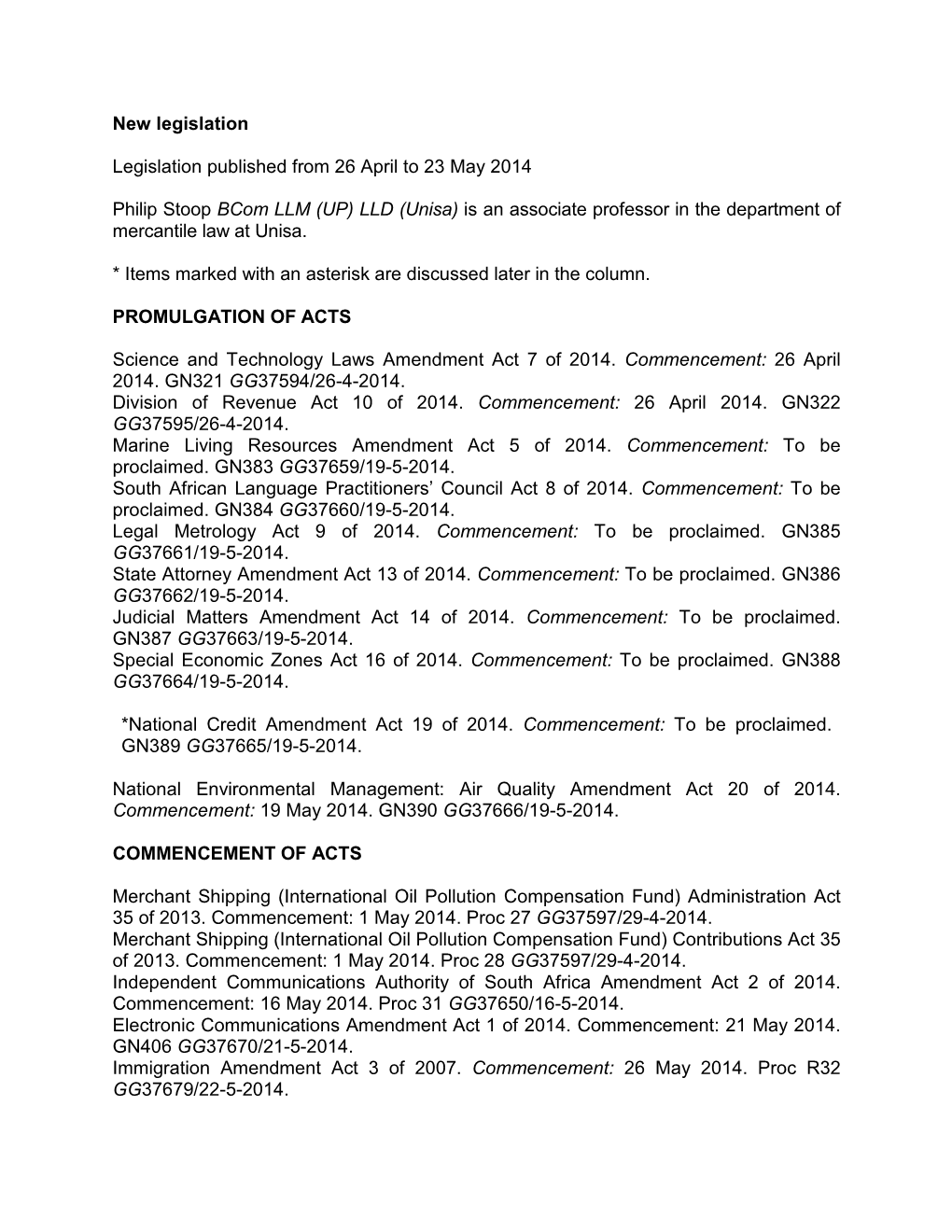

New Legislation Legislation Published from 26 April to 23 May

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Survey of Race Relations in South Africa: 1968

