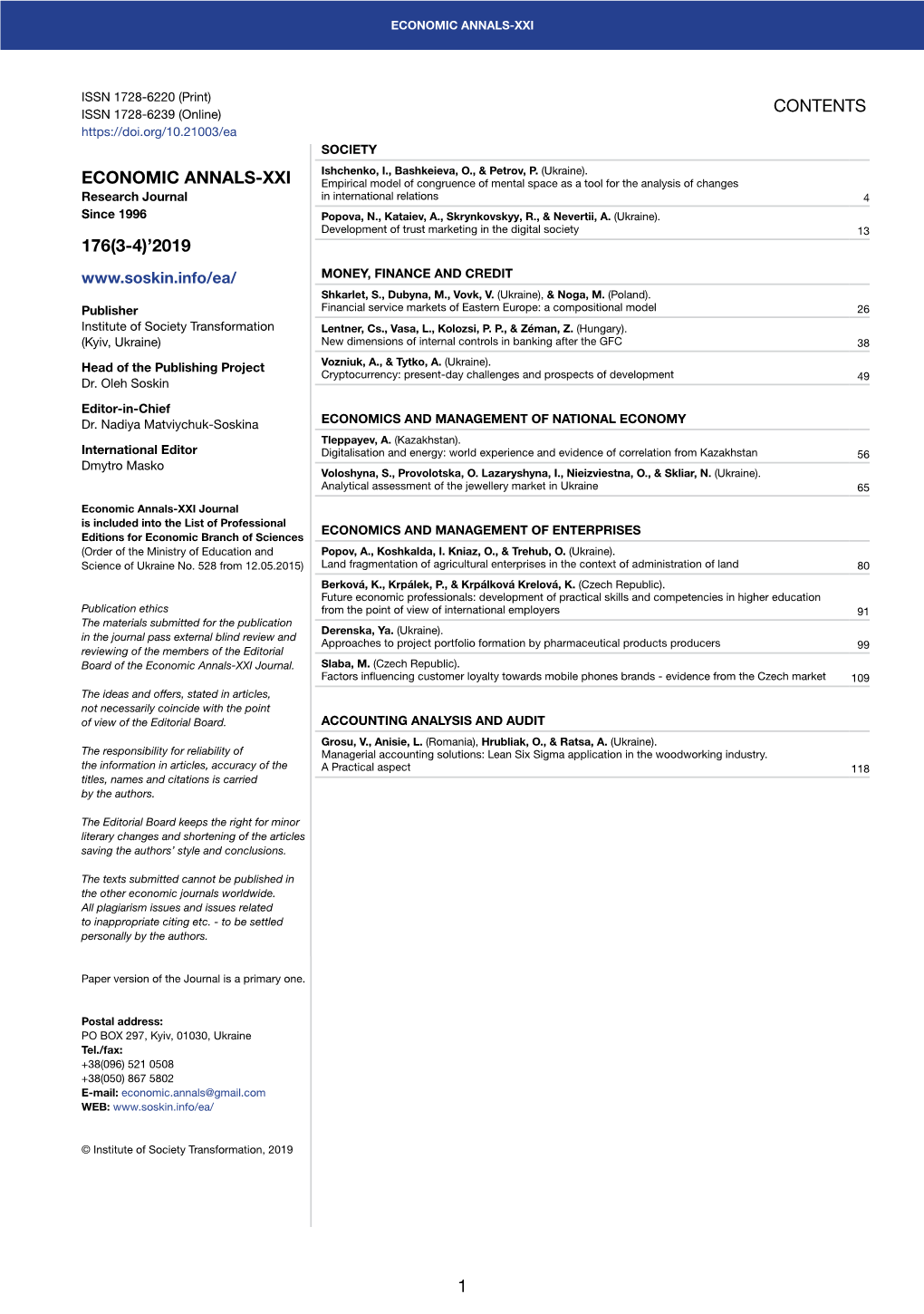

1 Contents Economic Annals-Xxi 176(3-4)'2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Grade 12 June Paper 1 2019

ALEXANDER ROAD HIGH SCHOOL June 2019 2 Hours English Home Language – PAPER 1 JL Total: 70 Grade 12 INSTRUCTIONS AND INFORMATION 1. This question paper consists of THREE sections: SECTION A: Comprehension (30) SECTION B: Summary (10) SECTION C: Language Structures and Conventions (30) 2. Read ALL the instructions carefully. 3. Answer ALL the questions. 4. Start EACH section on a NEW page. 5. Rule off after each section. 6. Number the answers correctly according to the numbering system used in this question paper. 7. Leave a line after EACH answer. 8. Pay special attention to spelling and sentence construction. 9. Suggested time allocation: SECTION A: 50 minutes SECTION B: 30 minutes SECTION C: 40 minutes 10. Write neatly and legibly. SECTION A: COMPREHENSION QUESTION 1: READING FOR MEANING AND UNDERSTANDING Read TEXT A below and answer the questions set. TEXT A The Night Witches: The All-Female World War II Squadron That Terrified the Nazis Gisely Ruiz, Published March 17, 2019, Updated April 11, 2019 1 The Night Witches decorated their planes with flowers and painted their lips with navigation pencils – then struck fear into the hearts of the Nazis. 2 The women of the 588th Night Bomber Regiment of the Soviet Air Forces had no radar, no machine guns, no radios, and no parachutes. All they had was a map, a compass, rulers, stopwatches, flashlights and pencils, yet they successfully completed 30,000 bombing raids and dropped more than 23,000 tons of munitions on advancing German armies during World War II. 3 The all-female Night Witches squadron was the result of women in the Soviet Union wanting to be actively involved in the war effort. -

Nadezhda Popova - Telegraph 21/07/13 18:50

Nadezhda Popova - Telegraph 21/07/13 18:50 Nadezhda Popova Nadezhda Popova, who has died aged 91, was a member of an elite corps of Soviet women — known as the “Night Witches” — who fought as bomber pilots in the air war against Germany, and the only one to win three Orders of the Patriotic War for bravery. Nadezhda Popova (standing) with some of her fellow 'Night Witches' Photo: NOVOSTI/TOPFOTO 5:21PM BST 10 Jul 2013 Unlike Soviet men, women were not formally conscripted into the armed forces. They were volunteers. But the haemorrhaging of the Red Army after the routs of 1941 saw mass campaigns to induct women into the military. They were to play an