Inner 10 Large & Mid Cap Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Award for Outstanding Performance in Food Safety

Winners Profile 2018 The following applicants were recommended by the Jury for different levels of recognition as they make their progress on their journey towards food safety excellence. Award for Outstanding Performance in Food Safety Bakery: Small & Medium Food Manufacturing ITC’s Co-Manufacturer, Food Creations Private Limited, Bangalore Beverage – Non Alcoholic: Large Food Manufacturing Pepsico India Holdings Pvt. Ltd, Sangareddy Foodstuffs for Particular Nutritional Uses: Large Food Manufacturing Nestlé India Limited, Samalkha, Panipat Food Testing Laboratories: Small and Medium Envirocare Laboratories Pvt. Ltd., Mumbai Hotels & Restaurants: Large Food Service Vivanta by Taj, Panaji, Goa Dairy: Large Food Manufacturing Hindustan Unilever Ltd., Nasik Quick Service Restaurants: Small & Medium Food Service Jubilant FoodWorks Limited, Domino’s – Pammal (DP66522), Chennai Tea Blending & Packeting: Large Food Manufacturing Tata Global Beverage Ltd. - Bengaluru Packeting Centre Wholesale & Warehousing: Large Food Service Metro Cash & Carry India Pvt. Ltd., Store: 16, Gaganpahad, Hyderabad Significant Achievement in Food Safety ITC Limited (Spices) Sri Sai Agro Products, ISG- Unit 2. Metro Cash & Carry India Pvt. Ltd. Store:46, Shahdara Delhi Nestlé India Limited, Bicholim Nestlé India Limited, Ponda Nestlé Quality Assurance Centre, Moga Pernod Ricard India (P) Limited - Rocky Unit, Derabassi Tata Global Beverages Ltd. - Pullivasal Packeting Center SRD Nutrients Pvt. Ltd, Darrang Varun Beverages Limited, Greater Noida-2 | 1 | Strong Commitment to Excel in Food Safety Arbro Pharmaceuticals Pvt. Ltd. (Analytical Division) ARBRO Laboratory, New Delhi Bisleri International Pvt Ltd, Rudrapur Bisleri International Pvt Ltd, Sahibabad Dr Oetker India Pvt. Ltd. Alwar Edward Food Research & Analysis Center Limited, Kolkata Ferrero India Pvt. Ltd. Baramati. Gopaljee Dairy Foods Pvt. -

SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI Trading As ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP

Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SANJEEVAK 1586083 01/08/2007 MANOJ ANANT JOSHI trading as ;AKSHAY PHARMA REMEDIES KAVRANA HOUSE, OPP. COTTON GREEN RLY. STN. MUMBAI-400033. MANUFACTURE & MERCHANT INDIAN NATIONAL Used Since :31/01/2001 MUMBAI MEDICINAL PREPARATIONS. 537 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 SEPTIGARD 1741718 08/10/2008 INDERJIT SINGH trading as ;INDERJIT SINGH B-104 , SWASTHYA SINGH , NEW DELHI -92 MERCHANTS & MANUFACTUERERS Address for service in India/Agents address: MAHTTA & CO. 43 - B/3, MAHTTA HOUSE,UDHAM SINGH NAGAR, LUDHIANA - 141 001, (PUNJAB). Proposed to be Used DELHI MEDICINAL & PHARMACEUTICAL PREPARATIONS. 538 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 FAIR & BEAUTY 1803779 08/04/2009 GALPHA LABORATORIES LIMITED 221, Kanakia Zillion, E Wing Bandra Kurla Complex Annex LBS Marg & CST Road Junction Kurla West MUMBAI 400070 MANUFACTURERS AND MERCHANTS INDIAN NATIONAL Used Since :15/11/2007 MUMBAI PHARMACEUTICAL AND MEDICINAL PREPARATIONS AND SUBSTANCES 539 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 O-BAMA 1815900 08/05/2009 KREMOINT PHARMA PVT. LTD. 151/5, SHRI KRISHNA DARSHAN, GARODIA NAGAR, GHATKOPAR (E), BOMBAY-400 077. MANUFACTURERS AND MERCHANTS. A CORPORATE ENTITY INCORPORATED IN INDIA UNDER THE COMPANIES ACT 1956. Address for service in India/Attorney address: KRISLAW CONSULTANTS BUILDING NO.4, C/104, SHANKESHWAR PALMS, BEHIND MODEL SCHOOL, KUMBHARKHANPADA, SUBHASH ROAD, DOMBIVILI(W) 421202 Used Since :02/05/2009 MUMBAI PHARMACETICAL AND MEDICINAL PREPARATIONS. 540 Trade Marks Journal No: 1836 , 12/02/2018 Class 5 AYUSHAKTI D-VYRO 1815928 08/05/2009 SMITA NARAM BUNGALOW NO.31, NEXT TO M. -