A survey of race relations in South Africa: 1968 http://www.aluka.org/action/showMetadata?doi=10.5555/AL.SFF.DOCUMENT.BOO19690000.042.000 Use of the Aluka digital library is subject to Aluka’s Terms and Conditions, available at http://www.aluka.org/page/about/termsConditions.jsp. By using Aluka, you agree that you have read and will abide by the Terms and Conditions. Among other things, the Terms and Conditions provide that the content in the Aluka digital library is only for personal, non-commercial use by authorized users of Aluka in connection with research, scholarship, and education. The content in the Aluka digital library is subject to copyright, with the exception of certain governmental works and very old materials that may be in the public domain under applicable law. Permission must be sought from Aluka and/or the applicable copyright holder in connection with any duplication or distribution of these materials where required by applicable law. Aluka is a not-for-profit initiative dedicated to creating and preserving a digital archive of materials about and from the developing world. For more information about Aluka, please see http://www.aluka.org A survey of race relations in South Africa: 1968 Author/Creator Horrell, Muriel Publisher South African Institute of Race Relations, Johannesburg Date 1969-01 Resource type Reports Language English Subject Coverage (spatial) South Africa, South Africa, South Africa, South Africa, South Africa, Namibia Coverage (temporal) 1968 Source EG Malherbe Library Description A survey of race -

Flower Route Map 2014 LR

K o n k i e p en w R31 Lö Narubis Vredeshoop Gawachub R360 Grünau Karasburg Rosh Pinah R360 Ariamsvlei R32 e N14 ng Ora N10 Upington N10 IAi-IAis/Richtersveld Transfrontier Park Augrabies N14 e g Keimoes Kuboes n a Oranjemund r Flower Hotlines O H a ib R359 Holgat Kakamas Alexander Bay Nababeep N14 Nature Reserve R358 Groblershoop N8 N8 Or a For up-to-date information on where to see the Vioolsdrif nge H R27 VIEWING TIPS best owers, please call: Eksteenfontein a r t e b e e Namakwa +27 (0)79 294 7260 N7 i s Pella t Lekkersing t Brak u West Coast +27 (0)72 938 8186 o N10 Pofadder S R383 R383 Aggeneys Flower Hour i R382 Kenhardt To view the owers at their best, choose the hottest Steinkopf R363 Port Nolloth N14 Marydale time of the day, which is from 11h00 to 15h00. It’s the s in extended ower power hour. Respect the ower Tu McDougall’s Bay paradise: Walk with care and don’t trample plants R358 unnecessarily. Please don’t pick any buds, bulbs or N10 specimens, nor disturb any sensitive dune areas. Concordia R361 R355 Nababeep Okiep DISTANCE TABLE Prieska Goegap Nature Reserve Sun Run fels Molyneux Buf R355 Springbok R27 The owers always face the sun. Try and drive towards Nature Reserve Grootmis R355 the sun to enjoy nature’s dazzling display. When viewing Kleinzee Naries i R357 i owers on foot, stand with the sun behind your back. R361 Copperton Certain owers don’t open when it’s overcast. -

National Road N12 Section 6: Victoria West to Britstown

STAATSKOERANT, 15 OKTOBER 2010 NO.33630 3 GOVERNMENT NOTICE DEPARTMENT OF TRANSPORT No. 904 15 October 2010 THE SOUTH AFRICAN NATIONAL ROADS AGENCY LIMITED Registration No: 98109584106 DECLARATION AMENDMENT OF NATIONAL ROAD N12 SECTION 6 AMENDMENT OF DECLARATION No. 631 OF 2005 By virtue of section 40(1)(b) of the South African National Roads Agency Limited and the National Roads Act, 1998 (Act NO.7 of 1998), I hereby amend Declaration No. 631 of 2005, by substituting the descriptive section of the route from Victoria West up to Britstown, with the subjoined sheets 1 to 27 of Plan No. P727/08. (National Road N12 Section 6: Victoria West - Britstown) VI ~/ o8 ~I ~ ~ ... ... CD +' +' f->< >< >< lli.S..E..I VICTORIA WEST / Ul ~ '-l Ul ;Ii; o o -// m y 250 »JJ z _-i ERF 2614 U1 iii,..:.. "- \D o lL. C\J a Q:: lL. _<n lLJ ~ Q:: OJ olLJ lL. m ~ Q:: Q) lLJ JJ N12/5 lL. ~ fj- Q:: ~ I\J a DECLARATION VICTORIA lLJ ... ... .... PLAN No. P745/09 +' a REM 550 +' :£ >< y -/7 0 >< WEST >< 25 Vel von stel die podreserwe voor von 'n gedeelte Z Die Suid Afrikoonse Nosionole Podogentskop 8eperk Die figuur getoon Sheet 1 of 27 a represents the rood reserve of 0 portion ~:~:~:~: ~ :~: ~:~:~:~:~:~ The figure shown w The South African Notional Roods Agency Limited ........... von Nosionole Roete Seksie 6 Plan w :.:-:-:-:.:.:-:.:-:-:.: N12 OJ of Notional Route Section P727108 w a D.O.9.A • U1 01 o II') g 01' ICTORIA0' z " o o (i: WEST \V II> ..... REM ERF 9~5 II') w ... -

