Acquisition and Divestitures Impairment of Long-Lived Assets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

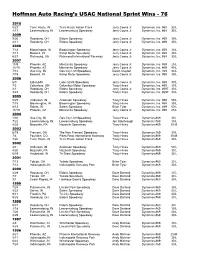

Hoffman Auto Racing's USAC National Sprint Wins

Hoffman Auto Racing’s USAC National Sprint Wins - 76 2010 5/27 Terre Haute, IN Terre Haute Action Track Jerry Coons Jr. Dynamics, Inc. #60 30 L 4/17 Lawrenceburg, IN Lawrenceburg Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 2009 9/26 Rossburg, OH Eldora Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 4/11 Rossburg, OH Eldora Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 2008 7/18 Bloomington, IN Bloomington Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 7/17 Boswell, IN Kamp Motor Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 6/27 Richmond, VA Richmond International Raceway Jerry Coons Jr. Dynamics, Inc. #69 30 L 2007 11/9 Phoenix, AZ Manzanita Speedway Jerry Coons Jr. Dynamics, Inc. #69 25 L 11/10 Phoenix, AZ Manzanita Speedway Jerry Coons Jr. Dynamics, Inc. #69 40 L 7/13 Gas City, IN Gas City I-69 Speedway Daron Clayton Dynamics, Inc. #69 30 L 7/19 Boswell, IN Kamp Motor Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 2006 6/9 Eldon,MO Lake Ozark Speedway Jerry Coons Jr. Dynamics, Inc. #69 30 L 7/5 Columbus, OH Columbus Motor Speedway Tracy Hines Dynamics, Inc. #69 30 L 4/1 Rossburg, OH Eldora Speedway Jerry Coons Jr. Dynamics, Inc. #69T 30 L 9/23 Rossburg, OH Eldora Speedway Tracy Hines Dynamics, Inc. #69T 30 L 2005 5/25 Anderson, IN Anderson Speedway Tracy Hines Dynamics, Inc. #69 50 L 7/15 Bloomington, IN Bloomington Speedway Tracy Hines Dynamics, Inc. #69 30 L 8/13 Salem, IN Salem Speedway Brian Tyler Dynamics, Inc. -

ISC-45 05 Annual FINAL.Qxd

ISC-45 COVER_comp_1.qxd 2/10/06 12:44 PM Page 1 THE FACE OF AMERICAN MOTORSPORTS International Speedway Corporation International Speedway Corporation 49th Annual Report 2005 Post Office Box 2801 Daytona Beach, Florida 32120-2801 386-254-2700 www.iscmotorsports.com For tickets, merchandise and information 888-4RACTIX (888-472-2849) www.racetickets.com ISC-45 COVER_1.qxd 2/9/06 10:44 AM Page 2 Board of Directors William C. France James C. France Chairman of the Board Chief Executive Officer International Speedway Corporation International Speedway Corporation Lesa France Kennedy Larry Aiello, Jr.1 President President and Chief Executive Officer International Speedway Corporation Corning Cable Systems J. Hyatt Brown1 John R. Cooper2 Chairman and Chief Executive Officer Retired as Vice President Brown & Brown, Inc. International Speedway Corporation Brian Z. France William P. Graves1 Chairman and Chief Executive Officer President and Chief Executive Officer NASCAR, Inc. American Trucking Associations Christy F. Harris Raymond K. Mason, Jr.1 Attorney in private practice of Chairman and President business and commercial law Centerbank of Jacksonville, N.A. TABLE OF CONTENTS Gregory W. Penske1 Edward H. Rensi1 President Retired as President and 3 Letter to Shareholders . Report of Management on Internal Control Penske Automotive Group, Inc. Chief Executive Officer Over Financial Reporting . 70 McDonald’s USA Selected Financial Data . 29 Chairman and Chief Executive Officer Market Price of and Dividends on Registrant’s Common Equity Team Rensi Motorsports Management’s Discussion and Analysis of Financial Condition and and Related Stockholder Matters. 71 Results of Operations. 30 Other Corporate Officers . 72 Consolidated Financial Statements . -

