Britain's Hottalent

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

Ecmi Report Q1 2021

An Acuris Company A unique look at UK ECM activity in the first quarter of 2021. April 2021 ECMi Report Q1 2021 perfectinfo.com Perfect Information ECMi Report Q1 2021 Introduction 2 Welcome to Perfect Information's ECM Insight (“ECMi”) market analysis report for Q1 2021. This report takes a unique look at UK ECM activity and examines the factors that have shaped market behaviour during the period. The information contained within is based solely on UK markets, providing a more in-depth examination than similar reviews focused on Pravin Patil Senior ECM Analyst EMEA. This analysis provides a general overview of market activity during the period before delving into some of the more interesting and noteworthy trends that have developed. In particular, this report looks at IPOs, secondary offerings, sector trends and carries out a thorough investigation of underwriting and banking fees. We have provided our own UK centric league tables for banks, legal advisers, financial advisers, reporting accountants and financial PR firms, as sorted by volume and value. perfectinfo.com Perfect Information ECMi Report Q1 2021 Contents 3 A unique look at UK ECM activity throughout the first quarter of 2021. Edited by Pravin Patil Senior ECM Analyst ECM Insight & Report Methodology 04 Overview 05 ECM Q1 2021 Highlights 06 Top 5 Deals 07 UK ECM Breakdown 08 UK ECM Overview 09 Top 5 IPOs & UK IPO Breakdown 10 Sector Analysis 11 Q1 2020 / Q1 2021 12 Q1 2020 / Q1 2021 AIM 13 Fees 14 Average Commission Breakdown 15 Average Commission 16 Fee Disclosure 17 League Tables 18 Criteria 26 Contacts 27 perfectinfo.com Perfect Information ECMi Report Q1 2021 ECM Insight Report Methodology 4 ECM Insight Report Methodology ECMi delivers fully verified ECM practice information to our This report sources its data from extracted and fully verified end users in minutes. -

'The Hurwitz Singularity'

‘The Hurwitz Singularity’ “In a moment of self-doubt in 2003, (Portrait of Edward VI, 1546) I rushed I wondered into the National Portrait home and within hours was devouring Gallery and tumbled across a strange the works of Escher, Da Vinci and many anamorphic piece by William Scrots more. In a breath I had found ‘brothers’.” 2 The art of anamorphic perspective. Not being the only one perspective has been to admire Hurwitz’s work, Colossal present, in the world of art, Magazine identified that ‘some Tsince the great Leonardo figurative sculptors carve their Da Vinci. It can be said that Da Vinci artworks from unforgiving stone, was the first artist to use anamorphic while others carefully morph the perspective, within the arts, followed human form from soft blocks of clay. by legends such as Hans Holbein Artist Jonty Hurwitz begins with over and Andreas Pozzo, who also used a billion computer calculations before anamorphic perspective within their spending months considering how to art. The two principal techniques materialize his warped ideas using of Anamorphosis are ‘perspective perspex, steel, resin, or copper.’[3] (oblique) and mirror (catoptric).’ [1] The Technique that I will be discussing is most familiar to relate to oblique Anamorphosis. It can be created using Graphic design techniques of perspective and using innovative print and precise design strategies. My first interest in anamorphic perspective was when producing an entry for the ‘Design Museum; 2014 Competition brief: Surprise.’[2] The theme of Surprise led me to discover the astonishment that viewers of anamorphic perspective art felt. Artists such as Jonty Hurwitz, joseph Egan and hunter Thomson; all of which are recognised for their modern approach to Anamorphosis, also created this amazement with their art. -

Report Publisher

€ FUND MANAGER'S COMMENT 31/08/2021 FRAMLINGTONGBP EQUITIES AXA Framlington UK Growth Fund R GBP Fund manager's report Main changes to the portfolio during August We increased our holding in Rotork which, despite a robust trading statement, fell sharply on the disappointing news that its well-liked CEO was leaving the business. However, the prospects for the business are still robust and it should do well as carbon-intensive industries increasingly look for efficiency savings, and from the burgeoning hydrogen market. We sold our position in TP ICAP as the growth prospects for the business look underwhelming, and we also took some profits in Sanne and Experian following a strong period of outperformance. Factors affecting performance during August August got off to a slow start due to worries that monetary policy would be tightened more quickly than previously anticipated and also as a result of continued pandemic-related concerns. However, it recovered strongly due to a combination of continued strong earnings, takeover activity, and capital inflows as a result of low interest rates and higher than usual savings levels. On the M&A front, an interesting development in August has been companies receiving improved counter offers to their initial bids, with Sanne, Meggitt and Morrisons all benefiting from this. UK GDP rebounded in the second quarter, growing 4.8% from the previous three months, following a 1.6% contraction in the first quarter. The expansion was driven mainly by household consumption and government spending. The second-quarter recovery left GDP 4.4% below pre-pandemic levels. In surprising news, the inflation rate fell to 2.0% year-on-year in July, from June’s recent peak level of 2.5%. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

