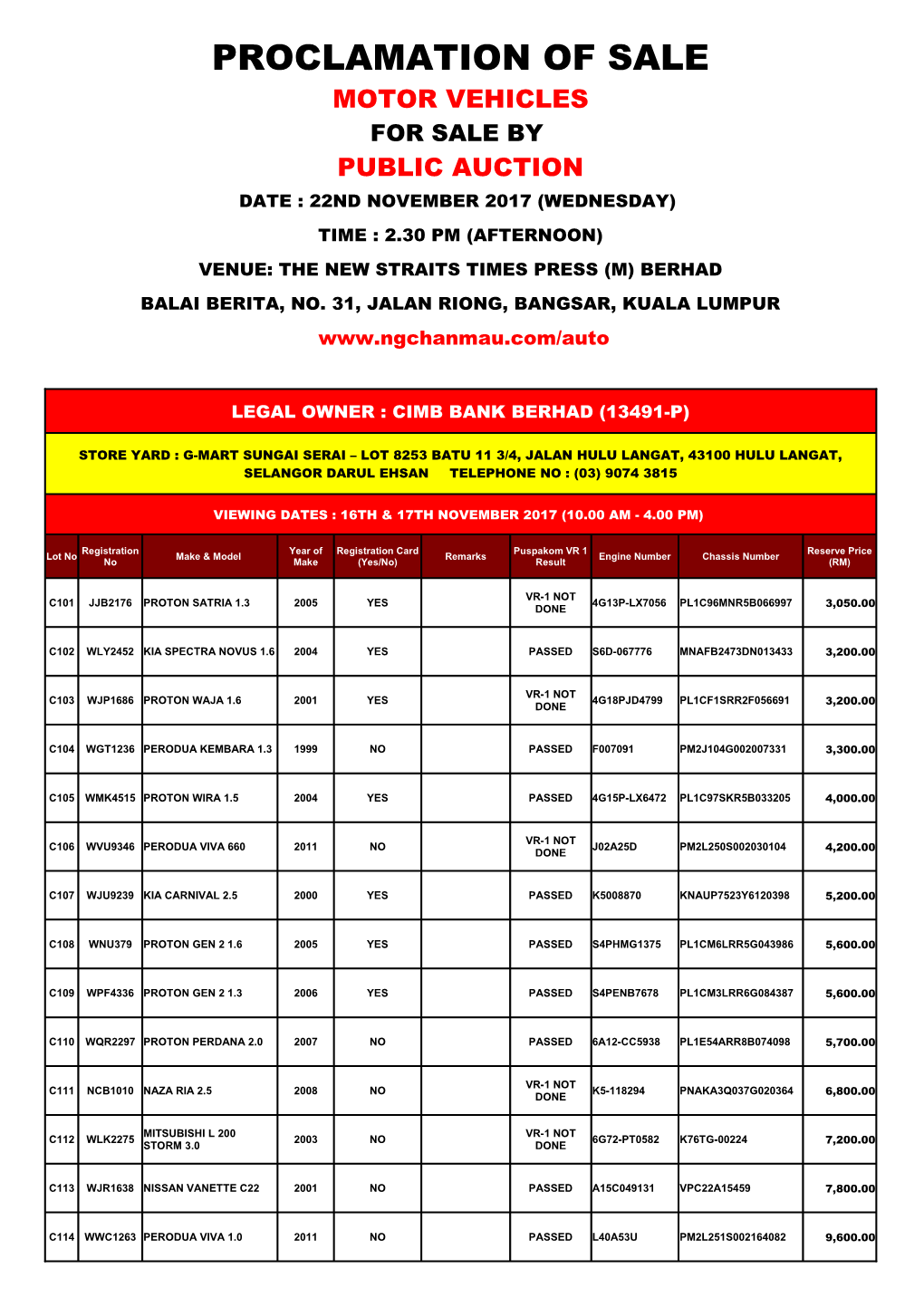

Proclamation of Sale

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018 | 2019

Annual Report 2018 | 2019 CHAN E Weathering storms and braving changes brought on by a volatile economy, United Motors has set its course on the highway to sustainability, and to discovering innovative solutions. Driving sustainable initiatives and streamlining operations while embracing evolving technology, we have reinforced ourselves by rewiring our DNA and expanding our horizons. 02 UNITED MOTORS LANKA PLC Annual Report 2018 | 2019 UNITED MOTORS LANKA PLC Annual Report 2018 | 2019 03 Contents Vision and Mission 06 Our Beginnings 07 06-43 Our Journey Thus Far 08 Review of the Business Operational and Financial Highlights 11 Events of the Year 13 Group Structure 20 Chairman’s Message 22 Group CEO Review of Operations 26 Board of Directors 30 Senior Management Team 34 Management Discussion and Analysis 46 Business Review 55 46-89 Financial Capital 58 Manufactured Capital 60 Management Review Social & Relationship Capital 61 Human Capital 77 Natural Capital 87 Intellectual Capital 89 How We Govern 92 Audit Committee Report 107 92-127 Remuneration Committee Report 110 Governance Nomination Committee Report 112 Related Party Transactions Review Committee Report 113 Enterprise Risk Management 115 Directors’ Statement on Internal Controls 121 Annual Report of the Board of Directors 122 04 UNITED MOTORS LANKA PLC Annual Report 2018 | 2019 Financial Calendar 131 Statement of Directors’ Responsibility 132 131-204 CEO and CFO’s Responsibility Statement 134 Financial Information Independent Auditor’s Report 135 Statement of Profit or Loss and Other -

Grab Marketing Strategy, Research & Development

