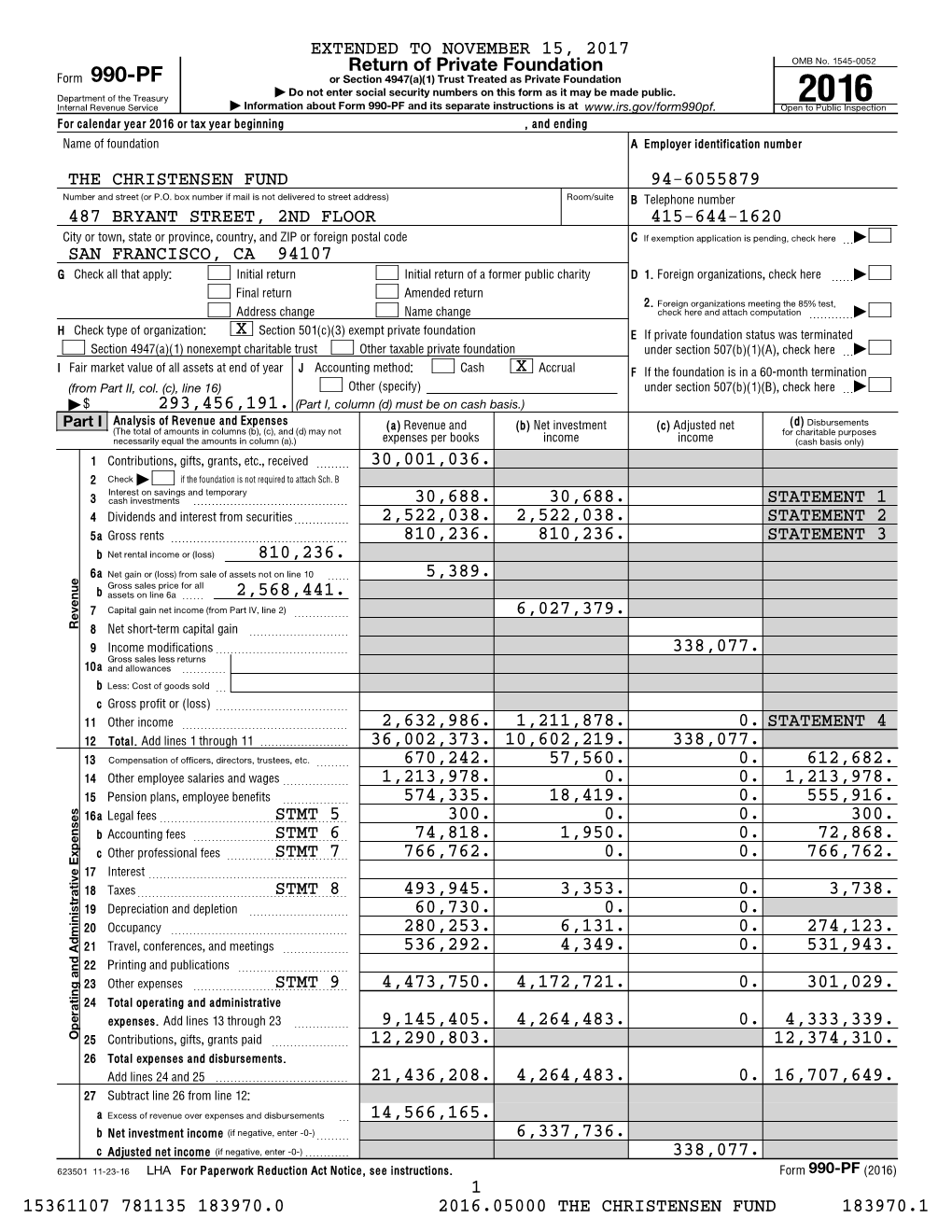

990-PF Or Section 4947(A)(1) Trust Treated As Private Foundation | Do Not Enter Social Security Numbers on This Form As It May Be Made Public

