The Railroad Rehabilitation and Improvement Financing (RRIF) Program

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Termination of Combat Zone Designation in Vietnam and Waters Adjacent Thereto Establishing an Emergency Board to Investigate

Executive Orders EO 13003 Texarkana Union Station Trust Company Union Pacific Fruit Express Union Pacific Railroad Galveston, Houston and Henderson Railroad Missouri-Kansas-Texas Railroad Oklahoma, Kansas & Texas Railroad Western Pacific Railroad Wichita Terminal Association Executive Order 13002 of May 13, 1996 Termination of Combat Zone Designation in Vietnam and Waters Adjacent Thereto By the authority vested in me as President by the Constitution and the laws of the United States of America, including section 112(c)(3) of the Internal Revenue Code of 1986 (26 U.S.C. 112(c)(3)), June 30, 1996, as of midnight thereof, is hereby designated as the date of termination of combatant activi- ties in the zone comprised of the area described in Executive Order No. 11216 of April 24, 1965. WILLIAM J. CLINTON THE WHITE HOUSE, May 13, 1996. Executive Order 13003 of May 15, 1996 Establishing an Emergency Board To Investigate Disputes Between Certain Railroads Represented by the National Carriers' Conference Committee of the National Railway Labor Conference and Their Employees Represented by the Brotherhood of Maintenance of Way Employes Disputes exist between certain railroads represented by the National Car- riers' Conference Committee of the National Railway Labor Conference, in- cluding Consolidated Rail Corporation (including the Clearfield Cluster), Burlington Northern Railroad Co., CSX Transportation Inc., Norfolk South- ern Railway Co., Atchison, Topeka and Santa Fe Railway Co., Union Pacific Railroad, Chicago & North Western Railway Co., Kansas City Southern Rail- way Co., and their employees represented by the Brotherhood of Mainte- nance of Way Employes. The railroads involved in these disputes are des- ignated on the attached list, which is made a part of this order. -

Presidential Documents 25131 Presidential Documents

Federal Register / Vol. 61, No. 97 / Friday, May 17, 1996 / Presidential Documents 25131 Presidential Documents Executive Order 13003 of May 15, 1996 Establishing an Emergency Board To Investigate Disputes Be- tween Certain Railroads Represented by the National Car- riers' Conference Committee of the National Railway Labor Conference and Their Employees Represented by the Brother- hood of Maintenance of Way Employes Disputes exist between certain railroads represented by the National Carriers' Conference Committee of the National Railway Labor Conference, including Consolidated Rail Corporation (including the Clearfield Cluster), Burlington Northern Railroad Co., CSX Transportation Inc., Norfolk Southern Railway Co., Atchison, Topeka and Santa Fe Railway Co., Union Pacific Railroad, Chicago & North Western Railway Co., Kansas City Southern Railway Co., and their employees represented by the Brotherhood of Maintenance of Way Employes. The railroads involved in these disputes are designated on the attached list, which is made a part of this order. The disputes have not heretofore been adjusted under the provisions of the Railway Labor Act, as amended (45 U.S.C. 151 et seq.) (the ``Act''). In the judgment of the National Mediation Board, these disputes threaten substantially to interrupt interstate commerce to a degree that would deprive a section of the country of essential transportation service. NOW, THEREFORE, by the authority vested in me as President by the Constitution and the laws of the United States, including section 10 of the Act (45 U.S.C. 160), it is hereby ordered as follows: Section 1. Establishment of Emergency Board (``Board''). There is established effective May 15, 1996, a Board of three members to be appointed by the President to investigate any and all of the disputes raised in mediation. -

