Altria 2018 CAGNY Remarks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Altria.Com/Proxy

6601 West Broad Street Richmond, Virginia 23230 Dear Fellow Shareholder: It is my pleasure to invite you to join us at the 2016 Annual Meeting of Shareholders of Altria Group, Inc. to be held on Thursday, May 19, 2016 at 9:00 a.m., Eastern Time, at the Greater Richmond Convention Center, 403 North 3rd Street, Richmond, Virginia 23219. At this year’s meeting, we will vote on the election of 11 directors, the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm and, if properly presented, two shareholder proposals. We will also conduct a non-binding advisory vote to approve the compensation of the Company’s named executive officers. There also will be a report on the Company’s business, and shareholders will have an opportunity to ask questions. To attend the meeting, an admission ticket and government-issued photo identification are required. To request an admission ticket, please follow the instructions on page 9 in response to Question 16. One immediate family member who is 21 years of age or older may accompany a shareholder as a guest. We use the U.S. Securities and Exchange Commission rule that allows companies to furnish proxy materials to their shareholders over the Internet. We believe this expedites shareholders receiving proxy materials, lowers costs and conserves natural resources. We thus are mailing to many shareholders a Notice of Internet Availability of Proxy Materials, rather than a paper copy of the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2015. -

Altria Group, Inc. Annual Report

ananan Altria Altria Altria Company Company Company an Altria Company ananan Altria Altria Altria Company Company Company | Inc. Altria Group, Report 2020 Annual an Altria Company From tobacco company To tobacco harm reduction company ananan Altria Altria Altria Company Company Company an Altria Company ananan Altria Altria Altria Company Company Company an Altria Company Altria Group, Inc. Altria Group, Inc. | 6601 W. Broad Street | Richmond, VA 23230-1723 | altria.com 2020 Annual Report Altria 2020 Annual Report | Andra Design Studio | Tuesday, February 2, 2021 9:00am Altria 2020 Annual Report | Andra Design Studio | Tuesday, February 2, 2021 9:00am Dear Fellow Shareholders March 11, 2021 Altria delivered outstanding results in 2020 and made steady progress toward our 10-Year Vision (Vision) despite the many challenges we faced. Our tobacco businesses were resilient and our employees rose to the challenge together to navigate the COVID-19 pandemic, political and social unrest, and an uncertain economic outlook. Altria’s full-year adjusted diluted earnings per share (EPS) grew 3.6% driven primarily by strong performance of our tobacco businesses, and we increased our dividend for the 55th time in 51 years. Moving Beyond Smoking: Progress Toward Our 10-Year Vision Building on our long history of industry leadership, our Vision is to responsibly lead the transition of adult smokers to a non-combustible future. Altria is Moving Beyond Smoking and leading the way by taking actions to transition millions to potentially less harmful choices — a substantial opportunity for adult tobacco consumers 21+, Altria’s businesses, and society. To achieve our Vision, we are building a deep understanding of evolving adult tobacco consumer preferences, expanding awareness and availability of our non-combustible portfolio, and, when authorized by FDA, educating adult smokers about the benefits of switching to alternative products. -