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Land Und Leute 22

Vorwort 11 Herausragende Sehenswürdigkeiten 12 Das Wichtigste in Kurze 14 Entfernungstabelle 20 Zeichenlegende 20 LAND UND LEUTE 22 Tadschikistan im Überblick 24 Landschaft und Natur 25 Gewässer und Gletscher 27 Klima und Reisezeit 28 Flora 29 Fauna 32 Umweltprobleme 37 Geschichte 42 Die Anfänge 42 Vom griechisch-baktrischen Reich bis zur Kushan-Dynastie 47 Eroberung durch die Araber und das Somonidenreich 49 Türken, Mongolen und das Emirat von Buchara 49 Russischer Einfluss und >Great Game< 50 Sowjetische Zeit 50 Unabhängigkeit und Burgerkrieg 52 Endlich Frieden 53 Tadschikistan im 21. Jahrhundert 57 Regierung 57 Wirtschaftslage 58 Kritik und Opposition 58 Tourismus 60 Politisches System in Theorie und Praxis 61 Administrative Gliederung 63 Wirtschaft 65 Bevölkerung und Kultur 69 Religionen und Minderheiten 71 Städtebau und Architektur 74 Volkskunst 77 Sprache 79 Literatur 80 Musik 85 Brauche 89 http://d-nb.info/1071383132 Feste 91 Heilige Statten 94 Die tadschikische Küche 95 ZENTRALTADSCHIKISTAN 102 Duschanbe 104 Geschichte 104 Spaziergang am Rudaki-Prospekt 110 Markt und Mahalla 114 Parks am Varzob-Fluss 115 Museen 119 Denkmaler 122 Duschanbe live 128 Duschanbe-Informationen 131 Die Umgebung von Duschanbe 145 Festung Hisor 145 Varzob-Schlucht 148 Romit-Tal 152 Tal des Karatog 153 Wasserkraftwerk Norak 154 Das Rasht-Tal 156 Ob-i Garm 158 Gharm 159 Jirgatol 159 Reiseveranstalter in Zentral tadschikistan 161 DER PAMIR 162 Das Dach der Welt 164 Ein geografisches Kurzportrait 167 Die Bewohner des Pamirs 170 Sprache und Religion 186 Reisen -

The Republic of Tajikistan Ministry of Energy and Industry

The Republic of Tajikistan Ministry of Energy and Industry DATA COLLECTION SURVEY ON THE INSTALLMENT OF SMALL HYDROPOWER STATIONS FOR THE COMMUNITIES OF KHATLON OBLAST IN THE REPUBLIC OF TAJIKISTAN FINAL REPORT September 2012 Japan International Cooperation Agency NEWJEC Inc. E C C CR (1) 12-005 Final Report Contents, List of Figures, Abbreviations Data Collection Survey on the Installment of Small Hydropower Stations for the Communities of Khatlon Oblast in the Republic of Tajikistan FINAL REPORT Table of Contents Summary Chapter 1 Preface 1.1 Objectives and Scope of the Study .................................................................................. 1 - 1 1.2 Arrangement of Small Hydropower Potential Sites ......................................................... 1 - 2 1.3 Flowchart of the Study Implementation ........................................................................... 1 - 7 Chapter 2 Overview of Energy Situation in Tajikistan 2.1 Economic Activities and Electricity ................................................................................ 2 - 1 2.1.1 Social and Economic situation in Tajikistan ....................................................... 2 - 1 2.1.2 Energy and Electricity ......................................................................................... 2 - 2 2.1.3 Current Situation and Planning for Power Development .................................... 2 - 9 2.2 Natural Condition ............................................................................................................ -

The World Bank the STATE STATISTICAL COMMITTEE of the REPUBLIC of TAJIKISTAN Foreword

The World Bank THE STATE STATISTICAL COMMITTEE OF THE REPUBLIC OF TAJIKISTAN Foreword This atlas is the culmination of a significant effort to deliver a snapshot of the socio-economic situation in Tajikistan at the time of the 2000 Census. The atlas arose out of a need to gain a better understanding among Government Agencies and NGOs about the spatial distribution of poverty, through its many indicators, and also to provide this information at a lower level of geographical disaggregation than was previously available, that is, the Jamoat. Poverty is multi-dimensional and as such the atlas includes information on a range of different indicators of the well- being of the population, including education, health, economic activity and the environment. A unique feature of the atlas is the inclusion of estimates of material poverty at the Jamoat level. The derivation of these estimates involves combining the detailed information on household expenditures available from the 2003 Tajikistan Living Standards Survey and the national coverage of the 2000 Census using statistical modelling. This is the first time that this complex statistical methodology has been applied in Central Asia and Tajikistan is proud to be at the forefront of such innovation. It is hoped that the atlas will be of use to all those interested in poverty reduction and improving the lives of the Tajik population. Professor Shabozov Mirgand Chairman Tajikistan State Statistical Committee Project Overview The Socio-economic Atlas, including a poverty map for the country, is part of the on-going Poverty Dialogue Program of the World Bank in collaboration with the Government of Tajikistan. -

