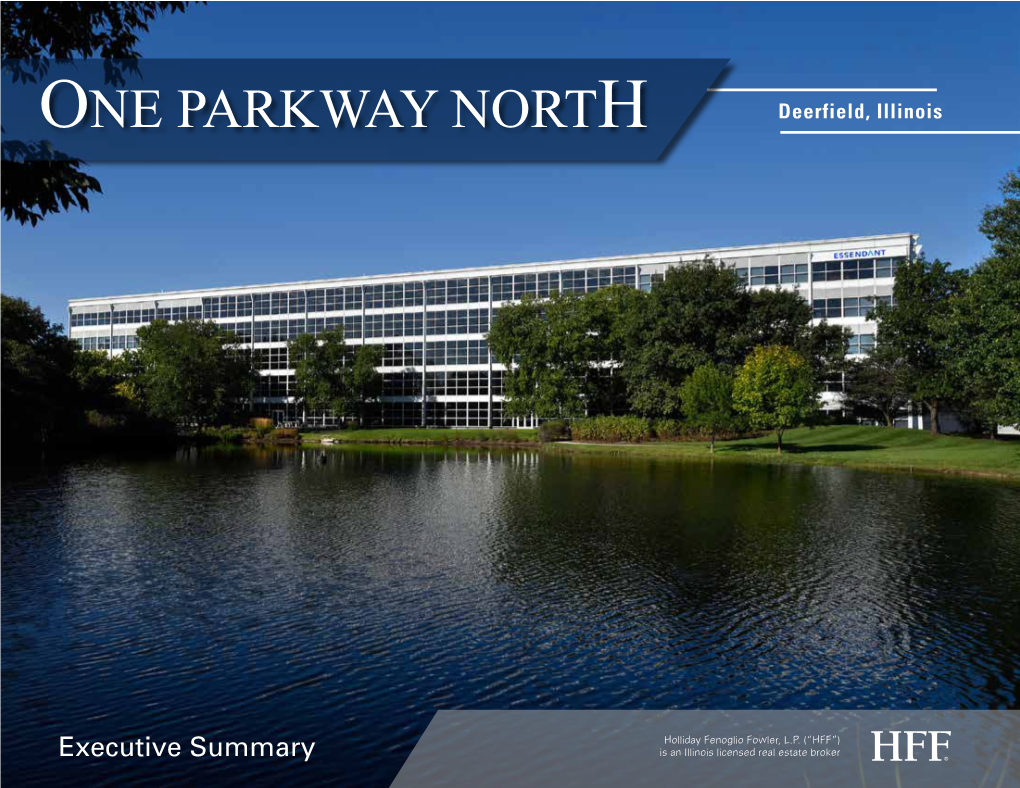

ONE PARKWAY NORTH Deerfield, Illinois

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Matching Gifts the Companies Listed Below Will Match Donations Their Employees Make to the Boy Scouts of America, Allowing Your

