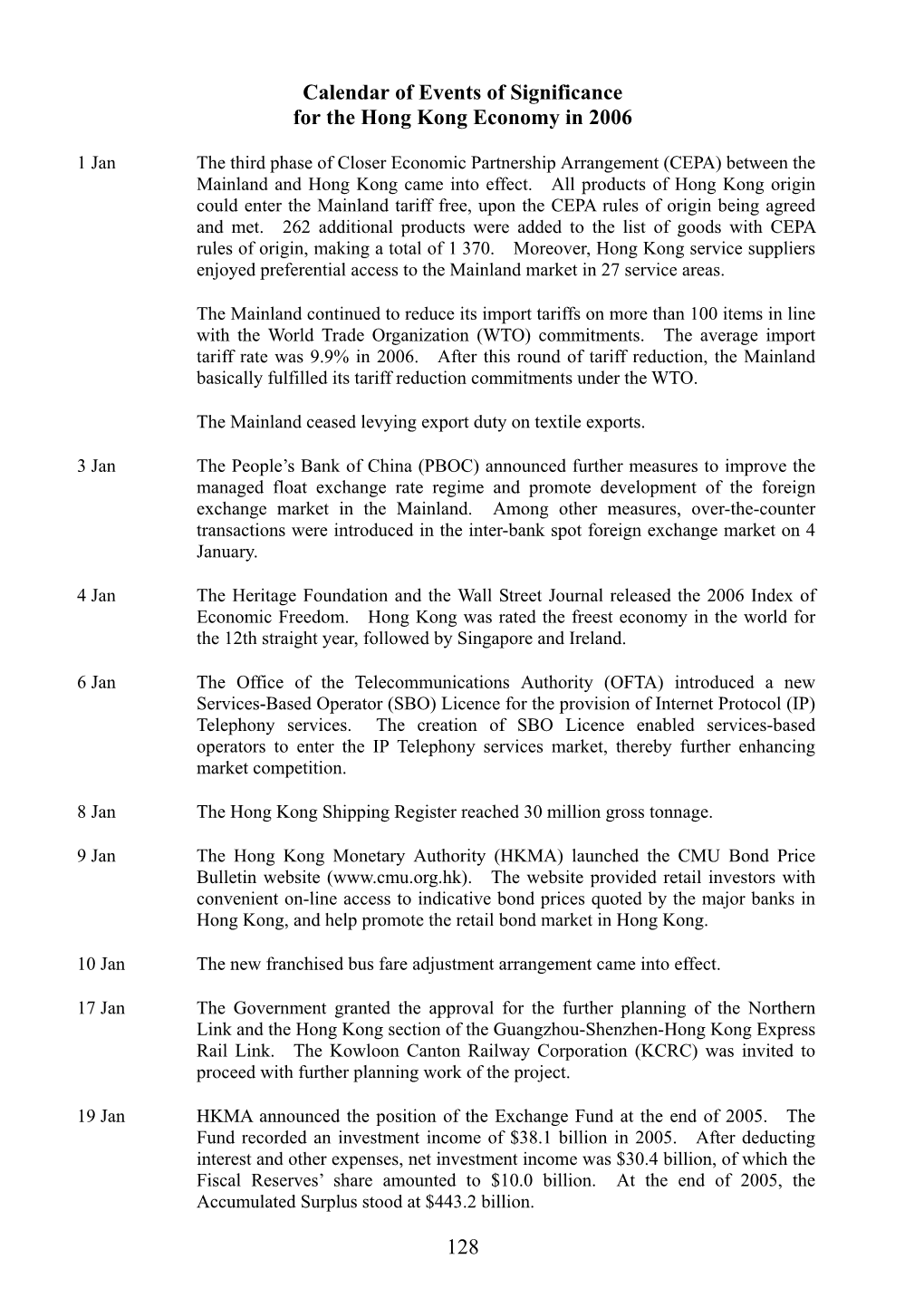

128 Calendar of Events of Significance for the Hong Kong

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Prospectus E.Pdf

IMPORTANT If you are in any doubt about this prospectus, you should consult your stockbroker, bank manager, solicitor, professional accountant or other professional adviser. (Incorporated in Hong Kong with limited liability under the Companies Ordinance) GLOBAL OFFERING Number of Offer Shares in the Global Offering: 2,298,435,000 (subject to adjustment and the Over-allotment Option) Number of Hong Kong OÅer Shares: 229,843,500 (subject to adjustment) Maximum OÅer Price: HK$9.50 per OÅer Share payable in full on application in Hong Kong dollars, subject to refund Nominal Value: HK$5.00 per Share Stock Code: 2388 Joint Global Coordinators and Joint Bookrunners BOC International Goldman Sachs (Asia) L.L.C. UBS Warburg Holdings Limited Joint Sponsors BOCI Asia Limited Goldman Sachs (Asia) L.L.C. UBS Warburg Asia Limited The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. A copy of this prospectus, together with the documents speciÑed in the section headed ""Documents Delivered to the Registrar of Companies'' in Appendix VIII, has been registered by the Registrar of Companies in Hong Kong as required by Section 38D of the Companies Ordinance, Chapter 32 of the Laws of Hong Kong. The Securities and Futures Commission and the Registrar of Companies in Hong Kong take no responsibility as to the contents of this prospectus or any other document referred to above. -

Rail Merger (1) Connected Transactions (2) Very Substantial Acquisition

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Circular does not constitute, or form part of, an offer or invitation, or solicitation or inducement of an offer, to subscribe for or purchase any of the MTRC Shares or other securities of the Company. If you are in any doubt as to any aspect of this Circular, or as to the action to be taken, you should consult a licensed securities LR 14.63(2)(b) dealer, bank manager, solicitor, professional accountant or other professional adviser. LR 14A.58(3)(b) If you have sold or transferred all your MTRC Shares, you should at once hand this Circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this Circular, makes no