Financial Statements As on 31 March 2017 F (06.05.2017) HOA .Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Useful Information for Shareholders

useful information for shareholders Financial Calendar Particulars Date Twelfth Annual General Meeting April 17, 2008 First Extra-ordinary General Meeting April 17, 2008 Transfer of bonus shares May 07, 2008 Half-yearly Financial Statements (Un-audited) June 30, 2008 Record date for Bonus Shares March 01, 2009 Next half-yearly Financial Statements June 30, 2009 2nd Extra-ordinary General Meeting The 2nd Extra-ordinary General Meeting of the shareholders of the Bank will be held on March 23, 2009 at 10:00 a.m. at the “Hall of Fame” of Bangladesh-China Friendship Conference Center (BCFCC), Agargaon, Dhaka. 13th Annual General Meeting The 13th Annual General Meeting of shareholders of the Bank will be held on March 23,2009 at 10:30 a.m. at the “Hall of Fame” of Bangladesh-China Friendship Conference Center (BCFCC), Agargaon, Dhaka. Information on dividends Bonus share @3.94719 for existing 1 share of Taka 100 each for 2007 were declared in 2008. 50% bonus share i.e. 1 bonus share for existing 2 shares of Taka 100 each is proposed for 2008. Share transfer system The shares of Dutch-Bangla Bank Limited (DBBL) are being traded at the Stock Exchanges in Dematerialized form since June 15, 2004 through Central Depository Bangladesh Limited (CDBL) as per directive of Securities and Exchange Commission (SEC). Physical shares, which are not yet dematerialized, can be dematerialized with CDBL through BO account with Depository Participant (DP). Information relating to shareholdings Distribution of shares of DBBL and shareholdings by the Directors are given in Note 17 to Financial Statements of this Annual Report. -

“E-Business and on Line Banking in Bangladesh: an Analysis”

“E-Business and on line banking in Bangladesh: an Analysis” AUTHORS Muhammad Mahboob Ali ARTICLE INFO Muhammad Mahboob Ali (2010). E-Business and on line banking in Bangladesh: an Analysis. Banks and Bank Systems, 5(2-1) RELEASED ON Wednesday, 07 July 2010 JOURNAL "Banks and Bank Systems" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Banks and Bank Systems, Volume 5, Issue 2, 2010 Muhammad Mahboob Ali (Bangladesh) E-business and on-line banking in Bangladesh: an analysis Abstract E-business has created tremendous opportunity all over the globe. On-line banking can act as a complementary factor of e-business. Bangladesh Bank has recently argued to introduce automated clearing house system. This pushed up- ward transition from the manual banking system to the on-line banking system. The study has been undertaken to ob- serve present status of the e-business and as its complementary factor on-line banking system in Bangladesh. The arti- cle analyzes the data collected from Bangladeshi banks up to February 2010 and also used snowball sampling tech- niques to gather answer from the five hundred respondents who have already been using on-line banking system on the basis of a questionnaire which was prepared for this study purpose. The study found that dealing officials of the banks are not well conversant about their desk work. The author observed that the country can benefit from successful utiliza- tion of e-business as this will help to enhance productivity. -

