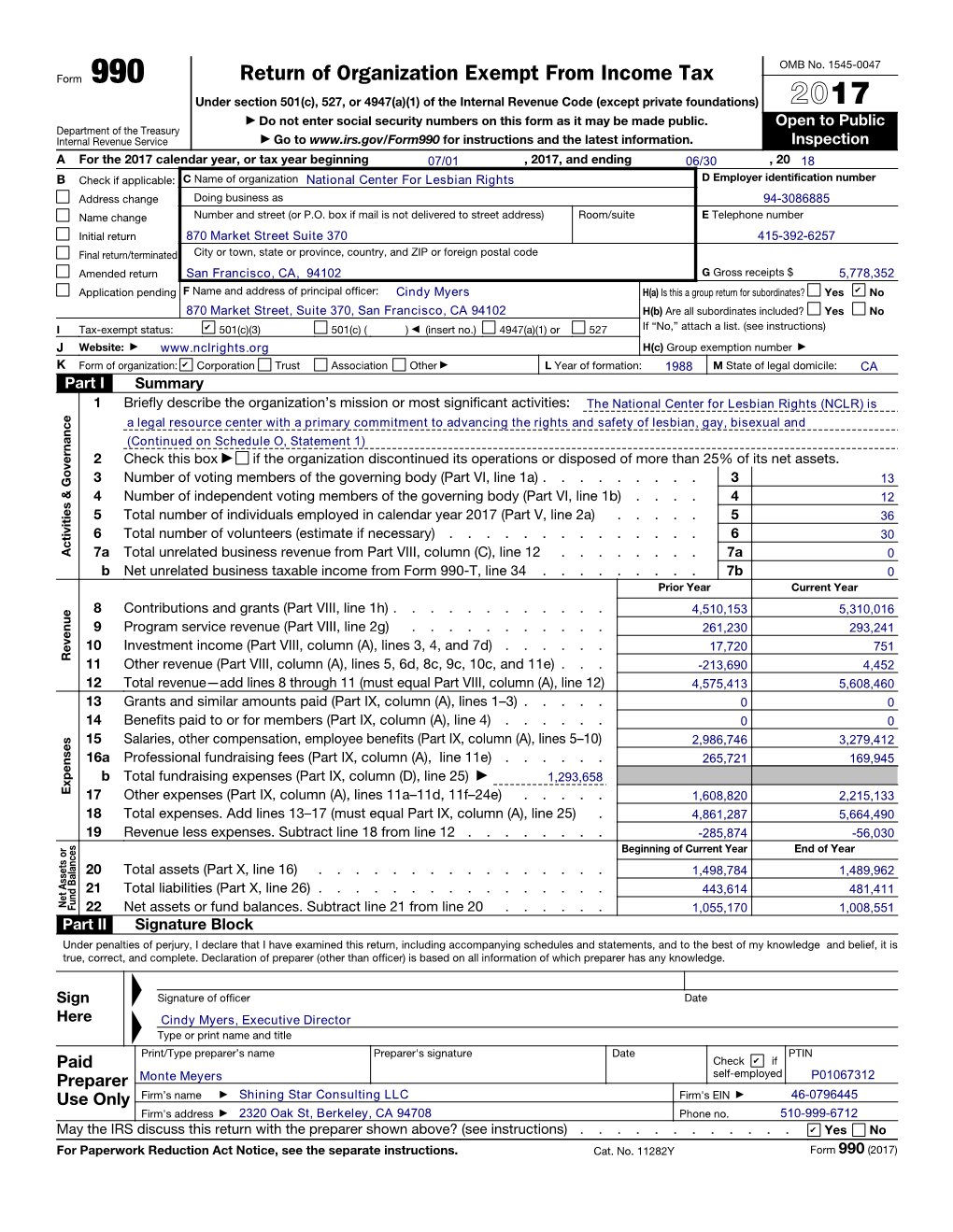

NCLR Form 990 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

8364 Licensed Charities As of 3/10/2020 MICS 24404 MICS 52720 T

8364 Licensed Charities as of 3/10/2020 MICS 24404 MICS 52720 T. Rowe Price Program for Charitable Giving, Inc. The David Sheldrick Wildlife Trust USA, Inc. 100 E. Pratt St 25283 Cabot Road, Ste. 101 Baltimore MD 21202 Laguna Hills CA 92653 Phone: (410)345-3457 Phone: (949)305-3785 Expiration Date: 10/31/2020 Expiration Date: 10/31/2020 MICS 52752 MICS 60851 1 For 2 Education Foundation 1 Michigan for the Global Majority 4337 E. Grand River, Ste. 198 1920 Scotten St. Howell MI 48843 Detroit MI 48209 Phone: (425)299-4484 Phone: (313)338-9397 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 46501 MICS 60769 1 Voice Can Help 10 Thousand Windows, Inc. 3290 Palm Aire Drive 348 N Canyons Pkwy Rochester Hills MI 48309 Livermore CA 94551 Phone: (248)703-3088 Phone: (571)263-2035 Expiration Date: 07/31/2021 Expiration Date: 03/31/2020 MICS 56240 MICS 10978 10/40 Connections, Inc. 100 Black Men of Greater Detroit, Inc 2120 Northgate Park Lane Suite 400 Attn: Donald Ferguson Chattanooga TN 37415 1432 Oakmont Ct. Phone: (423)468-4871 Lake Orion MI 48362 Expiration Date: 07/31/2020 Phone: (313)874-4811 Expiration Date: 07/31/2020 MICS 25388 MICS 43928 100 Club of Saginaw County 100 Women Strong, Inc. 5195 Hampton Place 2807 S. State Street Saginaw MI 48604 Saint Joseph MI 49085 Phone: (989)790-3900 Phone: (888)982-1400 Expiration Date: 07/31/2020 Expiration Date: 07/31/2020 MICS 58897 MICS 60079 1888 Message Study Committee, Inc. -

Organizations Endorsing the Equality Act

647 ORGANIZATIONS ENDORSING THE EQUALITY ACT National Organizations 9to5, National Association of Working Women Asian Americans Advancing Justice | AAJC A Better Balance Asian American Federation A. Philip Randolph Institute Asian Pacific American Labor Alliance (APALA) ACRIA Association of Flight Attendants – CWA ADAP Advocacy Association Association of Title IX Administrators - ATIXA Advocates for Youth Association of Welcoming and Affirming Baptists AFGE Athlete Ally AFL-CIO Auburn Seminary African American Ministers In Action Autistic Self Advocacy Network The AIDS Institute Avodah AIDS United BALM Ministries Alan and Leslie Chambers Foundation Bayard Rustin Liberation Initiative American Academy of HIV Medicine Bend the Arc Jewish Action American Academy of Pediatrics Black and Pink American Association for Access, EQuity and Diversity BPFNA ~ Bautistas por la PaZ American Association of Child