Matching Gifts The companies listed below will match donations their employees make to the Boy Scouts of America, allowing your gift to have twice the impact! Abbott Corn Products International ACCO CPC International Corp. ADM Discover Financial Services ADP, Inc. Eaton Vance Mgnt., Inc. Albertson's Ethicon, Inc. Allied Corp. Exxon/Mobil Altria Group, Inc. First Bank System, Inc. American Brands, Inc. FMC Corp. American Express Fort Dearborn Paper Co. American Gasket & Rubber Co. Fortune Brands American National Bank & Trust Co. of Chicago Gannett Inc. Arthur D. Raybin Assoc., Inc. Gary Williams Oil Product/The Piton Fdn. Astellas Pharma GATX Corporation AT&T General Electric Atlantic Richfield Gilman Paper Co. Avon Products GlaxoSmithKline B.F. Goodrich Co. Grainger, Inc. (3:1) Bank of America Gulf Western Industries, Inc. Barber-Coleman Co. H.J. Heinz Co. Fdn. Barnes & Roche, Inc. Haggerty Consulting Boeing North America Henry Crown & Co. BP Amoco Hewitt Associates, LLC Burlington Northern Hoffman-LaRoche, Inc. Burroughs Wellcome Co. HSBC-North America, Inc. Campbell Soup Co. IBM CAN Insurance IDS Cargill Illinois Tool Works, Inc. (3:1) CDW Corporation ING Equitable Life Chicago Tribune Foundation Investors Diversified Svcs., Inc. Citigroup John D. & Catherine T. MacArthur Fdn. Cigna Corp. John Hancock Mutual Life Ins. Co. Citicorp & Citibank Johnson & Higgins Colgate-Palmolive Co. Johnson & Johnson Corning Glass Works Jones Lang LaSalle Matching Gifts Continued Kemper Pittway Corp. Kids R Us Pizza Hut Kimberly-Clark Corp. PPG Industries, Inc. Kirkland & Ellis PQ Corp. Kraft Foods, Inc. Quaker Oats Leo Burnett Co., Inc. Quantum Chemical Corp. Lever Bros. Co. Ralston Purina Co. Life Iris Assn. -

Riverpark/Wedgewood Fund (RWGIX/RWGFX)

RiverPark/Wedgewood Fund (RWGIX/RWGFX) Third Quarter 2019 Review and Outlook The Fund was flat +0.33% during the third quarter of 2019. The benchmark Russell 1000 Growth Index gained +1.49%. The S&P 500 Index gained +1.70% during the quarter. Performance: Net Returns as of September 30, 2019 Current Year to One Three Five Since Quarter Date Year Year Year Inception Institutional Class (RWGIX) 0.33% 20.95% 2.63% 12.42% 7.33% 11.52% Retail Class (RWGFX) 0.23% 20.62% 2.34% 12.15% 7.15% 11.31% Russell 1000 Growth Total Return Index 1.49% 23.30% 3.71% 16.89% 13.39% 15.18% S&P 500 Total Return Index 1.70% 20.55% 4.25% 13.39% 10.84% 13.58% Morningstar Large Growth Category -0.48% 20.46% 1.89% 14.52% 10.94% 12.86% Total returns presented for periods less than 1 year are cumulative, returns for periods one year and greater are annualized. The inception date of the fund was September 30, 2010. The performance quoted herein represents past performance. Past performance does not guarantee future results. High short-term performance of the fund is unusual and investors should not expect such performance to be repeated. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be higher or lower than the performance quoted. For performance data current to the most recent month end, please call 888.564.4517. -

Download All Holdings (PDF)

AMG GW&K High Income Fund - Portfolio Holdings as of February 28, 2021 Name Sector Asset Class Country Currency Par/Shares Price ($) Market Value ($) % of Fund Starwood Property Trust Inc Fixed 4.75% Mar 2025 Corporate Bond US USD 262,000 102.22 $267,810 2.52% HCA Inc Fixed 5.38% Feb 2025 Corporate Bond US USD 236,000 112.25 $264,910 2.49% Delta Air Lines Inc Fixed 7.38% Jan 2026 Corporate Bond US USD 225,000 116.57 $262,274 2.47% United Airlines Holdings Inc Fixed 5.00% Feb 2024 Corporate Bond US USD 254,000 102.63 $260,668 2.45% Apache Corp Fixed 4.63% Nov 2025 Corporate Bond US USD 251,000 103.63 $260,099 2.45% General Electric Co Floating Perpetual Corporate Bond US USD 271,000 94.56 $256,255 2.41% Howmet Aerospace Inc Fixed 6.88% May 2025 Corporate Bond US USD 220,000 115.75 $254,639 2.39% Hudbay Minerals Inc Fixed 4.50% Apr 2026 144A Corporate Bond CA USD 250,000 101.38 $253,445 2.38% Service Properties Trust Fixed 7.50% Sep 2025 Corporate Bond US USD 223,000 113.47 $253,033 2.38% American Axle & Manufacturing Inc Fixed 6.25% Apr 2025 Corporate Bond US USD 243,000 103.01 $250,314 2.35% JPMorgan Chase & Co Floating Perpetual Corporate Bond US USD 245,000 102.00 $249,900 2.35% Penske Automotive Group Inc Fixed 3.50% Sep 2025 Corporate Bond US USD 243,000 101.75 $247,253 2.32% Ford Motor Co Fixed 4.35% Dec 2026 Corporate Bond US USD 231,000 106.57 $246,186 2.31% Sprint Corp Fixed 7.13% Jun 2024 Corporate Bond US USD 211,000 115.14 $242,956 2.28% Ovintiv Exploration Inc Fixed 5.63% Jul 2024 Corporate Bond US USD 206,000 109.65 $225,881 -

Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278E)

Nominee Report | U.S. Office of Government Ethics; 5 C.F.R. part 2634 | Form Approved: OMB No. (3209-0001) (March 2014) Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e) Filer's Information Shanahan, Patrick Michael Deputy Secretary of Defense, Department of Defense Other Federal Government Positions Held During the Preceding 12 Months: None Names of Congressional Committees Considering Nomination: ● Committee on Armed Services Electronic Signature - I certify that the statements I have made in this form are true, complete and correct to the best of my knowledge. /s/ Shanahan, Patrick Michael [electronically signed on 04/08/2017 by Shanahan, Patrick Michael in Integrity.gov] Agency Ethics Official's Opinion - On the basis of information contained in this report, I conclude that the filer is in compliance with applicable laws and regulations (subject to any comments below). /s/ Vetter, Ruth, Certifying Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] Other review conducted by /s/ Vetter, Ruth, Ethics Official [electronically signed on 06/08/2017 by Vetter, Ruth in Integrity.gov] U.S. Office of Government Ethics Certification /s/ Apol, David, Certifying Official [electronically signed on 06/08/2017 by Apol, David in Integrity.gov] 1. Filer's Positions Held Outside United States Government # ORGANIZATION NAME CITY, STATE ORGANIZATION POSITION HELD FROM TO TYPE 1 The Boeing Company Chicago, Illinois Corporation Senior Vice 3/1986 Present President 2 The University of Washington Seattle, -

The Activist Report

The Activist Report Volume 10 Issue 12 December | 2020 DISSECTING 10 Questions ACTIVIST 13F’S with Greg 45 days after the end of each quarter, 13F filings are made by investors who have more than $100 million of qualifying assets under management. We analyze the 13F filings of the major US activist investors and provide the following data and commentary: Marose Pg. Greg Marose is a co- founder and partner at (i) Aggregate Activist Holdings 8 Profile Advisors. He has (ii) Activist Concentration 8 advised established and (iii) 13F Commentary 9-10 emerging activists on strategic communica- (iv) 13F Analysis - Changes in Activist Holdings 11-16 tions for more than 50 (v) Quarterly Performance of Top Holdings 17-19 campaigns and election contests over the past (vi) Piling On 20 three years. In addition, he periodically applies his investor-side per- spective to helping boards and management teams navigate governance disputes. His Under the Threshold practice is known for developing effective Exxon Mobil (OXM): Engine No. 1; Monro (MNRO): Ides Capital; Ovin- tiv (OVV): Kimmeridge Energy; Aimco (AIV): Land & Buildings; Crown campaign strategies, producing impactful Castle (CCI): Elliott Management; Evergy (EVRG): Elliott Manage- letters and presentations, and positioning ment; Opko Health (OPK): Sian Capital; ZIOPHARM (ZIOP): WaterMill clients to engage with the media, proxy advi- On December 7, 2020, Engine No. 1 (“EN1”) sent a letter to Exx- sory firms and institutional shareholders. N on Mobil Corp’s (XOM) Board announcing that it has identified E the following four director candidates to be nominated, if nec- 13DM: What prompted you and Rich My- W essary, to the Company’s Board: (i) Gregory J. -