General Agreement On

RESTRICTED ON L/1852 GENERALGENERALAGREEMENTAGREEMENT ON 15 October 1962 TARIFFS AND TRADE Limited Distribution CONTRACTING PARTIES 23 October-16 November 1962 REPORT OF THE COMMITTEE ON BALANCE-OF-PAYMENTS RESTRICTIONS ON THE CONSULTATION UNDER ARTICLE XII:4(b) WITH THE REPULBLIC OF SOUTH AFRICA 1. The Committee has conducted the 1962 consultation with the Republic of South Africa under the provisions of paragraph 4(b) of Article XII. The Committee had before it (a) a basic document prepared by the South African authorities (BOP/12)1 and (b) documents provided by the International Monetary Fund, as noted in paragraph 2 below. In conducting the consultation the Committee followed the Plan for such consultations recommended by the CONTRACTING PARTIES (BISD, 7/S/97-98). The consultation was completed on 1 October 1962. The present report summarizes the main points of discussion during the consultation. Consultation with the International Monetary Fund 2. Pursuant to the provisions of Article XV of the General Agreement, the CONTRACTING PARTIES had invited the International Monetary Fund to consult with them in connexion with this consultation with South Africa. In accordance with the agreed procedure the representative of the Fund was invited to make a state- ment supplementing the Fund s documentation concerning the position of South Africa. The statement made was as follows: "The International Monetary Fund has transmitted to the CONTRACTING PARTIES the Executive Board decision relating to the last consultation with the Republic of South Africa under Article XIV of the Fund Agreement and the background material prepared in connection with that consultation. The background material was prepared before the announcement at the end of August last of further measures of relaxation (see Annex A, paragraph 21). -

C . __ P Ar T 1 0 F 2 ...".)

March Vol. 669 12 2021 No. 44262 Maart C..... __ P_AR_T_1_0_F_2_...".) 2 No. 44262 GOVERNMENT GAZETTE, 12 MARCH 2021 Contents Page No. Transport, Department of / Vervoer, Departement van Cross Border Road Transport Agency: Applications for Permits Menlyn ............................................................................................................................... 3 Applications Concerning Operating Licences Goodwood ......................................................................................................................... 7 Goodwood ......................................................................................................................... 23 Goodwood ......................................................................................................................... 76 Johannesburg – GPGTSHW968 ....................................................................................... 119 STAATSKOERANT, 12 Maart 2021 No. 44262 3 CROSS-BORDER ROAD TRANSPORT AGENCY APPLICATIONS FOR PERMITS Particulars in respect of applications for permits as submitted to the Cross-Border Road Transport Agency, indicating, firstly, the reference number, and then- (i) the name of the applicant and the name of the applicant's representative, if applicable. (ii) the country of departure, destination and, where applicable, transit. (iii) the applicant's postal address or, in the case of a representative applying on behalf of the applicant, the representative's postal address. (iv) the number and type of vehicles, -

District Management Area Is Located Along the South-Eastern Boundary of the Western Cape Province and Covers an Area of Approximately 4 170.35 Km²

