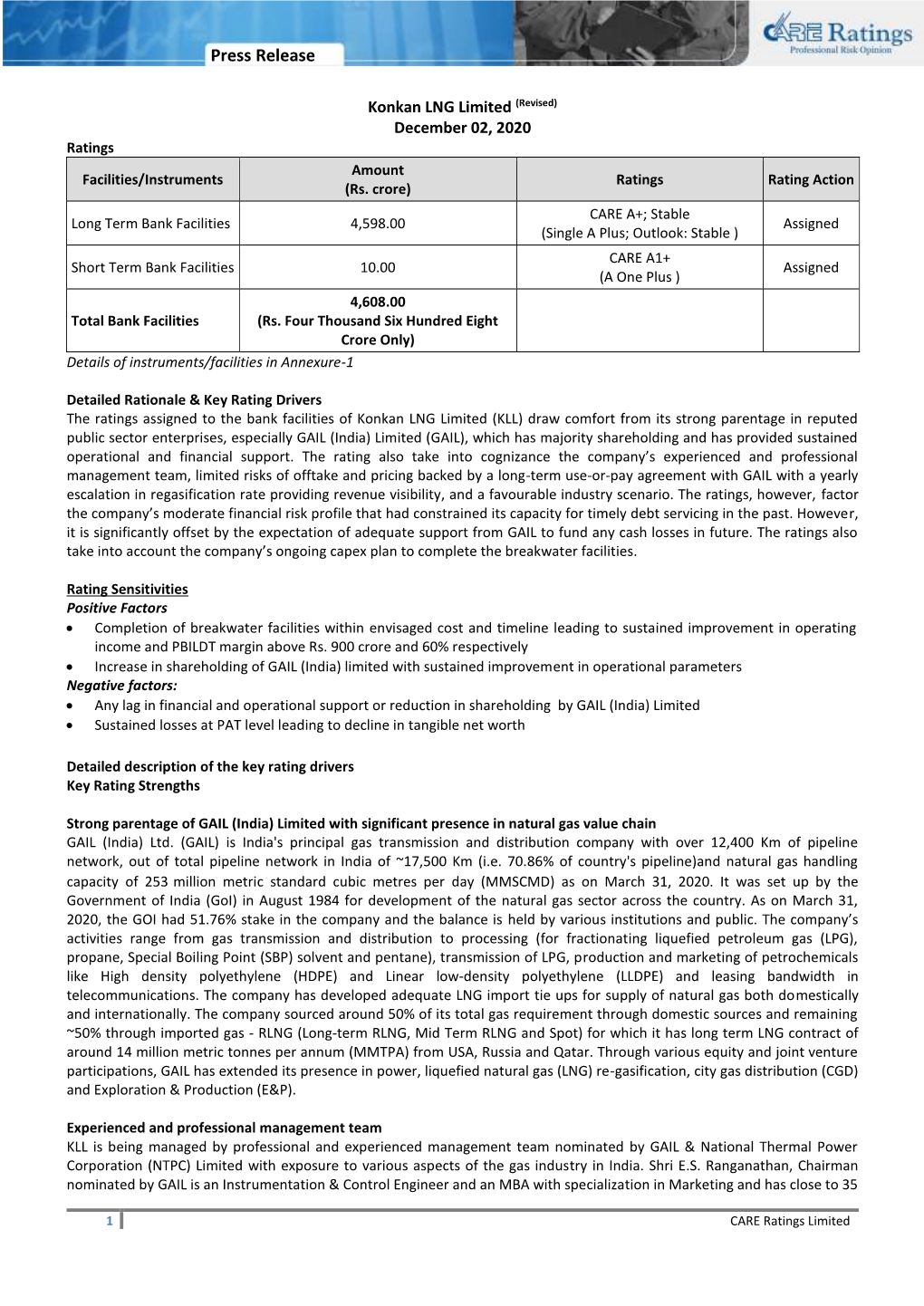

Konkan LNG Limited (Revised) December 02, 2020 Ratings Amount Facilities/Instruments Ratings Rating Action (Rs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cover 1 the Enron Story

