Case No COMP/M.6958 - CD&R/ WE BUY ANY CAR

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inting & Pictures Toys & Games

52 wiltsglosstandard.co.uk Thursday, August 21, 2014 Crockery & Cutlery For The Garden Furniture Household Miscellaneous Painting & Pictures Toys & Games DENBY Plates, selection of ELECTRIC TELESCOPIC SOFA Bed futon. Perfect FOLDING TRAVEL C HRADIATOR 24"H 20"W PRINTS/Posters 2 high RAILWAY engines (17) dinner, desert, side, sugar Hedge trimmer. VGC £30. condition. £20. 07501 CLOCK, German, Europa. c/w brackets etc little quality map of British singly framed all different bowl, milk jug, gravy boat 01453 543339 383718. Jewelled movement. Rare used white£15 single Empire goneby and ex cond £50 Tel 01285 X and saucers. All £2 each FREE TO COLLECTOR, model with calendar. panelsuit cloakroom Tel Aussie Tropical Island. 652604 01453 750244 bagged horse manure. OAK -effect glass top cof- Manual wind. New £5. 01285 861388 £20 01453 547331 07861 793875 fee table1200x600x460, 01453 811092 Curtains/Blinds vgc £80. 01285 655922 CLOCK, Black marble. Prams/Puschairs SCOOTER, good condi- GARDEN table, dark wood, STURDY CLOTHES hang- Heavy 10kg. 36cm tall 22- tion. Suit 6 - 12 years £5. slated, folding base not Table football. Ex cond CURTAINS 1 pair luxury WARDROBES 2 maple ing rail. Chrome, extend- 29 wide 15cm deep base. GRACO Mosaic One weathered excellent con- £10. 01454 616442 inter lined dark purple effect each with a mir- able & easy to assem- £80. 01453 547331 Deluxe Travel system. dition £25 Tel 01285 with gold embroidered rored door H76" D32" ble/dismantle. £12 01454 Complete, includes 641808 WII console, fit board 4 pattern, stillinpackage, W21" good condition £40 415844 pushchair, cosytoes, rain- Tel 01285 712036 games all vgc £35 TV/Video/Aerials 168cm x 182cm (66" x 07765937444 cover, car seat, box & DE Items Wanted instructions. -

The Road to Zero Next Steps Towards Cleaner Road Transport and Delivering Our Industrial Strategy

The Road to Zero Next steps towards cleaner road transport and delivering our Industrial Strategy July 2018 The Road to Zero Next steps towards cleaner road transport and delivering our Industrial Strategy The Government has actively considered the needs of blind and partially sighted people in accessing this document. The text will be made available in full on the Government’s website. The text may be freely downloaded and translated by individuals or organisations for conversion into other accessible formats. If you have other needs in this regard please contact the Department. Department for Transport Great Minster House 33 Horseferry Road London SW1P 4DR Telephone 0300 330 3000 General enquiries https://forms.dft.gov.uk Website www.gov.uk/dft © Crown copyright, 2018, except where otherwise stated. Printed in July 2018. Copyright in the typographical arrangement rests with the Crown. You may re-use this information (not including logos or third-party material) free of charge in any format or medium, under the terms of the Open Government Licence v2.0. To view this licence, visit http://www.nationalarchives.gov.uk/doc/open-government-licence Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. Contents Foreword 1 Policies at a glance 2 Executive Summary 7 Part 1: Drivers of change 21 Part 2: Vehicle Supply and Demand 33 Part 2a: Reducing emissions from vehicles already on our roads 34 Part 2b: Driving uptake of the cleanest new cars and vans 42 Part 2c: -

A Green Bus for Every Journey

A Green Bus For Every Journey Case studies showing the range of low emission bus technologies in use throughout the UK European engine Bus operators have invested legislation culminating significant sums of money and in the latest Euro VI requirements has seen committed time and resources the air quality impact of in working through the early new buses dramatically challenges on the path to improve but, to date, carbon emissions have not been successful introduction. addressed in bus legislation. Here in Britain, low carbon Investment has been made in new bus technologies and emission buses have been under refuelling infrastructure, and even routing and scheduling development for two decades or have been reviewed in some cases to allow trials and more, driven by strong Government learning of the most advanced potential solutions. policy. Manufacturers, bus operators A number of large bus operators have shown clear and fuel suppliers are embracing leadership by embedding low carbon emission buses into the change, aware that to maintain their sustainability agenda to drive improvements into the their viability, buses must be amongst environmental performance of their bus fleet. the cleanest and most carbon-efficient vehicles on the road. Almost 4,000 There have, of course, been plenty of hurdles along the Low Carbon Emission Buses (LCEB) are way; early hybrid and electric buses experienced initial now operating across the UK, with 40% of reliability issues like any brand new technology, but buses sold in 2015 meeting the low carbon through open collaboration the technology has rapidly requirements. These buses have saved over advanced and is now achieving similar levels of reliability 55,000 tonnes of greenhouse gas emissions as that employed in gas buses and conventional diesel (GHG) per annum compared with the equivalent buses, with warranties extending and new business number of conventional diesel buses. -

