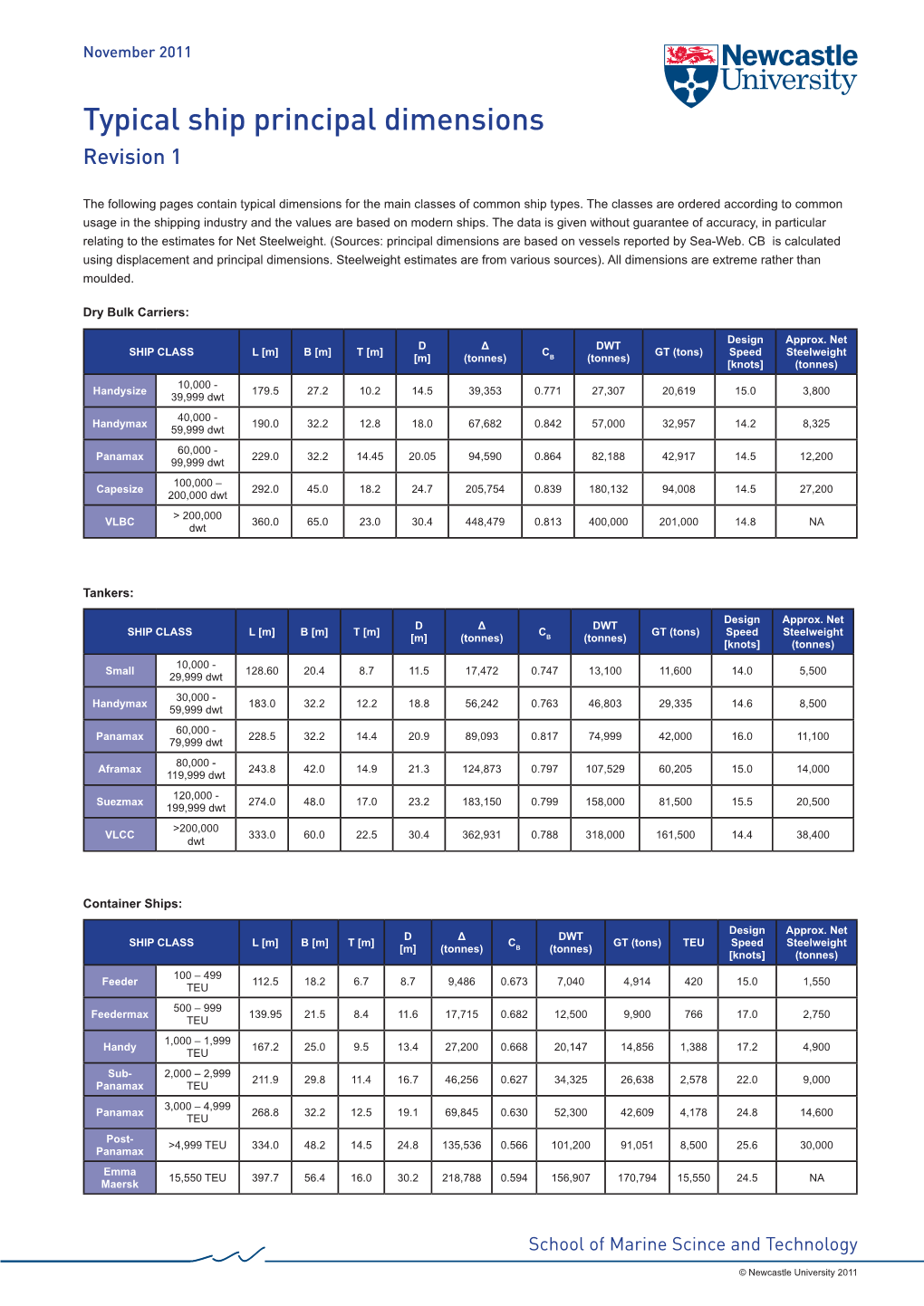

Typical Ship Principal Dimensions Revision 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eskola Juho Makinen Jarno.Pdf (1.217Mt)