!!""##$$%%""&&$$''''(())**))++,,((,,**$$''''))%%,,))'''' 2005/2006 DRAFT REVISED INTEGRATED DEVELOPMENT PLAN JULY 2005 EDEN DMA (WCDMA24) DRAFT REVISED IDP 2005/2006 EDEN DISTRICT MUNICIPALITY PO BOX 12, GEORGE, 6530 TEL: (044) 803 1300 FAX: (044) 874 6626 DRAFT REVISED IDP DMA (WCDMA04) 0 PREPARED BY OCTAGONAL DEVELOPMENT cc APRIL 2005 CONTENTS Page 1. INTRODUCTION 1.1 PURPOSE OF REPORT 1 1.2 BACKGROUND 1.2.1 Legal Framework 1 1.3 APPROACH AND METHODOLOGY 1.3.1 Approach 2 1.3.2 Methodology 4 1.3.3 Role-Player Participation 8 1.3.4 Geographical Context Of The Planning Area 8 2. CURRENT REALITIES 2.1 DEMOGRAPHY 9 2.2 INFRASTRUCTURE 15 2.3 LAND AND HUMAN SETTLEMENTS 20 2.4 EMPLOYMENT SECTORS 20 3. STRATEGIES 3.1 THE VISION 22 3.2 KEY COMPONENTS OF INTEGRATED DEVELOPMENT PLANS 23 3.3 DEVELOPMENT PRIORITIES 24 3.4 KEY PERFORMANCE AREAS 24 4. PROJECTS 4.1 ANALYSIS OF SPECIAL PROJECTS 32 4.2 GENERAL 33 5. INTEGRATION 6. APPROVAL DRAFT REVISED IDP DMA (WCDMA04) 1 PREPARED BY OCTAGONAL DEVELOPMENT cc APRIL 2005 1 INTRODUCTION 1.1 PURPOSE OF THE REPORT This Draft Revised IDP document for Eden DMA 2005/2006 should be read in collaboration with the IDP documents prepared for Eden DMA (WCDMA04), May 2004 and the Eden DM IDP May 2005. The Eden DMA (WCDMA04) accepts the responsibility that the National Constitution places on the functioning of local authorities. Eden DMA (WCDMA04) envisages achieving its set objectives with the limited financial and administrative resources available to: • Improve democracy and responsible governance for local communities • Rendering basic services on a sustainable basis to all of its communities • Improve social and economic development • Improve a safe and healthy environment • Motivate communities and community organizations to be involved in local government Eden DMA‘s approach in seeking long-term solutions to the improvement of the quality of life for all is to involve its communities, relevant structures and all necessary resources in realizing the objectives of the Integrated Development Planning process for Eden DMA. -

2019-20 Integrated Annual Report

INTEGRATED ANNUAL REPORT TWENTY TWENTY AUDITOR-GENERAL OF SOUTH AFRICA INTEGRATED ANNUAL REPORT 2020 THE 2020 REPORT THEME This integrated The public debate about the failure of accountability annual report is available mechanisms in the public sector led to the amended on the AGSA website Public Audit Act enhancing the auditor-general’s www.agsa.co.za powers to enable accountability. The powers allow us to take binding remedial action if material irregularities are not appropriately addressed and, where necessary, issue a certificate of debt to recover lost money from accounting officers or authorities. We accept our powers with the seriousness that they deserve and, in turn, we subject our use of these powers to full scrutiny, ensuring that we are held to 2 the same strict level of accountability as those Preamble to the Constitution we audit. ABOUT 3 THIS REPORT Letter to the Speaker As part of our legislated accountability, we provide Parliament with a detailed report of the Auditor- General South Africa’s annual activities. We also 4 align to the following best practices, standards and legislation: Performance snapshot • Public Audit Act 25 of 2004 (PAA) • Global Reporting Initiative (GRI) standards • International Integrated Reporting <IR> framework • King IV principles and codes • ISSAI 12 • Sustainable development goals This report is based on our annual activities measured against our commitments detailed in our 2019-22 strategic plan and budget. We welcome feedback on our integrated annual report to continue providing pertinent information in our reporting. Written feedback can be sent to [email protected] or reach out on twitter at @AuditorGen_SA 1 PREAMBLE TO THE CONSTITUTION We the people of South Africa, Recognise the injustices of our past; Honour those who suffered for justice and freedom in our land; Respect those who have worked to build and develop our country; and Believe that South Africa belongs to all who live in it, united in our diversity. -