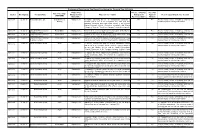

List of Files (NOC/ Consent/ Authorization - HW/BMW) Disposal Camp Date: 27-12-2017, Time: 10.30 AM, Venue: Head Office, UPPCB, Lucknow

List of Files (NOC/ Consent/ Authorization - HW/BMW) Disposal Camp Date: 27-12-2017, Time: 10.30 AM, Venue: Head Office, UPPCB, Lucknow CONSENT TO ESTABLISH - CTE (NOC) Sl.No. Name & Address of Industry/ File Circle/ Subject Section 1 DP Garg and Co. Pvt. Ltd., B-210, Phase-2, Noida C-1 NOC 2 Wondrous Buildmart Pvt. Ltd., Plot No. SC-02/A-9, Sec- C-1 NOC 150, Noida 3 Denso India Ltd., Noida Dadri Road, Post Tilpata, C-1 NOC Greater Noida 4 Saha Infratech Pvt. Ltd., Plot No. SC-01/ CA-07& SC- C-1 NOC 01/CA-08, Sec-150, Noida 5 Suncity Hitech Infrastructures Pvt. Ltd. "Sun Greentech C-1 NOC VALIDITY EXTENSION (upto City Integrated Township Project", NH-24, Village 14.11.22) Dasna, Ghaziabad 6 Shubh Tex, D-27, UPSIDC IA, Rooma, Kanpur C-2 NOC 7 Bharat Petrolium Corp. Ltd.,LPG Plant, UPSIDC IA, C-2 NOC Naini, Allahabad 8 Paswara Papers Ltd., Mohiddinpur, Delhi Road, Meerut C-3 NOC 9 ITC Ltd., Sardar Patel Marg, Saharanpur C-3 NOC 10 Santosh Pigment and Chemical Ind, HE-7, C-4 NOC Sikandrabad, Bulandshahar 11 DS Prints, D-39 UPSIDC IA, Sikandrabad, C-4 NOC Bulandshahar 12 Apco Infratech Pvt. Ltd., Village Meethepur, Gulawati, C-4 NOC Bulandshahar 13 Tricon Speciality Chemicals Pvt. Ltd., Sikandrabad IA, C-4 NOC Bulandshahar 14 Mahalaxmi Dyers, H-7, UPSIDC IA, Sikandrabad, C-4 NOC Bulandshahar 15 Varun Beverages Ltd., Plot No. B-2/1, UPSIDC, Sandila C-5 NOC Phase-IV, Hardoi 16 Smart Enterprises, H-55, Site-II, Ind.Area, Unnao C-5 NOC 17 Government Medical College, Village Dharnidharpur, C-7 NOC Tehsil Sadar, Shahjahanpur CONSENT TO OPERATE - CTO 1 Eldeco Infrastructure and Properties Ltd. -

Inner 24 India Pharma & Healthcare Fund Low

Tata India Pharma & Healthcare Fund (An open ended equity scheme investing in Pharma and Healthcare Services Sector) As on 30th June 2020 PORTFOLIO INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the Equity & Equity Related Total 23733.48 98.49 companies in the Pharma & Healthcare sectors in India. Healthcare Services Other Equities^ 380.78 1.58 INVESTMENT OBJECTIVE Narayana Hrudayalaya Ltd. 382720 1025.69 4.26 Repo 871.61 3.62 The investment objective of the scheme is to seek long Healthcare Global Enterprises Ltd. term capital appreciation by investing atleast 80% of its 410000 503.48 2.09 Portfolio Total 24605.09 102.11 net assets in equity/equity related instruments of the Apollo Hospitals Enterprise Ltd. 32500 438.70 1.82 Net Current Liabilities -507.01 -2.11 companies in the pharma & healthcare sectors in Pharmaceuticals India.However, there is no assurance or guarantee that Net Assets 24098.08 100.00 the investment objective of the Scheme will be Sun Pharmaceutical Industries Ltd. 870100 4115.14 17.08 achieved.The Scheme does not assure or guarantee any Dr Reddys Laboratories Ltd. 98000 3866.05 16.04 returns. Divi Laboratories Ltd. 102500 2335.87 9.69 DATE OF ALLOTMENT Lupin Ltd. 223000 2033.31 8.44 December 28, 2015 Ipca Laboratories Ltd. 95000 1590.68 6.60 Cipla Ltd. 230000 1472.58 6.11 FUND MANAGER Aurobindo Pharma Ltd. -

