Queens Quay Revitalization Public Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Expropriation of Part of 228-230 Queens Quay West

GM8.19 STAFF REPORT ACTION REQUIRED Expropriation of Part of 228-230 Queens Quay West and Part of the Lands at the Rear of 250-270 Queens Quay West for the Reconstruction of the York/Bay/Yonge Off-ramp from the F.G. Gardiner Expressway Date: October 23, 2015 To: Government Management Committee From: Chief Corporate Officer Wards: Ward 20 – Trinity Spadina Reference P:\2015\Internal Services\RE\Gm15038re (AFS #21976) Number: SUMMARY The purpose of this report is to seek authorization from City Council to commence proceedings for the expropriation of certain lands forming part of the condominium property known municipally as 228-230 Queens Quay West and certain lands located to the north (rear) of the condominium properties known municipally as 250-270 Queens Quay West. These lands are required for the reconstruction and realignment of the Gardiner Expressway's York/Bay/Yonge off ramp (the "Project") with a new ramp to Lower Simcoe Street. While discussions with the affected owner and condominium corporations are ongoing, it appears unlikely that satisfactory negotiated terms can be achieved, as the required land is directly part of, or subject to easements in favour of, condominium properties. Pursuant to the Condominium Act (Ontario), a condominium corporation is prohibited from selling part of the condominium's common elements unless at least 80% of the unit owners vote in favour of the sale and 80% of those persons with a registered claim against the property consent in writing to the sale. In order to release easements that benefit a condominium, a majority, or in some cases 80%, of the unit owners must approve the release. -

Bay Street, Between Harbour Street and Queens Quay West (York Street, Bay Street, and Yonge Street Ramp Removal)

REPORT FOR ACTION Parking Amendments - Bay Street, between Harbour Street and Queens Quay West (York Street, Bay Street, and Yonge Street Ramp Removal) Date: October 26, 2017 To: Toronto and East York Community Council From: Acting Director, Transportation Services, Toronto and East York District Wards: Ward 28, Toronto Centre-Rosedale SUMMARY As the Toronto Transit Commission (TTC) operates a transit service on Bay Street, City Council approval of this report is required. Transportation Services is requesting approval to amend the existing parking regulations on the east side of Bay Street, between Harbour Street and Queens Quay West. The proposed changes will allow for safe and efficient northbound right-turns from Bay Street to Harbour Street, and also improve sight lines at this intersection. RECOMMENDATIONS The Acting Director, Transportation Services, Toronto and East York District, recommends that: 1. City Council rescind the existing designated commercial loading zone in effect from 4:30 p.m. of one day to 8:00 a.m. of the next following day Monday to Friday and anytime Saturday, Sunday, and public holidays from July 1 to August 31, inclusive; Anytime from September 1 of one year to June 30 of the next following year, inclusive on the east side of Bay Street, between a point 53.6 metres north of Queens Quay West and a point 28 metres further north. 2. City Council rescind the existing designated bus parking zone in effect from 8:00 a.m. to 4:30 p.m. Monday to Friday from July 1 to August 31, inclusive, for a maximum period of 1 hour on the east side of Bay Street, between a point 53.6 metres north of Queens Quay West and a point 28 metres further north. -

