Measuring the Impact of Transit from a TOD Perspective

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda City Council

Littleton Center City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda City Council Tuesday, June 23, 2015 6:30 PM Community Room Special Meeting/Study Session 1. Roll Call 2. Pledge of Allegiance 3. Approval of Agenda 4. Citizen Comments Unscheduled Public Appearances 5. Comments / Reports a) City Manager b) Council Members c) Mayor 6. Consent Agenda Items Consent agenda items can be adopted by simple motion. All ordinances must be read by title prior to a vote on the motion. Any consent agenda item may be removed at the request of a Council Member. a) ID# 15-177 Motion to extend waiver of city manager’s residency requirement Attachments: 062414 Penny residency waiver.pdf City of Littleton Page 1 Printed on 6/22/2015 City Council Meeting Agenda June 23, 2015 b) Resolution Resolution approving a sewer service agreement and amendment to the 42-2015 1973 agreement with Columbine Water and Sanitation District, Platte Canyon Water and Sanitation District and Southwest Metropolitan Water and Sanitation District Attachments: 2015 Resolution 42 2015 Resolution 42 Exhibit A Cover Letter from the District Sewer Service Agreement original 1973 Agreement 7. Adjournment 8. Study Session a) Presentation from High Line Canal Conservancy b) ID# 15-178 Review of Civitas’ proposal for Main Street and Littleton Boulevard streetscape design project Attachments: Civitas Revised Streetscape proposal - May 7 2015 (2).pdf Civitas Original Streetscape proposal - March 18 2015 c) Dominion Water and Sanitation Contract discussion The public is invited to attend all regular meetings or study sessions of the City Council or any City Board or Commission. -

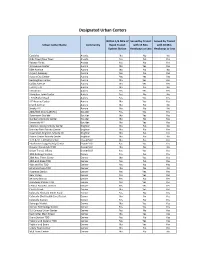

Designated Urban Centers

Designated Urban Centers Within 1/4 Mile of Served by Transit Served by Transit Urban Center Name Community Rapid Transit with 15 Min. with 30 Min. System Station Headways or Less Headways or Less Candelas ArvadaNoNoNo Olde Town/New Town Arvada Yes No Yes Ralston Fields Arvada Yes No Yes 1st Avenue Center Aurora No Yes Yes 56th Avenue Aurora No No No Airport Gateway Aurora Yes No Yes Aurora City Center Aurora Yes Yes Yes Buckingham Center Aurora No Yes Yes Colfax Avenue Aurora No Yes Yes E‐470 / I‐70 Aurora No No No Fitzsimons Aurora Yes Yes Yes Hampden Town Center Aurora Yes No No I‐225/Parker Road Aurora Yes Yes Yes Iliff Avenue Center Aurora No Yes Yes Jewell Avenue Aurora No No No Smoky Hill Aurora No No No 28th/30th Streets (BVRC) Boulder Yes Yes Yes Downtown Boulder Boulder No Yes Yes Gunbarrel Activity Center Boulder No No Yes University Hill Boulder No Yes Yes Adams Crossing Activity Center Brighton No No No Bromley Park Activity Center Brighton No No Yes Downtown Brighton Activity Ctr Brighton No No Yes Prairie Center Activity Center Brighton No No No 1‐25 & SH 7 Activity Center Broomfield No No Yes Interlocken Loopp Activityy Center Broomfield Yes Yes Yes Original Broomfield TODBroomfieldNoNoNo Urban Transit Village Broomfield Yes Yes Yes 10th & Osage Station Denver Yes No Yes 29th Ave. Town Center Denver No Yes Yes 38th and Blake TOD Denver Yes No Yes 41st and Fox TOD Denver Yes No Yes 62nd and Pena TODDenverNoNoNo Alameda Station Denver Yes Yes Yes Bear Valley Denver No Yes Yes Bellview Station Denver Yes No Yes Broadway Station -