Short Line Railcar Storage Locations

Short Line Car Storage Directory State Short Short Line Name Contact Name E-Mail Phone Car Hazmat Hazmat TIH/PIH TIH/PIH Restrictions Line Spots Loads Residue Loads Residue SCAC (Max) (empty but not cleaned) AL RJAL RJ Corman Childersburg Adam Boyles [email protected] 859 314-0891 42 YES YES YES YES AL SQSC Sequatchie Valley Railroad Byron Clinton [email protected] 931 580-7375 750 YES YES NO YES AL ATN Alabama & Tennessee River Railway, LLC Chris Richter [email protected] 920 209-0118 260 YES YES NO NO AL TASD Terminal Railway, Alabama State Docks Cliff Melton [email protected] 251 408-7077 100 NO NO NO NO AL AGR Alabama & Gulf Coast Railway Kevin Phillips [email protected] 904 562-0692 130 NO YES NO NO AL CAGY Columbus & Greenville Railway Kevin Phillips [email protected] 904 562-0692 440 YES YES NO NO AL COEH Conecuh Valley Railroad Co., Inc. Kevin Phillips [email protected] 904 562-0692 300 NO YES NO NO AL MNBR Meridian & Bigbee Railroad Kevin Phillips [email protected] 904 562-0692 240 NO YES NO NO AL TNHR Three Notch Railroad Co. Inc. Kevin Phillips [email protected] 904 562-0692 30 YES YES NO NO AL WGCR Wiregrass Central Railroad Kevin Phillips [email protected] 904 562-0692 100 NO YES NO NO AL EARY Eastern Alabama Railway Kevin Phillips [email protected] 904 562-0692 135 NO YES NO NO AL ALAB Alabama Railroad Co. Nathan Johns [email protected] 309 605-0119 300 YES YES NO NO 263k restriction AL ALE Alabama Export Railroad Meaghan Davis [email protected] 228 474-0711 80 NO NO NO NO CT CNZR Central New England Railroad Deb Belliveau [email protected] 860 666-1030 88 NO NO NO NO 263k restriction CT CSO Connecticut Southern Railroad Kevin Phillips [email protected] 904 562-0692 150 NO NO NO NO 263k restriction, Plate F CT NECR New England Central Railroad Kevin Phillips [email protected] 904 562-0692 400 NO NO NO NO CT HRRC Housatonic Railroad Co., Inc. -

Statement of Assessed Values for Local Tax Purposes for Railroads and Interstate Pipeline Transmission Companies

2019 Statement of Assessed Values for Local Tax Purposes for Railroads and Interstate Pipeline Transmission Companies www.tax.virginia.gov 2019 Statement of Assessed Values for Local Tax Purposes for Railroads and Interstate Pipeline Transmission Companies Virginia Department of Taxation P.O. Box 565 Richmond, Virginia 23218-0565 October 18, 2019 TO: Councils of Incorporated Cities and Towns Board of Supervisors of Counties Commissioners of the Revenue and Supervisors of Assessments Railroad Companies Interstate Pipeline Transmission Companies The document "Statement of Assessed Values for Local Tax Purposes for Railroads and Interstate Pipeline Transmission Companies" is a certified statement of the assessment made by the Department of Taxation for the tax year 2019 of the Virginia real estate and tangible personal property of railroad and interstate pipeline transmission companies. TABLE OF CONTENTS RAILROAD COMPANIES Name and Address of Officer Responsible for Company Tax Payments Page Number Buckingham Branch R. Mark Bryant 1 Railroad Company CEO P. O. Box 336 Dillwyn, VA 23936 CSX Transportation, Inc. Ryan Cole 2 Tax Officer 500 Water Street (J-910) Jacksonville, FL 32202 Chesapeake Western Jennifer L. Schilke 7 Railway Director State Taxes Norfolk Southern Corporation Taxation 1200 Peachtree Street, NE Atlanta, GA 30309 Commonwealth Railway, Inc. Michael B. Holben 7 Director of Finance 13901 Sutton Park Drive South Suite 125, Building A Jacksonville, FL 32224 Interstate Railroad Jennifer L. Schilke 8 Company Director State Taxes Norfolk Southern Corporation Taxation 1200 Peachtree Street, NE Atlanta, GA 30309 Norfolk and Portsmouth Jennifer L. Schilke 8 Belt Line Railroad Director State Taxes Company c/o Norfolk Southern Corporation Taxation 1200 Peachtree Street, NE Atlanta, GA 30309 Norfolk Southern Jennifer L. -