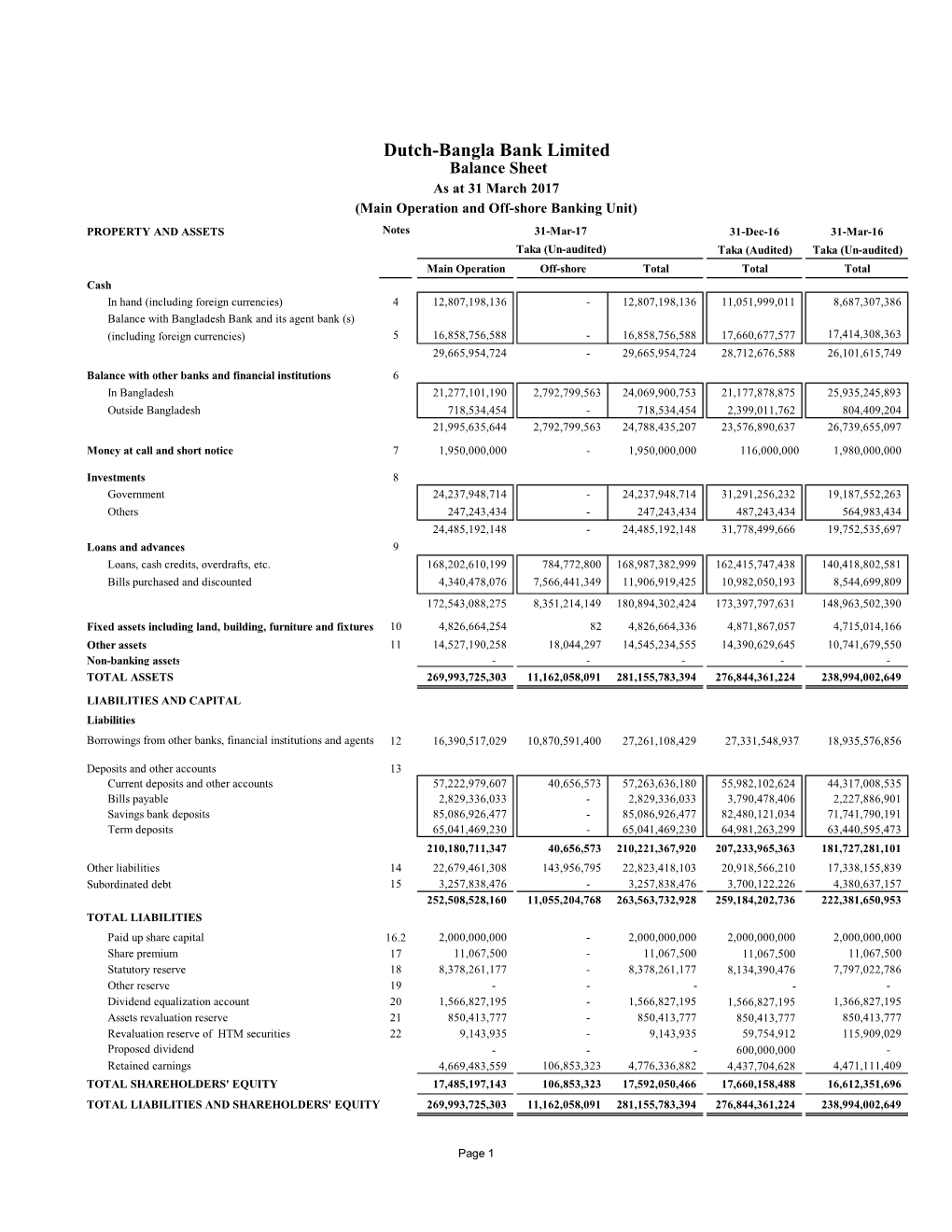

Dutch-Bangla Bank Limited Balance Sheet As at 31 March 2016 (Main Operation and Off-Shore Banking Unit)

Dutch-Bangla Bank Limited Balance Sheet As at 31 March 2016 (Main Operation and Off-shore Banking Unit) PROPERTY AND ASSETS Notes 31-Mar-16 31-Dec-15 31-Mar-15 Taka (Un-audited) Taka (Audited) Taka (Un-audited) Main Operation Off-shore Total Total Total Cash In hand (including foreign currencies) 4 8,687,307,386 - 8,687,307,386 8,296,998,632 7,020,803,945 Balance with Bangladesh Bank and its agent bank (s) (including foreign currencies) 5 17,414,308,363 - 17,414,308,363 14,555,926,865 15,178,783,055 26,101,615,749 - 26,101,615,749 22,852,925,497 22,199,587,000 Balance with other banks and financial institutions 6 In Bangladesh 23,883,193,400 2,052,052,493 25,935,245,893 27,591,599,177 13,010,752,944 Outside Bangladesh 804,409,204 - 804,409,204 1,154,177,150 1,840,924,301 24,687,602,604 2,052,052,493 26,739,655,097 28,745,776,327 14,851,677,245 Money at call and short notice 7 1,980,000,000 - 1,980,000,000 5,270,000,000 1,100,000,000 Investments 8 Government 19,187,552,263 - 19,187,552,263 19,405,280,474 25,193,823,649 Others 564,983,434 - 564,983,434 804,983,434 885,283,434 19,752,535,697 - 19,752,535,697 20,210,263,908 26,079,107,083 Loans and advances 9 Loans, cash credits, overdrafts, etc. -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

