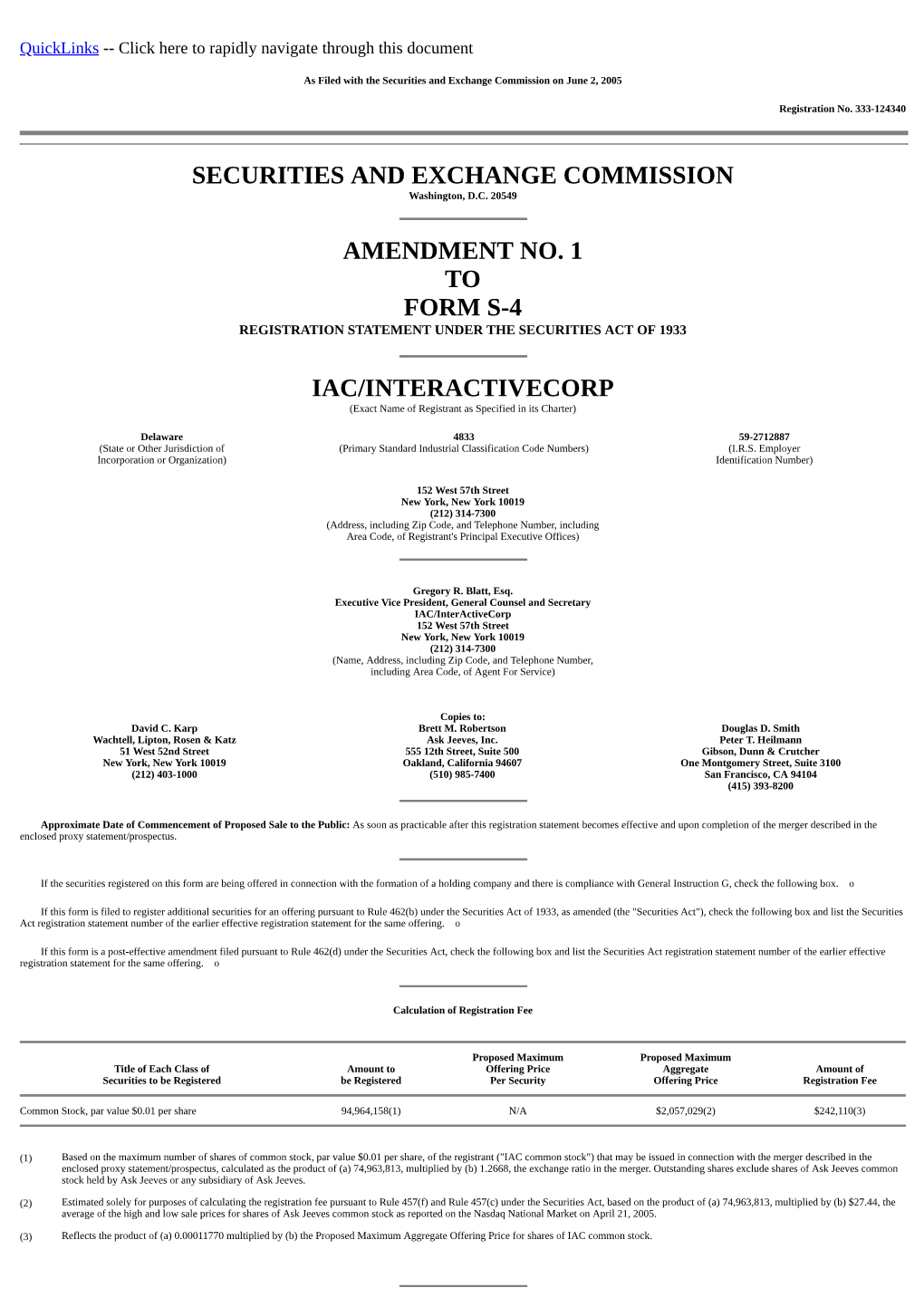

Securities and Exchange Commission on June 2, 2005

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Internet Economy 25 Years After .Com