Class I Railroad Annual Report

OEEAA – R1 OMB Clearance No. 2140-0009 Expiration Date 12-31-2022 Class I Railroad Annual Report Norfolk Southern Combined Railroad Subsidiaries Three Commercial Place Norfolk, VA 23510-2191 Full name and address of reporting carrier Correct name and address if different than shown (Use mailing label on original, copy in full on duplicate) To the Surface Transportation Board For the Year Ending December 31, 2020 Road Initials: NS Rail Year: 2020 ANNUAL REPORT OF NORFOLK SOUTHERN COMBINED RAILROAD SUBSIDIARIES ("NS RAIL") TO THE SURFACE TRANSPORTATION BOARD FOR THE YEAR ENDED DECEMBER 31, 2020 Name, official title, telephone number, and office address of officer in charge of correspondence with the Board regarding this report. (Name) Clyde H. "Jake" Allison Jr. (Title) Vice President and Controller (Telephone number) (757) 629-2680 (Area code) (Telephone number) (Office address) Three Commercial Place Norfolk, Virginia 23510-2191 (Street and number, city, state, and ZIP code) Railroad Annual Report R-1 NOTICE 1. This report is required for every class I railroad operating within the United States. Three copies of this Annual Report should be completed. Two of the copies must be filed with the Surface Transportation Board, Office of Economics, Environmental Analysis, and Administration, 395 E Street, S.W. Suite 1100, Washington, DC 20423, by March 31 of the year following that for which the report is made. One copy should be retained by the carrier. 2. Every inquiry must be definitely answered. Where the word "none" truly and completely states the fact, it should be given as the answer. If any inquiry is inapplicable, the words "not applicable" should be used. -

Ns 8001-A Switching and Absorption Tariff

NS 8001-A SWITCHING AND ABSORPTION TARIFF ISSUED: JULY 1, 2019 LOCAL AND JOINT FREIGHT TARIFF PUBLISHING RULES AND CHARGES ON SWITCHING AND EFFECTIVE: SEPTEMBER 1, 2019 ABSORPTION OF SWITCH CHARGES AT STATIONS ON NORFOLK SOUTHERN RAILWAY COMPANY Three Commercial Place Norfolk, VA 23510 www.nscorp.com Effective: September 1, 2019 NS 8001-A CONTENTS CANCELLATION NOTICE ..........................................................................................................................................................................9 PARTICIPATING CARRIERS .......................................................................................................................................................................9 CARRIER ABBREVIATIONS .......................................................................................................................................................................9 SECTION 1: RULES AND OTHER GOVERNING PROVISIONS ...................................................................................................................11 ITEM 1000 - DESCRIPTION OF GOVERNING CLASSIFICATION AND EXCEPTIONS ..............................................................................11 ITEM 1010 - STATION LISTS AND CONDITIONS .................................................................................................................................11 ITEM 1020 - EXPLOSIVES, DANGEROUS ARTICLES ............................................................................................................................11 -

Powerpoint Template

Accidents, Probable Causes and Recommendations 1 Accident Portage, Indiana Northern Indiana Commuter June 18, 1998 – 4:31 a.m. Grade Crossing – Commuter Struck a Steel Truck 3 Fatalities 5 Minor Injuries 2 3 4 Probable Cause …ineffective action by Federal, State, and private agencies to permanently resolve safety problems at the Midwest Steel grade crossing, which they knew to be a hazardous crossing. 5 Accident Butler, Indiana Norfolk Southern/Conrail March 25, 1998 – 4:48 a.m. Collision 1 Fatalities 2 Minor Injuries 6 7 8 Probable Cause • …was the failure of the [crew] to comply with operating rules • …the railroad’s failure to ensure employees’ compliance with operating rules. • …the railroad’s failure to ensure that its locomotive engineer training prepared students for operational situations • …the railroad’s signal maintenance program failure to respond to a reported signal deficiency 9 Accident Flora, Mississippi Canadian National/Amtrak April 6, 2005 – 6:33 p.m. Derailment 1 Fatality 10 11 12 Probable Cause …was the failure of the Canadian National Railway Company to properly maintain and inspect its track, resulting in a rail shift and the subsequent derailment of the train, and the Federal Railroad Administration's ineffective oversight to ensure the proper maintenance of the track by the railroad 13 Accident Dupont Circle, DC Washington Metropolitan Area Transit Authority May 14, 2006 – 10:16 a.m. Wayside Worker 1 Fatality . 14 15 Probable Cause • …was the failure of the automatic train control system (senior) mechanic to [be] aware of the presence of the train or …identify a safe area outside the train’s dynamic envelope. -