A Framework on Internet Banking Services for the Rationalized Generations

Asian Business Review, Volume 3, Number 2/2013 (Issue 6) ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) 0 A Framework on Internet Banking Services for the Rationalized Generations Md. Rahimullah Miah Lecturer in MIS, Leading University, Sylhet, Bangladesh ABSTRACT The augmented Internet Banking Service is increasingly popular both in Bangladesh and elsewhere. This paper explores a predicted framework for global Internet Banking that emphasizes the transformative interaction among the effective customers around the regional, national and global banking indicating advanced on backend models, instructional strategies, and transaction technologies in the context on upcoming generations. We have to develop the framework on global enhanced transaction systems especially individual global account, effective online banking systems to fulfill the required method, implementing design and appraising the feedback with standard technology according to network topology for disseminating of global banking technological arena. Despite decades of development, electronic payments still need practical examples of how to use electronic payment technology within a uniqueness and rationalized way including global electronic transaction, language tools, currency converter and electronic workstation. This research focuses the major issues responsible for Internet Banking based on respondents’ perception through various internet applications. The author presents a theoretical framework for our represented method, taking into account previous models and characteristics -

Customer Charter 1

Dutch-Bangla Bank Limited YOUR TRUSTED PARTNER TABLE OF CONTENT Article Number Topic Page Number 1.1 Introduction 1 1.2 Objectives of Customer Charter 1 1.3 Legal basis of the Customer Charter 1 1.4 Application of the Customer Charter 1 1.5 Impact of the violation of the Charter 1 2 Head Office Communication 2 3 Statistics of DBBL Branches , Offices and outlets etc 2 4 Office and Transaction Time Table 3 5 DBBL Service Desk 3 6 Common Areas Of DBBL Services 3-16 7 Service Charges 16 8 Rate of Interest 16 9 Customers Rights/Bankers Obligations 17 10 Customers Obligations/Bankers Right 18 11 Customer Complaints lodgment Process 19 12 Tips for Customers 20 13 How to protect yourself when banking online 21 14 Helping us serve you better 22 1.1 Introduction Customer Charter is a general statement of commitments for providing banking services and necessary information to our customers. It also aims at making our Customers conscious about their rights and obligations to bank as well. It outlines the types of services we will endeavor to provide and the various channels for customers to share feedback. The main objectives of the Customer Charter are to make the customers conscious about their general rights, obligations, grievance approach process so as to enable them in taking their own decision on banking matters. 1.2 Objectives of Customer Charter The Charter is intended to: 1. Define the standards of good practice and service; 2. Promote disclosure of information relevant and useful to Customers; 3. Promote informed and effective relationships between the Bank and its Customers; and 4. -

Dutch Bangla Bank Limited & HSBC

P a g e | 1 Jatiya Kabi Kazi Nazrul Islam University Trishal, Mymensingh Course Title: Research Methodology Course Code: 403 TITLE OF RESEARCH PROPOSAL: Dutch Bangla Bank Limited & HSBC Products “Life Line” A comparative study on the loan Evaluator: Shakhawat Hossain Sarkar Lecturer, Dept. of Accounting & Information Systems, Jatiya Kabi Kazi Nazrul Islam University. Submitted By: KAWSAR ALAM SHIHAB ID NO. : 08132536 SESSION: 2007-08 DEPTRTMENT OF AIS J.K.K.N.I.U [email protected] Date of Submission: 23rd October, 2012. P a g e | 2 Table of Contents 1. Abstract Page 03 2. Introduction Page 04 3. Source of Data and Methodology Page 05 a) Primary data: Page 05 b) Secondary data: Page 05 4. Research Output & Findings: Page 06 5. Conclusion: Page 06 6. Reference: Page 07 P a g e | 3 A comparative study on the loan Products “Life Line” Dutch Bangla Bank Limited & HSBC 1. Abstract: There is possibly nothing more important to a bank than the loans they make. Loans are the way a bank makes money. When loans go bad, it can be fatal to a bank. Loans are the lifeblood of a bank. All businesses sell products, and a bank's product is money. Banks make money by taking in funds from depositors and other sources and then lending money out to customers. The bank spread is the difference between what the interest a bank must pay to obtain the funds and the rate the bank charges on the loan. For example, a bank might pay two percent interest to a depositor and charge a customer six percent interest on a loan. -

