2018 Interim Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FCC-06-11A1.Pdf

Federal Communications Commission FCC 06-11 Before the FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of ) ) Annual Assessment of the Status of Competition ) MB Docket No. 05-255 in the Market for the Delivery of Video ) Programming ) TWELFTH ANNUAL REPORT Adopted: February 10, 2006 Released: March 3, 2006 Comment Date: April 3, 2006 Reply Comment Date: April 18, 2006 By the Commission: Chairman Martin, Commissioners Copps, Adelstein, and Tate issuing separate statements. TABLE OF CONTENTS Heading Paragraph # I. INTRODUCTION.................................................................................................................................. 1 A. Scope of this Report......................................................................................................................... 2 B. Summary.......................................................................................................................................... 4 1. The Current State of Competition: 2005 ................................................................................... 4 2. General Findings ....................................................................................................................... 6 3. Specific Findings....................................................................................................................... 8 II. COMPETITORS IN THE MARKET FOR THE DELIVERY OF VIDEO PROGRAMMING ......... 27 A. Cable Television Service .............................................................................................................. -

PDF Full Report

Heightening Sense of Crises over Press Freedom in Hong Kong: Advancing “Shrinkage” 20 Years after Returning to China April 2018 YAMADA Ken-ichi NHK Broadcasting Culture Research Institute Media Research & Studies _____________________________ *This article is based on the same authors’ article Hong Kong no “Hodo no Jiyu” ni Takamaru Kikikan ~Chugoku Henkan kara 20nen de Susumu “Ishuku”~, originally published in the December 2017 issue of “Hoso Kenkyu to Chosa [The NHK Monthly Report on Broadcast Research]”. Full text in Japanese may be accessed at http://www.nhk.or.jp/bunken/research/oversea/pdf/20171201_7.pdf 1 Introduction Twenty years have passed since Hong Kong was returned to China from British rule. At the time of the 1997 reversion, there were concerns that Hong Kong, which has a laissez-faire market economy, would lose its economic vigor once the territory is put under the Chinese Communist Party’s one-party rule. But the Hong Kong economy has achieved generally steady growth while forming closer ties with the mainland. However, new concerns are rising that the “One Country, Two Systems” principle that guarantees Hong Kong a different social system from that of China is wavering and press freedom, which does not exist in the mainland and has been one of the attractions of Hong Kong, is shrinking. On the rankings of press freedom compiled by the international journalists’ group Reporters Without Borders, Hong Kong fell to 73rd place in 2017 from 18th in 2002.1 This article looks at how press freedom has been affected by a series of cases in the Hong Kong media that occurred during these two decades, in line with findings from the author’s weeklong field trip in mid-September 2017. -

Ace AV Solution Vtek ARD-CX5 Channels List with Web Link As at 21St Nov, 2011

Ace AV Solution Vtek ARD-CX5 Channels List with Web Link as at 21st Nov, 2011. No 频道 Channel Language Service Provider Country Web Link 1 广东电视台体育频道 Guangdong Sports Cantonese Guangdong Television China http://www.gdtv.com.cn/newpage/dabenying/typd/index.asp 2 珠江台 GDTV Cantonese Guangdong Television China http://www.gdtv.com.cn/newpage/dabenying/zjpd2/index.asp 3 高尔夫 Golfbox China English Golf Box, China China http://www.golfbox.cn/ 4 CHC-HD 高清电影 CHC-HD Chinese Movies Mandarin People's Republic of China China http://www.chc2004.cn/huacheng/chc_h.htm 5 中国中央电视台5体育 CCTV5 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv5/ 6 中國中央電視台13新聞 CCTV13 Mandarin People's Republic of China China http://cctv.cntv.cn/cctvxinwen/ 7 中國中央電視台1綜合 CCTV1 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv1/ 8 中國中央電視台2財經 CCTV2 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv2/ 9 中國中央電視台3綜藝 CCTV3 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv3/ 10 中國中央電視台4中文國際(亞洲) CCTV4 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv4asia/ 11 中國中央電視台8電視劇 CCTV8 Mandarin People's Republic of China China http://cctv.cntv.cn/cctv8/ 12 凤凰卫视台 Phoenix Satellite TV Mandarin Phoenix Satellite Television Holdings Limited China http://phtv.ifeng.com/ 13 凤凰资讯台 Phoenix Satellite TV News Mandarin Phoenix Satellite Television Holdings Limited China http://news.ifeng.com/ 14 東方衛視 Dragontv Mandarin Shanghai Media Group China http://www.dragontv.cn/ 15 江蘇衛視 Jiangsu Satallite TV (JSBC) Mandarin Jiangsu Broadcasting Corporation China http://www.jsbc.com/ 16 深圳体育 Shenzhen Sports Mandarin Shenzhen Media Group China http://www.sztv.com.cn/szmg_television/index.do?a=channelindex0506&m=0506 17 湖南卫视 Hunantv Mandarin Golden Eagle Broadcasting System China http://zixun.hunantv.com/ 18 古巴电视 Cubavision Spanish Cuban Institute of Radio and Television Cuba http://www.cubavision.cubaweb.cu/portada.asp 19 法国时装 Fashion TV English Fashion TV France http://www.ftv.com/schedule 20 法国电视 TV5Monde French TV5MONDE, S.A. -

