Streetcar System Sponsorship and Advertising Review

Total Page:16

File Type:pdf, Size:1020Kb

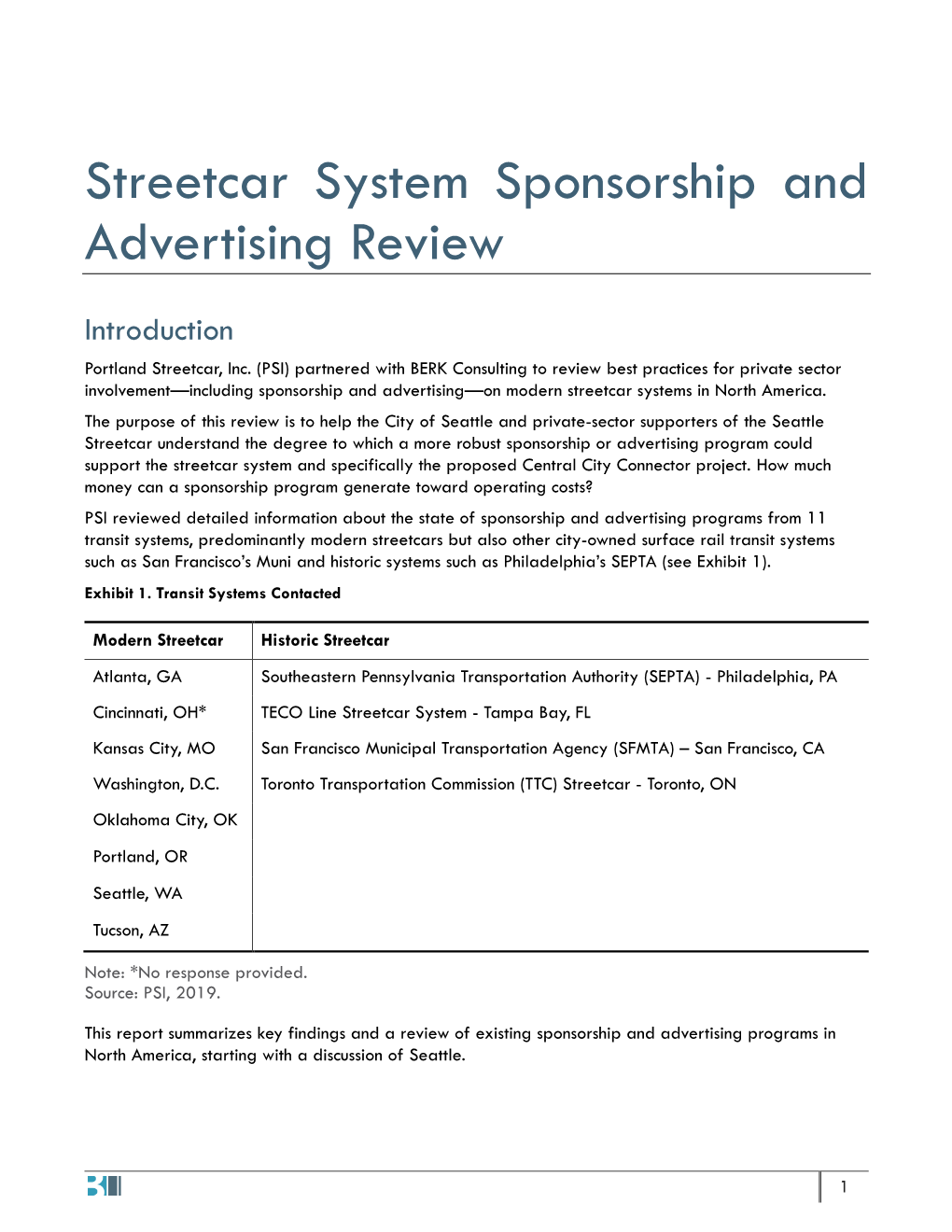

Load more

Recommended publications

-

FY 2027 HART Transit Development Plan

Hillsborough Area Regional Transit (HART) Transit Development Plan 2018 - 2027 Major Update Final Report September 2017 Prepared for Prepared by HART | TDP i Table of Contents Section 1: Introduction ..................................................................................................................................... 1-1 Objectives of the Plan ......................................................................................................................................... 1-1 State Requirements ............................................................................................................................................ 1-2 TDP Checklist ...................................................................................................................................................... 1-2 Organization of the Report .................................................................................................................................. 1-4 Section 2: Baseline Conditions ...................................................................................................................... 2-1 Study Area Description ....................................................................................................................................... 2-1 Population Trends and Characteristics ............................................................................................................. 2-3 Journey-to-Work Characteristics ....................................................................................................................... -

