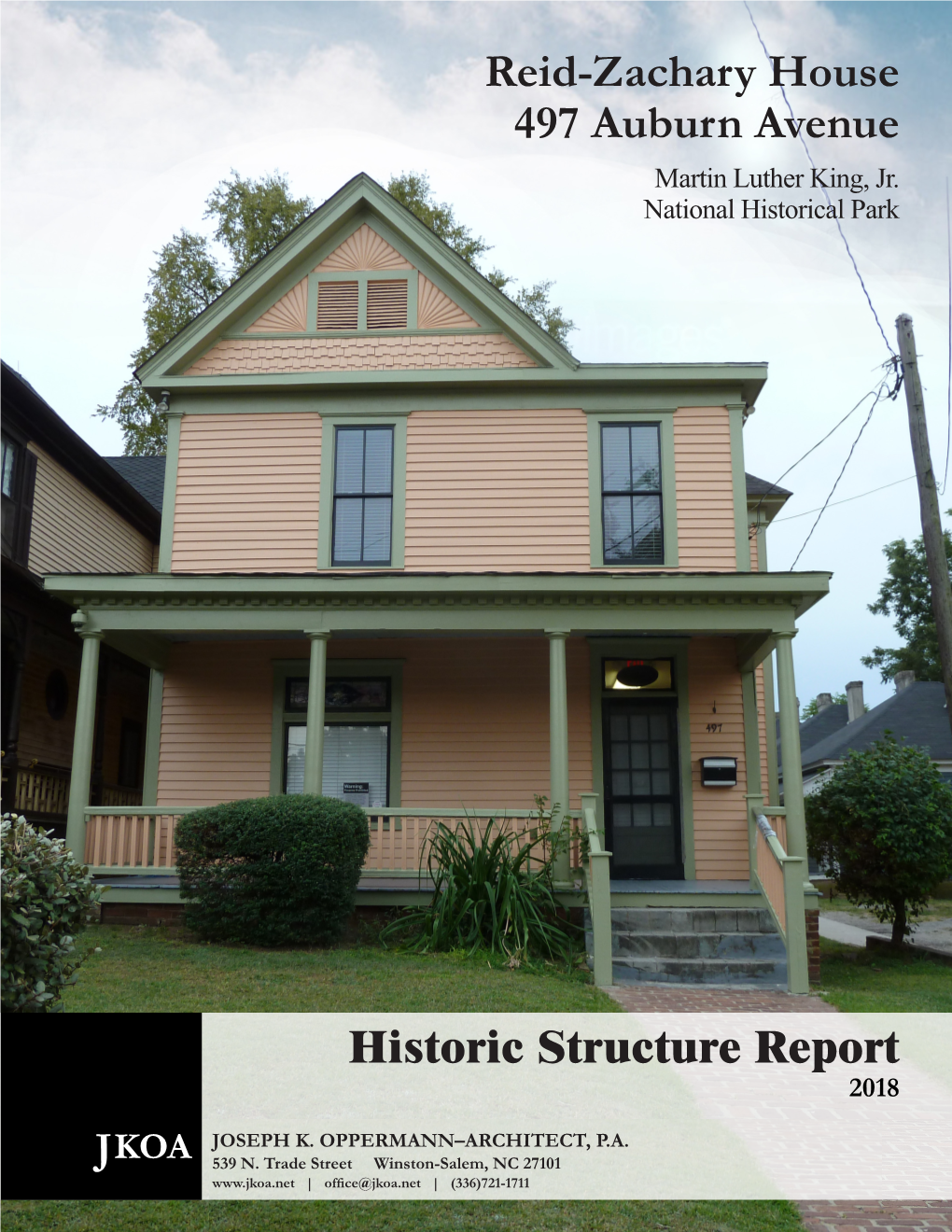

Reid-Zachary House 497 Auburn Avenue Historic Structure Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Objectivity, Interdisciplinary Methodology, and Shared Authority

