Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Análisis De Inversiones. Tema: Formación De Portafol

ESCUELA SUPERIOR DE COMERCIO Y ADMINISTRACIÓN UNIDAD TEPEPAN SEMINARIO: ANÁLISIS DE INVERSIONES. TEMA: FORMACIÓN DE PORTAFOLIOS ÓPTIMOS DE INVERSIÓN CON LAS ACCIONES: GRUPO FINANCIERO INBURSA, S.A.B. DE C.V., GRUPO FINANCIERO BANORTE, S.A.B DE C.V., GRUMA, S.A.B. DE C.V., KIMBERLY-CLARK DE MEXICO S.A.B. DE C.V. Y WAL-MART DE MEXICO, S.A.B. DE C.V. INFORME FINAL QUE PARA OBTENER EL TÍTULO DE CONTADOR PÚBLICO PRESENTAN: CHRISTIAN CRUZ BAÑOS. CLAUDIA HERNÁNDEZ DEL ANGEL. EVELYN VALERIANO HUERTA. LESLY SUSANA RAMÍREZ GARCÍA. MARÍA FABIOLA VÁZQUEZ SEDAS. CONDUCTORES DEL SEMINARIO: M. EN F. RAFAEL GUADALUPE RODRIGUEZ CALVO. M. EN C. RAÚL GARRIDO VILLEGAS. MÉXICO, D.F. NOVIEMBRE 2009. AGRADECIMIENTOS. AL INSTITUTO POLITÉCNICO NACIONAL. Agradecemos al Instituto Politécnico Nacional por abrirnos sus puertas y de esta forma contribuir al crecimiento de nuestro nivel educativo, ya que es una institución que ha generado profesionales exitosos durante muchos años; por lo cual nos sentimos con el compromiso de poner en alto nuestra institución y así corresponder al conocimiento y aprendizaje que nos brindo. A LA ESCUELA SUPERIOR DE COMERCIO Y ADMINISTRACIÓN UNIDAD TEPEPAN. Estamos agradecidos con esta escuela, por darnos hospedaje durante estos años, por habernos dado la oportunidad de superarnos profesionalmente proporcionándonos buenos profesores, los espacios necesarios para el desarrollo de nuestra carrera, así como mostrándonos el interés de que los alumnos concluyan sus estudios al poner a nuestra disposición una serie de opciones y servicios que fueron importantes en los momentos en los que por motivos personales teníamos que tomar la decisión de retirarnos dejando inconclusos nuestros estudios, nuevamente gracias a todos esto hoy estamos poniendo fin a esta primera parte de nuestra formación como profesionales, porque todavía nos queda mucho camino por recorrer para ser mejores cada día y estamos seguros de que nuestra escuela estará ahí para ofrecernos su apoyo cuando lo necesitemos. -

MEXICO Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT MEXICO Executive Summary Banking Mexico’s central bank, Banco de México (Banxico), is an independent body under the country’s constitution. It is responsible for monetary policy and is lender of last resort and provider of treasury services to the federal government. Banco de México shares responsibility for exchange rate policy and regulatory supervision of the finance sector with the Ministry of Finance and Public Credit (Secretaría de Hacienda y Crédito Público). Mexico does not apply central bank reporting requirements or export controls. Resident entities are permitted to retain both MXN (Mexican peso) and foreign currency bank accounts domestically and abroad. Non-resident entities may hold domestic and foreign currency bank accounts within Mexico. Local currency accounts are not convertible into foreign currency. Mexico’s stable and well capitalized banking system is dominated by large foreign-owned institutions following a period of privatization and consolidation in the early 2000s sparked by legislation permitting foreign investment in the sector. Banks currently operating in Mexico include 23 financial groups, 50 multiple banks, six development banks, 84 credit unions and 39 representative offices of foreign banks. Payments Mexico’s high- and low-value clearing systems (SPEI and SICAM) are owned and operated by the central bank. CECOBAN, a consortium of banks, owns and operates CCEN, a clearing system for retail payments. Electronic credit transfers are widely used by large companies, while debit and credit cards are very popular for retail payments. Cash and checks are still commonly used by smaller firms and households. Internet-based electronic banking services are offered to both corporate and retail customers. -

