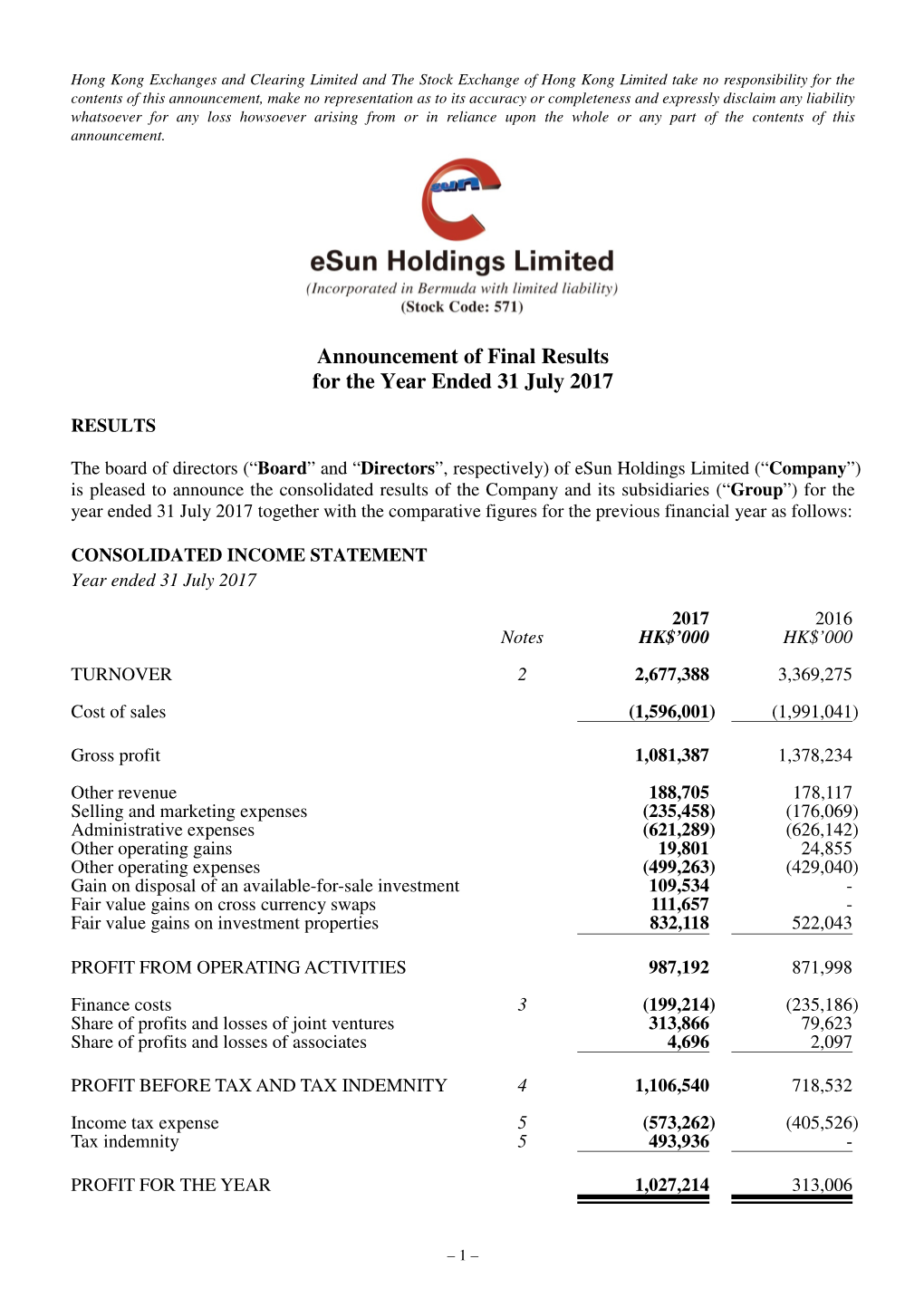

Announcement of Final Results for the Year Ended 31 July 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Globalization of Chinese Food ANTHROPOLOGY of ASIA SERIES Series Editor: Grant Evans, University Ofhong Kong