(NON-FILTER) KS FSC Cigarettes: Premiu

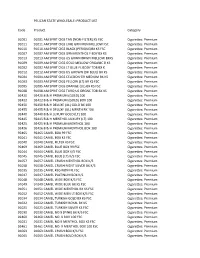

PELICAN STATE WHOLESALE: PRODUCT LIST Code Product Category 91001 91001 AM SPRIT CIGS TAN (NON‐FILTER) KS FSC Cigarettes: Premium 91011 91011 AM SPRIT CIGS LIME GRN MEN MELLOW FSC Cigarettes: Premium 91010 91010 AM SPRIT CIGS BLACK (PERIQUE)BX KS FSC Cigarettes: Premium 91007 91007 AM SPRIT CIGS GRN MENTHOL F BDY BX KS Cigarettes: Premium 91013 91013 AM SPRIT CIGS US GRWN BRWN MELLOW BXKS Cigarettes: Premium 91009 91009 AM SPRIT CIGS GOLD MELLOW ORGANIC B KS Cigarettes: Premium 91002 91002 AM SPRIT CIGS LT BLUE FL BODY TOB BX K Cigarettes: Premium 91012 91012 AM SPRIT CIGS US GROWN (DK BLUE) BX KS Cigarettes: Premium 91004 91004 AM SPRIT CIGS CELEDON GR MEDIUM BX KS Cigarettes: Premium 91003 91003 AM SPRIT CIGS YELLOW (LT) BX KS FSC Cigarettes: Premium 91005 91005 AM SPRIT CIGS ORANGE (UL) BX KS FSC Cigarettes: Premium 91008 91008 AM SPRIT CIGS TURQ US ORGNC TOB BX KS Cigarettes: Premium 92420 92420 B & H PREMIUM (GOLD) 100 Cigarettes: Premium 92422 92422 B & H PREMIUM (GOLD) BOX 100 Cigarettes: Premium 92450 92450 B & H DELUXE (UL) GOLD BX 100 Cigarettes: Premium 92455 92455 B & H DELUXE (UL) MENTH BX 100 Cigarettes: Premium 92440 92440 B & H LUXURY GOLD (LT) 100 Cigarettes: Premium 92445 92445 B & H MENTHOL LUXURY (LT) 100 Cigarettes: Premium 92425 92425 B & H PREMIUM MENTHOL 100 Cigarettes: Premium 92426 92426 B & H PREMIUM MENTHOL BOX 100 Cigarettes: Premium 92465 92465 CAMEL BOX 99 FSC Cigarettes: Premium 91041 91041 CAMEL BOX KS FSC Cigarettes: Premium 91040 91040 CAMEL FILTER KS FSC Cigarettes: Premium 92469 92469 CAMEL BLUE BOX -

Alameda County Tobacco Retailer License & Flavored Tobacco Training

ALAMEDA COUNTY TOBACCO RETAILER LICENSE & FLAVORED TOBACCO PRESENTATION 7/29/20 Providing Education and Support to Tobacco Retailers in Alameda County Agenda ❑ Welcome/Introductions ❑ Zoom Housekeeping ❑ Why Tobacco Retail Regulations? ❑ Alameda County’s Tobacco Retail Licensing Ordinance ❑ Restricted Tobacco Products ❑ Questionable Products ❑ Tobacco Retailer License Application Process ❑ Q & A WHY TOBACCO RETAIL REGULATIONS? Flavored Tobacco Hooks Kids Over 90% of adult smokers started before age 18 Flavored tobacco initiates youth tobacco use 4 out of 5 youth smokers started with a flavored product Adolescents are more likely than adults to use flavored e-cigs Fruit and candy flavors are designed to appeal to youth users by masking the harsh taste of tobacco Strong Tobacco Retail Licensing ordinances are effective at decreasing youth tobacco sales rates ALAMEDA COUNTY’S TOBACCO RETAILER LICENSING (TRL) ORDINANCE Overview of Adopted TRL Ordinance Purpose is to reduce youth access to tobacco, and to limit negative public health effects of tobacco use. Requires businesses in Unincorporated Alameda County that sell tobacco to obtain a local license annually to sell tobacco. Provides enforcement mechanism; holds retailers accountable to comply with local requirements, as well as state and federal tobacco laws. Overview of Adopted TRL Ordinance TRL ordinance adopted by BOS on January 14, 2020 Electronic Smoking Devices adopted by BOS on March 10, 2020 Retailers obtain TRL by August 7, 2020 Enforcement of both laws begin: September -