August 2017 Equity Outlook

AUGUST 2017 EQUITY OUTLOOK Q1FY18 earnings season, as expected, is turning out to be a period of challenges on account of GST implementation. Initial teething troubles in terms of inventory destocking and taxation relation clarity is leading to delay in revenue recognition. This process is likely to smoothen out over the next few months ie from 2HFY18. Nifty earnings during the quarter for companies having reported results is down -1.2% over last year same quarter. Our investee companies had another strong quarter of performance with most business delivering 20%+ profit growth – a few standouts like Bajaj Finance, Sundram Fastners, ACC, Escorts, Container Corporation, Gujarat Gas, Mahindra CIE, Titan, Quess Corp continue to deliver strong earnings on the other hand a few names as expected delivered a weak performance for the quarter like TV18, Greaves Cotton, Bajaj Auto, BASF. A gist of quarterly performance is given below. It is worth noting that we are optimistic of much improved performance for some of the companies which have not delivered growth during the current quarter like – Bajaj Auto – Expect volume growth of 10% with some improvement in margins leading to 15%+ profit growth BASF – Company has recently commissioned a large capacity and is facing teething troubles on quality of produce. We expect the management to take care of these initial issues and profit growth of 30%+ over the next few years Greaves Cotton – Bharat Stage IV norms for engine have been implemented from April 2017 – company has taken a 8-10% price increase along with improvement in volume growth starting August 2017 will lead to high sales growth along with improvement in margins. -

Annual-Report-2018-1

Index Corporate Overview 2-33 About NATCO Pharma 2 Key milestones 6 Business highlights FY 2018-19 8 Key performance indicators 10 Megatrends 12 Management message 14 Building businesses in diverse markets 18 Leveraging synergies through diversity 20 Advancing R&D diversification 22 Board of Directors and Key 24 Management Team Risk framework and mitigation 26 strategy Corporate social responsibility (CSR) 28 Environment, health & safety (EHS) 32 Key numbers of FY 2018-19 on consolidated basis Statutory Reports 34-98 Total Revenue PAT Management Discussion and Analysis 34 Board's Report 43 ` 22,247 million ` 6,444 million Corporate Governance Report 71 Business Responsibility Report 90 EBITDA Basic EPS ` 9,250 million ` 34.98 Financial Statements 99-192 Disclaimer Standalone Financials 99 In this Annual Report, we have disclosed forward-looking information to enable investors to comprehend our prospects and take investment decisions. This report and Consolidated Financials 147 other statements - written and oral - that we periodically make contain forward-looking statements that set out anticipated results based on the management’s plans and assumptions. We have tried, wherever possible, to identify such statements by using words such as ‘anticipate’, ‘estimate’, ‘expects’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, and Notice 193 words of similar substance in connection with any discussion of future performance. We cannot guarantee that these forward-looking statements will be realised, although we believe we have been prudent in our assumptions. The achievements of results are subject to risks, uncertainties and even inaccurate assumptions. Should known or unknown risks or uncertainties materialise, or should underlying assumptions prove inaccurate, actual results could vary materially from those anticipated, estimated or projected. -