Decarbonising Transport in Northern Ireland

Research and Information Service Research Paper 7 October 2020 Des McKibbin Decarbonising Transport in Northern Ireland NIAR 289-20 This paper provides an overview of potential policies for decarbonising road and rail transport in Northern Ireland in support of UK wide commitments to reach net zero Green House Gas (GHG) emissions by 2050. It has been prepared for the NI Assembly Infrastructure Committee to inform their discussion on potential areas of inquiry. Paper 57/20 7 October 2020 Research and Information Service briefings are compiled for the benefit of MLAs and their support staff. Authors are available to discuss the contents of these papers with Members and their staff but cannot advise members of the general public. We do, however, welcome written evidence that relate to our papers and these should be sent to the Research and Information Service, Northern Ireland Assembly, Room 139, Parliament Buildings, Belfast BT4 3XX or e-mailed to [email protected] NIAR 289-20 Research Paper Executive Summary Policy Framework Tackling climate change requires an international effort and as such both the UK and the EU are parties to the United Nations Framework Convention on Climate Change (UNFCCC). Both the UK and EU have signed up to international climate change obligations, such as the Kyoto Protocol and the Paris Agreement. The 2015 Paris Agreement, a successor to the Kyoto Protocol, has been signed by 194 states and the European Union The UK has ratified the Paris Agreement separately from the EU and has committed to upholding its Paris Agreement obligations post Brexit. The Climate Change Act 2008 (2008 Act) originally established long term statutory targets for the UK to achieve an 80% reduction in GHG by 2050 against a 1990 baseline. -

Cooley Working to Save Historic Trademarks

Eye Screenings Library Program for Free Cataract Aids Vets Surgeries Page 3 Page 4 Volume 36 • Issue 11 Serving Carmichael and Sacramento County since 1981 March 11, 2016 THE POPULIST REVOLUTION: ‘Giovanni’s BERNIE AND BEYOND Breakfast for the Birds Bucket List Vacation’ Fund Local Man Kicks off GoFundMe Account for Boy and Family Laughed off Airplane SACRAMENTO REGION, CA (MPG) - Page 14 Like most people who read their story, Keith Anthony doesn’t know the Phoenix family—7-year- old Giovanni, his mom, Christina Fabian, and dad, Jorge Alvarado— IT CAN BE A personally, but he was deeply moved by their recent plight when they were removed from an Allegiant Airlines HARD PILL TO flight after Giovanni began to experi- ence an allergic reaction to a dog that SWALLOW was on the airplane. As many sto- ries reported, passengers applauded as the family—who was attempt- ing a “bucket list” trip due to Jorge’s stage-4 terminal throat cancer— END OF THE exited the airplane. Anthony, a father of two who lives in Roseville, wanted to make BENCH right what he saw as a major lack of compassion—and to help this fam- While a green heron surveys nature’s buffet in American River shallows, ily take their trips before Alvarado BY GERRY SCHOLL a ruby-eye kite (right) hunts from on high. Breeding season behavior of waders, raptors, and scores of avian species will be observed during the can no longer do so, and launched Page 13 March 19th and 20th Bird and Breakfast fundraiser at Effie Yeaw Nature a GoFundMe page: “Giovanni’s Center. -