Racing Factbook Circuits

Racing Circuits Factbook Rob Semmeling Racing Circuits Factbook Page 2 CONTENTS Introduction 4 First 5 Oldest 15 Newest 16 Ovals & Bankings 22 Fastest 35 Longest 44 Shortest 48 Width 50 Corners 50 Elevation Change 53 Most 55 Location 55 Eight-Shaped Circuits 55 Street Circuits 56 Airfield Circuits 65 Dedicated Circuits 67 Longest Straightaways 72 Racing Circuits Factbook Page 3 Formula 1 Circuits 74 Formula 1 Circuits Fast Facts 77 MotoGP Circuits 78 IndyCar Series Circuits 81 IMSA SportsCar Championship Circuits 82 World Circuits Survey 83 Copyright © Rob Semmeling 2010-2016 / all rights reserved www.wegcircuits.nl Cover Photography © Raphaël Belly Racing Circuits Factbook Page 4 Introduction The Racing Circuits Factbook is a collection of various facts and figures about motor racing circuits worldwide. I believe it is the most comprehensive and accurate you will find anywhere. However, although I have tried to make sure the information presented here is as correct and accurate as possible, some reservation is always necessary. Research is continuously progressing and may lead to new findings. Website In addition to the Racing Circuits Factbook file you are viewing, my website www.wegcircuits.nl offers several further downloadable pdf-files: theRennen! Races! Vitesse! pdf details over 700 racing circuits in the Netherlands, Belgium, Germany and Austria, and also contains notes on Luxembourg and Switzerland. The American Road Courses pdf-documents lists nearly 160 road courses of past and present in the United States and Canada. These files are the most comprehensive and accurate sources for racing circuits in said countries. My website also lists nearly 5000 dates of motorcycle road races in the Netherlands, Belgium, Germany, Austria, Luxembourg and Switzerland, allowing you to see exactly when many of the motorcycle circuits listed in the Rennen! Races! Vitesse! document were used. -

Watkins Glen Track Map Pdf

Watkins glen track map pdf Continue Track Map Watkins Glen International Watkins Glen International - Watkins Glen, New Jersey Before heading to Watkins Glen International, be sure to print a track card. This will come in handy when trying to navigate the track on race day! See you on the track! Download (PDF, 724KB) Back Home Map of the original Watkins Glen Grand Prix Circuit, 1948 - 1952 White House S, Collier Monument, Schoolhouse Corner, Cornett Stone Bridge, Archie Smith Straight Railroad Corner, Monk's Corner, Big Bend, Milliken Corner, Start/Finish Line Original Circuit: 1948 - 1952 Self Guided Tour American Highway Race was revived in Watkins Glen, New Jersey on October 2, 1948, the first road race run since World War II. The 6.6-mile chain ran through the streets of the village, starting and ending in front of Schuyler County Court House. Permits from six government agencies are required for the closure of public roads for this event; State, County, Village, Reading, Dix and the New York State Parks Commission. It was also necessary to have permission from the New York Central Railroad to stop the trains during the race as the course crossed the tracks. The track was used for races from 1948 to 1952. Unchanged, it could be toured today as a public road. For those who were here in the early days, it is a sentimental journey. For those who have never been here, this is a lesson in the history of motorsport. The attractions listed below are also on our map of the original circuit. -

Out in Front of Motorsports Entertainment

OUT IN FRONT OF MOTORSPORTS ENTERTAINMENT 2 0 0 6 ANNUAL REPORT Driven by a Dream In 1957, “Big” Bill France’s innovative vision of a superspeedway capable of hosting the country’s most premier auto races began to take shape. He was able to break ground with the help of investors, and in 1959, that dream became a reality with the opening of Daytona International Speedway. Much has changed since then. In fiscal 2007, we celebrated the 49th running of The Great American Race, the Daytona 500. For nearly half a century, we have promoted Table of Contents racing on the high banks of Daytona International Speedway. Since the first green flag in 1959, our Company has embarked on a long and Letter to Shareholders . 3 successful path of growth to become a leader in motorsports entertainment. Selected Financial Data . 25 Complementing the vision of Big Bill was the steady hand of his wife, Management’s Discussion and Analysis of Financial Condition and Results of Operations. 26 Anne B. France, who ensured the company remained on solid financial Consolidated Financial Statements. 42 footing. Both Big Bill and Anne established the foundation upon which the Notes to Consolidated Financial Statements. 46 following generations of the France family would build the great American Reports of Independent Registered Public Accounting Firm . 68 success story. Beginning with a dream of a single superspeedway Report of Management on Internal Control in Florida, ISC has evolved into a preeminent leader in motorsports Over Financial Reporting. 70 entertainment with 13 major motorsports facilities in key markets across the Market Price of and Dividends on Registrant’s Common Equity and Related Stockholder Matters . -