Ajanta Pharma Limited

AJANTA PHARMA LIMITED CIN : L24230MH1979PLC022059 Registered & Corporate Office: ‘Ajanta House’, 98 Govt Industrial Area, Charkop, Kandivli (West), Mumbai - 400 067, Maharashtra, India Tel.: +91 22 6606 1000, Fax: +91 22 6606 1200 | E-mail: [email protected] | Website: www.ajantapharma.com POST BUYBACK PUBLIC ANNOUNCEMENT FOR THE ATTENTION OF EQUITY SHAREHOLDERS/ BENEFICIAL OWNERS OF EQUITY SHARES OF AJANTA PHARMA LIMITED This public announcement (the “Post Buyback Public Announcement”) is being made pursuant to the provisions of Regulation 24(vi) of the Securities and Exchange Board of India (Buy-Back of Securities) Regulations, 2018, for the time being in force including any statutory modifications and amendments from time to time (the “Buyback Regulations”). This Post Buyback Public Announcement should be read in conjunction with the Public Announcement dated November 4, 2020 which was published on November 5, 2020 (the “Public Announcement”) and the letter of offer dated November 25, 2020 (the “Letter of Offer”) issued in connection with the Buyback. The terms used but not defined in this Post Buyback Public Announcement shall have the same meanings as assigned in the Public Announcement and the Letter of Offer. 1. THE BUYBACK 1.1 Ajanta Pharma Limited (the “Company”) had announced the Buyback of not exceeding 7,35,000 (Seven Lakh Thirty Five Thousand) fully paid-up equity shares of face value of ₹2 each (“Equity Shares”) from all the existing shareholders / beneficial owners of Equity Shares as on the record date (i.e. Friday, November 13, 2020), on a proportionate basis, through the “Tender Offer” process at a price of ₹1,850/- (Rupees One Thousand Eight Hundred and Fifty Only) per Equity Share payable in cash for an aggregate consideration not exceeding ₹ 135,97,50,000 (Rupees One Hundred Thirty Five Crores Ninety Seven Lakhs and Fifty Thousand only) excluding the Transaction Costs (“Buyback Offer Size”). -

Natco Pharma Limited

Placement Document Not for Circulation Private and Confidential Serial No. [●] NATCO PHARMA LIMITED Originally incorporated as Natco Fine Pharmaceuticals Private Limited on September 19, 1981, the name of our Company was changed to “Natco Pharma Limited” on December 30, 1994 under the Companies Act, 1956. The registered office of our Company is at Natco House, Road no. 2, Banjara Hills, Hyderabad – 500 034, Telangana; Telephone: +91 40 2354 7532; Fax: +91 40 2354 8243; Email: [email protected]; Website: www.natcopharma.co.in; Corporate identification number:L24230TG1981PLC003201. Natco Pharma Limited (our “Company” or the “Issuer”) is issuing 1,600,000 equity shares of face value of Rs. 10 each (the “Equity Shares”) at a price of Rs. 2,130.55 per Equity Share, including a premium of Rs. 2,120.55 per Equity Share, aggregating to Rs. 3,408.88 million (the “Issue”). ISSUE IN RELIANCE UPON SECTION 42 OF THE COMPANIES ACT, 2013, AS AMENDED, READ WITH RULES MADE THEREUNDER, AND CHAPTER VIII OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2009, AS AMENDED (THE “SEBI ICDR REGULATIONS”). THIS ISSUE AND THE DISTRIBUTION OF THIS PLACEMENT DOCUMENT IS BEING MADE TO QUALIFIED INSTITUTIONAL BUYERS (“QIBs”) AS DEFINED IN THE SEBI ICDR REGULATIONS IN RELIANCE UPON CHAPTER VIII OF THE SEBI ICDR REGULATIONS, AS AMENDED AND SECTION 42 OF THE COMPANIES ACT, 2013, AS AMENDED, AND RULES MADE THEREUNDER. THIS PLACEMENT DOCUMENT IS PERSONAL TO EACH PROSPECTIVE INVESTOR AND DOES NOT CONSTITUTE AN OFFER OR INVITATION OR SOLICITATION OF AN OFFER TO THE PUBLIC OR TO ANY OTHER PERSON OR CLASS OF INVESTORS WITHIN OR OUTSIDE INDIA OTHER THAN QIBs. -

Inner 25 India Pharma & Healthcare Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata India Pharma & Healthcare Fund o i L g (An open ended equity scheme investing in Pharma and Healthcare Services Sector) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Pharma & Healthcare sectors in India. Equity & Equity Related Total 55184.24 97.88 Glenmark Pharmaceuticals Ltd. 167000 1089.76 1.93 INVESTMENT OBJECTIVE Healthcare Services Sanofi India Ltd. 13000 997.39 1.77 The investment objective of the scheme is to seek long Apollo Hospitals Enterprise Ltd. 70500 2551.99 4.53 Gland Pharma Ltd. 19662 673.29 1.19 term capital appreciation by investing atleast 80% of its Fortis Healthcare Ltd. 795000 1935.03 3.43 Laurus Labs Ltd. 90000 619.79 1.10 net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in Syngene International Ltd. 265000 1545.75 2.74 India.However, there is no assurance or guarantee that the investment objective of the Scheme will be Narayana Hrudayalaya Ltd. 301420 1483.74 2.63 Other Equities^ 1186.14 2.10 achieved.The Scheme does not assure or guarantee any Metropolis Healthcare Ltd. -