Innovation. Technology. Performance. for the URBAN RAIL COMMUNITY

Smart cities Tram-trains Ticketing Power Traction CBTC Train control Technology Mobility Telecommunications Innovation Innovation. Driverless Infrastructure Passenger Information Asset management FOR THE URBAN RAIL COMMUNITY Technology. Performance. www.terrapinn.com/railliveamericas Organized by Our Story Hall of Fame Revamped for the new year, RAIL Live! Americas 2019 is moving to Baltimore’s Inner Harbor as we build on the success of World MetroRail Congress Americas 2018, which continued our strong tradition of bringing together top leaders from the Americas’ most influential and innovative transit agencies. Andy Byford Jim Kenney 2018 leaders included Kevin Desmond, CEO of TransLink, Edward Reiskin, President Mayor Director of Transportation for the SFMTA, Jim Kenney, Mayor, City of Philadelphia New York City Transit City of Philadelphia Tom Gerend, Executive Director of KC Streetcar, Robert Puentes, President & CEO of the Eno Center for Transportation, Martin Buck, International Lead for Crossrail in London, and Lorenzo Aguilar Camelo, the General Director of Metrorrey in Monterrey, Mexico. KEY INDUSTRY DISCUSSIONS FOR 2019 WILL BE DIVIDED INTO FOUR Jascha Franklin-Hodge Bill Zebrowski Chief Information Officer BRAND NEW TRACKS: Chief Information Officer Department of Innovation & SEPTA • The Future of Mobility: Discussions around Mobility as a Service, Fare Collection, Technology, City of Boston Intermodality, Ridership, Passenger Information Systems, and First and Last Mile transport. • New Project Development: Examining Funding and Financing, Public-Private Partnerships, Procurement, Designing and Building New Metros, Light Rails, Commuter, and High-Speed Rail Lines. Meera Joshi Adam Giambrone NYC Taxi and Limousine Director, Brooklyn-Queens • Train Control: Covering ATC, CBTC, PTC, as well as the Full Spectrum of Commission Connector [Streetcars and LRT] Modernizing Signaling and Train Control Systems to Increase Safety and Capacity. -

Union Station Conceptual Engineering Study

Portland Union Station Multimodal Conceptual Engineering Study Submitted to Portland Bureau of Transportation by IBI Group with LTK Engineering June 2009 This study is partially funded by the US Department of Transportation, Federal Transit Administration. IBI GROUP PORtlAND UNION STATION MultIMODAL CONceptuAL ENGINeeRING StuDY IBI Group is a multi-disciplinary consulting organization offering services in four areas of practice: Urban Land, Facilities, Transportation and Systems. We provide services from offices located strategically across the United States, Canada, Europe, the Middle East and Asia. JUNE 2009 www.ibigroup.com ii Table of Contents Executive Summary .................................................................................... ES-1 Chapter 1: Introduction .....................................................................................1 Introduction 1 Study Purpose 2 Previous Planning Efforts 2 Study Participants 2 Study Methodology 4 Chapter 2: Existing Conditions .........................................................................6 History and Character 6 Uses and Layout 7 Physical Conditions 9 Neighborhood 10 Transportation Conditions 14 Street Classification 24 Chapter 3: Future Transportation Conditions .................................................25 Introduction 25 Intercity Rail Requirements 26 Freight Railroad Requirements 28 Future Track Utilization at Portland Union Station 29 Terminal Capacity Requirements 31 Penetration of Local Transit into Union Station 37 Transit on Union Station Tracks -