A Little Color, Please

A LITTLE BY COLOR, RON PLEASE FLANARY he late 1950s and all of the 1960s companies and the pride their employees were clearly not the best of times felt for the strategic transportation mission T for the American railroad industry. they delivered in their respective service The ascendancy it enjoyed in the earlier areas. years of the 20th century had largely dis- But, these early paint schemes were sipated by the time of the Great Depres- spawned in less expensive and more la- sion. Except for the resurgence during bor-intensive times. The L&N scheme, for the national emergency of World War II, example, used lacquer paint, which dried and a brief time in the post war economic faster (necessary with the multiple layers renaissance period, the industry would and masking these schemes required) but slowly see its share of interstate freight was much less durable than enamel. The and passenger traffic decay. The reasons scheme meant longer periods in the shop have been more thoroughly documented rather than hauling revenue traffic, and in countless theses on the subject, but the more frequent encores for repaints. Time wholesale disappearance of passengers, is money, and the corporate bean coun- mail, and express; the emergence of the ters at the company’s headquarters at 908 Interstate highway system; and growth in West Broadway in Louisville were feeling trucking and barge services were the ma- the pressure on all fronts to squeeze more jor factors. The overbuilt “Rust Belt” of the from every dollar in view of the mounting Northeast was hardest hit, but railroads pressures from other modes of transpor- in virtually every region of the country had tation. -

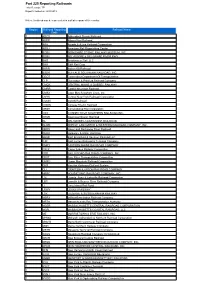

Part 225 Reporting Railroads.Pdf

Part 225 Reporting Railroads Total Records: 771 Report Created on: 4/30/2019 Notes: A railroad may be represented in multiple regions of the country. Region Railroad Reporting Railroad Name Code 1 ADCX Adirondack Scenic Railroad 1 APRR Albany Port Railroad 1 ARA Arcade & Attica Railroad Corporation 1 ARDJ American Rail Dispatching Center 1 BCRY BERKSHIRE SCENIC RAILWAY MUSEUM, INC. 1 BDRV BELVEDERE & DELAWARE RIVER RWY 1 BHR Brookhaven Rail, LLC 1 BHX B&H Rail Corp 1 BKRR Batten Kill Railroad 1 BSOR BUFFALO SOUTHERN RAILROAD, INC. 1 CDOT Connecticut Department Of Transportation 1 CLP Clarendon & Pittsford Railroad Company 1 CMQX CENTRAL MAINE & QUEBEC RAILWAY 1 CMRR Catskill Mountain Railroad 1 CMSX Cape May Seashore Lines, Inc. 1 CNYK Central New York Railroad Corporation 1 COGN COGN Railroad 1 CONW Conway Scenic Railroad 1 CRSH Consolidated Rail Corporation 1 CSO CONNECTICUT SOUTHERN RAILROAD INC. 1 DESR Downeast Scenic Railroad 1 DL DELAWARE LACKAWANNA RAILROAD 1 DLWR DEPEW, LANCASTER & WESTERN RAILROAD COMPANY, INC. 1 DRRV Dover and Rockaway River Railroad 1 DURR Delaware & Ulster Rail Ride 1 EBSR East Brookfield & Spencer Railroad LLC 1 EJR East Jersey Railroad & Terminal Company 1 EMRY EASTERN MAINE RAILROAD COMPANY 1 FGLK Finger Lakes Railway Corporation 1 FRR FALLS ROAD RAILROAD COMPANY, INC. 1 FRVT Fore River Transportation Corporation 1 GMRC Green Mountain Railroad Corporation 1 GRS Pan Am Railways/Guilford System 1 GU GRAFTON & UPTON RAILROAD COMPANY 1 HRRC HOUSATONIC RAILROAD COMPANY, INC. 1 LAL Livonia, Avon & Lakeville Railroad Corporation 1 LBR Lowville & Beaver River Railroad Company 1 LI Long Island Rail Road 1 LRWY LEHIGH RAILWAY 1 LSX LUZERNE & SUSQUEHANNA RAILWAY 1 MBRX Milford-Bennington Railroad Company 1 MBTA Massachusetts Bay Transportation Authority 1 MCER MASSACHUSETTS CENTRAL RAILROAD CORPORATION 1 MCRL MASSACHUSETTS COASTAL RAILROAD, LLC 1 ME MORRISTOWN & ERIE RAILWAY, INC. -