The Personalisation of Market Exchange in Gorno-Badakhshan, Tajikistan

[Final draft submitted] ‘No debt, no business’: The Personalisation of Market Exchange in Gorno-Badakhshan, Tajikistan By Carolin Maertens ERC Project Remoteness and Connectivity: Highland Asia in the World Department of Social and Cultural Anthropology Ludwig-Maximilians-Universität Munich Citation: Maertens, Carolin (2017): “No debt, no business”: The Personalisation of Market Exchange in Gorno-Badakhshan, Tajikistan. In: R. Hardenberg (ed.): Approaching Ritual Economy. Socio-Cosmic Fields in Globalized Contexts. RessourcenKulturen 4. Tuebingen: 159-192. Keywords: debt, trade, market, transition, Islam, personalisation, Tajikistan 1 Introduction If one happens to travel in a shared taxi the roughly 600 km distance from Tajikistan’s capital Dushanbe to Khorugh, the capital of its mountainous Autonomous Province Gorno- Badakhshan, one is likely to enjoy the increasingly spectacular view on mountains and torrential rivers for at least fourteen hours. And if one happens to be brave enough and free from giddiness, it is advisable to get hold of a seat on the right side in direction of travel, preferably the front seat, since it provides by far the best view (and increases the chance to find a functioning seatbelt). Following the Panj river upstream on a dirt road for a great part of the journey, one can marvel at the steep canyons one passes through, at rock walls rising high above one’s head and at adventurous pathways vanquished by walkers, motorcycles, cars and donkeys right across the Panj river, which forms the border with Afghanistan. Apart from the visual entertainment, one may also wonder about the trucks that rumble together with passenger cars along the sometimes critically narrow road strip high above the river, shipping consumer goods to the Pamir region. -

Chinese Censors Crack Down on Tweets

ABCDE Democracy Dies in Darkness SUNDAY, JANUARY 6, 2019 Chinese censors crack down on tweets Police head to doorsteps in interviews to The Washington Post that to pressure Twitter users authorities are sharply escalating the Twit- to delete messages ter crackdown. It suggests a wave of new and more aggressive tactics by state cen- by Gerry Shih sors and cyber-watchers trying to control the Internet. HONG KONG — The 50-year-old software Twitter is banned in China — as are engineer was tapping away at his computer other non-Chinese sites such as Facebook, in November when state security officials YouTube and Instagram. But they are filed into his office on mainland China. accessed by workarounds such as a virtual They had an unusual — and nonnego- private network, or VPN, which is software tiable — request. that bypasses state-imposed firewalls. Delete these tweets, they said. While Chinese authorities block almost The agents handed over a printout of all foreign social media sites, they rarely 60 posts the engineer had fired off to his have taken direct action against citizens 48,000 followers. The topics included U.S.- who use them, preferring instead to quietly China trade relations and the plight of monitor what the Chinese are saying. underground Christians in his coastal prov- But recently, Internet monitors and ince in southeast China. activists have tallied at least 40 cases of When the engineer did not comply Chinese authorities pressuring users to after 24 hours, he discovered that someone delete tweets through a decidedly low-tech had hacked into his Twitter account and method: showing up at their doorsteps. -

Tourism in Tajikistan As Seen by Tour Operators Acknowledgments

Tourism in as Seen by Tour Operators Public Disclosure Authorized Tajikistan Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized DISCLAIMER CONTENTS This work is a product of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. ACKNOWLEDGMENTS......................................................................i The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other INTRODUCTION....................................................................................2 information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. TOURISM TRENDS IN TAJIKISTAN............................................................5 RIGHTS AND PERMISSIONS TOURISM SERVICES IN TAJIKISTAN.......................................................27 © 2019 International Bank for Reconstruction and Development / The World Bank TOURISM IN KHATLON REGION AND 1818 H Street NW, Washington, DC 20433, USA; fax: +1 (202) 522-2422; email: [email protected]. GORNO-BADAKHSHAN AUTONOMOUS OBLAST (GBAO)...................45 The material in this work is subject to copyright. Because The World Bank encourages dissemination of its knowledge, this work may be reproduced, in whole or in part, for noncommercial purposes as long as full attribution to this work is given. Any queries on rights and li- censes, including subsidiary rights, should be addressed to the Office of the Publisher, The World Bank, PROFILE AND LIST OF RESPONDENTS................................................57 Cover page images: 1. Hulbuk Fortress, near Kulob, Khatlon Region 2. Tajik girl holding symbol of Navruz Holiday 3. -