Toronto Central Waterfront Public Forum #2

TORONTO CENTRAL WATERFRONT PUBLIC FORUM #2 Queens Quay Revitalization EA Bathurst Street to Lower Jarvis Street Municipal Class Environmental Assessment (Schedule C) December 08, 2008 1 WATERFRONT TORONTO UPDATE 2 Central Waterfront International Design Competition 3 Waterfront Toronto Long Term Plan – Central Waterfront 4 Waterfront Toronto Long Term Plan – Central Waterfront 5 Waterfront Toronto Long Term Plan – Central Waterfront 6 Waterfront Toronto Long Term Plan – Central Waterfront 7 East Bayfront Waters Edge Promenade: Design Underway 8 Spadina Wavedeck: Opened September 2008 9 Spadina Wavedeck: Opened September 2008 10 Spadina Wavedeck: Opened September 2008 Metropolis Article 11 Rees Wavedeck: Construction Underway 12 Simcoe Wavedeck: Construction Underway 13 Spadina Bridge: Construction Early-2009 14 What Have We Been Doing for the Past 11 Months? • Consider and follow up on comments from Public Forum 1 • Assess baseline technical feasibility of design alternatives – Over 90 meetings in total: • City and TTC technical staff • Partner agencies •Stakeholders • Landowners/Property Managers • Adjacent project efforts • Advanced transit and traffic modelling • Develop Alternative Design Concepts and Evaluation (Phase 3) • Coordination with East Bayfront Transit EA 15 Study Area: Revised 16 Overview • Review of EA Phases 1 & 2 from Public Forum #1: January 2008 • EA Phase 3: Alternative Design Alternatives – Long list of Design Alternatives – Evaluation of Design Alternatives • Next Steps – Evaluation Criteria for Shortlisted Design -

Presentation 7:20 Questions of Clarification 7:30 Facilitated Open House 8:30 Adjourn

Waterfront Transit “Reset” Phase 2 Study Public Information & Consultation Meetings September 18 & 26, 2017 Agenda 6:00 Open House 6:30 Agenda Review, Opening Remarks and Introductions 6:40 Study Overview and Presentation 7:20 Questions of Clarification 7:30 Facilitated Open House 8:30 Adjourn 2 Project Study Team • A Partnership of: • The project study team is led by a joint City-TTC- Waterfront Toronto Executive Steering Committee • Metrolinx, City of Mississauga and MiWay have also provided input on relevant aspects of the study 3 What’s the Purpose of this Meeting? • Present the waterfront transit network travel demand considerations to 2041 • Present and gather feedback on options assessment for transit improvements in key areas of the network, including: – Union Station – Queens Quay Connection – Humber Bay Link – Bathurst - Fleet - Lake Shore – Queens Quay Intersection • Report the overall draft findings of the Phase 2 Study, priorities, and draft directions for further study prior to reporting to Executive Committee and Council 4 Study Timeline 5 Phase 1 Recap To view the Phase 1 Report and other background material, please visit the City’s website: www.toronto.ca/waterfronttransit 6 Vision Provide high quality transit that will integrate waterfront communities, jobs, and destinations and link the waterfront to the broader City and regional transportation network Objectives Connect waterfront communities locally and to Downtown with reliable and convenient transit service: • Promote and support residential and employment growth -

Evaluating the Toronto Waterfront Aquatic Habitat Restoration Strategy

Evaluating the effectiveness of aquatic habitat restoration implemented using the Toronto Aquatic Habitat Restoration Strategy Kaylin Barnes1, Lyndsay Cartwright1, Rick Portiss1, Jon Midwood2, Christine Boston2, Monica Granados3, Thomas Sciscione1, Colleen Gibson1, Olusola Obembe1 1 Toronto and Region Conservation Authority 2 Fisheries and Oceans Canada 3 PREreview.org November 2020 Evaluating the Toronto Waterfront Aquatic Habitat Restoration Strategy EXECUTIVE SUMMARY Fish populations of the Laurentian Great Lakes are impacted by a variety of stressors. Commercial and recreational fishing directly affect the fishery through harvest while other stressors, such as land use changes and degraded water quality, indirectly affect survival and reproduction through a loss or degradation of habitat. Great Lakes fisheries are also affected by competition and predation by invasive species along with changes in climate such as increasing lake temperatures. An estimated 80% of the approximately 200 fish species found in the Great Lakes use the nearshore areas for some portion of their life and as such, coastal development pressures such as shoreline modifications and watershed urbanization continue to impact the fishery. The Toronto Waterfront Aquatic Habitat Restoration Strategy (TWAHRS) was developed by the Toronto and Region Conservation Authority with guidance from a committee of subject matter experts to provide practical information for decision-makers, designers and regulatory agencies to ensure that implementation of all waterfront projects incorporate opportunities to improve aquatic habitat. The TWAHRS includes an illustrated compendium of habitat restoration techniques intended to improve waterfront aquatic habitats for a diversity of species - fish, mammals, reptiles, amphibians, molluscs, invertebrates and plants; however, it focuses on fish because they are excellent indicators of the overall health of the ecosystem. -

