Report Publisher

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

Britain's Hottalent

Britain’s Hot Talent 2014/15 A handbook of UK venture capital innovation Editors Chris Etheridge Rory McDougall Managing Editor Tom Allchorne For additional information Tom Allchorne Email [email protected] 22 BVCA e: [email protected] w: bvca.co.uk Contents Introduction Foreword 4 Five facts about venture capital in the UK 5 Definitions of industry sectors 6 Company Profiles Chapter 1 Cleantech 7 Chapter 2 Digital & Consumer 17 Chapter 3 Finance & Business Support 47 Chapter 4 Information Technology 69 Chapter 5 Life Sciences 91 Chapter 6 Materials 105 Chapter 7 Media 113 Chapter 8 Medical 123 Chapter 9 Telecoms 145 Index Index by company name 158 Index by investor 163 Index by parliamentary constituency 180 e: [email protected] w: bvca.co.uk BVCA 3 Foreword Welcome to Britain’s Hot Talent 2014/15, the third edition of the BVCA handbook, showcasing a selection of this country’s most dynamic and cutting-edge young companies. Britain has a long and proud history of entrepreneurship and the businesses featured here present a snapshot of some of the exciting and creative work being carried out right now. This edition has profiles of over 100 venture-capital-backed companies from ten distinct sectors of the British economy, all fantastic examples of what can be achieved with ingenuity, hard work and the right support. Venture capital has long been a backer of innovative businesses, and such skills and investment are needed now more than ever before. As the UK recovers from the worst economic recession in over 50 years, it is vital that entrepreneurship is encouraged in all its forms and across all industries, from life sciences to finance, from digital media to online security. -

Ecmi Report Q1 2021

An Acuris Company A unique look at UK ECM activity in the first quarter of 2021. April 2021 ECMi Report Q1 2021 perfectinfo.com Perfect Information ECMi Report Q1 2021 Introduction 2 Welcome to Perfect Information's ECM Insight (“ECMi”) market analysis report for Q1 2021. This report takes a unique look at UK ECM activity and examines the factors that have shaped market behaviour during the period. The information contained within is based solely on UK markets, providing a more in-depth examination than similar reviews focused on Pravin Patil Senior ECM Analyst EMEA. This analysis provides a general overview of market activity during the period before delving into some of the more interesting and noteworthy trends that have developed. In particular, this report looks at IPOs, secondary offerings, sector trends and carries out a thorough investigation of underwriting and banking fees. We have provided our own UK centric league tables for banks, legal advisers, financial advisers, reporting accountants and financial PR firms, as sorted by volume and value. perfectinfo.com Perfect Information ECMi Report Q1 2021 Contents 3 A unique look at UK ECM activity throughout the first quarter of 2021. Edited by Pravin Patil Senior ECM Analyst ECM Insight & Report Methodology 04 Overview 05 ECM Q1 2021 Highlights 06 Top 5 Deals 07 UK ECM Breakdown 08 UK ECM Overview 09 Top 5 IPOs & UK IPO Breakdown 10 Sector Analysis 11 Q1 2020 / Q1 2021 12 Q1 2020 / Q1 2021 AIM 13 Fees 14 Average Commission Breakdown 15 Average Commission 16 Fee Disclosure 17 League Tables 18 Criteria 26 Contacts 27 perfectinfo.com Perfect Information ECMi Report Q1 2021 ECM Insight Report Methodology 4 ECM Insight Report Methodology ECMi delivers fully verified ECM practice information to our This report sources its data from extracted and fully verified end users in minutes. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

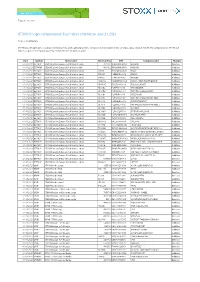

STOXX Changes Composition of Size Indices Effective on June 21, 2021

Zug, June 01, 2021 STOXX Changes composition of Size Indices effective on June 21, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Size Indices as part of the regular quarterly review effective on June 21, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 01.06.2021 EETMLP STOXX Eastern Europe Total Market Large 401112 TRAAKBNK91N6 AKBANK Deletion 01.06.2021 EETMMP STOXX Eastern Europe Total Market Mid 401112 TRAAKBNK91N6 AKBANK Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small UC003 HRKRASRA0008 KRAS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW027 PLERBUD00012 ERBUD Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW037 PLACTIN00018 ACTION Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small HR401D HRARNTRA0004 ARENA HOSPITALITY GROUP Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small GR801G GRS326003019 CRETE PLASTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL00BL PLINTKS00013 CFI HOLDING Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10OZ PLCPTRT00014 CAPTOR THERAPEUTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10Q1 PLCRPJR00019 CREEPY JAR Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10P0 PLCPTRT00030 CAPTOR THERAPEUTICS CERT Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10S3 PLPRBLG00010 PURE BIOLOGICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10T4 PLZSTAL00012 PGF POLSKA GRUPA FOTOWLT. -