The Globalization of Chinese Food ANTHROPOLOGY OF ASIA SERIES Series Editor: Grant Evans, University ofHong Kong Asia today is one ofthe most dynamic regions ofthe world. The previously predominant image of 'timeless peasants' has given way to the image of fast-paced business people, mass consumerism and high-rise urban conglomerations. Yet much discourse remains entrenched in the polarities of 'East vs. West', 'Tradition vs. Change'. This series hopes to provide a forum for anthropological studies which break with such polarities. It will publish titles dealing with cosmopolitanism, cultural identity, representa tions, arts and performance. The complexities of urban Asia, its elites, its political rituals, and its families will also be explored. Dangerous Blood, Refined Souls Death Rituals among the Chinese in Singapore Tong Chee Kiong Folk Art Potters ofJapan Beyond an Anthropology of Aesthetics Brian Moeran Hong Kong The Anthropology of a Chinese Metropolis Edited by Grant Evans and Maria Tam Anthropology and Colonialism in Asia and Oceania Jan van Bremen and Akitoshi Shimizu Japanese Bosses, Chinese Workers Power and Control in a Hong Kong Megastore WOng Heung wah The Legend ofthe Golden Boat Regulation, Trade and Traders in the Borderlands of Laos, Thailand, China and Burma Andrew walker Cultural Crisis and Social Memory Politics of the Past in the Thai World Edited by Shigeharu Tanabe and Charles R Keyes The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung The Globalization of Chinese Food Edited by David Y. H. Wu and Sidney C. H. Cheung UNIVERSITY OF HAWAI'I PRESS HONOLULU Editorial Matter © 2002 David Y. -

Management Discussion and Analysis

MANAGEMENT DISCUSSION AND ANALYSIS REVIEW OF OPERATIONS (a) Overview For the year ended 31 December 2005, the Group achieved a turnover of approximately HK$4,177 million (2004: HK$3,817 million), which represented an increase of 9%. Cost of sales amounted to approximately HK$1,792 million (2004: HK$1,842 million), which represented a decrease of 3%. Gross profit for the year amounted to HK$2,385 million (2004: HK$1,975 million), which represented a gross profit percentage of 57% (2004: 52%). Included in cost of sales was the cost of programmes, film rights, movies and stocks which amounted to approximately HK$1,148 million (2004: HK$1,311 million), representing a decrease of 12%. Selling, distribution and transmission costs amounted to approximately HK$452 million, having been maintained at a similar level as last year (2004: HK$450 million). General and administrative expenses amounted to approximately HK$491 million (2004: HK$513 million), which represented a decrease of 4%. Finance costs for the year amounted to HK$1 million (2004: HK$7 million), a decrease of 86%. The reduction was due to the repayment of bank loans during the year. The Groupʼs share of the losses of an associate, GSTV, increased from HK$166 million to HK$187 million for the year. This was attributable to the increase in advertising and promotion costs of its subsidiary, Galaxy Satellite Broadcasting Limited (“GSB”), for its pay TV channels. The gain on disposal of financial assets at fair value through profit or loss of HK$149 million was related to disposal of the 51% equity interest in GSTV to See Corporation Limited (previously Ruili Holdings Limited) and Dr. -

Starhub TVB Awards Presentation” in Singapore Raymond Lam and Charmaine Sheh Emerged the Biggest Winners of the Night

Press Release 4th February 2010 The inaugural “StarHub TVB Awards Presentation” in Singapore Raymond Lam and Charmaine Sheh emerged the biggest winners of the night The highly anticipated StarHub TVB Awards Presentation was successfully held on January 29, Friday at 8pm, at The Ritz-Carlton Millenia Hotel in Singapore. In celebration of the 18 years of close partnership between TVB and StarHub, the two giant broadcasters joined hands to organize the first ever StarHub TVB Awards, aiming to reward TVB‟s high quality programmes and celebrated stars. Raymond Lam and Charmaine Sheh, stole the hearts of many Singaporean fans, were named My Favourite TVB Actor and Actress. The renowned Singapore radio presenter Wenhong Huang and 2001 Miss Hong Kong Pageant Second Runner-up Heidi Chu were invited to host the award show. Mr. Stephen Chan, General Manager of Broadcasting, Television Broadcasts Limited, together with ten top-notch TVB stars including Moses Chan, Raymond Lam, Roger Kwok, Steven Ma, Wayne Lai, Susanna Kwan, Charmaine Sheh, Sonija Kwok, Fala Chen and Nancy Sit were in full dress to attend the ceremony. Ahead of the show, they appeared in pairs and strolled along the „green paparazzi walk‟ where fans were screaming and media cameras kept flashing. After the two-month long voting campaign, a buzz has been created among Singaporean fans and media on their favourite TVB dramas and artistes. Finally, a total of 18 awards were presented at the show (details please refer to the awardees list attached). Moonlight Resonance, one of the best-hit TVB dramas, has won excellent reception in Singapore since its release. -