Sec 2-Core Circle

TRANSFORMATIVE IDEA 1. THE CORE CIRCLE Re-imagine the valleys, bluffs and islands encircling the Downtown as a fully interconnected 900-hectare immersive landscape system THE CORE CIRLE 30 THE CORE CIRLE PUBLIC WORK 31 TRANSFORMATIVE IDEA 1. THE CORE CIRCLE N The Core Circle re-imagines the valleys, bluffs and islands E encircling the Downtown as a fully connected 900-hectare immersive landscape system W S The Core Circle seeks to improve and offer opportunities to reconnect the urban fabric of the Downtown to its surrounding natural features using the streets, parks and open spaces found around the natural setting of Downtown Toronto including the Don River Valley and ravines, Lake Ontario, the Toronto Islands, Garrison Creek and the Lake Iroquois shoreline. Connecting these large landscape features North: Davenport Road Bluff, Toronto, Canada will create a continuous circular network of open spaces surrounding the Downtown, accessible from both the core and the broader city. The Core Circle re- imagines the Downtown’s framework of valleys, bluffs and islands as a connected 900-hectare landscape system and immersive experience, building on Toronto’s strong identity as a ‘city within a park’ and providing opportunities to acknowledge our natural setting and connect to the history of our natural landscapes. East: Don River Valley Ravine and Rosedale Valley Ravine, Toronto, Canada Historically, the natural landscape features that form the Core Circle were used by Indigenous peoples as village sites, travelling routes and hunting and gathering lands. They are regarded as sacred landscapes and places for spiritual renewal. The Core Circle seeks to re-establish our connection to these landscapes. -

Rees Street Park Design Brief

MAY 15 2018 // INNOVATIVE DESIGN COMPETITION REES STREET PARK Design Competition Brief > 2 TABLE OF CONTENTS 1. INTRODUCTION 4 2. GOALS (FROM THE RFQ) 7 3. PROGRAM FOR REES STREET PARK 8 3.1 Required Design Elements: 8 3.2 Site Opportunities and Constraints 14 3.3 Servicing & infrastructure 18 3 Rees Street Park and Queens Quay, looking southeast, April 2018 4 1. INTRODUCTION Waterfront Toronto and the City of Toronto Parks Forestry and Recreation Department are sponsoring this six-week design competition to produce bold and innovative park designs for York Street Park and Rees Street Park in the Central Waterfront. Each of these sites will become important elements of the Toronto waterfront’s growing collection of beautiful, sustainable and popular public open spaces along Queens Quay. Five teams representing a range of different landscape design philosophies have been selected to focus on the Rees Street Park site based on the program set out in this Competition Brief. The program consists of nine Required Design Elements identified through community consultation, as well as a number of physical site opportunities and constraints that must be addressed in the design proposals. The design competition will kick off on May 15, 2018 with an all-day orientation session – at which the teams will hear presentations from Waterfront Toronto, government officials, and key stakeholders – and a tour of the site. At the end of June, completed proposals will be put on public exhibition during which time input will be solicited from stakeholders, city staff, and the general public. A jury comprised of distinguished design and arts professionals will receive reports from these groups, and then select a winning proposal to be recommended to Waterfront Toronto and City of Toronto Parks Forestry and Recreation. -

