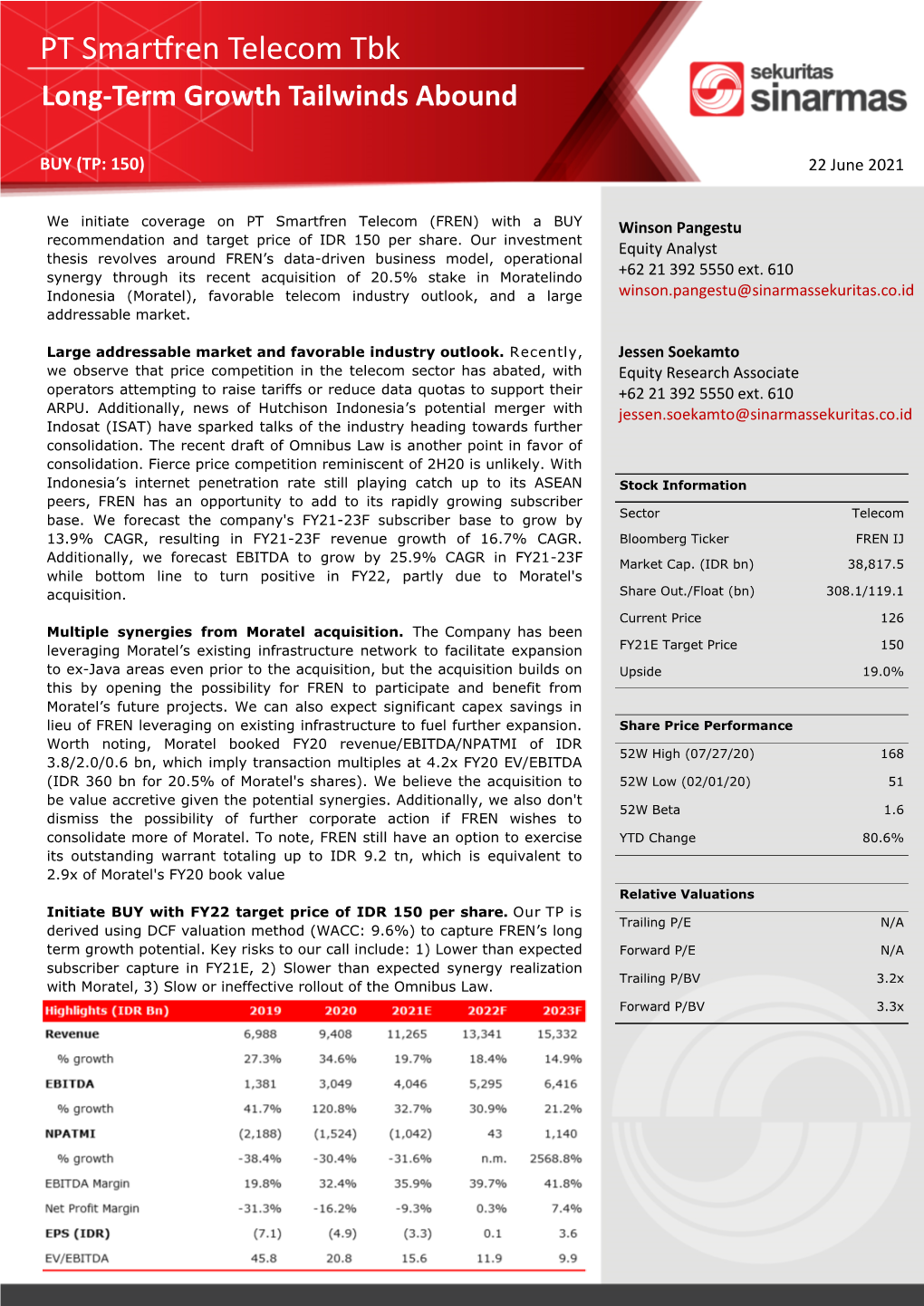

PT Smartfren Telecom Tbk Long-Term Growth Tailwinds Abound

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Daftar Pustaka

DAFTAR PUSTAKA Aisyah, Munity, Peer Group Effect on Moslem Consumer’s Decision To Purchase Halal-Labeled Cosmetics Al-Iqtishad: Vol. VII No. 2, Juli 2015. Angelidis, J. and N. Ibrahim: 2004, An Exploratory Study of the Impact of Degree of Religiousness upon an Individuals Corporate Social Responsive Orientation, Journal of Business Ethics 51, 119–128. Aridhona, Julia. 2017. Hubungan Perilaku Prososial dan Religiusitas dengan moral pada remaja Arifin, B. (2012). Etika dan Profesi Kependidikan. Jogjakarta: Ar-Ruzz Media. Bloodgood, J.M., Turnley, W.H. and Mudrack, P. (2008), The influence of ethics instruction, religiosity, and intelligence on cheating behavior, Journal of Business Ethics, Vol. 82 No. 3, pp. 557-571. Brady, N. and Hart, D. (2007), An exploration into the developmental psychology of ethical theory with implications for business practice and pedagogy, Journal of Business Ethics, Vol. 76 No. 4, pp. 397-412. Candy, V. (2013), Social responsibility and globalization, Journal of Applied Business Research, Vol. 29 No. 5, pp. 1353-1366. CNBC Indonesia. (2018, 01 Mei). 15 Bank Ini Kemungkinan Masuk Kategori Sistematik. Diperoleh 12 Juli 2018, dari https://www.cnbcindonesia.com/market/20180501074731- 17-13108/15-bank-ini-kemungkinan-masuk-kategori-sistemik CNN Indonesia. (2017, 26 Januari). Kredit Macet BNI Meningkat akibat tunggakan Dua Kreditur Jumbo. Diperoleh 12 Juli 2018, dari https://www.cnnindonesia.com/ekonomi/20170126180729-78-189299/kredit-macet-bni- meningkat-akibat-tunggakan-dua-debitur-jumbo Corner, P. D. (2009). Workplace spirituality and business ethics: Insights from an Eastern spiritual tradition. Journal of Business Ethics, 85, 377–389. Cornwall, M., S. L. Albrecht, P. H. Cunningham and B. -

TIP Openran: Toward Disaggregated Mobile Networking a Heavy Reading White Paper Produced for the Telecom Infra Project