At Work in the World

Perspectives in Medical Humanities At Work in the World Proceedings of the Fourth International Conference on the History of Occupational and Environmental Health Edited by Paul D. Blanc, MD and Brian Dolan, PhD Page Intentionally Left Blank At Work in the World Proceedings of the Fourth International Conference on the History of Occupational and Environmental Health Perspectives in Medical Humanities Perspectives in Medical Humanities publishes scholarship produced or reviewed under the auspices of the University of California Medical Humanities Consortium, a multi-campus collaborative of faculty, students and trainees in the humanities, medi- cine, and health sciences. Our series invites scholars from the humanities and health care professions to share narratives and analysis on health, healing, and the contexts of our beliefs and practices that impact biomedical inquiry. General Editor Brian Dolan, PhD, Professor of Social Medicine and Medical Humanities, University of California, San Francisco (ucsf) Recent Monograph Titles Health Citizenship: Essays in Social Medicine and Biomedical Politics By Dorothy Porter (Fall 2011) Paths to Innovation: Discovering Recombinant DNA, Oncogenes and Prions, In One Medical School, Over One Decade By Henry Bourne (Fall 2011) The Remarkables: Endocrine Abnormalities in Art By Carol Clark and Orlo Clark (Winter 2011) Clowns and Jokers Can Heal Us: Comedy and Medicine By Albert Howard Carter iii (Winter 2011) www.medicalhumanities.ucsf.edu [email protected] This series is made possible by the generous support of the Dean of the School of Medicine at ucsf, the Center for Humanities and Health Sciences at ucsf, and a Multi-Campus Research Program grant from the University of California Office of the President. -

2016 Investor Highlights

Our Mission is to own and develop financially disciplined businesses that are leaders in INVESTOR responsibly providing adult tobacco and wine consumers with superior branded products. HIGHLIGHTS INVEST IN SATISFY ADULT ALIGN WITH CREATE SUBSTANTIAL VALUE LEADERSHIP CONSUMERS SOCIETY FOR SHAREHOLDERS 2016 3 LONG-TERM FINANCIAL GOALS adjusted diluted a target dividend ADJUSTED Grow Maintain GREW EPS at an average annual payout ratio of approximately 1 DILUTED EPS rate of to of adjusted 7% 9% 80% diluted EPS +8.2% STRATEGIES INCREASED 1 MAXIMIZE income from core tobacco businesses over the long term. THE DIVIDEND BY Marlboro has been the leading U.S. cigarette brand for over +8.0% 40 years4 and is the retail REPRESENTING THE share leader in 50TH DIVIDEND all 50 states.5 Nat Sherman, acquired in INCREASE 2017, offers a portfolio of Copenhagen and Skoal combined represent more than IN super premium 47 YEARS half the smokeless cigarettes and premium SMOKELESS SEGMENT SMOKEABLE SEGMENT 5 cigar products. category. $ 2 GROW new income streams with innovative tobacco products. 5.5 In heated tobacco, Altria has the IN BILLION exclusive DIVIDENDS PAID AND SHARES REPURCHASED rights to commercialize World-Class MarkTen XL the IQOS system Research was the in the United States DELIVERED A fastest through an agreement TOTAL SHAREHOLDER with Philip Morris RETURN2 OF growing e-vapor International. brand in Q4 of 2016.5 20.5%, 3 MANAGE diverse income streams and a strong balance sheet to deliver consistent financial performance. TH THE 4 2017 marks the 50th anniversary In 2016, CONSECUTIVE of Chateau Ste. Michelle, Ste. -

Altria Group Inc. (MO)

5/8/2015 Altria Group Inc. (MO) • Altria Group, Inc. was founded in 1919 and is headquartered in Richmond, Virginia. (9,000 employees) Altria Group Inc. (MO) • Manufactures and sells cigarettes, smokeless products, and wine in the United States. Consumer Staples • Largest U.S. tobacco company accounting for 50.6% of total U.S. cigarette sales. • Provides finance leasing services primarily in aircraft, rail and surface transport, electric power, real estate, and manufacturing industries. Applied Portfolio Management • In addition, MO retains almost 27% economic and voting interest in SABMiller, the world’s second-largest brewing company. Investment Thesis Segments Breakdown • Altria is the largest player in the U.S. tobacco market, with about 50% share. • Marlboro is the dominant cigarette brand in the U.S. with about 42% market share. • Its Copenhagen and Skoal brands combined enjoy roughly 50% share in the steadily growing smokeless tobacco market. • Black & Mild is the second best selling machine-made large cigar in the U.S. • Altria’s annualized dividend payout ratio for 2014 was 80.9%, which was the highest in the S&P Food, Beverage & Tobacco Index. • MO has increased its dividend 48 times in the last 45 years & we expect this trend to continue. • Although we expect domestic cigarette industry volumes to contract over the long term, we see cigarette companies still having the ability to raise prices, and thus margins. • As the largest U.S. cigarette manufacturer, MO should lead this pricing strategy. 1 5/8/2015 Market Share • In 2013, Nu Mark introduced MarkTen e-vapor products in Indiana and Arizona. -