and Adolescent Psychiatry Brethren Mennonite Council for LGBTQ Interests American Association of University Women (AAUW) Caring Across Generations American Atheists Catholics for Choice American Bar Association Center for American Progress American Civil Liberties Union Center for Black Equity American Conference of Cantors Center for Disability Rights American Counseling Association Center for Inclusivity American Federation of State, County, and Municipal Center for Inquiry Employees (AFSCME) Center for LGBTQ and Gender Studies American Federation of Teachers CenterLink: The Community of LGBT Centers American Heart Association Central Conference -

March 12, 2017 Dear President Emmert & NCAA Governance: On

March 12, 2017 Dear President Emmert & NCAA Governance: On behalf of the undersigned, the Human Rights Campaign and Athlete Ally strongly encourage the NCAA to reaffirm its commitment to operating championships and events that are safe, healthy, and free from discrimination; and are held in sites where the dignity of everyone involved -- from athletes and coaches, to students and workers -- is assured. The NCAA has already demonstrated its commitment to ensuring safe and inclusive events. In response to state legislatures passing laws targeting LGBTQ people, the NCAA required that bidders seeking to host tournaments or events demonstrate how they will ensure the safety of all participants and spectators, and protect them from discrimination. Based on the new guidelines, the NCAA relocated events scheduled to be held in North Carolina due to the state’s discriminatory HB2 law. We commend these previous actions. With the next round of site selections underway, we urge the NCAA to reaffirm these previous commitments to nondiscrimination and inclusion by avoiding venues that are inherently unwelcoming and unsafe for LGBTQ people. Such locations include: ● Venues in cities or states with laws that sanction discrimination against LGBTQ people in goods, services and/or public accommodations; ● Venues in cities and/or states that prevent transgender people from using the bathroom and/or locker room consistent with their gender identity;1 ● Venues at schools that request Title IX exemptions to discriminate against students based on their sexual orientation and/or gender identity; and ● Venues in states that preempt or override local nondiscrimination protections for LGBTQ people. The presence of even one of these factors would irreparably undermine the NCAA’s ability to ensure the health, safety and dignity of event participants. -