A Nascar Affiliated Marketing Company Was Looking for Someone That Could Custom Design and Build a Long Life Trailer. They Look

A Nascar affiliated marketing company was looking for someone that could custom design and build a long life trailer. They looked toward Featherlite, Optima and several other well known aluminum trailer manufactures and were just not impressed. We gave them a tour of ATC's factory and introduced them to a couple of our engineers and they knew that ATC was the manufacture that they were looking for. ATC's CAD prints helped them know exactly how the trailers would be laid out so that they could order the simulators and other equipment to have installed. Advantage was able to provide business financing that made purchasing these trailers easy. Keep your eyes open at the following tracks and you may get to see this trailer in person and do some racing! Atlanta Motor Speedway Charlotte Motor Speedway Autodromo Hermanos Rodriguez Mansfield Motorsports Speedway Bristol Motor Speedway Martinsville Speedway Auto Club Speedway Memphis Motorsports Park Chicagoland Speedway Michigan International Speedway Darlington Raceway The Milwaukee Mile Daytona International Speedway Nashville Superspeedway Dover International Speedway Nazareth Speedway Gateway Int'l Raceway New Hampshire Motor Speedway Homestead-Miami Speedway Phoenix International Raceway Indianapolis Motor Speedway Pikes Peak International Raceway Indianapolis Raceway Park Pocono Raceway Sonoma Raceway Richmond International Raceway Kansas Speedway Talladega Superspeedway Kentucky Speedway Texas Motor Speedway Las Vegas Motor Speedway Watkins Glen International. -

Event Track Location Date Box Number Collection Auto Races 16Th Street Speedway Indianapolis, in 1950 Sep 15 CR-2-D Box 2 F26 9

Programs by Venue Event Track Location Date Box Number Collection Auto Races 16th Street Speedway Indianapolis, IN 1950 Sep 15 CR-2-D Box 2 f26 99A104 Eastern States Midget Racing Assoc 1986 Official Program Various Tracks 1986 Annual Mezz Box 19A TQ Midgets/Carts-Baltimore Indoor Racing 1st Mariner Arena Baltimore, MD 2012 Dec 8 Mezz Box 33 98A13 Accord Speedway Souvenir Magazine Accord Speedway Accord, NY 1982 Mezz Box 19A The Buckeye Sports Car Races Akron Airport Akron, OH 1957 Sep 1 Mezz Box 84 19A27 The Buckeye Sports Car Races Akron Airport Akron, OH 1958 Aug 3 Mezz Box 1 Auto Races Akron Motor Speedway Akron, NY 1935 Jul 14 CR-2-E Box 4 f10 99A104 Auto and Motorcycle Races Akron Motor Speedway Akron, NY 1935 May 30 CR-2-E Box 4 f8 99A104 Auto Races Akron Motor Speedway Akron, NY 1935 Sep 22 CR-2-E Box 4 f12 99A104 Midget Auto Races Akron Motor Speedway Akron, NY 1936 Jul 26 CR-2-E Box 4 f19 99A104 Auto Races Akron Motor Speedway Akron, NY 1936 May 30 CR-2-E Box 4 f16 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 May 30 CR-2-E Box 4 f21 99A104 Auto Races Akron Motor Speedway Akron, NY 1937 Sep 6 CR-2-E Box 4 f23 99A104 Talladega 500 Alabama International Motor Speedway Talladega, AL 1972 Aug 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1973 Aug 12 Mezz Box 28A Winston 500 Alabama International Motor Speedway Talladega, AL 1973 May 6 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, AL 1975 Aug 10 Mezz Box 28A Talladega 500 Alabama International Motor Speedway Talladega, -

