News Blaze of the Week

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Internship Report “Trade Operations of Dhaka Bank Limited-CPC”

Internship Report on “Trade Operations of Dhaka Bank Limited-CPC” Submitted to: Dr. Suman Paul Chowdhury Assistant Professor, and Coordinator, MBA Program BRAC Business School Submitted by: Md. Neaz Hossain Department: BBS Program: BBA Student ID: 08104038 Date of Submission: 2017 Letter of Transmittal Date: 2017 Dr. Suman Paul Chowdhury Assistant Professor, and Coordinator, MBA Program BRAC Business School Subject: Submission of Internship Report Dear Sir, With due respect, I would like to inform you that I have done my internship report on Trade Operations of Dhaka Bank Limited-CPC as per your instruction. I have worked with the LC team of CPC Trade Operations for three months (from Nov 1st 2016 to Jan 31st 2017). During these three months I have learned a lot of things from the team, not only the academic requirements but also to work hard. Considering the limited time and knowledge I have gathered through work experience, I have tried to prepare an informative report explaining very basic understanding of Trade & Finance of Dhaka Bank Limited. I will be grateful if you kindly approve this effort and give me your valuable judgment upon this report. Sincerely Yours, Md. Neaz Hossain Student ID: 08104038 BRAC Business School _______________________________ Acknowledgement The number of people to whom I am grateful is way too many to count. But first, I am grateful to my Creator Allah for helping me throughout my life. Then my parents, without their love and support I wouldn’t be here. I also would like to thank all of my teachers for their effort in educating me. -

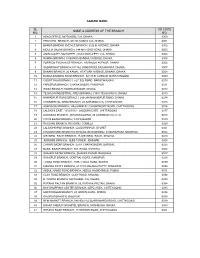

Agrani Bank Sl No. Name & Address of the Branch Ad Code

AGRANI BANK SL AD CODE NAME & ADDRESS OF THE BRANCH NO. NO. 1 HEAD OFFICE, MOTIJHEEL C/A, DHAKA 0000 2 PRINCIPAL BRANCH, 9/D DILKUSHA C/A, DHAKA 0001 3 BANGA BANDHU AVENUE BRANCH, 32 B.B. AVENUE, DHAKA 0002 4 MOULVI BAZAR BRANCH, 144 MITFORD ROAD, DHAKA. 0003 5 AMIN COURT, MOTIJHEEL, 62/63 MOTIJHEEL C/A, DHAKA 0004 6 RAMNA BRANCH, 18 BANGA BANDHU AVENUE, DHAKA 0005 7 FOREIGN EXCHANGE BRANCH, 1/B RAJUK AVENUE, DHAKA 0006 8 SADARGHAT BRANCH,3/7/1&2 JONSON RD,SADARGHAT, DHAKA. 0007 9 BANANI BRANCH, 26 KAMAL ATATURK AVENUE, BANANI, DHAKA. 0008 10 BANGA BANDHU ROAD BRANCH, 32/1 B.B. AVENUE, NARAYANGONJ 0009 11 COURT ROAD BRANCH, 52/1 B.B.ROAD, NARAYANGONJ 0010 12 FARIDPUR BRANCH, CHAWK BAZAR, FARIDPUR 0011 13 WASA BRANCH, KAWRAN BAZAR, DHAKA. 0012 14 TEJGAON INDUSTRIAL AREA BRANCH, 315/A TEJGAON I/A, DHAKA 0013 15 NAWABPUR ROAD BRANCH, 243-244 NAWABPUR ROAD, DHAKA 0014 16 COMMERCIAL AREA BRANCH, 28 AGRABAD C/A, CHITTAGONG 0015 17 ASADGONJ BRANCH, HAJI AMIR ALI CHOWDHURY ROAD, CHITTAGONG 0016 18 LALDIGHI EAST, 1012/1013 - LALDIGHI EAST, CHITTAGONG 0017 19 AGRABAD BRANCH, JAHAN BUILDING, 24 AGRABAD C/A, CTG 0018 20 COX'S BAZAR BRANCH, COX'S BAZAR 0019 21 RAJGANJ BRANCH, RAJGANJ, COMILLA 0020 22 LALDIGHIRPAR BRANCH, LALDIGHIRPAR, SYLHET 0021 23 CHAUMUHANI BRANCH,D.B.ROAD, BEGUMGONJ, CHAUMUHANI, NOAKHALI 0022 24 SIR IQBAL RAOD BRANCH, 25 SIR IQBAL RAOD, KHULNA 0023 25 JESSORE BRANCH, JESS TOWER, JESSORE 0024 26 CHAWK BAZAR BRANCH, 02/01 CHAWK BAZAR, BARISAL 0025 27 BARA BAZAR BRANCH, N.S. -

