Matthew J. Blevins, Vice President, Empire Stock Transfer Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Not for Publication United States Court of Appeals

NOT FOR PUBLICATION FILED AUG 28 2020 UNITED STATES COURT OF APPEALS MOLLY C. DWYER, CLERK FOR THE NINTH CIRCUIT U.S. COURT OF APPEALS EHM PRODUCTIONS, INC., DBA TMZ, a No. 19-55288 California corporation; WARNER BROS. ENTERTAINMENT INC., a Delaware D.C. No. corporation, 2:16-cv-02001-SJO-GJS Plaintiffs-Appellees, MEMORANDUM* v. STARLINE TOURS OF HOLLYWOOD, INC., a California corporation, Defendant-Appellant. Appeal from the United States District Court for the Central District of California S. James Otero, District Judge, Presiding Argued and Submitted August 10, 2020 Pasadena, California Before: WARDLAW and CLIFTON, Circuit Judges, and HILLMAN,** District Judge. Starline Tours of Hollywood, Inc. (Starline) appeals the district court’s * This disposition is not appropriate for publication and is not precedent except as provided by Ninth Circuit Rule 36-3. ** The Honorable Timothy Hillman, United States District Judge for the District of Massachusetts, sitting by designation. orders dismissing its First Amended Counterclaim (FACC) and denying its motion for leave to amend. We dismiss this appeal for lack of appellate jurisdiction. 1. Under 28 U.S.C. § 1291, the courts of appeals have jurisdiction over “final decisions of the district court.” Nat’l Distrib. Agency v. Nationwide Mut. Ins. Co., 117 F.3d 432, 433 (9th Cir. 1997). Generally, “a voluntary dismissal without prejudice is ordinarily not a final judgment from which the plaintiff may appeal.” Galaza v. Wolf, 954 F.3d 1267, 1270 (9th Cir. 2020) (cleaned up). A limited exception to this rule—which Starline seeks to invoke—permits an appeal “when a party that has suffered an adverse partial judgment subsequently dismisses its remaining claims without prejudice with the approval of the district court, and the record reveals no evidence of intent to manipulate our appellate jurisdiction.” James v. -

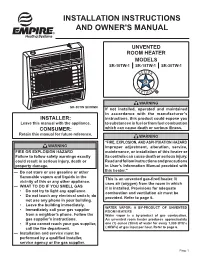

Installation INSTRUCTIONS and OWNER's MANUAL

Installation INSTRUCTIONS AND OWNER'S MANUAL UNVENTED ROOM HEATER MODELS SR-10TW-1 SR-18TW-1 SR-30TW-1 WARNING SR-30TW SHOWN If not installed, operated and maintained in accordance with the manufacturer’s INSTALLER: instructions, this product could expose you Leave this manual with the appliance. to substances in fuel or from fuel combustion CONSUMER: which can cause death or serious illness. Retain this manual for future reference. WARNING “FIRE, EXPLOSION, AND ASPHYXIATION HAZARD WARNING Improper adjustment, alteration, service, FIRE OR EXPLOSION HAZARD maintenance, or installation of this heater or Failure to follow safety warnings exactly its controls can cause death or serious injury. could result in serious injury, death or Read and follow instructions and precautions property damage. in User’s Information Manual provided with — Do not store or use gasoline or other this heater.” flammable vapors and liquids in the This is an unvented gas-fired heater. It vicinity of this or any other appliance. uses air (oxygen) from the room in which — WHAT TO DO IF YOU SMELL GAS it is installed. Provisions for adequate • Do not try to light any appliance. combustion and ventilation air must be • Do not touch any electrical switch; do provided. Refer to page 6. not use any phone in your building. • Leave the building immediately. WATER VAPOR: A BY-PRODUCT OF UNVENTED • Immediately call your gas supplier ROOM HEATERS from a neighbor’s phone. Follow the Water vapor is a by-product of gas combustion. gas supplier’s instructions. An unvented room heater produces approximately • If you cannot reach your gas supplier, one (1) ounce (30ml) of water for every 1,000 BTU’s call the fire department. -