representation as to its LR 14.58(1) accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the LR 14A.59(1) whole or any part of the contents of this Circular. App. 1B, 1 LR 13.51A RAIL MERGER (1) CONNECTED TRANSACTIONS (2) VERY SUBSTANTIAL ACQUISITION Joint Financial Advisers to the Company Goldman Sachs (Asia) L.L.C. UBS Investment Bank Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders Merrill Lynch (Asia Pacific) Limited It is important to note that the purpose of distributing this Circular is to provide the Independent Shareholders of the Company with information, amongst other things, on the proposed Rail Merger, so that they may make an informed decision on voting in respect of the EGM Resolution. -

Hong Kong SAR

Hong Kong SAR 104 Doing Business in Asia Pacific SEPTEMBER 2020 Chapter 1: Introduction 108 Chapter 2: Business environment 110 2.1 Hong Kong’s free economy 110 2.2 Gateway to mainland China 111 2.3 International outlook 112 2.4 Well-established legal and financial infrastructures 112 2.5 Favourable tax regime 113 Chapter 3: Business and corporate structures 114 3.1 Limited company 114 3.2 Unincorporated businesses 116 3.3 Forms of business collaboration 116 Chapter 4: Takeovers (friendly M&A) 117 4.1 Introduction 117 4.2 Hong Kong company law 118 4.3 Other common legal issues 118 4.4 Typical documentation 119 4.5 Due diligence 120 4.6 Sale and purchase agreement 120 Chapter 5: Foreign investment 122 5.1 Overview of Hong Kong’s business and investment environment 122 5.2 Restrictions on foreign investment 123 Chapter 6: Restructuring and insolvency 124 6.1 Legal framework 124 6.2 Liquidation 124 6.3 Restructuring 125 6.4 International insolvency 126 Doing Business in Asia Pacific SEPTEMBER 2020 105 Chapter 7: Employment, industrial relations, and work health and safety 127 7.1 Basic employment rights 127 7.2 Employment contract 128 7.3 Expatriates 129 7.4 Termination 129 7.5 Work health and safety 130 Chapter 8: Taxation 131 8.1 Outline 131 8.2 Profits tax 131 8.3 Salaries tax 133 8.4 Property tax 134 8.5 Stamp duty 134 8.6 Tax disputes 135 8.7 Anti-avoidance 135 Chapter 9: Intellectual property 135 9.1 Trademarks 136 9.2 Copyright 136 9.3 Registered designs 137 9.4 Patents 137 9.5 Confidential information 138 9.6 Private information 138 -

Techwatch No. 39

TechWatch is a publication designed to alert members to topics and issues that impact on CPAs and their working environment. We welcome your comments and feedback. Comments and suggestions on TechWatch should be addressed to Stephen Chan, Executive Director by email. ISSUE 39 • November/December 2005 HEADLINES Season’s Greetings from The Hong Kong Institute of Certified Public Accountants Wishing you a Merry Christmas and a Peaceful and Prosperous New Year 聖誕快樂 新年進步 Spotlight 1. Handbook Updates No. 22 & 23 CPD & Events 2. Technical Update Evening (TUE) 3. Professional Development Activities January And February 2006 4. New CPD Requirements Effective From 1 December 2005 International Submissions 5. IASB Submissions 6. IAASB Submission 7. International Ethics Standards Board Submission Financial Reporting 8. Amendments To Standards Arising From Companies (Amendment) Ordinance 2005 9. New Transitional Provisions In HKAS 16 And HKAS 40 10. Institute Issues Accounting Guideline 5 And Withdraws SSAP 27 11. Institute Invites Comments On Two IASB Discussion Papers 12. FRSC Meeting Summaries – 12 October and 9 November 2005 Audit & Assurance 13. Institute Invites Comments On IAASB ED Of Improving The Clarity Of IAASB Standards 14. Innovation And Technology Fund – Revised Example Report By Auditors 15. AASC Meeting Summary – 26 October 2005 HEADLINES Ethics 16. New Code Of Ethics For Professional Accountants Corporate Governance 17. Results Of The 2005 Best Corporate Governance Disclosure Awards Announced Banking 18. Example Disclosure Note On Regulatory Reserve 19. Commencement Of Banking (Amendment) Ordinance 2005 Insolvency & Corporate Restructuring 20. Institute Comments On Draft Subsidiary Legislation Under Bankruptcy (Amendment) Ordinance 2005 Taxation 21. Revenue (Abolition of Estate Duty) Ordinance 2005 Gazetted 22. -

Building on Strength Interim Report 2009 Vision We Aim to Be a Globally Recognised Leader That Connects and Grows Communities with Caring Service

Building on Strength Interim Report 2009 Vision We aim to be a globally recognised leader that connects and grows communities with caring service. Mission • Enhance customers’ quality of life and anticipate their needs. • Actively engage in communities we serve. • Foster a company culture that staff can learn, grow and take pride in. • Provide sustainable returns to investors. • Set ourselves new standards through innovation and continuous improvement. • Grow in Hong Kong, Mainland of China and capture opportunities in Europe by extending our core competencies. Values • Excellent Service • Mutual Respect • Value Creation • Enterprising Spirit Highlights Financial Operational • Financial results resilient despite economic downturn, • Merger synergies ahead of schedule and on track to with revenue increasing 1.2% to HK$8,630 million and achieve HK$450 million per year within 2009 EBITDA increasing marginally to HK$4,799 million • Patronage of Domestic Service increased 0.3%; Cross- • Property development profit of HK$2,147 million boundary and Airport Express decreased 0.4% and 11.5% respectively • Profit from underlying businesses (i.e. net profit attributable to equity shareholders, excluding • About 85% of the 2,169 units of Lake Silver have been investment property revaluation and related deferred sold while all 1,688 units of Phase A of Le Prestige have tax) increased 43% to HK$3,903 million been sold • Net profit attributable to equity shareholders • Project Agreement signed for West Island Line (including investment property revaluation) -

Growth Momentum

MTR Corporation Limited Annual Report 2010 Report Annual Limited Corporation MTR ANNUAL REPORT 2010 GROWTH MOMENTUM MTR Corporation Limited MTR Headquarters Building, Telford Plaza Kowloon Bay, Kowloon, Hong Kong GPO Box 9916, Hong Kong Telephone : (852) 2993 2111 Facsimile : (852) 2798 8822 www.mtr.com.hk Stock Code: 66 GROWTH MOMENTUM In 2010, the Company has ridden the economic recovery to post a strong set of results, with increases in revenue and profit. Looking ahead, our growth momentum continues, with our five major expansion projects in Hong Kong on track, and further progress in our growing portfolio of businesses in the Mainland of China and overseas. As a builder and operator of infrastructure assets, we try to ensure that our expansion plans benefit present and future generations, and our aim is to become a global leader in sustainable transportation. CONTENTS 2 MTR Corporation in Numbers – 2010 4 Hong Kong Operating Network with Future Extensions 6 MTR Corporation at a Glance 22 8 Chairman’s Letter Hong Kong Passenger 12 CEO’s Review of Operations Services and Outlook 19 Key Figures 20 Key Events in 2010 22 Executive Management’s Report 22 – Hong Kong Passenger Services 36 36 – Station Commercial and Station Commercial Rail Related Businesses and Rail Related 42 – Property and Other Businesses Businesses 54 – Hong Kong Network Expansion 60 – Mainland and Overseas Growth 66 – Human Resources 42 71 Financial Review Property 78 Ten-Year Statistics and Other Businesses 80 Investor Relations 82 Sustainability 83 Corporate Responsibility -

MTR Corporation 2008 Interim Results

MTR Corporation 2008 Interim Results 5 Aug 2008 MTR Corporation Limited 2008/8/5 Forward-looking statements Certain statements contained in this presentation may be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward- looking statements. MTR Corporation Page 2 Results highlights and business overview MTR Corporation Limited 2008/8/5 Solid First Half Achievements Success of Merger demonstrated in strong financial results Strong Recurring businesses see significant increases in Revenue and EBITDA Financial Net cash generated in 1H08 over HK$4.2 billion Results Successful pre-sales of the Capitol and Palazzo; profit booking dependent only on Occupation Permit issuance 6 new lines being developed 3 new approvals: Significant Shatin to Central Link (SCL), Kwun Tong Line Network Extension (KTE), and Express Rail Link (XRL) Extension Good progress on Kowloon Southern Link (KSL) , West Island Line (WIL) and South Island Line East (SIL(E)) MTR Corporation Page 4 Financial performance (HK$m) 1H1H 20082008 1H1H 20072007 ChangeChange TotalTotal revenuerevenue 8,527 4,852 75.7% EBITDAEBITDA 4,796 2,797 71.5% EBITDAEBITDA marginmargin 56.2% 57.6% 1.4% pt Property Property 348 1,664 79.1% developmentdevelopment profitprofit Underlying profit -

MTR Nordic the Rail+Property Model to Finance Public Transport

MTR Nordic The Rail+Property model to finance public transport Robert Westerdahl Business Development Director 15-03-06 Sid 1 Overview • Introduction to MTR internationally and in Sweden • The Rail+Property model to finance public transport infrastructure • Rail+Property in Sweden? 2 MTR’s vision: “We aim to be a leading multinational company that connects and grows communities with caring services” 15-03-06 Sid 3 3 MTR Corporation short facts One of the worlds largest global railway corporations with ~11 million passengers every working day Founded in Hong Kong 1975 as ”Mass Transit Railway Corporation” to build and operate the metro in Hong Kong Listed on the Hong Kong stock exchange since the year 2000 The Nordic countries are one of the prioritized growth regions for MTR 15-03-06 Sid 4 4 MTR is today operating 9 train systems on 3 continents Stockholm metro Beijing metro line 4, 14, 16 • 1,2 m pass./day (under construction) • 108 km tracks, 100 • 1,5 m pass./day stations • 55 km tracks, 41 stations Stockholm–Gothenburg Hangzhou Metro • High-speed train (Open • 0,2 m pass./day Access), start 21/3 2015 • 48 km tracks, 31 stations London Overground Hong Kong/Shenzen* • 2,3 m pass./day • 4,4 m pass./day • 110 km tracks, 55 stations • 212 km tracks, 152 stations Sydney NWRL commuter train London Crossrail • A new 15-year PPP contract to • New Metro under construct and operate 36km new construction. Mobilization commuter train line with 13 ongoing stations. Melbourne commuter train • 0,7 m pass./day • 372 km tracks, 212 stations OBS: passegers -

Chapter 3 Land Matters

Project Administration Handbook for Civil Engineering Works 2020 Edition CHAPTER 3 LAND MATTERS The parts of the PAH shown in blue and bold should only be updated by Works Branch of Development Bureau. Rev Issue Date Amendment Incorporated First Issue October 2020 NA Chapter 3 (Rev. 0) 1 Project Administration Handbook for Civil Engineering Works 2020 Edition SYNOPSIS This chapter sets out the procedures for the acquisition and control of land required for projects managed by CEDD, DSD, HyD and WSD. It does not cover the land requirements of quasi-government bodies such as the MTR Corporation Limited (MTRCL), but it describes the procedures necessary to avoid any possible interference with these land requirements. The authority for land matters is the Director of Lands (D of L) who exercises his duties through the respective District Lands Offices (DLOs). The role of CEDD, DSD, HyD and WSD in land matters is either as a works department requiring the temporary use of the site and associated areas, or in some instances as the operation department requiring the permanent use of the land. Because of the large number of departments that have a pertinent interest in land matters, it is necessary for formal procedures for the reservation, allocation, acquisition and clearance of land to be followed before any land can be made available for works to proceed. This chapter does not give details of procedures to be followed by the Lands Department (LandsD), which are covered by Land Instructions (LIs). However, reflections have been made to concur with the procedures laid down in the LIs. -

2006 Economic Background and 2007 Prospects

2006 ECONOMIC BACKGROUND AND 2007 PROSPECTS ECONOMIC ANALYSIS DIVISION ECONOMIC ANALYSIS AND BUSINESS FACILITATION UNIT FINANCIAL SECRETARY’S OFFICE GOVERNMENT OF THE HONG KONG SPECIAL ADMINISTRATIVE REGION February 2007 CONTENTS Paragraphs CHAPTER 1: OVERVIEW OF ECONOMIC PERFORMANCE IN 2006 Overall situation 1.1 - 1.2 The external sector 1.3 - 1.4 The domestic sector 1.5 - 1.6 The labour sector 1.7 - 1.8 The asset markets 1.9 - 1.10 Inflation 1.11 - 1.12 GDP by economic activity 1.13 - 1.15 Strengthening Hong Kong’s role in the Mainland’s economic 1.16 - 1.19 development Some highlights of economic policy 1.20 - 1.22 Box 1.1 Productivity growth in Hong Kong CHAPTER 2: ECONOMIC OUTLOOK FOR 2007 AND THE MEDIUM TERM Major external factors 2.1 Global economic outlook 2.2 - 2.4 Exchange rates and price competitiveness 2.5 - 2.8 Oil prices 2.9 Major domestic factors Interest rate movements 2.10 - 2.11 Integration with the Mainland 2.12 - 2.14 Outlook for the Hong Kong economy in 2007 2.15 - 2.21 Medium-term outlook for the Hong Kong economy 2.22 - 2.23 Box 2.1 Exchange rate movement as a prominent factor affecting Hong Kong’s export performance CHAPTER 3: THE EXTERNAL SECTOR Visible trade Total exports of goods 3.1 - 3.4 Imports of goods 3.5 Invisible trade Exports of services 3.6 Imports of services 3.7 Visible and invisible trade balance 3.8 Trade policy and other developments 3.9 Strengthening institutional framework 3.10 - 3.12 Other policy measures 3.13 - 3.14 Box 3.1 How would US economic slow-down impact on Hong Kong’s exports? CHAPTER -

Hong Kong Network Expansion

Executive Management’s Report Hong Kong Network Expansion Developing ONE Railway Network With the merger, the combined existing network increased 132% from 91 to 211.6 kilometres. Committed and future railway projects will further increase the combined network length by 28% from 211.6 to 271.6 kilometres. MTR Corporation Annual Report 2007 56 | 57 Executive Management’s Report Hong Kong Network Expansion South Island Line (East) will connect Admiralty Station to Ap Lei Chau via Ocean Park, Wong Chuk Hang and Lei Tung A combination of the Rail Merger, the Government’s declared and Kowloon Southern Link as well as proposals for the Kwun commitment to a number of priority rail infrastructure projects Tong Line extension, which we have previously submitted to and our continuing programme of asset enhancement and Government. The result is that 2008 is set to be an especially replacement made 2007 a milestone year for new rail projects active year both for the design of these new extension projects for the Company. These dynamic factors also set the scene for and the progress of works on existing extensions. 2008 to be a particularly vibrant year for the design and planning of future rail lines. On-going Projects West Island Line Network Extensions As the first in the wave of extension projects for the future, In his October 2007 Policy Address indicating long-term the West Island Line made significant progress. This proposed Government commitment to developing Hong Kong’s rail extension of the Island Line consists of three underground system as the backbone of passenger transport system, stations at Sai Ying Pun, University and Kennedy Town. -

ANNUAL REPORT 2008 This Annual Report Is Also Available Via

KOWLOON-CANTON RAILWAY CORPORATION KOWLOON-CANTON RAILWAY FOR FURTHER INFORMATION, PLEASE CONTACT: Kowloon-Canton Railway Corporation ANNUAL REPORT Tel: (852) 2688 1333 2008 Fax: (852) 3124 1073 Address: 8th Floor, Fo Tan Railway House, 9 Lok King Street Fo Tan, New Territories, Hong Kong ANNUAL REPORT 2008 ANNUAL REPORT This Annual Report is also available via: www.kcrc.com This Annual Report is printed on FSC certified paper using soy-based inks. Pulps used are elemental chlorine-free. This FSC logo identifies products which contain wood from well-managed forests and controlled sources certified in accordance with the rules of the Forest Stewardship Council. KOWLOON-CANTON RAILWAY CORPORATION CONTENTS 2 MANAGING BOARD & KEY MANAGEMENT 4 CHAIRMAN’S STATEMENT 6 CHIEF OFFICER’S STATEMENT AND FINANCIAL REVIEW 10 KOWLOON SOUTHERN LINK 12 CORPORATE GOVERNANCE REPORT 18 REPORT OF THE MEMBERS OF THE MANAGING BOARD 22 INDEPENDENT AUDITOR’S REPORT 24 FINANCIAL STATEMENTS AND NOTES 96 FIVE-YEAR STATISTICS MANAGING BOARD & KEY MANAGEMENT MANAGING BOARD Prof K C Chan SBS, JP (Left) PhD Chairman Secretary for Financial Services and the Treasury of the Hong Kong Special Administrative Region Government Eva Cheng Yu-wah JP (Right) B Soc Sc Secretary for Transport and Housing of the Hong Kong Special Administrative Region Government Stanley Y H Ying JP (Left) Member of Audit Committee Permanent Secretary for Financial Services and the Treasury (Treasury) of the Hong Kong Special Administrative Region Government Francis Ho Suen-wai JP (Right) Permanent