Reddening Or Reckoning?

Reddening or Reckoning? An Essay on China’s Shadow on Hong Kong Media 22 Years after Handover from British Rule Stuart Lau Journalist Fellow 2018 Reuters Institute for the Study of Journalism University of Oxford August 2019 CONTENTS 1. Preface 2 2. From top to bottom: the downfall of a TV station 4 3. Money, Power, Media 10 4. “Political correctness”: New normal for media 20 5. From the Big Brother: “We are watching you” 23 6. Way forward - Is objective journalism still what Hong Kong needs? 27 1 Preface Hong Kong journalists have always stood on the front line of reporting China, a country that exercises an authoritarian system of government but is nonetheless on track to global economic prominence. The often-overlooked role of Hong Kong journalists, though, has gained international attention in summer 2019, when weeks of citywide protests has viralled into the largest-scale public opposition movement ever in the city’s 22-year history as a postcolonial political entity under Chinese sovereignty, forcing the Hong Kong government into accepting defeat over the hugely controversial extradition bill. While much can be said about the admirable professionalism of Hong Kong’s frontline journalists including reporters, photojournalists and video journalists, most of whom not having received the level of warzone-like training required amid the police’s unprecedentedly massive use of potentially lethal weapons, this essay seeks to examine something less visible and less discussed by international media and academia: the extent to which China influences Hong Kong’s media organisations, either directly or indirectly. The issue is important on three levels. -

Alternative Media and Street Politics in Hong Kong

International Journal of Communication 12(2018), 3707–3728 1932–8036/20180005 Digital Amplification of Fringe Voices: Alternative Media and Street Politics in Hong Kong YIDONG WANG University of Wisconsin–Madison, USA This study examined the development of alternative media in Hong Kong from 2012 to 2016. This time period saw a proliferation of media outlets that represented alternative voices. Adopting the theoretical framework of media ecology, I analyzed the political economy of the alternative media niche. The emergence of the alternative media niche was facilitated by digital technologies, but technological development was not the sole driving force. The centralization of media ownership collided the ability of mainstream media outlets to represent a wide spectrum of opinions. Meanwhile, the legitimacy of institutional politics was challenged by street politics, and hence the loosening of institutional control over ideology opened up a new space for political discussion and civic engagement. Alternative media used digital technologies to respond to this decreased supply and increased demand for media production that amplified fringe voices within the Hong Kong civil society. Keywords: alternative media, media ecology, Hong Kong localism, political economy, media ownership Hong Kong is a media-saturated society. The city has a population of 7.3 million and a high volume of media products circulating among the local population. There are 52 daily newspapers, more than 600 periodicals, and seven licensed broadcast networks serving the 2.5 million households in Hong Kong (“Hong Kong: The Facts,” 2016). The statistics do not yet include many alternative media outlets that publish on a smaller scale but represent emerging fringe voices. -

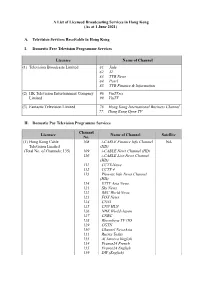

A List of Licensed Broadcasting Services in Hong Kong (As at 1 June 2021)