Chapter 4: Prince Albert Spatial Development Framework

CHAPTER 4: PRINCE ALBERT SPATIAL DEVELOPMENT FRAMEWORK 4.1 SPATIAL DEVELOPMENT VISION STATEMENT The vision to guide the 2020 Prince Albert MSDF is to: “Develop Prince Albert as a place of resilience and environmental quality with a unique and distinctive sense of place - where people choose to live, work and visit, an exemplar in the achievement of sustainable growth” This vision links to the 2020 Central Karoo District MSDF vision, which is: “Working together in Sustainable Spatial Development and Growth towards a Resilient Central Karoo” The municipal wide spatial concept used to realise the above vision, is shown in Figure 4.1 across. There are 5 socio-ecological systems of resilience shown in the shape of a ‘Caracal Paw’. Resilience refers to the capability of individuals, social groups, or sub social-ecological systems, not only to live with changes, disturbances, adversities or disasters (such as drought) but to adapt, innovate and transform into new, more desirable configurations. The palm and heart of the Caracal Paw is Prince Albert Historic Town together with the Swartberg Mountain Range, Swartberg Circle (R328 and R407), various mountain passes, dams, Klaarstroom Historic Town and N12 national and provincial route because together they provide the highest social, economic and political offering, road accessibility, upstream water source and storage and ecological connectivity for the region. The first toe (Prince Albert Road) is ecologically connected via the Dwyka River and infrastructurally through the N1 & R407. This toe is connected to the second toe (Leeu Gamka Town and Kruidfontein) via the N1 national route, which in turn feeds Prince Albert through the R 407. -

Schematic Diagrams Dvd Video Player Xv-N30bk,Xv-N33sl

XV-N30BK,XV-N33SL SCHEMATIC DIAGRAMS DVD VIDEO PLAYER XV-N30BK,XV-N33SL CD-ROM No.SML200303 Area Suffix (XV-N30BK) Area Suffix (XV-N33SL) J -------------------------- U.S.A. J -------------------------- U.S.A. C --------------------- Canada C --------------------- Canada UJ ------------ U.S.A Militaly UJ ------------ U.S.A Militaly B -------------------------- U.K. B -------------------------- U.K. E ------ Continental Europe E ------ Continental Europe EN ------- Northern Europe EN ------- Northern Europe EV --------- Eastern Europe EV --------- Eastern Europe EE ---- Russian Federation EE ---- Russian Federation US ---------------- Singapore UG - Turkey,South Africa,Egypt UX ------------- Saudi Arabia UP ---------------------- Korea UF ---------------------- China UB --------------- Hong Kong A --------------------- Australia UW ----- Brazil,Mexico,Peru UY ----------------- Argentina STANDBY/ON DISPLAY For only Europe TITLE/ 3D PHONIC GROUP RETURN CANCEL 132 4 5 6 7 8 9 100 +10 ANGLE SUB TITLE AUDIO ZOOM TOP MENU MENU CHOICE ENTER SLOW VFP ON SCREEN PREVIOUS SELECT NEXT CLEAR This illustration is XV-N30BK for U.S.A. Contents Safety precaution ------------------------ 2-2 Block diagrams --------------------------- 2-3 Standard schematic diagrams -------- 2-8 Printed circuit boards -------------------- 2-22 No.A0039SCH COPYRIGHT 2003 VICTOR COMPANY OF JAPAN, LIMITED. 2003/03 XV-N30BK/XV-N33SL In regard with component parts appearing on the silk-screen printed side (parts side) of the PWB diagrams, the parts that are printed over with black such as the resistor ( ), diode ( ) and ICP ( ) or identified by the " " mark nearby are critical for safety. When replacing them, be sure to use the parts of the same type and rating as specified by the manufacturer. (Except the JC version) 2-2 Power supply & system controller section(SHEET1) &systemcontroller supply Power diagrams Block TO CN801 AC-DC SHEET 2 FL ON/OFF D951 Q951,Q952 F+ C950 CN901 F- -VDISP AC IN Line filter AC-DC L901 D901 AC-DC B3.3V D952 C951,C953 AC-DC Power D5V REG. -

Affordability and Subsidies in Urban Public Transport: Assessing the Impact of Public Transport Affordability on Subsidy Allocation in Cape Town