ABSTRACT HISTORY TATE. RACHANICE CANDY PATRICE B.A. EMORY UNIVERSITY, 1987 M.P.A. GEORGIA STATE UNIVERSITY, 1990 M.A. UNIVERSITY OF WISCONSIN- MILWAUKEE, 1995 “OUR ART ITSELF WAS OUR ACTIVISM”: ATLANTA’S NEIGHBORHOOD ARTS CENTER, 1975-1990 Committee Chair: Richard Allen Morton. Ph.D. Dissertation dated May 2012 This cultural history study examined Atlanta’s Neighborhood Arts Center (NAC), which existed from 1975 to 1990, as an example of black cultural politics in the South. As a Black Arts Movement (BAM) institution, this regional expression has been missing from academic discussions of the period. The study investigated the multidisciplinary programming that was created to fulfill its motto of “Art for People’s Sake.” The five themes developed from the program research included: 1) the NAC represented the juxtaposition between the individual and the community, local and national; 2) the NAC reached out and extended the arts to the masses, rather than just focusing on the black middle class and white supporters; 3) the NAC was distinctive in space and location; 4) the NAC seemed to provide more opportunities for women artists than traditional BAM organizations; and 5) the NAC had a specific mission to elevate the social and political consciousness of black people. In addition to placing the Neighborhood Arts Center among the regional branches of the BAM family tree, using the programmatic findings, this research analyzed three themes found to be present in the black cultural politics of Atlanta which made for the center’s unique grassroots contributions to the movement. The themes centered on a history of politics, racial issues, and class dynamics. -

The Atlanta Preservation Center's

THE ATLANTA PRESERVATION CENTER’S Phoenix2017 Flies A CELEBRATION OF ATLANTA’S HISTORIC SITES FREE CITY-WIDE EVENTS PRESERVEATLANTA.COM Welcome to Phoenix Flies ust as the Grant Mansion, the home of the Atlanta Preservation Center, was being constructed in the mid-1850s, the idea of historic preservation in America was being formulated. It was the invention of women, specifically, the ladies who came J together to preserve George Washington’s Mount Vernon. The motives behind their efforts were rich and complicated and they sought nothing less than to exemplify American character and to illustrate a national identity. In the ensuing decades examples of historic preservation emerged along with the expanding roles for women in American life: The Ladies Hermitage Association in Nashville, Stratford in Virginia, the D.A.R., and the Colonial Dames all promoted preservation as a mission and as vehicles for teaching contributive citizenship. The 1895 Cotton States and International Exposition held in Piedmont Park here in Atlanta featured not only the first Pavilion in an international fair to be designed by a woman architect, but also a Colonial Kitchen and exhibits of historic artifacts as well as the promotion of education and the arts. Women were leaders in the nurture of the arts to enrich American culture. Here in Atlanta they were a force in the establishment of the Opera, Ballet, and Visual arts. Early efforts to preserve old Atlanta, such as the Leyden Columns and the Wren’s Nest were the initiatives of women. The Atlanta Preservation Center, founded in 1979, was championed by the Junior League and headed by Eileen Rhea Brown. -

REGIONAL RESOURCE PLAN Contents Executive Summary

REGIONAL RESOURCE PLAN Contents Executive Summary ................................................................5 Summary of Resources ...........................................................6 Regionally Important Resources Map ................................12 Introduction ...........................................................................13 Areas of Conservation and Recreational Value .................21 Areas of Historic and Cultural Value ..................................48 Areas of Scenic and Agricultural Value ..............................79 Appendix Cover Photo: Sope Creek Ruins - Chattahoochee River National Recreation Area/ Credit: ARC Tables Table 1: Regionally Important Resources Value Matrix ..19 Table 2: Regionally Important Resources Vulnerability Matrix ......................................................................................20 Table 3: Guidance for Appropriate Development Practices for Areas of Conservation and Recreational Value ...........46 Table 4: General Policies and Protection Measures for Areas of Conservation and Recreational Value ................47 Table 5: National Register of Historic Places Districts Listed by County ....................................................................54 Table 6: National Register of Historic Places Individually Listed by County ....................................................................57 Table 7: Guidance for Appropriate Development Practices for Areas of Historic and Cultural Value ............................77 Table 8: General Policies -

