The Activist Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon)

F INANCIAL S TATEMENTS, M ANAGEMENT’ S D ISCUSSION AND A NALYSIS AND S UPPLEMENTAL S CHEDULES Division of Investment Department of the Treasury State of New Jersey Pension Fund June 30, 2009 and 2008 (With Independent Auditors’ Report Thereon) Division of Investment Department of the Treasury State of New Jersey Pension Fund Financial Statements June 30, 2009 and 2008 Contents Independent Auditors’ Report ..........................................................................................................1 Management’s Discussion and Analysis .........................................................................................3 Basic Financial Statements: Statements of Net Assets .................................................................................................................7 Statements of Changes in Net Assets...............................................................................................8 Notes to Financial Statements ..........................................................................................................9 Supplemental Schedules: Schedule 1 – Combining Schedule of Net Assets ..........................................................................31 Schedule 2 – Combining Schedule of Changes in Net Assets .......................................................32 Schedule 3 – Portfolio of Investments – Common Fund A ...........................................................33 Schedule 4 – Portfolio of Investments – Common Fund B ...........................................................57 -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Companies That Hire Felons in Cincinnati, Ohio You’Ve Made a Mistake in the Past and Now You’Re Looking for a Company That Will Hire Felons in Cincinnati, Ohio

Companies That Hire Felons in Cincinnati, Ohio You’ve made a mistake in the past and now you’re looking for a company that will hire felons in Cincinnati, Ohio. First off, we commend you for trying to get back on track and you should know that our website was built specifically to help people just like you. Even though Cincinnati, Ohio is a beautiful place, not every company there is willing to hire felons and that’s where we come in. We’ve done extensive research to find 100+ companies that hire felons and modified that list specifically to Cincinnati, Ohio. Read more: http://jobsforfelonshub.com/locations/jobs-for-felons-in-cincinnati- ohio/#ixzz4IHPFiGJd ADM Baxter Community Education AT&T Bed Bath & Beyond Centers Aamco Best Western Compaq Abbott Labs Big Boy Restaurants ConAgra Foods Ace Hardware Black & Decker Concentrix Alaska Airlines Blue Cross and Blue Shield Dairy Queen Albertsons Association Darden Allied Van Lines Boeing Dart Container Allstate Braum's Deer Park Spring Water Altria Bridgestone Americas Delta Air Lines American Airlines Buffalo Wild Wings Delta Faucet American Express CDW Denny's American Financial Caldwell Banker Discount Tire American Greetings Calvin Klein Dole Food Ameriprise Campbell Soup Company Dollar Rent a car Andersen Canon Dollar Tree Anthem Blue Cross and Captain D's Domino's Blue Shield Carl's Jr Dr Pepper Snapple Group Apple Carrier DuPont Applebee's Casio USA Dunkin' Donuts Aramark Caterpillar Duracell Ashley Furniture Chick-fil-A -

Federated Hermes Global Allocation Fund Portfolio of Investments

Federated Hermes Global Allocation Fund Portfolio of Investments February 28, 2021 (unaudited) Shares, Principal Amount or Contracts Value COMMON STOCKS—61.7% Communication Services—4.7% 16,115 Activision Blizzard, Inc. $ 1,540,755 631,541 1 Alibaba Pictures Group Ltd. 87,855 910 1 Alphabet, Inc., Class A 1,839,938 1,123 1 Alphabet, Inc., Class C 2,287,394 40,806 America Movil S.A.B. de C.V. 26,078 54,940 Auto Trader Group PLC 420,303 1,517 1 CarGurus, Inc. 39,366 8,884 1 China Literature Ltd. 82,706 673,966 China Tower Corp Ltd. 101,244 579 1 Consolidated Communications Holdings, Inc. 3,046 6,511 1 Facebook, Inc. 1,677,364 1,281 1 GOGO, Inc. 15,180 615 Gray Television, Inc. 11,162 2,708 Hellenic Telecommunication Organization SA 41,552 466 Iliad SA 82,419 1,285 Info Edge India Ltd. 85,275 9,198 Intouch Holdings Public Co. Ltd. 16,883 372 Kakao Corp. 161,412 4,275 Konami Corp. 276,169 6,796 LG Uplus Corp. 71,269 289 1 Loral Space & Communications Ltd. 12,814 9,070 Mobile Telesystems, ADR 74,555 1,570 1 MSG Networks, Inc. 26,627 4,084 MTN Group Ltd. 19,616 134 NCsoft Corp. 111,428 7,678 NetEase, Inc. 167,874 4,726 New York Times Co., Class A 241,829 1,526 Nexon Co., Ltd. Tokyo 48,078 649 NHN Corp. 216,418 477 Nintendo Co. Ltd. 289,740 15,254 Omnicom Group, Inc. 1,048,407 3,664 1 Orbcomm, Inc. -