550 Queen's Quay W #311

LIST PRICE $$259,800 ADDRESS 550 Queen’s Quay W #311 See More Photos And Community Information At… www.TorontoRealEstate.ca How Much Can YOU Afford? Based on 4.95% 5% 10% 15% 25% Mortgage Rate Down Down Down Down Down Payment $13,000 $26,000 $39,000 $65,000 TOTAL Monthly Payment $2,125 $2,025 $1,950 $1,750 (Mortgage, taxes, condo fees & utilities) Closing Costs $17,000 $30,000 $43,000 $69,000 (Including down payment) Gross Income Req’d To $68,500 $64,000 $60,500 $52,500 Qualify For The Mortgage Above calculations are estimates only for income required and closing costs … buyer must verify for themselves! Welcoming lobby with friendly, 24 hr concierge, terrific gym, sauna, and whirlpool. Huge party room with kitchen and library/TV area. Terrific city and lake views from the rooftop deck. List Of Neighbourhood Features Restaurants Many restaurants along Queens Quay … and fine dining in downtown Toronto, all the way from Hooters and Gretzky’s to the top of the CN Tower Night Clubs / Theatre duMaurier and Premier Dance Theatres, CIBC Stage and more at Harbourfront Centre … and Toronto’s Entertainment District … approx. King to Richmond, Duncan to Peter; The Paramount at Richmond and John has multi-theatres for 1st run movies, and the Princess of Wales at King & John for live theatre and musicals. Bookstores / Coffee Cafes all along Harbourfront; Chapters at SW corner of Richmond & Peter; Starbucks; Second Cup Shops at Pier 6, Harbourfront Parks Toronto Music Garden, 475 Queens Quay W; Greenspace at the Ferry Docks, ferry access to the Toronto Islands with more than 230 hectares of parkland; Spadina Quay Wetland; Harbour Square; Coronation Park, south of Lakeshore, west of Stadium Rd, and along the lake front. -