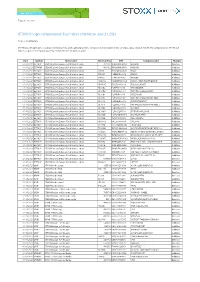

STOXX Changes Composition of Size Indices Effective on June 21, 2021

Zug, June 01, 2021 STOXX Changes composition of Size Indices effective on June 21, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Size Indices as part of the regular quarterly review effective on June 21, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 01.06.2021 EETMLP STOXX Eastern Europe Total Market Large 401112 TRAAKBNK91N6 AKBANK Deletion 01.06.2021 EETMMP STOXX Eastern Europe Total Market Mid 401112 TRAAKBNK91N6 AKBANK Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small UC003 HRKRASRA0008 KRAS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW027 PLERBUD00012 ERBUD Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW037 PLACTIN00018 ACTION Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small HR401D HRARNTRA0004 ARENA HOSPITALITY GROUP Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small GR801G GRS326003019 CRETE PLASTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL00BL PLINTKS00013 CFI HOLDING Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10OZ PLCPTRT00014 CAPTOR THERAPEUTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10Q1 PLCRPJR00019 CREEPY JAR Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10P0 PLCPTRT00030 CAPTOR THERAPEUTICS CERT Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10S3 PLPRBLG00010 PURE BIOLOGICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10T4 PLZSTAL00012 PGF POLSKA GRUPA FOTOWLT. -

London IPO Activity Skyrockets in Q1 2021

London IPO activity skyrockets in Q1 2021 IPO Eye An overview of the London Stock Exchange listings in Q1 2021 Market overview A busy start to 2021 for the London markets Main Market AIM Twelve floats Raised: Eight admissions Raised: The London Stock Exchange witnessed the best start to a year since 2007 with 20 issuers raising £5.6b in the first quarter of 2021, more than half of the £9.4b £5.2b £441m raised in the whole of 2020. The Main Market saw 12 IPOs which raised a combined £5.2b, whilst the Alternative Largest IPO: Largest IPO: Investment Market (AIM) saw eight admissions in the quarter raising £441m. The Dr Martens plc tinyBuild Inc largest Main Market IPO in the period was Dr Martens plc which raised £1.5b, and the largest AIM admission was tinyBuild Inc which raised £154m. Raised: Raised: The performance during the first three months of 2021 is in stark contrast to the same period in 2020 when there were just three IPOs on the Main Market and two £1.5b £154m on AIM, which raised a combined total of £615m — a value nine times lower than this year’s opening quarter. The UK has maintained both its position as the leading listing location in Europe for fund raising and, on a global basis, remains in third place behind the US and China for funds raised via IPO. The markets also had three cross border IPOs in In addition to the extensive IPO activity, the London markets also continued to the quarter including FixPrice, the retailer from the Russian Federation, that raised offer support to existing issuers with over £9b being raised in further offers and £1.2b through the issue of Global depository receipts (GDRs). -

Rule Technische Universiteit

( Technische Universiteit Eindhoven rUle University of Technolog Path of life in mixed reality Proposed by: Prof. G.W.M. Rauterberg September 2012 - June 2013 By Kiarash Irandoust [email protected] Coach: Lucian Reindl, ©K. Irandoust 2013 2 This report is a brief overview of my master graduation project "Path of life in It is worth mentioning that the information and knowledge that I gained in this mixed reality"; a project which intends to create an interactive installation that stage are the foundation of the final design. enable visitors to experience deeply rooted cultural dimensions based on seven My reason for choosing this topic was due to my vision on creating societal stages in life. i The design challenge is drawing on results from different disci changes and the responsibility that I feel as a designer. My intension was to in plines: religion, sociology, design, and engineering sciences 1. form people and invite them to re-think about issues which are inseparable part of our life and consciously/unconsciously have a great impact on our life. I started this project by looking at various definitions of culture. What is cul ture? And how does culture manifest itself in life? Subsequently, I looked at the Second iteration, conceptualization and validation: the conceptualization pro meaning of life; what does life mean? And how do different cultures look at life cess was through idea generation and model making. It was an iterative process (seven stages of life). Furthermore, I looked at the concept of death from differ in which the final concept shaped gradually. -

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda Welcome London Stock J.P. Morgan Deloitte DWF Q&A Exchange and closing Simon Olsen Marcus Stuttard Barry Meyers Az Ajam-Hassani Chris Stefani Simon Olsen © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 2 Deloitte IPO Masterclass You are in good company Attended Listed Attended Listed 2013 2015 2015 2015 2013 2014 2015 2015 2013 2015 2015 2015 2013 2015 2016 2018 2013 2014 2016 2018 2014 2016 2016 2018 2014 2015 2016 2019 2014 2015 2017 2018 2014 2015 2017 2018 2014 2014 2018 2021 2014 2015 2019 2021 ITF 2015 2016 © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 3 A pick up in global Equity Capital Markets activity Global IPO activity has been above the three-year average for the past three quarters Quarterly issuance value and volume – globally since 2017 200 1000 180 900 160 800 140 700 120 600 100 500 80 400 Deal value (£bn) value Deal Number of deals of Number 60 300 40 200 20 100 0 0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Value Volume Follow-On IPO Follow-on IPO Source: Dealogic. All IPOs and Follow-Ons with a deal value greater than or equal to £10m % increase Global stockmarket indices performance since January 2020 from trough 130 83.1% 79.5% • There has been a resurgence in global ECM activity 120 following a period of slight decline from early 2017. -