THE INTERNET ECONOMY 25 YEARS AFTER .COM TRANSFORMING COMMERCE & LIFE March 2010 25Robert D. Atkinson, Stephen J. Ezell, Scott M. Andes, Daniel D. Castro, and Richard Bennett THE INTERNET ECONOMY 25 YEARS AFTER .COM TRANSFORMING COMMERCE & LIFE March 2010 Robert D. Atkinson, Stephen J. Ezell, Scott M. Andes, Daniel D. Castro, and Richard Bennett The Information Technology & Innovation Foundation I Ac KNOW L EDGEMEN T S The authors would like to thank the following individuals for providing input to the report: Monique Martineau, Lisa Mendelow, and Stephen Norton. Any errors or omissions are the authors’ alone. ABOUT THE AUTHORS Dr. Robert D. Atkinson is President of the Information Technology and Innovation Foundation. Stephen J. Ezell is a Senior Analyst at the Information Technology and Innovation Foundation. Scott M. Andes is a Research Analyst at the Information Technology and Innovation Foundation. Daniel D. Castro is a Senior Analyst at the Information Technology and Innovation Foundation. Richard Bennett is a Research Fellow at the Information Technology and Innovation Foundation. ABOUT THE INFORMATION TECHNOLOGY AND INNOVATION FOUNDATION The Information Technology and Innovation Foundation (ITIF) is a Washington, DC-based think tank at the cutting edge of designing innovation policies and exploring how advances in technology will create new economic opportunities to improve the quality of life. Non-profit, and non-partisan, we offer pragmatic ideas that break free of economic philosophies born in eras long before the first punch card computer and well before the rise of modern China and pervasive globalization. ITIF, founded in 2006, is dedicated to conceiving and promoting the new ways of thinking about technology-driven productivity, competitiveness, and globalization that the 21st century demands. -

Electronic Commerce Basics

Electronic Commerce Principles and Practice This Page Intentionally Left Blank Electronic Commerce Principles and Practice Hossein Bidgoli School of Business and Public Administration California State University Bakersfield, California San Diego San Francisco New York Boston London Sydney Tokyo Toronto This book is printed on acid-free paper. ∞ Copyright © 2002 by ACADEMIC PRESS All Rights Reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage and retrieval system, without permission in writing from the publisher. Requests for permission to make copies of any part of the work should be mailed to: Permissions Department, Harcourt Inc., 6277 Sea Harbor Drive, Orlando, Florida 32887-6777 Academic Press A Harcourt Science and Technology Company 525 B Street, Suite 1900, San Diego, California 92101-4495, USA http://www.academicpress.com Academic Press Harcourt Place, 32 Jamestown Road, London NW1 7BY, UK http://www.academicpress.com Library of Congress Catalog Card Number: 2001089146 International Standard Book Number: 0-12-095977-1 PRINTED IN THE UNITED STATES OF AMERICA 010203040506EB987654321 To so many fine memories of my brother, Mohsen, for his uncompromising belief in the power of education This Page Intentionally Left Blank Contents in Brief Part I Electronic Commerce Basics CHAPTER 1 Getting Started with Electronic Commerce 1 CHAPTER 2 Electronic Commerce Fundamentals 39 CHAPTER 3 Electronic Commerce in Action -