Cover 1 The Enron Story: Controversial Issues and People s Struggle Contents Preface I. The Project and the First Power Purchase Agreement II. Techno-economic and Environmental Objections III. Local People“s Concerns and Objections IV. Grassroots Resistance, Cancellation of the Project and It“s Revival V. The Renegotiated Enron Deal and Resurgence of Grassroots Resistance VI. Battle in the Court VII. Alternatives to Enron Project Conclusions Appendices I Debate on Techno-economic objections II The Merits of the Renegotiated Project III Excerpts from the Reports of Amnesty International IV Chronology of Events Glossary The Enron Story, Prayas, Sept. 1997 Cover 3 Cover 4 The Enron Story, Prayas, Sept. 1997 (PRAYAS Monograph Series) The Enron Story: Controversial Issues and People s Struggle Dr. Subodh Wagle PRAYAS Amrita Clinic, Athavale Corner Karve Road Corner, Deccan Gymkhana Pune, 411-004, India. Phone: (91) (212) 341230 Fax: (91) (212) 331250 (Attn: # 341230) PRAYAS Printed At: The Enron Story, Prayas, Sept. 1997 For Private Circulation Only Requested Contribution: Rs. 15/- The Enron Story, Prayas, Sept. 1997 Preface cite every source on every occasion in such a brief monograph. But I am indebted for the direct and indirect help from many The Enron controversy has at least four major categories individuals (and their works) including, Sulbha Brahme, Winin of issues: techno-economic, environmental, social, and legal or Pereira and his INDRANET group, Samaj Vidnyan Academy, procedural. In the past, the Prayas Energy Group has concentrated Abhay Mehta, and many activists especially, Yeshwant Bait, its efforts mainly on the techno-economic issues. Many Ashok Kadam, and Arun and Vijay Joglekar. -

Maharatna Companies, Along with Important Information of the Maharatna Companies

The Government of India categorizes Central Public Sector Enterprises (CPSEs) under three different categories - Maharatna, Navratna, and Miniratna. These categorisations are based on different criteria. This article gives the eligibility criteria for the status; list of Maharatna companies, along with important information of the Maharatna companies. Aspirants preparing for IAS Exam should have a firm grip over the latest developments in the field of Economy. Maharatna Companies - Eligibility Criteria & Benefits of the Maharatna Status PSUs in India are also categorised based on their special non-financial objectives and are registered under Section 8 of Companies Act, 2013 (erstwhile Section 25 of Companies Act, 1956). In 2010, the government established the higher Maharatna category. Eligibility Criteria: 1. Three years with an average annual net profit of over Rs. 2500 crore or 2. Average annual Turnover of Rs. 20,000 crore for 3 years, or 3. Average annual Net worth of Rs. 10,000 crore for 3 years Benefits for Investment: 1. Rs. 1,000 crore - Rs. 5,000 crore, or free to decide on investments up to 15% of their net worth in a project Maharatna Companies - List of 10 Central Public Sector Enterprises (CPSE) Below table gives the list of Maharatna Companies (As of January 2020) Sl.No Central Public Sector Enterprises (CPSE) 1 National Thermal Power Corporation (NTPC) 2 Oil and Natural Gas Corporation (ONGC) 3 Steel Authority of India Limited (SAIL) 4 Bharat Heavy Electricals Limited (BHEL) 5 Indian Oil Corporation Limited (IOCL) 6 Hindustan Petroleum Corporation Limited (HPCL) 7 Coal India Limited (CIL) 8 Gas Authority of India Limited (GAIL) 9 Bharat Petroleum Corporation Limited (BPCL) 10 Power Grid Corporation of India (POWERGRID) Maharatna Companies - Brief Details of 10 Public Sector Enterprises National Thermal Power Corporation (NTPC) In May 2010, NTPC was conferred Maharatna status by the Union Government of India. -

Konkan LNG Private Limited (KLPL), Dabhol ------RFQ/ Tender No: KLPL/C&P/INST/SFL011/33000011/2019-20 Dated 01.08.2019

