BOBCAPS Consumer Newsletter | March 19

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Award for Outstanding Performance in Food Safety

Winners Profile 2018 The following applicants were recommended by the Jury for different levels of recognition as they make their progress on their journey towards food safety excellence. Award for Outstanding Performance in Food Safety Bakery: Small & Medium Food Manufacturing ITC’s Co-Manufacturer, Food Creations Private Limited, Bangalore Beverage – Non Alcoholic: Large Food Manufacturing Pepsico India Holdings Pvt. Ltd, Sangareddy Foodstuffs for Particular Nutritional Uses: Large Food Manufacturing Nestlé India Limited, Samalkha, Panipat Food Testing Laboratories: Small and Medium Envirocare Laboratories Pvt. Ltd., Mumbai Hotels & Restaurants: Large Food Service Vivanta by Taj, Panaji, Goa Dairy: Large Food Manufacturing Hindustan Unilever Ltd., Nasik Quick Service Restaurants: Small & Medium Food Service Jubilant FoodWorks Limited, Domino’s – Pammal (DP66522), Chennai Tea Blending & Packeting: Large Food Manufacturing Tata Global Beverage Ltd. - Bengaluru Packeting Centre Wholesale & Warehousing: Large Food Service Metro Cash & Carry India Pvt. Ltd., Store: 16, Gaganpahad, Hyderabad Significant Achievement in Food Safety ITC Limited (Spices) Sri Sai Agro Products, ISG- Unit 2. Metro Cash & Carry India Pvt. Ltd. Store:46, Shahdara Delhi Nestlé India Limited, Bicholim Nestlé India Limited, Ponda Nestlé Quality Assurance Centre, Moga Pernod Ricard India (P) Limited - Rocky Unit, Derabassi Tata Global Beverages Ltd. - Pullivasal Packeting Center SRD Nutrients Pvt. Ltd, Darrang Varun Beverages Limited, Greater Noida-2 | 1 | Strong Commitment to Excel in Food Safety Arbro Pharmaceuticals Pvt. Ltd. (Analytical Division) ARBRO Laboratory, New Delhi Bisleri International Pvt Ltd, Rudrapur Bisleri International Pvt Ltd, Sahibabad Dr Oetker India Pvt. Ltd. Alwar Edward Food Research & Analysis Center Limited, Kolkata Ferrero India Pvt. Ltd. Baramati. Gopaljee Dairy Foods Pvt. -

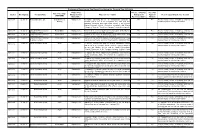

List of Files (NOC/ Consent/ Authorization - HW/BMW) Disposal Camp Date: 27-12-2017, Time: 10.30 AM, Venue: Head Office, UPPCB, Lucknow

List of Files (NOC/ Consent/ Authorization - HW/BMW) Disposal Camp Date: 27-12-2017, Time: 10.30 AM, Venue: Head Office, UPPCB, Lucknow CONSENT TO ESTABLISH - CTE (NOC) Sl.No. Name & Address of Industry/ File Circle/ Subject Section 1 DP Garg and Co. Pvt. Ltd., B-210, Phase-2, Noida C-1 NOC 2 Wondrous Buildmart Pvt. Ltd., Plot No. SC-02/A-9, Sec- C-1 NOC 150, Noida 3 Denso India Ltd., Noida Dadri Road, Post Tilpata, C-1 NOC Greater Noida 4 Saha Infratech Pvt. Ltd., Plot No. SC-01/ CA-07& SC- C-1 NOC 01/CA-08, Sec-150, Noida 5 Suncity Hitech Infrastructures Pvt. Ltd. "Sun Greentech C-1 NOC VALIDITY EXTENSION (upto City Integrated Township Project", NH-24, Village 14.11.22) Dasna, Ghaziabad 6 Shubh Tex, D-27, UPSIDC IA, Rooma, Kanpur C-2 NOC 7 Bharat Petrolium Corp. Ltd.,LPG Plant, UPSIDC IA, C-2 NOC Naini, Allahabad 8 Paswara Papers Ltd., Mohiddinpur, Delhi Road, Meerut C-3 NOC 9 ITC Ltd., Sardar Patel Marg, Saharanpur C-3 NOC 10 Santosh Pigment and Chemical Ind, HE-7, C-4 NOC Sikandrabad, Bulandshahar 11 DS Prints, D-39 UPSIDC IA, Sikandrabad, C-4 NOC Bulandshahar 12 Apco Infratech Pvt. Ltd., Village Meethepur, Gulawati, C-4 NOC Bulandshahar 13 Tricon Speciality Chemicals Pvt. Ltd., Sikandrabad IA, C-4 NOC Bulandshahar 14 Mahalaxmi Dyers, H-7, UPSIDC IA, Sikandrabad, C-4 NOC Bulandshahar 15 Varun Beverages Ltd., Plot No. B-2/1, UPSIDC, Sandila C-5 NOC Phase-IV, Hardoi 16 Smart Enterprises, H-55, Site-II, Ind.Area, Unnao C-5 NOC 17 Government Medical College, Village Dharnidharpur, C-7 NOC Tehsil Sadar, Shahjahanpur CONSENT TO OPERATE - CTO 1 Eldeco Infrastructure and Properties Ltd. -