Information Security and Ethics: Social and Organizational Issues

Information Security and Ethics: Social and Organizational Issues Marian Quigley IRM Press Information Security and Ethics: Social and Organizational Issues Marian Quigley Monash University, Australia IRM Press Publisher of innovative scholarly and professional information technology titles in the cyberage Hershey • London • Melbourne • Singapore Acquisitions Editor: Mehdi Khosrow-Pour Senior Managing Editor: Jan Travers Managing Editor: Amanda Appicello Development Editor: Michele Rossi Copy Editor: Ingrid Widitz Typesetter: Amanda Appicello Cover Design: Debra Andree Printed at: Integrated Book Technology Published in the United States of America by IRM Press (an imprint of Idea Group Inc.) 701 E. Chocolate Avenue, Suite 200 Hershey PA 17033-1240 Tel: 717-533-8845 Fax: 717-533-8661 E-mail: [email protected] Web site: http://www.irm-press.com and in the United Kingdom by IRM Press (an imprint of Idea Group Inc.) 3 Henrietta Street Covent Garden London WC2E 8LU Tel: 44 20 7240 0856 Fax: 44 20 7379 3313 Web site: http://www.eurospan.co.uk Copyright © 2005 by IRM Press. All rights reserved. No part of this book may be reproduced in any form or by any means, electronic or mechanical, including photocopying, without written permission from the publisher. Library of Congress Cataloging-in-Publication Data Information security and ethics : social and organizational issues / Marian Quigley, editor. p. cm. Includes bibliographical references and index. ISBN 1-59140-233-6 (pbk.) -- ISBN 1-59140-286-7 (hardcover) -- ISBN 1-59140-234-4 (ebook) 1. Technology--Social aspects. 2. Computer security. 3. Information technology--Social aspects. 4. Information technology--Moral and ethical aspects. I. -

Harnessing Collective Intelligence for the Learning Communities; a Review of Web 2.0 and Social Computing Technologies

Journal of Computer Science and Information Technology June 2014, Vol. 2, No. 2, pp. 111-129 ISSN: 2334-2366 (Print), 2334-2374 (Online) Copyright © The Author(s). 2014. All Rights Reserved. Published by American Research Institute for Policy Development Harnessing Collective Intelligence for the Learning Communities; a Review of Web 2.0 and Social Computing Technologies R. K. Sungkur1 and D. Rungen1 Abstract Web 2.0 and Social Computing is based upon the knowledge of connecting people globally using adequate technologies to increase people interaction. Technology has always played a key role for innovation in education, and with the advent of Web 2.0 and social computing, educators have been quick in recognizing the great potential that this represents. There has been a dramatic shift of information power and everything is decentralized, participatory and collaborative. Properly filtering and harnessing ‘user-generated content’ in web 2.0 and social computing can represent a valuable repository of knowledge for the learning communities. Nowadays, the number of people accessing social websites is rising exponentially and educators are seriously contemplating the option of using these social websites to reach the learners, especially youngsters. The Facebook phenomenon is particularly true in this situation where we find many learners sharing notes, uploading learning materials, discussing on a particular topic related to learning and education. So in a way, we find that these social websites are no longer being used only for entertainment but also for learning purposes. This is limited not only to Facebook. So many social websites together with the accompanying web 2.0 tools and features if properly used, can represent an interesting repository of knowledge. -

State Dependence at Internet Portals

State Dependence at Internet Portals AVI GOLDFARB Joseph L. Rotman School of Management University of Toronto Toronto, ON M5S 3E6 Canada [email protected]. This study offers evidence of the existence of switching costs on the Internet. It uses more flexible methods than previously possible to separate switching costs from serially correlated unobservables at Internet portals. The data contain nearly 1,000 observations per household, allowing for household- specific regressions that control for all household-specific heterogeneity. The results show that households exhibit switching costs. The loyalty generated by these costs drives a large fraction of portal visits and generates considerable revenues; however, these revenues are not large enough to justify the losses incurred by Internet portals in the 1990s while building market share. The results also suggest that random coefficients models overestimate true state dependence. 1. Introduction Consumers who have purchased a particular brand in the past often face (real or perceived) costs of purchasing a different brand. Klemperer (1995) and others have shown that these “switching costs” give firms market power over their repeat customers. If switching costs are large enough, they may imply that current market shares drive future prof- itability. Furthermore, switching costs may discourage entry, dampen incentives to differentiate, and generally reduce competitiveness. The perception that significant switching costs would provide above-normal returns in the long run led many Internet businesses in the 1990s to incur short-run losses in pursuit of market share. Fast Company This research was supported by the Social Science Research Council’s Program in Applied Economics Predissertation Fellowship, by a Plurimus Corporation Fellowship, and by a SSHRC grant number 538-02-1013. -