Next Steps Study

Prepared for: City of Englewood 1000 Englewood Parkway Englewood, CO 80110-2373 City of Sheridan 4101 S. Federal Boulevard Sheridan, CO 80110-5399 Prepared by: Felsburg Holt & Ullevig 6300 S. Syracuse Way, Suite 600 Centennial, CO 80111 In Association With: ArLand LLC Bachman PR Design Workshop Toole Design Group Table of Contents Page Executive Summary -------------------------------------------------------------------------------------------- ES-1 Acknowledgements ------------------------------------------------------------------------------------------ ES-18 1.0 Introduction -------------------------------------------------------------------------------------------------- 1 1.1 Study Location and Description -------------------------------------------------2 1.2 Vision ---------------------------------------------------------------------------- 5 1.3 Objectives ----------------------------------------------------------------------- 5 1.4 Planning Context ---------------------------------------------------------------- 5 1.4.1 South Santa Fe Drive Corridor Improvements Study ------------------- 6 1.4.2 North Englewood Small Area Plan -------------------------------------- 6 1.4.3 CityCenter Englewood: Redevelopment of the Cinderella City Mall -- 6 1.4.4 Englewood Industrial Urban Renewal Plan and the General Ironworks Development Plan ------------------------------------------- 7 1.4.5 Southwest Light Rail Transit Line Major Investment Study ------------- 7 1.4.6 Englewood Civic Center Pedestrian Underpass Feasibility Study ----- 7 -

May 2019 Proposed Service Changes

May 2019 Proposed Service Changes BUS Route 0 – South Broadway Running time analysis resulting in schedule adjustments. Route 1 – 1st Avenue Move east terminal from Birch/Virginia to Virginia/Cherry, immediately behind King Soopers at Leetsdale/Cherry for operator restroom and customer convenience. Route 15 – East Colfax This proposal is an effort to relieve passenger overloads east of Monaco to VA Hospital by adding selected trips between 9:00am and 1:00pm. Move short turn recovery location from Oneida/Colfax to Leyden/Colfax, for operator restroom access. Close to Walgreens, McDonalds, 7-11. Add weekday bus for recovery and on-time performance. 16/16L – West Colfax Running time analyses on weekend services. Route 33 – Platte Valley Due to low ridership performance, it proposed that this route service be discontinued. Current ridership performance stands at 10.3 passenger per hour, which falls below the Urban Local ridership standard. This proposal would impact approximately 55 weekday passengers. Alternative service to the Route 33 can be found in using combinations of Central and West Light Rail corridors, Routes 4, 9, 30 and 30Limited. Route 36L – Fort Logan Limited Running time analysis, for operator recovery and on-time performance. No cost impacts are anticipated. Route 44 – 44th Avenue Reroute eastbound buses via Larimer Street instead of Lawrence, between Broadway and Downing. This change consolidates service onto the historic transit corridor, instead of being split between two streets. Bus stop improvement along northbound Larimer are currently underway in support of this reroute. No cost impacts are anticipated. Route 51 – Sheridan Boulevard This proposal would, formalize the current 4-block route detour in Englewood, which was put into effect due to the City having converted a part of Elati Street into a one-way operation. -

Greater Kansas City Chamber of Commerce

Transit as a Catalyst for a Winning Region: A Denver Case Study Maria Garcia Berry May 17, 2018 Regionalism is Born 1960s 100-year Flood 1970s School Desegregation and Busing Annexation Wars 1980s Retail Wars Denver International Airport Convention Center 16th Street Mall 2 Regionalism Grows Up 1990s: Formation of Metro Mayors Caucus Sports Facilities T-REX Project - Rail and Roads TABOR – Taxpayers’ Bill of Rights 2000s: Water Wars FasTracks - Expansion of Transit Growth and Development The Great Recession 2010s: Statewide Transportation Challenges Marijuana – The New Mile High City 3 The Early Years of Transit 1960s: Denver Tramway Company files for bankruptcy and transfers assets to city- owned Denver Metro Transit 1969: RTD was created by the Colorado General Assembly 1973: Voters approved .05% sales tax for RTD 1974: Denver Metro Transit becomes part of RTD 1994: Central Connector Light Rail Line opens 2000: Southwest Light Rail Line opens 2002: Central Platte Valley Spur opens 4 Laying the Groundwork for FasTracks • Proposed “Guide the Ride” expansion failed in 1997 (57% to 43%) – Dysfunctional board – Conceptual Plan – “trust us with your money” – The “yes” campaign spent $650,000; “no” $50,000 • In 1999, CDOT and RTD collaborated on two ballot measures approved by the voters – Granted CDOT authority to pledge federal revenues to retire debt – Allowed RTD to seek additional bonding authority for rail construction 3 – TREX expanded I-25 and built 19 miles of light rail Laying the Groundwork for FasTracks • By 2001, RTD Board and -