Independent market research and competitive analysis of next-generation business and technology solutions for service providers and vendors TIP OpenRAN: Toward Disaggregated Mobile Networking A Heavy Reading white paper produced for the Telecom Infra Project AUTHOR: GABRIEL BROWN, PRINCIPAL ANALYST, HEAVY READING WHY OPEN, DISAGGREGATED RADIO ACCESS NETWORKS? Mobile networks serve more than 9 billion connections and generate almost $1 trillion in service revenue annually, according to research firm Omdia.* And with millions of cell sites deployed globally, this makes radio access networks (RANs) the most important distributed network infrastructure in the world. As operators enter the 5G era, the RAN is increasingly software-driven and based on open implementation and open interfaces. Some of the largest equipment vendors are migrating from integrated single-vendor systems to more modular, open platforms. In parallel, a new wave of challengers is adopting software-centric design principles to develop disaggregated, virtual RANs (vRANs) optimized for cloud deployment and operation. This paper profiles the work of the Telecom Infra Project (TIP) OpenRAN Project Group. TIP is an industry initiative focused on advancing open telecom networking through disaggregation, open interfaces, and the development of reference implementations. The TIP OpenRAN Project Group is one of the foremost open RAN initiatives in the industry. It is focused on collaborative working, reference implementations, interoperability, field trials, and developing pathways to commercial deployment of OpenRAN solutions. This paper identifies and explains the key achievements of the project group and looks ahead to the next phases of OpenRAN development. It places the work of the group in a wider industry context to illustrate how OpenRAN helps operators and the wider ecosystem advance their goals for low cost, high performance mobile connectivity. -

Downloading of Movies, Television Shows and Other Video Programming, Some of Which Charge a Nominal Or No Fee for Access

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 5.50% Notes due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Barometer of Mobile Internet Connections in Indonesia Publication of March 14Th 2018