The Church That Christ Built” Sincerely

The Foster Family Dear Big Bethel Family and Friends: I greet you in the Name of our Lord and Savior Jesus the Christ. Today, Big Bethel AME Church - Atlanta’s oldest African American church congregation - celebrates One Hundred Seventy-Two (172) years of worship, fellowship and ministry. Big Bethel has withstood the test of time and yet, God still signifies Big Bethel as a Beacon of Light for downtown Atlanta which still proudly proclaims that “Jesus Saves.” At this time of celebration – let us all give thanks and honor to the glory of God for Big Bethel AME Church. We joyously welcome Bishop John Richard Bryant as our anniversary preacher. We welcome Bishop Bryant and his guests to Big Bethel AME Church. Please allow me to give God praise for our Church Anniversary Chairpersons: Sis. Nannette McGee, Sis. Geri Dod- son, Sis. Roz Thomas. Let me also thank the entire Church Anniversary committee for a job well done!!! We thank God again for all of the wonderful Anniversary Month activities - the Tailgate Kickoff Sunday, the Pilgrimage to Oak- land Cemetery, the Youth History Program, the Revival Week, the Trinity Table Weekend, the Kwanzaa-Sol and Mime Anniversary Concert and the Children Sabbath Weekend. Sis. Mary Ann, Kristina (Dewey and Zoey), John Jr. and Jessica join me in wishing our ‘Big Bethel Family’ a blessed 172nd Anniversary!!! “The Church that Christ Built” Sincerely, Rev. John Foster, Ph.D. Senior Pastor 2 Big Bethel AME Church BISHOP JOHN RICHARD BRYANT—RETIRED 106TH ELECTED & CONSECRATED BISHOP OF THE AFRICAN METHODIST EPISCOPAL CHURCH Bishop John Richard Bryant is the son of the late Bishop Harrison James Bryant and Edith Holland Bryant. -

Judge Mendoza, for Agreeing To

Q1: Today is November 5, 2005. It is 11:26 am. We are in room 2510 of the Daley Center Cook County Court building where we’re interviewing Judge Patricia Mendoza about her legal career, her background, how she became a judge in the Cook County system. Thank you, Judge Mendoza, for agreeing to talking with us today. The first thing we’d like to do is ask you a little bit about your background and upbringing, how your early experiences influenced your decision to enter the legal profession. Can you tell us a little bit about what it was like growing up in the Back of the Yards neighborhood in the 1960s? A: Well, it’s a working-class neighborhood. They have -- it was a changing neighborhood, changing over from Polish– Lithuanian to Mexican. You know, it was lower middle class. And there’s not a lot -- I don’t know. You know, it’s what I knew, so I couldn’t really compare it to anything else at the time. Q1: Mm-hmm. Did your parents -- had they lived there for a long time, or...? A: We actually moved there when I was 11. They had a bridal shop business that they opened up there. They had had a business previously, and I don’t know the name of the neighborhood. It was like 55th and the Garfield, Halsted area. That neighborhood had undergone a lot of race riots. 1 I vague -- I distinctly remember, you know, the riots because the store was on the dividing line -- at that time Halsted was the dividing line -- between black and white. -

Apple Stores

For the exclusive use of M. Henny, 2015. 9-502-063 REV: MAY 20, 2010 LUC WATHIEU Apple Stores Ron Johnson (HBS ’84), Apple Computer’s Senior Vice-President of Retail, never missed a chance to show a customer through the nearest Apple Store. A former Vice-President of Merchandising at Target (a leading department store chain), Johnson joined Apple in January 2000 with the mission to oversee the creation of the company’s own stores. The first store opened in May 2001—and just seven months later, 27 identical stores had been opened across the United States. During his store visits, Johnson tried computer applications, listened to a store employee make a presentation in front of the 10-foot screen at the rear of the store in “the theater,” and respectfully introduced his guests to the local “genius,” the official title of a very knowledgeable employee who stood behind a “bar” (complete with stools and water bottles) and helped solve consumer problems. Every detail of the store experience had been carefully designed, and as much as Johnson enjoyed each tour, he was also checking that all the store’s elements were perfectly under control. “The store experience has to be the same every day, every hour, in every store. We care passionately about that,” he often said. The stores were expanding to new territories, mostly in high traffic shopping malls, with the explicit purpose of “enriching people’s lives” and converting new customers to Apple products. To complete that mission successfully, Johnson’s focus was on choosing the right locations, selecting and training knowledgeable and dedicated employees, and defining the most effective utilization of the innovative store elements such as the theater and the genius bar. -