Transportation Element 08-08-08 – NON ADOPTED PORTION

Future of Hillsborough Comprehensive Plan for Unincorporated Hillsborough County Florida TRANSPORTATION ELEMENT As Amended by the Hillsborough County Board of County Commissioners June 5, 2008 (Ordinance 08- 13) Department of Community Affairs Notice of Intent to Find Comprehensive Plan Amendments in Compliance published August 4, 2008 {DCA PA No. 08-1ER-NOI-2901- (A)-(l)} August 26, 2008 Effective Date This Page Intentionally Blank. 2 Hillsborough County Transportation Element Hillsborough County Transportation Element TABLE OF CONTENTS PAGE I. INTRODUCTION ................................................................................. 7 II. INVENTORY AND ANALYSIS ............................................................ 15 III. FUTURE NEEDS AND ALTERNATIVES............................................ 81 IV. GOALS, OBJECTIVES AND POLICIES............................................121 V. PLAN IMPLEMENTATION AND MONITORING ..................................161 VI. DEFINITIONS ................................................................................167 Sections IV, V, VI, Appendix C, D, G, I, and Appendix J Maps 2, 2B, 15, and 25 of the Transportation Element have been adopted by the Board of County Commissioners as required by Part II, Chapter 163, Florida Statutes. The remainder of the Transportation Element and appendices contains background information. Hillsborough County Transportation Element 3 TRANSPORTATION APPENDIX A-J Appendix A Inventory of State Roads in Hillsborough County Appendix B Inventory of County Roads -

City of Milwaukee, Wis. Environmental Assessment October 2011

City of Milwaukee, Wis. Environmental Assessment October 2011 Prepared by the City of Milwaukee in cooperation with the Federal Transit Administration (THIS PAGE INTENTIONALLY LEFT BLANK) Milwaukee Streetcar Environmental Assessment ii October 2011 RESPONSIBLE AGENCIES Lead Agency: Federal Transit Administration Project Sponsors: City of Milwaukee WHERE TO FIND COPIES OF THIS DOCUMENT A hard copy of the document is available for public inspection at the Federal Transit Administration field office at the following location: Federal Transit Administration Region V 200 West Adams Street, Suite 320 Chicago, Illinois 60606 Hard copies of the document will also be available at the following locations: Milwaukee Public Library – Central Milwaukee Public Library – Center Street 814 W. Wisconsin Avenue 2727 W. Fond du Lac Avenue Milwaukee, Wisconsin 53233 Milwaukee, Wisconsin 53210 Milwaukee Public Library – Forest Home Milwaukee Department of City Development 1432 W. Forest Home Avenue 809 Broadway, 1st Floor Milwaukee, Wisconsin 53204 Milwaukee, WI 53202 Legislative Reference Bureau, Milwaukee City Hall City Hall, Room B-11 200 East Wells Street Milwaukee, WI 53202 To view an electronic copy of this document, please visit the project Web site at www.themilwaukeestreetcar.com. CONTACT INFORMATION For additional information concerning this document please contact our public involvement coordinator who can direct your questions and comments to the appropriate person: Lois Kimmelman, Environmental Protection Specialist Federal Transit Administration Region 5 200 West Adams St., Suite 320 Chicago, IL 60606 Kristine Martinsek, Milwaukee Streetcar Public Involvement Coordinator Martinsek and Associates 1325 E. Potter Avenue Milwaukee, WI 53207 Milwaukee Streetcar Environmental Assessment iii October 2011 ABSTRACT The proposed Milwaukee Streetcar project would establish a starter streetcar system in and around downtown Milwaukee connecting workers, visitors and residents to key destinations and attractions. -