Tajikistan Situation Update # 5

TAJIKISTAN SITUATION UPDATE # 5 Tajikistan Humanitarian Situation Brief No. 5 Distribution of household emergency kits to evacuated households, Children’s Music school of Rushon district, © UNICEF in Tajikistan/Inter-Agency Assessment Mission/December 2015 HIGHLIGHTS SITUATION IN NUMBERS The 7 December 2015 earthquake affected over 5,000 persons, displaced 654 Date: 10 January 2016 people, including 354 children, led to 2 fatalities and at least 10 injured. The assessments indicate 144 houses are destroyed, 516 partially damaged, 3 schools fully and 12 schools partially damaged, and a variety of other public infrastructure sustained different levels of damages. The main impacted Emergency supplies of the area is GBAO, the upper Bartang Valley, which is mountainous, remote and value of approximately isolated. US$125,000 have been released to date by Low temperature and first snows hitting GBAO underline the urgency of UNICEF to support the ensuring sustained relief assistance, including winterization for the earthquake-affected population. response. While the assessments are being conducted, UNICEF supported displaced 654 people families with immediate life-saving items, including 165 hygiene kits and 328 evacuated from affected areas water storage containers, 114 household emergency assistance packages have benefitted from and 182 sets of bed linen and 256 blankets. emergency supplies Initial assessments suggest that support with child friendly spaces and dispatched by UNICEF worth temporary learning centres may be required, since the majority of collective US$25,000. centres are in schools. Schools are currently on a one-month break and UNICEF with the Department of Education will review the requirements in Over 500 each centre. -

Social and Economic Inclusion of Women from Migrant Households in Tajikistan

Office for Democratic Institutions and Human Rights SOCIAL AND ECONOMIC INCLUSION OF WOMEN FROM MIGRANT HOUSEHOLDS IN TAJIKISTAN ASSESSMENT REPORT Warsaw September 2012 TABLE OF CONTENTS EXECUTIVE SUMMARY...................................................................................................................4 INTRODUCTION .............................................................................................................................6 TERMINOLOGY ..............................................................................................................................9 CHAPTER 1. METHODOLOGY .......................................................................................................10 1.1. OBJECTIVE OF THE PROJECT ........................................................................................................10 1.2. OBJECTIVE OF THE ASSESSMENT ..................................................................................................10 1.3. METHODOLOGY OF THE ASSESSMENT ..........................................................................................10 1.4. LIMITATIONS OF THE STUDY ........................................................................................................14 CHAPTER 2. OVERVIEW OF THE LEGAL, POLICY AND INSTITUTIONAL FRAMEWORK ...................15 2.1. APPLICABLE LEGISLATION AND POLICIES IN THE AREAS OF MIGRATION AND GENDER .............................15 2.1.1. MIGRATION .................................................................................................................................15 -

06 LIBOR Materials

LIBOR Item ID: 65 From: Lee, Timothy </O=EXCHANGELABS/OU=EXCHANGE ADMINISTRATIVE GROUP (FYDIBOHF23SPDLT)/CN=RECIPIENTS/CN=D9770D766B6642C4AC0F9F116D0B180D- TIMOTHY LEE> To: (b) (6) Subject: LIBOR Sent: June 29, 2012 8:16 AM Received: June 29, 2012 8:16 AM What do you think the odds are that Bob Diamond is filing for unemployment by Labor Day? ----- Timothy Lee Senior Policy Advisor 202-730-2821 [email protected] RE: LIBOR Item ID: 29 From: (b) (6) To: Lee, Timothy <[email protected]> Subject: RE: LIBOR Sent: June 29, 2012 10:28 AM Received: June 29, 2012 10:29 AM 50-50 From: Lee, Timothy [mailto:[email protected]] Sent: Friday, June 29, 2012 8:17 AM To: (b) (6) (b) (6) Subject: LIBOR What do you think the odds are that Bob Diamond is filing for unemployment by Labor Day? ----- Timothy Lee Senior Policy Advisor 202-730-2821 [email protected] Confidentiality Notice: The information in this email and any attachments may be confidential or privileged under applicable law, or otherwise protected from disclosure to anyone other than the intended recipient(s). Any use, distribution, or copying of this email, including any of its contents or attachments by any person other than the intended recipient, or for any purpose other than its intended use, is strictly prohibited. If you believe you received this email in error, please permanently delete it and any attachments, and do not save, copy, disclose, or rely on any part of the information. Please call the OIG at 202-730-4949 if you have any questions or to let us know you received this email in error. -