essential role. More than 8,000 women fought in the charnel house of Stalingrad. In late 1941 Stalin signed an order to establish three all-women Air Force units to be grouped into separate fighter, dive bomber and night bomber regiments. Over the next four years these regiments flew a combined total of more than 30,000 combat sorties and dropped 23,000 tons of bombs. Nadezhda Popova, then aged 19, was one of the first to join the best-known of the three units, the 588th Night Bomber Regiment (later renamed the 46th Taman Guards Night Bomber Aviation Regiment). http://www.telegraph.co.uk/news/obituaries/10171897/Nadezhda-Popova.html Page 1 sur 4 Nadezhda Popova - Telegraph 21/07/13 18:50 The 588th was not well equipped. Wearing hand-me-down uniforms from male pilots, the women flew 1920s-vintage Polikarpov PO-2 two-seater biplanes, which consisted of fabric strung over a plywood frame, and lacked all but the most rudimentary instruments. -

Annual Report 2009

Bi-Annual 2009 - 2011 REPORT R MUSEUM OF ART UNIVERSITY OF FLORIDA CELEBRATING 20 YEARS Director’s Message With the celebration of the 20th anniversary of the Harn Museum of Art in 2010 we had many occasions to reflect on the remarkable growth of the institution in this relatively short period 1 Director’s Message 16 Financials of time. The building expanded in 2005 with the addition of the 18,000 square foot Mary Ann Harn Cofrin Pavilion and has grown once again with the March 2012 opening of the David A. 2 2009 - 2010 Highlighted Acquisitions 18 Support Cofrin Asian Art Wing. The staff has grown from 25 in 1990 to more than 50, of whom 35 are full time. In 2010, the total number of visitors to the museum reached more than one million. 4 2010 - 2011 Highlighted Acquisitions 30 2009 - 2010 Acquisitions Programs for university audiences and the wider community have expanded dramatically, including an internship program, which is a national model and the ever-popular Museum 6 Exhibitions and Corresponding Programs 48 2010 - 2011 Acquisitions Nights program that brings thousands of students and other visitors to the museum each year. Contents 12 Additional Programs 75 People at the Harn Of particular note, the size of the collections doubled from around 3,000 when the museum opened in 1990 to over 7,300 objects by 2010. The years covered by this report saw a burst 14 UF Partnerships of activity in donations and purchases of works of art in all of the museum’s core collecting areas—African, Asian, modern and contemporary art and photography. -

