An Economic Analysis of Potential Changes to the Aircraft Sales and Use Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PUBLIC HEARING: April 11, 2017 – Planning and Land Development Regulation Commission (PLDRC) Meeting

Page 1 of 37 GROWTH AND RESOURCE MANAGEMENT DEPARTMENT PLANNING AND DEVELOPMENT SERVICES DIVISION CURRENT PLANNING ACTIVITY 123 W. Indiana Avenue, DeLand, FL 32720 (386) 736-5959 PUBLIC HEARING: April 11, 2017 – Planning and Land Development Regulation Commission (PLDRC) meeting SUBJECT: Request to amend Chapter 72, Section 72-296 Airport Hazards, of the Volusia County Zoning Code, creating Airport Protection and Land Use Compatibility Zone regulations pursuant to F.S. Ch. 333; and request to establish the Airport Protection and Land Use Compatibility Overlay Zone over unincorporated lands in the vicinity of publicly owned and maintained airports and radar navigation facilities LOCATION: Unincorporated Volusia County properties adjacent to airports operated by the Cities of New Smyrna Beach, Daytona Beach, Ormond Beach, Pierson, DeLand and Sanford, along with the ASR-9 radar site APPLICANT: County of Volusia STAFF: Michael E. Disher, AICP, Planner III I. SUMMARY OF REQUEST In response to statutory requirements and mandatory deadlines of F.S. 333 regarding airport protection zoning, Volusia County proposes the creation of an overlay zoning classification covering unincorporated property in the vicinity of airports publicly owned and operated by the Cities of New Smyrna Beach, Daytona Beach, Ormond Beach, Pierson, DeLand and Sanford, along with the ASR-9 radar site. All local governments in the state of Florida are required by F.S. 333 to adopt airport protection standards if located in the “airport hazard area” of a public-use airport. The purpose of these standards is to establish reasonable protections for airport operations and aircraft, to minimize the exposure of adjacent properties to airport hazards and noise, to prohibit incompatible land uses and structures around airports, and to provide for coordination between municipalities and the county. -

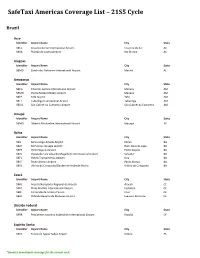

Safetaxi Americas Coverage List – 21S5 Cycle

SafeTaxi Americas Coverage List – 21S5 Cycle Brazil Acre Identifier Airport Name City State SBCZ Cruzeiro do Sul International Airport Cruzeiro do Sul AC SBRB Plácido de Castro Airport Rio Branco AC Alagoas Identifier Airport Name City State SBMO Zumbi dos Palmares International Airport Maceió AL Amazonas Identifier Airport Name City State SBEG Eduardo Gomes International Airport Manaus AM SBMN Ponta Pelada Military Airport Manaus AM SBTF Tefé Airport Tefé AM SBTT Tabatinga International Airport Tabatinga AM SBUA São Gabriel da Cachoeira Airport São Gabriel da Cachoeira AM Amapá Identifier Airport Name City State SBMQ Alberto Alcolumbre International Airport Macapá AP Bahia Identifier Airport Name City State SBIL Bahia-Jorge Amado Airport Ilhéus BA SBLP Bom Jesus da Lapa Airport Bom Jesus da Lapa BA SBPS Porto Seguro Airport Porto Seguro BA SBSV Deputado Luís Eduardo Magalhães International Airport Salvador BA SBTC Hotéis Transamérica Airport Una BA SBUF Paulo Afonso Airport Paulo Afonso BA SBVC Vitória da Conquista/Glauber de Andrade Rocha Vitória da Conquista BA Ceará Identifier Airport Name City State SBAC Aracati/Aeroporto Regional de Aracati Aracati CE SBFZ Pinto Martins International Airport Fortaleza CE SBJE Comandante Ariston Pessoa Cruz CE SBJU Orlando Bezerra de Menezes Airport Juazeiro do Norte CE Distrito Federal Identifier Airport Name City State SBBR Presidente Juscelino Kubitschek International Airport Brasília DF Espírito Santo Identifier Airport Name City State SBVT Eurico de Aguiar Salles Airport Vitória ES *Denotes -

CARES ACT GRANT AMOUNTS to AIRPORTS (Pursuant to Paragraphs 2-4) Detailed Listing by State, City and Airport