London IPO Activity Skyrockets in Q1 2021

London IPO activity skyrockets in Q1 2021 IPO Eye An overview of the London Stock Exchange listings in Q1 2021 Market overview A busy start to 2021 for the London markets Main Market AIM Twelve floats Raised: Eight admissions Raised: The London Stock Exchange witnessed the best start to a year since 2007 with 20 issuers raising £5.6b in the first quarter of 2021, more than half of the £9.4b £5.2b £441m raised in the whole of 2020. The Main Market saw 12 IPOs which raised a combined £5.2b, whilst the Alternative Largest IPO: Largest IPO: Investment Market (AIM) saw eight admissions in the quarter raising £441m. The Dr Martens plc tinyBuild Inc largest Main Market IPO in the period was Dr Martens plc which raised £1.5b, and the largest AIM admission was tinyBuild Inc which raised £154m. Raised: Raised: The performance during the first three months of 2021 is in stark contrast to the same period in 2020 when there were just three IPOs on the Main Market and two £1.5b £154m on AIM, which raised a combined total of £615m — a value nine times lower than this year’s opening quarter. The UK has maintained both its position as the leading listing location in Europe for fund raising and, on a global basis, remains in third place behind the US and China for funds raised via IPO. The markets also had three cross border IPOs in In addition to the extensive IPO activity, the London markets also continued to the quarter including FixPrice, the retailer from the Russian Federation, that raised offer support to existing issuers with over £9b being raised in further offers and £1.2b through the issue of Global depository receipts (GDRs). -

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda Welcome London Stock J.P. Morgan Deloitte DWF Q&A Exchange and closing Simon Olsen Marcus Stuttard Barry Meyers Az Ajam-Hassani Chris Stefani Simon Olsen © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 2 Deloitte IPO Masterclass You are in good company Attended Listed Attended Listed 2013 2015 2015 2015 2013 2014 2015 2015 2013 2015 2015 2015 2013 2015 2016 2018 2013 2014 2016 2018 2014 2016 2016 2018 2014 2015 2016 2019 2014 2015 2017 2018 2014 2015 2017 2018 2014 2014 2018 2021 2014 2015 2019 2021 ITF 2015 2016 © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 3 A pick up in global Equity Capital Markets activity Global IPO activity has been above the three-year average for the past three quarters Quarterly issuance value and volume – globally since 2017 200 1000 180 900 160 800 140 700 120 600 100 500 80 400 Deal value (£bn) value Deal Number of deals of Number 60 300 40 200 20 100 0 0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Value Volume Follow-On IPO Follow-on IPO Source: Dealogic. All IPOs and Follow-Ons with a deal value greater than or equal to £10m % increase Global stockmarket indices performance since January 2020 from trough 130 83.1% 79.5% • There has been a resurgence in global ECM activity 120 following a period of slight decline from early 2017. -

Moments That Matter, Every Day. Moonpig Group Plc Prospectus: February 2021 Prospectus: February 2021

Moments that matter, every day. Moonpig Group plc Prospectus: February 2021 February plc Prospectus: Moonpig Group Prospectus: February 2021 Moonpig Group plc 10 Back Hill London EC1R 5EN This document comprises a prospectus (the “Prospectus”) relating to Moonpig Group plc (the “Company”) prepared in accordance with the prospectus regulation rules (the “Prospectus Regulation Rules”) of the Financial Conduct Authority (the “FCA”) made under Section 73A of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”). This document has been approved as a prospectus by the FCA as competent authority under the UK version of Regulation (EU) 2017/1129 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). The FCA only approves this document as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation in respect of a prospectus. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this document. Investors should make their own assessment as to the suitability of investing in the securities. The Prospectus will be made available to the public in accordance with Rule 3.2 of the Prospectus Regulation Rules. Capitalised terms used in this document which are not otherwise defined have the meanings given to them in the section headed “Glossary”. Application will be made to the FCA for all of the ordinary shares of GBP 0.10 each in the capital of the Company (the “Ordinary Shares”) to be admitted to the premium listing segment of the Official List maintained by the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for all such Ordinary Shares to be admitted to trading on the London Stock Exchange’s main market for listed securities (the “Main Market”) (together, “Admission”). -

'Movers & Shakers in Retail Top 100' Report for 2017

Welcome Welcome to the latest annual ‘Retail Insider Top 100 Movers & Shakers Glynn Davis in Retail’ report that highlights the achievements of those individuals Retailinsider.com who are helping to build their businesses by fully grasping the opportunity twitter @glynndavis presented by digital. Needless to say, in the eight years that the report has been produced it has had to evolve in order to reflect the industry and the people it is seeking to represent. Eight years down the line it is absolutely the case that the entire retail sector is in the midst of a digital transformation and so arguably this report has never been more relevant. As with last year, the people in the report are increasingly not holding the titles of e-commerce or multi-channel directors but are heading up businesses. These are the digitally focused retailers that are setting the pace and leaving many others in something of a predicament. When taking a look at the highest achievers in this report it is clear how the retail landscape is changing and where the future, and the positions of power and influence, potentially lies. However, while lots of things are changing in the industry the aim of the report remains the same in that it looks for individuals that are contributing to their organisations through outstanding achievement and showing innovative tendencies. I would very much like to thank the Advisory Panel involved in this year’s report who contributed greatly to the process and helped ensure that the final product has credibility. Finally, it’s a big thank you to K3 Retail for their highly valued continued sponsorship of this Movers & Shakers report that I feel contributes to the sector by pointing the way forward though highlighting its most valuable asset: people. -