Holocaust Heroes

Board of Directors Helen Hardacre Susan Schweitzer HOLOCAUST HEROES: FIERCE FEMALES Linda Stein TAPESTRIES AND SCULPTURE BY LINDA STEIN Honorary Board Loreen Arbus (H2F2) Abigail Disney Lauren Embrey OVERVIEW AS OF 6/19/17 Merle Hoffman Carol Jenkins HOLOCAUST HEROES: FIERCE FEMALES IS A NEW TRAVELING EVENT Patti Kenner UNDER THE UMBRELLA OF, AND FACILITATED BY, Ruby Lerner Pat Mitchell OUR TEAM AT THE NON-PROFIT Ellen Poss HAVE ART: WILL TRAVEL! (HAWT). Elizabeth Sackler Gloria Steinem WE WOULD LIKE TO DISCUSS THE POSSIBILITY Advisory Council OF THIS EVENT COMING TO YOU. Sue Ginsburg: Chair Mary Blake Beth Bolander Jerome Chanes The gallery exhibition (see testimonials) is made up of: Sarah Connors A. Ten Heroic Tapestries Marilyn Falik Eva Fogelman B. Twenty Spoon to Shell Sculptures Karen Keifer-Boyd C. One Protector Sculpture with Wonder Woman Shadow Michael Kimmel John McCue D. Video (7-minutes on loop) featuring Abigail Disney, Elizabeth Sackler and Jeanie Rosensaft Menachem Rosensaft Gloria Steinem and others: http://www.haveartwilltravel.org/events/holocaust- Amy Stone heroes/ Executive Director E. Holocaust Heroes Book Ann Holt F. Two Magic Scarf of Ten Heroes with Interactive Local Performance Studio Manager G. Educational Inititiative and Interactive Website (optional) Rachel Birkentall This exhibition is shipped in ten tubes and two crates weighing a total of 542 lbs. For storage, crates and tubes can be stacked within a 4’x6’x8’ area. A. Heroic Tapestries: These highlight ten females who represent different aspects of bravery during the time of the Holocaust. Each tapestry is 5 ft sq, leather, metal, canvas, paint, fabric and mixed media. -

Dear Friends! on Behalf of Ministry of Culture of the Russian Federation I

ƒÓÓ„Ë ‰ÛÁ¸ˇ! Dear friends! ŒÚ ËÏÂÌË ÃËÌËÒÚÂÒÚ‚‡ ÍÛθÚÛ˚ –ÓÒÒËÈÒÍÓÈ On behalf of Ministry of Culture of the Russian ‘‰‡ˆËË ÔÓÁ‰‡‚Ρ˛ ‚‡Ò Ò Ì‡˜‡ÎÓÏ ‡·ÓÚ˚ Federation I would like to congratulate you all on 19-„Ó ŒÚÍ˚ÚÓ„Ó ÓÒÒËÈÒÍÓ„Ó ÍËÌÓÙÂÒÚË‚‡Îˇ the opening of the 19-th Open Russian Film "üËÌÓÚ‡‚". Festival "Kinotavr". ‘ÂÒÚË‚‡Î¸ ‚ —Ó˜Ë ‚Ò„‰‡ ·˚Î Ò‡Ï˚Ï ˇÍËÏ, The Festival in Sochi has always been the most Ò‡Ï˚Ï ÓÊˉ‡ÂÏ˚Ï, Ò‡Ï˚Ï Î˛·ËÏ˚Ï vivid, most anticipated, most admired and most Ô‡Á‰ÌËÍÓÏ Ë ÒÓ·˚ÚËÂÏ Ì‡ˆËÓ̇θÌÓ„Ó ÍËÌÓ. celebrated event for national cinema. But it is Œ‰Ì‡ÍÓ ËÏÂÌÌÓ ÚÂÔ¸, ̇ ‚ÓÎÌ ‡Òˆ‚ÂÚ‡ only now when domestic film industry is ÓÚ˜ÂÒÚ‚ÂÌÌÓ„Ó ÍËÌÓËÒÍÛÒÒÚ‚‡, "üËÌÓÚ‡‚" blooming, "Kinotavr" has become the main ÒÚ‡ÌÓ‚ËÚÒˇ „·‚ÌÓÈ ÔÓÙÂÒÒËÓ̇θÌÓÈ professional platform for the first-night showings, Ô·ÚÙÓÏÓÈ ‰Îˇ ÔÂϸÂÌ˚ı ÔÓÒÏÓÚÓ‚, meetings and discussions for all creative ‚ÒÚ˜ Ë ‰ËÒÍÛÒÒËÈ ‚ÒÂı Ú‚Ó˜ÂÒÍËı ÔÓÍÓÎÂÌËÈ generations of Russian cinematographers. ÓÒÒËÈÒÍËı ÍËÌÂχÚÓ„‡ÙËÒÚÓ‚. Participation in festival's programme is already an ”˜‡ÒÚË ‚ ÍÓÌÍÛÒÌÓÈ ÔÓ„‡ÏÏ "üËÌÓÚ‡‚‡" achievement, already success for every creative Ò‡ÏÓ ÔÓ Ò· ˇ‚ΡÂÚÒˇ ÛÒÔÂıÓÏ ‰Îˇ ÒÓÁ‰‡ÚÂÎÂÈ person in our film industry. To win at "Kinotavr" ͇ʉÓÈ ËÁ ‚˚·‡ÌÌ˚ı ÎÂÌÚ. œÓ·Â‰‡ ̇ beyond doubt means to receive the best ever proof "üËÌÓÚ‡‚Â" ÒÚ‡ÌÓ‚ËÚÒˇ ·ÂÒÒÔÓÌ˚Ï of innovation and craftsmanship and excellence. -

In the Forge of Stalin of Forge the in Kotljarchuk AUS Andrej Gammalsvenskby Is the Only Swedish Settlement to the East from Finland, Founded in 1782

AUS AndrejAUS Kotljarchuk In the Forge of Stalin Gammalsvenskby is the only Swedish settlement to the east from Finland, founded in 1782. In the past of Gammalsvenskby the history of the Soviet Union, Sweden, Acta Universitatis Stockholmiensis the international communist movement and Nazi Germany combined in a bizar- Stockholms Studies In History, 100 re form. And even when the ploughmen of the Kherson steppes did not left their native village, the great powers themselves visited them with the intention to rule forever. The history of colony is viewed through the prism of the theory of “forced normalization” and the concept of “changes of collective identity“. The author intends to study the techniques of forced normalization and the strategy of the In the Forge of Stalin collective resistance. Swedish Colonists of Ukraine in Totalitarian Experiments Andrej Kotljarchuk is an associate professor in history, working as a university of the Twentieth Century lecturer at the Department of History, Stockholm University; and as a senior rese- archer at the School of Historical and Contemporary Studies, Södertörn University. His research focuses on ethnic minorities and role of experts’ communities, mass Andrej Kotljarchuk Stockholm 2014 violence and the politics of memory. His recent publications include the book chap- ters “The Nordic Threat: Soviet Ethnic Cleansing on the Kola Peninsula” (2014), “The Memory of Roma Holocaust in Ukraine: Mass Graves, Memory Work and the Politics of Commemoration” (2014); as well as the articles “World War II Memory Politics: Jewish, Polish and Roma Minorities of Belarus”, in Journal of Belarusian Studies (2013) and “Kola Sami in the Stalinist terror: a quantitative analysis”, in Journal of Northern Studies (2012). -

CONTENTS WORLD ECONOMY and INTERNATIONAL ECONOMIC RELATIONS Tikhonova, A., Melnikova, N

ISSN 1728-6220 (Print) ISSN 1728-6239 (Online) CONTENTS https://doi.org/10.21003/ea WORLD ECONOMY AND INTERNATIONAL ECONOMIC RELATIONS Tikhonova, A., Melnikova, N. (Russia), & Lukács, E. (Hungary). Consequences of the integration ECONOMIC ANNALS-XXI to the Eurasian Economic Union: methodology of statistical evaluation and first results 4 Research Journal Since 1996 ECONOMICS AND MANAGEMENT OF NATIONAL ECONOMY 170(3-4)’2018 Lemishko, О. (Ukraine). Modelling of endogenous factors impacting the efficiency of the aggregate capital in Ukraine’s agriculture 10 www.soskin.info/ea/ Sokil, O., Zhuk, V. (Ukraine), & Vasa, L. (Hungary). Integral assessment of the sustainable development of agriculture in Ukraine 15 Publisher Khvesyk, M., Bystryakov, I., Obykhod, H., & Khvesyk, Yu. (Ukraine). Institute of Society Transformation Assessment of the safety of environment in terms of sustainable development 22 (Kyiv, Ukraine) Head of the Publishing Project ECONOMICS AND MANAGEMENT OF ENTERPRISES Dr. Oleh Soskin Popova, N., Shynkarenko, V., Kryvoruchko, O. (Ukraine), & Zéman, Z. (Hungary). Editor-in-Сhief Enterprise management in VUCA conditions 27 Dr. Nadiya Matviychuk-Soskina Slávik, Š. (Slovakia). Insight into start-up, its action and surroundings 32 International Editor Ilchenko, N., Kulik, A. (Ukraine), & Magda, R. (Hungary). Dmytro Masko Trends in development of wholesale trade in Ukraine 38 Kostyshyn, N., Semchyshyn, L., & Yakovets, T. (Ukraine). Economic Annals-XXI Journal Modeling of an effective strategy of the process of product implementation with reference to seasonality 43 is included into the List of Professional Dunn, J. (USA), Brunner, T. (Switzerland), Legeza, D., Konovalenko, A., & Demchuk, O. (Ukraine). Editions for Economic Branch of Sciences Factors of the marketing macro system effecting children’s food production 49 (Order of the Ministry of Education and Science of Ukraine No. -