LGBTQ Organizations Unite in Calling for Transformational Change in Policing

LGBTQ Organizations Unite in Calling for Transformational Change in Policing Black people have been killed, Black people are dying at the hands of police, our country is in crisis, and we all need to take action. We cannot sit on the sidelines, we cannot acquiesce, and we cannot assign responsibility to others. We, as leaders in the LGBTQ movement, must rise up and call for structural change, for divestment of police resources and reinvestment in communities, and for long-term transformational change. Now is the time to take action, and this letter amplifies our strong calls for urgent and immediate action to be taken. Ongoing police brutality and systemic racism have plagued this nation for generations and have been captured on video and laid bare to the public in the United States and around the world. In 2019, more than 1,000 people were killed at the hands of the police.1 We mourn the unacceptable and untimely deaths of Michael Brown, Tamir Rice, Sandra Bland, Philando Castile, Eric Garner, Stephon Clark, Freddie Gray, George Floyd, Breonna Taylor, Mya Hall, Tony McDade, Rayshard Brooks, and many more who were gone too soon. We have seen with increased frequency the shocking video footage of police brutality. Officers have been recorded instigating violence, screaming obscenities, dragging individuals out of cars, using unnecessary force, holding individuals at gunpoint, and kneeling on peoples’ necks to the desperate plea of “I can’t breathe.” These occurrences are stark reminders of a police system that needs structural changes, deconstruction, and transformation. No one should fear for their lives when they are pulled over by the police. -

Employment Discrimination Based on Sexual Orientation and Gender Identity in Michigan

Employment Discrimination Based on Sexual Orientation and Gender Identity in Michigan Christy Mallory and Brad Sears February 2015 Executive Summary More than 4% of the American workforce identifies as lesbian, gay, bisexual, or transgender (LGBT). Approximately 184,000 of these workers live in Michigan. Michigan does not have a statewide law that prohibits discrimination based on sexual orientation or gender identity in both public and private sector employment. This report summarizes recent evidence of sexual orientation and gender identity employment discrimination, explains the limited current protections from sexual orientation and gender identity employment discrimination in Michigan, and estimates the administrative impact of passing a law prohibiting employment discrimination based on these characteristics in the state. 184,000 32% 84% 65% 16% 86 Estimated Income Workforce Transgender New Disparity Public Support Covered by Workers Complaints if Number of between for LGBT LGBT-Inclusive Reporting LGBT LGBT Workers Straight and Workplace Local Non- Workplace Protections Gay Male Protections Discrimination Discrimination are Added to Workers Laws State Laws Same-sex couples per 1,000 households, Discrimination experienced by transgender by Census tract (adjusted) workers in Michigan1 84% 44% 34% 23% Harassed or Not Hired Lost a Job Denied a Mistreated Promotion 1 Key findings of this report include: • In total there are approximately 300,000 LGBT adults in Michigan, including nearly 184,000 who are part of Michigan’s workforce.2 • Media reports, lawsuits, and complaints to community-based organizations document incidents of sexual orientation and gender identity discrimination against employees in Michigan. These include reports from a CEO, a nursing assistant, and a local government employee. -