Juho Eskola Jarno Mäkinen MERENKULKIJA Merenkulun koulutusohjelma Merikapteenin suuntautumisvaihtoehto 2014 MERENKULKIJA Eskola, Juho Mäkinen, Jarno Satakunnan ammattikorkeakoulu Merenkulun koulutusohjelma Merikapteenin suuntautumisvaihtoehto Toukokuu 2014 Ohjaaja: Teränen, Jarmo Sivumäärä: 126 Liitteitä: 3 Asiasanat: historia, komentosilta, slangi ja englanti, lastinkäsittely ja laivateoria, Meriteidensäännöt ja sopimukset, yleistä merenkulusta. ____________________________________________________________________ Opinnäytetyömme aiheena oli luoda merenkulun tietopeli, joka sai myöhemmin nimekseen Merenkulkija. Työmme sisältää 1200 sanallista kysymystä, ja 78 kuvakysymystä. Kysymysten lisäksi teimme pelille ohjeet ja pelilaudan, jotta Merenkulkija olisi mahdollisimman valmis ja ymmärrettävä pelattavaksi. Pelin sanalliset kysymykset on jaettu kuuteen aihealueeseen. Aihealueita ovat: historia, komentosilta, slangi ja englanti, lastinkäsittely ja laivateoria, meriteidensäännöit, lait ja sopimukset ja viimeisenä yleistä merenkulusta. Kuvakysymykset ovat sekalaisia. Merenkulkija- tietopeli on suunnattu merenkulun opiskelijoille, tarkemmin kansipuolen päällystöopiskelijoille. Toki kokeneemmillekin merenkulkijoille peli tarjoaa varmasti uutta tietoa ja palauttaa jo unohdettuja asioita mieleen. Merenkulkija- tietopeli soveltuu oppitunneille opetuskäyttöön, ja vapaa-ajan viihdepeliksi. MARINER Eskola, Juho Mäkinen, Jarno Satakunnan ammattikorkeakoulu, Satakunta University of Applied Sciences Degree Programme in maritime management May 2014 Supervisor: -

China's Merchant Marine

“China’s Merchant Marine” A paper for the China as “Maritime Power” Conference July 28-29, 2015 CNA Conference Facility Arlington, Virginia by Dennis J. Blasko1 Introductory Note: The Central Intelligence Agency’s World Factbook defines “merchant marine” as “all ships engaged in the carriage of goods; or all commercial vessels (as opposed to all nonmilitary ships), which excludes tugs, fishing vessels, offshore oil rigs, etc.”2 At the end of 2014, the world’s merchant ship fleet consisted of over 89,000 ships.3 According to the BBC: Under international law, every merchant ship must be registered with a country, known as its flag state. That country has jurisdiction over the vessel and is responsible for inspecting that it is safe to sail and to check on the crew’s working conditions. Open registries, sometimes referred to pejoratively as flags of convenience, have been contentious from the start.4 1 Dennis J. Blasko, Lieutenant Colonel, U.S. Army (Retired), a Senior Research Fellow with CNA’s China Studies division, is a former U.S. army attaché to Beijing and Hong Kong and author of The Chinese Army Today (Routledge, 2006).The author wishes to express his sincere thanks and appreciation to Rear Admiral Michael McDevitt, U.S. Navy (Ret), for his guidance and patience in the preparation and presentation of this paper. 2 Central Intelligence Agency, “Country Comparison: Merchant Marine,” The World Factbook, https://www.cia.gov/library/publications/the-world-factbook/fields/2108.html. According to the Factbook, “DWT or dead weight tonnage is the total weight of cargo, plus bunkers, stores, etc., that a ship can carry when immersed to the appropriate load line. -