August 2017 Equity Outlook

AUGUST 2017 EQUITY OUTLOOK Q1FY18 earnings season, as expected, is turning out to be a period of challenges on account of GST implementation. Initial teething troubles in terms of inventory destocking and taxation relation clarity is leading to delay in revenue recognition. This process is likely to smoothen out over the next few months ie from 2HFY18. Nifty earnings during the quarter for companies having reported results is down -1.2% over last year same quarter. Our investee companies had another strong quarter of performance with most business delivering 20%+ profit growth – a few standouts like Bajaj Finance, Sundram Fastners, ACC, Escorts, Container Corporation, Gujarat Gas, Mahindra CIE, Titan, Quess Corp continue to deliver strong earnings on the other hand a few names as expected delivered a weak performance for the quarter like TV18, Greaves Cotton, Bajaj Auto, BASF. A gist of quarterly performance is given below. It is worth noting that we are optimistic of much improved performance for some of the companies which have not delivered growth during the current quarter like – Bajaj Auto – Expect volume growth of 10% with some improvement in margins leading to 15%+ profit growth BASF – Company has recently commissioned a large capacity and is facing teething troubles on quality of produce. We expect the management to take care of these initial issues and profit growth of 30%+ over the next few years Greaves Cotton – Bharat Stage IV norms for engine have been implemented from April 2017 – company has taken a 8-10% price increase along with improvement in volume growth starting August 2017 will lead to high sales growth along with improvement in margins. -

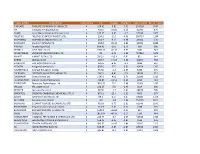

Votes Cast Data for F.Y. 2019-20

Disclosure of Vote Cast by Tata Mutual Fund during the Financial Year 2019-2020 Proposal by Investee company’s Vote (For/ Type of meetings Quarter Meeting Date Company Name Management or Proposal's description Management Against/ Reason supporting the vote decision (AGM/EGM) Shareholder Recommendation Abstain) April-June 02-Apr-19 Piramal Enterprise Ltd Court Convened Management Resolution approving Scheme of Amalgamation pursuant to For For This is normal course of business and has no Meeting Sections 230 to 232 of the Companies Act, 2013 and other material impact for minority shareholders applicable provisions and Rules made thereof, if any, between Piramal Phytocare Limited (˜Transferor Company") and Piramal Enterprises Limited ("Transferee Company") and their respective Shareholders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Navneet For For This is normal course of business and has no Healthcare Limited Saluja, Managing Director (DIN: 02183350) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Anup For For This is normal course of business and has no Healthcare Limited Dhingra, Director - Operations (DIN: 07602670) material impact for minority share holders April-June 11-Apr-19 GlaxoSmithKline Consumer Postal Ballot Management Revision in the terms of payment of remuneration to Mr. Vivek For For This is normal course of business and -

Varun Beverages Limited Q4 & CY2017 Results Presentation Disclaimer (A Pepsico Franchisee)

February 16, 2018 (a PepsiCo franchisee) Varun Beverages Limited Q4 & CY2017 Results Presentation Disclaimer (a PepsiCo franchisee) Certain statements in this communication may be ‘forward looking statements’ within the meaning of applicable laws and regulations. These forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those suggested by the forward-looking statements. Important developments that could affect the Company’s operations include changes in the industry structure, significant changes in political and economic environment in India and overseas, tax laws, import duties, litigation and labour relations. Varun Beverages Limited (VBL) will not be in any way responsible for any action taken based on such statements and undertakes no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances. 2 Table of Content (a PepsiCo franchisee) 1 Company Overview 2 Q4 & CY2017 Results Overview 3 Financial Highlights 4 Industry Prospects 5 Annexure 3 Company Snapshot (a PepsiCo franchisee) Key player in the beverage industry Operations spanning across 6 countries – 3 in the Indian Subcontinent (India, Sri Lanka, Nepal) contribute ~90% to revenues; 3 in Africa (Morocco, Zambia, Zimbabwe) contribute ~10% Over 25 years strategic association with PepsiCo – accounting for ~ 51% of PepsiCo’s beverage sales volume in India and present in 21 States and 2 UTs Total Sales Volumes (MN Cases*) 2012-2017: Sales Volume -