National Felony Friendly Companies

Aamco Dairy Queen Home Depot Radisson Ace Hardware Dart Containers Huddle House Red Lobster Allied Van Lines Deer Park Spring Water IBM Red Robin Albertson's Delta Faucet IHOP Restaurant Depot Allstate Insurance Denny's Ikea Reyes Beverage Group. -

Appendix D: Securities Held by Funds

Annual Report of Activities Pursuant to Act 44 of 2010 September 30, 2015 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2015. 1011778 BC ULC / NEW RED 144A ABCAM PLC ACCELYA KALE SOLUTIONS LTD 198 INVERNESS DRIVE WEST ABC-MART INC ACCENTURE PLC 21ST CENTURY FOX AMERICA INC ABC-MART INC NPV CFD ACCESS CIG 10/14 TL 21ST CENTURY ONCOLOGY 4/15 TL ABENGOA SA ACCIONA SA 22ND CENTURY GROUP INC ABENGOA YIELD PLC ACCO BRANDS CORP 32 CAPITAL FUND LTD (THE) ABERCROMBIE & FITCH CO ACCOR SA 361 DEGREES INTERNATIONAL LTD ABERDEEN ASSET MANAGEMENT PLC ACCRETIVE CO LTD CFD 3D SYSTEMS CORP ABERTIS INFRAESTRUCTURAS SA ACCRUED INTEREST FOR PRIVATE 3I GROUP PLC ABILITY ENTERPRISE CO LTD ACCTON TECHNOLOGY CORP 3M CO ABILITY NETWORK 5/14 COV-LITE ACCUVANT 12/14 COV-LITE 2ND 4L TECHNOLOGIES 5/14 COV-LITE ABINGWORTH BIOVENTURE V LP ACCUVANT 12/14 -

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT to SECTION 14(A) of the SECURITIES EXCHANGE ACT of 1934

SCHEDULE 14A INFORMATION PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES EXCHANGE ACT OF 1934 Filed by the Registrant [X] Filed by a Party other than the Registrant [ ] ________________________ Check the appropriate box: [ ] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) [X] Definitive Proxy Statement [ ] Definitive Additional Materials [ ] Soliciting Material Pursuant to Section 240.14a-12 ________________________ ALEXANDER & BALDWIN, INC. (Name of Registrant as Specified in its Charter) ___________________________________ (Name of Person(s) Filing Proxy Statement if other than the Registrant) ________________________ Payment of Filing Fee (Check the appropriate box): [X] No fee required. [ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: [ ] Fee paid previously with preliminary materials. [ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: 822 Bishop Street, Honolulu, Hawaii 96813 March 10, 2011 To the Shareholders of Alexander & Baldwin, Inc.: You are invited to attend the 2011 Annual Meeting of Shareholders of Alexander & Baldwin, Inc., to be held in the Bankers Club on the 30th Floor of the First Hawaiian Center, 999 Bishop Street, Honolulu, Hawaii, on Tuesday, April 26, 2011 at 8:30 a.m. -