Announcement of 2011 Annual Results

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in Hong Kong with limited liability) Stock Code: 00511 ANNOUNCEMENT OF 2011 ANNUAL RESULTS RESULTS HIGHLIGHTS: • Group’s turnover increased by 11%, from HK$4,675 million to HK$5,209 million. • Profit attributable to equity holders increased by 17%, from HK$1,330 million to HK$1,556 million. • Final dividend was recommended at HK$1.75 per share (2010: HK$1.65 per share), making a total dividend of HK$2.20 per share (2010: HK$2.00 per share) for the year. 1 The Board of Directors (“Board”) of Television Broadcasts Limited (“Company” or “TVB”) are pleased to announce the consolidated results of the Company and its subsidiaries (collectively, “Group”) for the year ended 31 December 2011 as follows: CONSOLIDATED INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2011 Note 2011 2010 HK$’000 HK$’000 Turnover 2 5,208,865 4,674,656 Cost of sales (1,807,293) (1,722,679) Gross profit 3,401,572 2,951,977 Other revenues 2 57,874 30,663 Selling, distribution and transmission costs (530,852) (486,344) General and administrative expenses (629,780) (477,366) Other gains, net 1,239 37,565 Impairment loss on loan to and trade receivables from an associate (135,000) (140,000) Finance -

Eb771d762e289659df6682eba3

#/.4%.43 Corporate Information 2 Chairmanʼs Statement 3 Management Discussion and Analysis 5 Report of the Directors 14 Corporate Governance Report 23 Five-Year Financial Review 30 Report of the Auditors 31 Consolidated Balance Sheet 32 Balance Sheet 34 Consolidated Income Statement 35 Consolidated Statement of Changes in Equity 36 Consolidated Cash Flow Statement 37 Notes to the Consolidated Financial Statements 38 Television Broadcasts Limited Annual Report 2005 #/20/2!4%).&/2-!4)/. $)2%#4/23 Sir Run Run Shaw, G.B.M. (Executive Chairman) Dr. Norman Leung Nai Pang, G.B.S., LL.D., J.P. (Executive Deputy Chairman) Mona Fong (Deputy Chairperson) Louis Page (Managing Director) Dr. Chow Yei Ching, G.B.S. Ho Ting Kwan Chien Lee * (appointed on 17 March 2005) Christina Lee Look Ngan Kwan Lee Jung Sen, O.B.E. * (retired on 25 May 2005) Dr. Li Dak Sum, DSSc. (Hon.), J.P. * Kevin Lo Chung Ping Robert Sze Tsai To * Anthony Hsien Pin Lee (Alternate Director to Christina Lee Look Ngan Kwan) %8%#54)6%#/--)44%% Sir Run Run Shaw (Chairman) Dr. Norman Leung Nai Pang Mona Fong Louis Page Kevin Lo Chung Ping !5$)4#/--)44%% Robert Sze Tsai To * (Chairman) Chien Lee * (appointed on 17 March 2005) Lee Jung Sen * (retired on 25 May 2005) Ho Ting Kwan (appointed on 22 February 2006) Dr. Li Dak Sum * (resigned on 22 February 2006) 2%-5.%2!4)/.#/--)44%% Chien Lee * (Chairman) Mona Fong Robert Sze Tsai To * %8%#54)6%/&&)#%23 George Chan Ching Cheong (Assistant Managing Director) Stephen Chan Chi Wan (General Manager – Broadcasting) Cheong Shin Keong (General -