Grab Marketing Strategy, Research & Development Gabriel Willy Widyatama1, Shankar Chelliah2, Yang Kai3, Yang Yingxing4, Yee Chew Tien5, Wee Choo Mey6, Liem Gai Sin7 University Ma Chung1,7 Jl. Villa Puncak Tidar No.1, Doro, Karangwidoro, Kec. Dau, Malang, Jawa Timur 65151 University Sains Malaysia2,3,4,5,6 11800 Gelugor, Penang, Malaysia Correspondence Email: [email protected] ABSTRACT Grab is a Singapore-based company providing transportation applications available in six countries in Southeast Asia. It utilizes smartphone cloud-based technology to provide ride-hailing and logistics services, food delivery, and courier service. This study proposes to determine and analyze the problems that exist in the Grab company. One of the problems in a company is a competition between companies. One of the competitors is GO-JEK. This research is expected to provide solutions to problems that exist within the company. How to stand out from competitors, attract more customers and drivers, and various training courses for drivers? What should the company decide on the price? In different countries, how should companies operate under different government policies? Keywords: Application, Grab, Marketing, Strategy, Transportation INTRODUCTION Grab Holdings Inc. formerly known as MyTeksi and GrabTaxi, it is a Singapore based transportation company that was originally founded in Malaysia and moved its headquarters to Singapore. Grab is an Uber-like service that offers rides, and on- demand taxi service with flat rate fees based on the city. Grab allows the customer to quickly book a ride from the app, wait for the grab car, and pay the fare through app or by using cash. -

Dealership Staff Can Help Reduce the Number of Problems Owners Experience with Their New Vehicle