2018 Streetcar Summit Westin New Orleans – Canal Place All Sessions in the Grand Ballroom

2018 Streetcar Summit Westin New Orleans – Canal Place All Sessions in the Grand Ballroom Sunday, April 15, 2018 4:00 – 5:00 pm The Next Generation: Conversations between students from local universities and experts in the field 5:00 – 7:00 pm Reception at the Hotel Monday, April 16, 2018 8:00 – 9:00 am Registration, Check in and Breakfast 9:00 – 10:00 am Welcome and brief updates on projects DJ Baxter, SOJ, Chair Community Streetcar Coalition Board 10:00 – 10:30 am Legislative Update Jeff Boothe, Executive Director, Community Streetcar Coalition 10:30 – 10:45 am Break 10:45 – 12:00 pm Evolving Technology – Off-Wire Vehicles and Autonomous Streetcars Moderator: Barbara Schroeder, Alstom Transport Curtis Ailes, City of Seattle Jim Barbaresso, HNTB Mark Dorn, AECOM 12:00 – 1:30 pm Lunch 1:30 – 3:00 pm Evolving Role of Streetcars in Urban Transit Systems Moderator: Ethan Melone, Parsons Robin Aredondo-Savage, Vice Mayor, City of Tempe, AZ Jeff Boothe, Boothe Transit Consulting Tom Gerend, Kansas City Streetcar Authority Keith Jones, RATP Dev America, Washington DC Streetcar Luis Mota, Valley Metro 3:00 – 4:15 pm Planning for the next 10-100 years: Stories from the Veterans Moderator: Jeff Boothe, Community Streetcar Coalition Dan Bower, Executive Director, Portland Streetcar, Inc. Chris Eilerman, City of Seattle Adelee Le Grand, Transdev, New Orleans 4:15 – 4:45 pm Statistics Tracked – what do we choose and why? DJ Baxter, SOJ, Chair Community Streetcar Coalition Board 4:45 – 5:15 pm Opening 2018! – Special look at the new systems opening -

Congress Participants

CONGRESS PARTICIPANTS "COMPAGNIA TRASPORTI LAZIALI" SOCIETÀ REGIONALE S.P. A. Italy 9292 - REISINFORMATIEGROEP B.V. Netherlands AB STORSTOCKHOLMS LOKALTRAFIK - STOCKHOLM PUBLIC TRANSPORT Sweden AB VOLVO Sweden ABB SCHWEIZ AG Switzerland ABG LOGISTICS Nigeria ABU DHABI DEPARTMENT OF TRANSPORT United Arab Emirates ACCENTURE Germany ACCENTURE Finland ACCENTURE Canada ACCENTURE Singapore ACCENTURE BRAZIL Brazil ACCENTURE BRISBANE Australia ACCENTURE SAS France ACTIA AUTOMOTIVE France ACTV SOCIETÀ PER AZIONI Italy ADDAX- ASSESORIA FINANCEIRA Brazil ADNKRONOS Italy ADV SPAZIO SRL Italy AESYS - RWH INTL. LTD Germany AGENCE BELGA Belgium AGENCE FRANCE PRESSE France AGENCE METROPOLITAINE DE TRANSPORT Canada AGENZIA CAMPANA PER LA MOBILITÀ SOSTENIBILE Italy AGENZIA ESTE NEWS Italy AGENZIA MOBILITA E AMBIENTE E TERRITORIO S.R.L. Italy AGENZIA PER LA MOBILITÀ ED IL TRASPORTO PUBBLICO LOCALE DI MODENA S.P.A. Italy AGETRANSP Brazil AIT AUSTRIAN INSTITUTE OF TECHNOLOGY GMBH Austria AJUNTAMENT DE BARCELONA Spain AKERSHUS FYLKESKOMMUNE - AKERSHUS COUNTY COUNCIL Norway AL AHRAME Egypt AL FAHIM United Arab Emirates AL FUTTAIM MOTORS United Arab Emirates AL RAI MEDIA GROUP-AL RAI NEWSPAPER Kuwait ALBERT - LUDWIGS - UNIVERSITÄT FREIBURG INSTITUT FÜR VERKEHRSWISSENSCH Germany ALCOA WHEEL AND TRANSPORTATION PRODUCTS Hungary ALEXANDER DENNIS LIMITED United Kingdom ALEXANDER DENNIS Ltd United Kingdom ALLINNOVE Canada ALMATY METRO Kazakhstan ALMATYELECTROTRANS Kazakhstan ALMAVIVA SPA Italy ALSTOM France ALSTOM MAROC S.A. Morocco AMBIENTE EUROPA Italy AMERICAN PUBLIC TRANSPORTATION ASSOCIATION USA ANDHRA PRADESH STATE ROAD TRANSPORT CORPORATION India APAM ESERCIZIO S.P.A. Italy ARAB UNION OF LAND TRANSPORT Jordan AREA METROPOLITANA DE BARCELONA Spain AREP VILLE France ARIA TRANSPORT SERVICES USA ARRIVA (ESSA ALDOSARI) United Arab Emirates ARRIVA ITALIA S.R.L. -