Nazareth Speedway Rebirth Continues to Move at Slow Pace

Nazareth Speedway rebirth continues to move at slow pace By Pamela Sroka-Holzmann | The Express-Times on December 26, 2012 at 6:05 AM Mario Andretti of Nazareth poses in the pits at Nazareth Speedway. Express-Times File Photo The rebirth of the Nazareth Speedway continues to roll slowly along. It’s been eight years since auto racers lapped around the track, which was home to such racing greats as Mario Andretti, who won the 1969 U.S. Auto Club dirt champ car race there. It’s been seven years since the property went on the sales block, currently listed for $18.8 million. “My fans ask me all the time what is happening to the Nazareth Speedway,” Andretti said in an interview last week. “Every time I drive by it, it brings back quite pleasant memories. It’s a shame honestly.” The 157-acre site at Routes 191 and 248 is owned by Daytona-based International Speedway Corp., also known as ISC, which owns or operates about 13 motorsports facilities. Both Charles Talbert -- director, investor and corporate communications spokesman for International Speedway Corp -- and Glenn Fritts, senior vice president and broker of record at Weichert Commercial Brokerage, say little about the interest they have seen in the property. “The owners are still considering several opportunities -- each has its own benefits and issues,” Fritts said in an email. “Really the status hasn’t changed,” Talbert said. “The property still remains for sale. We definitely have interest in it.” Township Manager Timm Tenges said it’s been years since anyone has come before the township with plans to revive the property. -

For Immediate Release Media Contact

FOR IMMEDIATE RELEASE MEDIA CONTACT: Jonathan Gibson, Penske Corporation [email protected] 704-962-1307 Alex Damron, Hulman & Company [email protected] 317-501-4218 PENSKE CORPORATION TO PURCHASE HULMAN & COMPANY Acquisition to include the Indianapolis Motor Speedway, the NTT IndyCar Series and IMS Productions INDIANAPOLIS, IND. (November 4, 2019) – The Board of Directors of Hulman & Company announced today that it has entered into an agreement to be acquired by Penske Corporation, a global transportation, automotive and motorsports leader. Penske Entertainment Corp., a subsidiary of Penske Corporation, will acquire all Hulman & Company principal operating assets, including the Indianapolis Motor Speedway, the NTT IndyCar Series and IMS Productions. The transaction will close following receipt of applicable government approvals and other standard conditions. The acquisition by the Penske organization will carry the future of the legendary Speedway and the IndyCar Series forward for the next generation of racing fans. It was the vision of Carl Fisher to build the Indianapolis Motor Speedway (IMS) in 1909 and the track hosted its first races later that year. Eddie Rickenbacker later purchased the Speedway in 1927 before selling it to Tony Hulman and Hulman & Company in 1945. IMS has been the host of the world’s largest single-day sporting event – the Indianapolis 500 Mile Race – for more than 100 years. The iconic venue has also hosted NASCAR, Formula One and other racing series events throughout its storied history. The NTT IndyCar Series continues to be the premier open-wheel racing series in North America and is one of the most competitive championships in the world. -

View Annual Report

reportANNUAL 2001 SeeSee YouYou aatt tthehe RRaces!aces! Annual Report 2001 ISC remains uniquely positioned to maintain its leadership status while delivering the best in motorsports entertainment. ISC Total Revenue 1997-2001 (In Millions) $600 Letter to Shareholders . .3 500 Selected Financial Data . .17 400 300 Management’s Discussion and 200 Analysis of Financial Condition and Results of Operations . .18 100 0 1997 1998 1999 2000 2001 Consolidated Financial Statements . .28 Notes to Consolidated ISC Operating Income Financial Statements . .32 1997-2001 (In Millions) $180 Report of Independent 150 Certified Public Accountants . .47 120 90 Market for Registrant’s Common Equity and Related Stockholder Matters . .48 60 30 Other Executive Officers . .48 0 1997 1998 1999 2000 2001 Board of Directors . .49 1 “We remain excited about the future and believe our proven business strategies uniquely position our company to successfully capitalize on the industry’s future growth opportunities.” William C. France Chairman and Chief Executive Officer “The combination of strategic expansion, increased media benefits, effective event promotion and focused marketing efforts helped drive record financial results across the board.” James C. France President and Chief Operating Officer “Our long-term development efforts were rewarded in 2001 with the much-anticipated openings of the Kansas Speedway and Chicagoland Speedway.” Lesa D. Kennedy Executive Vice President 2 To Our Fellow Shareholders, International Speedway Corporation enjoyed a year of significant milestones and record financial success during 2001. The Company expanded its impressive national presence with the opening of two world-class facilities in key media markets. In addition, the Company enjoyed the first year of substantial financial benefit and increased exposure associated with NASCAR’s long-term domestic television broadcast rights agreements. -