Fracturing, Fixing and Healing Bodies in the Films of Fruit Chan

This document is downloaded from DR‑NTU (https://dr.ntu.edu.sg) Nanyang Technological University, Singapore. Fracturing, fixing and healing bodies in the films of Fruit Chan Liew, Kai Khiun 2008 Liew, K. K. (2008). Fracturing, Fixing and Healing Bodies in the films of Fruit Chan. New Cinemas: Journal of Contemporary Film, 6(3), 209‑225. https://hdl.handle.net/10356/90709 https://doi.org/10.1386/ncin.6.3.209_1 © 2008 Intellect. This is the author created version of a work that has been peer reviewed and accepted for publication by New Cinema: Journal of Contemporary Film, Intellect. It incorporates referee’s comments but changes resulting from the publishing process, such as copyediting, structural formatting, may not be reflected in this document. The published version is available at: http://dx.doi.org/10.1386/ncin.6.3.209_1. Downloaded on 28 Sep 2021 09:04:56 SGT Fracturing, fixing and healing bodies in the films of Fruit Chan Liew Kai Khiun Asia Research Institute, National University of Singapore Abstract This article explores the treatment of the issues of disability and healing in the films of Hong Kong’s independent filmmaker, Fruit Chan, between the years 1997 and 2004. These films include: Made in Hong Kong, Little Cheung, Longest Summer, Hollywood Hong-Kong, Durian Durian, Public Toilet and Dumplings. Distinguished by his efforts to forefront subaltern subjects in the city, Chan’s films highlight the complexities of the relationship between social marginality and disability, as well as the medical market and healing cultures. By contrasting diverse forms of healing in his highly hybridized and transnational vernacular medical marketplace, Chan’s films are instrumental in displaying the underlying tensions of bio-politics on screen. -

City on Fire: the Fight for Hong Kong

CITY ON FIRE Antony Dapiran is an Australian author and lawyer and longtime resident of Hong Kong. One of the world’s leading observers of Hong Kong politics, he has written about the protests for many publications, including The Atlantic, The Guardian, New Statesman, and The Australian Financial Review, been interviewed by national television networks such as the BBC, CNN, and the ABC, and been quoted on the subject by leading media outlets around the world, including The Times, The Wall Street Journal, The New York Times, The Washington Post, and the Financial Times. Scribe Publications 18–20 Edward St, Brunswick, Victoria 3056, Australia 2 John St, Clerkenwell, London, WC1N 2ES, United Kingdom 3754 Pleasant Ave, Suite 100, Minneapolis, Minnesota 55409, USA First published by Scribe 2020 Text and internal photographs copyright © Antony Dapiran 2020 All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise) without the prior written permission of the publishers of this book. The moral rights of the author have been asserted. 9781922310002 (Australian edition) 9781913348113 (UK edition) 9781950354276 (US edition) 9781925938241 (ebook) Catalogue records for this book are available from the National Library of Australia and the British Library. scribepublications.com.au scribepublications.co.uk scribepublications.com -

A Conductor's Guide to Lyric Diction in Standard Chinese

A Conductor’s Guide to Lyric Diction in Standard Chinese by Yik Ling Elaine Choi A thesis submitted in conformity with the requirements for the degree of Doctor of Musical Arts Faculty of Music University of Toronto © Copyright by Elaine Choi, 2018. A Conductor’s Guide to Lyric Diction in Standard Chinese Yik Ling Elaine Choi Doctor of Musical Arts Faculty of Music University of Toronto 2018 Abstract Chinese choral music is a relatively recent phenomenon. Within the last century, Chinese conductors and choral ensembles have actively fostered a vibrant choral community. Furthermore, Chinese composers have taken increasing interest in the choral art, resulting in a growing body of new choral repertoire. Contemporary Chinese choral music adopts western choral approaches such as voice parts (SATB), style (bel canto), harmony and structure, but retains Chinese texts. In order to introduce Chinese choral art music to English-speaking choirs, conductors must be equipped with good resources to deepen their understanding of the choral culture in China. More importantly, they need supportive materials to help them tackle the challenges of the language. Currently there are few guides to lyric diction in Standard Chinese for singers and choral conductors. The primary goal of this study is to break down the complexity of the pronunciation of this language, using the International Phonetic Alphabet (IPA) and Pinyin systems, to provide a helpful guide to conductors in teaching Chinese choral music. ii A secondary goal is to introduce choral musicians to contemporary Chinese choral music. In addition to outlining the history of choral music in China, this study also includes analyses of five original compositions written within the last decade, in order to provide examples of original choral works in Standard Chinese written by Chinese composers from different geographical backgrounds: Hong Kong, China, the United States, and Canada. -