Proxy Statement and Notice of 2020 Annual Meeting

Proxy Statement and Notice of 2020 Annual Meeting Pioneering global ideas for cleaner air and smoother, quieter and safer transportation Tuesday, May 12, 2020 at 10:00 a.m., Central Time To the Stockholders of Tenneco Inc.: I cordially invite you to attend Tenneco’s 2020 Annual Meeting of Stockholders to be held Tuesday, May 12, 2020, at 10:00 a.m., Central Time. This year’s annual meeting will be held entirely online to allow for greater participation in light of the public health impact of the coronavirus outbreak (COVID-19). Stockholders may participate in this year’s annual meeting by visiting the following website www.virtualshareholdermeeting.com/TEN2020. Your vote is very important! Whether or not you plan to attend the annual meeting, we urge you to read the enclosed proxy statement and vote as soon as possible via the Internet, by telephone or, if you receive a paper proxy card or voting instruction form in the mail, by mailing the completed proxy card or voting instruction form. A record of our activities for the year 2019 is contained in our Form 10-K. Thank you for your confidence and continued support. Brian J. Kesseler Chief Executive Officer Tenneco Inc. April 1, 2020 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS What: The Annual Meeting of Stockholders of Tenneco Inc. (the “Annual Meeting”) When: Tuesday, May 12, 2020 at 10:00 a.m., Central Time Where: Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our partners and stockholders, the Annual Meeting will be held in a virtual meeting format only. -

Business Analytics

NICK, ’20 Business Analytics Business Analytics Experiential Learning SAMPLE COURSES: Throughout their undergraduate careers, students work in small teams to solve real-world problems from local companies. • BALT 3330: Database Structures and Queries Students get a briefing from company executives on the problem • BALT 4320: Data and Text Mining and work all semester on the project scope and deliverables. At • FINA 4330: Predictive Analytics the end of the semester, the student teams present the results to the company. • BALT 4350: Web Intelligence and Analytics Hackathon Benedictine hosts an annual Hackathon for current BenU students SIMILAR MAJORS: along with students from local community colleges. The event Finance, Marketing, Data Science offers students a chance to work collaboratively in small teams on an analytics and Big Data project. A more recent Hackathon was sponsored by IBM and teams explored Chicago crime data for their project. BUSINESS ANALYTICS ALUMNI Communication Skills Our alumni have built successful careers at Zurich All business analytics students have project-based classes which Insurance, Northwestern, Conversant, CDW, allow them to gain practical and valuable experience as well as Morningstar, UniFirst Corporation, Nicor Gas, learn how to communicate their findings effectively. Students Invesco, Ace Hardware, Dial America, Kraft Heinz learn how to present technical results through written and oral Company, FedEx, Crowe, First Midwest Bank, presentations. These skills are essential in a dynamic business and Chamberlain Group – just to name a few. world and are highly sought-after by employers. WHY STUDY BUSINESS ANALYTICS AT BENEDICTINE? The growing field of analytics is transforming the way companies do business. Analytics can help improve managerial and organizational decision making by transforming data into actions and business insights. -