CIPAC Freight Rail Sector Coordinating Council Charter

Rail Sector Coordinating Council Charter Approved: April 2015 1. Official Designation The official designation of this organization is the Rail Sector Coordinating Council. 2. Purpose In accordance with the National Infrastructure Protection Plan (NIPP), this charter defines the structure and governance of the cooperative efforts of railroads operating in the United States to advance the security mission, physical and cyber. 3. Mission The Rail Sector Coordinating Council (SCC) is the rail industry organized and managed representative forum for coordination and for consultations on matters pertaining to physical and cyber security – both amongst railroads and industry organizations and with governmental entities in the United States. Areas of activity for the Rail SCC are: - Serving as the principal rail industry liaison with United States government departments and agencies on matters pertaining to security; - Coordinating with these governmental components on rail security strategy, programs, and policies; - Identifying and advancing capabilities, procedures, and related opportunities to enhance collective means to address security challenges; and - Defining and pursuing priorities for intelligence analyses and security information sharing between United States government components and the industry. 4. Governance 4.1 Membership - Membership in the Rail SCC is open to freight and passenger railroads that operate in the United States. - The current membership roster is an Appendix to this Charter. 1 - The distinction between “Participating” and “Consultative” members reflects the differing level of involvement by the organizations. - Participating members engage regularly in the teleconferences or meetings of the SCC. - Consultative members receive communications on SCC activities, with the continuous opportunity to participate in consultations and to provide input. -

Summary of Class II and Class III Railroad Capital Needs and Funding Sources

Summary of Class II and Class III Railroad Capital Needs and Funding Sources Federal Railroad Administration _________________________________________________________________ A Report to Congress _________________________________________________________________ DOT/FRA October 2014 (This Page Intentionally Left Blank.) i Table of Contents EXECUTIVE SUMMARY ........................................................................................................... iii INTRODUCTION .......................................................................................................................... 1 CLASS II AND CLASS III RAILROADS .................................................................................... 2 PAST CLASS II AND CLASS III RAILROAD INVESTMENT ................................................. 4 Class II and Class III Railroad Safety Trend............................................................................... 4 Capability to Handle 286,000-Pound Axle Weights ................................................................... 5 PREVIOUS STUDIES.................................................................................................................... 6 FRA’s 1993 Study ....................................................................................................................... 6 UGPTI 2002 Study ...................................................................................................................... 7 Other Studies (AASHTO and ZETA-TECH) ............................................................................ -

Surviving Virginia Railroad Stations

Surviving Virginia Railroad Stations Abingdon: Two passenger railroad stations built by the Norfolk & Western Railway here still stand. Ajax: The passenger station originally built by the F&P here still stands. Alexandria: The passenger and freight stations originally built by the Richmond, Fredericksburg & Potomac Railroad here still stand, the former used as an Amtrak and Virginia Railway Express stop. Allisonia: The passenger station originally built by the Norfolk & Western Railway here still stands. Altavista: The passenger railroad station originally built by the Southern here still stands. Amherst: The passenger railroad station originally built by the Southern here still stands, derelict. Antlers: The passenger station originally built by the Norfolk, Franklin & Danville Railway here still stands. Appalachia: The passenger station originally built by the Interstate Railroad, Louisville & Nashville and Southern Railroad here still stands. Also, the Interstate's freight depot here remains. Appomatox: The passenger station originally built by the N&W here still stands. Arrington: The passenger railroad station originally built by the Southern here still stands, used as a business. Ashcake: The passenger railroad station originally built by the C&O here still stands. Ashland: The passenger railroad station originally built by the RF&P here still stands, used as an Amtrak stop. Axton: The passenger depot originally built by the Carolina & Northwestern Railroad here still stands, used as a business. Balcony Falls: The passenger railroad station originally built by the C&O here still stands, owned by CSX. Baskerville: The passenger station originally built by the NF&D here still stands. Bealeton: The passenger station originally built by the Southern here still stands, restored, used as a museum.