Automotive Quarterly – August 2019

Automotive Automotive Quarterly – August 2019 Inhalt Kapitalmärkte und Umsätze .............................................1 Absatz ..................................................................................2 Margen und Durchschnittspreise .....................................3 Effizienz: F&E und Mitarbeiterproduktivität ..................4 Effizienz: Vorräte ...............................................................5 M&A-Transaktionen – Automobilmarkt .........................6 Seite 7 Sonderthema Effektive BEV-Einführung in Europa – jenseits der Hauptmärkte Kapitalmärkte und Umsätze 1. Auto-Werte unter Vorjahr, aber wieder im Abbildung 1. Aktienindex-Entwicklung Aufschwung [100% = Indexstand zum Berichtsstart 30.06.2017] 150 Seit dem Tiefpunkt im vierten Quartal 2018 sind sowohl die STOXX® Europe 600 STOXX® Global 3000 140 STOXX® Europe 600 STOXX® Global 3000 allgemeinwirtschaftlichen Indizes als auch die Automobilwerte 130 Automobiles & Parts Automobiles & Parts wieder im Erholungsmodus. Auch im Vergleich zum ersten Quar- Abbildung120 1. Aktienindex-Entwicklung tal 2019 sind allgemeine Werte in Europa (+3,5%) und weltweit [100% = Indexstand zum Berichtsstart 30.06.2017] 110 (+2,6%) im Wachsen begriffen. Gleiches gilt für die automobilen 150 100 STOXX® Europe 600 STOXX® Global 3000 Indizes, doch notieren diese weiterhin unter dem Vorjahresquar- 140 STOXX® Europe 600 STOXX® Global 3000 90 tal: Der STOXX Global 3000 Auto notiert 1,6% über dem Q1 130 Automobiles & Parts Automobiles & Parts aber 7,6% unter dem Q2/2018, der STOXX Europe 600 Auto 80 120 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 5,1% notiert über dem Q1 aber 6,5% unter dem Q2/2018. 1102017 2017 2017 2018 2018 2018 2018 2019 2019 Trotz leichter Erholung der Automobilindizes innerhalb der letzten Quelle:100 Arthur D. Little, STOXX®; jeweils Werte zum Quartalsende drei Quartale scheint die Stimmung weiter getrübt. Auch melden 90 fast alle Hersteller Belastungen durch Handelsstreit, Brexit und Abbildung80 2. -

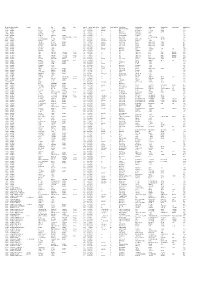

Credit Balance Report

Financial Solutions Non Domestic Rates – Credit Balance Report June 2020 This report will list all non domestic rates accounts that have a credit balance, from the rating year 2013/2014 to 2020/2021. Detailed in the report is the ratepayer name (only limited companies or other organisations), credit amount, rating year, property address, property description and reference. This report is updated monthly. Rec Yr Credit Ratepayer Property Address 1 Property Address 2 Property Address 3 Property Address 4 Property Address 5 Postcode Reference 2020 -£419.14 A & J Robertson (granite) Ltd 402 Viewfield Road Coatbridge ML5 5QU N014654 2020 -£766.25 A & J Robertson (granite) Ltd 499/501 499 Windmillhill Street Motherwell ML1 2UF N010446 2018 -£4.00 A7 Greendykeside Limited 1 Greendykeside Longriggend Airdrie ML6 7TT N014150 2019 -£468.04 About Grab Hire Uk Ltd Unit 2 Evans Business Cen 100 Inchinnan Road Industrial Estate Bellshill ML4 3JA N013226 2016 -£4.61 Abr Properties Wishaw Limited 1 Young Street Wishaw ML2 8HJ N003118 2020 -£2,281.24 Ace Travel (Scotland) Ltd Ninian Road 1 Brownsburn Industrial Estate Airdrie ML6 9SE N015734 2019 -£177.26 Acqsys Supply Chain Solutions Ltd Unit 1 Medi Park Mallard Way 6 Phoenix Crescent Strathclyde Business Park Bellshill ML4 3NJ N003622 2017 -£127.67 Acumen Steel Processing Ltd Unit 20, 17 & 20 Flemington Ind Park 1 Robberhall Road Motherwell ML1 N013069 2017 -£20.71 Acumen Steel Processing Ltd Unit 14a Flemington Ind Park 1 Robberhall Road Motherwell ML1 N015144 2019 -£2,279.70 Adt Fire And Security Plc -

05-30-2014.Pdf

MARTIN COUNTY Vol. 12, No. 52 www.HometownNewsOL.com Friday, May 30, 2014 POTTING SOIL EARL ON CARS HOROSCOPE HURRICANE? Learn what is the best potting The truth behind ‘guaranteed Find out what your What the effects of a soil for your plants credit approval’ horoscope has in store hurricane might be on your for you weekend golf trip GARDENING 14 BUSINESS 3 ENTERTAINMENT 9 GOLF 16 COMPUTE THIS Tireless effort SEAN MCCARTHY brings children into ne of the most basic moves one Oneeds to master in forever families order to get anything By Anna-Marie Menhenott children on the walls of the gallery done on a personal com- [email protected] in 2007. Since that time, he has wit- puter is the "click." nessed the adoption of more than Sounds simple and TREASURE COAST — For Frank 60 children. obvious, doesn't it? Avilla, the faces on the Heart Gallery “It’s incredibly rewarding when I Well, it is, but as many of Okeechobee & the Treasure new computer users are can stand in a courtroom and Coast are more than just children watch the judge bang the gavel as finding, it's not necessar- who need a home… they are the ily simple. There are a an adoption is finalized,” Mr. Avilla faces of those who need someone said. “We place the faces of hard to few things that need to to stand up for them. be kept in mind in order place children on the gallery. Chil- Photo courtesy of Children’s Home Society Mr. Avilla, marketing specialist dren between the age of 7 and 17 to master that one basic for Children’s Home Society, began Frank Avilla is the Director of Marketing at Children’s Home action. -