A List of Licensed Broadcasting Services in Hong Kong (As at 1 June 2021) A. Television Services Receivable in Hong Kong I. Domestic Free Television Programme Services Licensee Name of Channel (1) Television Broadcasts Limited 81. Jade 82. J2 83. TVB News 84. Pearl 85. TVB Finance & Information (2) HK Television Entertainment Company 96. ViuTVsix Limited 99. ViuTV (3) Fantastic Television Limited 76. Hong Kong International Business Channel 77. Hong Kong Open TV II. Domestic Pay Television Programme Services Channel Licensee Name of Channel Satellite No. (1) Hong Kong Cable 108 i-CABLE Finance Info Channel NA Television Limited (HD) (Total No. of Channels: 135) 109 i-CABLE News Channel (HD) 110 i-CABLE Live News Channel (HD) 111 CCTV-News 112 CCTV 4 113 Phoenix Info News Channel (HD) 114 ETTV Asia News 121 Sky News 122 BBC World News 123 FOX News 124 CNNI 125 CNN HLN 126 NHK World-Japan 127 CNBC 128 Bloomberg TV HD 129 CGTN 130 Channel NewsAsia 131 Russia Today 133 Al Jazeera English 134 France24 French 135 France24 English 139 DW (English) - 2 - Channel Licensee Name of Channel Satellite No. 140 DW (Deutsch) 151 i-CABLE Finance Info Channel 152 i-CABLE News Channel 153 i-CABLE Live News Channel 154 Phoenix Info News 155 Bloomberg 201 HD CABLE Movies 202 My Cinema Europe HD 204 Star Chinese Movies 205 SCM Legend 214 FOX Movies 215 FOX Family Movies 216 FOX Action Movies 218 HD Cine p. 219 Thrill 251 CABLE Movies 252 My Cinema Europe 253 Cine p. 301 HD Family Entertainment Channel 304 Phoenix Hong Kong 305 Pearl River Channel 311 FOX 312 FOXlife 313 FX 317 Blue Ant Entertainment HD 318 Blue Ant Extreme HD 319 Fashion TV HD 320 tvN HD 322 NHK World Premium 325 Arirang TV 326 ABC Australia 331 ETTV Asia 332 STAR Chinese Channel 333 MTV Asia 334 Dragon TV 335 SZTV 336 Hunan TV International 337 Hubei TV 340 CCTV-11-Opera 341 CCTV-1 371 Family Entertainment Channel 375 Fashion TV 376 Phoenix Chinese Channel 377 tvN 378 Blue Ant Entertainment 502 Asia YOYO TV 510 Dreamworks 511 Cartoon Network - 3 - Channel Licensee Name of Channel Satellite No. -

A1) a New Online Platform with All TVB Productions - Mytv SUPER

FAQ - myTV SUPER About myTV SUPER Q1) What is myTV SUPER? A1) A new online platform with all TVB productions - myTV SUPER. You can enjoy over 30 TVchannels by the brand new myTV SUPER Box and APP. You can catch up on your favorite programs with instant 3-hours playback function of designated channels. Besides, myTV SUPER provides TVB drama library, Asian dramas and variety shows, movies, classic movies and other popular acquired programs. You can pick your favorite show anytime and anywhere through TV set, PC, Smartphone or Tablet PC. myTV SUPER also provides live streaming channels, VOD, time shift, and catch-up which brings you to a new horizon of TV and online video watching excitement! All programs and channels are subject to the final announcement of myTV SUPER. Q2) What are the differences among myTV SUPER, myTV and GOTV? A2) Users of myTV can review the 5 free TVB channels anytime anywhere, some channels are available for live streaming too. While through GOTV people can watch over ten thousands of TVB classic dramas in the past 40 years. Yet myTV SUPER, subscribers can watch more than 30 channels! It not only supports live streaming and review functions, but also let you to playback your favorite programs just 3 hours ago. myTV SUPER provides TVB drama library, Asian dramas and variety shows, movies, classic movies and other popular acquired programs. You can pick your favorite show anytime and anywhere through TV set, PC, Smartphone or Tablet PC which brings you to a new horizon of TV and online video watching excitement! Q3) Does myTV SUPER have any service area restriction? A3) myTV SUPER is available in Hong Kong only. -