Solid Profitable Growth

SOLID PROFITABLE GROWTH 2015 Annual report For more than 20 years, we have been supporting our clients with top quality financial services. We are a company with a reputation for building solid, lasting alliances with our clients. We want to become the leading company in our market by helping companies to grow thus making Mexico stronger. 2 SOLID PROFITABLE GROWTH With a multi-product offering focused on three core business lines —leasing, factoring and auto loans— UNIFIN’s financial solidity comes from its origination process and its skillful, well-timed portfolio management. Total portfolio Ps. 18.9 billion 3 SOLID • The compiled information is submitted to a The loan origination process is handled by a special- credit committee: i) Minor Risk Committee for ized team in each business line, using cutting-edge transactions below Ps. 7.5 million, with a dig- technology and various selection criteria: ital response within 72 hours; ii) Major Risk Loan origination process Committee, which meets in person to decide • Strict and formal analysis of national and ION on larger transactions, providing a response VAT CL ENO IEN global economies and trends in various R T P ND R within two weeks. A OS LE P industries. A EC S TI ET N S G S • We also have highly rigorous systems involv- A 6 • 16 dynamic credit scorings, analysis for ma- 1 ing month to month tracking and monitoring, jor and minor risk and analytic parameters that in compliance with anti-money laundering are part of our in-house model. and data privacy laws. 5 E E T A T P I P M L I M C O A C 2 T I T O I N D E R Collection process C 4 -5 0 2-7 8-30 31-60 61-90 +90 C R E D I S T E B C U N E 3 R R E E A F U E R A N D Administrative L E E-mail G A In-person L Payment Call center Workout Court collection reminder collection date 2nd reminder collection TEAM 1 TEAM 2 TEAM 3 TEAM 4 Collection is simpler because UNIFIN maintains ownership of the assets. -

Press Release for IMMEDIATE RELEASE

Press Release FOR IMMEDIATE RELEASE GRUPO TELEVISA ANNOUNCES RECAPITALIZATION · Grupo Televisa will undertake a share recapitalization to facilitate the incorporation of certain shares held by Grupo Televicentro S.A. de C.V., (“Televicentro”) into the Televisa CPO facility without diluting any Televisa shareholder. · Televicentro will cease to be a shareholder of Televisa and its current shareholders will become direct shareholders in Televisa. The Televicentro shareholders agreement and the related Put Option will be terminated. · Televicentro shareholders will enter into a Trust Agreement to govern the voting and potential disposition of their Televisa shares. Mexico City, March 25, 2004 – Grupo Televisa, S.A. (“Televisa” or the “Company”, NYSE: TV; BMV: TLEVISACPO) announced today a series of transactions to concentrate all equity ownership in the Company at the Televisa level. The initiatives fall into three categories as described below: 1. Televisa Share Recapitalization Televisa will undergo a share recapitalization to incorporate a portion of the Televisa shares held by Televicentro into Televisa’s most widely held and traded equity vehicles (namely the CPO/GDS), and without any economic dilution to any shareholder. · Televisa will undertake a 25:1 stock split applicable to all Series A, D, and L Shares. · A new series of common stock, the Series B Shares, will be created. These shares will be ordinary shares that, like the A Shares, will have the right to vote on all matters subject to shareholder approval. · A share dividend -