CARES ACT GRANT AMOUNTS TO AIRPORTS (pursuant to Paragraphs 2-4) Detailed Listing By State, City And Airport State City Airport Name LOC_ID Grand Totals AK Alaskan Consolidated Airports Multiple [individual airports listed separately] AKAP $16,855,355 AK Adak (Naval) Station/Mitchell Field Adak ADK $30,000 AK Akhiok Akhiok AKK $20,000 AK Akiachak Akiachak Z13 $30,000 AK Akiak Akiak AKI $30,000 AK Akutan Akutan 7AK $20,000 AK Akutan Akutan KQA $20,000 AK Alakanuk Alakanuk AUK $30,000 AK Allakaket Allakaket 6A8 $20,000 AK Ambler Ambler AFM $30,000 AK Anaktuvuk Pass Anaktuvuk Pass AKP $30,000 AK Anchorage Lake Hood LHD $1,053,070 AK Anchorage Merrill Field MRI $17,898,468 AK Anchorage Ted Stevens Anchorage International ANC $26,376,060 AK Anchorage (Borough) Goose Bay Z40 $1,000 AK Angoon Angoon AGN $20,000 AK Aniak Aniak ANI $1,052,884 AK Aniak (Census Subarea) Togiak TOG $20,000 AK Aniak (Census Subarea) Twin Hills A63 $20,000 AK Anvik Anvik ANV $20,000 AK Arctic Village Arctic Village ARC $20,000 AK Atka Atka AKA $20,000 AK Atmautluak Atmautluak 4A2 $30,000 AK Atqasuk Atqasuk Edward Burnell Sr Memorial ATK $20,000 AK Barrow Wiley Post-Will Rogers Memorial BRW $1,191,121 AK Barrow (County) Wainwright AWI $30,000 AK Beaver Beaver WBQ $20,000 AK Bethel Bethel BET $2,271,355 AK Bettles Bettles BTT $20,000 AK Big Lake Big Lake BGQ $30,000 AK Birch Creek Birch Creek Z91 $20,000 AK Birchwood Birchwood BCV $30,000 AK Boundary Boundary BYA $20,000 AK Brevig Mission Brevig Mission KTS $30,000 AK Bristol Bay (Borough) Aleknagik /New 5A8 $20,000 AK -

Alachua County

FLORIDA DEPARTMENT OF TRANSPORTATION 5 - YEAR TRANSPORTATION PLAN ($ IN THOUSANDS) TENTATIVE FY 2022 - 2026 (12/02/2020 15.48.40) ALACHUA COUNTY Item No Project Description Work Description Length 2022 2023 2024 2025 2026 Highways: State Highways Item No Project Description Work Description Length 2022 2023 2024 2025 2026 4135171 D2-ALACHUA COUNTY TRAFFIC SIGNAL MAINTENANCE AGREEMENT TRAFFIC CONTROL DEVICES/SYSTEM .000 1,103 OPS 1,157 OPS 4358891 SR120(NW 23 AVE) & SR25(US441)(NW 13 ST) TRAFFIC SIGNAL UPDATE .005 94 ROW 214 ROW 165 ROW 762 CST 4437011 SR20 EAST ON-RAMP IN HAWTHORNE RR CROSSING #625010J RAILROAD CROSSING .146 432 RRU 4395331 SR20 FROM: EAST OF US301 TO: PUTNAM C/L LANDSCAPING 1.399 85 PE 1,229 CST 4436951 SR20 W ON-RAMP IN HAWTHORNE RR CROSSING NUMBER 927690S RAILROAD CROSSING .118 362 RRU 4432581 SR20(SE HAWTHORN ROAD) FROM: CR325 TO: WEST OF US301 RESURFACING 5.340 8,528 CST 4355641 SR200(US301) @SR24 CSXRR BR.NO260001 & SR25(US441) PED OVRPS BR.260003 BRIDGE - PAINTING .097 919 CST 4470321 SR222 (39TH AVE) FROM NW 92ND CT TO NW 95TH BLVD RESURFACING 3.293 719 PE 6,995 CST 4373771 SR226(SW 16TH AVE) AT SW 10TH TERRACE PEDESTRIAN SAFETY IMPROVEMENT .004 354 CST 4479641 SR24 FROM SR222 TO SR200(US301) RESURFACING 10.706 2,414 PE 16,633 CST 4358911 SR25(US441) @ SR24(SW ARCHER RD) TRAFFIC SIGNAL UPDATE .006 552 PE 37 ROW 261 ROW 848 CST 4344001 SR25(US441) @ SW 14TH DRIVE TRAFFIC SIGNAL UPDATE .037 1,037 CST 4470331 SR25(US441) FROM SR331(WILLISTON ROAD) TO SR24(ARCHER ROAD) RESURFACING 2.032 4,377 CST 2078502 SR26 CORRIDOR -