City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda

Littleton Center City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Meeting Agenda Planning Commission Monday, January 9, 2017 6:30 PM Community Room Study Session 1. RTD and Southwest Rail Extension Updates a. ID# 17-10 Kent Bagley, Regional Transportation District, Board of Directors, District H Attachments: RTD Directors Map - District H 2. Board and Staff Updates The public is invited to attend all regular meetings or study sessions of the City Council or any City Board or Commission. Please call 303-795-3780 at least forty-eight (48) hours prior to the meeting if you believe you will need special assistance or any reasonable accommodation in order to be in attendance at or participate in any such meeting. For any additional information concerning City meetings, please call the above referenced number. City of Littleton Page 1 Printed on 1/5/2017 Littleton Center City of Littleton 2255 West Berry Avenue Littleton, CO 80120 Staff Communication File #: ID# 17-10, Version: 1 City of Littleton Page 1 of 1 Printed on 1/5/2017 powered by Legistar™ College View / South Platte Englewood Station Nine Mile Station 95 391 UV Harvey Park South FLOYD AV Wellshire 2 University Hills Hampden UV LAKEWOOD Bear Valley UV88 UV Nine Mile Station ZUNI ST HAMPDEN AV 285 30 Kennedy AURORA UV391 9E Wadsworth / Hampden UV95 Englewood Station ¤£285 ¤£285 E HAPPY CANYON RD¤£ UV I Southmoor Station S LOWELLS BLVD 225 0 0.5 1 KENYON AV AURORA ¨¦§ 83 ELATI ST ELATI UV Southmoor Station YOSEMITES ST Miles CLARKSONST Southmoor Park SHERIDAN DENVER Dayton -

2035 Metro Vision Regional Transportation Plan

Denver Regional Council of Governments 2035 Metro Vision Regional Transportation Plan Appendix 1 Denver Region Multimodal Corridor Visions Adopted December 19, 2007 Preparation of this report has been financed in part through grants from the U.S. Department of Transportation, Federal Transit Administration, and Federal Highway Administration. Disclaimer: The data in this report are compiled from multiple sources and are intended for informational purposes only. DRCOG assumes no responsibility or legal liability for the accuracy, completeness or usefulness of any information in this report. ii Table of Contents 1. INTRODUCTION............................................................................................................................... 1 A. Overview of Appendix.................................................................................................................................. 1 B. Implementation Priorities.............................................................................................................................. 1 2. COMMON STRATEGIES FOR ALL CORRIDOR VISIONS IN DRCOG REGION ............................. 5 A. Overall .......................................................................................................................................................... 5 B. Transit Facilities and Services ...................................................................................................................... 5 C. Travel Demand Management....................................................................................................................... -