Lista De Entidades Autorizadas Para Captar Emisoras

Lista de Entidades Autorizadas para Captar Emisoras Clave Clave No. Razón Social Captación No. Razón Social Captación PES PES ACCIONES Y VALORES BANAMEX, S.A. Investa Bank, S.A., Institución de Banca 25 126 Si 1 2 DE C.V., CASA DE BOLSA, INTEGRANTE Si Múltiple DEL GRUPO FINANCIERO BANAMEX. BANCO NACIONAL DE COMERCIO GRUPO FINANCIERO INBURSA, S.A.B. EXTERIOR, SOCIEDAD NACIONAL DE 38 Si 128 Si 2 DE C.V. 26 CRÉDITO, INSTITUCIÓN DE BANCA DE DESARROLLO GRUPO FINANCIERO BANORTE, S.A.B. 40 Si 3 DE C.V. Banco Nacional de Obras y Servicios 129 Públicos, Sociedad Nacional de Crédito, Si GRUPO FINANCIERO BANCRECER, S.A. 27 41 Si Institución de Banca de Desarrollo 4 DE C.V. Nacional Financiera, Sociedad Nacional CASA DE BOLSA FINAMEX, S.A.B. DE 42 Si 130 de Crédito, Institución de Banca de Si 5 C.V. 28 Desarrollo 6 62 BANCO NACIONAL DE MEXICO, S.A. Si Banco Nacional del Ejército, Fuerza Aérea y Armada, Sociedad Nacional BANCO SANTANDER (MEXICO), S.A., 29 133 Si INSTITUCION DE BANCA MULTIPLE, de Crédito, Institución de Banca de 67 Si 7 GRUPO FINANCIERO SANTANDER Desarrollo MEXICO ALMACENADORA AFIRME, S.A. DE 8 70 HSBC MEXICO, S.A. Si 30 173 C.V., ORGANIZACION AUXILIAR DEL Si CREDITO, AFIRME GRUPO FINANCIERO Scotiabank Inverlat, S.A., Institución 9 72 de Banca Múltiple, Grupo Financiero Si AF Banregio, S.A. de C.V., Sociedad Scotiabank Inverlat 31 204 Financiera de Objeto Múltiple, Entidad Si Regulada 75 BBVA BANCOMER, S.A. Si 10 ARRENDADORA AFIRME, S.A. -

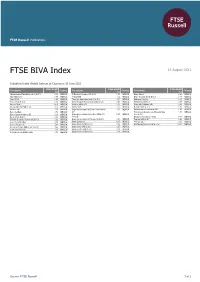

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Nota Informativa (AEAL 09Abr19

SUMMARY RELATED TO THE INFORMATION PROVIDED AS PART OF THE SERIES “L” SPECIAL SHAREHOLDERS’ MEETING OF AMÉRICA MÓVIL, S.A.B. DE C.V., TO BE HELD ON APRIL 09, 2019 IN MEXICO CITY AT 10:00 A.M. _____________________________________________________________________________________________ By means of a resolution adopted by the Board of Directors of AMÉRICA MÓVIL, S.A.B. DE C.V. (the “Company” or “AMX”), in its meeting held on February 12, 2019, the Company called its Series “L” shareholders to a Special Shareholders’ Meeting (the “Meeting”), to be held on April 09, 2019 at 10:00 a.m. (Mexico City Time), in the Company’s Auditorium located at Lago Zurich 245, Plaza Carso, Edificio Telcel, 15th Floor, Colonia Ampliación Granada, Miguel Hidalgo, 11529, Mexico City, in order to address the following items: I. Appointment or, as the case may be, reelection of the members of the Board of Directors of the Company that the holders of the Series “L” shares are entitled to appoint. Adoption of resolutions thereon. II. Appointment of delegates to execute, and if, applicable, formalize the resolutions adopted by the Meeting. Adoption of resolutions thereon. Information related to the items of the Agenda Appointment or reelection of the members of the Board of Directors of the Company that the holders of the Series “L” shares are entitled to appoint Item I. Submission of a proposal for the approval by the Meeting of the reelection of the Company’s current board members that the holders of the Series “L” shares are entitled to appoint. If the aforesaid proposal is approved, the following persons would be reelected as board members: Pablo Roberto González Guajardo Principal occupation: CEO of Kimberly Clark de México, S.A.B. -

Rating Action: Moody's Downgrades Eight Mexican Banks and the IPAB; Outlook Negative