International Seaways Inc

International Seaways, Inc. Third Quarter 2020 Earnings Presentation November 6, 2020 Disclaimer Forward-Looking Statements During the course of this presentation, the Company (International Seaways, Inc. (INSW)) may make forward-looking statements or provide forward-looking information. All statements other than statements of historical facts should be considered forward-looking statements. Some of these statements include words such as ‘‘outlook,’’ ‘‘believe,’’ ‘‘expect,’’ ‘‘potential,’’ ‘‘continue,’’ ‘‘may,’’ ‘‘will,’’ ‘‘should,’’ ‘‘could,’’ ‘‘seek,’’ ‘‘predict,’’ ‘‘intend,’’ ‘‘plan,’’ ‘‘estimate,’’ ‘‘anticipate,’’ ‘‘target,’’ ‘‘project,’’ ‘‘forecast,’’ ‘‘shall,’’ ‘‘contemplate’’ or the negative version of those words or other comparable words. Although they reflect INSW’s current expectations, these statements are not guarantees of future performance, but involve a number of risks, uncertainties, and assumptions which are difficult to predict. Some of the factors that may cause actual outcomes and results to differ materially from those expressed in, or implied by, the forward-looking statements include, but are not necessarily limited to, vessel acquisitions, general economic conditions, competitive pressures, the nature of the Company’s services and their price movements, and the ability to retain key employees. The Company does not undertake to update any forward-looking statements as a result of future developments, new information or otherwise. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures, including Time Charter Equivalent (“TCE”) revenue, EBITDA, Adjusted EBITDA, and total leverage ratios, designed to complement the financial information presented in accordance with generally accepted accounting principles in the United States of America because management believes such measures are useful to investors. TCE revenues, which represents shipping revenues less voyage expenses, is a measure to compare revenue generated from a voyage charter to revenue generated from a time charter. -

Malacca-Max the Ul Timate Container Carrier

MALACCA-MAX THE UL TIMATE CONTAINER CARRIER Design innovation in container shipping 2443 625 8 Bibliotheek TU Delft . IIIII I IIII III III II II III 1111 I I11111 C 0003815611 DELFT MARINE TECHNOLOGY SERIES 1 . Analysis of the Containership Charter Market 1983-1992 2 . Innovation in Forest Products Shipping 3. Innovation in Shortsea Shipping: Self-Ioading and Unloading Ship systems 4. Nederlandse Maritieme Sektor: Economische Structuur en Betekenis 5. Innovation in Chemical Shipping: Port and Slops Management 6. Multimodal Shortsea shipping 7. De Toekomst van de Nederlandse Zeevaartsector: Economische Impact Studie (EIS) en Beleidsanalyse 8. Innovatie in de Containerbinnenvaart: Geautomatiseerd Overslagsysteem 9. Analysis of the Panamax bulk Carrier Charter Market 1989-1994: In relation to the Design Characteristics 10. Analysis of the Competitive Position of Short Sea Shipping: Development of Policy Measures 11. Design Innovation in Shipping 12. Shipping 13. Shipping Industry Structure 14. Malacca-max: The Ultimate Container Carrier For more information about these publications, see : http://www-mt.wbmt.tudelft.nl/rederijkunde/index.htm MALACCA-MAX THE ULTIMATE CONTAINER CARRIER Niko Wijnolst Marco Scholtens Frans Waals DELFT UNIVERSITY PRESS 1999 Published and distributed by: Delft University Press P.O. Box 98 2600 MG Delft The Netherlands Tel: +31-15-2783254 Fax: +31-15-2781661 E-mail: [email protected] CIP-DATA KONINKLIJKE BIBLIOTHEEK, Tp1X Niko Wijnolst, Marco Scholtens, Frans Waals Shipping Industry Structure/Wijnolst, N.; Scholtens, M; Waals, F.A .J . Delft: Delft University Press. - 111. Lit. ISBN 90-407-1947-0 NUGI834 Keywords: Container ship, Design innovation, Suez Canal Copyright <tl 1999 by N. Wijnolst, M . -