Membership List; Russell 2000 Index

Russell US Indexes Membership list Russell 2000® Index Company Ticker Company Ticker 1-800-FLOWERS.COM CL A FLWS AFC GAMMA AFCG 1LIFE HEALTHCARE ONEM AFFIMED N.V. AFMD 1ST SOURCE SRCE AGEAGLE AERIAL SYSTEMS UAVS 22ND CENTURY GROUP INC. XXII AGENUS AGEN 2U TWOU AGILITI AGTI 3-D SYSTEMS DDD AGILYSYS AGYS 4D MOLECULAR THERAPEUTICS FDMT AGIOS PHARMACEUTICALS AGIO 89BIO ETNB AGREE REALTY ADC 8X8 EGHT AIR TRANSPORT SERVICES GROUP ATSG 9 METERS BIOPHARMA INC NMTR AKEBIA THERAPEUTICS AKBA 908 DEVICES MASS AKERO THERAPEUTICS AKRO A10 NETWORKS ATEN AKOUOS AKUS AAON INC AAON AKOUSTIS TECHNOLOGIES INC AKTS AAR CORP AIR AKOYA BIOSCIENCES AKYA ABERCROMBIE & FITCH A ANF ALAMO GROUP ALG ABM INDUSTRIES INC ABM ALARM.COM HOLDINGS ALRM ACACIA RESEARCH - ACACIA TECHNOLOGIES ACTG ALBANY INTERNATIONAL A AIN ACADEMY SPORTS AND OUTDOORS ASO ALBIREO PHARMA ALBO ACADIA PHARMACEUTICALS ACAD ALDEYRA THERAPEUTICS ALDX ACADIA REALTY AKR ALECTOR ALEC ACCEL ENTERTAINMENT (A) ACEL ALERUS FINANCIAL CORP. ALRS ACCELERATE DIAGNOSTICS AXDX ALEXANDER & BALDWIN INC. ALEX ACCO BRANDS ACCO ALEXANDERS INC ALX ACCOLADE ACCD ALIGNMENT HEALTHCARE ALHC ACCRETIVE HEALTH RCM ALIGOS THERAPEUTICS ALGS ACCURAY ARAY ALKAMI TECHNOLOGY ALKT ACI WORLDWIDE ACIW ALKERMES PLC ALKS ACLARIS THERAPEUTICS ACRS ALLAKOS ALLK ACUSHNET HOLDINGS GOLF ALLEGHENY TECHNOLOGIES ATI ACUTUS MEDICAL AFIB ALLEGIANCE BANCSHARES ABTX ADAPTHEALTH AHCO ALLEGIANT TRAVEL ALGT ADDUS HOMECARE ADUS ALLETE ALE ADICET BIO INC ACET ALLIED MOTION TECHNOLOGIES AMOT ADIENT PLC ADNT ALLOGENE THERAPEUTICS ALLO ADTALEM GLOBAL EDUCATION -

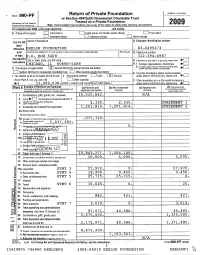

• Form 990-PF Return of Private Foundation

• Form 990-PF Return of Private Foundation OMB No 1545-0052 or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department of the Treasury 2009 Internal Revenue Service Note. The foundation may be able to u se a copy of this return to satisfy state reporting requirements For calendar year 2009, or tax year beginning , and ending G Check all that apply Initial return 0 Initial return of a former public charity Final return Amended return = Address change 0 Name chang e Name of foundation A Employer identification number Use the IRS label Otherwise , XELON FOUNDATION 83-0499473 print Number and street (or P O box number if man is not delivered to street address) Room/suite B Telephone number ortype . P.O. BOX 5408 312-394-4987 See Specific City or town , state , and ZIP code C If exemption application is pending, check here Instructions D 1. H ICAGO IL 60680-540 8 Foreign organizations , check here ► p 2. Foreign organizations meeting the 85% test, ► H Check typ e of org anization X Section 501 (c )( 3 ) exem t p rivate foundation check here and attach computation foundation Section 4947 (a )( 1 ) nonexem pt charitable trust 0 Other taxable p rivate E If p rivate foundation status was terminated I Fair market value of all assets at end of year J Accounting method 0 Cash [XI Accrual under section 507(b)(1)(A), check here (from Part Il, co!. (c), line 16) = Other (specify) F If the foundation is in a 60-month termination (Part 1, column (d) must be on cash basis ) ► $ 5 3 9 9 9 6 3 8 . -

(EDGE) Tax Credit Program 2020 Annual Report

Economic Development for a Growing Economy (EDGE) Tax Credit Program 2020 Annual Report June 28, 2021 Dear Governor Pritzker and Members of the General Assembly: As you know, the Economic Development for a Growing Economy (EDGE) Tax Credit Program is a local economic development tool that aims to promote job creation in Illinois through the award of tax credits to eligible businesses. As provided for in the EDGE Act, I am submitting an annual report summarizing the status of the program. Please feel free to contact me if you have any questions. Sincerely, Sylvia I. Garcia Acting Director Illinois Department of Commerce & Economic Opportunity 217.782.7500 Springfield | 312.814.7179 Chicago | www.illinois.gov/dceo TABLE OF CONTENTS 1. Introduction .................................................................................................................................................................... 2 2. Eligibility Requirements .................................................................................................................................................. 2 3. Competitor State Tax Incentive Programs ...................................................................................................................... 4 4. Program Summary .......................................................................................................................................................... 9 5. Summary of Projects Approved and Executed During Calendar Year 2020 ................................................................ -