Cards Holdco Limited (The “Company”) Prepared in Accordance with the Prospectus Regulation Rules (The “Prospectus

174396 Proof 8 Tuesday, January, 12, 2021 01:35 This document comprises a registration document (the “Registration Document”) relating to Cards Holdco Limited (the “Company”) prepared in accordance with the prospectus regulation rules (the “Prospectus Regulation Rules”) of the Financial Conduct Authority (the “FCA”) made under Section 73A of the A1.1.5 Financial Services and Markets Act 2000 (as amended) (the “FSMA”). The Registration Document has been approved by the FCA, as competent authority under the UK version of Regulation (EU) 2017/1129 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). The FCA only approves this Registration Document as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is the subject of this Registration Document. Capitalised terms used in this document which are not otherwise defined have the meanings given to them in the section headed “Glossary”. The Company and its directors, whose names appear on page 30 of this document (the “Directors”), accept A1.1.1 responsibility for the information contained in this document and declare that, to the best of the knowledge A1.1.2 of the Company and the Directors, the information contained in this document is in accordance with the facts and contains no omission likely to affect its import. This document should be read in its entirety, including the section headed “Risk Factors” beginning on page 3, for a discussion of certain risks related to the Company and its subsidiaries (together with Company, the “Group”). -

NOAH Newsletter

v People Building our Future Featuring 40 inspiring European start-up stories of innovative companies which have proven to be highly successful over recent years. We’re delighted to have hosted all of them across our NOAH Conferences! Buy on Amazon Buy on teNeues.com Contents Title Page Title Page NOAH Top List: European FinTech 28-29 Cover 1 Selected Transaction Comps 30-37 NOAH Hall of Fame 2 Strategic Buyers by Segment 30-35 Agenda 3 Financial Buyers by Segment 36-37 The NOAH Conferences 4-8 Pipedrive 38 Porsche at NOAH Berlin 2019 9 NOAH Disruptor List 39-46 European Online Valuations 10 NOAH Top List: European SaaS 47-48 The NOAH Conferences 49 Universe of Public Internet Companies 11 The NOAH Ecosystem 50 Sector Valuations 12 Real Winners on Stage 51-52 Sector KPIs 13 CHRONEXT 53 Historical Valuation by Region 14 NOAH London 2019 Review 54-58 Growth Driven Valuation 15 NOAH London 2019 Overview 54 Significant European Movers 16 NOAH London 2019 Highlights 55 Deutsche Börse Venture Network 17 Event Impressions 56-57 Trading Comparables 18-26 Sponsors & Partners 58 Advertising, Classifieds 18 NOAH Berlin 2019 Review 59-63 Classifieds (Cont’d), Content, Digi. 19 Entertainment, E-commerce NOAH Berlin 2019 Overview 59 E-commerce (Cont’d) 20 NOAH Berlin 2019 Highlights 60 E-commerce (Cont’d). Education, 21 Fitness/Wearables, Gambling Event Impressions 61-63 Gaming (Cont’d), Hardware & 22 Sponsors & Partners 64 Semiconductors Hardware & Semiconductors (Cont’d), Target Global 65 23 Healthcare & Science, IoT NOAH Advisors 66 Brokerage, Travel, -

Sink Or Swim: Lessons Learned from the 2014 Ipo Season

SINK OR SWIM: LESSONS LEARNED FROM THE 2014 IPO SEASON IN-DEPTH ANALYSIS BY THE MBS GROUP MARIA G HENDERSON Partner & Head of the Private Equity Practice MOIRA BENIGSON Partner & Head of the Board Practice CONTENTS 1. INTRODUCTION 3 2.KEY FINDINGS 4 3. CONTEXT 5 4. THE PROCESS 8 5. THE IPO PROCESS AND ITS DEMANDS ON THE BUSINESS 9 6. APPOINTING THE NON-EXECUTIVE BOARD 13 7. MANAGING THE TRANSITION TO PLC 16 8. THE IPO PROCESS VERSUS OTHER M&A TRANSACTIONS 19 9. SUMMARY 21 1.INTRODUCTION 2014 is the year of the IPO. In the first half of the year, the London Stock Exchange saw 79 new listings, 37 on the Main Market. Of those, 21 have been consumer and retail businesses (Main Market: 12). The trend is set to continue into the second half, but in the first six months of 2014 alone, there have only been 18 fewer IPOs than in the whole of 2013. Particularly notable floats in the sector have included Poundland, Pets at Home and more recently SSP. Performance has been mixed and there has been much commentary on froth, fatigue and saturation in the market. As a result several IPO hopefuls have cancelled or stalled plans to list, while others have instead opted for entirely different transactions, such as House of Fraser and Travelex, both of which went through a trade sale in the spring. In the context of such a fluid and changing market, we have set out to understand what it takes to build an IPO- ready business and board that can react quickly to favourable market conditions.