April 2016-March 2017

Information of documents for which observations issued by SEBI Sr. Issuer company Coordinating LM Type of Draft OD Processing Status No. (Pre-issue) Issue receipt date 1 Larsen & Toubro Kotak Mahindra IPO 12 Observations issued Infotech Limited Capital Limited (OFS) April on 20 May 2016 2016 2 RBL Bank Ltd Kotak Mahindra IPO + OFS 23 June Observation Issued Capital Co. Ltd 2015 on 27 July 2016 3 Varun Beverages Kotak Mahindra IPO 22 June Observations issued Limited Capital Company 2016 on 31 August 2016 Limited 4 Aster DM Kotak Mahindra IPO 24 June Observations issued Healthcare Limited Capital Limited (Fresh + 2016 on 02 November OFS) 2016 5 Sheela Foam Edelweiss IPO 29 July Observations issued Limited Financial (OFS) 2016 on 03 November Services Limited 2016 6 L & T Technology Kotak Mahindra IPO 15 July Observations issued Services Limited Capital Company (OFS) 2016 on 24 August 2016 Limited 7 ICICI Prudential DSP Merrill IPO 18 July Observations issued Life Insurance Lynch Limited (OFS) 2016 on 02 September Company Limited 2016 8 Greensignal Bio India Overseas IPO (Fresh 04 July Observations issued Pharma Ltd. Bank - Merchant Issue + 2016 on 09 September Banking Division OFS) 2016 9 Endurance Axis Capital IPO (OFS) 07 July Observations issued Technologies Limited 2016 on 09 September Limited 2016 10 CIL Nova Hem Securities RI 07 July Observations issued Petrochemicals Ltd Ltd 2016 on 16 September 2016 11 PNB Housing Kotak Mahindra IPO 05 July Observations issued Finance Limited Capita Company (Fresh 2016 on 06 October 2016 Limited -

Mf Movers & Shakers

MF MOVERS & SHAKERS MARCH 2021 DART Research Tel: +91 22 40969700 E-mail: [email protected] April 12, 2021 April 12, 2021 2 Top Five Buys & Sells Top Ten MF's March 2021 3 Top Five Buys & Sells of Top MFs for the month of March 2021 No of Shares No of Shares Highest Increase in Exposure Names Bought in Highest Decrease in Exposure (by nos of shares) Bought in (by nos of shares) March 2021 March 2021 Bharat Petroleum Corporation 4,547,448 The Indian Hotels 9,826,101 Steel Authority Of India 1,995,000 Vedanta 2,988,456 Axis MF Torrent Power 1,889,278 Tata Motors 2,574,406 Suryoday Small Finance Bank 1,887,039 EPL 2,572,954 Mahindra & Mahindra Financial Services 1,644,663 Wipro 2,226,978 Bank Of Baroda 36,590,405 Vodafone Idea 21,490,000 Steel Authority Of India 9,632,297 Vedanta 7,799,200 Birla SL MF National Aluminium 7,524,001 GMR Infrastructure 4,837,500 IDFC First Bank 3,122,875 Ashok Leyland 4,252,923 State Bank Of India 2,870,884 Bharti Airtel 3,662,791 Motherson Sumi Systems 6,769,756 Vodafone Idea 8,750,000 GAIL 3,502,259 Oil & Natural Gas Corporation 8,463,632 DSP BR MF Welspun Corp 2,559,989 Vedanta 7,199,288 ITC 2,520,668 Hindalco Industries 2,468,290 Prism Johnson 2,389,002 ICICI Prudential Life Insurance 2,343,372 Max Healthcare Institute 21,422,593 Vodafone Idea 18,830,000 Indian Railway Finance Corporation 13,939,480 Siti Networks 17,967,767 HDFC MF Oil & Natural Gas Corporation 7,327,497 Power Grid Corporation Of India 13,081,255 Varroc Engineering 6,735,218 State Bank Of India 12,478,973 Bharti Airtel 5,846,094 -