FALSE ORACLES: Consumer Reaction to Learning the Truth About How Search Engines Work Results of an Ethnographic Study

FALSE ORACLES: Consumer Reaction to Learning the Truth About How Search Engines Work Results of an Ethnographic Study A report by Leslie Marable Researcher/Writer Consumer WebWatch Based on field research conducted by Context-Based Research Group Released: June 30, 2003 AKNOWLEDGEMENTS: Consumer WebWatch would like to thank the following people for their assistance in helping to shape the early phases of this project. Sambhavi Cheemalapati, Research Librarian, Information Center, Consumers Union Denise I. Garcia, Principal Analyst, Media & Advertising, Gartner G2 Sandy Schlosser, New Media Project Manager, ConsumerReports.org Beverly J. Thomas, Senior Attorney, Internet Advertising Program, U.S. Federal Trade Commission 2 TABLE OF CONTENTS EXECUTIVE SUMMARY.........................................................................................................................................4 MAJOR FINDINGS:........................................................................................................................................5 FIGURE 1: PARTICIPANT DEMOGRAPHIC PROFILES.......................................................................5 INTRODUCTION.......................................................................................................................................................7 THE 15 SITES ASSESSED IN THIS STUDY: ..............................................................................................7 WHY FOCUS ON SEARCH ENGINES? .....................................................................................................8 -

Unleashing the Ideavirus 1 Unleashing the Ideavirus

Unleashing the Ideavirus 1 www.ideavirus.com Unleashing the Ideavirus By Seth Godin Foreword by Malcolm Gladwell ©2000 by Do You Zoom, Inc. You have permission to post this, email this, print this and pass it along for free to anyone you like, as long as you make no changes or edits to its contents or digital format. In fact, I’d love it if you’d make lots and lots of copies. The right to bind this and sell it as a book, however, is strictly reserved. While we’re at it, I’d like to keep the movie rights too. Unless you can get Paul Newman to play me. Ideavirus™ is a trademark of Do You Zoom, Inc. So is ideavirus.com™. Designed by Red Maxwell You can find this entire manifesto, along with slides and notes and other good stuff, at www.ideavirus.com . This version of the manifesto is current until August 17, 2000. After that date, please go to www.ideavirus.com and get an updated version. You can buy this in book form on September 1, 2000. This book is dedicated to Alan Webber and Jerry Colonna. Of course. Unleashing the Ideavirus 2 www.ideavirus.com STEAL THIS IDEA! Here’s what you can do to spread the word about Unleashing the Ideavirus: 1. Send this file to a friend (it’s sort of big, so ask first). 2. Send them a link to www.ideavirus.com so they can download it themselves. 3. Visit www.fastcompany.com/ideavirus to read the Fast Company article. -