2.3.: Executive Summary Table of Contents

2.3.: Executive Summary Altria Client Services LLC USSTC MRTP Application for Copenhagen® Snuff Fine Cut 2.3.: EXECUTIVE SUMMARY TABLE OF CONTENTS 2.3. OVERVIEW .................................................................................................................5 2.3.1. Background .................................................................................................................10 2.3.1.1. The harm caused by tobacco use is primarily attributable to cigarette smoking.......................................................................................................................10 2.3.1.2. ST products are substantially less harmful than cigarette smoking. ...........................10 2.3.1.3. The proposed modified risk claim presents a harm reduction opportunity for Adult Smokers. ...........................................................................................................14 2.3.2. Scientific Evidence Supporting Market Authorization ...............................................15 2.3.3. Health Risks of the Tobacco Product .........................................................................17 2.3.3.1. Epidemiological evidence on the Health Risks of ST applies to the candidate product. .......................................................................................................................18 2.3.3.2. MST as the Predominant Form of ST Use ..................................................................19 2.3.3.3. Candidate Product and USSTC Contribution to Total MST Volume -

Is Guided by Five Core Values: Integrity, Trust and Respect; Driving Creativity; Executing with Quality; Passion to Succeed;

is guided by five core values: Integrity, Trust and Respect; Driving Creativity; Altria Group’s Executing with Quality; Passion to Succeed; and Sharing with Others. We pursue Management Team our mission by focusing our efforts on four core strategies: Invest in Leadership; Front (left to right): Align with Society; Satisfy Adult Consumers; and Create Substantial Value for Martin J. Barrington Shareholders. On the following pages of this report, we highlight some of the Executive Vice President many steps taken by the Altria family of companies in pursuit of our mission. and Chief Compliance and While litigation continues to be a challenge, we believe that the legal environ- Administrative Officer ment continues to remain manageable. In 2008, for the first time in 16 years, no Linda M. Warren tobacco case was tried to verdict against any cigarette manufacturer, and, with the Vice President exception of the Engle progeny cases, we continued to see declines in the number and Controller of personal injury individual and class action suits filed against PM USA. PM USA David R. Beran retains strong defenses against pending claims and has a superior legal team that Executive Vice President will continue to vigorously defend it. and Chief Financial Officer 2009 will be a challenging year for most companies, but I believe that our Denise F. Keane businesses are uniquely positioned for success. The economic environment and Executive Vice President the significant increases in tobacco excise tax rates present challenges, but Altria and General Counsel began preparing for these issues last year. I believe that careful management of John R. -

Monograph 19: the Role of the Media in Promoting and Reducing Tobacco

5 Themes and Targets of Tobacco Advertising and Promotion As with any consumer product, tobacco industry marketing efforts show clear evidence of targeting specific population subgroups and using themes and strategies designed to build brand loyalty and market share. This chapter provides an overview of specific themes and population targets employed in tobacco advertising and promotion based on studies of marketing materials and tobacco industry documents. n Key tobacco marketing themes include taste and satisfaction, implied harm reduction, affinity with desirable social characteristics, brand loyalty, and smokers’ rights. n Specific targeting criteria for tobacco advertising and promotion can include age, gender, race or ethnicity, and sexual orientation. Such groups can be targeted directly—for instance, by focusing on rugged individualism for men or weight control for women—or indirectly through adult themes such as independence or peer acceptance that also appeal to young smokers. n Tobacco brands are frequently designed to appeal to specific market segments or population subgroups, such as blue-collar women, African Americans, and young adult smokers. In addition to advertising, promotional channels for tobacco products can include affinity magazines, direct mail, coupons for gift catalogs, and promotional booths at targeted venues as well as other niche-market efforts. Marketing objectives for these channels range from creating new markets to attracting young smokers who are making their long-term brand choice. Understanding targeted marketing is also an important consideration in designing tobacco control efforts. 141 5 . T h e m e s a n d Ta r g e t s o f To b a c c o A d v e r t i s i n g a n d P r o m o t i o n ban cigarette advertising on television Introduction and radio. -