TOP Tankers Inc

TOP Tankers Inc. October 2005 NASDAQ: “TOPT” Page 1 Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of applicable federal securities laws. Such statements are based upon current expectations that involve risks and uncertainties. Any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. For example, words such as “may,” “will,” “should,” “estimates,” “predicts,” “potential,” “continue,” “strategy,” “believes,” “anticipates,” “plans,” “expects,” “intends” and similar expressions are intended to identify forward-looking statements. Actual results and the timing of certain events may differ significantly from the results discussed or implied in the forward-looking statements. Among the factors that might cause or contribute to such a discrepancy include, but are not limited to, the risk factors described in the Company’s Registration Statement filed with the Securities and Exchange Commission, particularly those describing variations on charter rates and their effect on the Company’s revenues, net income and profitability as well as the value of the Company’s fleet. Page 2 Evangelos J. Pistiolis, Chief Executive Officer Page 3 Founder & Continued Equity Sponsorship Dynamic Founder & Continued Equity Sponsorship Entered shipping business in 1992, tankers in 1999 July 2004, $135.1m IPO acquired 2 DH Suezmax and 8 DH Handymax tankers November 2004, $148.1m follow-on, acquired 5 DH Suezmax tankers 2005, Organic Growth: -

Trends in Bulkcarrier Market & Port Activity.Pptx

If necessary change logos on covers/ chapter dividers and in the footer. Dedicated logos are available in the template tool at the end of the list Trends In Bulkcarrier If you want to update Title and Subtitle in the Market & Port Activity footer, go to View tab → Slide Master Presentation to the International and change it on Dry Bulk Terminals Group first slide in the left pane 11 April 2019, Barcelona Trevor Crowe, Director, Date format: Day, month and year Clarksons Research e.g. 30 June 2018 Ref: A4036b Agenda Trends In Bulkcarrier Market & Port Activity 1. Introduction to the Clarksons group, Clarksons Research and Sea/net 2. Global Dry Bulk Port Activity – Looking At The Big Picture 3. Profiles & Case Studies - Drilling Down For Port Intelligence 4. Summary Trends In Bulkcarrier Market & Port Activity | International Dry Bulk Terminals Group, 11 April 2019 2 EnablingThe Clarksons Global Group Trade Clarksons is the 167 YEARS world’s leading provider 48 OFFICES of integrated shipping services IN 22 COUNTRIES FTSE 250 Our intelligence adds value by 15+ YEARS enabling clients to make more INCREASING DIVIDENDS efficient and informed decisions to achieve their business objectives 24/7 5,000+ INTERNATIONAL CLIENTS Trends In Bulkcarrier Market & Port Activity | International Dry Bulk Terminals Group, 11 April 2019 Clarksons Research Market leader, excellent brand, >120 staff globally, broad and diverse product range and client base OFFSHORE AND ENERGY SHIPPING AND TRADE The leading provider offshore Market leaders in timely and data for more than 30 years. authoritative information on all Providing clients with the key aspects of shipping. -

ANNUAL REPORT 2016 Corporate Profile

ANNUAL REPORT 2016 Corporate Profile Diana Shipping Inc. (NYSE: DSX) is a global provider of shipping transportation services. We specialize in the ownership of dry bulk vessels. As of April 28, 2017 our fleet consists of 48 dry bulk vessels (4 Newcastlemax, 14 Capesize, 3 Post-Panamax, 4 Kamsarmax and 23 Panamax). The Company also expects to take delivery of one Post-Panamax dry bulk vessel by the middle of May 2017, one Post-Panamax dry bulk vessel by the middle of June 2017 as well as one Kamsarmax dry bulk vessel by the middle of June 2017. As of the same date, the combined carrying capacity of our fleet, excluding the three vessels not yet delivered, is approximately 5.7 million dwt with a weighted average age of 7.91 years. Our fleet is managed by our wholly-owned subsidiary Diana Shipping Services S.A. and our established 50/50 joint venture with Wilhelmsen Ship Management named Diana Wilhelmsen Management Limited in Cyprus. Diana Shipping Inc. also owns approximately 25.7% of the issued and outstanding shares of Diana Containerships Inc. (NASDAQ: DCIX), a global provider of shipping transportation services through its ownership of containerships, that currently owns and operates twelve container vessels (6 Post-Panamax and 6 Panamax). Among the distinguishing strengths that we believe provide us with a competitive advantage in the dry bulk shipping industry are the following: > We own a modern, high quality fleet of dry bulk carriers. > Our fleet includes groups of sister ships, providing operational and scheduling flexibility, as well as cost efficiencies. -