MF 35 Fund One Pager

BR“BuyS RightT : BSit TightR” ST BRSnowT Bin fourRS differentTBRS colorsTBRS BRSTBRSTBRSTBR Motilal Oswal MOSt Focused Invests in enduring B25 RFund STBRSTBwRealth creaStors T Motilal Oswal MOSt Focused Invests in emerging BMidcapR 30 Fund TBRwealth creators T BRSTBSRSTBRSTBSRS Motilal Oswal MOSt Focused Invests in emerging and BMulticapRS 35 FundT BRSTBRenduringST wealthB creatorRs Lock in fund that invests Motilal Oswal MOSt Focused in wealth creators BLongR Term SFund TBRSTBplusR Saves TSax T BR TBR T BRSTBSRSTBRSTBSRS Focused Low Churn QGLP No load BRSTBPortfolioRSTBPortfolioRSTStocksBR BRSInvesTt nowB to addR colorSs Tto yourB porRolioST BRSCall:T 1800-200-6626B | SMS:R FOCUSS to 575753T BRSTBRS Website: www.motilaloswalmf.com Our Investment Philosophy The recommended way to create Wealth from equity- 'Buy Right : Sit Tight' At Molal Oswal Asset Management Company (MOAMC), our investment philosophy and invesng style is centered on 'Buy Right: Sit Tight‘ principal. ‘Buy Right' means buying quality companies at a reasonable price and 'Sit Tight' means staying invested in them for a longer me to realise the full growth potenal of the stocks. Buy Right Stock Characteristics Sit Tight Approach QGLP ‘Q’uality denotes quality of the business and Buy and Hold: We are strictly buy and hold management investors and believe that picking the right ‘G’rowth denotes growth in earnings and business needs skill and holding onto these sustained RoE businesses to enable our investors to benefit from the entire growth cycle needs even more ‘L’ongevity denotes longevity of the skill. competitive advantage or economic moat of the business Focus: Our portfolios are high conviction portfolios with 20 to 25 stocks being our ideal ‘P’rice denotes our approach of buying a good n u m b e r. -

Votes Cast Data for F.Y. 2019-20

Disclosure of Vote Cast by Tata Mutual Fund during the Financial Year 2019-2020 Proposal by Investee company’s Vote (For/ Type of meetings Quarter Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/EGM) Shareholder Recommendation Abstain) April-June 02-Apr-19 Piramal Enterprise Ltd Court Convened Management Resolution approving Scheme of Amalgamation pursuant to For For This is normal course of business and has no Meeting Sections 230 to 232 of the Companies Act, 2013 and other material impact for minority shareholders applicable provisions and Rules made thereof, if any, between Piramal Phytocare Limited (˜Transferor Company") and Piramal Enterprises Limited ("Transferee Company") and their respective Shareholders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Navneet For For This is normal course of business and has no Healthcare Limited Saluja, Managing Director (DIN: 02183350) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Anup For For This is normal course of business and has no Healthcare Limited Dhingra, Director - Operations (DIN: 07602670) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Vivek For For This is normal course of business and -

CARE Ratings Ltd

CARE/HO/RL/2020-21/2749 Mr. Arvind Agrawal Chief Financial Officer Ajanta Pharma Limited Ajanta House, Charkop, Kandivali (W), Mumbai-400067 October 1, 2020 Confidential Dear Sir, Credit rating for bank facilities On the basis of recent developments including operational and financial performance of your company for FY20 (audited) and Q1FY21 (provisional), our Rating Committee has reviewed the following ratings: Facilities Amount Rating1 Rating (Rs. crore) Action Long-term/Short-term Bank 55.00 CARE AA; Stable/CARE A1+ Facilities (reduced from 87.50) (Double A; Outlook: Stable/A Reaffirmed One Plus) Total 55.00 (Rs. Fifty Five crore only) 2. Refer Annexure 1 for details of rated facilities. 3. The rationale for the rating will be communicated to you separately. A write-up (press release) on the above rating is proposed to be issued to the press shortly, a draft of which is enclosed for your perusal as Annexure-2. We request you to peruse the annexed document and offer your comments if any. We are doing this as a matter of courtesy to our clients and with a view to ensure that no factual inaccuracies have inadvertently crept in. Kindly revert as early as possible. In any case, if we do not hear from you by October 5, 2020 we will proceed on the basis that you have no any comments to offer. 4. CARE reserves the right to undertake a surveillance/review of the rating from time to time, based on circumstances warranting such review, subject to at least one such review/surveillance every year. 5.