Advertising Opportunity Guide Print

AAAE’S AAAE DELIVERS FOR AIRPORT EXECUTIVES NO.1 RATED PRODUCT M AG A Z IN E AAAEAAAE DELIVERSDELIVERS FOR AIRPORTAIRPORT EXECUTIVESEXECUTIVES AAAE DELIVERS FOR AIRPORT EXECUTIVES AAAE DELIVERS FOR AIRPORT EXECUTIVES MMAGAZINE AG A Z IN E MAGAZINE MAGAZINE www.airportmagazine.net | August/September 2015 www.airportmagazine.net | June/July 2015 www.airportmagazine.net | February/March 2015 NEW TECHNOLOGY AIDS AIRPORTS, PASSENGERS NON-AERONAUTICAL REVENUE SECURITYU.S. AIRPORT TRENDS Airport Employee n Beacons Deliver Airport/ Screening Retail Trends Passenger Benefits n Hosting Special Events UAS Security Issues Editorial Board Outlook for 2015 n CEO Interview Airport Diversity Initiatives Risk-Based Security Initiatives ADVERTISING OPPORTUNITY GUIDE PRINT ONLINE DIGITAL MOBILE AIRPORT MAGAZINE AIRPORT MAGAZINE ANDROID APP APPLE APP 2016 | 2016 EDITORIAL MISSION s Airport Magazine enters its 27th year of publication, TO OUR we are proud to state that we continue to produce AVIATION Atop quality articles that fulfill the far-ranging needs of airports, including training information; the lessons airports INDUSTRY have learned on subjects such as ARFF, technology, airfield and FRIENDS terminal improvements; information about the state of the nation’s economy and its impact on air service; news on regulatory and legislative issues; and much more. Further, our magazine continues to make important strides to bring its readers practical and timely information in new ways. In addition to printed copies that are mailed to AAAE members and subscribers, we offer a full digital edition, as well as a free mobile app that can be enjoyed on Apple, Android and Kindle Fire devices. In our app you will discover the same caliber of content you’ve grown to expect, plus mobile-optimized text, embedded rich media, and social media connectivity. -

CARES ACT FUNDING by Michael Mcdougall, Aviation Communications Manager

News from the Florida Department of Transportation Aviation Office www.fdot.gov/aviation SPRING 2020 CARES ACT FUNDING by Michael McDougall, Aviation Communications Manager n March 27, 2020, President Trump signed a $2.2 trillion stimulus bill into law called the Coronavirus Aide, Relief, and Economic Security Act (CARES Act), of which $10 billion in grants was allocated to provide relief to eligible airports in the U.S. that have been impacted during the COVID-19 pandemic. Previously, the Federal Aviation O Administration (FAA) would fund a large percentage of AIP eligible projects and there would be a local match contributed by the Airport’s sponsor. As a result of the CARES Act, temporary changes have been made to the Airport Improvement Program (AIP). $500 million of the $10 billion is now available to increase the federal share of certain projects up to 100 percent. The other $9.5 billion will be made available to airports to cover expenses such as operational costs, payroll, debt services, aiding in protection, prevention, and future preparations to combat complications from the pandemic. For projects identified to receive 100 percent federal funding, there will be no local contribution. All airports that are in the National Plan of Integrated Airport Systems (NPIAS) were eligible for funding, as determined by an airport’s classification of either commercial service or general aviation. Commercial Service airports (those with 10,000 or more annual passenger boardings) were eligible to receive up to $7.4 billion of CARES Act funding, based on their total annual enplanements. This is similar to how Commercial Service airports receive the AIP entitlement funds. -

VALKARIA AIRPORT IS GA AIRPORT of the YEAR! by Liesl King, Airport Administration/Aviation Paralegal

News from the Florida Department of Transportation Aviation Office www.fdot.gov/aviation FALL 2019 VALKARIA AIRPORT IS GA AIRPORT OF THE YEAR! by Liesl King, Airport Administration/Aviation Paralegal uilt in 1942, Valkaria Airport (X59) is located in east- Cape Canaveral Air Force Station and Kennedy Space Center. In central Florida within the community of Grant-Valkaria 1959, the United States Department of Defense and the General in Brevard County. Brevard County boasts 71 miles of Services Administration conveyed that part of the Valkaria facility coastline in one of the most historical places on earth, the not dedicated to MISTRAM to the county government of Brevard B Space Coast. The airport sits on 660 acres of land and is County, Florida for use as a public airport. flanked by a championship golf course to the south. Taking off to the east, flyers get an immediate breathtaking view of the Indian River and RECENT IMPROVEMENTS Atlantic Ocean beyond. To the north, Cape Canaveral and Kennedy Over the past several years, Airport Director Steve Borowski’s vision Space Center are only a short drive, and an even shorter flight! Pilots for X59 and the general aviation community has become a reality with can request a flyover of the former space shuttle landing area and get grant assistance from the Federal Aviation Administration (FAA) and a birds-eye view of what shuttle astronauts saw when touching down. Florida Department of Transportation (FDOT). From new hangars and a new terminal building, to an instrument approach for runway 14/32, SERVING THE COMMUNITY the airport has gone from 16,000 annual operations several years ago Valkaria Airport is owned by Brevard County and is a public-use to 65,000 annual operations. -