Konkan LNG Private Limited (KLPL), Dabhol ---------------------------------------------------------------------------------- RFQ/ Tender No: KLPL/C&P/INST/SFL011/33000011/2019-20 dated 01.08.2019 BIDDING DOCUMENT FOR Hiring of AMC for Testing and Calibration of IR Gas Detectors in LNG terminal at KLPL for contract period of 24 months. TENDERING UNDER “DOMESTIC COMPETITIVE BIDDING” Prepared and Issued by Konkan LNG Private Limited At & Post Anjanwel, Tal-Guhagar Dist.: Ratnagiri Maharashtra-415634 Ph. No. : 02359-241015 BID/OFFER/TENDER IS TO BE SUBMITTED AT BELOW ADDRESS THROUGH REGD.POST / COURIER:- HOD (C&P), Konkan LNG Private Limited At & Post Anjanwel, Tal-Guhagar Dist.: Ratnagiri Maharashtra-415634 Ph. No. : 02359-241015 Tender No: KLPL/C&P/INST/SFL011/33000011/2019-20 for Hiring of AMC for Testing and Calibration of IR Gas Detectors in LNG terminal at KLPL for contract period of Two years Page 1 of 162 SECTION-I INVITATION FOR BID (IFB) Tender No: KLPL/C&P/INST/SFL011/33000011/2019-20 for Hiring of AMC for Testing and Calibration of IR Gas Detectors in LNG terminal at KLPL for contract period of Two years. Page 2 of 162 SECTION-I "INVITATION FOR BID (IFB)” Ref No: KLPL/C&P/INST/SFL011/33000011/2019-20 Date: 01.08.2019 To, PROSPECTIVE BIDDERS SUB: TENDER DOCUMENT FOR Hiring of AMC for Testing and Calibration of IR Gas Detectors in LNG terminal at KLPL for contract period of 24 months. Dear Sir/Madam, 1.0 Konkan LNG Pvt. Limited, promoted by M/s GAIL (India) Limited & M/s NTPC Limited, having registered office at 16, Bhikaji Cama Place, New Delhi 110066 & CIN No. -

NTPC Limited and BPDP on Build, Own and Operate Basis

Name of the Issue: NTPC 1Type of issue (IPO/ FPO) FPO 2 Issue size (Rs cr) 8,480.10 3 Grade of issue alongwith name of the rating agency Not applicable* * Grading applicable only for initial public offerings, as per ICDR and other applicable regulations 4 Subscription Level (Number of times) 1.24* Source: Final Post Issue Monitoring Report. * The above figure is net of cheque returns, but before technical rejections; Amount of subscription includes all bids received at Employee price of Rs 191 for eligible Employees, at floor price of Rs 201 for Retail Category and Non Institutional Category and above Floor Price of Rs 201 per equity share, at clearing price of Rs. 202 per equity share received from QIBs 5 QIB Holding (as a % of outstanding capital) Particulars % (i) allotment in the issue - Feb 18, 2010 (1) 4.53% (ii) at the end of the 1st Quarter immediately after the listing of the issue (March 31, 2010) (2) 11.59% (iii) at the end of 1st FY (March 31, 2010) (2) 11.59% (iv) at the end of 2nd FY (March 31, 2011) (2) 11.84% (v) at the end of 3rd FY (March 31, 2012) (2) 11.68% Source: (1) Basis of Allotment. Excludes pre-issue holding by QIBs. (2) Clause 35 Reporting with the Stock Exchanges. Represents holding of "Institutions" category. 6 Financials of the issuer (Rs. Crore) Parameters 1st FY (March 31, 2010) 2nd FY (March 31, 2011) 3rd FY (March 31, 2012) Income from operations* 50,163. 3 59,505.4 65,893.7 Net Profit for the period 8,837. -