Overview of Major Developments in the Communications Market

Chapter 5: Overview of Major Developments in the Communications Market Overview of Major Developments in the Communications Market 14 COMMUNICATIONS AUTHORITY ANNUAL REPORT 2018/19 Chapter 5: Overview of Major Developments in the Communications Market Broadcasting (RTHK), as the public service broadcaster in Hong Kong, provided three channels and two 5.1 An Overview of the Developments of them were simulcast in both analogue and in the Broadcasting Market digital formats. 5.1.1 Number of Licensees and Channels As at March 2019, there were two pay TV licensees, viz. Hong Kong Cable Television Television Programme Services Limited (HKCTV) and PCCW Media Limited (PCCW Media), providing a total of 389 pay As at March 2019, the total number of free television channels and offering a diverse range TV, pay TV and non-domestic TV licensees was of local and overseas productions. Among 19. They provided 622 television channels1, those channels, over 130 were HDTV channels. of which 448 were receivable in Hong Kong, representing a slight decrease of 3% since As at March 2019, there were 14 non- March 2018. An overview of the channels domestic TV licensees providing a total provided by the television programme service of 221 television channels, representing an licensees is shown in Figure 1. increase of 18% since March 2018. Hong Kong viewers could receive 47 of those As at March 2019, there were three free TV television channels. licensees, viz. Fantastic Television Limited (Fantastic TV), HK Television Entertainment During the period under review, there were Company Limited (HKTVE) and Television 22 other licensable TV licensees providing Broadcasts Limited (TVB). -

2019 Annual Report

FINANCIAL HIGHLIGHTS 2019 2018 Change Earnings & Dividends# Per Share Earnings per Share # Performance nd Dividends per Share Celebrating its 52 3.5 Loss per share HK$(0.67 ) HK$(0.45 ) 48% 3 Dividends per share year of operation, Television 2.5 - Interim HK$0.30 HK$0.30 2 - Final HK$0.20 HK$0.70 HK$0.50 HK$1.00 Broadcasts Limited is the 1.5 HK$ 1 HK$’mil HK$’mil leading terrestrial TV broadcaster 0.5 Revenue from external customers - Hong Kong TV broadcasting 2,190 2,923 -25% Since0 2016, TVB has headquartered in Hong Kong. TVB - myTV SUPER 442 402 10% -0.5 - Big Big Channel business 129 87 47% been-1 transformed from - Programme a licensing and 2015 2016 2017 2018 2019 is also one of the largest distribution 740 870 -15% YEAR # excluding special dividend - Overseas pay TV and traditional media to a TVB Anywhere 144 140 3% commercial Chinese programme - Other activities 4 55 -92% major digital player, 3,649 4,477 2019 Revenue from External Customers by producers in the world with an Operating Segment Segment profit/(loss)* % relating to 2018 are shown in brackets operating over-the-top - Hong Kong TV broadcasting (304 ) 194 N/A annual production output of over - myTV SUPER 40 16 154% Hong Kong TV broadcastingservices - Big Big Channel business 44 (19 ) N/A 60% (65%) myTV SUPER - Programme licensing and 22,000 hours of dramas and distribution 412 414 -1% Programmeand TVB Anywhere - Overseas, pay TV and licensing and TVB Anywhere (10 ) (16 ) -37% variety programmes, in addition distribution - Other activities (4 ) (17 ) -74% 20%social (19%) media platform - CorporateBig support# (152 ) (150 ) 1% to documentaries and news Other activities 26 422 -94% 1% (2%) Big Channel and e-commerceTotal expensesΔ 3,698 4,062 -9% reports, and an archive library of Overseas pay TV myTV SUPER Big Big andplatform TVB Anywhere 12% (9%) Big ChannelBig Shop Loss attributable. -

SPECTRUM TV® PRODUCT INFO Why Spectrum TV®?