Useful Information for Shareholders

useful information for shareholders Financial Calendar Particulars Date Twelfth Annual General Meeting April 17, 2008 First Extra-ordinary General Meeting April 17, 2008 Transfer of bonus shares May 07, 2008 Half-yearly Financial Statements (Un-audited) June 30, 2008 Record date for Bonus Shares March 01, 2009 Next half-yearly Financial Statements June 30, 2009 2nd Extra-ordinary General Meeting The 2nd Extra-ordinary General Meeting of the shareholders of the Bank will be held on March 23, 2009 at 10:00 a.m. at the “Hall of Fame” of Bangladesh-China Friendship Conference Center (BCFCC), Agargaon, Dhaka. 13th Annual General Meeting The 13th Annual General Meeting of shareholders of the Bank will be held on March 23,2009 at 10:30 a.m. at the “Hall of Fame” of Bangladesh-China Friendship Conference Center (BCFCC), Agargaon, Dhaka. Information on dividends Bonus share @3.94719 for existing 1 share of Taka 100 each for 2007 were declared in 2008. 50% bonus share i.e. 1 bonus share for existing 2 shares of Taka 100 each is proposed for 2008. Share transfer system The shares of Dutch-Bangla Bank Limited (DBBL) are being traded at the Stock Exchanges in Dematerialized form since June 15, 2004 through Central Depository Bangladesh Limited (CDBL) as per directive of Securities and Exchange Commission (SEC). Physical shares, which are not yet dematerialized, can be dematerialized with CDBL through BO account with Depository Participant (DP). Information relating to shareholdings Distribution of shares of DBBL and shareholdings by the Directors are given in Note 17 to Financial Statements of this Annual Report. -

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION of BANGLADESH (ICB) 02 BRAC BANK LIMITED 03 EASTERN BANK

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION OF BANGLADESH (ICB) 01 Head Office, Purana Paltan, Dhaka 02 Local Office, Nayapaltan, Dhaka 03 Chittagong Branch, Chittagong 04 Khulna Branch, Khulna 05 Rajshahi Branch, Rajshahi 06 Barisal Branch, Barisal 07 Sylhet Branch, Sylhet 08 Bogra Branch, Bogra 02 BRAC BANK LIMITED 01 Asad Gate Branch, Dhaka 02 Banani Branch, Dhaka 03 Bashundhara Branch, Dhaka 04 Donia Branch, Dhaka 05 Eskaton Branch, Dhaka 06 Graphics Building Branch, Motijheel, Dhaka 07 Uttara Branch, Dhaka 08 Shyamoli Branch, Dhaka 09 Gulshan Branch, Dhaka 10 Manda Branch, Dhaka 11 Mirpur Branch, , Dhaka 12 Nawabpur Branch, Dhaka 13 Rampura Branch, Dhaka 14 Narayanqani Branch, Narayanganj 15 Agrabad Branch, Chittagong 16 CDA Avenue Branch, Chittagong 17 Potia Branch, Chittagong 18 Halisohor Branch, Chittagong 19 Kazirdeuri Branch, Chittagong 20 Momin Road Branch, Chittagong 21 Bogra Branch, Bogra 22 Rajshahi Branch, Rajshahi 23 Jessore Branch, Jessore 24 Khulna Branch, Khulna 25 Barisal Branch, Barisal 26 Zindabazar Branch, Sylhet 03 EASTERN BANK LIMITED 01 Principal Branch, Dilkusha, Dhaka 02 Motijheel Branch, Dhaka 03 Mirpur Branch, Dhaka 04 Bashundhara Branch, Dhaka 05 Shyamoli Branch, Dhaka 06 Narayanganj Branch 07 Jessore Branch 08 Choumuhoni Branch 09 Agrabad Branch, Chittagong 10 Khatunganj Branch, Chittagong 11 Bogra Branch, Bogra 12 Khulna Branch, Khulna 13 Rajshahi Branch, Rajshahi 14 Savar Branch, Savar, Dhaka 15 Moulvi Bazar Branch, Sylhet Page # 1 Bank Code Br. Code Bank & Branch Name 04 BANK ASIA LIMITED 01 Principal Office , Motijheel C.A., Dhaka 02 Corporate Branch, Dhaka 03 Gulshan Branch, Dhaka 04 Uttara Branch, Dhaka 05 North South Rd. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