Shakespeare Unlimited: How King Lear Inspired Empire

Shakespeare Unlimited: How King Lear Inspired Empire Ilene Chaiken, Executive Producer Interviewed by Barbara Bogaev A Folger Shakespeare Library Podcast March 22, 2017 ---------------------------- MICHAEL WITMORE: Shakespeare can turn up almost anywhere. [A series of clips from Empire.] —How long you been plannin’ to kick my dad off the phone? —Since the day he banished me. I could die a thousand times… just please… From here on out, this is about to be the biggest, baddest company in hip-hop culture. Ladies and gentlemen, make some noise for the new era of Hakeem Lyon, y’all… MICHAEL: From the Folger Shakespeare Library, this is Shakespeare Unlimited. I‟m Michael Witmore, the Folger‟s director. This podcast is called “The World in Empire.” That clip you heard a second ago was from the Fox TV series Empire. The story of an aging ruler— in this case, the head of a hip-hop music dynasty—who sets his three children against each other. Sound familiar? As you will hear, from its very beginning, Empire has fashioned itself on the plot of King Lear. And that‟s not the only Shakespeare connection to the program. To explain all this, we brought in Empire’s showrunner, the woman who makes everything happen on time and on budget, Ilene Chaiken. She was interviewed by Barbara Bogaev. ---------------------------- BARBARA BOGAEV: Well, Empire seems as if its elevator pitch was a hip-hop King Lear. Was that the idea from the start? ILENE CHAIKEN: Yes, as I understand it, now I didn‟t create Empire— BOGAEV: Right, because you‟re the showrunner, and first there‟s a pilot, and then the series gets picked up, and then they pick the showrunner. -

Redalyc.SUGAR, EMPIRE, and REVOLUTION in EASTERN CUBA

Caribbean Studies ISSN: 0008-6533 [email protected] Instituto de Estudios del Caribe Puerto Rico Casey, Matthew SUGAR, EMPIRE, AND REVOLUTION IN EASTERN CUBA: THE GUANTÁNAMO SUGAR COMPANY RECORDS IN THE CUBAN HERITAGE COLLECTION Caribbean Studies, vol. 42, núm. 2, julio-diciembre, 2014, pp. 219-233 Instituto de Estudios del Caribe San Juan, Puerto Rico Available in: http://www.redalyc.org/articulo.oa?id=39240402008 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative SUGAR, EMPIRE, AND REVOLUTION IN EASTERN CUBA... 219 SUgAR, EMPIRE, AND REVOLUTION IN EASTERN CUBA: ThE gUANTáNAMO SUgAR COMPANy RECORDS IN ThE CUBAN hERITAgE COLLECTION Matthew Casey ABSTRACT The Guantánamo Sugar Company Records in the Cuban Heritage Col- lection at the University of Miami represent some of the only accessible plantation documents for the province of Guantánamo in republican Cuba. Few scholars have researched in the collection and there have not been any publications to draw from it. Such a rich collection allows scholars to tie the province’s local political, economic, and social dynamics with larger national, regional, and global processes. This is consistent with ongoing scholarly efforts to understand local and global interactions and to pay more attention to regional differences within Cuba. This research note uses the records to explore local issues of land, labor, and politics in republican-era Guantánamo in the context of larger national and international processes. -

BT TM-15 Manual.Pdf

BT_TM-15_Manual.qxp 6/17/09 5:23 PM Page C OWNER’S MANUAL BTPAINTBALL.COM BT_TM-15_Manual.qxp 6/17/09 5:23 PM Page D CONTENTS Page 1. Rules for Safe Marker Handling 1 2. Introduction and Specifications 1 3. Battery Replacement and Life Indicator 1 4. Compressed Air/Nitrogen Supply 2 5. Basic Operation 2 6. Firing the TM-15 4 7. Break Beam Eyes Operation 4 8. Unloading the TM-15 5 9. Regulator and Velocity Adjustments 5 10. Programming 6 11. Setting Functions 7 12. Trigger Adjustments 9 13. General Maintenance 10 14. Assembly/Disassembly Instructions 11 15. Storage and Transportation 14 16. Troubleshooting Guide 14 For manuals and warranty details, go to: 17. Diagrams and Parts List 17 paintballsolutions.com WARRANTY (Inside Back Cover) For manuals in other languages, (where appli- cable), go to:paintballsolutions.com ©2009 BT Paintball Designs, Inc. The BT Shield, “Battle Tested” and “TM-15” are trademarks of NEITHER BT PAINTBALL DESIGNS, INC. NOR ANY OF ITS PRODUCTS ARE AFFILIATED WITH TIPPMANN SPORTS, LLC. BT Paintball Designs, Inc. All rights reserved. BTPAINTBALL.COM BT_TM-15_Manual.qxp 6/17/09 5:23 PM Page 1 1. Rules for Safe Marker Handling nology. The TM-15 is precision engineered from magnesium alloy, aircraft- IMPORTANT: Never carry your TM-15 uncased when not on a playing grade aluminum, and composite materials. We expect you to play hard and field. The non-playing public and law enforcement personnel may not be play frequently and the TM-15 was built with this in mind. able to distinguish between a paintball marker and firearm. -

