappeenranta Airport Finland 29 JOE EFJO Joensuu Airport Finland 30 KEM EFKE Kemi/Tornio Airport Finland 31 HEM EFHF Helsinki Malmi Airport Finland 32 TMP EFTP Tampere Airport Finland 33 KAJ EFKI Kajaani Airport Finland 34 OUL EFOU Oulu Airport Finland 35 SVL EFSA Sanvolinna Airport Finland 36 TKU EFTU Turku Airport Finland 37 HEL EFHK Helsinki Vantaa Airport Finland 38 MHQ EFMA Mariehamn Airport Finland 39 CDG -

Catalog May Vary According to Requirements and Conditions, and Are Subject to Change Without Notice

SUPERIOR SOLUTIONS FOR SAVINGS ALL THROUGH THE LIFE CYCLE Welcome to Tips, one of the world’s leading manufacturers of premium ground support equipment. For half a century Tips’ products are prized for their engineering excellence, low maintenance costs, operational safety, and durability. The most important reason for all these is the fact that all our products are made in co-operation with users, and are therefore based on our clients’ needs and individualities. Just like no two people are identical, neither are ground support equipment users. Products are considered superior when they serve their users’ needs with maximum efficiency and minimum trouble. We think of our customers as partners whose needs help us design and finish our products to the highest industry standards. Our partners enjoy real-time online support for quick trouble-shooting and repairs as well as specialist training for operation and maintenance. Premium products are expected to outlast the competition, and this requires extra care for timely introduction of the most advanced technolo- gies. In ground support equipment of today it means gradual transition from diesel to electric power, and introduction of advanced electronic and digital instruments for more precise and safer operating. Passengers do not expect airlines to compromise on safety. A tiny little thing may decide between life or death. With GSE it may not be quite that dramatic, but opting for superior quality saves our partners a lot of money over many years. And in the ever more environmentally conscious -

A Model for Air Transport Market Competition Assessment: Airline and Alliance Perspective

UNIVERSITY OF BELGRADE FACULTY OF TRANSPORT AND TRAFFIC ENGINEERING Jovana G. Kuljanin A MODEL FOR AIR TRANSPORT MARKET COMPETITION ASSESSMENT: AIRLINE AND ALLIANCE PERSPECTIVE Doctoral Dissertation Belgrade, 2019 UNIVERZITET U BEOGRADU SAOBRAĆAJNI FAKULTET Jovana G. Kuljanin MODEL ZA OCENU KONKURENCIJE NA TRŽIŠTU VAZDUŠNOG SAOBRAĆAJA: AVIOKOMPANIJE I ALIJANSE Doktorska disertacija Beograd, 2019 Adviser: D. Sc. Milica Kalić, Full professor, University of Belgrade – Faculty of Transport and Traffic Engineering Committee: D. Sc. Boris Begović, Full professor, University of Belgrade – Faculty of Law (Chairman) D. Sc. Michele Ottomanelli, Full professor, Polytechnic University of Bari, Italy D. Sc. Radosav Jovanović, Associate professor, University of Belgrade – Faculty of Transport and Traffic Engineering D. Sc. Manuel Renold, Associate professor, Zurich University of Applied Sciences, Switzerland Mentor: Dr Milica Kalić, redovni profesor, Univerzitet u Beogradu – Saobraćajni fakultet Članovi komisije: Dr Boris Begović, redovni profesor, Univerzitet u Beogradu – Pravni fakultet (predsednik komisije) Dr Michele Ottomanelli, redovni profesor, Politehnički univerzitet u Bariju, Italija Dr Radosav Jovanović, vanredni profesor, Univerzitet u Beogradu – Saobraćajni fakultet Dr Manuel Renold, vanredni profesor, Univerzitet primenjenih nauka u Cirihu, Švajcarska The thesis was supported by the Ministry of Education, Science and Technological Development, Republic of Serbia, through the Project TR36033 (2011-2019), A Support to Sustainable Development