Dealership Staff Can Help Reduce The Number of Problems Owners Experience With Their New Vehicle Honda Receives Two Model-Level Awards For Initial Quality, Perodua and Toyota Each Get One KUALA LUMPUR: 27 November 2015 — The salesperson plays a critical role in reducing the number of problems owners experience with their new vehicle, according to the J.D. Power Asia Pacific 2015 Malaysia Initial Quality StudySM (IQS) released today. Automakers continue to add features, specifically entertainment and connectivity technology, to their vehicle. By explaining at the time of delivery all of the features of the vehicle and how they work, the salesperson can make sure the owner is comfortable with the technology thus significantly reducing the number of problems the owner experienced with their vehicle. The study finds that when the salesperson provides a comprehensive explanation of the vehicle and its features, owners report an average of 79 problems per 100 vehicles (PP100). In contrast, owners who indicate their salesperson provided no explanation, or only a partial explanation, report an average of 163 PP100. “With all of the new content automakers are putting in their vehicles, it is absolutely critical for salespeople to provide comprehensive explanation of vehicle, including a test drive, to make sure the customer fully understands how to operate all of the technology and its benefits,” said Rajaswaran Tharmalingam, country head, Malaysia, J.D. Power. “The technology may work exactly as it’s designed, but if the customer doesn’t know how to use it or had difficulties using it, they deem it a problem. The salesperson can greatly reduce those problems simply spending time with the customer during the delivery process going through the vehicle and its accessories.” Tharmalingam noted that given the importance of the test drive, only 59 percent of customers in Malaysia took one during their shopping process. -

PROCLAMATION of SALE MOTOR VEHICLES for Sale by Public Auction on Thursday, 13Th June 2019 @ 2.30 P.M Venue : Unit No

PROCLAMATION OF SALE MOTOR VEHICLES For Sale By Public Auction On Thursday, 13th June 2019 @ 2.30 p.m Venue : Unit No. 6 (B-0-6), Ground Floor, Block B Megan Avenue II, No 12, Jln Yap Kwan Seng, Kuala Lumpur www.ngchanmau.com/auto "Prospect bidders may submit bids for the Auto e-Bidding via www.ngchanmau.com/auto. *Please register at least one (1) working day before auction day for registration & verification purposes". To get a digital copy of auction listings by Car Make / Model, please SMS or Whatsapp to 012-5310600. LEGAL OWNER : CIMB BANK BERHAD (13491-P) / CIMB ISLAMIC BANK BERHAD (671380-H) REGN. TRANS RESERVE LOT REGISTRATION YEAR OF PUSPAKOM ENGINE CHASSIS MAKE & MODEL CARD REMARKS MISSIO PRICE NO NO MAKE VR 1 RESULT NUMBER NUMBER (YES / NO) N TYPE (RM) STORE YARD : G-MART SUNGAI SERAI - LOT 8253, BATU 11 3/4, JALAN HULU LANGAT, 43100 HULU LANGAT, SELANGOR TELEPHONE NO : (03) 9074 3815 VIEWING DATES : 7th & 10th June 2019 (10.00 AM - 4.00 PM) C101 VF6859 PERODUA ALZA 1.5 2016 NO PASSED G82B91K PM2M502G002296241 A 32,000.00 C102 BPL2786 PERODUA ALZA 1.5 2018 NO PASSED G53B57R PM2M502G002334048 A 41,000.00 C103 WC7514U PERODUA AXIA 1.0 2016 NO PASSED H29B48R PM2B200S003171513 A 18,600.00 C104 WC3976T PERODUA AXIA 1.0 2016 NO PASSED H21B93V PM2B200S003156396 A 18,600.00 C105 W2093G PERODUA MYVI 1.3 2013 NO PASSED T51A33T PM2M602S002140415 A 15,000.00 C106 WA2139M PERODUA MYVI 1.3 2014 YES PASSED T07B52A PM2M602S002183889 M 19,800.00 VR-1 NOT C107 WA1494D PERODUA MYVI 1.5 2014 NO WITHDRAWN R12A24L PM2M603S002103084 M 25,000.00 DONE -

The Product Effect: Do Designed Products Convey Their Characteristics to Their Owners?