BRANCHES Dhaka Region Opening Sl

BRANCHES Dhaka Region Opening Sl. Branch Address Tel/Fax Email Date Market Complex (1st Floor), Amin Bazar Tel: 900 8998 March 01 Amin Bazar Jame Mosque, 780, [email protected] Branch Begun Bari Union, Fax: 905 5118 15, 2001 Amin Bazar, Savar, Dhaka 73/B, Kemal Ataturk Tel: 986 2942, 988 October 02 Banani Branch Avenue, Banani, 1582 (Dir.), 988 2324-5 [email protected] 07, 1996 Dhaka Fax: 883 3481 88, Shahid Syed Tel: 711 0463, 711 Bangshal Nazrul Islam December 03 Branch 3748, 717 5275 [email protected] Sharani, (1st & 2nd 06, 1995 Fax: 955 8451 flr), Dhaka 1100 House: 23, Block: K, Baridhara Shahid Shuhrawardi Tel: 88320635(Dir.) November 04 [email protected] Branch Avenue, Baridhara, Fax: 883 2068 14, 2006 Dhaka 1229 Nilachal (1st floor), Tel: 839 6420, 839 Plot# 14, Block# B, July 05 Banashree 6421 [email protected] Branch Main Road, 18, 2012 Banashree, Dhaka Fax: 839 6426 Eleven Square, Holding No. #01, Road Banani Road No. #11, Ward No. December 06 Cell: 01714 097763 [email protected] No. 11 Branch #19/5, Banani R/A, 27, 2017 Thana - Banani, District - Dhaka Board Bazar, Tel: 929 3595-6 November 07 Board Bazar Gazipur Gazipur [email protected] Branch 1704 Fax: 929 3595-106 08, 2006 Zone Service Building, Room # Tel: 778 9671 April 08 DEPZ Branch 48-51, DEPZ, [email protected] Ganakbari Savar, Fax: 778 9672 12, 2001 Dhaka 1349 House No. 500, Tel: 911 1537, 912 Road: 07, August 09 Dhanmondi 2278 (Dir.) [email protected] Branch Dhanmondi R/A, 01, 2000 Dhaka 1205 Fax: 812 5481 Ground floor, Plot Tel: 910 3651(Dir.) June 10 Dhanmondi [email protected] Model Branch No. -

“E-Business and on Line Banking in Bangladesh: an Analysis”

“E-Business and on line banking in Bangladesh: an Analysis” AUTHORS Muhammad Mahboob Ali ARTICLE INFO Muhammad Mahboob Ali (2010). E-Business and on line banking in Bangladesh: an Analysis. Banks and Bank Systems, 5(2-1) RELEASED ON Wednesday, 07 July 2010 JOURNAL "Banks and Bank Systems" FOUNDER LLC “Consulting Publishing Company “Business Perspectives” NUMBER OF REFERENCES NUMBER OF FIGURES NUMBER OF TABLES 0 0 0 © The author(s) 2021. This publication is an open access article. businessperspectives.org Banks and Bank Systems, Volume 5, Issue 2, 2010 Muhammad Mahboob Ali (Bangladesh) E-business and on-line banking in Bangladesh: an analysis Abstract E-business has created tremendous opportunity all over the globe. On-line banking can act as a complementary factor of e-business. Bangladesh Bank has recently argued to introduce automated clearing house system. This pushed up- ward transition from the manual banking system to the on-line banking system. The study has been undertaken to ob- serve present status of the e-business and as its complementary factor on-line banking system in Bangladesh. The arti- cle analyzes the data collected from Bangladeshi banks up to February 2010 and also used snowball sampling tech- niques to gather answer from the five hundred respondents who have already been using on-line banking system on the basis of a questionnaire which was prepared for this study purpose. The study found that dealing officials of the banks are not well conversant about their desk work. The author observed that the country can benefit from successful utiliza- tion of e-business as this will help to enhance productivity. -