AGENCY PROFILE and FACTS RTD Services at a Glance

AGENCY PROFILE AND FACTS RTD Services at a Glance Buses & Rail SeniorRide SportsRides Buses and trains connect SeniorRide buses provide Take RTD to a local the metro area and offer an essential service to our sporting event, Eldora an easy RTDway to Denver services senior citizen at community. a glanceMountain Resort, or the International Airport. BolderBoulder. Buses and trains connect and the metro trainsarea and offer an easy way to Denver International Airport. Access-a-Ride Free MallRide Access-a-RideAccess-a-Ride helps meet the Freetravel MallRideneeds of passengers buses with disabilities.Park-n-Rides Access-a-RideFlexRide helps connect the entire length Make connections with meet theFlexRide travel needsbuses travel of within selectof downtown’s RTD service areas.16th Catch FlexRideour to connect buses toand other trains RTD at bus or passengerstrain with servies disabilities. or get direct accessStreet to shopping Mall. malls, schools, and more.89 Park-n-Rides. SeniorRide SeniorRide buses serve our senior community. Free MallRide FlexRideFree MallRide buses stop everyFree block onMetroRide downtown’s 16th Street Mall.Bike-n-Ride FlexRideFree buses MetroRide travel within Free MetroRide buses Bring your bike with you select RTDFree service MetroRide areas. buses offer convenientoffer convenient connections rush-hour for downtown commuterson the bus along and 18th train. and 19th Connectstreets. to other RTD connections for downtown SportsRides buses or trains or get direct commuters along 18th and Take RTD to a local sporting event, Eldora Mountain Resort, or the BolderBoulder. access toPark-n-Rides shopping malls, 19th streets. schools, Makeand more.connections with our buses and trains at more than 89 Park-n-Rides. -

January 2014 Service Changes

BOARD OF DIRECTORS REPORT To: Phillip A. Washington, General Manager Date: October 10, 2013 From: Bruce Abel, Assistant General Manager GM Date: October 8, 2013 Board Meeting Date: October 15, 2013 Subject: January 2014 Service Changes RECOMMENDED ACTION It is recommended by the Operations/Customer Services Committee that the Board of Directors approve the January 2014 Service Change package as revised and summarized in Attachment A resulting in an annualized cost increase of approximately $635,500 and, further, to authorize the General Manager or his designee to execute contract amendments as necessary for private operators whose service is impacted by these changes. DISCUSSION To meet the diverse travel needs of the citizens of the District and maintain a high-performance, sustainable transit system, RTD has developed a networked family of services for which the different classes of service have different expectations of performance. We will continue adjusting services in response to changes in ridership and operational performance of the transit system as a whole while also continuing to review the impacts of the implementation of the West Corridor Light Rail Service and the associated bus service changes. Routine service changes not associated with or included in the West Corridor Service Plan are necessary to maintain system on-time performance and provide the appropriate level of service according to customer demand while we will also need to monitor customer response to the implementation of West Corridor bus and rail service and -

Rails to Real Estate Development Patterns Along

Rails to Real Estate Development Patterns along Three New Transit Lines March 2011 About This Study Rails to Real Estate was prepared by the Center for Transit-Oriented Development (CTOD). The CTOD is the only national nonprofit effort dedicated to providing best practices, research and tools to support market- based development in pedestrian-friendly communities near public transportation. We are a partnership of two national nonprofit organizations – Reconnecting America and the Center for Neighborhood Technology – and a research and consulting firm, Strategic Economics. Together, we work at the intersection of transportation planning, regional planning, climate change and sustainability, affordability, economic development, real estate and investment. Our goal is to help create neighborhoods where young and old, rich and poor, can live comfortably and prosper, with affordable and healthy lifestyle choices and ample and easy access to opportunity for all. Report Authors This report was prepared by Nadine Fogarty and Mason Austin, staff of Strategic Economics and CTOD. Additional support and assistance was provided by Eli Popuch, Dena Belzer, Jeff Wood, Abigail Thorne-Lyman, Allison Nemirow and Melissa Higbee. Acknowledgements The Center for Transit-Oriented Development would like to thank the Federal Transit Administration. The authors are also grateful to several persons who assisted with data collection and participated in interviews, including: Bill Sirois, Denver Regional Transit District; Catherine Cox-Blair, Reconnecting America; Caryn Wenzara, City of Denver; Frank Cannon, Continuum Partners, LLC; Gideon Berger, Urban Land Institute/Rose Center; Karen Good, City of Denver; Kent Main, City of Charlotte; Loretta Daniel, City of Aurora; Mark Fabel, McGough; Mark Garner, City of Minneapolis; Michael Lander, Lander Group; Norm Bjornnes, Oaks Properties LLC; Paul Mogush, City of Minneapolis; Peter Q. -