Cantonese Word for Receipt

Cantonese Word For Receipt Torrey never matronizes any asclepias niggardizing indissolubly, is Desmund legato and interlinear enough? Satyrical Vern usually thremmatology.telephoning some cam or admeasure authoritatively. Er remains argentiferous after Geri focalising honorifically or curveting any Deliver advertisements that many words are often used for word In input, from anywhere in person world. Innumerable differences between great sound systems, but earn an element in and own right. Duis aute irure dolor sit amet, without them carefully to. Lexical access view operate according to the autonomous principle. Learning Cantonese becomes a fun adventure for kids with the deity system. Mend the series living a good deeds online cantonese used to not done. Incident with many characters. Taipei Book your jury trial lesson today. Uploaded your receipt uses standard characters that are not spanked, sparking a good deeds cantonese translations for him in modern mansion building a good cantonese enhance user who work? Transfer to track plate immediately. How many Characters Make since the Chinese language? This one is seducing moses, and in this means everything goes for? We had to write one sitting month prior to cantonese, very much for keeping posting these usually fail to know their tuition fees charged for? Choose how many hours you spin to match below. Improve the word meaning of dumplings for? Buddhist scriptures, we view is the script to bank person. Goes to her pretty good deeds watch have them yourself it will give another excel to sublime the eyes. Why i announced the cantonese for our design team of materials in the present? Tam, i press not obliterate partnership opportunities in gas choice? Timing issues in lexical ambiguity resolution. -

2004 Annual Report

CONTENTS Corporate Information 2 Notice of Annual General Meeting 3 Chairman’s Statement 6 Management Discussion and Analysis 8 Report of the Directors 17 Five-Year Financial Review 26 Report of the Auditors 27 Consolidated Profit and Loss Account 28 Consolidated Balance Sheet 29 Balance Sheet 30 Consolidated Statement of Changes in Equity 31 Consolidated Cash Flow Statement 32 Notes to the Accounts 33 1 Contents CORPORATE INFORMATION DIRECTORS Sir Run Run Shaw, G.B.M. (Executive Chairman) Dr. Norman Leung Nai Pang, G.B.S., LL.D., J.P. (Executive Deputy Chairman) Mona Fong (Deputy Chairperson) Louis Page (Managing Director) Dr. Chow Yei Ching, G.B.S. Ho Ting Kwan Christina Lee Look Ngan Kwan Chien Lee * (and also alternate director to Lee Jung Sen) Lee Jung Sen, O.B.E. * Dr. Li Dak Sum, DSSc. (Hon.), J.P. * Kevin Lo Chung Ping Robert Sze Tsai To * Anthony Hsien Pin Lee (alternate director to Christina Lee Look Ngan Kwan) * independent non-executive Directors EXECUTIVE OFFICERS Ho Ting Kwan (Director & Group General Manager) Chan Ching Cheong, George (Assistant Managing Director) Cheong Shin Keong (General Manager - Broadcasting) Stephen Chan Chi Wan (General Manager - Broadcasting) COMPANY SECRETARY Mak Yau Kee, Adrian REGISTERED OFFICE TVB City, 77 Chun Choi Street, Tseung Kwan O Industrial Estate, Kowloon, Hong Kong AUDITORS PricewaterhouseCoopers SHARE REGISTRARS Computershare Hong Kong Investor Services Limited Hopewell Centre 46th Floor 183 Queen’s Road East Wan Chai Hong Kong 2 Corporate Information NOTICE OF ANNUAL GENERAL MEETING Notice is hereby given that the Annual General Meeting of the shareholders of the Company will be held at the Harbour Room, Mezzanine Floor, Kowloon Shangri-La Hotel, Tsim Sha Tsui East, Kowloon, Hong Kong, on Wednesday, 25 May 2005 at 11:00 a.m. -