The Product Effect: Do Designed Products Convey Their Characteristics To Their Owners? Raja Ahmad Azmeer Raja Ahmad Effendi Submitted in partial fulfillment of the requirements of the Degree of Doctor of Philosophy Faculty of Design Swinburne University of Technology 2011 ABSTRACT ABSTRACT Malaysia is unique within the Islamic world in developing a motor car industry that is geared towards both internal and export markets. After achieving initial success, its export performance has failed to match that of its international competitors. Factors that are suspected to contribute to this failure is in the technology and styling of its models. Moreover, with the implementation of AFTA (Asean Free Trade Area) in Malaysia, the car industry is expected to face the influx of inexpensive established brands from ASEAN countries which will gradually dominate the local market. The research was cross-cultural and tested for possible differences based on nationality and gender. It used qualitative and quantitative techniques consisting of a Car Positioning Task using Semantic Differential scales and a derivation of the Room Effect method in order to investigate the perception of cars and its effect upon the perception of its owner. The pilot and actual surveys using Room Effect method were carried out with international participants. The results indicated that it is reliable and can be used to reveal cultural and gender differences. The research also indicated that the Room Effect method is practical for application to the car industry. ii ACKNOWLEDGEMENTS ACKNOWLEDGEMENTS This thesis marks the conclusion of a three year PhD program in Design at the Faculty of Design, Swinburne University of Technology, Melbourne, Australia. -

Umw Holdings Berhad Corporate Presentation

BEYOND BOUNDARIES UMW HOLDINGS BERHAD CORPORATE PRESENTATION FEBRUARY 2020 UMW HOLDINGS BERHAD OUR BUSINESS DIVERSIFIED PORTFOLIO AUTOMOTIVE EQUIPMENT MANUFACTURING LANDBANK & ENGINEERING • Manufacture • Distribution • Manufacture of • Unlocking value • Assembly • Trading fan case of our vast landbank in • Distribution • Leasing • Manufacture of automotive Serendah • Sales & service • After-sales components service • Blending & distribution of lubricants UMW HOLDINGS BERHAD 2 OUR STRENGTH LEADER IN OUR CORE BUSINESS SEGMENTS AUTOMOTIVE EQUIPMENT MANUFACTURING & ENGINEERING • Leader in the Malaysian • Distribute Komatsu heavy • First Malaysian company to automotive industry with equipment in 5 countries in manufacture and assemble 51.4% market share (2019) the Asia-Pacific region. fan cases for Rolls-Royce as through Toyota, Lexus and a Tier 1 supplier. Perodua marques. • Hold more than 50% market share for Toyota forklift in • Manufacture and export Malaysia and Singapore; have KYB shock absorbers to 38 operations in 5 countries in countries from Malaysia. Asia-Pacific. UMW HOLDINGS BERHAD 3 OUR REVENUE AND PBT CONTRIBUTION SEGMENTAL BREAKDOWN 2014 2015 2016 2017 2018 1% 2% 6% 5% 6% 7% 6% 7% 7% 7% 13% 13% 14% 20% 13% 13% 14% 21% 22% 21% 86% 81% 81% 78% 81% 81% 79% 72% 71% 72% REVENUE PBT REVENUE PBT REVENUE PBT * REVENUE PBT * REVENUE PBT * Automotive Equipment Manufacturing & Engineering * Excluding Aerospace sub-segment (within Manufacturing & Engineering) which was loss-making due to start-up operations UMW HOLDINGS BERHAD 4 OUR INTERNATIONAL -

Global Trends and Malaysia's Automotive Sector

2021-3 Global Trends and Malaysia’s Automotive Sector: Ambitions vs. Reality Tham Siew Yean ISEAS - Yusof Ishak Institute Email: [email protected] March 2021 Abstract The paper seeks to examine the development of the Malaysian automotive sector in the midst of rapid global changes in technology, consumer preferences and sustainability concerns. The sector represents a case of infant industry protection which includes, among its objectives, the state’s aspiration to nurture Bumiputera entrepreneurs as national champions for the sector. Despite close to three decades of protection, the two national car projects continue to depend on foreign partners for technology support. The National Automotive Policies (NAPs) strive to push the sector towards the technology frontier with foreign and domestic investments while seeking to be a regional hub and grooming national Bumiputera champions. The inherent conflicts in these objectives create disincentives for investments while the domestic market is held captive to the national car producers. Although policies continue to espouse grand visions, the reality is that Malaysia’s car makers continue to be inward-looking and exporting remains insignificant. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- JEL Classification: O14, O25 Keywords: Automotive Sector, Industrial Policy Global Trends and Malaysia’s Automotive Sector: Ambitions vs. Reality Tham Siew Yean 1. Introduction The use of state intervention for development has been espoused in theory and practice in many countries. The World Bank (1993) study on the East Asian miracle economies is often attributed to illustrate the success of state intervention in industrial policy. However, the study itself cautions that the use of industrial policy needs to be supported with good fundamental policies, evaluation and monitoring of the support given. -