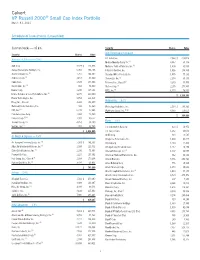

Calvert VP Russell 2000 Small Cap Index Portfolio

Calvert VP Russell 2000® Small Cap Index Portfolio March 31, 2021 Schedule of Investments (Unaudited) Common Stocks — 95.6% Security Shares Value Auto Components (continued) Security Shares Value Aerospace & Defense — 0.8% LCI Industries 2,064 $ 273,026 Modine Manufacturing Co.(1) 4,047 59,774 AAR Corp. 2,929 $ 121,993 Motorcar Parts of America, Inc.(1) 1,400 31,500 Aerojet Rocketdyne Holdings, Inc. 6,050 284,108 Patrick Industries, Inc. 1,816 154,360 AeroVironment, Inc.(1) 1,761 204,382 Standard Motor Products, Inc. 1,855 77,131 Astronics Corp.(1) 2,153 38,840 Stoneridge, Inc.(1) 2,174 69,155 Cubic Corp. 2,599 193,808 Tenneco, Inc., Class A(1) 4,240 45,453 Ducommun, Inc.(1) 914 54,840 Visteon Corp.(1) 2,255 274,997 Kaman Corp. 2,245 115,146 XPEL, Inc.(1) 1,474 76,545 (1) Kratos Defense & Security Solutions, Inc. 9,875 269,390 $ 3,264,343 Maxar Technologies, Inc. 5,852 221,323 Automobiles — 0.1% Moog, Inc., Class A 2,368 196,899 National Presto Industries, Inc. 420 42,869 Winnebago Industries, Inc. 2,534 $ 194,383 PAE, Inc.(1) 5,218 47,066 Workhorse Group, Inc.(1)(2) 8,033 110,615 Park Aerospace Corp. 1,804 23,849 $ 304,998 Parsons Corp.(1)(2) 1,992 80,557 Banks — 8.3% Triumph Group, Inc. 4,259 78,280 (1) Vectrus, Inc. 987 52,745 1st Constitution Bancorp 623 $ 10,971 $ 2,026,095 1st Source Corp. 1,262 60,046 Air Freight & Logistics — 0.3% ACNB Corp. -

John Perkins - Steam

JOHN PERKINS - STEAM 1 2 Qo Please state your name and business address. 3 My name is John Perkins and my business address is 4 4 Irving Place, New York, NY 10003. 5 By whom are you employed and in what capacity? 6 I am Director, Corporate Finance, for Consolidated 7 Edison Company of New York, Inc. (~Con Edison" 8 ~CECONY" or the ~Company"). 9 Briefly describe your educational background. i0 I graduated from MIT in 1972 and received B.S. degrees ii in Economics and Civil Engineering. I received M.A. 12 and M.Phil. degrees in Economics from Yale University 13 in 1974 and 1975, respectively. I took several 14 additional graduate courses in Finance from New York 15 University. 16 Please summarize your professional background. 17 I joined Con Edison in 1982. My previous positions 18 have been as Director, Financial Administration, 19 Director, Corporate Planning, Director, Financial 20 Services, and Manager, Financial Services. Prior to 21 joining Con Edison, I was employed by Chase JOHN PERKINS - STEAM 1 Econometrics/Interactive Data from 1980-1982 and by 2 the Graduate School of Business of Columbia University 3 (1976-1979), where I taught courses in economics and 4 transportation. 5 Oo Please describe your current responsibilities. 6 My responsibilities include preparing the cash 7 forecast and planning and executing financing for 8 Consolidated Edison, Inc. (~CEI"), and its 9 subsidiaries, including Con Edison and Orange and I0 Rockland Utilities, Inc. (~Orange & Rockland"). In ii addition, I manage the relationships with credit 12 rating agencies and undertake various financial 13 analyses.