Nickel, Cobalt & Manganese

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manganese Toxicity May Appear Slowly Over Months and Years

MANGANESE 11 2. RELEVANCE TO PUBLIC HEALTH 2.1 BACKGROUND AND ENVIRONMENTAL EXPOSURES TO MANGANESE IN THE UNITED STATES Manganese is a naturally occurring element and an essential nutrient. Comprising approximately 0.1% of the earth’s crust, it is the twelfth most abundant element and the fifth most abundant metal. Manganese does not exist in nature as an elemental form, but is found mainly as oxides, carbonates, and silicates in over 100 minerals with pyrolusite (manganese dioxide) as the most common naturally-occurring form. As an essential nutrient, several enzyme systems have been reported to interact with or depend on manganese for their catalytic or regulatory function. As such, manganese is required for the formation of healthy cartilage and bone and the urea cycle; it aids in the maintenance of mitochondria and the production of glucose. It also plays a key role in wound-healing. Manganese exists in both inorganic and organic forms. An essential ingredient in steel, inorganic manganese is also used in the production of dry-cell batteries, glass and fireworks, in chemical manufacturing, in the leather and textile industries and as a fertilizer. The inorganic pigment known as manganese violet (manganese ammonium pyrophosphate complex) has nearly ubiquitous use in cosmetics and is also found in certain paints. Organic forms of manganese are used as fungicides, fuel-oil additives, smoke inhibitors, an anti-knock additive in gasoline, and a medical imaging agent. The average manganese soil concentrations in the United States is 40–900 mg/kg; the primary natural source of the manganese is the erosion of crustal rock. -

Evolution and Understanding of the D-Block Elements in the Periodic Table Cite This: Dalton Trans., 2019, 48, 9408 Edwin C

Dalton Transactions View Article Online PERSPECTIVE View Journal | View Issue Evolution and understanding of the d-block elements in the periodic table Cite this: Dalton Trans., 2019, 48, 9408 Edwin C. Constable Received 20th February 2019, The d-block elements have played an essential role in the development of our present understanding of Accepted 6th March 2019 chemistry and in the evolution of the periodic table. On the occasion of the sesquicentenniel of the dis- DOI: 10.1039/c9dt00765b covery of the periodic table by Mendeleev, it is appropriate to look at how these metals have influenced rsc.li/dalton our understanding of periodicity and the relationships between elements. Introduction and periodic tables concerning objects as diverse as fruit, veg- etables, beer, cartoon characters, and superheroes abound in In the year 2019 we celebrate the sesquicentennial of the publi- our connected world.7 Creative Commons Attribution-NonCommercial 3.0 Unported Licence. cation of the first modern form of the periodic table by In the commonly encountered medium or long forms of Mendeleev (alternatively transliterated as Mendelejew, the periodic table, the central portion is occupied by the Mendelejeff, Mendeléeff, and Mendeléyev from the Cyrillic d-block elements, commonly known as the transition elements ).1 The periodic table lies at the core of our under- or transition metals. These elements have played a critical rôle standing of the properties of, and the relationships between, in our understanding of modern chemistry and have proved to the 118 elements currently known (Fig. 1).2 A chemist can look be the touchstones for many theories of valence and bonding. -

Promotion Effects and Mechanism of Alkali Metals and Alkaline Earth

Subscriber access provided by RES CENTER OF ECO ENVIR SCI Article Promotion Effects and Mechanism of Alkali Metals and Alkaline Earth Metals on Cobalt#Cerium Composite Oxide Catalysts for N2O Decomposition Li Xue, Hong He, Chang Liu, Changbin Zhang, and Bo Zhang Environ. Sci. Technol., 2009, 43 (3), 890-895 • DOI: 10.1021/es801867y • Publication Date (Web): 05 January 2009 Downloaded from http://pubs.acs.org on January 31, 2009 More About This Article Additional resources and features associated with this article are available within the HTML version: • Supporting Information • Access to high resolution figures • Links to articles and content related to this article • Copyright permission to reproduce figures and/or text from this article Environmental Science & Technology is published by the American Chemical Society. 1155 Sixteenth Street N.W., Washington, DC 20036 Environ. Sci. Technol. 2009, 43, 890–895 Promotion Effects and Mechanism such as Fe-ZSM-5 are more active in the selective catalytic reduction (SCR) of N2O by hydrocarbons than in the - ° of Alkali Metals and Alkaline Earth decomposition of N2O in a temperature range of 300 400 C (3). In recent years, it has been found that various mixed Metals on Cobalt-Cerium oxide catalysts, such as calcined hydrotalcite and spinel oxide, showed relatively high activities. Composite Oxide Catalysts for N2O One of the most active oxide catalysts is a mixed oxide containing cobalt spinel. Calcined hydrotalcites containing Decomposition cobalt, such as Co-Al-HT (9-12) and Co-Rh-Al-HT (9, 11), have been reported to be very efficient for the decomposition 2+ LI XUE, HONG HE,* CHANG LIU, of N2O. -

