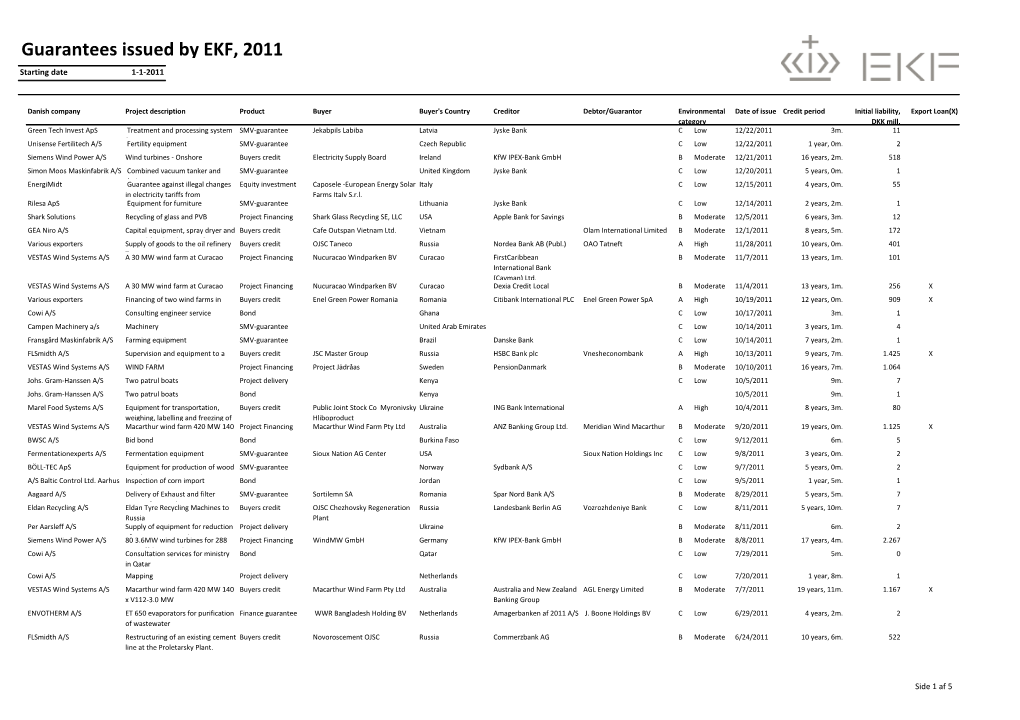

Guarantees Issued by EKF, 2011 Starting Date 1-1-2011

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jyske Bank H1 2014 Agenda

Jyske Bank H1 2014 Agenda • Jyske Bank in brief • Jyske Banks Performance 1968-2013 • Merger with BRFkredit • Focus in H1 2014 • H1 2014 in figures • Capital Structure • Liquidity • Credit Quality • Strategic Issues • Macro Economy & Danish Banking 2013-2015 • Danish FSA • Fact Book 2 Jyske Bank in brief 3 Jyske Bank in brief Jyske Bank focuses on core business Description Branch Network • Established and listed in 1967 • 2nd largest Danish bank by lending • Total lending of DKK 344bn • 149 domestic branches • Approx. 900,000 customers • Business focus is on Danish private individuals, SMEs and international private and institutional investment clients • International units in Hamburg, Zürich, Gibraltar, Cannes and Weert • A de-centralised organisation • 4,352 employees (end of H1 2013) • Full-scale bank with core operations within retail and commercial banking, mortgage financing, customer driven trading, asset management and private banking • Flexible business model using strategic partnerships within life insurance (PFA), mortgage products (DLR), credit cards (SEB), IT operations (JN Data) and IT R&D (Bankdata) 4 Jyske Bank in brief Jyske Bank has a differentiation strategy “Jyske Differences” • Jyske Bank wants to be Denmark’s most customer-oriented bank by providing high standard personal financial advice and taking a genuine interest in customers • The strategy is to position Jyske Bank as a visible and distinct alternative to more traditional providers of financial services, with regard to distribution channels, products, branches, layout and communication forms • Equal treatment and long term relationships with stakeholders • Core values driven by common sense • Strategic initiatives: Valuebased management Differentiation Risk management Efficiency improvement Acquisitions 5 1990 1996 2002 2006 (Q4) 2011/2012 Jyske Bank performance 1968-2013 6 ROE on opening equity – 1968-2013 Pre-tax profit Average: (ROE on open. -

External Borkers List

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2018 Global Head of Trading, Erling Skorstad 15/10/2018 Legal Name City of Domicile Country of Domicile LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABN Amro Group NV Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BCS Prime Brokerage Limited London UK 213800UU8AHE2B6QUI26 BGC Brokers LP London UK ZWNFQ48RUL8VJZ2AIC12 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Carnegie AS Norway Oslo Norway 5967007LIEEXZX57BC18 Carnegie Investment Bank AB (publ) Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities AS Oslo Norway 5967007LIEEXZXA40G44 CLSA (UK) London UK 213800VZMAGVIU2IJA72 Commerzbank AG Frankfurt -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Beholdningsoversigt 31.03.2021 Jyske Bank.Xlsx