Wisdot State Management Plan for Transit

State Management Plan For the following federal programs: 49 U.S.C. § 5304 – Statewide Planning 49 U.S.C. § 5310 – Enhanced Mobility of Seniors and Individuals with Disabilities 49 U.S.C. § 5311 – Formula Grants for Rural Areas 49 U.S.C. § 5339 – Bus and Bus Facilities Prepared by the Public and Specialized Transit Section Bureau of Transit, Local Roads, Railroads, and Harbors Division of Transportation Investment Management Wisconsin Department of Transportation Date: May 18, 2020 Wisconsin Department of Transportation 1 State Management Plan for Federal Transit Programs Contact information: Ian Ritz, Chief Public and Specialized Transit Section 4822 Madison Yards Way, 6th Floor South Madison, WI 53705 608-266-0189 [email protected] This document is available in alternate formats upon request. Date: May 18, 2020 Wisconsin Department of Transportation 2 State Management Plan for Federal Transit Programs TABLE OF CONTENTS DEFINITIONS and ACRONYMS ........................................................................................................................ 4 FORWARD ........................................................................................................................................................... 6 PLAN CONTENT .................................................................................................................................................. 7 A. PROGRAM GOALS AND OBJECTIVES .................................................................................................... 7 B. ROLES AND -

Public Relations Manager Atlanta Streetcar

CITY OF ATLANTA 55 TRINITY Ave, S.W Kasim Reed ATLANTA, GEORGIA 30335-0300 Sonji Jacobs Dade Mayor Director of Communications City of Atlanta TEL (404) 330-6004 City of Atlanta Public Relations Manager Atlanta Streetcar Title: Public Relations Manager Department: Atlanta Streetcar / Department of Public Works Supervisor: Tim Borchers, Executive Director, Atlanta Streetcar Interested candidates should submit a cover letter and resume to [email protected] no later than Friday, September 13, 2013 at 5:30 p.m. About the Atlanta Streetcar The Atlanta Streetcar is the first phase of a comprehensive, regional streetcar and transit system in the City of Atlanta and the region to address issues of transportation, land use, smart growth, and sustainability while providing last-mile connectivity to riders. The Atlanta Streetcar is a modern, ADA compliant, electrically powered transit system. The streetcar will run for 2.7 miles in the heart of Atlanta’s downtown, business, tourism and convention corridor connecting Centennial Olympic Park area with the vibrant Sweet Auburn and Edgewood Avenue districts. The Atlanta Streetcar project is a cooperative effort by the City of Atlanta, the Atlanta Downtown Improvement District (ADID) and MARTA. The streetcar will run through the heart of Atlanta's business, tourism and convention corridor, bringing jobs and new economic development to the city. Public Relations Manager Overview The Atlanta Streetcar seeks an energetic and articulate Public Relations Director for our press initiatives. The Public Relations Manager will be the primary spokesperson for the Atlanta Streetcar. S/he will work with our staff and partners to build and undertake communications strategies that keep the public informed on the construction and operation of the Streetcar. -

Grand Central Building Anchor Full Block Between Se 8Th & 9Th / Se Morrison & Belmont 808 Se Morrison Street | Portland | Oregon | 97214