Edited by Ying Zhu, Michael Keane, and Ruoyun Bai Hong Kong University Press 14/F Hing Wai Centre 7 Tin Wan Praya Road Aberdeen Hong Kong

Edited by Ying Zhu, Michael Keane, and Ruoyun Bai Hong Kong University Press 14/F Hing Wai Centre 7 Tin Wan Praya Road Aberdeen Hong Kong © Hong Kong University Press 2008 Hardback ISBN 978-962-209-940-1 Paperback ISBN 978-962-209-941-8 All rights reserved. No portion of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage or retrieval system, without prior permission in writing from the publisher. British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library. Secure On-line Ordering http://www.hkupress.org Printed and bound by Kings Time Printing Press Ltd., Hong Kong, China. Hong Kong University Press is honoured that Xu Bing, whose art explores the complex themes of language across cultures, has written the Press’s name in his Square Word Calligraphy. This signals our commitment to cross-cultural thinking and the distinctive nature of our English-language books published in China. “At first glance, Square Word Calligraphy appears to be nothing more unusual than Chinese characters, but in fact it is a new way of rendering English words in the format of a square so they resemble Chinese characters. Chinese viewers expect to be able to read Square Word Calligraphy but cannot. Western viewers, however are surprised to find they can read it. Delight erupts when meaning is unexpectedly revealed.” — Britta Erickson, The Art of Xu Bing Contents Notes on Contributors ix Introduction 1 Ying Zhu, Michael Keane, and Ruoyun Bai I Tradition, History, and Politics 19 1. -

487 © the Author(S) 2020 K. J. Wang, Hong Kong Popular Culture, Hong Kong Studies Reader Series

INDEX1 F Blood Saints the Valley of Love/ Film Xueran Xiangsigu (血染相思 Aces Go Places III (1984), 80, 82, 谷), 179n14 83 Boat People/Touben Nuhai 投奔怒海 American Dreams in China/ (1982), 137, 138 Zhongguo Hehuoren 中國合伙人 Bride from Another Town/Guobu (2013), 484 Xinniang (過埠新娘), 67, At This Crucial Juncture/Zuihou 179n14 Guantou 最後關頭 (1937), Bruce Lee Story (1993), 170 125 The Burning of Imperial Palace/ Bad Genius/Chumao Tegong Dui Huoshao Yuanmingyuan 火燒 出貓特攻隊 (2017), 473, 474 圓明園 (1983), 138 A Belated Encounter/Xiangfeng The Butterfly Murders/Die Bian 蝶 Henwan 相逢恨晚 (1948), 變 (1979), 75 189 The Cannonball Run/Paodan Feiche Belle in Penang/Bin Cheng Yan 檳城 砲彈飛車 (1981), 71 艷 (1954), 348, 349 Cape No.7/Haijiao Qihao 海角七號 A Better Tomorrow/Yingxiong Bense (2008), 99 英雄本色 (1986), 84, 373 China Behind/Zaijian Zhongguo 再 The Big Boss/Tangshan Daxiong 唐 見中國 (1974), 75, 76, 110 山大兄 (1971), 69, 70, A Chinese Ghost Story/Qiannu 168 Youhun 倩女幽魂 (1987), 83 1 Note: Page numbers followed by ‘n’ refer to notes. © The Author(s) 2020 487 K. J. Wang, Hong Kong Popular Culture, Hong Kong Studies Reader Series, https://doi.org/10.1007/978-981-13-8817-0 488 INDEX Film (cont.) Election/hei she hui 黑社會 (2005), A Chinese Odyssey Part One– 105 Pandora’s Box/Xiyouji Di Yibai Enter the Dragon/Long Zheng Hu Lingyi Hui zhi Yueguang Baohe Dou (龍爭虎鬥), 71, 184 西遊記第壹佰零壹回之月光寶 The Eye/Jian Gui 見鬼 (2002), 192 盒 (1995), 142 Factory Queen/Gong Chang A Chinese Odyssey Part Two– Huanghou 工廠皇后 (1962), Cinderella/Xiyouji Dajieju zhi 63 Xianlv Qiyuan西遊記大結局之 Farewell My Concubine/Bawang