1 Sandra Rigot Associate Professor Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Highest Concentration of Qualified Students

Education The Highest Concentration of Qualified Students Paris Region offers a world-class education system with an ever-increasing number of programs catering to the needs of international students and families. Universities, engineering, business and specialized schools rank among the most prestigious in the world and offer an internationally renowned education, providing everyone with the best adapted training curriculum. © GOBELINS, l'école de l'image The French Primary and Secondary Education (public and private) Education System 3,200 nurseries 6,925 pre-schools and primary Nursery Pre-school / Primary school Secondary High school The education system is schools starting Kindergarten 6 to 10 years old school 16 to 18 years old operated by the French Public 1,997 secondary and high schools from 2-3 to 11 to 15 Baccalauréat Education Authority. 3 months old 5 years old years old Diploma 1,330,500 pupils Schooling is compulsory from 6 90.2% in public schools to 16 years old. 1,087,184 students 3,129,966 21% Public pre-school is available for 80.7% in public middle students in primary, of France’s student children starting from 2 years old. and high-schools middle and high-schools population in primary, middle, and high schools Higher Education Post A-Level year European grades and credits (ects) Internship Internship +8 PHD Internship +5 Medecine MASTER’S Grandes Ecoles Pharmacy Odontology +3 +2 BACHELOR’S Pro Bachelor’s CGPE BTS DUT Entrance examination A-Levels MESR (French Ministry of Higher Education and Research) - BTS: Technical programs - DUT : University Diploma of Technology Grandes Ecoles : Engineering & Business schools - CPGE : class which prepares students to enter the Grandes Ecoles 20 Paris Region Facts & Figures 2021 Education Highly Educated Students Main Branches of Higher Education (in 2019-20) 91 doctoral schools Bachelor’s, Master’s, and PhD: University programs in technology: 17,566 PhD students, incl. -

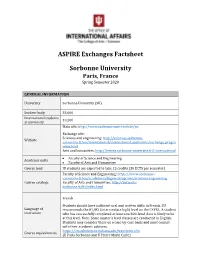

ASPIRE Exchanges Factsheet Sorbonne University

ASPIRE Exchanges Factsheet Sorbonne University Paris, France Spring Semester 2020 GENERAL INFORMATION University Sorbonne University (SU) Student body 55,600 International students 10,200 at university Main site: http://www.sorbonne-universite.fr/en Exchange site: Sciences and engineering: http://sciences.sorbonne- Website universite.fr/en/international/international_applicants/exchange_progra mme.html Arts and humanities: http://lettres.sorbonne-universite.fr/l-international • Faculty of Science and Engineering Academic units • Faculty of Arts and Humanities Course load IU students are expected to take 15 credits (30 ECTS per semester) Faculty of Science and Engineering: https://www.sorbonne- universite.fr/en/academics/degree-programs/sciences-engineering Course catalogs Faculty of Arts and Humanities: http://vof.paris- sorbonne.fr/fr/index.html French Students should have sufficient oral and written skills in French. SU Language of recommends the B1/B2 (intermediate high) level on the CEFRL. A student instruction who has successfully completed at least one 300-level class is likely to be at this level. Note: Some master’s level classes are conducted in English. Students may consider these on a case-by-case basis and must consult with their academic advisors. https://cts.admissions.indiana.edu/transferin.cfm Course equivalencies (U Paris Sorbonne and U Pierre Marie Curie) SU uses number grades based on a 20-point grading scale, with 10 being the passing point. SU will provide transcripts for students taking part in Grades and the exchange. At the student’s request, the College will review courses to Transcripts determine how they will apply to your degree. Please note that IU does not accept Pass/Fail. -

2018 Booklet (PDF, 1Mo)

EUROPEAN STUDIES PROGRAMME 2018 TABLE OF CONTENTS SCIENCES PO AT A GLANCE .......................................................................................................... 3 PROGRAMME ..................................................................................................................................... 4 The team ........................................................................................................................................... 4 Overview of the programme ............................................................................................................. 7 Course structure ............................................................................................................................... 8 Course syllabus ................................................................................................................................ 9 Recommended readings ................................................................................................................ 11 Course planning .............................................................................................................................. 14 Institutional visits in Paris ............................................................................................................... 15 USEFUL INFORMATION .................................................................................................................. 16 The library ...................................................................................................................................... -