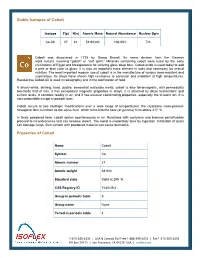

Stable Isotopes of Cobalt Properties of Cobalt

Stable Isotopes of Cobalt Isotope Z(p) N(n) Atomic Mass Natural Abundance Nuclear Spin Co-59 27 32 58.93320 100.00% 7/2- Cobalt was discovered in 1735 by Georg Brandt. Its name derives from the German word kobald, meaning "goblin" or "evil spirit." Minerals containing cobalt were used by the early civilizations of Egypt and Mesopotamia for coloring glass deep blue. Cobalt oxide is used today to add a pink or blue color to glass. It is also an important trace element in soils and necessary for animal nutrition. The most important modern use of cobalt is in the manufacture of various wear-resistant and superalloys. Its alloys have shown high resistance to corrosion and oxidation at high temperatures. Radioactive Cobalt-60 is used in radiography and in the sterilization of food. A silvery-white, shining, hard, ductile, somewhat malleable metal, cobalt is also ferromagnetic, with permeability two-thirds that of iron. It has exceptional magnetic properties in alloys. It is attached by dilute hydrochloric and sulfuric acids. It corrodes readily in air, and it has unusual coordinating properties, especially the trivalent ion. It is noncombustible except in powder form. Cobalt occurs in two allotropic modifications over a wide range of temperatures: the crystalline close-packed- hexagonal form is known as the alpha form, which turns into the beta (or gamma) form above 417 ºC. In finely powdered form, cobalt ignites spontaneously in air. Reactions with acetylene and bromine pentafluoride proceed to incandescence and can become violent. The metal is moderately toxic by ingestion. Inhalation of dusts can damage lungs. -

Cobalt Publications Rejected As Not Acceptable for Plants and Invertebrates

Interim Final Eco-SSL Guidance: Cobalt Cobalt Publications Rejected as Not Acceptable for Plants and Invertebrates Published literature that reported soil toxicity to terrestrial invertebrates and plants was identified, retrieved and screened. Published literature was deemed Acceptable if it met all 11 study acceptance criteria (Fig. 3.3 in section 3 “DERIVATION OF PLANT AND SOIL INVERTEBRATE ECO-SSLs” and ATTACHMENT J in Standard Operating Procedure #1: Plant and Soil Invertebrate Literature Search and Acquisition ). Each study was further screened through nine specific study evaluation criteria (Table 3.2 Summary of Nine Study Evaluation Criteria for Plant and Soil Invertebrate Eco-SSLs, also in section 3 and ATTACHMENT A in Standard Operating Procedure #2: Plant and Soil Invertebrate Literature Evaluation and Data Extraction, Eco-SSL Derivation, Quality Assurance Review, and Technical Write-up.) Publications identified as Not Acceptable did not meet one or more of these criteria. All Not Acceptable publications have been assigned one or more keywords categorizing the reasons for rejection ( Table 1. Literature Rejection Categories in Standard Operating Procedure #4: Wildlife TRV Literature Review, Data Extraction and Coding). No Dose Abdel-Sabour, M. F., El Naggr, H. A., and Suliman, S. M. 1994. Use of Inorganic and Organic Compounds as Decontaminants for Cobalt T-60 and Cesium-134 by Clover Plant Grown on INSHAS Sandy Soil. Govt Reports Announcements & Index (GRA&I) 15, 17 p. No Control Adams, S. N. and Honeysett, J. L. 1964. Some Effects of Soil Waterlogging on the Cobalt and Copper Status of Pasture Plants Grown in Pots. Aust.J.Agric.Res. 15, 357-367 OM, pH Adams, S. -

The Development of the Periodic Table and Its Consequences Citation: J

Firenze University Press www.fupress.com/substantia The Development of the Periodic Table and its Consequences Citation: J. Emsley (2019) The Devel- opment of the Periodic Table and its Consequences. Substantia 3(2) Suppl. 5: 15-27. doi: 10.13128/Substantia-297 John Emsley Copyright: © 2019 J. Emsley. This is Alameda Lodge, 23a Alameda Road, Ampthill, MK45 2LA, UK an open access, peer-reviewed article E-mail: [email protected] published by Firenze University Press (http://www.fupress.com/substantia) and distributed under the terms of the Abstract. Chemistry is fortunate among the sciences in having an icon that is instant- Creative Commons Attribution License, ly recognisable around the world: the periodic table. The United Nations has deemed which permits unrestricted use, distri- 2019 to be the International Year of the Periodic Table, in commemoration of the 150th bution, and reproduction in any medi- anniversary of the first paper in which it appeared. That had been written by a Russian um, provided the original author and chemist, Dmitri Mendeleev, and was published in May 1869. Since then, there have source are credited. been many versions of the table, but one format has come to be the most widely used Data Availability Statement: All rel- and is to be seen everywhere. The route to this preferred form of the table makes an evant data are within the paper and its interesting story. Supporting Information files. Keywords. Periodic table, Mendeleev, Newlands, Deming, Seaborg. Competing Interests: The Author(s) declare(s) no conflict of interest. INTRODUCTION There are hundreds of periodic tables but the one that is widely repro- duced has the approval of the International Union of Pure and Applied Chemistry (IUPAC) and is shown in Fig.1. -

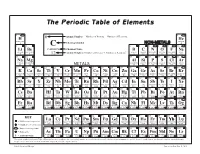

The Periodic Table of Elements

The Periodic Table of Elements 1 2 6 Atomic Number = Number of Protons = Number of Electrons HYDROGENH HELIUMHe 1 Chemical Symbol NON-METALS 4 3 4 C 5 6 7 8 9 10 Li Be CARBON Chemical Name B C N O F Ne LITHIUM BERYLLIUM = Number of Protons + Number of Neutrons* BORON CARBON NITROGEN OXYGEN FLUORINE NEON 7 9 12 Atomic Weight 11 12 14 16 19 20 11 12 13 14 15 16 17 18 SODIUMNa MAGNESIUMMg ALUMINUMAl SILICONSi PHOSPHORUSP SULFURS CHLORINECl ARGONAr 23 24 METALS 27 28 31 32 35 40 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 POTASSIUMK CALCIUMCa SCANDIUMSc TITANIUMTi VANADIUMV CHROMIUMCr MANGANESEMn FeIRON COBALTCo NICKELNi CuCOPPER ZnZINC GALLIUMGa GERMANIUMGe ARSENICAs SELENIUMSe BROMINEBr KRYPTONKr 39 40 45 48 51 52 55 56 59 59 64 65 70 73 75 79 80 84 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 RUBIDIUMRb STRONTIUMSr YTTRIUMY ZIRCONIUMZr NIOBIUMNb MOLYBDENUMMo TECHNETIUMTc RUTHENIUMRu RHODIUMRh PALLADIUMPd AgSILVER CADMIUMCd INDIUMIn SnTIN ANTIMONYSb TELLURIUMTe IODINEI XeXENON 85 88 89 91 93 96 98 101 103 106 108 112 115 119 122 128 127 131 55 56 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 CESIUMCs BARIUMBa HAFNIUMHf TANTALUMTa TUNGSTENW RHENIUMRe OSMIUMOs IRIDIUMIr PLATINUMPt AuGOLD MERCURYHg THALLIUMTl PbLEAD BISMUTHBi POLONIUMPo ASTATINEAt RnRADON 133 137 178 181 184 186 190 192 195 197 201 204 207 209 209 210 222 87 88 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 FRANCIUMFr RADIUMRa RUTHERFORDIUMRf DUBNIUMDb SEABORGIUMSg BOHRIUMBh HASSIUMHs MEITNERIUMMt DARMSTADTIUMDs ROENTGENIUMRg COPERNICIUMCn NIHONIUMNh -

3. Micronutrients There Are 7 Essential Plant Nutrient Elements Defined As

3. Micronutrients There are 7 essential plant nutrient elements defined as micronutrients [boron (B), zinc (Zn), manganese (Mn), iron (Fe), copper (Cu), molybdenum (Mo), chlorine (Cl)]. They constitute in total less than 1% of the dry weight of most plants. The following discussion focuses primarily on the soil characteristics for the micronutrients. a. Boron (B) Boron is included in the Standard Soil Test. The level of soil boron is “insufficient” or “low” when extractable boron is less than 0.1 pound per acre. Soil boron is found in both organic and inorganic forms that are made available to plants as either or both soil organic matter is decomposed and/or boron-containing minerals dissolve. There may be between 20 to 200 pounds boron in the surface layer of South Carolina soils, but only a small portion is available to 3- plants. Boron, as the borate (BO3 ) anion, is mobile in the soil and can be easily leached from the surface soil. Calcium, potassium, and nitrogen concentrations in both the soil and plant can affect boron availability and plant function, the calcium:boron (Ca:B) ratio relationship being the most important. Therefore, soils high in calcium will require more boron than soils low in calcium. The chance for boron toxicity is greater on low calcium-content soils. The need to include boron in the fertilizer recommendation is determined by: • crop requirement • soil boron test level For any given crop when boron is recommended, a high rate of boron may be required on: • clay-type soils • soils that are high in water pH and/or calcium content • high organic matter content soils • soils where boron is broadcast versus boron being either banded or foliar applied Boron is routinely included in the fertilizer recommendation for the crops cotton, peanut, alfalfa, apple, root crops, cabbage, broccoli, and cauliflower, and when reseeding clover or where clover seeds are to be harvested. -

Manganese (Mn) and Zinc (Zn) for Citrus Trees1 Mongi Zekri and Tom Obreza2

SL403 Manganese (Mn) and Zinc (Zn) for Citrus Trees1 Mongi Zekri and Tom Obreza2 This publication is part of a series about understand- 8. Calcium (Ca) ing nutrient requirements for citrus trees. For the rest of the series, visit http://edis.ifas.ufl.edu/ 9. Sulfur (S) topic_series_citrus_tree_nutrients. 10. Manganese (Mn) To maintain a viable citrus industry, Florida growers must consistently and economically produce large, high-quality 11. Zinc (Zn) fruit crops year after year. Efficiently producing maximum yields of high-quality fruit is difficult without understand- 12. Iron (Fe) ing soil and nutrient requirements of bearing citrus trees. 13. Copper (Cu) Most Florida citrus is grown on soils inherently low in fertility with low-cation exchange capacity (CEC) and low 14. Boron (B) water-holding capacity; thus, soils are unable to retain sufficient quantities of available plant nutrients against 15. Chlorine (Cl) leaching caused by rainfall or excessive irrigation. 16. Molybdenum (Mo) Seventeen elements are considered necessary for the growth of green plants: 17. Nickel (Ni) 1. Carbon (C) Plants obtain C, H, and O from carbon dioxide and water. The remaining elements, which are called the “mineral 2. Hydrogen (H) nutrients,” are obtained from the soil. Mineral nutrients are classified as macronutrients and micronutrients. The 3. Oxygen (O) term “macronutrients” refers to the elements that plants require in large amounts (N, P, K, Mg, Ca, and S). The term 4. Nitrogen (N) “micronutrients” applies to plant nutrients that are essential 5. Phosphorus (P) to plants but are needed only in small amounts (Mn, Zn, Fe, Cu, B, Cl, Mo, and Ni). -