![[4910-13] DEPARTMENT of TRANSPORTATION Federal](https://docslib.b-cdn.net/cover/9869/4910-13-department-of-transportation-federal-1389869.webp)

[4910-13] DEPARTMENT of TRANSPORTATION Federal

This document is scheduled to be published in the Federal Register on 06/25/2021 and available online at [4910-13] federalregister.gov/d/2021-13274, and on govinfo.gov DEPARTMENT OF TRANSPORTATION Federal Aviation Administration 14 CFR Part 71 [Docket No. FAA-2021-0169; Airspace Docket No. 21-ASO-3] RIN 2120-AA66 Proposed Amendment of Class D and Class E Airspace; South Florida AGENCY: Federal Aviation Administration (FAA), DOT. ACTION: Notice of proposed rulemaking (NPRM). SUMMARY: This action proposes to amend Class D and Class E airspace in the south Florida area, by updating the geographic coordinates of the following airports; Fort Lauderdale-Hollywood International Airport, Miami-Opa Locka Executive Airport, (formerly Opa Locka Airport), North Perry Airport, Pompano Beach Airpark, Miami International Airport, Homestead ARB, Boca Raton Airport, Miami Executive Airport (formerly Kendall-Tamiami Executive Airport). This action would also update the geographic coordinates of the Fort Lauderdale Very High Frequency Omnidirectional Range Collocated with Distance Measuring Equipment (VOR/DME), and the QEEZY Locator Outer Marker (LOM). This action would also make an editorial change replacing the term Airport/Facility Directory with the term Chart Supplement in the legal descriptions of associated Class D and E airspace. Controlled airspace is necessary for the safety and management of instrument flight rules (IFR) operations in the area. DATES: Comments must be received on or before [INSERT DATE 45 DAYS AFTER THE DATE OF PUBLICATION IN THE FEDERAL REGISTER]. ADDRESSES: Send comments on this proposal to: the U.S. Department of Transportation, Docket Operations, 1200 New Jersey Avenue SE, West Building Ground Floor, Room W12-140, Washington, DC 20590-0001; Telephone: (800) 647-5527, or (202) 366-9826. -

January 14, 2000

CFASPP Continuing Florida Aviation System Planning Process ________________________________________________________________________________________________ NORTHWEST FLORIDA REGION GREG DONOVAN, A.A.E., CHAIR May 7, 2008 Dear Committee Members, Advisors, and Participants, Subject: NORTHWEST FLORIDA REGION CFASPP Committee Meeting Date/Time: Thursday, June 5, 2008 at 10:00 AM (Central Standard Time). Location: Okaloosa Regional Airport, Terminal Conference Room. CFASPP Round 2008-2 is set for May 20th -June 5th at various locations around the State. The Round will conclude on July 19th with a Statewide Committee Meeting at the Breakers Resort in Palm Beach immediately prior the FAC Annual Conference. By the time the regional meetings are held for this Round, the Florida Legislative Session for 2008 will have come to an end signaling the beginning of a new set of challenges for airport sponsors. Aviation Planning has become even more difficult in this day and age with the continuing uncertainty brought about by budget adjustments at all levels of government. As a result, I would like to cordially invite you to join your fellow airport community members at our next regional meeting on June 5, 2008 as we continue our discussions on the direction of aviation in Florida. As we noted during the last round, the meeting agenda and handout material are now being distributed to you in electronic form. In order to ensure continued delivery of your meeting materials, please be sure that you check and if necessary update your contact information on the attendance roster at the meeting. If you should have any questions or concerns prior to the meeting, please feel free to let me know or you may contact Dan Afghani, CFASPP Administrator via e-mail at [email protected]. -