Barometer of mobile Internet connections in Indonesia Publication of March 14th 2018 Year 2017 nPerf is a trademark owned by nPerf SAS, 87 rue de Sèze 69006 LYON – France. Contents 1 Methodology ................................................................................................................................. 2 1.1 The panel ............................................................................................................................... 2 1.2 Speed and latency tests ....................................................................................................... 2 1.2.1 Objectives and operation of the speed and latency tests ............................................ 2 1.2.2 nPerf servers .................................................................................................................. 2 1.3 Tests Quality of Service (QoS) .............................................................................................. 2 1.3.1 The browsing test .......................................................................................................... 2 1.3.2 YouTube streaming test ................................................................................................ 3 1.4 Filtering of test results .......................................................................................................... 3 1.4.1 Filtering of devices ........................................................................................................ 3 2 Overall results 2G/3G/4G ............................................................................................................ -

Analisis Kinerja Keuangan Berdasarkan Metode Eva Studi Pada Perusahaan Telekomunikasi Yang Tercatat Di Bursa Efek Indonesia (Bei) Tahun 2013

Vol. 3. No. 1, Juni 2015 Ekuitas – Jurnal Pendidikan Ekonomi ANALISIS KINERJA KEUANGAN BERDASARKAN METODE EVA STUDI PADA PERUSAHAAN TELEKOMUNIKASI YANG TERCATAT DI BURSA EFEK INDONESIA (BEI) TAHUN 2013 Ni Made Tatsani Widi Arini Jurusan Pendidikan Ekonomi Universitas Pendidikan Ganesha Singaraja, Indonesia e-mail: [email protected] ABSTRAK Penelitian ini bertujuan untuk mengetahui (1) nilai NOPAT pada Perusahaan Telekomunikasi yang telah tercatat di BEI tahun 2013, (2) nilai biaya modal pada perusahaan telekomunikasi yang telah tercatat di BEI tahun 2013, (3) kinerja keuangan perusahaan telekomunikasi yang telah tercatat di BEI tahun 2013 ditinjau dengan metode EVA. Jenis penelitian ini adalah deskriptif kuantitatif. Data dikumpulkan dengan metode dokumentasi dan analisis data yang digunakan yaitu analisis EVA. Hasil penelitian menunjukkan (1) nilai NOPAT PT Telekomunikasi Indonesia Tbk. adalah Rp 20.987.000.000.000,00, PT Indosat Tbk. sebesar Rp 841.838.000.000,00, PT Smartfren Tbk. sebesar Rp -1.784.682.909.136,00, PT XL Axiata Tbk. sebesar Rp 1.301.438.000.000,00, PT Bakrie Telecom sebesar Rp 27.320.180.033,00. (2) Biaya modal untuk PT Telekomunikasi Indonesia Tbk. sebesar Rp 10.284.848.546.016,00, PT Indosat Tbk. sebesar Rp 3.273.701.158.489,00, PT Smartfren Tbk. sebesar Rp 790.441.706.857,00, PT XL Axiata sebesar Tbk. Rp 1.670.800.564.235,00, dan biaya modal PT Bakrie Telecom sebesar Rp 196.585.006.260,00. (3) Hasil analisis EVA menunjukkan PT Telekomunikasi Indonesia Tbk. memililki nilai EVA>0, ini berarti kinerja keuangan perusahaan telah mampu menciptakan nilai tambah bagi perusahaan. -

Analysis and Testing of Data Transmission of Providers in Indonesia Using Gsm and Cdma Modem

(IJID) International Jurnal on Informatics for Development, Vol. 6, No. 1, 2017 ANALYSIS AND TESTING OF DATA TRANSMISSION OF PROVIDERS IN INDONESIA USING GSM AND CDMA MODEM Fanni Rakhman Hakim Bambang Sugiantoro Department of Informatics Department of Informatics Faculty of Sains and Technology Faculty of Sains and Technology State Islamic University Sunan Kalijaga State Islamic University Sunan Kalijaga Yogyakarta, Indonesia Yogyakarta, Indonesia [email protected] AbstractFThe technology of internet nowadays has Basically everyone who is connected to the Internet, become most important aspect and becomes they can exchange information and data between one primary need for certain group of peoples who person with others, either in the form of images, work in some field like sounds, video, text and more. With the it community, education,economy,health,etc. One of the biggest utilizing it in resolving the problem of the daily work problem which mostly brought by so many people that demands speed and accuracy. One of them is in is speed in data transfer. This paper emphasize in the speed of the data transfer. directly testing the quality of data transmission from each transmission technology. The equipment Mobile technology is also growing rapidly in line used by this paper is ZTE Join Air help, the with the needs of the community to get simcard provided by Telkomsel,XL, and indosat, communication service that is quick and easy. Some while CDMA technology used simcard provided by service providers mid-haul vying Indonesia good- smartfren and esia and modem provided by based Global System for Mobile Communication Smartfren which its series is EC176-2. -