BRIEF SUMMARY of the PROJECT 1 Indian Oil Corporation Ltd

BRIEF SUMMARY OF THE PROJECT Indian Oil Corporation Ltd. (Indian Oil) is India's largest public corporation in terms of revenue and is one of the five Maharatna status companies of India, apart from Coal India Limited, NTPC Limited, Oil and Natural Gas Corporation and Steel Authority of India Limited. It is the highest ranked Indian company and the world's 119th largest public corporation in the prestigious Fortune 'Global 500' listing in the year 2015. Beginning in 1959 as Indian Oil Company Ltd., Indian Oil Corporation Ltd. was formed in 1964 with the merger of Indian Refineries Ltd. (Estd. 1958). Indian Oil accounts for nearly half of India's petroleum products market share, 35% national refining capacity (together with its subsidiary Chennai Petroleum Corporation Ltd., or CPCL), and 71% downstream sector pipelines through capacity. The Indian Oil Group owns and operates 11 of India's 23 refineries with a combined refining capacity of 80.7 MMTPA (million metric tons per annum). There are nine refineries located at Guwahati, Digboi, Barauni, Gujarat, Haldia, Mathura, Panipat, Bongaigaon and Paradeep these also include refineries of subsidiary Chennai Petroleum Corporation Ltd. (CPCL). The Corporation's cross-country pipelines network, for transportation of crude oil to refineries and finished products to high-demand centers, spans over 11,220 km. With a throughout capacity of 80.49 MMTPA for crude oil and petroleum products and 9.5 MMSCMD for gas, this network meets the vital energy needs of the consumers in an efficient, economical and environment-friendly manner. This is First phase Petroleum product storage capacity enhancement project at existing Jaipur petroleum terminal at Mohanpura, Jaipur of Indian Oil Corporation Ltd. -

Eoi for 1000 Mwh of BESS at NTPC Power Plants

(GLOBAL INVITATION FOR EXPRESSION OF INTEREST) NTPC Limited (A Government of India Enterprise) Invites Expression of Interest (EoI) From Any Indian/Global Company/ their Consortium/ Affiliates/Representatives For SettinG up 1000 MWh of Grid-scale Battery EnerGy StoraGe System (BESS) at NTPC Power Plants in India 1 | Page (GLOBAL INVITATION FOR EXPRESSION OF INTEREST) DOCUMENTS OF EoI This EOI document comprises the following sections: (i) Section I : EoI Information (ii) Section II : Introduction (iii) Section III : Instructions to the Applicants (iv) Section IV : Consideration of Response (v) Section V : Application Form and Annexures 2 | Page (GLOBAL INVITATION FOR EXPRESSION OF INTEREST) Section - I EoI Information 3 | Page (GLOBAL INVITATION FOR EXPRESSION OF INTEREST) DETAILED NOTICE INVITING EXPRESSION OF INTEREST (EoI) EoI No.: NTPC/BD/EoI-05/2021-22 Date: 26.06.2021 NTPC is InvitinG an Expression of Interest from Indian/Global Company/ their Con- sortium/ Affiliates/Representatives for settinG up 1000 MWh of Grid-scale Battery EnerGy StoraGe System at sinGle/split across multiple NTPC Power Plants in India 1. NTPC Limited (A Government of India Enterprise) intends to set up 1000 MWh of Grid-scale Battery Energy Storage System at single/split across multiple NTPC power plants in India. In this regard, NTPC Limited invites Expression of Interest (EoI) from any Indian/Global Company/their Consortium/Affiliates/Representatives (hereinafter called APPLICANT). Note: This EOI is to assess commercialization prospects of Setting up Grid- scale Battery Energy Storage System. The BESS shall be set up within NTPC power plant premises. After identifying the APPLICANTs through EoI who are interested in setting up 1000 MWh Grid-scale Battery Energy Storage System, Request for Proposals (RfP) for undertaking project(s) at single/split across multiple NTPC plants shall be invited separately for setting up the facilities and scalable model for further additional requirements. -

Annual Report for FY 2015-16(PDF)

INSIDE Wipro in Brief 02 Board’s Report 65 Design it Build it 04 Corporate Governance Report 109 Financial Highlights 08 Financial Statements Key Metrics 09 Standalone Financial Statements Letters under India GAAP 130 Chairman’s Letter to the Stakeholders 10 Consolidated Financial Statements Vice-Chairman’s Letter to the Stakeholders 12 under India GAAP 171 CEO’s Letter to the Stakeholders 14 Consolidated Financial Statements Board of Directors under IFRS 216 Prole of Board of Directors 16 Business Responsibility Report 265 Sustainability Highlights 2015-16 22 Glossary 270 Management Discussion & Analysis An Integrated Approach 24 Industry and Business Overview 26 Business Strategy 27 Business Model 30 Good Governance and Management Practices 35 Risk Managment 35 Capitals and Value Creation 38 Certain statements in this annual report concerning our future growth prospects are forward-looking statements, which involve a number of risks, and uncertainties that could cause actual results to dier materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding uctuations in our earnings, revenue and prots, our ability to generate and manage growth, intense competition in IT services, our ability to maintain our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time and cost overruns on xedprice, xed-time frame contracts, client concentration, restrictions on immigration, -