Dhaka Bank Limited and Its Subsidiary Consolidated Balance

Dhaka Bank Limited and its Subsidiary Consolidated Balance Sheet As at 31 March 2014 31.03.2014 31.12.2013 Taka Taka PROPERTY AND ASSETS Cash 13,291,336,562 11,900,762,425 Cash in Hand (including foreign currencies) 1,639,689,695 1,609,002,280 Balance with Bangladesh Bank & Sonali Bank (including foreign 11,651,646,867 10,291,760,145 currencies) Balance With Other Banks & Financial Institutions 3,167,753,956 2,692,952,439 In Bangladesh 1,937,169,093 1,927,287,468 Outside Bangladesh 1,230,584,863 765,664,971 Money at Call and Short Notice 718,900,000 338,900,000 Investments 21,488,401,455 20,240,852,234 Government 17,141,287,206 16,009,301,980 Others 4,347,114,249 4,231,550,254 Loans & Advances 101,331,332,253 100,364,424,555 Loans, Cash Credit & Over Draft etc. 99,308,138,204 98,150,571,358 Bills Discounted and Purchased 2,023,194,049 2,213,853,197 Premises and Fixed Assets 2,600,391,551 2,538,497,507 Other Assets 8,112,917,336 7,300,718,533 Non-Banking Assets 23,166,033 23,166,033 Total Assets 150,734,199,146 145,400,273,725 LIABILITIES & CAPITAL Liabilities Borrowings from other banks, financial institutions 5,752,046,372 3,649,917,871 and agents Deposits and Other Accounts 118,588,027,088 115,981,165,413 Current Accounts & Other Accounts 11,200,677,886 10,171,783,633 Bills Payable 1,076,546,533 991,276,689 Savings Bank Deposits 9,258,356,453 8,870,151,906 Term Deposits 97,052,446,216 95,947,953,185 Non Convertible Subordinated Bond 2,000,000,000 2,000,000,000 Other Liabilities 12,183,588,071 11,724,374,595 Total Liabilities 138,523,661,531 -

Dutch-Bangla Bank Limited Balance Sheet As at 31 March 2016 (Main Operation and Off-Shore Banking Unit)

Dutch-Bangla Bank Limited Balance Sheet As at 31 March 2016 (Main Operation and Off-shore Banking Unit) PROPERTY AND ASSETS Notes 31-Mar-16 31-Dec-15 31-Mar-15 Taka (Un-audited) Taka (Audited) Taka (Un-audited) Main Operation Off-shore Total Total Total Cash In hand (including foreign currencies) 4 8,687,307,386 - 8,687,307,386 8,296,998,632 7,020,803,945 Balance with Bangladesh Bank and its agent bank (s) (including foreign currencies) 5 17,414,308,363 - 17,414,308,363 14,555,926,865 15,178,783,055 26,101,615,749 - 26,101,615,749 22,852,925,497 22,199,587,000 Balance with other banks and financial institutions 6 In Bangladesh 23,883,193,400 2,052,052,493 25,935,245,893 27,591,599,177 13,010,752,944 Outside Bangladesh 804,409,204 - 804,409,204 1,154,177,150 1,840,924,301 24,687,602,604 2,052,052,493 26,739,655,097 28,745,776,327 14,851,677,245 Money at call and short notice 7 1,980,000,000 - 1,980,000,000 5,270,000,000 1,100,000,000 Investments 8 Government 19,187,552,263 - 19,187,552,263 19,405,280,474 25,193,823,649 Others 564,983,434 - 564,983,434 804,983,434 885,283,434 19,752,535,697 - 19,752,535,697 20,210,263,908 26,079,107,083 Loans and advances 9 Loans, cash credits, overdrafts, etc. -

Independent Auditor's Report and Audited Consolidated & Separate Financial Statements for the Year Ended 31 December 2016

Dhaka Bank Limited and its subsidiaries Independent Auditor's Report and Audited Consolidated & Separate Financial Statements For the year ended 31 December 2016 BDBL Bhaban (Level -13 & 14), 12 Kawran Bazar Commercial Area, Dhaka - 1215, Bangladesh. ACNABIN Cbartered Accowntants BDBL Bhaban (Level-13 & 14) Telephone: (88 02) 81.44347 ro 52 1.2 Kawran Bazar Commercial Area (88 02) 8189428 to 29 Dhaka-121.5, Bangladesh. Facsimile: (88 02) 8144353 e-mail: <[email protected]> Web: www.acnabin.com INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF DHAKA BANK LIMITED Report on the Financial Statements We have audited the accompanying consolidated financial statements of Dhaka Bank Limited and its subsidiaries namely Dhaka Bank Securities Limited and Dhaka Bank Investment Limited ("the Group") as well as the separate financial statements of Dhaka Bank Limited ("the Bank"), which comprise the consolidated balance sheet of the Group and the separate balance sheet as at 31" December 2016 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statements for the year then ended and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements and Internal Controls Management is responsible for the preparation of consolidated financial statements of the Group and also the separate financial statements of the Bank that give a true and fair view in accordance with Bangladesh -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE