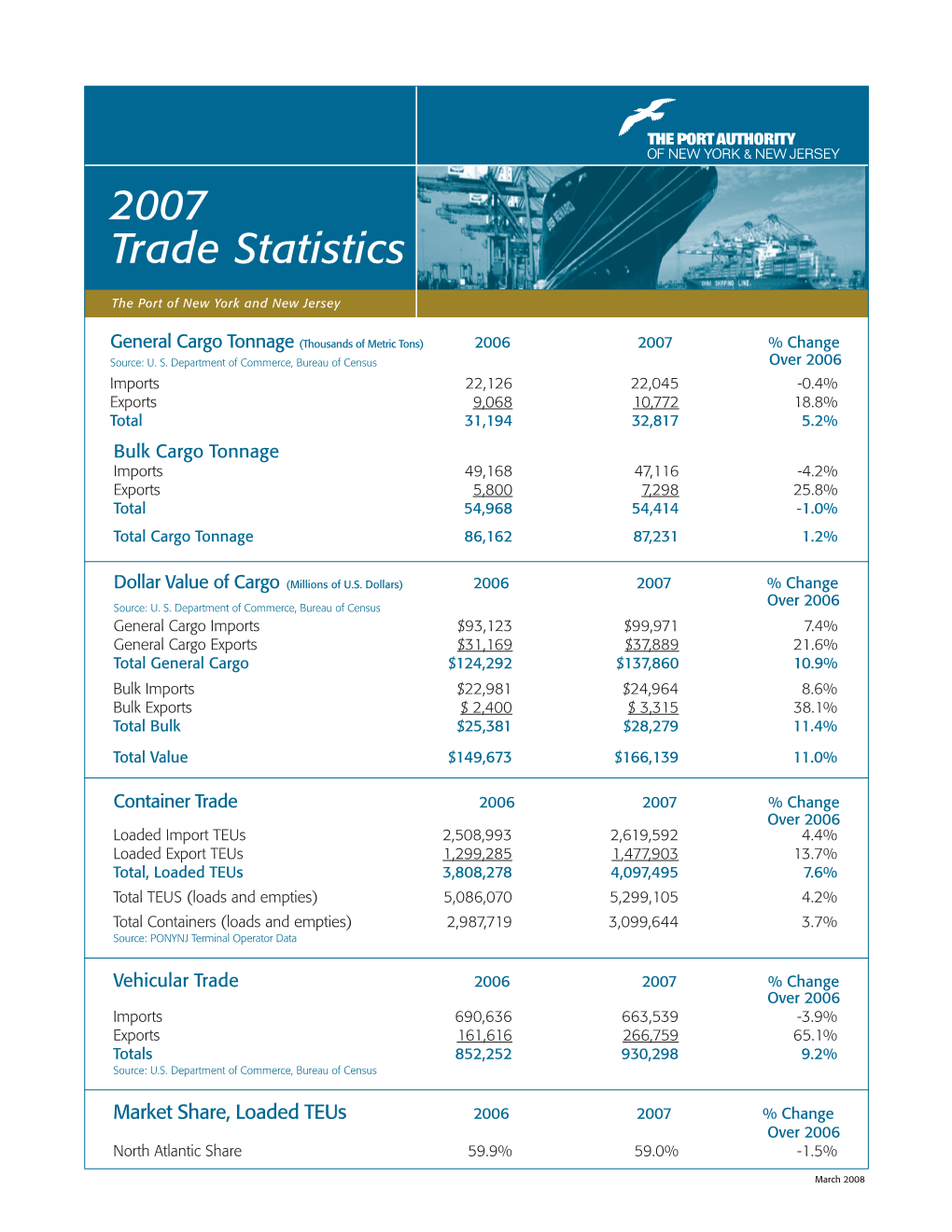

Download 2007 Trade Stats Sheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bayonne Bridge Lesson Plan

The Bayonne Bridge: The Beautiful Arch Resources for Teachers and Students [Printable and Electronic Versions] The Bayonne Bridge: The Beautiful Arch Resources for Teachers And Students [Printable and Electronic Versions] OVERVIEW/OBJECTIVE: Students will be able to understand and discuss the history of NOTES: the Bayonne Bridge and use science and engineering basics • Key words indicated in to investigate bridge design and test an arch bridge model. Bold are defined in call- out boxes. TARGET GRADE LEVEL: • Teacher-only text Fourth grade instruction, adaptable to higher levels as indicated with Italics. desired in the subjects of Social Studies and Engineering. FOCUS: In Part I, students learn about history of the Bayonne Bridge including the many engineering challenges encountered during the project and the people who helped overcome those challenges. In Part II, students learn engineering concepts to understand how bridges stay up and use these concepts to complete activities on bridge design before applying these concepts to theorize how the Bayonne Bridge works. MATERIALS: • Part I: DVD of “The Bayonne Bridge Documentary” • Part II: 2–4 heavy textbooks or 2 bricks per group; 2 pieces of “cereal box” cardboard or similar, 12 x 8 in; weights (anything small that can be stacked on the structure); red and blue marker, crayon or colored pencil for each student or group. The Bayonne Bridge: The Beautiful Arch Contents Teacher Materials | Part I: History of the Bayonne Bridge . T-1 Teacher Materials | Part II: Bridge Engineering . T-7 Student Materials | Part I: History of the Bayonne Bridge . S-1 Student Materials | Part II: Bridge Engineering . -

Traffic Rules and Regulations/"Green Book" (PDF, 220

TRAFFIC RULES AND REGULATIONS For the Holland Tunnel Lincoln Tunnel George Washington Bridge Bayonne Bridge Goethals Bridge Outerbridge Crossing Revised September 2016 The Port Authority of New York and New Jersey is a self-supporting agency of the States of New York and New Jersey. It was created by a compact between the two States in 1921 for the development of transportation facilities and the promotion and protection of commerce in the New York/New Jersey metropolitan region. At the top of the organization is the twelve-member Board of Commissioners, appointed by the Governors of New York and New Jersey. There are six members from each state who serve for six-year overlapping terms. The Commissioners serve with-out pay as a public service. They report directly to the Governors of the two States, who have veto power over Commissioners’ actions. A career staff of more than 7,000 employees, headed by the Executive Director, is responsible to the Board of Commissioners. Over the years the Port Authority, at the direction of the States of New York and New Jersey has developed airports, marine terminals, bridges and tunnels, bus terminals, the PATH rapid transit system, the World Trade Center and other facilities of commerce and transportation. All of this has been accomplished without burden to the taxpayers. These undertakings are public projects; all are built with moneys borrowed solely on the Port Authority’s credit. There is no power to tax, or to pledge the credit of the States. i FOREWORD This booklet is intended to provide the users of Port Authority tunnels and bridges with detailed and specific information concerning rules, regulations and toll rates established by the Port Authority to regulate the conduct of traffic moving in or upon these vehicular crossings. -

The Port Authority of NY & NJ

The Port Authority of NY & NJ 2012 to 2015 TOLL RATE TABLE George Washington Bridge, Lincoln Tunnel, Holland Tunnel, Goethals Bridge, Outerbridge Crossing, Bayonne Bridge PEAK HOURS: Weekdays 6 - 10 a.m., 4 - 8 p.m., Sat. & Sun. 11a.m. - 9 p.m. OFF-PEAK HOURS: All other times OVERNIGHT HOURS for Trucks: 10 p.m. - 6 a.m. Weekdays Beginning Dec. 2, 2012 Dec. 1, 2013 Dec. 7, 2014 Dec. 6, 2015 VEHICLE TYPE Trk Trk Trk Trk Off-Peak Peak Cash Off-Peak Peak Cash Off-Peak Peak Cash Off-Peak Peak Cash Overnight Overnight Overnight Overnight Class Vehicles with Two Axles and 1 $8.25 $10.25 N/A $13.00 $9.00 $11.00 N/A $13.00 $9.75 $11.75 N/A $14.00 $10.50 $12.50 N/A $15.00 Single Rear Wheels Vehicles with Two Axles and 2 $22.00 $24.00 $19.00 $30.00 $26.00 $28.00 $23.00 $34.00 $30.00 $32.00 $27.00 $38.00 $34.00 $36.00 $31.00 $42.00 Dual Rear Wheels** 3 Vehicles with Three Axles** $33.00 $36.00 $28.50 $45.00 $39.00 $42.00 $34.50 $51.00 $45.00 $48.00 $40.50 $57.00 $51.00 $54.00 $46.50 $63.00 4 Vehicles with Four Axles** $44.00 $48.00 $38.00 $60.00 $52.00 $56.00 $46.00 $68.00 $60.00 $64.00 $54.00 $76.00 $68.00 $72.00 $62.00 $84.00 5 Vehicles with Five Axles** $55.00 $60.00 $47.50 $75.00 $65.00 $70.00 $57.50 $85.00 $75.00 $80.00 $67.50 $95.00 $85.00 $90.00 $77.50 $105.00 Vehicles with Six Axles or 6 $66.00 $72.00 $57.00 $90.00 $78.00 $84.00 $69.00 $102.00 $90.00 $96.00 $81.00 $114.00 $102.00 $108.00 $93.00 $126.00 more** + Each add'l Axle $11.00 $12.00 $9.50 $15.00 $13.00 $14.00 $11.50 $17.00 $15.00 $16.00 $13.50 $19.00 $17.00 $18.00 $15.50 $21.00 Class -

Commercial User Guide Page 1 FINAL 1.12

E-ZPass Account User Guide Welcome to the Pennsylvania Turnpike Commission’s E-ZPass Commercial Account program. With E-ZPass, you will be able to pass through a toll facility without exchanging cash or tickets. It helps ease congestion at busy Pennsylvania Turnpike interchanges and works outside of Pennsylvania for seamless travel to many surrounding states; anywhere you see the purple E-ZPass sign (see attached detailed listing). The speed limit through E-ZPass lanes is 5-miles per hour unless otherwise posted. The 5-mile per hour limit is for the safety of all E-ZPass customers and Pennsylvania Turnpike employees. If you have any questions about your E-ZPass account, please contact your company representative or call the PTC E-ZPass Customer Service Center at 1.877.PENNPASS (1.877.736.6727) and ask for a Commercial E-ZPass Customer Service Representative. Information is also available on the web at www.paturnpike.com . How do I install my E-ZPass? Your E-ZPass transponder must be properly mounted following the instructions below to ensure it is properly read. Otherwise, you may be treated as a violator and charged a higher fare. Interior Transponder CLEAN and DRY the mounting surface using alcohol (Isopropyl) and a clean, dry cloth. REMOVE the clear plastic strips from the back of the mounting strips on the transponder to expose the adhesive surface. POSITION the transponder behind the rearview mirror on the inside of your windshield, at least one inch from the top. PLACE the transponder on the windshield with the E-ZPass logo upright, facing you, and press firmly. -

New York City Truck Route

Staten Island Additional Truck and Commercial Legal Routes for 53 Foot Trailers in New York City Special Midtown Manhattan Rules Cross Over Mirrors Requirement Legal Routes for 53 Foot Trailers 10 11 12 13 14 15 Vehicle Resources The New York City interstate routes approved for 53 foot trailers are: The two rules below apply in Manhattan Due to the height of large trucks, it can North d Terrace ● I-95 between the Bronx-Westchester county line and I-295 on New York City m be difficult for truck drivers to see what is h Throgs from 14 to 60 Streets, and from 1 to 8 ic R ● I-295 which connects I-95 with I-495 Rich mo Avenues, inclusive. They are in effect happening directly in front of their vehicles. 95 n Thompskinville d L L NYCDOT Truck and Commercial Vehicle 311 ● I-695 between I-95 and I-295 Te Neck r Broadway Cross Over Mirrors, installed on front of the cab race Information Cross between the hours of 7 AM and 7 PM daily, ● I-495 between I-295 and the Nassau-Queens county line Bronx 95 www.nyc.gov/trucks 95 Expwy except Sundays. There may be different of a truck, are a simple way of eliminating a ZIP Code Index Expwy Av ● I-678 between I-95 and the John F. Kennedy International Airport To New Jersey h Turnpike ut 695 restrictions on particular blocks. Check truck driver’s front “blind spots” and allows the 10301 Staten Island L-14 o ● I-95 between I-695 and the New Jersey state line on the upper level of the S NYCDOT Truck Permit Unit 212-839-6341 carefully. -

Verrazano-Narrows Bridge CCTV, VMS, CMS & Lane Controllers

SYSTEMS ENGINEERING ANALYSIS REPORT Verrazano-Narrows Bridge CCTV, VMS, CMS & Lane Controllers VN-03 May, 2011 Prepared by MTA Bridges & Tunnels In cooperation with For Final PSE SEA May-2011 TABLE OF CONTENTS 1. INTRODUCTION ....................................................................................................... 1 1.1 Report Organization ....................................................................................................... 4 1.2 Intended Audience…………………………………………………………..………………….4 1.3 Scope……………………………………………………………………………..………………..5 2. MTA B&T ITS PLANNING PROCESS & ITS PROGRAM ........................................ 7 2.1 ITS PLANNING PROCESS OVERVIEW ......................................................................... 7 2.2 THE MTA B&T ITS ARCHITECTURE ............................................................................ 8 3. VN-SIE APPROACHES ITS SUBSYSTEMS ............................................................. 9 3.1 Portions of the Regional ITS Architecture Being Implemented ............................... 10 3.2 Project Level Architecture.. ......................................................................................... 12 3.3 Customized Market Package Analysis ....................................................................... 12 3.3.1 Traffic Surveillance ......................................................................................... 17 3.3.2 Freeway Control ............................................................................................. 17 3.3.3 -

Triborough Bridge and Tunnel Authority

February 1, 2018 Supplement To Official Statement Dated January 25, 2018 Relating to $351,930,000 TRIBOROUGH BRIDGE AND TUNNEL AUTHORITY (MTA Bridges and Tunnels) General Revenue Bonds, Series 2018A The Official Statement dated January 25, 2018 (the Official Statement) for the above- referenced Bonds is hereby supplemented as follows: The inside cover page is hereby deleted and replaced in its entirety with the following: $351,930,000 Triborough Bridge and Tunnel Authority (MTA Bridges and Tunnels) General Revenue Bonds, Series 2018A Maturity Principal Interest CUSIP Number† (November 15) Amount Rate Yield* (89602R) 2043 $51,830,000 5.00% 2.93% DV4 2044 54,425,000 5.00 2.94 DW2 2045 57,145,000 5.00 2.95 DX0 2046 60,005,000 5.00 2.96 DY8 2047 63,005,000 4.00 3.27 DZ5 2048 65,520,000 4.00 3.28 EA9 The Series 2018A Bonds are subject to redemption, as described under the caption “DESCRIPTION OF SERIES 2018A BONDS – Redemption Prior to Maturity” in Part I. The following summarizes the optional redemption provisions: the Series 2018A Bonds are subject to redemption prior to maturity on any date on and after May 15, 2028, at the option of MTA Bridges and Tunnels, in whole or in part at 100% of the principal amount thereof, together with accrued interest thereon up to but not including the redemption date. _____________________________ * Priced at the stated yield to the May 15, 2028 optional redemption date at a redemption price of 100%. † CUSIP numbers have been assigned by an organization not affiliated with MTA Bridges and Tunnels and are included solely for the convenience of the holders of the Series 2018A Bonds. -

Staten Island West Shore Alternatives Analysis

Staten Island West Shore Alternatives Analysis Public Open House September 25, 2019 Agenda • Introductions and Overview – Study Team – Study Process • West Shore Transit Needs • Alternatives Considered – Study Goals – Long List • Community Engagement • Next Steps Staten Island West Shore Alternatives Analysis 2 INTRODUCTIONS & OVERVIEW Staten Island West Shore Alternatives Analysis 3 Study Team • MTA NYCT – Eric Bohn, Project Manager – David Leyzerovsky, Deputy PM – Melissa Farley, Government/Community Relations • AECOM Team – Ruby Siegel, Project Manager – Joe Sperrazza, Deputy PM – Maura Fitzpatrick, Outreach Coordinator Staten Island West Shore Alternatives Analysis 4 Study Process • Build on prior studies • Perform credible and transparent evaluation of alternatives • Conduct extensive customer surveys to understand transit needs – 3,600 bus intercept surveys – 700 Employer/University on-line surveys • Brief West Shore elected officials • Engage with SIEDC and other stakeholders and interested public • Recommend near and longer-term Preferred Alternative(s) Staten Island West Shore Alternatives Analysis 5 Study Status Activity Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb West Shore Transit Needs Public Outreach Preliminary Long List of Alternatives Initial Screening Recommended Long List of Alternatives Screening Short List of Alternatives Selection of a Recommended Preferred Alternative and Alternatives Analysis Report Public Outreach Event Key Milestone Event Staten Island West Shore Alternatives Analysis 6 WEST SHORE TRANSIT -