Approval Car Price Issued As of 31St January 2020

APPROVAL CAR PRICE ISSUED AS OF 31ST JANUARY 2020 DATE SHOWROOM PASSENGER MOTOR VEHICLES BRAND PASSENGER MOTOR VEHICLES MODEL /TYPE DATE ISSUED PRICE (SRP) EFFECTIVE EXPIRY ALFA ROMEO ALFA ROMEO GIULIA 620 QV V6 (G.H.K MOTORS SDN BHD) ALFA ROMEO GIULIA 620 QV V6 2.9L AUTO SEDAN PETROL 27-May-19 21-Apr-19 20-Apr-20 $139,973.00 ALFA ROMEO GIULIA 620 GME ALFA ROMEO GIULIA 620 GME 2.0L AUTO SEDAN PETROL 27-May-19 21-Apr-19 20-Apr-20 $63,353.00 ALFA ROMEO STELVIO ALFA ROMEO STELVIO 2.0L 8-SPEED AUTOMATIC TRANSMISSION AWD SUV 7-Jan-20 1-Dec-19 30-Nov-20 $75,262.00 PETROL (SOLID PAINT) ALFA ROMEO STELVIO 2.0L 8-SPEED AUTOMATIC TRANSMISSION AWD SUV 7-Jan-20 1-Dec-19 30-Nov-20 $77,538.00 PETROL (SPECIAL PAINT) ALFA ROMEO VELOCE 620 2.0L GME 2000 ALFA ROMEO GIULIA VELOCE 620 2.0L AUTO GME 2000 SEDAN PETROL 27-Jul-19 3-Jun-19 2-Jun-20 $69,666.00 AUDI AUDI A3 TFSI S-TRONIC (T. C. Y. MOTORS SDN BHD) AUDI A3 1.2L TFSI S-TRONIC AUTO SEDAN PETROL 26-Dec-19 31-Dec-19 30-Dec-20 $43,631.00 AUDI A3 TFSI S-TRONIC SPORTBACK AUDI A3 1.2L TFSI S-TRONIC AUTO SPORTBACK PETROL 7-Sep-19 11-Sep-19 10-Sep-20 $46,803.00 AUDI A4 TFSI S-TRONIC BLACK EDITION AUDI A4 2.0L TFSI S-TRONIC AUTO SEDAN PETROL - BLACK EDITION 19-Jun-19 3-Jun-19 2-Jun-20 $55,068.00 AUDI A4 TFSI QUATTRO S-TRONIC AUDI A4 2.0L TFSI QUATTRO S-TRONIC AUTO AWD SEDAN PETROL 19-Jun-19 3-Jun-19 2-Jun-20 $67,560.00 AUDI A4 TFSI ULTRA QUATTRO S-TRONIC AUDI A4 2.0L TFSI ULTRA QUATTRO AWD S-TRONIC AUTO SEDAN PETROL 25-Feb-19 11-Feb-19 10-Feb-20 $68,676.00 AUDI A5 TFSI QUATTRO S-TRONIC COUPE AUDI A5 2.0L TFSI -

Case Studies of Perodua Viva, Perodua Myvi and Proton Suprima

Journal of the Society of Automotive Engineers Malaysia Volume 3, Issue 3, pp 333-340, September 2019 e-ISSN 2550-2239 & ISSN 2600-8092 Parametric Study of a Blind Spot Zone: Case Studies of Perodua Viva, Perodua Myvi and Proton Suprima M. S. Muhamad Azmi*1,2, A. H. Ismail1,2, M. S. M. Hashim1,2, M. S. Azizizol1,2, S. Abu Bakar1,2, N. S. Kamarrudin1,2, I. I. Ibrahim1,2, M. R. Zuradzman1,2, A. Harun1,3, I. Ibrahim1,2, M. K. Faizi1,2, M. A. M. Saad1,2, M. F. H. Rani1,2, M. A. Rojan1,2 and M. H. Md Isa4 1Motorsports Technology Research Unit (MoTECH), Universiti Malaysia Perlis, Pauh Putra Campus, 02600 Arau, Perlis, Malaysia 2School of Mechatronic Engineering, Universiti Malaysia Perlis, Pauh Putra Campus, 02600 Arau, Perlis, Malaysia 3School of Microelectronic Engineering, Universiti Malaysia Perlis, Pauh Putra Campus, 02600 Arau, Perlis, Malaysia 4Malaysian Institute of Road Safety Research (MIROS, 43000 Kajang, Malaysia *Corresponding author: [email protected] ORIGINAL ARTICLE Open Access Article History: Abstract – The initial works on Blind Spot Zone (BSZ) identification presents the importance of the blind spot towards the everyday drive. The Received alarming collision rate in the blind spot zone especially when changing 20 Oct 2018 lanes has triggered the necessity of BSZ detection and warning system, focusing on a daily-used and affordable car segment. Such technologies Received in are recently available at top variant cars. Therefore, a low cost yet revised form facilitative BSZ detection and warning system is required. This paper 3 Aug 2019 presents the continuity experimental result of identification of the BSZ of Accepted three different car segments, i.e. -

Toyota Gear Shift/Select Cable

INDEX PAGES TOYOTA 1 ~ 53 NISSAN 54 ~ 91 MAZDA 92 ~ 104 HINO 105 ~ 115 ISUZU 116 ~ 137 MITSUBISHI 138 ~ 160 PROTON 161 ~ 164 DAIHATSU 165 ~ 172 SUZUKI 173 ~ 180 HONDA 181 ~ 193 SUBARU 194 ~ 195 HYUNDAI 196 ~ 199 DAEWOO & KIA & SSANGYONG 200 ~ 203 AMERICAN & EUROPEAN VEHICLES 204 ~ 212 MOTORCYCLES 213 ~ 215 KUBOTA,TRACTOR & FORK LIFT 216 ~ 218 OTHERS 219 ~ 221 CABLES FOR SOUTH AFRICA MAKET 222 ~ 229 ADDITIONAL ITEMS 230 TOYOTA OEM NUMBER ICI NUMBER MODEL TOYOTA ACCELERATOR CABLE 35520-12050 CATY123 AE 8# 35520-12072 CATY145 KE70 ATM 81.08- 35520-12110 CATY124 TE 7# 35520-12200 CATY158 35520-12201 CATY158 35520-12240 CATY126 HILUX LN85/106 88-92, AE101, AE92, AT171 35520-12300 CATY148 AE100,101,110 4FC 91.08- 35520-12310 CATY151 COROLLA AE101 4A-FE 91.06-93.05 35520-12370 CATY122 35520-12390 CATY150 COROLLA AE101 4A-FE 93.05- , AE102,111 1991-1995 RHD 35520-12391 CATY150 COROLLA AE101 4A-FE 93.05- , AE102,111 1991-1995 RHD 35520-16090 CATY147 EE101,92.05-95.05,EP82 3F .92.01- 35520-20070 CATY141 CRESSIDA 35520-28011 CATY133 35520-30030 CATY146 MS112,122,132,133 8MX73 84.08- 35520-33010 CATY217 CAMRY SXV10# 2.2L 5S-FE DOHC 16V MPFI 4CYL 4SP AUTO, VCV10, MCV10 ATM 1992-2001 35520-33050 CATY234 AVALON XL,XLS (MCX10) 1996-1999/CAMRY CE,LE,XLE (MCV20) 1997-2001/SOLARA MCV20 1999-2003/LEXUS ES300 (MCV20) 1996-2001 47616-26040 CATY192 62-CATY002 CATY002 HILUX LN50 62-CATY004 CATY004 HILUX 62-CATY026 CATY026 HILUX HIACE Y SERIES LN80/85/106/130 LHD 92-94 3L 78120-35013 CATY156 78120-90506 CATY159 DYNA RB10 '77-79 78150-06020 CATY220 TOYOTA CAMRY -

Asean NCAP's Success and Challenges in Promoting Safer

Transport and Communications Bulletin for Asia and the Pacific No. 89, 2019 ASEAN NCAP’S SUCCESS AND CHALLENGES IN PROMOTING SAFER VEHICLES IN THE ESCAP REGION Khairil Anwar Abu Kassim, Ahmad, Jawi and Ishak Abstract Starting from 2011, ASEAN NCAP has been mandated to carry out crash tests on new cars in the ESCAP region, particularly Southeast Asia. With a total population of over 630 million, the 10 countries comprising ASEAN have seen passenger vehicle sales reach over three million units. To date, 90 percent of the vehicles sold in ASEAN market have been tested by ASEAN NCAP. Their safety aspects have been greatly improved over time. But aside from the safety of car occupants, ASEAN NCAP is also concerned with the safety of vulnerable road users. In November 2018, ASEAN NCAP announced its latest road map which focuses on the safety of motorcyclists in the region. ASEAN NCAP’s efforts have also been recognized by the Malaysian government, as of next year, all car dealers are to showcase the star rating issued by ASEAN NCAP on the car’s front windshield and side mirror in all showroom and sales centres in Malaysia. This is to educate buyers to choose the models that give priority to the best rating. The current paper shall provide an overview of the results produced by ASEAN NCAP, including its success and challenges to elevate the safety standards of passenger vehicles in the Southeast Asian market. In addition, the last section will describe ASEAN NCAP road map which guides its journey toward achieving SDG targets 3.6 and 11.2. -

In Response to Your Recent Request for Information Regarding; Within Your Constabulary, What Is the Highest Speed (Mph) Recorde

Uned Rhyddid Gwybodaeth / Freedom of Information Unit Response Date: 25/05/2018 2018/444 – Highest Speed In response to your recent request for information regarding; Within your constabulary, what is the highest speed (mph) recorded from 1st January 2017 up to and including May 2018. Please break this down to include the make and model of the car caught speeding and also by any one detection method. For example – a Toyota Yaris was caught speeding at 71mph in a 60mph zone in November 2017 Within your constabulary, in this time period, what is the most common car make and model caught speeding? The highest speed recorded was a BMW 330D AC AUTO travelling at 141 mph, captured by a mobile camera unit in October 2017. Vehicle makes and models are not retained in the system for notices we are unable to process, so we do not have a definitive list of all types. Also, vehicles are recorded in the camera system including all model varieties. It isn’t possible to consolidate all these simply into one model group. I have attached a full list for you to analyse. THIS INFORMATION HAS BEEN PROVIDED IN RESPONSE TO A REQUEST UNDER THE FREEDOM OF INFORMATION ACT 2000, AND IS CORRECT AS AT 18/05/2018 Vehicle Total ABARTH 500 9 ABARTH 500 CUSTOM 2 ABARTH 595 1 ABARTH 595 COMPETIZONE 1 ABARTH 595 TURISMO 4 ABARTH 595 TURISMO S-A 2 ABARTH 595C COMPETIZIONE 1 ABARTH 595C COMPETIZONE S-A 1 AIXAM CROSSLINE MINAUTO CVT 1 AJS JS 125-E2 1 ALEXANDER DENNIS 11 ALFA ROMEO 2 ALFA ROMEO 147 1 ALFA ROMEO 147 COLLEZIONE JTDM 1 ALFA ROMEO 147 COLLEZIONE JTDM 8V 1 ALFA