Bharat Petroleum Corporation Ltd

Bharat Petroleum Corporation Ltd. Investor Presentation February 2016 Disclaimer No information contained herein has been verified for truthfulness completeness, accuracy, reliability or otherwise whatsoever by anyone. While the Company will use reasonable efforts to provide reliable information through this presentation, no representation or warranty (express or implied) of any nature is made nor is any responsibility or liability of any kind accepted by the Company or its directors or employees, with respect to the truthfulness, completeness, accuracy or reliability or otherwise whatsoever of any information, projection, representation or warranty (expressed or implied) or omissions in this presentation. Neither the Company nor anyone else accepts any liability whatsoever for any loss, howsoever, arising from use or reliance on this presentation or its contents or otherwise arising in connection therewith. This presentation may not be used, reproduced, copied, published, distributed, shared, transmitted or disseminated in any manner. This presentation is for information purposes only and does not constitute an offer, invitation, solicitation or advertisement in any jurisdiction with respect to the purchase or sale of any security of BPCL and no part or all of it shall form the basis of or be relied upon in connection with any contract, investment decision or commitment whatsoever. The information in this presentation is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed and it may not contain all material information concerning the Company. We do not have any obligation to, and do not intend to, update or otherwise revise any statements reflecting circumstances arising after the date of this presentation or to reflect the occurrence of underlying events, even if the underlying assumptions do not come to fruition. -

Press Release Ratnagiri Gas and Power Private

Press Release Ratnagiri Gas and Power Private Ltd October 19, 2020 Ratings Facilities Amount (Rs. crore) Rating1 Rating Action Bank facilities – Fund-based – Long 1,461.05 Revised from CARE BB-; Stable CARE D term -Term Loan (reduced from 1562.70) (Double B minus) 1,461.05 Total (Rs. One thousand four hundred sixty one crore and five lakh only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers CARE has revised the ratings of Ratnagiri Gas and Power Private Ltd (RGPPL) to CARE D. Facilities with this rating are in default or are expected to be in default soon. The revision in the long term rating of RGPPL factors in the delay in servicing of its principal obligations by the company which were due at the end of September 2020. Key Rating Sensitivities: Positive: Timely servicing of debt obligations for more than three months. Detailed description of the key rating drivers Key Rating Weaknesses Delays in servicing of debt obligations RGPPL had not serviced the principal obligations due at the end of September 2020. The company is in discussion with its lenders for one time settlement (OTS) of its outstanding debt of Rs 1461.05 crore. As per minutes of the consortium meeting held on September 17, 2020, the company had proposed its lenders for OTS for which lead lender has given in-principle approval with cut- off date considered as September 01, 2020. Other lenders are still under process of taking requisite approvals. The company has only paid interest obligations due for the month of Sept 2020 while it has not made the principal payment due on Sept 30, 2020 as the process for OTS is underway. -

2020052639.Pdf

'-• DISTRICT SURVEY REPORT RATNAGIRI DISTRICT FOR SAND MINING OR RIVER BED SAND MINING: .. Prepared under " A) Appendix -X of MOEFCC, GOI Notification S.O 141(E) dated 15/0112016 •_, B) Sustaniable Sand Mining Guideliness C) MOEFCC, GOI,Notification S.O. 3611(E) dated 25/07/2018 (2019-2020) Prepared By District Mining Officer, Collector Officer, Ratnagiri Declaration In compliance to the notification, guidelines issued by Ministry if Environment, Forest and Climate Change, Government of India, New Delhi, District Survey Re'port for Ratnagiri district is prepared and published. Place : Ratnagiri Date: 29/03/2019 • •.. • .. • • • • MAP OF RATNAGIRI DISTRICT: • • MAr (,f • RAINAGIRI tR" 1 nrs AOMINISTRAllli1 ">n UP • "l" • • '" • • 17" • 30' • ~ .. • 17' is' A • N • • .. • • 16" • S' • INOEX DISTlI'ICl BOUHCAIh' • ,. DISTRICT ...,.;.oQUAAT&:N TAi..I..IKA BOtl"O~Y • ... ',"-UK'" HlAO~- • • • • • • • • • • • • • • • • OBJECTIVE:- • The main objective of the preparation of District Survey Report (as per the • 'Sustainable Sand Mining Guideline) is to ensure the following: • Identification of the areas of aggradations or deposition where mining can be • allowed and identification of areas of erosion and proximity to infrastructural structures and installation where mining should be prohibited and calculation of annual rate of replenishment • and allowing time for replenishment after mining in the area. • • 1.0 Introduction: • Whereas by notification of the Government of India in erstwhile Ministry of Environment, • Forest issued vide number S.O. 1533 (E),dated the 14 th September,2006 published in the • Gazette of India, Extraordinary, Part II ,Section 3, Subsection (ii)(hereafter referred to as the • said notification) directions have been given regarding the prior environment clearance; and whereas, the Ministry of Environment, Forest and Climate Change has amended the said • notification vide S.O. -