The Impact of the New Panama Canal on Cost-Savings in the Shipping Industry

the International Journal Volume 13 on Marine Navigation Number 3 http://www.transnav.eu and Safety of Sea Transportation September 2019 DOI: 10.12716/1001.13.03.07 The Impact of the New Panama Canal on Cost-savings in the Shipping Industry D. Zupanovic, L. Grbic & M. Baric University of Zadar, Zadar, Croatia ABSTRACT: The passage through the Panama Canal has become the usual waterway for all the ships that can navigate through the Canal. The traffic through the canal is limited by the size of a ship. The need for the expansion of the Canal has emerged due to the development of the global trade and the shipping industry. The new dimensions of the lock‐chambers determine the size of the ships as well. The new generation of ships built to the largest specifications possible to transit the current locks of the canal are called the Post‐Panamax vessels. The maximum dimensions of these ships are 366 meters in length, 49 meters in beam and 15.2 metres in draught. The paper analyses savings in the operational costs on three types of the Post‐Panamax vessels after the Canal expansion. 1 INTRODUCTION The construction of the new and expanded canal enabled the passage of the Post‐Panamax ships. The The construction of the Canal, which lasted for 34 navigation of this category became a standard in the years, introduced the shorter and more efficient route maritime industry and proved the Canal to be of great between the east and west coasts of the United States importance to the world shipping. -

Dictionary.Pdf

THE SEAFARER’S WORD A Maritime Dictionary A B C D E F G H I J K L M N O P Q R S T U V W X Y Z Ranger Hope © 2007- All rights reserved A ● ▬ A: Code flag; Diver below, keep well clear at slow speed. Aa.: Always afloat. Aaaa.: Always accessible - always afloat. A flag + three Code flags; Azimuth or bearing. numerals: Aback: When a wind hits the front of the sails forcing the vessel astern. Abaft: Toward the stern. Abaft of the beam: Bearings over the beam to the stern, the ships after sections. Abandon: To jettison cargo. Abandon ship: To forsake a vessel in favour of the life rafts, life boats. Abate: Diminish, stop. Able bodied seaman: Certificated and experienced seaman, called an AB. Abeam: On the side of the vessel, amidships or at right angles. Aboard: Within or on the vessel. About, go: To manoeuvre to the opposite sailing tack. Above board: Genuine. Able bodied seaman: Advanced deckhand ranked above ordinary seaman. Abreast: Alongside. Side by side Abrid: A plate reinforcing the top of a drilled hole that accepts a pintle. Abrolhos: A violent wind blowing off the South East Brazilian coast between May and August. A.B.S.: American Bureau of Shipping classification society. Able bodied seaman Absorption: The dissipation of energy in the medium through which the energy passes, which is one cause of radio wave attenuation. Abt.: About Abyss: A deep chasm. Abyssal, abysmal: The greatest depth of the ocean Abyssal gap: A narrow break in a sea floor rise or between two abyssal plains. -

Suez-Max Tanker Optimization

Design Analysis of a New Generation of Suezmax Tankers Igor Belamarić,1 Predrag Čudina,2 Kalman Žiha3 A thoroughly investigated design of a new generation of Suezmax tankers incorporating the builder's consideration in the form of a condensed mathematical model is presented. The design model is provided for practical application and for a fast assessment of the conceptual design. The design model is subjected to different methods of design analysis in order determine an adequate design and the appropriate procedure applicable in the design office. In addition, the computational, building and operational uncertainties involved in the design and mathematical model are considered. The uncertainty analysis based on tolerances indicates a wider choice of designs within acceptable limits. INTRODUCTION The enlarged profile of the Suez Canal, along with The design concept of the Suezmax tanker is intensive development of double-hull structures described by a mathematical/numerical model during the past number of years, has had a great following design principles [Watson & Gilfillan impetus on the design of a new generation of 1977, Taggart 1980]; this concept is subjected to an Suezmax tankers. analysis giving a solid basis for design selection and Basic dilemmas in the design of tankers concern the decision-making, [Žanić, Grubišić & Trincas 1992]. longitudinal bulkheads, shape of the midship section, Due to the large number of uncertainties involved cargo loading/unloading equipment, capacity and in the design model, a certain skepticism may arise design of segregated ballast tanks, as well as the among practicing engineers concerning highly arrangement of engine room, and have been sophisticated and accurate numerical procedures. -