Analisis Kualitas Jaringan 4G Menggunakan Parameter

ANALISIS KUALITAS JARINGAN 4G MENGGUNAKAN PARAMETER QUALITY OF SERVICE DI KOTA MAKASSAR Analysis Of 4G Network Quality Using Parameters Quality Of Service In The City Of Makassar Ayu Fitrah Alyah1, Dyah Darma Andayani 2, Syahrul3 Pendidikan Teknik Informatika dan Komputer, Jurusan Teknik Informatika dan Komputer Universitas Negeri Makassar [email protected] Abstrak - Perkembangan teknologi infomasi dan Teknologi dari layanan broadband sendiri telekomunikasi berkembang secara cepat dari generasi ke terus berkembang, dimulai dari generasi pertama atau generasi, perkembangan teknologi tersebut telah sampai biasa disebut dengan istilah 1G (Generasi Pertama), dimana pada generasi ini memiliki standar teknologi kegenerasi 4G. Perkembangan jaringan 4G memiliki Nordic Mobile Telephone (NMT) yang digunakan kemampuan transmisi yang besar terutama dalam hal berbasis analog, kemudian masuk ke generasi 2G kecepatan download dan upload, karena banyaknya teknologi sudah berbasis digital dilanjutkan ke generasi keinginan masyarakat akan kualitas jaringan dari provider 2.5G dengan peningkatan dalam kapasitas Bandwitdh yang dapat digunakan dengan lancar dan cepat, hal ini dari generasi sebelumnya sampai pada tahun 2000 an dimanfaatkan perusahaan telekomunikasi membangun perkembangan teknologi telekomnikasi di dunia Internet Service Provider (ISP) yang lebih cepat tersebut telah mencapai generasi 4G LTE bahkan 5G. Dengan berkembangnya jaringan seluler menggunakan jaringan 4G. Adanya perbedaan kualitas seperti hadirnya teknologi 4G LTE yang memiliki jaringan pada provider yang memicu untuk melakukan kemampuan transmisi yang besar terutama dalam hal pengujian kualitas jaringan 4G. Penelitian ini bertujuan kecepatan untuk download dan upload, serta banyaknya untuk menganalisis kualitas jaringan 4G dari berbagai keinginan masyarakat akan kualitas jaringan dari provider layanan telepon seluler di wilayah Kota Makassar, provider yang dapat digunakan untuk mengakses secara diwakili oleh Tiga provider. -

Depressed Valuations, Worth Their Uplift

Equity Research Telco Monday,24 May 2021 Telco OVERWEIGHT Depressed valuations, worth their uplift TLKM relative to JCI Index Our key thesis remains the buoyant data traffic enhanced by OTT and ecommerce solutions. Mobile competition could potentially ease off, and xxxx new competition levers will enhance outlook. Remain OVERWEIGHT. Telco M&A; short to medium term beneficiaries. 4,247 Towers divestment was performed at lightning speed by Indosat in the eyes of investors, and is able now to announce debt repayments. Their 1Q21 results renders a higher 2021 prospect to turn net profit and therefore Indosat becomes an attractive asset, unimaginable a few quarters back, – and offers a commanding lead in their M&A negotiation with Hutch3. Although M&A talks took extension implying stumbling issues in their way; but definitely will set the backdrop for the remainder of 2021. Last week telco stocks gained as catalysts reinforced one another; Indosat positive 1Q21 results and together with Smartfren aiming to post near zero net losses and become more attractive M&A targets, Telkomsel EXCL relative to JCI Index additional investment placing in Goto, and XL Axiata looking to benefit from xxxx slack in Indosat+Hutch3 combined future performance. Buoyant data traffic enhanced by OTT and ecommerce. XL 1Q21 numbers showed signs of market weakness XL posted results in 1Q21, with topline/EBITDA dragged by competition. 4Q20 and FY20 periods were heavily influenced by promotion of Unlimited data plans, smaller validity data plans to address weakening purchasing power, and from school data subsidies. These apply also in Indosat but it had better its capex resources and spectrum migration to 4G. -