Dossier De Presse TOUT SAVOIR SUR EMPIRE

DOSSIER DE PRESSE TOUT SAVOIR SUR EMPIRE DÉCOUVRIR LES PREMIÈRES IMAGES DE LA SAISON 1 SUCCESS STORY : Série dramatique n°1 de la saison 2014/15 aux USA Série n°2 de la saison 2014/15 aux USA, derrière Big Bang Theory sur CBS Meilleur score pour une nouvelle série aux USA depuis Desperate Housewives et Grey’s Anatomy en 2004-2005 Plus forte progression durant une première saison (+65%) depuis Docteur House en 2004 Série la plus tweetée avec 627 369 live tweets par épisode (devant The Walking Dead) SYNOPSIS Lucious Lyon (Terrence Howard, nominé aux lorsque son ex-femme, Cookie (Taraji P. Henson, Oscars et aux Golden Globes pour Hustle & nominée aux Oscars et aux Emmy Awards, Flow) est le roi du hip-hop. Ancien petit voyou, L’étrange histoire de Benjamin Button, Person son talent lui a permis de devenir un artiste of Interest), revient sept ans plus tôt que prévu, talentueux mais surtout le président d’Empire après presque 20 ans de détention. Audacieuse Entertainment. Pendant des années, son et sans scrupule, Cookie considère qu’elle s’est règne a été sans partage. Mais tout bascule sacrifiée pour que Lucious puisse démarrer sa lorsqu’il apprend qu’il est atteint d’une maladie carrière puis bâtir un empire, en vendant de la dégénérative. Il est désormais contraint de drogue. Trafic pour lequel elle a été envoyée transmettre à ses trois fils les clefs de son en prison. empire, sans faire éclater la cellule familiale déjà fragile. Pour le moment, Lucious reste à la tête d’Empire Entertainment. -

High Energy Live Music for Weddings & Events. Playing All Your Favorite Songs

FEEL IT IN YOUR FEET! High energy live music for weddings & events. Playing all your favorite songs. GET YOUR PARTY STARTED! We are a premium, customizable 3 to 14 musician band specializing in high-energy music for festivals, weddings and corporate events. Past clients: We play a wide variety of musical genres at a world class standard. Our band members are full-time professional musicians, who excel at everything from Frank Sinatra, The Beatles, and Whitney Houston to Beyoncé, Daft Punk, Bruno Mars, and more. Our repertoire ranges from Great Gatsby Extravaganzas to 90’s Throwback Parties and everything in between. Amazing dance parties are how the Emerald Empire have earned their fantastic reputation and we pride ourselves on flawless performance–it’s all about great preparation and a genuine love for what we do to ensure you have the best night of your life. Atlanta Charleston Nashville Charlotte Who we’ve performed with: Birmingham Aretha Franklin Jill Scott Prince Savannah Bruno Mars JJ Grey & Mofro Stevie Wonder Memphis Greg Allman Band Lionel Richie Tedeschi Trucks Band Raleigh Janelle Monáe Martina McBride & more. Jay-Z Maxwell Greenville & All Around The World BENEFITS OF WORKING WITH US Easy communication and WE USE A UNIQUE Performance and client DISCOUNTS affordable prices. ONLINE BAND PLANNING services of the highest AVAILABLE quality. The atmosphere we SYSTEM THAT ALLOWS will bring to your event is FOR WEEKDAY FOR FLEXIBLE EVENT unrivaled! EVENTS! UPDATES. LAST MINUTE EVENT? We can provide all production Considerate with volume Social media posts with NO PROBLEM. WE’RE aspects for the event and able to comply with vendor tags when photos (professional sound system, venue sound regulations or are available. -