Affordability and Subsidies in Urban Public Transport: Assessing the impact of public transport affordability on subsidy allocation in Cape Town by Jaco Piek Thesis presented in partial fulfilment of the requirements for the degree of MCom (Transport Economics) in the Faculty of Economic and Management Sciences at Stellenbosch University Supervisor: Mr. JA Van Rensburg December 2017 The financial assistance of the National Research Foundation (NRF) towards this research is hereby acknowledged. Opinions expressed and conclusions arrived at, are those of the author and are not necessarily to be attributed to the NRF Stellenbosch University https://scholar.sun.ac.za Declaration By submitting this thesis/dissertation electronically, I declare that the entirety of the work contained therein is my own, original work, that I am the sole author thereof (save to the extent explicitly otherwise stated), that reproduction and publication thereof by Stellenbosch University will not infringe any third party rights and that I have not previously in its entirety or in part submitted it for obtaining any qualification. Date: December 2017 Copyright © 2017 Stellenbosch University All rights reserved i Stellenbosch University https://scholar.sun.ac.za ABSTRACT Cape Town is characterised by high commuting costs and high travel times due to a spatial mismatch between housing and jobs, as a result of apartheid planning policies. This dissertation investigated the use of an Intra-City Affordability Index to better understand this mismatch by analysing transport expenditure and potential travel patterns of public transport commuters in Cape Town. The results from the constructed affordability index analysed public transport affordability within this context. -

Fares & Schedule

FARES & SCHEDULE EFFECTIVE 01 JUNE 2021 gautrain.co.za | 0800 GAUTRAIN Welcome aboard the Gautrain! Thank you for choosing Gautrain, South Africa’s first, premier rapid rail transport system that has been built to exacting international transportation and safety regulations, so you may be assured of a speedy, safe, and comfortable journey with us. The Gautrain commenced operations in 2010 and to date we have over 120 million passengers entries at stations. With an average punctuality of 98.55%, the Gautrain is one of the most reliable passenger train services in the world – an achievement that we are exceptionally proud of. Travelling at a maximum speed of 160 kilometres per hour, it connects Hatfield station with Johannesburg Park station in approximately 42 minutes, and Sandton station with the OR Tambo International Airport in less than 15 minutes. Gautrain operates across Johannesburg, Tshwane and Ekurhuleni and connects to the OR Tambo International Airport. A fleet of Gautrain buses service over twenty bus routes that provide access to nine of our ten train stations (OR Tambo excluded). Parking and drop-off facilities are available at all stations, except for the OR Tambo station. In addition, a midi-bus service provides an additional shuttle service along select routes. We understand that in addition to your time, you value your safety and that is why we go to great lengths to safeguard both. We have over 860 Close Circuit Television (CCTV) surveillance cameras that are linked to a state-of-the-art security control room, manned by staff who are in constant communication with roaming on-site security personnel, ensuring your safety when using the Gautrain service. -

Flower Route Map 2017

K o n k i e p en w R31 Lö Narubis Vredeshoop Gawachub R360 Grünau Karasburg Rosh Pinah R360 Ariamsvlei R32 e N14 ng Ora N10 Upington N10 IAi-IAis/Richtersveld Transfrontier Park Augrabies N14 e g Keimoes Kuboes n a Oranjemund r Flower Hotlines O H a ib R359 Holgat Kakamas Alexander Bay Nababeep N14 Nature Reserve R358 Groblershoop N8 N8 Or a For up-to-date information on where to see the Vioolsdrif nge H R27 VIEWING TIPS best owers, please call: Eksteenfontein a r t e b e e Namakwa +27 (0)72 760 6019 N7 i s Pella t Lekkersing t Brak u Weskus +27 (0)63 724 6203 o N10 Pofadder S R383 R383 Aggeneys Flower Hour i R382 Kenhardt To view the owers at their best, choose the hottest Steinkopf R363 Port Nolloth N14 Marydale time of the day, which is from 11h00 to 15h00. It’s the s in extended ower power hour. Respect the ower Tu McDougall’s Bay paradise: Walk with care and don’t trample plants R358 unnecessarily. Please don’t pick any buds, bulbs or N10 specimens, nor disturb any sensitive dune areas. Concordia R361 R355 Nababeep Okiep DISTANCE TABLE Prieska Goegap Nature Reserve Sun Run fels Molyneux Buf R355 Springbok R27 The owers always face the sun. Try and drive towards Nature Reserve Grootmis R355 the sun to enjoy nature’s dazzling display. When viewing Kleinzee Naries i R357 i owers on foot, stand with the sun behind your back. R361 Copperton Certain owers don’t open when it’s overcast.