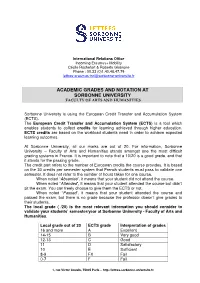

Academic Grades & Notation Sorbonne University

International Relations Office Incoming Erasmus+ Mobility Cécile Rochefort & Roberta Giubrone Phone : 00.33 (0)1.40.46.47.79 [email protected] ACADEMIC GRADES AND NOTATION AT SORBONNE UNIVERSITY FACULTY OF ARTS AND HUMANITIES Sorbonne University is using the European Credit Transfer and Accumulation System (ECTS). The European Credit Transfer and Accumulation System (ECTS) is a tool which enables students to collect credits for learning achieved through higher education. ECTS credits are based on the workload students need in order to achieve expected learning outcomes. At Sorbonne University, all our marks are out of 20. For information, Sorbonne University – Faculty of Arts and Humanities stands amongst one the most difficult grading systems in France. It is important to note that a 10/20 is a good grade, and that it stands for the passing grade. The credit part refers to the number of European credits the course provides. It is based on the 30 credits per semester system that French students must pass to validate one semester. It does not refer to the number of hours taken for one course. When noted “ Absentee ”, it means that your student did not attend the course. When noted “ Attended ”, it means that your student attended the course but didn’t sit the exam. You can freely choose to give them the ECTS or not. When noted “ Passed ”, it means that your student attended the course and passed the exam, but there is no grade because the professor doesn’t give grades to their students. The local grade ( /20) is the most relevant information you should consider to validate your students’ semester/year at Sorbonne University - Faculty of Arts and Humanities . -

Fall Semester 2021)

Sorbonne university : List of courses opened to 4EU+ students (fall semester 2021) Course title Responsible University Description Language Prerequisites Credits Duration Dates Learning content & Type of objectives examination Representation of Lubov Jurgenson Sorbonne The twentieth century has often been thought of French & 2 or 3 Course starts in Literary and artistic The student violence and (luba.jurgenson@wa Université as a century of mass violence, of which Central Russian according to September – currents of the 20th must produce a literary modernity nadoo.fr) Europe and Russia (and later the USSR) were the the work exact date to be century and their personal work on privileged theater. This violence, at the origin of provided by announced dialogue with the one of the profound cultural mutations, had a considerable the student events that provoked seminar themes: influence on the evolution of epistemological Every second mass violence. either a frameworks in literary studies and the humanities Tuesday (3-6 pm) presentation or a and gave rise to a protean corpus of literary, written paper testimonial or theoretical narratives (and even visual works) that question the legitimacy of culture and knowledge while contributing to the construction of new representational models. How does this complexity relate to the literary modernities of the 20th century? Multiculturality in Delphine Bechtel Sorbonne "Museum, monument, memorial site in Central French & 2 or 3 Course starts in Study of the Students will Central and (delphine.bechtel@ -

The Academic Structures of Boston, London and Paris: a Comparison Report Prepared for CNRS

The academic structures of Boston, London and Paris: a comparison Report prepared for CNRS CLIENT: Centre National de la Recherche Scientifique (CNRS) DATE: October 2016 [email protected] - www.sirisacademic.com 2 THE ACADEMIC STRUCTURES OF BOSTON, LONDON AND PARIS: A COMPARISON October 2016 Submitted to: Centre Nationnal de la Recherche Scientifique By SIRIS Academic Av. Francesc Cambó, 17 08003 Barcelona Spain Tel. +34 93 624 02 28 [email protected] www.sirisacademic.com For more information and comments about this report, please contact us at [email protected] 3 EXECUTIVE SUMMARY ..................................................................................................................................... 6 KEY RECOMMENDATIONS ................................................................................................................................ 8 LINKS TO THE INTERACTIVE VISUALISATIONS PRESENTED IN THIS REPORT .................................................... 12 Rankings overview ..................................................................................................................................................... 12 Maps of science ......................................................................................................................................................... 12 Visualisation of ranking’s qualitative vs. quantitative criteria ................................................................................... 12 Visualisations of ranking’s qualitative criteria vs. -

Innovation and Sustainability in French Fashion Tech Outlook and Opportunities. Report By