INSTRUMENT_TYPE ISIN ISSUER_NAME Formue Københavns Kommune i kr. 4.069.081.439,62 Equity GB00B0SWJX34 London Stock Exchange Group PLC 1.701.893,31 Equity GB00B24CGK77 Reckitt Benckiser Group PLC 3.564.881,56 Equity AU000000SYD9 Sydney Airport 1.337.059,47 Equity JP3435000009 Sony Corp 6.910.276,86 Equity US0091581068 Air Products and Chemicals Inc 3.520.243,74 Equity US87918A1051 Teladoc Health Inc 1.795.360,11 Equity NL0012169213 QIAGEN NV 1.219.259,56 Equity US12504L1098 CBRE Group Inc 1.615.018,42 Equity FR0013154002 Sartorius Stedim Biotech 1.136.250,30 Equity CH0432492467 Alcon Inc 1.661.975,62 Equity FR0000121667 EssilorLuxottica SA 2.339.599,76 Equity CH0010645932 Givaudan SA 2.497.439,42 Equity CH0013841017 Lonza Group AG 2.547.489,13 Equity FR0010533075 Getlink SE 1.081.032,87 Equity AU0000030678 Coles Group Ltd 1.716.338,55 Equity NO0003054108 Mowi ASA 988.624,03 Equity GB00BHJYC057 InterContinental Hotels Group PLC 1.324.892,92 Equity NL0013267909 Akzo Nobel NV 2.081.864,14 Equity CA12532H1047 CGI Inc 1.974.562,46 Equity SE0012455673 Boliden AB 1.168.396,04 Equity BMG475671050 IHS Markit Ltd 1.720.814,54 Equity CA82509L1076 Shopify Inc 5.815.734,65 Equity CA7677441056 Ritchie Bros Auctioneers Inc 1.079.486,62 Equity JP3198900007 Oriental Land Co Ltd/Japan 2.377.930,50 Equity US6516391066 Newmont Corp 3.214.940,55 Equity IE00BK9ZQ967 Trane Technologies PLC 1.962.517,98 Equity GB00B39J2M42 United Utilities Group PLC 1.586.616,23 Equity US0036541003 ABIOMED Inc 1.469.304,62 Equity US9553061055 West Pharmaceutical Services Inc 1.484.522,98 -

EMTN-2020-Prospectus.Pdf

Prospectus JYSKE BANK A/S (incorporated as a public limited company in Denmark) U.S.$8,000,000,000 Euro Medium Term Note Programme On 22 December 1997, the Issuer (as defined below) entered into a U.S.$1,000,000,000 Euro Medium Term Note Programme (the “Programme”). This document supersedes the Prospectus dated 11 June 2019 and any previous Prospectus and/or Offering Circular. Any Notes (as defined below) issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. This Prospectus does not affect any Notes issued before the date of this Prospectus. Under the Programme, Jyske Bank A/S (the “Issuer”, “Jyske Bank” or the “Bank”) may from time to time issue notes (the ”Notes”), which may be (i) preferred senior notes (“Preferred Senior Notes”), (ii) non-preferred senior notes (“Non-Preferred Senior Notes”), (iii) subordinated and, on issue, constituting Tier 2 Capital (as defined in the Terms and Conditions of the Notes) (“Subordinated Notes”) or (iv) subordinated and, on issue, constituting Additional Tier 1 Capital (as defined in the Terms and Conditions of the Notes) (“Additional Tier 1 Capital Notes”) as indicated in the applicable Final Terms (as defined below). Notes may be denominated in any currency (including euro) agreed between the Issuer and the relevant Dealer (as defined below). The maximum aggregate principal amount of all Notes from time to time outstanding under the Programme will not exceed U.S.$8,000,000,000 (or its equivalent in other currencies calculated as described herein), subject to any increase as described herein. -

Quarterly Report for Q1 2008 for Spar Nord Bank DKK 183 Million in Pre-Tax Profits - Forecast for Core Earnings for the Year Repeated