Starting an Online Business for Dummies, 6Th Edition

Index global networking, 254 • Symbols and guerilla marketing, 249–250 language, 251–255 Numerics • multilingual sites, 252–253, 255 = (equal sign), 139 newsgroups, 242–244 (...) ellipses, 323 newsletters, 198–199, 235, 238–241 1-800-FLOWERS, 343–344 overview, 233–234 1shoppingcart.com (Web site), 241 paying for, 261 1st American Card Service, 173, 174 professional services, 60–61 1000 Markets (Web site), 317 salutations, 251–252 AdWords (Google), 247, 263–268, 290 affi liate (Amazon.com), 288–290 • A • affi liate network, 291 About Me page (eBay), 306–309 Alfresco, 210–211 About.com (Web site), 62 algorithms, 161 Absolute Software Corp.’s CompuTrace Alibaba marketplace, 228 Plus, 159 AliExpress (Web site), 228 Access Market Square (Web site), 91 alt discussion group, 214–215 accounting Amazing Keys (Web site), 22 methods of, 372–373 Amazon, 19, 34, 287–294 programs for, 41 American Express, 173–174 tools “An American in the French Languedoc” basics, 371–376 (Vickers), 236 software, 376–381 animating ads, 250 taxes, 381–384 announcement lists, 243 accounting periods, 373 antivirus protection, 156–157 accrual-basis accounting, compared with AOL, as Internet search service, 261 cash-basis accounting, 372–373 AOL Shopping, 91 Ad-Aware, 159–160 applets (Java), 108 Adler, David M. (attorney), 356 application service provider (ASP), Adobe Acrobat Reader, 365 150–153 Adobe ColdFusion, 148 AquaPrix, Inc. (Web site), 150 Adobe Dreamweaver,COPYRIGHTED 101–102, 130–131 Arlington MATERIAL Virginia Computer Repair, 62 Adobe PageMaker, 99 Art Gaga (Web site), 63 Adobe Photoshop, 76, 313, 365 ArtFire Adobe Quark Xpress, 99 customer service, 196 Adobe Systems Inc. -

Causes of Failure in Web Applications

Causes of Failure in Web Applications Soila Pertet and Priya Narasimhan CMU-PDL-05-109 December 2005 Parallel Data Laboratory Carnegie Mellon University Pittsburgh, PA 15213-3890 Abstract This report investigates the causes and prevalence of failure in Web applications. Data was collected by surveying case studies of system failures and by examining incidents of website outages listed on technology websites such as CNET.com and eweek.com. These studies suggest that software failures and human error account for about 80% of failures. The report also contains an appendix that serves as a quick reference for common failures observed in Web applications. This appendix lists over 40 incidents of real-world site outages, outlining how these failures were detected, the estimated downtime, and the subsequent recovery action. Acknowledgements: We thank the members and companies of the PDL Consortium (including EMC, Hewlett-Packard, Hitachi, IBM, Intel, Microsoft, Network Appliance, Oracle, Panasas, Seagate, Sun, and Veritas) for their interest, insights, feedback, and support. 1 . Keywords: Web applications, causes of failure, fault chains, unplanned downtime. 2 1 Introduction The Web serves as an integral part of the day-to-day operation of many organizations. Businesses often rely on the Web to attract clients, communicate with suppliers, and generate revenues. As a result, the cost of failed online transactions can be significant: a single hour of downtime could cost a retailer thousands of dollars in lost sales. For example, during the Thanksgiving holiday weekend in 2001, Amazon.com suffered a series of outages, which cost the retailer an estimated $25,000 per minute of downtime [1]. -

Mosaic® USA Group and Segment Descriptions Mosaic USA

Mosaic® USA Group and Segment Descriptions Mosaic USA Group and Segment listing % of Households A01 American Royalty 0.73% Power Elite Platinum Prosperity A02 1.43% A A03 Kids and Cabernet 0.96% Picture Perfect Families 1.10% 6.13% A04 A05 Couples with Clout 1.43% A06 Jet Set Urbanites 0.48% B07 Generational Soup 0.98% Flourishing Families Babies and Bliss 1.65% 4.42% B08 B B09 Family Fun-tastic 1.22% B10 Asian Achievers 0.56% C11 Aging of Aquarius 2.34% Booming with Confidence C12 Golf Carts and Gourmets 0.41% C 5.34% C13 Silver Sophisticates 0.97% C14 Boomers and Boomerangs 1.62% D15 Sports Utility Families 1.77% Suburban Style D16 Settled in Suburbia 0.77% D 5.02% D17 Cul de Sac Diversity 1.03% D18 Soulful Spenders 1.45% E19 Full Pockets, Empty Nests 1.10% Thriving Boomers E20 No Place Like Home 1.50% E 5.13% E21 Unspoiled Splendor 2.52% Fast Track Couples 1.59% Promising Families F22 F 3.36% F23 Families Matter Most 1.77% Status Seeking Singles 1.29% Young, City Solos G24 G25 Urban Edge 0.72% G 2.01% H26 Progressive Potpourri 1.00% Middle-class Melting Pot Birkenstocks and Beemers 1.18% 5.76% H27 H H28 Everyday Moderates 1.09% H29 Destination Recreation 2.49% I30 Stockcars and State Parks 1.50% Family Union I31 Blue Collar Comfort 1.38% I 5.40% I32 Latin Flair 0.98% I33 Hispanic Harmony 1.55% J34 Aging in Place 2.41% Autumn Years J35 Rural Escape 1.76% J 5.64% J36 Settled and Sensible 1.48% K37 Wired for Success 1.00% Significant Singles K38 Gotham Blend 1.01% K 4.72% K39 Metro Fusion 1.01% K40 Bohemian Groove 1.92% L41 Booming and -