Soft Magnetic Cobalt-Iron Alloys Vacoflux and Vacodur

SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX AND VACODUR ADVANCED MAGNETIC SOLUTIONS THE COMPANY VACUUMSCHMELZE ADVANCED MAGNETIC SOLUTIONS VAC is a leading manufacturer of magnetic materials as well as our refined solutions and their special magnetic and solutions. We passionately advance the tech- properties are the key to making our customers’ nologies of today and tomorrow. As a reliable partner, systems smaller, lighter, more efficient and, last but we work with our customers to develop application not least, safer. Thereby we contribute significantly to solutions that make it possible to meet constantly the saving of resources and the protection of our increasing requirements. We push technical boundaries environment. with groundbreaking solutions. The use of our materials 2 SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX® AND VACODUR® THE COMPANY VACUUMSCHMELZE Contents Introduction Page 4 Magnetic properties Page 7 DC magnetic properties of strip material Page 8 DC magnetic properties of solid material Page 9 Specific iron losses of strip material Page 9 Mechanical properties Page 10 Mechanical properties of strip material Page 11 Mechanical properties of solid material Page 11 Physical properties Page 12 Corrosion resistance of VACOFLUX 9 CR Page 13 Processing Page 14 Magnetic final annealing Page 14 Adjusting mechanical properties for VACODUR strip material Page 16 General processing information Page 17 Forms of supply Page 18 SOFT MAGNETIC COBALT-IRON ALLOYS VACOFLUX® AND VACODUR® 3 INTRODUCTION VACUUMSCHMELZE is one of the world’s leading manufac- Our range of soft magnetic materials comprises nickel-iron, turers of special alloys with a particular focus on magnetic silicon-iron and cobalt-iron alloys, as well as amorphous and and specific physical properties. -

The Nickel Silvers

Copper Development Association The Nickel Silvers Design Data and Applications 1965 Please note this publication is provided as an archive copy. The information given may therefore not be current. The Nickel Silvers Design Data and Applications 1965 Copper Development Association Copper Development Association is a non-trading organisation sponsored by the copper producers and fabricators to encourage the use of copper and copper alloys and to promote their correct and efficient application. Its services, which include the provision of technical advice and information, are available to those interested in the utilisation of copper in all its aspects. The Association also provides a link between research and user industries and maintains close contact with other copper development associations throughout the world. Website: www.copperinfo.co.uk Email: [email protected] Copyright: All information in this document is the copyright of Copper Development Association Disclaimer: Whilst this document has been prepared with care, Copper Development Association can give no warranty regarding the contents and shall not be liable for any direct, indirect or consequential loss arising out of its use Contents Contents ...............................................................................................................................................................1 Introduction .........................................................................................................................................................2 -

Determination of Acute Toxicity of Copper and Cobalt for Tilapia Nilotica

Journal of Bioresource Management Volume 2 Issue 1 Article 3 Determination of Acute Toxicity of Copper and Cobalt for Tilapia nilotica Asif Naseem Rai University of Agriculture Faisalabad, [email protected] Asmat Ullah Hazara University, Mansehra Jibran Haider Forest and Wildlife Department, Gilgit-Baltistan Follow this and additional works at: https://corescholar.libraries.wright.edu/jbm Part of the Biodiversity Commons, and the Biology Commons Recommended Citation Rai, A. N., Ullah, A., & Haider, J. (2015). Determination of Acute Toxicity of Copper and Cobalt for Tilapia nilotica, Journal of Bioresource Management, 2 (1). DOI: 10.35691/JBM.5102.0012 ISSN: 2309-3854 online This Article is brought to you for free and open access by CORE Scholar. It has been accepted for inclusion in Journal of Bioresource Management by an authorized editor of CORE Scholar. For more information, please contact [email protected]. Determination of Acute Toxicity of Copper and Cobalt for Tilapia nilotica © Copyrights of all the papers published in Journal of Bioresource Management are with its publisher, Center for Bioresource Research (CBR) Islamabad, Pakistan. This permits anyone to copy, redistribute, remix, transmit and adapt the work for non-commercial purposes provided the original work and source is appropriately cited. Journal of Bioresource Management does not grant you any other rights in relation to this website or the material on this website. In other words, all other rights are reserved. For the avoidance of doubt, you must not adapt, edit, change, transform, publish, republish, distribute, redistribute, broadcast, rebroadcast or show or play in public this website or the material on this website (in any form or media) without appropriately and conspicuously citing the original work and source or Journal of Bioresource Management’s prior written permission.