To Stock Exchange Announcement OMX The Nordic Exchange Copenhagen No. 5, 2008 and the press For further information, contact: Lasse Nyby Chief Executive Officer Tel. +45 9634 4011 30 April 2008 Ole Madsen, Communications Manager Tel. +45 9634 4010 Quarterly report for Q1 2008 for Spar Nord Bank DKK 183 million in pre-tax profits - forecast for core earnings for the year repeated • Annualized 18% return on equity before tax • Net interest income up 15% to DKK 313 million • Net income from fees, charges and commissions down 20% to DKK 104 million • Market-value adjustments reduced to DKK 8 million • Costs grew 11% • DKK 8 million recognized as net income due to reversed impairment of loans and advances and related items • Earnings from the trading portfolio and an extra payment regarding Totalkredit amount to DKK 37 million in total • Lending up 15%, and a 26% hike in deposits • Forecast for core earnings for the year repeated Spar Nord Bank A/S • Moody’s rating: C, A1, P-1 (unchanged, outlook stable) Skelagervej 15 Developments in Q1 2008 P. O. Box 162 • 13 consecutive quarterly periods with net growth in customers DK-9100 Aalborg • Net interest income DKK 13 million up on Q4 2007 • Net income from fees, charges and commissions in line with Q3 and Q4 2007 results Reg. No. 9380 • Sustained strong credit quality level – reporting recognition of net income from Telephone +45 96 34 40 00 impairment of loans, advances, etc. for the 10th consecutive quarterly period Telefax + 45 96 34 45 60 • Business volume at same level as at end-2007 Swift spno dk 22 • Leasing activities continue to develop on a very satisfactory note • Interest margin widening at a moderate pace www.sparnord.dk • Wider yield spread between Danish mortgage-credit bonds and government bonds means distinctively lower market-value adjustments and loss on earnings from invest- [email protected] ment portfolios • Improved excess coverage relative to strategic liquidity target CVR-nr. -

Jyske Bank Q4 2020

Jyske Bank Q4 2020 23 February 2021 2020 in brief Clients experienced Negative rates – for better or worse All Progress Counts A changing organisation • More online meetings. • More clients began to invest • Own wind turbine to offset CO2 • An organisational change in the instead of having cash deposits. emission from direct and development organisation with • More specialists. indirect power consumption a view to becoming even more • To an increasing degree, the covered by means of own agile. • Fewer branches to visit. negative interest rate renewable energy production. environment was reflected in • Organisational changes in • A brand new mobile banking deposit rates for personal • First estimate of CO e emission Personal Clients to become platform. 2 clients. from business volumes. more focused and specialized. • Increased flexibility with Jyske • Targets for sustainability in all Frihed. • Advantageous interest rates • Many employees experienced and remortgaging opportunities material business areas. changed working conditions due for home owners remained. to COVID-19. • Energy loans and CO2 calculator facilitating energy retrofitting. • The sale of Jyske Bank Gibraltar • A new equity fund offering more was finalized. sustainable investment solutions. • New VISA card without Dankort. COVID-19 • Lockdown and restrictions affected Danish society in 2020. • Clients received individual advice and guidance about the COVID-19 situation. • Jyske Bank's employees were most flexible and adaptive, and the bank remained accessible. • A COVID-19 -

Remuneration for Bank Executives

Remuneration for bank execu- tives A study on the impacts of corporate governance codes on executive re- muneration in Sweden, Denmark and the United Kingdom between 2004 and 2010 Degree Project within Business Administration Author: Andreas Klang and Niclas Kristoferson Tutor: Assoc. Prof. Dr. Dr. Petra Inwinkl Jönköping May 2011 Acknowledgements The process of this degree project, would not have been what it is without a number of people whom have contributed and played a part in shaping it to what it is today We would like to thank our tutor Assoc. Prof. Dr. Dr. Petra Inwinkl for herr advice and guidance throughout the process of the whole thesis. This thesis would not have been the same without her influential ideas and constructive criticism. We would also like to thank our seminare partners for their constructive feedback dur- ing all seminars. At last we would like to thank our families and girlfriends whom have endure us during the past six months with constant support and love. Andreas Klang Niclas Kristoferson Division of work The authors of the Remuneration for bank executives, a study on the impacts of corporate go- vernance codes on executive remuneration in Sweden, Denmark and the United Kingdom be- tween 2004 and 2010 are Andreas Klang and Niclas Kristoferson. Andreas Klang have done fif- ty per cent and Niclas Kristoferson have done fifty per cent. Degree Project within Business Administration Title: Remuneration for Bank Executive- A study on the impacts of corporate governance on executive remuneration Author: Andreas Klang and Niclas Kristoferson Tutor: Assoc. Prof. Dr. Dr. -