Market Watch

AMi Market Watch contents • H1 new car registration performance • Sales per franchised outlet data and brand comparison for 2013 and historic • Sales per franchised outlet segmented into brand type (volume, i premium etc) Market Watch • Dealer group financial status report August 2013 on 2012 • AM100 spring 2013 analysis Welcome to the second issue of AMi Market Watch, a quarterly update of the major events in the car retail market, • New car launch activity this year providing insight and analysis, together with a look at the • Dealer group acquisition activity attitudes and confidence of dealers and manufacturers. • News summary The primary source of data is AM’s information portal AMi (www.am-online.com/ami) together with insight from the • New car pricing and finance offer SMMT and AM’s research and insight business Sewell’s. trends Price £250 i Market Watch Winners and losers New car in the June market Winners: Suzuki: volume growth registrations of 38.14% in June Renault: + 34.27% – Q2 2013 Ford: + 31.89% Vauxhall: + 16.57% Maserati: + 66.67% Volumes in Q2 rose 13% this year, posting the Aston Martin: + 61.67% strongest quarterly rise since Q3 2011. VW: + 14.43% UK new car registrations continued to rise across private, fleet and business sales types, although private demand has secured the most significant growth. Lotus: + 466.67% Registrations in June grew 13.4% securing a 16th successive month of growth and pushing half year volumes through the one million mark. Losers: The UK continues to buck new car market trends in some EU27 countries, with buyers returning to the market after a sustained hold-off from purchasing new vehicles, enticing finance deals and desire to switch Chrysler: down 32.26% to more fuel-efficient models driving market growth. -

Friday, July 16, 2021

REALTY CHECK ROGERS COLUMN The new math of No, a cat’s place real estate boom is in the house How do you sell 4,649 We don’t let dogs roam the houses in June when there are city streets. So why is it OK only 4,308 available for sale? for cats? It shouldn’t be. P3 P3 July 16-22, 2021 Vol. 47 | Issue 29 NASHVILLE EDITION www.TNLedger.com The power of information. LedgerDAVIDSON • WILLIAMSON • RUTHERFORD • CHEATHAM WILSON SUMNER• ROBERTSON • MAURY • DICKSON • MONTGOMERY FORMERLY WESTVIEW SINCE 1978 ‘Great unknown’ of Photo by Michelle Morrow |The Ledger |The Michelle Morrow by Photo COVID still lingers Health offi cials wait, worry as public Story by Kathy Carlson brushes aside continuing risks begins on page 2 ern Express, Inc, BEHIND THE WHEEL Hampshire Insurance Company, Western Express, Inc, Def Atty(s): John W Barringer, 08/30/2010, 10C3341 October 8 - 14, 2010 Patricia McClarren vs Star Insurance Company, Westwood Church Of Christ, Law & GovernmentPltf(s): James T Collins, Def(s): Star Insurance Company, Westwood Church Of Christ, Def Get dirty for PublicAtty(s): David John Deming, 08/30/2010, 10C3343 Pltf(s): James A Richard Dicaire vs Cbs Personnel Holdings Inc, Cbs Personnel Services LLC, Kilgore Group Inc Collectively Staffmark, Staffmark Investment LLC, Records Pltf Atty(s): n/a, Def(s): Cbs Personnel Holdings Inc, Cbs Personnel less than $40K 08/26/2010, 10C3303 Services LLC, Kilgore Group Inc Collectively Staffmark, Staffmark James T Collins vs Rogers Group Inc, Investment LLC, Def Atty(s): Stephen B Morton, 08/26/2010, Pltf Atty(s): n/a, Def(s): Rogers Group Inc, Def Atty(s): Heather E Hardt, 08/26/2010,inside 10C3308 & online James A Wells vs Jenco Construction Inc, Want to go off -roading or Wells, Pltf Atty(s): n/a, Def(s): JencoTNLedger.com Construction Inc,Pltf(s): Def Atty(s): Judy R Lawson, Jennifer S White, 08/25/2010, 10C3282 Jessica Grimwood vs Intrepid USA Healthcare Services, at least look like you might? RealtyPltf(s): JessicaCheck Grimwood, ...................................... -