Raise the Curtain

JAN-FEB 2016 THEAtlanta OFFICIAL VISITORS GUIDE OF AtLANTA CoNVENTI ON &Now VISITORS BUREAU ATLANTA.NET RAISE THE CURTAIN THE NEW YEAR USHERS IN EXCITING NEW ADDITIONS TO SOME OF AtLANTA’S FAVORITE ATTRACTIONS INCLUDING THE WORLDS OF PUPPETRY MUSEUM AT CENTER FOR PUPPETRY ARTS. B ARGAIN BITES SEE PAGE 24 V ALENTINE’S DAY GIFT GUIDE SEE PAGE 32 SOP RTS CENTRAL SEE PAGE 36 ATLANTA’S MUST-SEA ATTRACTION. In 2015, Georgia Aquarium won the TripAdvisor Travelers’ Choice award as the #1 aquarium in the U.S. Don’t miss this amazing attraction while you’re here in Atlanta. For one low price, you’ll see all the exhibits and shows, and you’ll get a special discount when you book online. Plan your visit today at GeorgiaAquarium.org | 404.581.4000 | Georgia Aquarium is a not-for-profit organization, inspiring awareness and conservation of aquatic animals. F ATLANTA JANUARY-FEBRUARY 2016 O CONTENTS en’s museum DR D CHIL ENE OP E Y R NEWL THE 6 CALENDAR 36 SPORTS OF EVENTS SPORTS CENTRAL 14 Our hottest picks for Start the year with NASCAR, January and February’s basketball and more. what’S new events 38 ARC AROUND 11 INSIDER INFO THE PARK AT our Tips, conventions, discounts Centennial Olympic Park on tickets and visitor anchors a walkable ring of ATTRACTIONS information booth locations. some of the city’s best- It’s all here. known attractions. Think you’ve already seen most of the city’s top visitor 12 NEIGHBORHOODS 39 RESOURCE Explore our neighborhoods GUIDE venues? Update your bucket and find the perfect fit for Attractions, restaurants, list with these new and improved your interests, plus special venues, services and events in each ’hood. -

Building Pentimento: a Framework for Maintaining Cultural Identity in Urban Development

Building Pentimento: A Framework for Maintaining Cultural Identity in Urban Development By: Brandon C. Jones May 2018 A capstone submitted in partial fulfillment of the requirements for the degree of M.A. in Cultural Sustainability Capstone Committee: Roxanne J. Kymaani, Ph.D. Susan Eleuterio Elke Davidson Goucher College 1 Table of Contents Abstract ................................................................................................................................. 4 Prologue ............................................................................................................................... 5 A Note from the Author ......................................................................................................... 8 Chapter One: Introduction .................................................................................................... 9 Research Aim: .................................................................................................................................................... 13 Methodology and Thesis Outline .................................................................................................. 13 Chapter Two: Understanding the Atlanta Canvas ................................................................. 15 The First Coat of Paint: History and Context .................................................................................. 15 The Second Coat of Paint: Community Distinction & Vulnerability ................................................. 23 Chapter Three: -

Historic Structure Report

National Park Service U.S. Department of the Interior Martin Luther King, Jr. National Historic Site 526 Auburn Avenue Martin Luther King, Jr. National Historic Site Historic Structure Report Cultural Resources, Partnerships, and Science Division Southeast Region 526 Auburn Avenue Martin Luther King, Jr. National Historic Site Historic Structure Report May 2017 Prepared by: WLA Studio SBC+H Architects Palmer Engineering Under the direction of National Park Service Southeast Regional Offi ce Cultural Resources, Partnerships, & Science Division The report presented here exists in two formats. A printed version is available for study at the park, the Southeastern Regional Offi ce of the National Park Service, and at a variety of other repositories. For more widespread access, this report also exists in a web-based format through ParkNet, the website of the National Park Service. Please visit www.nps. gov for more information. Cultural Resources, Partnerships, & Science Division Southeast Regional Offi ce National Park Service 100 Alabama Street, SW Atlanta, Georgia 30303 (404)507-5847 Martin Luther King, Jr. National Historic Site 450 Auburn Avenue, NE Atlanta, GA 30312 www.nps.gov/malu About the cover: View of 526 Auburn Avenue, 2016. 526 Auburn Avenue Martin Luther King, Jr. National Historic Site Historic Structure Report Approved By : Superintendent, Date Martin Luther King, Jr. National Historic Site Recommended By : Chief, Cultural Resource, Partnerships & Science Division Date Southeast Region Recommended By : Deputy Regional Director, -