LGBT Tra Ally Aining Proje G Ma Ect S Anua Safe Al

LGBT Ally Project Safe Training Manual Compiled & Edited by: Jamiil Gaston Office of Student Engagement, Multicultural Programs Melissa Grunow, M.A. Office of Leadership Programs and First Year Experience Lawrence Technological University 2012 1 2 Contents Introduction 3 Terms & Definitions 4‐5 Sexual Orientation 6‐7 Gender Identity 8 Signs & Symbols 9‐11 LGBT History 12 Laws & Policy: USA 13 Laws & Policy: Michigan 14 Laws & Policy: LTU 15 Coming Out 16 Being an Ally 17 Additional Resources 18 3 Introduction How to Use this Manual The ever‐changing landscape of the LGBT community and political atmosphere surrounding LGBT issues makes it difficult to create a standalone permanent manual. This manual has been compiled as a counterpart to the Project Safe Training. The myriad of resources included on the Project Safe Training disk will be referred to in many sections of this manual in addition to various internet resource links. We like to recognize the work that has been/is being done, not only at Lawrence Technological University, but other schools, colleges, universities, and grassroots and community organizations around the United States and world. We have done our best to include or link to as many of those resources as possible. You will find many sections of this manual contain a simple statement redirecting you to one of those resources. *If you find a resource missing or broken link, or would like us to consider including any additional resources please email [email protected]. Mission & Goals The mission of Project Safe is to provide a safe, nonjudgmental campus environment for all LTU students, faculty, staff, and allies who may have questions and/or concerns related to gay, lesbian, bisexual, and transgender issues. -

EQMI ACLU Request for Interpretative Statement

Co-Chairs Laura Reyes Kopack and Rasha Demashkieh Michigan Civil Rights Commission 110 West Michigan Avenue, Suite 800 Lansing, MI 48913 June 30, 2017 Dear Co-Chairs Reyes Kopack and Demashkieh: We are writing to request that the Michigan Civil Rights Commission (“Commission”) issue an interpretative statement finding that the prohibition on sex discrimination in employment, housing, and public accommodations found in Michigan’s Elliott-Larsen Civil Rights Act (“Elliott-Larsen”), MCL 37.2101 et seq., includes a prohibition on discrimination based on an individual’s gender identity and sexual orientation. The Commission has the authority to issue such a statement under MCL 37.2601; MCL 24.201 et seq.; Mich Admin Code, R 37.23. This interpretative statement is of critical importance to lesbian, gay, bisexual, and transgender (LGBT) Michiganders. As you are no doubt aware, unlike 18 other states1, Michigan does not have a state law that explicitly prohibits anti-LGBT discrimination in employment, housing, or public accommodations. The Commission itself has concluded that discrimination against LGBT people in Michigan “exists and is significant” and “has direct negative economic effects on Michigan.”2 In addition, although the federal prohibition on sex discrimination in employment under Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e-2(a)(1) (“Title VII”), has been interpreted to encompass discrimination based on gender identity and sexual orientation, many LGBT people in Michigan do not receive the benefit of this prohibition, because they work for employers with fewer than fifteen employees, the threshold for Title VII coverage. Amending Elliott-Larsen to prohibit discrimination based on gender identity and sexual orientation is a top public policy priority for Michigan’s LGBT community and our respective organizations. -

Sexual Assault in LGBTQ Community (Pdf)

Resources SafeHouse Services are all free, confidential, and inclusive. We provide: What is sexual 24 Hour HelpLine: 734-995-5444 assault? Sexual Help getting a protection order Legal advocacy assault is when there Counseling Sexual Assault Safety Planning is sexual contact: Support Groups Shelter in LGBTIQ • Without consent. • With the use of coercion, physical Local Resources: Communities force, deception or threat. Jim Toy Community Center • When the victim/survivor is 734-995-9867 mentally or physically incapacitated, http://www.wrap-up.org/ intoxicated or impaired, asleep or The Neutral Zone unconscious. (734) 214-9995 • Sexual assault can be touching or http://www.neutral-zone.org/ Pride Zone at Ozone any type of sexual penetration (oral, Center (734)662-2265 A Resource for Lesbian, anal or vaginal) with any body part or http://ozonehouse.org/programs Gay, Bisexual, object. /queerzone.php Spectrum Center Transgender, Intersex, 734-763-4186 http://spectrumcenter.umich.edu Queer, and Questioning SafeHouse Center recognizes that (U of M affiliate resource) sexual assault occurs by and against Survivors of Sexual Assault all genders and across all sexual Michigan Resources: orientations. We work to end the Michigan Coalition to End oppression of all people as well as Domestic Violence & Sexual value and celebrate the diversity of Violence 517-347-7000 our community. SafeHouse Center www.mcedsv.org also strives to protect the rights of Equality Michigan 313-537-7000 everyone. equalitymi.org National Resources: National Sexual Assault Hotline: 1- 800-656-HOPE http://www.rainn.org/ Information provided by SafeHouse Center and the Michigan Coalition to End Domestic Violence and Sexual Assault What can I do if I have Common fears of What are your rights? been sexually assaulted? LGBTIQ survivors of You have the right to: • Be treated with dignity and respect in sexual assault: regards to your gender identity and/or sexual • Talk to someone you trust: You can ask • Not being taken seriously or having orientation and as a survivor. -