Spectrum Products and Services VER 2221.1 Charter Communications Who We Are: • A Fortune 80, leading broadband connectivity company and cable operator. What We Offer: • Advanced video, high-speed Internet, and telephone services under the Spectrum Brand. Where We Serve: • 41 states providing service to more than 30 million residential and business customers. Our Mission: • To provide value to our customers. We do this every day by offering high-quality entertainment and communication services while continually improving customer care through the commitment of our 98,000 employees nationwide. Deliver Exceptional Customer Experience: • Focus on delivering the highest value to our customers, always with a sense of urgency • We strive to provide the best products and services and we stand behind everything we do • Our continued success depends on exceeding the expectations of our customers General Business Conduct You play a critical role in our ongoing efforts to continue that positive trend. To that end, you are expected to embrace Charter’s customer service philosophy by following thesetenets: • Always take appropriate action to address a customer’s concerns or needs and transform the customer experience • Treat the customer with the utmost respect and dignity • Always behave professionally • Ensure that the customer’s experience is exceptional before ending an interaction • If the opportunity arises, sell Charter’s products and services to an existing or potential customer • NEVER misuse or improperly disclose confidential customer information or purposely record false customer information • Comply fully with the law and Charter’s policies to secure new customers, retain existing customers, upgrade services, or disconnect services REMEMBER: You are a Charter Ambassador Doing Business the Right Way Some Guidelines to Follow: Doing Business the Right Way Spectrum Coverage SPECTRUM TV® PRODUCT INFO Why Spectrum TV®? With Spectrum TV®, your favorites are on anytime, anywhere. -

Review of Operations

REVIEW OF OPERATIONS HONG KONG TV BROADCASTING As the most watched platform in Hong Kong, TVB channels continue to attract a diversified advertiser Hong Kong TV broadcasting business continued to be base. The fast moving consumer goods (“FMCG”) the largest revenue contributor, accounting for 65% of category continued to dominate our client base. the Group’s revenue. This segment includes Hong Kong Overall, the rankings of the key advertisers in the terrestrial TV broadcasting and the co-production of spending league table were maintained stable with drama serials partnering with leading Chinese online the five top spending categories mirroring those of last video platforms. During the year, segment revenue year. Milk powder secured the top spending position from external customers increased by HK$105 million but witnessed a further decline this year as the retail or 4% year-on-year from HK$2,818 million to HK$2,923 sales had persistently been affected by enforcement of million mainly due to higher co-production income the hand-carry limit for infant formula across border, earned during the year. a law introduced back in 2013. The second largest category, loan and mortgage companies continued ADVERTISING REVENUE to use TV commercials for their image-building campaigns and had increased spending from last year. The year of 2018 started on a fairly optimistic tone. Skincare category, secured the third position with an However, tensions arising from US-China trade disputes ad-spend growth reversing the downward trend since intensified since mid-year, bringing volatilities to 2014. But it is still too early to conclude a turnaround the stock markets around the world and dampening for this category. -

Makes Weekdays Strong Days

November16,1970:Our40thYear:$1.00 Broadcasting THE BUSINESSWEEKLY OF TELEVISION AND RADIO An indecisive fourth quarter ends iffy spot -TV year Fight shapes up on override of political- broadcasting veto Noncommercial broadcasters move into the target zone Promotion experts continue their search for relevancy Screen Gems makes weekdays strong days NOVEMBER 1970 MAGILLA GORILLA Screen Gems (150 color S M T W T F S has other strong 7- minute cartoons) shows that will Premiere week - work successfully tops in its time for you across - period on WPIX, the- board. New York. THE FARMER'S DAUGHTER (101 HUCKLEBERRY half- hours), THE HOUND! YOGI BEAR DONNA REED (276 color SHOW (175 half - 7- minute cartoons) hours), DENNIS THE MENACE (146 half- hours), THE FLINTSTONES FATHER KNOWS (166 -color half - BEST (191 half- hours) hours) and QUICK DRAW McGRAW (135 cartoons). THE FLYING NUN Call us. On a (82 color half- weekday. hou rs) Premiering now in 35 markets. Screen Gems HAZEL (154 color half- hours) A team of professional broadcast journalists presenting clearly and concisely the events and people that affect our lives. It cuts through the froth. Gets to the heart of an issue, problem or statement. The approach is more informal, relaxed,. conversational. Become a part of Washington's first and only... Steve Gilmartin Louis Allen 5:30 & 11:00 PM Joe McCaffrey Jim Steer Fred) Thomas WMALTV THE EVENING STAR BROADCASTING CO. WASHINGTON. D.C. REPRESENTED BY HARRINGTON, RIGHTER & PARSONS. INC. TRUST US This is the Buddah Group's promotional force. We're your most valuable record programming tool.