Taking Stock of the COVID-19 Pandemic in Indonesia Deloitte Indonesia Business and Industry Updates

Deloitte Indonesia Business and Industry Updates Taking stock of the COVID-19 pandemic in Indonesia Deloitte Indonesia Business and Industry Updates Taking stock of the COVID-19 pandemic in Indonesia More than nine months after the first Figure 1: Rolling 7-day average of daily confirmed COVID-19 cases in Indonesia confirmed COVID-19 case was reported in (March-December 2020) 1 Indonesia on 2 March 2020 , the world’s 7000 Indonesia fourth most populous country continues to grapple with the monumental task of 6000 controlling the outbreak, while keeping its 5000 economy running as smoothly and safely as 4000 possible. 3000 At this time of writing, Indonesia has 2000 experienced more than 840,000 confirmed COVID-19 cases and 24,500 deaths2, with 1000 a rolling 7-day average of about 7,000 daily 0 confirmed cases at the end of 2020 (see 2 Mar 2020 30 Apr 19 Jun 8 Aug 27 Sep 16 Nov 31 Dec 2020 Figure 1). Source: Our World in Data, 2020. This is an unprecedented time for the economy, and even as some level of optimism rebounds with the launch of Indonesia’s mass vaccination program on 13 January 20213, there remains a significant amount of uncertainty regarding the economy and its recovery prospects. Across the globe, the battle against COVID-19 continues. With the rollout of vaccination programs worldwide, it is perhaps timely to take stock of the pandemic’s impacts on several key industries in Indonesia’s economy, and the considerations that businesses will need to make as they look forward to a post- pandemic future. -

An Analysis of Economic Value Added Method As a Tool of Measurement

Advances in Economics, Business and Management Research, volume 123 1st International Conference on Accounting, Management and Entrepreneurship (ICAMER 2019) An Analysis of Economic Value Added Method as a Tool of Measurement of Profitability Comparison (Case Study at Telecommunication Company Listed on the Indonesia Stock Exchange Period 2013-2018) Aoliyah Firasati Management Study Program, Faculty of Economics Universitas Swadaya Gunung Jati Cirebon, Indonesia [email protected] Abstract—This study aims to measure the profitability projects that are the focus are on revamping Indonesia's comparisons between the companies based on the analysis infrastructure. Toll roads, airports and ports are sectors that will method of Economic Value Added (EVA) during the period 2013 be of particular concern. In addition, the information to 20185attelecommunicationscompanies listed on the Indonesia technology sector is also in the spotlight because of a number Stock Exchange (IDX). The method used is descriptive analysis of Joko Widodo's new programs such as e-government, e- using time series data. The results of this study indicate that there catalog and e-budgeting. So, the government will need the is profitability comparison between telecommunications services of issuers of the information technology sector to companies namely PT. Telekomunikasi Indonesia Tbk where its realize the plan. profitability is better that the value of EVA during six years is positive or EVA > 1 compared to other telecommunications Meanwhile the issuers of the tower sector have interesting Therefore, it can be said that PT. Telekomunikasi Indonesia Tbk. prospects. There are several reasons the prospect of this issuer The poorest profitability of the company is PT. -