Media Analysis.Docx

Surname 1 Student’s Name Professor’s Name Course Date Media Analysis The first season of Empire drama series was premiered on Fox on January 7, 2015, and till March 18, 2015. The show was aired on Fox on Wednesdays at 9.00 PM ET (Fox, 2015). The 12 episodes American Television series, centers on an entertainment company, The Empire Entertainment Company. It is a family business making lots of profit from signing in popular musicians and hip-hop artists as well as recordings from talented family members. Each of the family members fights for control over the company. The main casts in the movie are a divorced couple Lucious Lyon and his ex-wife Cookie Lyon. The couple has three sons Andre (oldest son and married to Rhonda), Jamal (middle son), and Hakeem Lyon (Fox, 2015). Lucious and Cookie spent most of their early lives in drug dealing until Cookie was imprisoned. Although the family was living in poverty, they had ambitions to prosper in the music industry. They were a happy family always protecting and encouraging each other until Cookie was imprisoned (Fox, 2015). The interaction in the Empire Series is family-based. The ambitions and fight for control over The Empire Company bring the interactions in the family (IMDb, 2015). While in jail, the interaction between Cookie, Lucious, and their sons are minimal. After the release of Cookie from jail, her relationship with her ex-husband Lucious is business-centered until episode 7, where it becomes intimate (Fox, 2015). Although the divorced couple tries to keep their relationshipx-essays.com business-wise, it is clear Lucious loves Cookie. -

EMPIRE and Comfort Systems OWNER’S MANUAL

INSTALLATION INSTRUCTIONS EMPIRE AND Comfort Systems OWNER’S MANUAL DIRECT VENT Direct Vent Zero Clearance Gas GAS FIREPLACE HEATER Fireplace Heater MODEL SERIES MILLIVOLT STANDING PILOT DVP42DP31(N,P)-2 DIRECT IGNITION DVP42DP51N-1 INTERMITTENT PILOT DVP42DP71(N,P)-3 REMOTE RF Installer: Leave this manual with the appliance. DVP42DP91(N,P)-3 Consumer: Retain this manual for future reference. UL FILE NO. MH30033 GAS-FIRED WARNING: If the information in these instruc- tions are not followed exactly, a fire or explosion may result causing property damage, personal in- jury or loss of life. — Do not store or use gasoline or other flammable WARNING: If not installed, operated and maintained vapors and liquids in the vicinity of this or any in accordance with the manufacturer’s instructions, other appliance. this product could expose you to substances in fuel — WHAT TO DO IF YOU SMELL GAS or from fuel combustion which can cause death or • Do not try to light any appliance. serious illness. • Do not touch any electrical switch; do not use any phone in your building. This appliance may be installed in an aftermarket, • Immediately call your gas supplier from a permanently located, manufactured home (USA only) neighbor’s phone. Follow the gas supplier’s or mobile home, where not prohibited by state or local instructions. codes. • If you cannot reach your gas supplier, call the fire department. This appliance is only for use with the type of gas indicated on the rating plate. This appliance is not — Installation and service must be performed by a convertible for use with other gases, unless a certified qualified installer, service agency or the gas sup- kit is used. -

Ever Faithful

Ever Faithful Ever Faithful Race, Loyalty, and the Ends of Empire in Spanish Cuba David Sartorius Duke University Press • Durham and London • 2013 © 2013 Duke University Press. All rights reserved Printed in the United States of America on acid-free paper ∞ Tyeset in Minion Pro by Westchester Publishing Services. Library of Congress Cataloging- in- Publication Data Sartorius, David A. Ever faithful : race, loyalty, and the ends of empire in Spanish Cuba / David Sartorius. pages cm Includes bibliographical references and index. ISBN 978- 0- 8223- 5579- 3 (cloth : alk. paper) ISBN 978- 0- 8223- 5593- 9 (pbk. : alk. paper) 1. Blacks— Race identity— Cuba—History—19th century. 2. Cuba— Race relations— History—19th century. 3. Spain— Colonies—America— Administration—History—19th century. I. Title. F1789.N3S27 2013 305.80097291—dc23 2013025534 contents Preface • vii A c k n o w l e d g m e n t s • xv Introduction A Faithful Account of Colonial Racial Politics • 1 one Belonging to an Empire • 21 Race and Rights two Suspicious Affi nities • 52 Loyal Subjectivity and the Paternalist Public three Th e Will to Freedom • 94 Spanish Allegiances in the Ten Years’ War four Publicizing Loyalty • 128 Race and the Post- Zanjón Public Sphere five “Long Live Spain! Death to Autonomy!” • 158 Liberalism and Slave Emancipation six Th e Price of Integrity • 187 Limited Loyalties in Revolution Conclusion Subject Citizens and the Tragedy of Loyalty • 217 Notes • 227 Bibliography • 271 Index • 305 preface To visit the Palace of the Captain General on Havana’s Plaza de Armas today is to witness the most prominent stone- and mortar monument to the endur- ing history of Spanish colonial rule in Cuba. -