Matching Gift Companies to the Archdiocese of Galveston-Houston

Matching Gift Companies to the Archdiocese of Galveston-Houston AbbVie ConocoPhillips Petroleum Co. Northwestern Mutual Life Insurance Company ACE INA Foundation Cooper Industries Nuevo Energy Company Administaff Dell Occidental Petroleum Adobe Deutsche Bank Americas Foundation Ocean Energy Aetna Foundation, Inc. Dominion Foundation Pepsico Foundation AIM Foundation Dow Chemical Company Pfizer Foundation Air Liquide America Corp. Dresser-Rand Phillips 66 Air Products & Chemicals, Inc. Duke Energy Foundation/ECO6Q PipeVine, Inc. Albemarle Corporation Dynegy Inc. Procter & Gamble Allstate Foundation ECG Management Consultants Inc. Prospect Capital Management Amerada Hess Corporation Eli Lilly and Company Foundation Prudential American Express Encap Investments LP Rockwell International Corporation American General Corporation Entergy SBC Foundation American International Group Inc. Enterprise Products Shell Oil Company Foundation Ameriprise Financial EP Energy Southdown, Inc. Amica Companies Foundation EOG Resources Southwestern Energy (SWN) Anadarko Petroleum Corp. Equistar Chemicals LP Square D Foundation Anderson Greenwood Equiva Services LLC Teleflex Foundation Anheuser-Busch Foundation Exelon Foundation Tenet Healthcare Foundation Apache Corporation ExxonMobil Foundation Tenneco Apple Inc Fleet Boston Financial Foundation Texaco Inc. Arco Foundation, Inc. Ford Texas Instruments Foundation Arco Steel Inc FMC Technologies, Inc. The Boeing Company ARS National Services, Inc. General Electric The Clorox Company Attachmate General Mills, -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Market Cap Close ADV

Market Cap Close ADV 1598 67th Pctl $745,214,477.91 $23.96 225,966.94 801 33rd Pctl $199,581,478.89 $10.09 53,054.83 2399 Listing_ Revised Ticker_Symbol Security_Name Exchange Effective_Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M Altisource Asset Management AAMC Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L American Equity Inv Life Hldg AEL Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L ASPEN Insurance Holding AHL Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

CDW CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 333-169258 CDW CORPORATION (Exact name of registrant as specified in its charter) Delaware 26 -0273989 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 200 N. Milwaukee Avenue Vernon Hills, Illinois 60061 (Address of principal executive offices) (Zip Code) (847) 465-6000 (Registrant’s telephone number, including area code) None (Former name, former address and former fiscal year, if changed since last report) Securities registered pursuant to Section 12(b) of the Act: None Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Visualization at Boeing: Past, Present, Future

Engineering, Operations & Technology Information Technology Visualization:Acquiring Information using Past Visual, Analytics Present, and Future at Boeing Dave Kasik Senior Technical Fellow The Boeing Company Dave Kasik and [email protected] Senesac The Boeing Company June, 2011 BOEING is a trademark of Boeing Management Company. Copyright © 2011 Boeing. All rights reserved. A Bit About Us Engineering, Operations & Technology | Information Technology . Dave: . Involved in comppgputer graphics since 1969 . Boeing Senior Technical Fellow . ACM Distinguished Scientist . Stand-in on starship bridges . Known around Boeing as – A curmudgeon about virtual reality in the immersive, stereo sense – An a dvoca te for augmen te d rea lity – Leading proponent and expert for broad use of visualization for geometric and non-geometric data . Chr is: . Involved in computer graphics since 1990 . Boeing Senior Architect . Specialty - being able to apply technology to real world problems . Passion is to simplify complex problems Copyright © 2012 Boeing. All rights reserved. 2 Why Are We Here? Engineering, Operations & Technology | Information Technology . Boeing builds astounding aerospace products . We require hugely varied technology, ranging from . Basic physics to . Networking (on-board & conventional) to . Computing (real-time systems & traditional) to . Material science to . Natural language analysis to . Basically, you name it, we have it . Boeing generates terror -by tes of data . Has worked with advanced visual analysis techniques to gain more insight from our data Copyright © 2012 Boeing. All rights reserved. 3 Outline Engineering, Operations & Technology | Information Technology . Motivation . Past: Give a quick Boeing history of projects that changed computer graphics . Present: Stress current 3D use cases in Boeing . FtFuture: How is compu ter grap hics evol living t o address industrial needs? Copyright © 2012 Boeing.