Upaya Peningkatan Brand Equity Kartu Perdana Smartfren

Journal of Industrial & Quality Engineering p-ISSN : 2303-2715 https://ojs.unikom.ac.id/index.php/inaque e-ISSN : 2622-5816 DOI: https://doi.org/10.34010/iqe.v8i2.3315 UPAYA PENINGKATAN BRAND EQUITY KARTU PERDANA SMARTFREN Yoanita Yuniati, Dhiya Kamilah, Abu Bakar Program Studi Teknik Industri, Institut Teknologi Nasional Bandung Jl. P.H.H. Mustofa No. 23 Bandung 40124 Telp (022) 7272215 Email: [email protected] ABSTRAK Dalam kondisi pentingnya jaringan internet, jumlah pengguna kartu perdana Smartfren masih lebih rendah dibandingkan pesaing. Hasil survey Top Brand Award menunjukkan bahwa tahun 2019 Smartfren menempati urutan ke-4 dengan index 6%. Hal tersebut dapat menunjukkan bahwa Smartfren belum memiliki merek yang kuat, sehingga perlu dilakukan upaya peningkatan ekuitas merek (brand equity). Penelitian ditujukan menghasilkan rancangan usulan peningkatan brand equity kartu perdana Smartfren. Penyebaran kuesioner dilakukan terhadap 137 responden. Persentase tingkatan brand awareness Smartfren adalah 6% untuk tingkatan top of mind, 55% tingkatan brand recall, 29% brand recognition, dan 11% unaware of brand. Hasil perhitungan perceived quality menunjukkan nilai rata-rata kepuasan Smartfren sebesar 2,92 (skala 4) artinya kepuasan Smartfren belum sangat baik. Smartfren memiliki 6 asosiasi positif yang terbentuk dan 7 asosiasi tereliminasi. Tingkat brand loyality pengguna kartu perdana Smartfren berada pada price buyer. Usulan meliputi peningkatan penguatan asosiasi merk, menambah diskon, meningkatkan partisipasi dalam aktivitas menjadi sponsor kegiatan, memperbaiki kualitas jaringan dan kecepatan internet terkait luas jangkauan atau cakupan layanan Smartfren, serta ukuran kartu perdana. Kata kunci: Brand Equity, Brand Awareness, Perceived Quality, Brand Association, Brand Loyalty. ABSTRACT In the importance of Internet network in today's society, the number of users of Smartfren simcard still lower than the competitor. -

ID GPS Site Id Site Name Lokasi Kelurahan Kecamatan Id Pemilik Pemilik Menara OPERATOR A001 150001 Minggiran Jl Raya Minggiran R

ID_GPS site_id Site_name Lokasi Kelurahan Kecamatan id pemilik Pemilik_menara OPERATOR A001 150001 Minggiran Jl Raya Minggiran RT 01 Imogiri Imogiri 2 Indosat INDOSAT A002 150002 Pasiban Jl Pasiban RT 05 Imogiri Imogiri 1 Telkomsel TELKOMSEL A003 150003 Karangtalun Jl Desa RT 03/05 Karangtalun Imogiri 4 XL Axiata XL A004 150004 Ngancar Ngancar RT 02 Karangtalun Imogiri 6 Smartfren SMARTFREN A005 150005 Gaban Gaban Karangtalun Imogiri 8 Bakrie ( Esia ) ESIA A006 150006 Sriharjo Jl Jogja Panggang RT 01 Sriharjo Imogiri 7 Axis AXIS A007 150007 Mojohuro Jl Jogja Panggang RT 01 Sriharjo Imogiri 14 Protelindo PROTELINDO A008 150008 Selopamioro Jl Spn RT 01 Selopamioro Imogiri 21 Indonesian Tower INDOSAT A009 150009 Pibal Jl Pibal Selopamioro Imogiri 1 Telkomsel TELKOMSEL A010 150010 Tegalrejo Tegalrejo RT 05 Girirejo Imogiri 4 XL Axiata XL (DALAM_TAHAP_PEMBANGUNAN) A011 150011 Mangunan Jl Mangunan RT 16 Mangunan Dlingo 1 Telkomsel TELKOMSEL A012 150012 Mangunan Jl Mangunan RT 16 Mangunan Dlingo 4 XL Axiata XL,HCPT A013 150013 Tegal Senggotan Tegal Senggotan Ngestiharjo Kasihan 1 Telkomsel TELKOMSEL A014 150014 Donggalan Kauman Donggalan Kauman RT 05 Tirtonirmolo Kasihan 7 Axis AXIS A015 150015 Donggalan Kauman Donggalan Kauman RT 05 Tirtonirmolo Kasihan 14 Protelindo AXIS A016 150016 Glugo Glugo Panggungharjo Sewon 1 Telkomsel TELKOMSEL A017 150017 Kaluran Bakung Kaluran RT 01 Bakung Bangunharjo Sewon 1 Telkomsel TELKOMSEL,FLEXI A018 150018 Semail Dusun Semail RT 02 Bangunharjo Sewon 14 Protelindo HCPT,ESIA,TELKOMSEL,FREN A019 150019 Timbulharjo