Innovation and sustainability in French Fashion Tech outlook and opportunities Commissioned by the Netherlands Enterprise Agency and the Innovation Department of the Embassy of the Kingdom of the Netherlands in France December 2019 This study is commissioned by the Innovation Department of the Embassy of the Kingdom of the Netherlands in France and the Netherlands Enterprise Agency (RVO.nl). Written by Alice Gras and Claire Eliot Translated by Sophie Bramel pages 6-8 INTRODUCTION 7 01. Definition and key dates 8 02. Dutch fashion tech dynamics I 9-17 THE CONVERGENCE OF ECOLOGICAL AND ECONOMIC SUSTAINABILITY IN FASHION 11-13 01. Key players 14 02. Monitoring impact 14-16 03. Sustainable innovation and business models 17 04. The impact and long-term influence of SDGs II 18-30 THE FRENCH FASHION INNOVATION LANDSCAPE 22-23 01. Technological innovation at leading French fashion companies 25-26 02. Public institutions and federations 27-28 03. Funding programmes 29 04. Independent structures, associations and start-ups 30 05. Specialised trade events 30 06. Specialised media 30 07. Business networks 30 08 . Technological platforms III 31-44 FASHION AND SCIENTIFIC RESEARCH: CURRENT AND FUTURE OUTLOOK 34-35 01. Mapping of research projects 36-37 02. State of fashion research in France 38-39 03. Key fields of research in fashion technology and sustainability 40 04. Application domains of textile research projects 42-44 05. Fostering research in France IV 45-58 NEW TECHNOLOGIES TO INNOVATE IN THE FRENCH FASHION SECTOR 47 01. 3D printing 48 02. 3D and CAD Design 49-50 03. Immersive technologies 51 04. -

Sarah Schneider-Strawczynski

SARAH SCHNEIDER-STRAWCZYNSKI Citizenship: French and Swiss. 48, boulevard Jourdan, 75014 Paris. 4th floor, office 72. Personal website [email protected] Placement Officer Placement Assistant Professor David Margolis Ms. Roxana Ban +33(0)1 80 52 18 58 +33(0)1 80 52 19 43 [email protected] [email protected] CURRENT POSITIONS Paris School of Economics j Paris 1 Panth´eon-Sorbonne Sept. 2017 - ... Ph.D. Candidate in Economics. Thesis: \Essays on the Economic and Political Effects of Migration". Thesis supervisor: Prof. Hillel Rapoport. Thesis jury: Prof. Simone Bertoli, Prof. Christina Gathmann, Prof. Julien Grenet, Prof. Sergei Guriev, Prof. Vincent Pons, Prof. Hillel Rapoport. Institut Convergence Migrations March 2018 - ... Fellow at the Economic Department (Dynamics). Harvard Kennedy School Sept - Dec. 2021 Visiting Scholar, Center for International Development. Hosting scholar: Prof. Dani Rodrik. REFERENCES Hillel Rapoport Sergei Guriev Paris School of Economics Sciences Po Paris 48 boulevard Jourdan, 28, rue des Saints P`eres, 75014 Paris, France 75007 Paris, France +33(0)1 80 52 16 14 +33 (0)1 45 49 54 15 [email protected] [email protected] Liam Wren Lewis Vincent Pons Paris School of Economics Harvard Business School 48 boulevard Jourdan, Morgan Hall 289, Soldiers Field, 75014 Paris, France Boston, MA 02163, United-States +33(0)1 80 52 17 23 +1 617 899 7593 [email protected] [email protected] RESEARCH FIELDS Applied Microeconomics: Primary Migration Economics, Political Economy Secondary Labor Economics, Development Economics 1 /4 PRE-DOCTORAL EDUCATION Paris School of Economics j Paris 1 Panth´eon-Sorbonne 2015 - 2017 M.Sc. -

Pushing the Frontiers of Innovative Research

LERU Office tel +32 16 32 99 71 Minderbroedersstraat 8 [email protected] Pushing the frontiers B-3000 Leuven www.leru.org Belgium @LERU_Office of innovative research The League of European Research Universities has published the following papers: Position papers: Advice papers: League of European Research Universities • Women, research and universities: excellence without gender bias (July 2012) • Good Practice Elements in Doctoral Training (January 2014) • Research universities and research assessment (June 2012) • LERU Roadmap for Research Data (December 2013) University of Amsterdam University College London • Doctoral degrees beyond 2010: training talented researchers for society • The future of SSH in Europe: collected LERU papers on the SSH research agenda Universitat de Barcelona Lund University (March 2010) (September 2013) University of Cambridge University of Milan • Harvesting talent: strengthening research careers in Europe (January 2010) • International Curricula and Student Mobility (April 2013) University of Edinburgh Ludwig-Maximilians-Universität München • What are universities for? (September 2008) • Social Sciences and Humanities: essential fields for European research and in • The future of the European Research Area (September 2007) Horizon 2020 (June 2012) University of Freiburg University of Oxford • Doctoral studies in Europe: excellence in researcher training (May 2007) • The TTO, a university engine transforming science into innovation (January 2012) Université de Genève Pierre & Marie Curie University • Universities -