2015 New York City Bridge Traffic Volumes

2015 New York City Bridge Traffic Volumes TM NEW YORK CITY Bill de Blasio Polly Trottenberg Mayor Commissioner A member of the New York Metropolitan Transportation Council 2015 New York City Bridge Traffic Volumes Contract C033467 2014-2015: PTDT14D00.E01 2015-2016: PTDT15D00.E01 The preparation of this report was financed in part with funds from the U.S. Department of Transportation, Federal Highway Administration, under the Federal Highway Act of 1956, as amended, and the Urban Mass Transportation Act of 1964, as amended. This document is disseminated by the New York City Department of Transportation in the interest of information exchange. It reflects the views of the New York City Department of Transportation (NYCDOT), which is responsible for the facts and the accuracy of the data presented herein. The report does not necessarily reflect any official views or policies of the Federal Transit Administration, the Federal Highway Administration, or the State of New York. The report does not constitute a standard, specification, or regulation. NYCDOT is grateful to the Metropolitan Transportation Authority Bridges and Tunnels (MTABT), the Port Authority of New York and New Jersey (PANYNJ), and the New York Metropolitan Transportation Council (NYMTC) for providing data used to develop this report. Prepared by: New York City Department of Transportation Polly Trottenberg Commissioner Margaret Forgione Chief Operating Officer Joseph Jarrin, Executive Deputy Commissioner for Strategic and Agency Services Ryan Russo Deputy Commissioner Charles Ukegbu, Assistant Commissioner, Regional & Strategic Planning Naim Rasheed Senior Director, Traffic Engineering & Planning Alexander M. Keating Director of Special Projects Richard P. Roan Special Projects Danny Yoder Special Projects Published October 2016 2015 NEW YORK CITY BRIDGE TRAFFIC VOLUMES 2,661,105 5.8% Decrease (‐6,428 Daily vehicles per day used the 47 toll‐free Vehicles) bridges monitored by the New York City Department of Transportation in Williamsburg Bridge over the East 2015. -

Table of Contents

Corridors Vehicle Speed Data - 2011 TABLE OF CONTENTS County Corridor From Street To Street Page BRONX Appendix A Inerstate I‐278 Triborough Bridge I‐95 A‐15 Inerstate I‐87 Westchester County Line I‐278 A‐2 Inerstate I‐95 New York County Line Westchester County Line A‐14 Bronx River Pkwy Inerstate I‐278 Westchester County Line A‐13 TOC Boston Rd Bronx River Pkwy Ropes Ave A‐12 1 Boston Rd 3rd Ave E Tremont Ave A‐1 Bruckner Blvd Inerstate I‐87 Westchester Ave A‐16 Edward L Grant Hwy/Dr M. L. King Jerome Ave W Kingsbridge Rd A‐4 Fordham Rd New York County Line Boston Rd A‐10 Grand Concours e E 138th St Mosholu Pkwy S A‐6 Gun Hill Rd Gun Hill Pkwy Inerstate I‐95 A‐7 Jerome Ave/Central Park Ave E 204th St Westchester County Line A‐8 Jerome Ave/Macombs Dam Bridge W 169th St New York County Line A‐5 Tremont Ave Sedgwick Ave Williamsbridge Rd A‐11 Webster Ave/Melrose Ave 3rd Ave Westchester Ave A‐9 Westchester Ave 3rd Ave Inerstate I‐95 A‐3 KINGS Appendix B Inerstate I‐278 Verrazanno Bridge Kosciuszko Bridge B‐11 Atlantic Avenue 6th Ave Queens County Line B‐2 Belt Pkwy Inerstate I‐278 Queens County Line B‐5 Bushwick Ave Maspeth Ave Pennsylvania Ave B‐6 Conduit Blvd Atlantic Ave Queens County Line B‐7 State Hwy 27 Inerstate I‐278 Ocean Pkwy B‐20 Williamsburg Bridge Inerstate I‐278 Clinton St (Manhattan) B‐22 Fort Hamilton Pkwy Marine Ave State Hwy 27 B‐9 4th Ave Flatbush Ave Shore Rd B‐1 Avenue U Stillwell Ave Mill Ave B‐3 Bedford Ave Division Ave Emmons Ave B‐4 N E W Y O R K C I T Flatbush Ave/Marine Pkwy Bridge Manhattan Bridge Rockaway Point -