Scorpio Tankers Inc. Company Presentation June 2018

Scorpio Tankers Inc. Company Presentation June 2018 1 1 Company Overview Key Facts Fleet Profile Scorpio Tankers Inc. is the world’s largest and Owned TC/BB Chartered-In youngest product tanker company 60 • Pure product tanker play offering all asset classes • 109 owned ECO product tankers on the 50 water with an average age of 2.8 years 8 • 17 time/bareboat charters-in vessels 40 • NYSE-compliant governance and transparency, 2 listed under the ticker “STNG” • Headquartered in Monaco, incorporated in the 30 Marshall Islands and is not subject to US income tax 45 20 38 • Vessels employed in well-established Scorpio 7 pools with a track record of outperforming the market 10 14 • Merged with Navig8 Product Tankers, acquiring 27 12 ECO-spec product tankers 0 Handymax MR LR1 LR2 2 2 Company Profile Shareholders # Holder Ownership 1 Dimensional Fund Advisors 6.6% 2 Wellington Management Company 5.9% 3 Scorpio Services Holding Limited 4.5% 4 Magallanes Value Investor 4.1% 5 Bestinver Gestión 4.0% 6 BlackRock Fund Advisors 3.3% 7 Fidelity Management & Research Company 3.0% 8 Hosking Partners 3.0% 9 BNY Mellon Asset Management 3.0% 10 Monarch Alternative Capital 2.8% Market Cap ($m) Liquidity Per Day ($m pd) $1,500 $12 $10 $1,000 $8 $6 $500 $4 $2 $0 $0 Euronav Frontline Scorpio DHT Gener8 NAT Ardmore Scorpio Frontline Euronav NAT DHT Gener8 Ardmore Tankers Tankers Source: Fearnleys June 8th, 2018 3 3 Product Tankers in the Oil Supply Chain • Crude Tankers provide the marine transportation of the crude oil to the refineries. -

Maritime Transport Over Danish Ports 2015 Quarter 4

Documentation of statistics for Maritime Transport over Danish Ports 2015 Quarter 4 Statistics Denmark Sejrøgade 11 DK 2100 København Ø 1 / 11 1 Introduction The purpose of statistics on maritime transport over Danish ports is to describe the volume of and the development in ship traffic to and from Danish ports. The statistics have been compiled in the present form since 1997. Maritime statistics have been produced since 1834 and published annually from about 1900. In the period from 1991 to 1996, Statistics Denmark compiled only summary statistics on the throughput of ports. 2 Statistical presentation The most important variables used in the statistics are: Calls at port, type of ship, size of ship, flag state, port of loading/unloading, weight of goods and type of goods and passengers. The statistics are based on two separate data collections: Maritime traffic on larger Danish ports (quarterly) and Maritime traffic on minor Danish ports (annually). It is supplemented with information on goods on ferries from the data collection on Ferries and Passenger ships (quarterly). 2.1 Data description The statistics contain information on calls at port, type of ship, size of ship, flag state, port of loading/unloading, weight of goods and type of goods and passengers. The statistics are based on two separate data collections: Maritime traffic on larger Danish ports (quarterly) and Maritime traffic on minor Danish ports (annually). It is supplemented with information on goods on ferries from the data collection on Ferries and Passenger ships (quarterly). The larger ports that handles at least 1 mill. tonnes of goods annually report every single port call with detailed information on the vessel, origin or destination port and type of goods.