Empty Properties

Liable From Property Reference Account Name Account Name Address Address Address Address Postcode Rv Empty From Exempt Epr Empty Prop Exemption Type VO Property Description Code VO Property Description Correspondence Address Correspondence Address Correspondence Address Correspondence Address Correspondence Address 01/04/1994 6100362000002 BISHOPS THE AVENUE WORCESTER WR1 3QA 8300 21/07/2012 Y Y Listed Building CS3 HAIRDRESSING SALON AND PREMISES 4 CHARNWOOD CLOSE ST JOHNS WORCESTER WR2 4NZ 05/06/2015 6106080001411 PART 1ST FLOOR 14 THE TYTHING WORCESTER WR1 1HD 5200 01/04/2016 Y Y Listed Building CO Offices C/O MR DAVID DUCKHAM 14 THE TYTHING WORCESTER WR1 1HD 31/08/2011 6101482000100 1 COMER ROAD WORCESTER WR2 5HU 1775 31/08/2011 Y Y RV CS SHOP AND PREMISES ST JOHNS FISH BAR LAMBERT ROAD WORCESTER WR2 5HU 01/04/1994 6106080004101 R/O 41 THE TYTHING WORCESTER WR1 1JT 2000 01/04/2002 Y Y RV IF3 WORKSHOP AND PREMISES 3 STEPHENSON TERRACE WORCESTER WR1 3EA 23/06/1997 6106020011300 CAR SALES ADJ 113 TUNNEL HILL WORCESTER WR4 9SB 1875 01/04/2002 Y Y RV CX CAR SALES LAND AND PREMS 113 TUNNEL HILL WORCESTER WR4 9SB 01/03/2007 610068550600C GROUND FLOOR UNIT 60C BLACKPOLE TRADING ESTATE WEST WORCESTER WR3 8TJ 6500 31/07/2016 N Y CO OFFICES AND PREMISES UNIT 60C BLACKPOLE TRADING ESTATE WEST WORCESTER WR3 8TJ 10/08/2013 6106080001311 GND FLOOR REAR 1ST & 2ND FLOORS 13 THE TYTHING WORCESTER WR1 1HD 4550 10/08/2013 Y Y Listed Building IF3 Workshop and Premises C/O 2 MELSTOCK ROAD KINGS HEATH BIRMINGHAM B14 7ND 09/12/2001 6102970000100 1 HUNGERPIT -

Credit Balance Report

Financial Solutions Non Domestic Rates – Credit Balance Report July 2020 This report will list all non domestic rates accounts that have a credit balance, from the rating year 2013/2014 to 2020/2021. Detailed in the report is the ratepayer name (only limited companies or other organisations), credit amount, rating year, property address, property description and reference. This report is updated monthly. Rec Yr Credit Ratepayer Property Address 1 Property Address 2 Property Address 3 Property Address 4 Property Address 5 Postcode Reference 2020 -£766.25 A & J Robertson (granite) Ltd 499/501 499 Windmillhill Street Motherwell ML1 2UF N010446 2020 -£419.14 A & J Robertson (granite) Ltd 402 Viewfield Road Coatbridge ML5 5QU N014654 2020 -£1,069.43 A. & E. Ceresa Limited 154 Cumbernauld Road Stepps Glasgow G33 6HA N008469 2018 -£4.00 A7 Greendykeside Limited 1 Greendykeside Longriggend Airdrie ML6 7TT N014150 2019 -£468.04 About Grab Hire Uk Ltd Unit 2 Evans Business Cen 100 Inchinnan Road Industrial Estate Bellshill ML4 3JA N013226 2016 -£4.61 Abr Properties Wishaw Limited 1 Young Street Wishaw ML2 8HJ N003118 2019 -£177.26 Acqsys Supply Chain Solutions Ltd Unit 1 Medi Park Mallard Way 6 Phoenix Crescent Strathclyde Business Park Bellshill ML4 3NJ N003622 2017 -£20.71 Acumen Steel Processing Ltd Unit 14a Flemington Ind Park 1 Robberhall Road Motherwell ML1 N015144 2017 -£127.67 Acumen Steel Processing Ltd Unit 20, 17 & 20 Flemington Ind Park 1 Robberhall Road Motherwell ML1 N013069 2018 -£1,529.97 Airdrie Print Services Limited Unit 4 4 Flowerhill