History and Projection of Traffic, Toll Revenues and Expenses

Attachment 6 HISTORY AND PROJECTION OF TRAFFIC, TOLL REVENUES AND EXPENSES AND REVIEW OF PHYSICAL CONDITIONS OF THE FACILITIES OF TRIBOROUGH BRIDGE AND TUNNEL AUTHORITY September 4, 2002 Prepared for the Triborough Bridge and Tunnel Authority By 6-i TABLE OF CONTENTS Page TRANSPORTATION INFRASTRUCTURE 1 Triborough Bridge and Tunnel Authority (TBTA) 1 Metropolitan Area Arterial Network 3 Other Regional Toll Facilities 4 Regional Public Transportation 5 TOLL COLLECTION ON THE TBTA FACILITIES 5 Current Toll Structure and Operation 5 E-ZPass Electronic Toll Collection System 8 Passenger Car Toll Rate Trends and Inflation 9 HISTORICAL TRAFFIC, REVENUES AND EXPENSES AND ESTIMATED/FORECAST NUMBERS FOR 2002 12 Traffic and Toll Revenue, 1991 - 2001 12 Traffic by Facility and Vehicle Class, 2001 14 Monthly Traffic, 2001 15 Impact of September 11 Terrorist Attack 16 Estimated Traffic and Toll Revenue, 2002 20 Operating Expenses 1991 – 2001 21 Forecast of Expenses, 2002 23 FACTORS AFFECTING TRAFFIC GROWTH 23 Employment, Population and Motor Vehicle Registrations 24 Fuel Conditions 28 Toll Impacts and Elasticity 30 Bridge and Tunnel Capacities 32 TBTA and Regional Operational and Construction Impacts 33 Other Considerations 40 Summary of Assumptions and Conditions 41 PROJECTED TRAFFIC, REVENUES AND EXPENSES 43 Traffic and Toll Revenue at Current Tolls 43 Traffic and Toll Revenue with Periodic Toll Increases 45 Operating Expenses 48 Net Revenues from Toll Operations 49 REVIEW OF PHYSICAL CONDITION 50 Review of Inspection Reports 51 Long-Term Outlook -

Bay Ridge Flats Anchorage Not for Navigational Use - Please Refrence Noaa Chart 12334

Sandy Hook Pilots New York - New Jersey Harbor Hudson River, East River & Long Island Sound 2014 Tide Tables NOTICE THIS PUBLICATION CONTAINS TIDE AND/OR TIDAL CURRENT PREDICTIONS AND ASSOCIATED INFORMATION PRODUCED BY ANDOBTAINED FROM THE DEPARTMENT OFCOMMERCE, NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION (NOAA), NATIONAL OCEAN SERVICE. THESE PREDICTIONS ARE RECEIVED PRIOR TO OCTOBER OF THE PREVIOUS YEAR AND ARE SUBJECT TO REVISION BY NOAA WITHOUT NOTICE. TIDES MAY VARY WITH WEATHER CONDITIONS. ALL OTHER INFORMATION CONTAINED IN THIS PUBLICATION IS OBTAINED FROM SOURCES BELIEVED TO BE RELIABLE. WE DISCLAIM LIABILITY FOR ANY MISTAKES OR OMISSIONS IN ANY OF THE INFORMATION CONTAINED HEREIN. THE TIME OF TIDES SET FORTH IN THESE TABLES IS GIVEN AT EASTERN STANDARD TIME. PLEASE NOTE: SLACK WATER TIMES ARE AN ESTIMATE BASED ON PILOT OBSERVATIONS AND THEIR ACCURACY CANNOT BE GUARANTEED. Compliments of THE UNITED NEW YORK SAND HOOK PILOTS BENEVOLENT ASSOCIATION and THE UNITED NEW JERSEY SANDY HOOK PILOTS BENEVOLENT ASSOCIATION 201 Edgewater Street Staten Island, N.Y. 10305 www.sandyhookpilots.com Masters or Agents are requested to advise Pilots of any change in arrival time 12 hours in advance. New York Pilots.............................................................. 718.448.3900 New Jersey Pilots.......................................................... 718.448.3900 Hell Gate Pilots.............................................................. 718.448.3900 Long Island Sound Pilots.............................................. 718.448.3900