Smokeless Tobacco and Kids

SMOKELESS TOBACCO AND KIDS Since 1970, smokeless tobacco has gone from a product used primarily by older men to one used predominantly by young men and boys. This trend has occurred as smokeless tobacco promotions have increased dramatically and a new generation of smokeless tobacco products has hit the market. Far from being a “safe” alternative to cigarette smoking, smokeless tobacco use causes cancer and increases the risk of developing other health problems, including nicotine addiction and the potential to move on to combustible tobacco products. Smokeless Tobacco Use Although cigarette smoking among youth in the U.S. has declined significantly since 2000, use of smokeless tobacco among youth has declined much more slowly.1 • The 2020 National Youth Tobacco Survey (NYTS) showed that 3.1 percent of all high school students overall reported current use of smokeless tobacco products, with 4.8 percent of high school boys currently using smokeless tobacco.2 • Each day, more than 1,000 kids ages 12-17 use smokeless tobacco for the first time.3 • In 2019, among current high school smokeless tobacco users, 37.9 percent used these products on 20 to 30 of the previous 30 days, which is considered frequent use.4 • Based on data from the Youth Risk Behavior Survey (YRBS), smokeless tobacco use among high school boys exceeded the national rate in 19 states. In 2019, the states with the highest boys’ smokeless tobacco use rates were West Virginia (14.5%), Alabama (13.6%), Tennessee (13.5%), Ohio (12.8%), Arkansas (11.4%), and South Carolina (11.4%).5 • Based on 2013 data from the YRBS, high school athletes use smokeless tobacco at higher rates than non-athletes (11.1% vs. -

Altria Group and Its Companies Believe That Investing in Leading Arts and Cultural Organizations Helps to Create Vibrant and Engaging Communities

Altria Group and its companies believe that investing in leading arts and cultural organizations helps to create vibrant and engaging communities. For this reason, Altria has supported the visual and performing arts for more than 50 years, including numerous significant exhibitions at the National Gallery of Art. In 2014, Altria is proud to build upon this history by sponsoring the National Gallery of Art’s exhibition Andrew Wyeth: Looking Out, Looking In. This exhibition is exclusive to the National Gallery of Art and highlights a number of previously unexhibited paintings by Wyeth, who is widely considered one of America’s most important artists of the twentieth century. “We are honored to be partnering with the National Gallery of Art to highlight the work of this truly iconic American painter,” states Bruce Gates, Senior Vice President of External Affairs for Altria Client Services. “We are also thrilled to be supporting the scholarship on this remarkable artist.” Much of Altria’s support focuses on select major exhibition sponsorships that bring thought-provoking, world-class cultural experiences to its communities, including Richmond, Virginia, and Washington, D.C. Altria champions organizations that inspire and reflect the qualities it values in its business operations — creativity, diversity, excellence, and innovation. A Fortune 200 company headquartered in Richmond, Altria Group owns the premier tobacco companies in the United States, Philip Morris USA, U.S. Smokeless Tobacco Company, John Middleton, and NuMark, all headquartered in Richmond, Virginia. Their premium brands include Marlboro, Copenhagen, Skoal, Black & Mild, and MarkTen. Altria also owns Ste. Michelle Wine Estates, one of the country’s top premium wine producers, Philip Morris Capital Corporation, an investment company, and has a continuing economic and voting interest in SABMiller.