The University of Bergen Department of Linguistic, Literary and Aesthetic Studies

The University of Bergen Department of Linguistic, Literary and Aesthetic Studies DIKULT350 Master’s Thesis in Digital Culture Spring 2017 The viral art effect How virality and viral art as a part of our social networks can affect our society and how we perceive interfaces. Lasse Huldt Pedersen Abstract ___________________________________________________________________________ The purpose of this study is to achieve a better understanding of virality and viral art beyond an object-oriented approach. Today our everyday lives are increasingly incorporated with Internet technology and our online representations of ourselves, and the social media platforms have become an influential source of information where they provide us with trending/viral content that shows up in abundance in our newsfeeds. Questions regarding how we are influenced by all this information arise all the time, with an ongoing debate about whether or not the Internet is a form of societies of control. The Internet as an intricate and sophisticated network that gives us the option of working from home and managing a lot of activities and actions without even leaving the bed in the morning, comes with a price. The cost is freedom, as our actions become monitored and a demand of availability becomes constant. As virality and viral art can spread very fast through the networks that the Internet consist of, they become parts of important events and topics. This cross-disciplinary study of the properties of virality and viral art as allegorical devices argues that viral art should not be understood as a standalone object but a combination of many elements present and part of our interaction online and how it can affect society. -

Moments That Matter, Every Day. Moonpig Group Plc Prospectus: February 2021 Prospectus: February 2021

Moments that matter, every day. Moonpig Group plc Prospectus: February 2021 February plc Prospectus: Moonpig Group Prospectus: February 2021 Moonpig Group plc 10 Back Hill London EC1R 5EN This document comprises a prospectus (the “Prospectus”) relating to Moonpig Group plc (the “Company”) prepared in accordance with the prospectus regulation rules (the “Prospectus Regulation Rules”) of the Financial Conduct Authority (the “FCA”) made under Section 73A of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”). This document has been approved as a prospectus by the FCA as competent authority under the UK version of Regulation (EU) 2017/1129 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). The FCA only approves this document as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation in respect of a prospectus. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this document. Investors should make their own assessment as to the suitability of investing in the securities. The Prospectus will be made available to the public in accordance with Rule 3.2 of the Prospectus Regulation Rules. Capitalised terms used in this document which are not otherwise defined have the meanings given to them in the section headed “Glossary”. Application will be made to the FCA for all of the ordinary shares of GBP 0.10 each in the capital of the Company (the “Ordinary Shares”) to be admitted to the premium listing segment of the Official List maintained by the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for all such Ordinary Shares to be admitted to trading on the London Stock Exchange’s main market for listed securities (the “Main Market”) (together, “Admission”). -

ILLUSION.Pdf

PUBLISHED BY SCIENCE GALLERY PEARSE STREET, TRINITY COLLEGE DUBLIN, DUBLIN 2, IRELAND SCIENCEGALLERY.COM T: +353 (O)1 896 4091 E: [email protected] ISBN: 978-0-9926110-0-2 INTRO 04 THE WILLING SUSPENSION OF DISBELIEF 06 ALL THE UNIVERSE IS FULL OF THE LIVES OF PERFECT CREATURES 08 BOTTLE MAGIC 10 COLUMBA 12 COUNTER 14 CUBES 16 DELICATE BOUNDARIES 18 DIE FALLE 20 MOIRÉ MATRIX: HYBRID FORM 22 MOTION AFTEREFFECT ILLUSION 24 PENROSE PATTERN & FIGURE-GROUND 26 REVELATORS I–VII 28 SIGNIFICANT BIRDS 30 SIMPLY SMASHING 32 SOMETHING IN THE WAY IT MOVES 34 SUPERMAJOR 36 THE HURWITZ SINGULARITY 38 THE INVISIBLE EYE 40 THE POINT OF PERCEPTION 42 TITRE VARIABLE NO9 44 TYPOGRAPHIC ORGANISM 46 WHAT WE SEE 48 YOU. HERE. NOW. 50 ARTIST’S BIOGRAPHIES 52 ACKNOWLEDGEMENTS 58 CURATORS 59 SCIENCE GALLERY SUPPORTERS 60 NOTHING IS AS IT SEEMS Should we always believe what we see right in front pattern of diamonds that gives the optical illusion of of us? Can you trust your senses? Has technology six cubes, when in fact the cube you see only consists made things clearer or muddied the waters between of three diamond shapes grouped together. Another reality and fiction? And is anything really as it seems? work, The Hurwitz Singularity by Jonty Hurwitz, makes Illusions distort the senses and mystify our logical the viewer actively engage with the piece’s structural thinking. The human mind can be easily fooled. composition before the illusion can be revealed. ILLUSION: NOTHING IS AS IT SEEMS offers Similar to contemporary illusionists, cutting- an insight into the human mind through an exploration edge research is also concerned with why our brains make of the motivations and mechanisms of sensory deception.