Redesigning Streets for a Growing City and Better Neighbourhoods

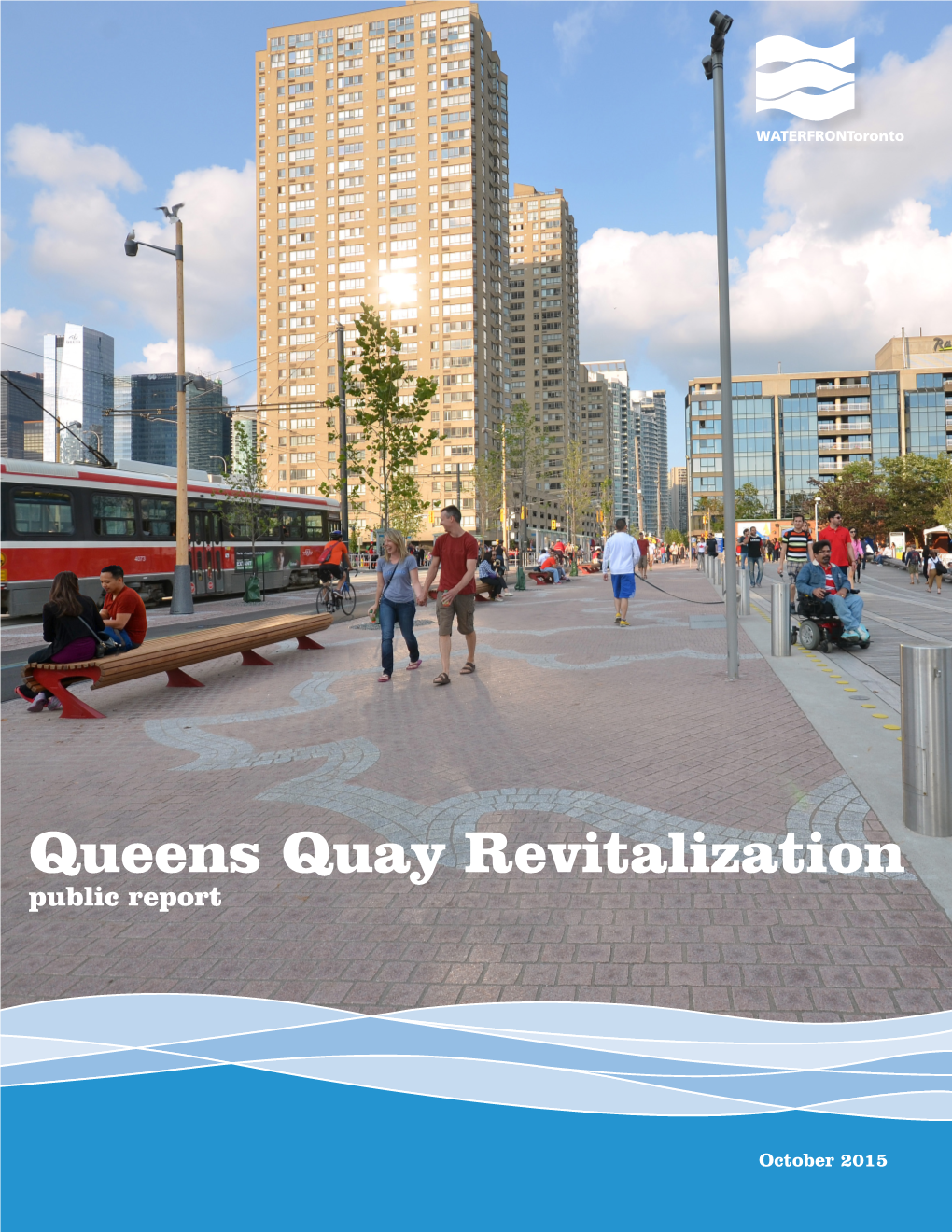

Toronto’s Great Streets Redesigning Streets for a Growing City and Better Neighbourhoods July 2018 Toronto’s Great Streets Redesigned for Greatness Harbord Street Roncesvalles Avenue St. Clair Avenue West Bike lanes for safer mobility & village improvement Toronto placemaking at its best The streetcar neighbourhood The 2014 redesign installed continuous cycling Completed in 2011, the Roncesvalles redesign The dedicated streetcar lane, opened in 2010, has infrastructure from Ossington to Parliament, trans- focused on placemaking and people, improving safety made hopping on transit an efficient alternative to forming Harbord into one of the most well-travelled and enhancing pedestrian space while strengthening the car and has transformed this midtown corridor bike routes in the city. Roncy’s capacity to serve local needs. into a vibrant main street. Queens Quay West Market Street A street for all users A future-proof street for people (and patios!) The 2015 redesign repositioned Queens Quay as Market Street’s 2014 redesign prioritizes the pedes- a public waterfront promenade, reallocating street trian experience to support adjacent retail and space to accommodate all modes – pedestrians, restaurants while celebrating the unique heritage cyclists, transit, and cars. and culture of St. Lawrence Market. Toronto’s Great Streets 2 Toronto’s Great Streets The Ones to Watch Bloor Street King Street Downtown Yonge Street Bike lanes on Bloor from east to west Relief for Toronto’s busiest surface transit route Canada’s Main Street See (a) credit image The Bike Lane Pilot Project on Bloor Street proved to The King Street Pilot Project transformed this busy A vision to pedestrianize a busy foot traffic stretch of be a great success and the lanes are now permanent. -

Waterfront Transit Network Update – Summer 2020 Agenda

Waterfront Transit Network Update Stakeholder Advisory Committee (SAC) July 23, 2020 Waterfront Transit Network Update – Summer 2020 Agenda 1. Project Overview 1. Context 2. Background 3. Timeline 2. Portal Selection Study - Summary of findings 3. Network Phasing Study – Upcoming work 4. EA Addenda/TPAP – Upcoming work 5. Preliminary Design and Engineering – Upcoming work Waterfront Transit Network Update – Summer 2020 Context Distillery Loop Union Station Waterfront Transit Network Update – Summer 2020 Background • In April 2019 , City Council endorsed the streetcar loop expansion at Union Station as the preferred option for the Union Queens Quay Link, and directed staff to commence the preliminary design and engineering phase of the extension of light rail transit to the East Bayfront beginning in 2020. • The first part of this work includes feasibility studies to assess: • An alternative portal location for the LRT along Queens Quay between Bay Street and Yonge Street, which may provide overall cost and public realm benefits • Consideration of phasing option(s) that may expedite the east-west streetcar service on Queens Quay to the East Bayfront Waterfront Transit Network Update – Summer 2020 Timeline Last time we met We are here TTC East Preliminary Transit Preliminary Bayfront Design – EBF Waterfront Union Station Project Design and Transit Portal + Transit – Queens Assessment Engineering Class EA Tunnel Reset Quay Link Process Structures Study (TPAP) (PDE) 2010 2011 2018 2019 2020 2020-2021 2020-2021 Study area from Preliminary Council Council approved Refine two Identify phase 1 Complete the Complete PDE Bay to Cherry design and cost directed streetcar loop implementation TPAP process (30% design) three St. -