Indepth Feb 2021.Pdf

FEBRUARY 2021 IN-DEPTH INVESTMENT BULLETIN OF AEGON LIFE INSURANCE COMPANY LTD AEGON, toh tension gone. INDEX Description Page No. Enhanced Equity Fund 6 Accelerator Fund 7 Pension Enhanced Equity Fund 8 Pension Index Fund 9 Group Equity Fund 10 Blue Chip Equity Fund 11 Opportunity Fund 12 Debt Fund 14 Pension Debt Fund 15 Secure Fund 16 Pension Secure Fund 17 Conservative Fund 18 Balanced Fund 20 Pension Balanced Fund 22 Stable Fund 24 NAVPF Fund 26 Indepth | Feb 2021 | 2 Commentary on the Indian Securities Market for January 2021 Nifty (down 2.5%) was marginally negative after giving positive return in the last three months. The covid cases continued to decline across the country with only two states having more than 10000 active cases now. The vaccination program has also started in the country with healthcare workers receiving the vaccination first. The dollar index took a breather after 2 consecutive months of depreciation. It was up 0.7% and closed at 90.58 level. The rupee continued to appreciate for the 3 rd month in a row and appreciated marginally by 11 paise to close at 72.95 level. Brent crude continued its upmove and was up another 8% to close above $55 mark. It has moved up by 49% in the last three months. Gold corrected by 2.67% to close at $1847. Foreign institutional investors (FIIs) investment continued to be strong in January albeit lower than last two months with inflow of $2.7 bn. Domestic institutional investors (DIIs) continued to be net sellers as outflows in Equity mutual funds continued for the sixth month in a row. -

FTSE India 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE India 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3M India 0.1 INDIA Glenmark Pharmaceuticals 0.14 INDIA Oil India Ltd 0.07 INDIA ABB India 0.13 INDIA GMR Infrastructure 0.1 INDIA Oracle Financial Services Software 0.12 INDIA ACC 0.24 INDIA Godrej Consumer Products 0.45 INDIA Page Industries 0.24 INDIA Adani Enterprises 0.57 INDIA Godrej Industries 0.07 INDIA Petronet LNG 0.24 INDIA Adani Gas 0.4 INDIA Godrej Properties 0.18 INDIA PI Industries 0.3 INDIA Adani Green Energy 0.63 INDIA Grasim Industries 0.82 INDIA Pidilite Industries 0.47 INDIA Adani Ports and Special Economic Zone 0.77 INDIA Gujarat Gas 0.19 INDIA Piramal Enterprises 0.41 INDIA Adani Power 0.15 INDIA Havells India 0.34 INDIA Power Finance 0.21 INDIA Aditya Birla Capital 0.08 INDIA HCL Technologies 1.52 INDIA Power Grid Corp of India 0.78 INDIA Alkem Laboratories 0.11 INDIA HDFC Asset Management 0.27 INDIA Punjab National Bank 0.06 INDIA Ambuja Cements 0.33 INDIA HDFC Life Insurance Company 0.63 INDIA Rajesh Exports 0.11 INDIA Apollo Hospitals Enterprise 0.51 INDIA Hero MotoCorp 0.54 INDIA RBL Bank 0.13 INDIA Ashok Leyland 0.25 INDIA Hindalco 0.75 INDIA REC 0.2 INDIA Asian Paints 1.92 INDIA Hindustan Aeronautics 0.05 INDIA Reliance Industries 9.35 INDIA Astral 0.25 INDIA Hindustan Petroleum 0.3 INDIA Reliance Industries - Partly Paid 0.36 INDIA AU Small Finance Bank 0.23 INDIA Hindustan -

India First. India's First

India First. India's First. Annual Report 2016 Varun Beverages Limited Contents 1 Corporate Overview pg10 2 Who We Are 6 Refreshing Facts 8 Key Highlights for the Year 10 Chairman’s Message 13 Business Model 14 Deep-rooted Relationships Chairman’s Message 15 People 16 Board of Directors pg12 18 5-Years Highlights 20 Awards and CSR 21 Statutory Reports Business Model 21 Board’s Report 39 Corporate Governance Report pg15 64 Management Discussion & Analysis 74 Financial Statements 74 Consolidated Financial Statements People 130 Standalone Financial Statements pg20 Forward Looking Statements Awards and CSR This report may contain some statements on the Company’s business or financials which may be construed as forward looking based on the management’s plans and assumptions. The actual results may be materially different from these forward-looking statements although we believe we have been prudent in our assumptions. This annual report is also available online on our website : www.varunpepsi.com The spirit of India first is all about our Passion, Commitment & Determination... to challenge limits, enhance competencies and dominate the beverage space in India to put India on a global beverage map to make India an important destination for PepsiCo to create world-class manufacturing and distribution standards in India We shall be able to achieve this spirit of India first by leveraging the achievements of our legacy of being India’s first across diverse areas. This includes the distinction of being: Recognized as one of the first beverage manufacturers and distributors in India Amongst the first to receive PepsiCo’s license for manufacturing and selling multiple beverage products across multiple locations in India Market-leaders in the Indian beverage space Our Chairman (Mr. -