Academic Bulletin for Paris, France 2018-19

Academic Bulletin for Paris, France: 2018-19 Page 1 of 21 (5/15/18) Academic Bulletin for Paris, France 2018-19 Introduction The Academic Bulletin is the CSU International Programs (IP) “catalog” and provides academic information about the program in Paris, France. CSU IP participants must read this publication in conjunction with the Academic Guide for CSU IP Participants (also known as the “Academic Guide”). The Academic Guide contains academic policies which will be applied to all IP participants while abroad. Topics include but are not limited to CSU Registration, Enrollment Requirements, Minimum/Maximum Unit Load in a Semester, Attendance, Examinations, Assignment of Grades, Grading Symbols, Credit/No Credit Option, Course Withdrawals and other policies. The Academic Guide also contains information on academic planning, how courses get credited to your degree, and the academic reporting process including when to expect your academic report at the end of your year abroad. To access the Academic Guide, go to our website here and click on the year that pertains to your year abroad. For general information about the Paris Program, refer to the CSU IP website under “Programs”. Academic Program Information The International Programs is affiliated with Mission Interuniversitaire de Coordination des Échanges Franco-Américains (MICEFA), the academic exchange organization of the cooperating institutions of the Universities of Paris listed below. Institut Catholique de Paris (ICP) Sorbonne Université (formerly Université Pierre-et-Marie- Institut -

Programme Description 2015 (PDF, 1.6

Table of contents Sciences Po at a glance Overview Map of Sciences Po Campus Programme curriculum Coordination & teaching Summer Camp Agenda Course syllabus To go further: useful resources Students class List Around Sciences Po The district of Saint-Germain-des-Prés Cultural attractions near Sciences Po Cafés’ and restaurants near Sciences Po Transportation Useful contacts Useful French Words and phrases Sciences Po at a glance Overview Sciences Po was established in February 1872 as the École Libre des Sciences Politiques by a group of French intellectuals, politicians and businessmen led by Émile Boutmy. Following defeat in the 1870 war, the demise of Napoleon III, and the Paris Commune, these men sought to reform the training of French politicians. Politically and economically, people feared France's international stature was waning due to inadequate teaching of its political and diplomatic corps. The new school developed a humanistic and pragmatic teaching program with instructors including academics as well as practitioners such as ministers, high civil servants, and businessmen. Sidney and Beatrice Webb used the purpose and curriculum of Sciences Po as part of their inspiration for creating the London School of Economics and Political Science in 1895. Sciences Po further strengthened its role as a scientific publication centre with significant donations from the Rockefeller Foundation. Sciences Po periodicals such as la Revue française de science politique, la Chronologie politique africaine, and the Cahiers de la Fondation as well as its nine research centers and main publishing house, Presses de Sciences Po, contribute to the notoriety attained by Sciences Po research. Sciences Po has undergone many reforms and introduced a compulsory year abroad component to its Bachelor degree, and now offers a multilingual curriculum in French, English, and other languages. -

Master Evolution, Natural Heritage, and Societies Education Rooted in a Museum’S Mission

MASTER EVOLUTION, NATURAL HERITAGE, AND SOCIETIES EDUCATION ROOTED IN A MUSEUM’S MISSION AT THE INTERSECTION OF EARTH, LIFE, SOCIAL, AND HUMAN SCIENCES, THE MUSEUM HAS BEEN DEVOTED TO NATURAL HISTORY FOR NEARLY FOUR CENTURIES. THE INSTITUTION AIMS TO BETTER UNDERSTAND THE DYNAMIC OF BIODIVERSITY IN THE PAST AND PRESENT IN ORDER TO ANTICIPATE THE FUTURE CONTRIBUTING TO SUSTAINABLE DEVELOPMENT THROUGH FOSTERING RESPONSIBLE MANAGEMENT OF RESOURCES AND ECOSYSTEMS, AND SPREADING KNOWLEDGE TO EVERYONE. © M.N.H.N. - M. Tengberg - M. © M.N.H.N. STUDY AT THE MUSEUM MASTER’S IN EVOLUTION, NATURAL HERITAGE, AND SOCIETIES – ENHS TARGET SKILLS The Master’s program trains researchers, experts, and professionals in 4 fields. — Description, inventory, and the historical interpretation of natural entities; — Evolution and dynamics of living processes from the molecular or genomic level to the scale of biotopes; — Human evolutionary and cultural history, past and present relationships between societies, spaces, and ecosystems — Diffusion of knowledge to the general public ONE DEGREE IN 6 SPECIALTIES — Ecology, Biodiversity, Evolution (EBE) — Environment: Natural and Social Dynamics (EDTS) — Living and Environmental Mechanisms (MVE) — Museology, Sciences, Culture and Societies (MSCS) — Quaternary and Prehistory(QP) — Systematics, Evolution, Paleontology(SEP) © M.N.H.N. - M. Tengberg - M. © M.N.H.N. © M.N.H.N. - K. Joaquina - K. © M.N.H.N. HIGH GRADUATE EMPLOYABILITY Graduates seeking employment benefit greatly from the establishment’s professional and scientific