Insider Report OFFICE CONDO

Insider Report OFFICE CONDO GTA RESEARCH AND INSIDER INSIGHTS SUPPORTING COMMERCIAL REAL ESTATE DECISIONS | 2018 Why Office Space Ownership is Catching On The City of Toronto’s push to revitalize transit-connected communities through mixed use developments has increased the supply of office condominiums and resulted in more organizations choosing to “buy” rather than “lease” their office space. For the right tenants, it’s a smart investment that will pay off long term. Stats Paint the Picture Strong GTA Condo Sales 1 MSF % New Downtown2.3 Office transit-connected Market Record low supply since 2013 availability $ PSF SF Average850 price for 600kYonge & Eglinton new Central Area potential space developments coming on stream For more information contact: Stefan Teague, Executive Managing Director, Market Leader, GTA, Cushman & Wakefield ULC direct: 416-359-2379 | cell: 416-278-0015 | [email protected] Insider Report OFFICE CONDO GTA RESEARCH AND INSIDER INSIGHTS SUPPORTING COMMERCIAL REAL ESTATE DECISIONS | 2018 Growing Trend in Tight Leasing Market The concept of companies owning their own office space in smaller standalone buildings is far from new, but the trend to investing in an office condo in larger buildings wasn’t widely embraced until 2015. That’s when the Hullmark Centre at 4789 Yonge Street and the World on Yonge at 7191 Yonge Street arrived on the scene – major builds providing more options to office condo ownership. These two developments brought a total of 340,000 square feet (Hullmark Centre, 240,000 square feet; World on Yonge, 100,000 square feet) to the market. In 2017, the new 7 St. -

130 Queens Quay E 1,915 SF for Sale: Office

Click Here for Virtual Tour! 130 Queens Quay E 1,915 SF For Sale: Office Here is where your business will grow. lennard.com 130 Queens Quay E 1,915 SF Office space located in the Waterfront Communities-The Island neighborhood in Toronto Suite Availability 819 Immediate Available Space Listing Agents 1,915 SF (approximately) Dillon Stanway Sales Representative Sale Price 416.649.5904 $2,290,000 [email protected] Condo Fees William J. Dempsey** $1,042.29 / month Partner Taxes 416.649.5940 $21,915.10 (2020) [email protected] **Broker Benefits • One of the best located and finished units in the East Tower • Top floor in east tower below the amenities. • Bright corner unit with great Views – 2 sides with full windows. • South and east facing – end of hall privacy. • Access to common amenity space with 2 high tech board rooms, lounge, large outdoor terrace & BBQ area over looking lake. • 24 hrs concierge • Bike locker room and shower room. • Secure heated storage locker available. Move In condition • Finished drop ceiling and premium carpet for sound attenuation • LED lighting throughout • 3 heat/cool zones with separate thermostats. • 5 private offices with glass side lights • 2 larger rooms with view • Separate kitchen with full fridge and dishwasher • Dividing half wall in open space • Extensively pre-wired for data and voip runs from server cupboard lennard.com 130 Queens Quay E lennard.com 130 Queens Quay E Building amenities Main Lobby Bike Storage Private Shower Facilities 130 Queens Quay E Common areas Private Meeting Rooms Rooftop