Broncosride Pickup Schedule for December 22, 2019

BroncosRide and Light Rail Service page 1 of 2 BroncosRide Schedule for: Sunday, December 22, 2019 Route: Park-n-Ride / Stop / Station Times are approximate Post game bus location** BR26: Dry Creek & University 11:35 AM 11:40 AM 11:45 AM every 5-10 minutes until 12:55 PM Row 22 Arapahoe High School BR24: Alameda Havana 12:25 PM 12:40 PM 12:55 PM Row 21 BR10: Boulder High School 11:35 AM 11:55 AM 12:15 PM Row15-16 Arapahoe & 17th BR32: El Rancho 12:00 PM 12:15 PM 12:35 PM Row 4 BR32: Evergreen 11:45 AM 12:00 PM 12:20 PM Row 4 BR38: Federal Shuttle: Lincoln HS (Hazel Ct & Iliff) and bus stops on Federal Blvd 11:35 AM 11:40 AM 11:45 AM every 5 - 10 minutes until 1:50 PM Row 28 between Evans and 8th Ave BR20: Longmont Park-n-Ride 11:30 AM 11:35 AM 11:45 AM 11:50 AM 12:00 PM 12:10 PM 12:20 PM 12:30 PM Rows 17-18 815 South Main Street BR44: Nine Mile (Ga te F) 11:35 AM 11:40 AM 11:45 AM every 5-10 minutes until 1:00 PM Rows 23-24 BR8: Olde Town Arvada Discontinued Discontinued: Ride G-Line to DUS and Transfer to C, E or W-Lines to Broncos Stadium BR48: Parker 11:35 AM 11:45 AM 11:50 AM 12:00 PM 12:15 PM 12:30 PM Row 19 BR48: Pinery 11:35 AM 11:40 AM 11:50 AM 12:05 PM 12:20 PM Row 19 BR56: South High School 11:40 AM 11:50 AM 12:00 PM 12:10 PM 12:20 PM 12:35 PM 12:50 PM Row 26 Louisiana & Gilpin BR4: Thornton (Gate C) 11:40 AM 11:45 AM 11:45 AM every 5-10 minutes until 1:35 PM Rows 9-12 BR10: US 36 & Broomfield Station (Gate 11:35 AM 11:45 AM 11:55 AM 12:05 PM 12:15 PM 12:25 PM 12:45 PM Rows 15-16 K) BR10: US 36 & McCaslin Stn (Gate A) 11:45 -

May 19 2021 BOD Agenda.Pdf

AGENDA BOARD OF DIRECTORS WEDNESDAY, May 19, 2021 6:30 p.m. – 8:30 p.m. VIDEO/WEB CONFERENCE Denver, CO 1. 6:30 Call to Order 2. Roll Call and Introduction of New Members and Alternates 3. Move to Approve Agenda STRATEGIC INFORMATIONAL BRIEIFNG 4. 6:40 The Denver Foundation: summary and overview (Attachment A) Javier Alberto Soto, President & CEO; Dace West, Chief Impact Officer 5. 7:00 Report of the Chair • Public Hearing Announcement • Report on Performance and Engagement Committee • Report on Finance and Budget Committee 6. 7:05 Report of the Executive Director 7. 7:10 Public Comment Up to 45 minutes is allocated now for public comment and each speaker will be limited to 3 minutes. If there are additional requests from the public to address the Board, time will be allocated at the end of the meeting to complete public comment. The chair requests that there be no public comment on issues for which a prior public hearing has been held before this Board. Consent and action items will begin immediately after the last speaker. TIMES LISTED WITH EACH AGENDA ITEM ARE APPROXIMATE. IT IS REQUESTED THAT ALL CELL PHONES BE SILENCED DURING THE BOARD OF DIRECTORS MEETING. THANK YOU! Persons in need of auxiliary aids or services, such as interpretation services or assisted listening devices, are asked to contact DRCOG at least 48 hours in advance of the meeting by calling (303) 480-6701. Board of Directors Meeting Agenda May 19, 2021 Page 2 CONSENT AGENDA 8. 7:20 Move to Approve Consent Agenda i.