Explanation of Tax Estimates Formula for Tax Estimates Based on Mid

Explanation of Tax Estimates 1. "Tax": Estimated for the full year of 2016. The tax figure is based on the corporate tax formula. See below for details of calculating taxable income and estimated taxes. 2. "Tax/Assets": The assets total is from June 30, 2016. 3. "Tax/Gross Income": Gross income is the sum of accounts 110, 119, 120, 124, 131 and 659 on the call report, reported for Mid-Year 2016. 4. "Tax/Operating Expenses": Operating expense is account 671 on the call report. Formula for Tax Estimates Based on Mid-Year 2016 Call Report To estimate each credit union's taxes for the first half of 2016, we (1) computed taxable income for the year, (2) applied the tax formula to calculate an annual tax figure, (3) multiply this figure by .84 (allowing for tax management practices) to arrive at a more realistic amount. We computed taxable income from data in the NCUA/NASCUS mid-year call report. The numbers in parentheses below refer to "Account Codes" on the call report. 1. CALCULATION OF TAXABLE INCOME Taxable Income = Net Income After Cost of Funds (661a) - Net Chargeoffs (550 minus 551) + Provision for Loan Loss (300) II. CALCULATION OF TAX Annual Taxable Income (TI) Annual Tax Negative Negative 0 - $50,000 0.15 (TI) $50,000 - $75,000 $7,500 + 0.25 (TI-$50,000) $75,000 - $100,000 $13,750 + 0.34 (TI - $75,000) $100,000 - $335,000 $22,250 + 0.39 (TI - $100,000) $335,000 - $10 Mil $113,900 + 0.34 (TI - $335,000) $10 Mil - $15 Mil $3,400,000 + .35 (TI - $10 Mil) $15 Mil - $18.3 Mil $5,150,000 + .38 (TI - $15 Mil) Over $18.3 Mil $6,416,667 + .35 (TI - $18.3 Mil) III. -

Entrepreneurship in the Natural Food and Beauty Categories Before 2000: Global Visions and Local Expressions

Entrepreneurship in the Natural Food and Beauty Categories before 2000: Global Visions and Local Expressions Geoffrey Jones Working Paper 13-024 August 28, 2012 Copyright © 2012 by Geoffrey Jones Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Entrepreneurship in the Natural Food and Beauty Categories before 2000: Global Visions and Local Expressions Geoffrey Jones Harvard Business School August 2012 Abstract This working paper examines the creation of the global natural food and beauty categories before 2000. This is shown to have been a lengthy process of new category creation involving the exercise of entrepreneurial imagination. Pioneering entrepreneurs faced little consumer demand for natural products, and little consumer knowledge of what they entailed. The creation of new categories involved three overlapping waves of entrepreneurship. The first involved making the ideological case for natural products. This often entailed investment in education and publishing activities. Second, entrepreneurs engaged in the creation of industry associations which could advocate, as well as give the nascent industry credibility and create standards. Finally, entrepreneurs established retail stores, supply and distribution networks, and created brands. Entrepreneurial cognition and motivation frequently lay in individual, and very local, experiences, but many of the key pioneers were also highly globalized in their world views, with strong perception of how small, local efforts related to much bigger and global pictures. A significant sub-set of the influential historical figures were articulate in expressing strong religious convictions. -

Fire Station No. 6 Our Lady of Lourdes Catholic Church and School

North FREEDOM PARKWAY To Carter Center 0 20 100 Meters From Freedom Parkway, turn south onto Boulevard 0 100 500 Feet and follow signs to parking lot. Cain Street Boulevard John Wesley Dobbs Avenue International Boulevard Parking lot John Wesley Dobbsentrance Avenue Butler Street Exit Ellis Street NATIONAL HISTORIC SITE BOUNDARY PRESERVATION DISTRICT BOUNDARY PARKING John Wesley Dobbs Avenue Irwin Street Irwin Street Butler Street Courtland Street Piedmont Avenue Big Bethel African National Park Service Alexander Hamilton, Jr., Methodist Episcopal Visitor Center Home 450 Auburn Ave. The visitor center 102 Howell St. Built 1890-95. This Church Fort Street has exhibits, a video program, and elegant house, whose architectural Hilliard Street John Wesley Dobbs Avenue 220 Auburn Ave. Built 1890s; re- Hogue Street built 1924. The church’s most prom- a schedule of park activities. details include a Palladian window Rucker Building National Park Service personnel and Corinthian columns, was home 158-60 Auburn Ave. Completed inent feature, the “Jesus Saves” sign on the steeple, was added when provide information and answer to Atlanta’s leading black building Atlanta Life Insurance 1904. Atlanta’s first black office questions. contractor in the early 1900s. building was constructed by busi- the structure was rebuilt after a Double “Shotgun” Company Building PROMENADE nessman and politician Henry A. 1920 fire. Row Houses 148 Auburn Ave. Completed 1920; Rucker. The King Center annex (142 Auburn) built 1936. From The Martin Luther King, Jr., Center 472-488 Auburn Ave. Built in 1905 Prince Hall Masonic for Empire Textile Company mill 1920 to 1980, this was the head- for Nonviolent Social Change, Inc., Jackson Street quarters of the country’s largest workers.