'Our Demands Are Simple'

Campaign to End Michigan LGBTQ Discrimination Falls Short on Signature Collection Pride 2020 Goes Virtual Around State and Country ‘Our DemanDemandsds Are SimpSimple’le’ LGBTLGBTQ-AffirmingQ-Affirming PPoliceolice Brutality PrProtestotest Held at DetrDetroitoit Joe Louis Monument PRIDESOURCE.COM JUNE 4, 2020 | VOL. 2823 | FREE VOL. 2823 • JUNE 4, 2020 ISSUE 1148 PRIDE SOURCE MEDIA GROUP 20222 Farmington Rd., Livonia, Michigan 48152 Phone 734.293.7200 PUBLISHERS Susan Horowitz & Jan Stevenson EDITORIAL 10 Editor in Chief Susan Horowitz, 734.293.7200 x 102 [email protected] Entertainment Editor Chris Azzopardi, 734.293.7200 x 106 [email protected] News & Feature Editor Eve Kucharski, 734.293.7200 x 105 [email protected] 22 10 News & Feature Writers Michelle Brown, Ellen Knoppow, Jason A. Michael, Drew Howard, Jonathan Thurston CREATIVE Webmaster & MIS Director Kevin Bryant, [email protected] Columnists Charles Alexander, Michelle E. Brown, Mikey Rox, D’Anne Witkowski, Gwendolyn Ann Smith, Dana Rudolph Cartoonists Paul Berg Contributing Photographers Andrew Potter, Andrew Cohen, Roxanne Frith, Tih Penfil ADVERTISING & SALES 18 20 Director of Sales Jan Stevenson, 734.293.7200 x 101 [email protected] MICHIGAN NEWS 8 Motor City Pride to Host June 6 Virtual Pride Celebration Sales Representatives 4 LGBTQ-Affirming Police Brutality Protest Held at Ann Cox, 734.293.7200 x 103 Detroit Joe Louis Monument [email protected] 10 Ferndale Mayor on Pride Month, Coronavirus 6 Campaign to End Michigan LGBTQ Discrimination and Being an Ally National Advertising Representative Falls Short on Signature Collection, Changes Course Rivendell Media, 212.242.6863 12 Ypsilanti Pride Festival Virtual Livestream at 5 p.m. -

July 3, 2018 Robert R. Redfield, M.D. Director Centers for Disease Control & Prevention 1600 Clifton Road Atlanta, GA

July 3, 2018 Robert R. Redfield, M.D. Director Centers for Disease Control & Prevention 1600 Clifton Road Atlanta, GA 30329-4027 USA Dear Dr. Redfield, The undersigned organizations are writing in support of maintaining the Sexual Orientation and Gender Identity (SOGI) optional module to the Behavioral Risk Factor Surveillance System (BRFSS). As you are aware, BRFSS is the nation's premier system of health-related telephone surveys that collect state data about U.S. residents regarding their health-related risk behaviors, chronic health conditions, and use of preventive services. The CDC provides the BRFSS to states to obtain data on risk behaviors and health conditions in the U.S. population. The SOGI module in the BRFSS — an optional module since 2014 — has been used in more than 30 states and territories and have provided the first representative snapshot of transgender health in the United States. In 2017 the optional BRFSS SOGI module was funded by the Assistant Secretary for Planning and Evaluation (ASPE). However, ASPE did not fund its inclusion beyond 2017. The information collected as a part of the SOGI module to the BRFSS provides critical data that helps improve the health and wellness of our nation. This is an extremely important source of data on these issues and is particularly relevant to shaping our response to the intersectional HIV, Viral Hepatitis, and the drug overdose epidemics. We understand from the Williams Institute that until late in the process the draft survey for 2019 did not include the SOGI module because of a lack of funding although we understand the CDC has now found the money necessary to add the module to BRFSS 2019. -