GRAND CENTRAL BUILDING ANCHOR FULL BLOCK BETWEEN SE 8TH & 9TH / SE MORRISON & BELMONT 808 SE MORRISON STREET | PORTLAND | OREGON | 97214 APPROXIMATELY 20,617 SQUARE FOOT ANCHOR SPACE WITH OFF-STREET PARKING AVAILABLE ANCHOR SIGNAGE OPPORTUNITY PRIME LOCATION IN THE CENTRAL EASTSIDE INDUSTRIAL DISTRICT ANCHOR SIGNAGE OPPORTUNITY SE MORRISON STREET Looking East From SE 7th & Morrison CENTRAL EASTSIDE INDUSTRIAL DISTRICT | SE 8TH & MORRISON / SE 9TH & BELMONT THE GRAND CENTRAL BUILDING Building Overview | A Contributing Historic Property to Portland’s Fruitpacking District The Grand Central Building is a Spanish Colonial Revival building originally constructed in 1929 as a public market in Portland’s fruitpacking district and featured 23 separate vendors. Available Space | Anchor Space Total: Approximately 20,617 Square Feet First Floor: 15,617 Square Feet Mezzanine: 5,000 Square Feet Parking | The Grand Central Building features an underground parking garage with 76 parking spaces as well as a surface lot on the west side of the building with 28 additional parking spaces. Building Co-Tenants | West Face of Building Area Retailers | Building Location | Located between SE Morrison & Belmont Streets, SE 8th & 9th Avenues The Central Eastside Industrial District (CEID), the area bound by Interstate 84 to the North, the Willamette River to the west, Powell Blvd / Hwy 26 to the south, and NE/SE 12th Avenue to the east, was once the fruitpacking center of Portland. Located immediately east across the Burnside, Morrison, and Hawthorne Bridges from Downtown Portland, the CEID provides a convenient - and often more spacious - alternative to the CBD for office users and retailers looking to locate in the Central City. -

KC JAZZ STREETCAR ROLLS out for DEBUT the 2021 Art in the Loop KC Streetcar Reveal Set for 4 P.M

FOR IMMEDIATE RELEASE June 24, 2021 Media Contact: Donna Mandelbaum, KC Streetcar Authority, 816.627.2526 or 816.877.3219 KC JAZZ STREETCAR ROLLS OUT FOR DEBUT The 2021 Art in the Loop KC Streetcar Reveal Set for 4 p.m. Friday. (Kansas City, Missouri) – The sound of local jazz will fill Main Street as the KC Streetcar debuts its latest streetcar wrap in collaboration with Art in the Loop. Around 4 p.m., Friday, June 25., the 2021 Art in the Loop KC “Jazz” Streetcar will debut at the Union Station Streetcar stop located at Pershing and Main Street. In addition to art on the outside of the KC Streetcar, the inside of the streetcar will feature live performances from percussionist Tyree Johnson and Deremé Nskioh on bass guitar. “We are so excited to debut this very special KC Streetcar wrap,” Donna Mandelbaum, communications director with the KC Streetcar Authority said. “This is our fourth “art car” as part of the Art in the Loop program and each year the artists of Kansas City continue to push the boundaries on how to express their creativity on a transit vehicle.” Jazz: The Resilient Spirit of Kansas City was created by Hector E. Garcia, a local artist and illustrator. Garcia worked for Hallmark Cards for many years as an artist and store merchandising designer. As a freelance illustrator, he has exhibited his “Faces of Kansas City Jazz” caricature collections in Kansas City jazz venues such as the Folly Theater and the Gem Theater. In addition to being an artist, Garcia enjoys Kansas City Jazz – both listening to it and playing it on his guitar. -

ANC6A Resolution No. 2021-002

ANC 6A RESOLUTION NO. 2021-002 Resolution regarding ANC 6A support for completing the DC Streetcar from Benning Road Metro Station to Georgetown as Planned and Promised WHEREAS, Advisory Neighborhood Commissions (ANCs) were created to “advise the Council of the District of Columbia, the Mayor, and each executive agency with respect to all proposed matters of District government policy,” including transportation and economic development; WHEREAS, public transportation is a shared public benefit and can only function as such when it’s shared with all neighborhoods; WHEREAS, ANC 7E recently passed a resolution of support for the streetcar extension to Benning Road Metro station; WHEREAS, the District Department of Transportation (DDOT) recently published its Final Environmental Assessment where it found the extension to Benning Metro Station is the preferred alternative and only feasible alternative from an engineering perspective; WHEREAS, the eastward extension to Benning Road Metro is the only feasible alternative that provides a multi-modal connection to Metro; WHEREAS, the eventual westward extension to Georgetown would establish the only east-west rail-transit option for travel all the way to Georgetown; WHEREAS, the eventual westward extension to Georgetown would be the first and only fully unified transit system from eastern portions of the District to Georgetown; WHEREAS, the full streetcar route from Benning Road Metro to Georgetown would provide an enjoyable and robust east-west transportation option for residents in ward 6 and