The Wickedest Flying Witches

THE WICKEDEST FLYING WITCHES Calling a female pilot a ‘flying witch’ in avant-garde America could bring condemnation, censorship, and protesters trampling down the weeds in my front yard. So, stick with me on this: The flying ‘Night Witches’ of WWII gained their nickname from an adversary, out of respect for their boldness and deadly sneak attacks. Moral of the story: never sell a female pilot short. The conduit to ‘flying witches’ most likely began with Katherine Wright, sister of the Wright brothers. Katherine not only flew with her brothers but contributed as much vigor and knowledge to the first flight at Kitty Hawk as did her famous KATHERINE WRIGHT brothers. Harriet Quimby was the first woman in America to become a licensed pilot. Nice start, but it would take the U.S. military 65 years to accept female pilots plus another 17 years before the ladies were allowed inside the cockpits of combat aircraft. HARRIET Chopper pilot Major Marie Rossi was the first American female pilot to lose her life in a combat role on March 1, 1991 near her home base in northern Saudi Arabia. She was 32 years old. Ranked as the top female Air Force pilot in the 1990’s, Lt. Col. Martha MAJOR ROSSI McSally was the first woman to fly a fighter aircraft on combat sorties. She also flew over 100 combat hours in an A-10 Warthog over Iraq in the mid-90s. The U.S. Air Force Thunderbirds performance team recruited Major Nicole Malachowski as their first female demonstration pilot in 2006. -

Nancy Condee, the Imperial Trace. Recent Russian Cinema

The Imperial Trace This page intentionally left blank The Imperial Trace Recent Russian Cinema nancy Condee 1 2009 3 Oxford University Press, Inc., publishes works that further Oxford University’s objective of excellence in research, scholarship, and education. Oxford New York Auckland Cape Town Dar es Salaam Hong Kong Karachi Kuala Lumpur Madrid Melbourne Mexico City Nairobi New Delhi Shanghai Taipei Toronto With offi ces in Argentina Austria Brazil Chile Czech Republic France Greece Guatemala Hungary Italy Japan Poland Portugal Singapore South Korea Switzerland Thailand Turkey Ukraine Vietnam Copyright © 2009 by Oxford University Press, Inc. Published by Oxford University Press, Inc. 198 Madison Avenue, New York, New York 10016 www.oup.com Oxford is a registered trademark of Oxford University Press All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior permission of Oxford University Press. Library of Congress Cataloging-in-Publication Data Condee, Nancy. Imperial trace : recent Russian cinema / Nancy Condee. p. cm. Includes bibliographical references and index. ISBN 978-0-19-536676-1; 978-0-19-536696-9 (pbk.) 1. Motion pictures—Russia (Federation)—History. I. Title. PN1993.5.R9C66 2009 791.430947’09049—dc22 2008029349 9 8 7 6 5 4 3 2 1 Printed in the United States of America on acid-free paper Acknowledgments Grateful acknowledgment is due, fi rst of all, to my home institution, the University of Pittsburgh, where the Dean’s Offi ce of the School of Arts and Sciences, the Department of Slavic Languages and Literatures, the University Center for International Studies, and the Russian and East European Studies Center are the primary units to which I am indebted for support and leave time. -