Finding Aid for Phil Harms Collection, 1896-2003

Finding Aid for PHIL HARMS COLLECTION, 1896-2003 Accession 2009.103 Finding Aid Published: May 2016 Benson Ford Research Center, The Henry Ford 20900 Oakwood Boulevard ∙ Dearborn, MI 48124-5029 USA [email protected] ∙ www.thehenryford.org Phil Harms Collection 2009.103 OVERVIEW REPOSITORY: Benson Ford Research Center The Henry Ford 20900 Oakwood Blvd Dearborn, MI 48124-5029 www.thehenryford.org [email protected] ACCESSION NUMBER: 2009.103 CREATOR: Harms, Phil TITLE: Phil Harms Collection INCLUSIVE DATES: 1896-2003 BULK DATES: 1920-1970 QUANTITY: 53.7 cubic ft. (59 boxes) LANGUAGE: The materials are in English. ABSTRACT: The Phil Harms Collection documents the history of open wheel automobile racing in the United States through still and moving images, data and statistics, event programs, publications, periodicals, and news clippings. Page 2 of 54 Phil Harms Collection 2009.103 ADMINISTRATIVE INFORMATION ACCESS RESTRICTIONS: The collection is open for research TECHNICAL RESTRICTIONS: Use of original film contained in the collection is restricted. Access may be unavailable due to lack of appropriate software and hardware, or use copies may need to be produced unless otherwise noted. Researchers interested in this material should contact Benson Ford Research Center staff ([email protected]). COPYRIGHT: Copyright has been transferred to The Henry Ford by the donor. Copyright for some items in the collection may still be held by their respective creator(s). ACQUISITION: Collection acquired by The Henry Ford in 2009. RELATED MATERIAL: Related material held by The Henry Ford: - Books separated from the archival collection are located in the library collection of the Benson Ford Research Center. -

Grading the Economic Impact of the Daytona 500 Robert A

Marquette Sports Law Review Volume 10 Article 13 Issue 2 Spring High Octane? Grading the Economic Impact of the Daytona 500 Robert A. Baade Victor Matheson Follow this and additional works at: http://scholarship.law.marquette.edu/sportslaw Part of the Entertainment and Sports Law Commons Repository Citation Robert A. Baade and Victor Matheson, High Octane? Grading the Economic Impact of the Daytona 500, 10 Marq. Sports L. J. 401 (2000) Available at: http://scholarship.law.marquette.edu/sportslaw/vol10/iss2/13 This Symposium is brought to you for free and open access by the Journals at Marquette Law Scholarly Commons. For more information, please contact [email protected]. HIGH OCTANE? GRADING THE ECONOMIC IMPACT OF THE DAYTONA 500 ROBERT A. BAADE VICTOR MATHESON* INTRODUCTION Economic impact studies relating to professional sports have prolifer- ated in recent times. Those familiar with the sports industry understand that the avalanche of impact studies is not without purpose. Many of these reports have been commissioned to rationalize the use of public funds for building sports infrastructure. A recent study noted that by 2005 virtually all major league professional baseball, basketball, football and hockey teams will play in stadiums or arenas built after 1990 at a cost to the public of more than $14 billion.' Taxpayers have to be con- vinced that the investment in professional sports is prudent. Other sports interests have emulated the behavior of the major professional sports, and the opening of the public purse for major professional sports has triggered a deluge of requests for funds for commercial sports for everything from local golf tournaments to horse racing tracks.