National Transportation Safety Board Aviation Accident Preliminary Report

National Transportation Safety Board Aviation Accident Preliminary Report Location: Lakeland, FL Accident Number: ERA21LA201 Date & Time: May 1, 2021, 14:28 Local Registration: N125WC Aircraft: Beech A36 Injuries: 1 Fatal, 1 Serious Flight Conducted Part 91: General aviation - Personal Under: On May 1, 2021, about 1428 eastern daylight time, a Beech A36, N125WC, was destroyed when it was involved in an accident near Lakeland, Florida. The private pilot was seriously injured, and the pilot- rated passenger was fatally injured. The airplane was operated as a Title 14 Code of Federal Regulations Part 91 personal flight. According to Automatic Dependent Surveillance-Broadcast (ADS-B) data, earlier on the day of the accident the airplane flew to several airports before arriving at Bartow Executive Airport (BOW), Bartow, Florida. The accident flight departed BOW about 1420 and proceeded toward Lakeland Linder International Airport (LAL), Lakeland, Florida. According to recorded air traffic control communications with the LAL air traffic control tower, the flight was instructed by the local controller to join the right downwind leg of the airport traffic pattern for runway 9 at or above 1,500 ft mean sea level (msl). The local controller observed the airplane descending to 800 ft msl and informed the pilot that the flight needed to be at or above 1,500 ft msl, and to turn southbound. An occupant of the airplane advised the controller of an engine failure. The airplane was cleared to land on runway 5, and subsequently cleared to land on runway 27, after a transport category airplane that was on approach to runway 9 was instructed to go-around; however, the pilot or passenger advised that the airplane could not reach the runway. -

Propelling Aviation Careers

Vol 19-02 Propelling April 25, 2019 Aviation Careers IN THIS ISSUE MESSAGE FROM THE NEW EDUCATION COMMITTEE CO-VICE CHAIR WELCOME MESSAGE 1 Wow! I can hardly believe it is April! Our Committee has accomplished so much already this year, and we have a never-ending list of ideas that we want to accomplish. I am happy to be welcomed NEW STUDENT MEMBER 2 on board as a Co-Vice Chair for the Education Committee, and join with the efforts of leaders such as Derek and Sierra as we strive for bigger and better successes. SCHOLARSHIP 2 RECIPIENT I work as the Resilience Program Manager, part of the Emergency Management and Resilience Department, at the Tampa International Airport . I joined TPA 5 years ago as the Public Safety Administration FUNDRAISING Manager responsible for law enforcement compliance, budgeting 3 HIGHLIGHTS and records. In 2015, I embarked on a new adventure with the Operations Department as the Operations Administration Manager overseeing the department budget, managing both the high school and college internship programs, employee engagement efforts, and most recently developing an agency-wide THANK YOU EVENT 4 wellness program. You may have seen me during the 2018 Annual FAC Conference in SPONSORS Tampa, Florida this past year. As part of the Host Committee, I managed all volunteer activity, helped develop sessions and organized events. WHERE ARE THEY NOW 5 Each year, I help manage a high school internship program that is coordinated through the *NEW* Tampa Bay Regional Aeronautics Academy. This agency works with schools in the Hillsborough, Pinellas and Polk County Regions. -

Florida Flyer, Winter Edition 2020

News from the Florida Department of Transportation Aviation Office www.fdot.gov/aviation WINTER 2020 FLAGLER EXECUTIVE AIRPORT WHERE SERVICE SOARS! by Roy Sieger, Airport Director, Flagler Executive Airport ike many airports in Florida, the Flagler Executive 11-29. This was the largest project ever at the airport since the original Airport (FIN) was constructed shortly after America was construction in 1942. The project encompassed 183 acres in order to thrust into war as a result of the attack on Pearl Harbor relocate the runway 400’ south, shift it 800’ east, and extend it 501’ on December 7, 1941. When the airport was originally east. L constructed, it was called the Bulow Outlying Field The airport is currently in the design phase of a new 15,000 square (X47) and was utilized as a flight training base for NAS Jacksonville. foot GA Terminal facility. The terminal will accommodate airport Following WWII, in 1947 the airport was deeded to the Flagler administrative offices, a fixed base operator (FBO), public space, County Board of County Commissioners (BOCC) by the War Assets meeting space, and room for additional tenants. The GA Terminal Administration, through the Surplus Property Act of 1944. Since that facility is the next step in the evolution of the airport. time, the airport has been a public use general aviation (GA) airport that is operated and maintained under the Flagler County BOCC. In 2016, a new airport logo was created that incorporated both the new airport name (Flagler Executive Airport) and the identifier (FIN). The rebranding reflects the transition to serve more corporate tenants and visitors, as well as the expansion of the airfield and services provided by the county-operated FBO.