How Search Engines Work

How Search Engines Work By Danny Sullivan, Editor October 14, 2002 The term "search engine" is often used generically to describe both crawler-based search engines and human-powered directories. These two types of search engines gather their listings in radically different ways. Crawler-Based Search Engines Crawler-based search engines, such as Google, create their listings automatically. They "crawl" or "spider" the web, then people search through what they have found. If you change your web pages, crawler-based search engines eventually find these changes, and that can affect how you are listed. Page titles, body copy and other elements all play a role. Human-Powered Directories A human-powered directory, such as the Open Directory, depends on humans for its listings. You submit a short description to the directory for your entire site, or editors write one for sites they review. A search looks for matches only in the descriptions submitted. Changing your web pages has no effect on your listing. Things that are useful for improving a listing with a search engine have nothing to do with improving a listing in a directory. The only exception is that a good site, with good content, might be more likely to get reviewed for free than a poor site. "Hybrid Search Engines" Or Mixed Results In the web's early days, it used to be that a search engine either presented crawler-based results or human-powered listings. Today, it extremely common for both types of results to be presented. Usually, a hybrid search engine will favor one type of listings over another. -

A Practical Guide to Planning for E-Business Success: How to E

A Practical Guide to Planning for E-Business Success How to E-Enable Your Enterprise A Practical Guide to Planning for E-Business Success How to E-Enable Your Enterprise Anita Cassidy ST. LUCIE PRESS A CRC Press Company Boca Raton London New York Washington, D.C. A Practical Guide to Planning for E-Business Success How to E-Enable Your Enterprise SL3046_frame_FM Page ii Friday, July 13, 2001 4:11 PM A Practical Guide to Planning for E-Business Success How to E-Enable Your Enterprise Anita Cassidy ST. LUCIE PRESS A CRC Press Company Boca Raton London New York Washington, D.C. 3046/disclaimer Page 1 Wednesday, July 18, 2001 11:41 AM Library of Congress Cataloging-in-Publication Data Cassidy, Anita. A practical guide to planning for E-business success : how to E-enable your enterprise / by Anita Cassidy. p. cm. Includes index. ISBN 1-57444-304-6 (alk. paper) 1. Electronic commerce. 2. Business enterprises—Computer network resources. 3. Business planning. 4. Internet. I. Title: Guide to planning for E-business success. II. Title: Planning for E-business success. III. Title. HF5548.32 .C377 2001 658¢.054678—dc21 2001041872 This book contains information obtained from authentic and highly regarded sources. Reprinted material is quoted with permission, and sources are indicated. A wide variety of references are listed. Reasonable efforts have been made to publish reliable data and information, but the author and the publisher cannot assume responsibility for the validity of all materials or for the consequences of their use. Neither this book nor any part may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, microfilming, and recording, or by any information storage or retrieval system, without prior permission in writing from the publisher.