Dutch - Bangla Bank Limited

DUTCH - BANGLA BANK LIMITED UN-AUDITED FINANCIAL STATEMENTS For the Third Quarter ended 30 September 2019 Dutch-Bangla Bank Limited Consolidated Balance Sheet As at 30 September 2019 PROPERTY AND ASSETS Notes 30-Sep-19 31-Dec-18 30-Sep-18 Taka (Un-audited) Taka (Audited) Taka (Un-audited) Cash In hand (including foreign currencies) 4 13,588,077,031 17,419,869,741 13,424,335,615 Balance with Bangladesh Bank and its agent bank (s) (including foreign currencies) 5 21,515,865,165 32,728,425,040 25,272,773,773 35,103,942,197 50,148,294,781 38,697,109,388 Balance with other banks and financial institutions 6 In Bangladesh 13,775,674,405 6,715,668,728 19,872,111,450 Outside Bangladesh 138,592,298 656,896,195 2,646,119,188 13,914,266,703 7,372,564,923 22,518,230,638 Money at call on short notice 7 13,170,000,000 - 2,670,000,000 Investments 8 Government 43,878,875,002 31,457,164,331 25,593,984,526 Others 1,411,283,434 751,283,434 251,283,434 45,290,158,436 32,208,447,765 25,845,267,960 Loans and advances 9 Loans, cash credits, overdrafts, etc. 228,437,319,738 209,463,408,465 196,168,533,474 Bills purchased and discounted 17,168,958,714 22,090,531,874 21,013,792,031 - - 245,606,278,452 231,553,940,339 217,182,325,505 Fixed assets including land, building, furniture and fixtures 10 5,483,822,895 5,737,308,593 5,129,942,207 Other assets 11 21,613,894,320 19,448,234,568 19,350,180,886 Non-banking assets - - - TOTAL ASSETS 380,182,363,003 346,468,790,969 331,393,056,584 LIABILITIES AND CAPITAL Liabilities Borrowings from other banks, financial institutions -

Premittances.Pdf

BANGLADESH BANK Statistics Department (BOP Division) Wage Earners’ Remittance during the month of September’2021 (Million USD) Sl. Bank Sep,2021 no State Owned Commercial Banks 01-02,Sep 05-09,Sep 12-16,Sep 19-23,Sep 01-23,Sep 1 Agrani Bank 8.88 46.99 40.12 25.57 121.56 2 Janata Bank 5.30 18.30 14.79 10.40 48.79 3 Rupali Bank 3.72 11.14 8.91 10.13 33.90 4 Sonali Bank 11.93 18.33 29.07 17.47 76.80 5 BASIC Bank 0.01 0.05 0.03 0.02 0.11 6 BDBL 0.00 0.00 0.00 0.00 0.00 Sub Total 29.84 94.81 92.92 63.59 281.16 Specialized Banks 7 Bangladesh Krishi Bank 2.67 11.59 10.17 5.99 30.42 8 RAKUB. 0.00 0.00 0.00 0.00 0.00 Sub Total 2.67 11.59 10.17 5.99 30.42 Private Commercial Banks 9 AB Bank Ltd. 1.70 4.04 2.81 2.52 11.07 10 Al-Arafah Islami Bank Ltd. 3.41 10.83 11.82 10.58 36.64 11 Bangladesh Commerce Bank Ltd. 0.14 0.35 0.27 0.20 0.96 12 Bank Asia Ltd. 9.42 24.57 19.44 15.83 69.26 13 BRAC Bank Ltd. 2.14 9.40 6.76 5.03 23.33 14 Community Bank Bangladesh Ltd. 0.00 0.00 0.00 0.00 0.00 15 Dhaka Bank Ltd. -

61806439.Pdf

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by BRAC University Institutional Repository A comparative study on the loan products “Life Line” Dutch Bangla Bank Limited A comparative study on the loan products “Life Line” Dutch Bangla Bank Limited Submitted by: Syeda Eshana Ahsan ID:10204088 Submitted to: Feihan Ahsan Internship Advisor, BRAC Business School Brac University Date of Submission: September 08 2015 08, 2015 Feihan Ahsan Advisor, BRAC Business School BRAC University, 66 Mohakhali, Dhaka-1212 Subject: Submission of Internship Report Dear Sir, It gives me enormous pleasure to submit the internship report on “Loan and Advance Department of DBBL” as per the Advisor’s instruction. I expect this report to be informative as well as comprehensive. Working in Dutch Bangla Bank Ltd was an inspiring experience for me. I believe that the knowledge and the experience I gathered will facilitate me a lot in my future career life. With my limited knowledge, I have tried my level best to prepare the report worthwhile. Your acceptance and appreciation would surely inspire me. For any further explanations about the report, I will be gladly available to clarify the ins and outs. You can reach me at [email protected] Sincerely Yours, ------------------------------------- Syeda Eshana Ahsan ID: 10204088 Acknowledgment I have completed my internship at DBBL (Ashkona branch) from July 05th to september 5th. My internship report won’t be possible without contribution of few people. At first we desire to express our deepest sense of gratitude of almighty Allah. With profound regard I gratefully acknowledge my respected course teacher Feihan Ahsan , Lecturer BRAC Business School of BRAC University for his generous help and day to day suggestion in the process of my internship report. -