PDF File with Dabhol Case Write-Up from Indian Perspective Including

Dabhol Power Company11 Introduction In April 2003, power cuts and rolling blackouts were becoming regular occurrences in western India, and yet the ~$3 billion 2184 MW Dabhol Power Project in India’s western coast lay idle; after having been shut down for close to two years (~ 22 months). The impasse related to the project is amply reflected in the headlines of two Indian financial dailies, Business Standard &The Economic Times on April 4th, 2003. Foreign Lenders Want to End Dabhol PactPact (Business(Business StandardStandard – AprilApril 44thth)) Slow progress in project restructuring forces lenders to take decision In a major blow to efforts by the domestic lenders to restart the first phase of the Dabhol power project, overseas lenders to the project have expressed their intention to terminate the power purchase agreement (PPA) with the Maharashtra State Electricity Board (MSEB). FII Lenders to Terminate Dabhol PPA (The Economic Times – AprilApril 44thth)) A face-off between the offshore lenders and domestic lenders of Dabhol Power Company is now imminent. Even as discussions were on to restart phase-I of DPC, the foreign lenders have decided to terminate the power purchase agreement with MSEB. The Dabhol Power Project was originally conceptualised in 1992 as a show case project for India & for Enron (the main project sponsor). The project, which was identified as a fast-track project by the Government of India (GoI), was the largest gas based independent power project in the world and was also the largest foreign direct investment into India. It was also Enron’s largest power venture. Yet more than a decade later, the project, which is almost fully constructed and was partially operational, has run into numerous disputes among the various counter- parties and is on the verge of being junked. -

Brief Industrial Profile of Ratnagiri District

Government of India Ministry of MSME Brief Industrial Profile of Ratnagiri District Carried out by MSME-Development Institute, Mumbai (Ministry of MSME, Govt. of India) Kurla Andheri Road, Saki Naka, Mumbai – 400 072. Phone: 022-28576090/28573091 Fax: 022-28578092 E-mail: [email protected] Web: msmedimumbai.gov.in Contents S. Topic Page No. No. 1. General Characteristics of the District 3 1.1 Location & Geographical Area 3 1.2 Topography 3 1.3 Availability of Minerals 3 1.4 Forest 3 1.5 Administrative set up 4 2.0 District at a glance 5 2.1 Existing status of Industrial Area in the District Ratnagiri 7 3.0 Industrial Scenario of Ratnagiri 7 3.1 Industry at Glance 7 3.2 Year wise trend of units registered 8 3.3 Details of existing Micro & Small Enterprises & Artisan Units in the 8 District 3.4 Large scale industries/Public sector undertakings 9 3.5 Major exportable items 9 3.6 Growth trend 9 3.7 Vendorisation / Ancillarisation of the Industry 9 3.8 Medium scale enterprises 10 3.8.1 List of the units in Ratnagiri & nearby areas 10 3.8.2 Major exportable items 11 3.9 Service Enterprises 11 3.9.2 Potential areas for service industry 11 3.10 Potential for new MSMEs 12-13 4.0 Existing clusters of Micro & Small Enterprise 13 4.1 Details of Major Clusters 13 4.1.1 Manufacturing sector 13 4.1.2 Service sector 13 4.2 Details of identified cluster 14 4.2.1 Mango Processing Cluster 14 5.0 General issues raised by Industries Association during the course of 14 meeting 6.0 Steps to set up MSMEs 2 Brief Industrial Profile of Ratnagiri District 1.