Final Report April 2007

JFPR Grant No. 9078-TAJ Community-based Rural Road Maintenance Project Baseline Survey and Poverty Impact Assessment Report Draft Final Report April 2007 Gregory R. Gajewski, Ph.D. Poverty Impact Specialist and Principal in Charge Project Implementation Unit Ministry of Transport Republic of Tajikistan The Louis Berger Group, Inc. THE LOUIS BERGER GROUP, INC. TABLE OF CONTENTS LIST OF ACRONYMS / ABBREVIATIONS / TAJIK WORDS ...........................................................................4 EXECUTIVE SUMMARY .........................................................................................................................................5 KEY FINDINGS ..........................................................................................................................................................6 1. INTRODUCTION...............................................................................................................................................8 1.1. PROJECT DESCRIPTION ..................................................................................................................................8 1.2. OBJECTIVE OF BASELINE SURVEY AND POVERTY IMPACT ASSESSMENT REPORT..........................................9 1.2.1. Unique Feature – Development Impact Study with a Control Group ..................................................9 2. PRIMARY DATA COLLECTION ...................................................................................................................9 2.1. DATA/INFORMATION COLLECTION -

Environmental Degradation, Migration, Internal Displacement, and Rural Vulnerabilities in Tajikistan

Environmental Degradation, Migration, Internal Displacement, and Rural Vulnerabilities in Tajikistan May 2012 This study was conducted with financial support from the International Organization for Migration Development Fund. In its activities, IOM believes that a humane and orderly migration responds to the interests of migrants and society, as a whole. As a leading intergovernmental organization IOM is working with its partners in the international community, guided by the following objectives: to promote the solution of urgent migration problems, improve understanding of the problems in the area of migration; encourage social and economic development through migration; assert the dignity and well-being of migrants. Publisher: International Organization for Migration (IOM) Mission in the Republic of Tajikistan Dushanbe, 734013 22-A Vtoroy Proezd, Azizbekov Street Telephone: +992 (37) 221-03-02 Fax: +992 (37) 251-00-62 Email: [email protected] Website: http://www.iom.tj © 2012 International Organization for Migration (IOM) All rights reserved. No part of this publication may be reproduced or distributed in any way - through electronic and mechanical means, photocopying, recording, or otherwise without the prior written permission of the publisher. The opinions expressed in this report represent those of individual authors and unless clearly labeled as such do not rep- resent the opinions of the International Organization for Migration. Environmental Degradation, Migration, Internal Displacement, and Rural Vulnerabilities in Tajikistan May 2012 Saodat Olimova Muzaffar Olimov ACKNOWLEDGEMENTS The authors of this report express their deepest gratitude to Zeynal Hajiyev, Chief of IOM Mission in Tajikistan and the employees of the IOM country office, especially Moyonsho Mahmadbekov, Patrik Shirak and Zohir Navjavonov for their invaluable advice on improving the structure and content of this report. -

Protecting Pennsylvania's Investments

September 30, 2012 Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2012 September 30, 2012 The Commonwealth of Pennsylvania has enacted legislation (Act 44 of 2010) requiring public funds to divest from companies doing business in Iran and/or Sudan that meet certain thresholds of activity. Additionally, Act 44 prohibits Pennsylvania’s public funds from purchasing securities of a company once it appears on scrutinized business activities lists, regardless of whether the funds already have direct holdings in such company. Act 44 requires that the public funds each year assemble and provide a report to the Governor, the President Pro Tempore of the Senate, the Speaker of the House of Representatives, and each member of the boards of the Pennsylvania Municipal Retirement System, the State Employees’ Retirement System, and the Public School Employees’ Retirement System. Accordingly, we have prepared this report on the activities our funds have undertaken to comply with the requirements of Act 44 during the period July 1, 2011 to June 30, 2012. This report includes: The most recent scrutinized companies lists (Sudan and Iran). A summary of correspondence with scrutinized companies. All investments sold, redeemed, divested or withdrawn in compliance with Act 44, the costs and expenses of such transfers, and a determination of net gain or loss on account of such transactions incurred in compliance with the Act. A list of publicly traded securities held by the public funds. Page 1 of 136 Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2012 A copy of the Act can be downloaded from the Internet by going to http://www.legis.state.pa.us/cfdocs/legis/home/session.cfm (Go to section entitled “by Bill,” select the 2009-2010 Regular Session and enter SB 928).