Ecais Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl

ECAIs Credit Rating of Scheduled Banks for 2020-21 (As of Financial Statements 2019) Sl. Long Term Equivalent BB No. Name Name of ECAI Rating Rating Short Term Rating Date of Rating SCBs(04) 1 Sonali Bank Limited CRISL A(AAA) 2 ST-2(ST-1) Nov 26, 2020 2 Janata Bank Limited CRISL A(AAA) 2 ST-2(ST-1) July 18, 2020 3 Agrani Bank Limited Alpha A+(AAA) 2 ST-2(ST-1) July 26, 2020 4 Rupali Bank Limited ECRL A-(AAA) 2 ST-3(ST-1) Sept 21, 2020 PCBs (23) 5 Mercantile Bank Limited ECRL AA 1 ST-2 May 22, 2020 6 AB Bank Limited Argus A+ 2 ST-2 Dec 19, 2019 7 One Bank Limited ECRL AA 1 ST-2 Mar 10, 2020 8 Eastern Bank Ltd CRISL AA+ 1 ST-2 June 22, 2020 9 Standard Bank Limited CRISL AA 1 ST-2 June 28, 2020 10 Uttara Bank Limited ECRL AA 1 ST-2 July 01, 2020 11 Dutch-Bangla Bank Limited CRISL AA+ 1 ST-1 July 16, 2020 12 Pubali Bank Limited NCRL AA+ 1 ST-1 June 30, 2020 13 Dhaka Bank Limited ECRL AA 1 ST-2 April 8, 2020 14 Jamuna Bank Limited CRAB AA2 1 ST-2 June 30, 2020 15 The City Bank Limited CRAB AA2 1 ST-2 May 29, 2020 16 United Commercial Bank Ltd ECRL AA 1 ST-2 May 07, 2020 17 Bank Asia Limited CRAB AA2 1 ST-2 June 30, 2020 18 IFIC Bank Limited ECRL AA 1 ST-2 July 01, 2020 19 BRAC Bank Limited CRAB AA1 1 ST-1 June 28, 2020 20 Premier Bank Limited Argus AA+ 1 ST-1 May 30, 2020 21 Prime Bank Limited ECRL AA 1 ST-2 July 01, 2020 22 Mutual Trust Bank Ltd. -

Annual Report 2020 I

24th Annual General Meeting 08 July 2020 Partial view of the Hon’ble Shareholders and Members of the Board of Directors at 24th AGM held through digital platform. NOTICE OF THE 25th ANNUAL GENERAL MEETING Notice is hereby given that the 25th Annual General Meeting (AGM) of the Hon’ble Members of Dutch-Bangla Bank Limited (the Bank / the Company) will be held on Monday, April 26, 2021 at 10.00 A.M. The AGM will be held virtually by using digital platform through the following link http://tinyurl.com/dbblagm2021 to transact the following businesses: dutchbanglabank.com on or by 4 P.M., April 21, 2021. The maximum Agenda length of the video / audio recording be 2 (two) minutes. 01. To receive, consider and adopt the Audited vi. The detailed procedures to participate in the virtual meeting and Financial Statements of the Company with Frequently Asked Questions (FAQs) have been provided in the Auditors’ Report thereon and the Directors’ Report Annual Report and published on the Investor Relations’ Section of for the year ended December 31, 2020. the Company’s website at: www.dutchbanglabank.com vii. We encourage the Members to login to the system prior to 10:00 02. To declare dividend for the year 2020. A.M. (Dhaka time) on 26.04.2021. Please allow ample time to login 03. To elect Directors. and establish your connectivity. The webcast will start at 10:00 A.M. (Dhaka Time). Please contact +880 9666322050 (Ext. 750999), 04. To appoint the Auditors for the year 2021 and fix +880 9612322050 (Ext.