Rating Action: Moody's downgrades eight Mexican banks and the IPAB; outlook negative 22 Apr 2020 Mexico, April 22, 2020 -- Moody's de México ("Moody's") has today downgraded to Baa1, from A3, the long- term global local and foreign currency deposit, issuer and debt ratings, where applicable of BBVA Bancomer, S.A. (BBVA), Banco Mercantil del Norte, S.A. (Banorte), Banco Santander México, S.A. (Santander México), Banco Nacional de México, S.A. (Citibanamex), HSBC México, S.A. (HSBC México), Banco Nacional de Obras y Servicios Públicos, S.N.C. (Banobras), Nacional Financiera, S.N.C. (Nafin), Banco Nacional de Comercio Exterior, S.N.C. (Bancomext), and the deposit insurer, Instituto para la Protección al Ahorro Bancario (IPAB). Moody's also affirmed MUFG Bank México, S.A.'s (MUFG) Baa1 deposit ratings. In the same rating action, Moody's affirmed the Aaa.mx/MX-1 long- and short-term Mexican National Scale ratings of BBVA, Banorte, Santander México, Citibanamex, HSBC México, Banobras, Nafin, Bancomext, and the IPAB. Moody's also affirmed long- and short-term Mexican National Scale ratings of Banco del Bajío, S.A. (BanBajío) at Aa2.mx/MX-1 and of MUFG at Aa1.mx/MX-1. The rating outlook on BBVA, Banorte, Santander México, Banobras, Nafin, Bancomext, and the IPAB remains negative. The rating outlook for Citibanamex and HSBC México was changed to stable, from negative. The rating outlook on BanBajío was changed to negative, from stable of its global local and foreign currency ratings. The rating outlook on MUFG remained stable. Moody's also affirmed the baseline credit assessments (BCAs) and adjusted BCAs of BBVA, Banorte, Santander México, Citibanamex, HSBC México, BanBajío, MUFG, Banobras, Nafin and Bancomext. -

Member's Profile

Member’s Profile Organization Name: S.D. INDEVAL, S.A. DE CV. Country/ Region: MÉXICO Name of CEO: GERARDO JAVIER GAMBOA ORTIZ Capital (US$): 12,424,615.00 USD Number of Officers and Employees: 59 Ownership and Governance (Main Shareholders) No. CASAS DE BOLSA 1 ABN AMRO Securities (México), S.A. de C.V., Casa de Bolsa 2 Acciones y Valores Banamex, S.A. de C.V, Casa de Bolsa, Integrante del Grupo Financiero Banamex 3 Actinver Casa de Bolsa, S.A. de C.V. 4 Casa de Bolsa Arka, S.A. de C.V. 5 Casa de Bolsa Banorte, S.A. de C.V., Grupo Financiero Banorte 6 Casa de Bolsa BBVA Bancomer, S.A. de C.V., Grupo Financiero BBVA Bancomer 7 Casa de Bolsa Citibank, S.A. de C.V., Grupo Financiero Citibank 8 Casa de Bolsa Santander, S.A. de C.V., Grupo Financiero Santander 9 Deutsche Securities, S.A. de C.V., Casa de Bolsa 10 Finamex Casa de Bolsa, S.A. de C.V., Grupo Financiero Finamex 11 GBM Grupo Bursátil Mexicano, S.A. de C.V., Casa de Bolsa 12 HSBC Casa de Bolsa, S.A. de C.V., Grupo Financiero HSBC 13 ING (México), S.A. de C.V., Casa de Bolsa, ING Grupo Financiero 14 Interacciones Casa de Bolsa, S.A. de C.V., Grupo Financiero Interacciones 15 Inversora Bursátil, S.A. de C.V., Casa de Bolsa, Grupo Financiero Inbursa 16 Invex Casa de Bolsa, S.A. de C.V., Invex Grupo Financiero 17 IXE Casa de Bolsa, S.A. -

MVIS Mexico Index

FACTSHEET MVIS Mexico Index The MVIS Mexico Index (MVMEX) tracks the performance of the largest and most liquid companies in Mexico. The index is a modified market cap-weighted index, and it also includes non-local companies incorporated outside Mexico that generate at least 50% of their revenue in Mexico. MVMEX covers at least 90% of the investable universe. Key Features Size and Liquidity Requirements Full MCap of at least 150 mln USD.Three month average-daily-trading volume of at least 1 mln USD at a review and also at the previous two reviews.At least 250,000 shares traded per month over the last six months at a review and also at the previous two reviews. Pure-Play Index includes non-local companies. Diversification Company weightings are capped at 8%. Review All Time High/Low 52-Week High/Low Quarterly. Total Return Net Index 2,897.69/703.32 2,331.21/1,590.38 Index Data INDEX PARAMETERS FUNDAMENTALS* ANNUALISED PERFORMANCE* Launch Date 14 Jul 2010 Components 38.00 Price/Earnings Trailing 19.53 1 Month -5.07% Type Country Volatility (1 year) 19.21 Price/Book 2.16 1 Year 37.47% Currency USD Full MCap bn USD 434.87 Price/Sales 1.68 3 Years 1.13% Base Date 30 Dec 2004 Float MCap bn USD 229.26 Price/Cash Flow 9.41 5 Years 1.47% Base Value 1,000.00 Correlation* (1 year) 0.91 Dividend Yield 2.15 Since Inception 4.78% * as of 30 Sep 2021 * MSCI Mexico IMI * Total Return Net Index Country and Size Weightings COUNTRY WEIGHTINGS EXCL. -