12Thjune 2014 Helsinki Eba Clearing Shareholders

REPORT OF THE BOARD EBA CLEARING SHAREHOLDERS MEETING 12TH JUNE 2014 HELSINKI Contents 1. Introduction 3 2. The Company’s activities in 2013 5 2.1 EURO1/STEP1 Services 5 2.2 STEP2 Services 8 2.3 Operations 15 2.4 Legal, Regulatory & Compliance 18 2.5 Risk Management 20 2.6 Other corporate developments 21 2.7 The MyBank initiative 23 2.8 Activities of Board Committees 23 2.9 Corporate matters 26 2.10. Financial situation 29 3. The Company’s activities in 2014 32 3.1 EURO1/STEP1 Services 32 3.2 STEP2 Services 33 3.3 PRETA S.A.S. 35 3.4 Other relevant matters of interest 36 Appendix 1: Changes in EURO1/STEP1 participation 37 Appendix 2: List of participants in EURO1/STEP1 40 Appendix 3: List of direct participants in STEP2 45 Appendix 4: Annual accounts for 2013 53 2 EBA CLEARING SHAREHOLDERS MEETING // 12th June 2014 // Report of the Board 1. Introduction 2013 was marked by the major changeover that the SEPA migration end-date for euro retail payments of 1st February 2014 represented for payment service providers in the Eurozone and their customers. SEPA migration-related activities were also the top priority for EBA CLEARING throughout 2013. The Company continued to strengthen and enhance the STEP2 platform and intensified its customer support activities to assist its users across Europe in ensuring a disruption-free changeover to the SEPA instruments for their customers. SEPA migration affirmed the position of the STEP2 platform among the leading retail payment systems in Europe. The timely delivery of its SEPA Services as well as the processing capacity, operational robustness and rich functionality of the system made STEP2 the platform of first choice of many European communities in preparation of and during this migration. -

Updated As of 01/06/2017 Changes Highlighted in Yellow

NEW QUARTER TOTAL PDship per Previous Quarter Firm Legal Entity Holding Dealership AT BE BG CZ DE DK ES FI FR GR HU IE IT LV LT NL PL PT RO SE SI SK UK Current Quarter Changes Bank March 2016) ABLV Bank ABLV Bank, AS 1 bank customer bank customer 0 Abanka Vipa Abanka Vipa d.d. 1 bank customer bank customer 0 ABN Amro ABN Amro Bank N.V. 3 bank inter dealer bank inter dealer 0 Alpha Bank Alpha Bank S.A. 1 bank customer bank customer 0 Allianz Group Allianz Bank Bulgaria AD 1 bank customer bank customer 0 Banca IMI Banca IMI S.p.A. 3 bank inter dealer bank inter dealer 0 Banca Transilvania Banca Transilvania 1 bank customer bank customer 0 Banco BPI Banco BPI + 1 bank customer bank customer 0 Banco Comercial Português Millenniumbcp + 1 bank customer bank customer 0 Banco Cooperativo Español Banco Cooperativo Español S.A. + 1 bank customer bank customer 0 Banco Santander S.A. + Banco Santander / Santander Group Santander Global Banking & Markets UK 6 bank inter dealer bank inter dealer 0 Bank Zachodni WBK S.A. Bank Millennium Bank Millennium S.A. 1 bank customer bank customer 0 Bankhaus Lampe Bankhaus Lampe KG 1 bank customer bank customer 0 Bankia Bankia S.A.U. 1 bank customer bank customer 0 Bankinter Bankinter S.A. 1 bank customer bank customer 0 Bank of America Merrill Lynch Merrill Lynch International 9 bank inter dealer bank inter dealer 0 Barclays Barclays Bank PLC + 17 bank inter dealer bank inter dealer 0 Bayerische Landesbank Bayerische Landesbank 1 bank customer bank customer 0 BAWAG P.S.K. -

Private Information Trading and Enhanced Accounting Disclosure of Bank Stocks

PRIVATE INFORMATION TRADING AND ENHANCED ACCOUNTING DISCLOSURE OF BANK STOCKS Rocco Huang1 The World Bank, and the University of Amsterdam Abstract In this study, price-volume patterns of traded bank stocks in 47 countries around the world are examined, to study whether enhanced accounting information disclosure is associated with lower information asymmetry between informed and uninformed investors in the trading of bank stocks, as measured by Llorente et al. (2002)’s private information trading (PIT) indicator. The study finds that, the second pillar of Basel II, stronger supervisory power, is surprisingly associated with more private information trading (although we do not argue for causality in either direction). In contrast, the third pillar (information disclosure) of Basel II is found to be quite effective in reducing private information trading in bank stocks. We find that bank- level enhanced disclosures of accounting information (such as classification of loans or deposits by maturity), as defined by a composite index proposed by Nier (2005), is associated with significantly less PIT, and the magnitude of the effect is large enough to counteract the influence of existing national policies. Finally, we also find that level of PIT is not higher in bank than in their size-matched nonfinancial stocks, which suggests that banks may not be special when it comes to information asymmetry. 1 I especially want to thank Stijn Claessens for his numerous comments, suggestions, and encouragement, which help substantially improve this paper. I appreciate valuable comments from Vidhi Chhaochharia, Luc Laeven, and participants at a seminar in the World Bank. This paper’s findings, interpretations and conclusions are entirely those of the author and do not necessarily represent the views of the World Bank, its Executive Directors or the countries they represent. -

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A.