Gender and Social Justice Internship Organizations*

A Select Sample of Local Organizations Lansing & East Lansing area Allen Neighborhood Center Planned Parenthood Affiliates of Michigan www.allenneighborhoodcenter.org www.miplannedparenthood.org Clean Water Action The Refugee Development Center www.cleanwateraction.org/mi/index.html www.refugeedevelopmentcenter.com Cristo Rey Community Center & Health Clinic St. Vincent Catholic Charities (STVCC), Refugee www.cristo-rey.org Services www.stvcc.org Ending Violent Encounters (EVE) www.eveinc.org SIREN/Eaton Shelter (located in Charlotte, MI) http://www.sireneatonshelter.org/ Capital Area Response Effort (CARE) http://www.svdplansing.org/2/ Lansing Association for Human Rights http://lahronline.org/ Haven House www.havenhouseel.org Michigan Department of Community Health http://www.michigan.gov/mdch Lansing Area Aids Network (LAAN) http://laanonline.org/501c/newlaan/index.htm The Listening Ear Other Areas of Michigan www.thelisteningear.net Arab Community Center for Economic and Social Michigan Energy Options Services - Dearborn www.michiganenergyoptions.org www.accesscommunity.org/site/PageServer?pagename =Environmental_Program Michigan Environmental Council www.mecprotects.org Growing Hope - Ypsilanti www.growinghope.net Women’s Center of Greater Lansing http://womenscenterofgreaterlansing.org/ National Family Court Watch www.nationalfamilycourtwatchproject.org Greater Lansing Food Bank Garden Project http://www.greaterlansingfoodbank.org/the-garden- The Ecology Center – Ann Arbor project.html www.ecocenter.org NorthWest Initiative Equality Michigan – Grand Rapids & Detroit http://www.nwlansing.org/ www.equalitymi.org MSU Sponsored Gender Related Internship Opportunities: Gender and Development: NGO Internships in Malawi - Allows students the opportunity to carry a full semester course load while participating in a non-governmental organization (NGO) internship. Students begin coursework for six weeks in East Lansing during Spring Semester and spend ten weeks in Malawi (Summer Session), which includes a six-week full-time internship with an NGO. -

Return of Organization Exempt from Income Tax OMB No

Return of Organization Exempt From Income Tax OMB No. 1545-0047 Form 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) 2016 Department of the Treasury | Do not enter social security numbers on this form as it may be made public. Open to Public Internal Revenue Service | Information about Form 990 and its instructions is at www.irs.gov/form990. Inspection A For the 2016 calendar year, or tax year beginning and ending B Check if C Name of organization D Employer identification number applicable: Address change THE TRIANGLE FOUNDATION Name change Doing business as EQUALITY MICHIGAN/MICHIGAN EQUAL 38-2556668 Initial return Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number Final return/ 19641 WEST SEVEN MILE ROAD (313)537-7000 termin- ated City or town, state or province, country, and ZIP or foreign postal code G Gross receipts $ 1,249,942. Amended return DETROIT, MI 48219 H(a) Is this a group return Applica- tion F Name and address of principal officer:STEPHANIE WHITE for subordinates? ~~ Yes X No pending SAME AS C ABOVE H(b) Are all subordinates included? Yes No I Tax-exempt status: X 501(c)(3) 501(c) ( )§ (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions) J Website: | WWW.EQUALITYMI.ORG H(c) Group exemption number | K Form of organization: X Corporation Trust Association Other | L Year of formation: 1991 M State of legal domicile: MI Part I Summary 1 Briefly describe the organization's mission or most significant activities: TO ACHIEVE FULL EQUALITY AND RESPECT FOR ALL PEOPLE IN MICHIGAN REGARDLESS OF SEXUAL ORIENTATION, 2 Check this box | if the organization discontinued its operations or disposed of more than 25% of its net assets.