Thirty Years of Religious Freedom in Russia: the Case of Ekaterinburg

Occasional Papers on Religion in Eastern Europe Volume 40 Issue 2 Article 3 3-2020 Thirty Years of Religious Freedom in Russia: The Case of Ekaterinburg Elena Glavatskaya Institute of History and Archaeology of the Ural Branch of the Russian Academy of Sciences, and Ural Federal University Follow this and additional works at: https://digitalcommons.georgefox.edu/ree Part of the Christianity Commons, and the Eastern European Studies Commons Recommended Citation Glavatskaya, Elena (2020) "Thirty Years of Religious Freedom in Russia: The Case of Ekaterinburg," Occasional Papers on Religion in Eastern Europe: Vol. 40 : Iss. 2 , Article 3. Available at: https://digitalcommons.georgefox.edu/ree/vol40/iss2/3 This Article, Exploration, or Report is brought to you for free and open access by Digital Commons @ George Fox University. It has been accepted for inclusion in Occasional Papers on Religion in Eastern Europe by an authorized editor of Digital Commons @ George Fox University. For more information, please contact [email protected]. THIRTY YEARS OF RELIGIOUS FREEDOM IN RUSSIA: THE CASE OF EKATERINBURG By Elena Glavatskaya Elena Glavatskaya is a history professor at Ural Federal University and a senior research fellow at the Institute of History and Archaeology of the Ural Branch of the Russian Academy of Sciences in Ekaterinburg, Russia. She received a PhD in history for her dissertation, which focused on the Siberian people’s religious traditions. She has published over one hundred articles on ethnic and religious minorities in Russia and the Russian Orthodox Church history. Glavatskaya currently leads a research project focused on ethno-religious and demographic dynamics in the Urals. -

Sanskar School Home Assignment Class – Vii Subject – English

SANSKAR SCHOOL HOME ASSIGNMENT CLASS – VII SUBJECT – ENGLISH https://youtu.be/yXmHwGGoJH0 NIGHT WITCHES KEY TERMS a. flimsiness - weakness and thickness b. manoeuvre -move or turn in a skilful and controlled manner c. decorated -honoured formally, often with a medal or badge d. legacy-something valuable that is passed down generations and belongs to everyone. e. sorties - quick attacks made by an aircraft or a group of aircraft. f. brothers in arms - soldiers fighting on the same side. UNDERSTANDING THE TEXT A. Answer these questions :- 1.What were the disadvantages of the type of aircraft used by the female fighter pilots? What was the disadvantage Ans. The aircraft used by the female fighter pilots were built mainly of plywood and canvas. They were small and usually reserved for training and crop-dusting. These planes, if hit by bullets, could burst into flames. One plane could carry only two bombs at a time. A strong wind could toss the plane about. However, the advantage of these small and flimsy planes was that they could be manoeuvred quickly and easily 2.Nobody could understand why the brave lad who had taken on a Nazi squadron wouldn't drink vodka. What mistake were the people in this situation making? What does this say about female fighter pilots - were they a common or an uncommon figure at that time? Ans.The people in this situation were making the mistake of thinking that the brave pilot must have been a man—a brave lad. This shows that the female fighter pilots were an uncommon figure at that time—the people did not immediately think that the pilot might be a woman. -

Teaching Guide for Teaching the Historical Fiction Book, Among the Red Stars by Gwen C

Teaching Guide for teaching the historical fiction book, Among the Red Stars by Gwen C. Katz (Harper Teen: 2017) World War Two has shattered Valka's homeland of Russia, and Valka is determined to help the effort. She knows her skills as a pilot rival the best of the men, so when an all-female aviation group forms, Valka is the first to sign up. Flying has always meant freedom and exhilaration for Valka, but dropping bombs on German soldiers from a fragile canvas biplane is no joyride. The war is taking its toll on everyone, including the boy Valka grew up with, who is fighting for his life on the front lines. As the war intensifies and those around her fall, Valka must decide how much she is willing to risk to defend the skies she once called home. Inspired by the true story of the airwomen the Nazis called Night Witches, Gwen C. Katz weaves a tale of strength and sacrifice, learning to fight for yourself, and the perils of a world at war. (from the back cover of the book) This book can be used with advanced middle school students or with high school students studying World War II (WWII), flight/aviation, geography, or women in non-traditional roles. The four lesson plans included in this teaching guide all align with specific middle school and high school Common Core State Standards for History/Social Studies. The full text of these standards is included at the end of the teaching guide. The “Common Core State Standards” are copyright 2010 by the National Governors Association Center for Best Practices and Council of Chief State School Officers.