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No. of Trades TINPLATE TINPLATE COMPANY OF INDIA LTD. A 169.95 -9.95 -5.53 153718 3337 NH Narayana Hrudayalaya Ltd A 401.5 -21.85 -5.16 12932 676 YAARII Yaarii Digital Integrated Services Ltd A 100.35 -4.95 -4.7 67244 1006 PRESTIGE PRESTIGE ESTATES PROJECTS LTD. A 294.2 -12.5 -4.08 185797 1354 RESPONIND RESPONSIVE INDUSTRIES LTD. A 162.9 -6.75 -3.98 26584 770 RAMCOSYS RAMCO SYSTEMS LTD. A 504.8 -20.35 -3.88 33782 2838 PAISALO Paisalo Digital Ltd A 666.45 -26.2 -3.78 699 166 KPRMILL K.P.R. Mill Limited A 1183.35 -45.35 -3.69 3442 943 MOREPENLAB MOREPEN LABORATORIES LTD. A 39 -1.45 -3.58 484850 1675 VMART V-MART RETAIL LTD. A 2812.9 -102.9 -3.53 821 345 SOBHA Sobha Limited A 504.7 -17.65 -3.38 10297 738 ELGIEQUIP ELGI EQUIPMENTS LTD. A 195.5 -6.25 -3.1 9966 597 NEOGEN Neogen Chemicals Ltd A 878.6 -27.5 -3.03 10454 1267 NAVNETEDUL Navneet Education Limited A 75.55 -2.3 -2.95 6298 273 EVEREADY EVEREADY INDUSTRIES INDIA LTD. A 282.5 -8.45 -2.9 19378 571 DALBHARAT Dalmia Bharat Ltd A 1543.3 -43.8 -2.76 21030 5329 FLUOROCHEM Gujarat Fluorochemicals Ltd A 730.85 -19.55 -2.61 9223 743 THYROCARE Thyrocare Technologies Ltd A 1010.35 -25.7 -2.48 15603 1332 VRLLOG VRL Logistics Ltd A 226.35 -5.6 -2.41 3614 206 SPENCER Spencers Retail Ltd A 68.95 -1.7 -2.41 28478 509 ORIENTCQ ORIENTAL CARBON & CHEMICALS LTD.-$ A 873.1 -21.4 -2.39 4605 373 SUVEN SUVEN LIFE SCIENCES LTD. -

Dated: 11 September 2019

Dated: 11 September 2019 Indices CMP %1D Market Outlook Sensex 37145 0.44 Nifty 11003 0.52 Indian markets indicates for a flat to positive opening tracking Asian markets which are trading little higher BSE-Midcap 13495 0.97 today following muted session overnight stateside that left stocks on Wall Street little changed. Back home Nifty BSE-Smallcap 12710 0.92 Has formed a Bullish Candle on daily scale as sustained buying interest was seen for most part of the session. It SGX Nifty 11007 0.36 is forming higher highs- higher lows from past three trading sessions and supports are gradually shifting higher. We expect the momentum to continue and any the closing above 11,150 could spark a sharp upside. Technically key support level is at 10,918 followed by 10,834. If the index remains on the upward trajectory, key resistance levels to watch out for are 11,057 and 11,112. Index FY20 FY21E FY22E Top Domestic News Sensex EPS 1439 1900 2305 P/E 25 19 16 . Sun Pharma increases its stake in PJSC Biosintez of Russia to 100 percent Nifty EPS 472 593 708 . JK Tyre redesignated Anshuman Singhania Deputy MD with immediate effect P/E 23 18 15 . Tata Motors - Jaguar Land Rover retail sales in August 2019 were 34,176 vehicles, down 6.7 percent compared to August 2018 . IL&FS Engineering & Construction appoints Bhaskara Rao & Co as the sole statutory auditor . Meghmani Organics' subsidiary, MFL to set up project of Epichlorohydrin for Rs 275 crore . Varun Beverages approves to acquire 20 percent of issued & paid-up equity share capital of Lunarmech Global Current %1D Technologies Indices Value .