Scene on Radio American Empire (Season 4, Episode 9) Transcript

Scene on Radio American Empire (Season 4, Episode 9) Transcript http://www.sceneonradio.org/s4-e9-american-empire/ John Biewen: Chenjerai, we are opening a can of worms with this one. We’ve talked a lot about how the U.S. has dealt with democracy on the North American continent. But we really haven’t explored the U.S role in democracy out there in the larger world. Chenjerai Kumanyika: Oh, so you mean like how we’ve brought democracy to other people around the world? John Biewen: Well, we’ve brought something. But, yes, actually I thought we should as part of this series, we should explore an idea that is controversial for a lot of people, and that is the idea of American empire. Chenjerai Kumanyika: Okay, so, what you’re saying is we’re about to start a whole new podcast. Like right now. John Biewen: (Laughs) Exactly. Obviously, it could be at least a twenty part series, but actually, for today, maybe, could we just do one episode? 1 Chenjerai Kumanyika: I think it’s easy actually. America’s not an empire. We’re a force for freedom in the world, and my evidence for this is World War II. And I think we’re done. Thanks for listening. John Biewen: (laughs) Yeah. That does settle it really. Chenjerai Kumanyika: This is one of those areas where I think it’s good to have a podcast actually, because this stuff comes up in my social world, you know, like at dinner parties. Do you remember before COVID when we used to actually have dinner parties? John Biewen: Faint memories of that experience. -

Improving Small Business Lending in the Rochester NY Community

#AllTogetherNow: Improving Small Business Lending in the Rochester NY Community WRITTEN BY: BARBARA VAN KERKHOVE, PhD. EMPIRE JUSTICE CENTER BOARD OF DIRECTORS JoAnn Smith (Chair) Raymond Brescia, Esq. (Vice Chair) Rivera Carey PLLC Albany Law School Kristen Clark CPA, FHFMA (Treasurer) Deborah P. Amory, Ph.D (Secretary) The Bonadio Group Empire State College Odette Belton, Esq. John P. Bringewatt, Esq. Monroe County Public Defender Harter Secrest & Emery LLP Tehresa Coles Maureen DeRosa The AYCO Company Albany Nancy Engelhardt L. Theresa Macon Energeia Partnership at Molloy College Rochester David Tennant, Esq. Emily Whalen, Esq. Nixon Peabody Brown & Weinraub All directors serve as volunteers. EMPIRE JUSTICE CENTER LEADERSHIP Anne Erickson, President & CEO Bryan Hetherington, Chief Counsel Kristin Brown, Vice President Kristi Hughes, Vice President Lori McCormick, Chief Financial Officer ABOUT EMPIRE JUSTICE CENTER Empire Justice Center is a statewide, public interest law firm with offices in Albany, Rochester, White Plains, Yonkers and Central Islip (Long Island). Empire Justice focuses on changing the “systems” within which poor and low-income families live. With a focus on poverty law, Empire Justice undertakes research and training, acts as an informational clearinghouse, and provides litigation backup to local legal services programs and community based organizations. As an advocacy organization, Empire Justice engages in legislative and administrative advocacy on behalf of those impacted by poverty and discrimination. As a non-profit law firm, Empire Justice provides legal assistance to those in need and undertakes impact litigation in order to protect and defend the rights of disenfranchised New Yorkers. #AllTogetherNow 2 TABLE OF CONTENTS I INTRODUCTION 3 II PURPOSE OF REPORT AND STRUCTURE 5 III AGGREGATE ANALYSIS 5 A.