It's the Best Way to Send Money Home

It’s the best way to send money home. The Directo a México logo and “Directo a México” are service marks of the Federal Reserve Banks in the United States and service marks of the Banco de México in Mexico Outline o What is Directo a México? o Bansefi & Beneficiary Account Registration (BAR) Overview o Testimonial o Getting Started o Q & A 2 Account to Account Transfers o Uses existing ACH software and NACHA rules o CBR/PBR SEC codes o Certainty of Payment oNext business day funds availability (by 2:30 p.m. CT) o Same day as U.S. settlement* o Low cost oPer item surcharge of $0.67 to U.S. financial institutions o U.S. financial institutions determine own fee to customers – generally, financial institutions charge between $2.50 - $5.00. *Assuming not a bank holiday in Mexico. 3 More Pesos for Every Dollar Sent o U.S. dollar to Mexican peso conversion at highly competitive rate for every payment—regardless of amount 4 Foreign Exchange Savings Directo a Mexico FX rates compared to data in Appleseed study on FX rates of other transfers for 2 week period in 2005. “Banked Bonus” – Directo a México FX rate results in beneficiary receiving peso 10.90 equivalent of US$5 more per transfer (on a US$350 payment) 10.85 10.80 10.75 10.70 10.65 10.60 10.55 10.50 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 10a 3p 6/13 6/14 6/15 6/16 6/17 6/20 6/21 6/22 6/23 6/24 Texas Avg Directo a México Georgia Avg Nebraska Avg Illinois Avg 5 Study available at: http://appleseeds.net/servlet/PublicationInfo?articleId=48 Directo a México Kit Helps -

Annual Report '05 a N N U a L R E P O R T 2

ANNUAL REPORT 2005 ANNUAL REPORT ‘05 Mission A Financial Group committed to Mexico, comprising the best human capital and created to efficiently care for and increase the patrimony of our clients and partners Vision To be leaders in mexico’s financial sector with regard to profitable growth, in the benefit of our clients, collaborators and partners Values • Commitment to Mexico • Long-Term Vision • Integral Personnel Development • Integrity • Reliability • Austerity Key Capacities • Operating Efficiency • Slender Structure with Good Communication and Clear Leadership • Transparency and Little Bureaucracy • Result-Driven • Clear Business Approach • Pertinent Risk Selection Index Relevant Figures 02 Corporate Structure 04 Report to Shareholders 05 Audit Committee Report 07 Board of Directors 09 General Directors 09 Directors’ Curricula 10 Results of Grupo Financiero Inbursa 11 Subsidiaries of Grupo Financiero Inbursa 12 Banco Inbursa 12 Seguros Inbursa y Patrimonial Inbursa 16 Pensiones Inbursa 18 Operadora Inbursa de Sociedades de Inversión 20 Inversora Bursátil 22 Fianzas Guardiana Inbursa 22 Pieta (Pietá) 1498 – 1500, Bronze with brown patina Michelangelo Buonarroti Annual Report Grupo Financiero Inbursa RELEVANT FIGURES 02 Relevant Figures Stockholder’s Equity1 Stockholder’s Equity2 (National Banking and Securities (US GAAP B USD) Commission GAAP B Ps) 50.000 50.000 3,600 3,600 8000 8000 800 800 40,892.8 40.000 40.000 40,892.8 3,400 3,400 6000 6000 600 600 637.3 637.3 3,495.0 3,495.0 8,790.0 8,790.0 39,142.1 5,549.6 39,142.1 30.000 30.000 3,200 3,200 4000 4000 5,549.6 400 400 414.9 414.9 3,236.0 32,102.8 3,236.0 32,102.8 20.000 20.000 3,000 3,000 2000 2000 200 200 2,913.4 2,913.4 2004 2004 2004 2004 2004 2004 2004 2004 2005 2005 2005 2005 2005 2005 2005 2005 In May 2005, dividends in the amount of 900 B Ps were paid.