IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kopi Af Aktivlisten 2021-06-30 Ny.Xlsm

Velliv noterede aktier i alt pr. 30-06-2021 ISIN Udstedelsesland Navn Markedsværdi (i DKK) US0378331005 US APPLE INC 1.677.392.695 US5949181045 US MICROSOFT CORP 1.463.792.732 US0231351067 US AMAZON.COM INC 1.383.643.996 DK0060534915 DK NOVO NORDISK A/S-B 1.195.448.146 US30303M1027 US FACEBOOK INC-CLASS A 1.169.094.867 US02079K3059 US ALPHABET INC-CL A 867.740.769 DK0010274414 DK DANSKE BANK A/S 761.684.457 DK0060079531 DK DSV PANALPINA A/S 629.313.827 US02079K1079 US ALPHABET INC-CL C 589.305.120 US90138F1021 US TWILIO INC - A 514.807.852 US57636Q1040 US MASTERCARD INC - A 490.766.560 US4781601046 US JOHNSON & JOHNSON 478.682.981 US70450Y1038 US PAYPAL HOLDINGS INC 471.592.728 DK0061539921 DK VESTAS WIND SYSTEMS A/S 441.187.698 US79466L3024 US SALESFORCE.COM INC 439.114.061 US01609W1027 US ALIBABA GROUP HOLDING-SP ADR 432.325.255 US8835561023 US THERMO FISHER SCIENTIFIC INC 430.036.612 US22788C1053 US CROWDSTRIKE HOLDINGS INC - A 400.408.622 KYG875721634 HK TENCENT HOLDINGS LTD 397.054.685 KR7005930003 KR SAMSUNG ELECTRONICS CO LTD 389.413.700 DK0060094928 DK ORSTED A/S 378.578.374 ES0109067019 ES AMADEUS IT GROUP SA 375.824.429 US46625H1005 US JPMORGAN CHASE & CO 375.282.618 US67066G1040 US NVIDIA CORP 357.034.119 US17275R1023 US CISCO SYSTEMS INC 348.160.692 DK0010244508 DK AP MOLLER-MAERSK A/S-B 339.783.859 US20030N1019 US COMCAST CORP-CLASS A 337.806.502 NL0010273215 NL ASML HOLDING NV 334.040.559 CH0012032048 CH ROCHE HOLDING AG-GENUSSCHEIN 325.008.200 KYG970081173 HK WUXI BIOLOGICS CAYMAN INC 321.300.236 US4370761029 US HOME DEPOT INC 317.083.124 US58933Y1055 US MERCK & CO. -

Blackrock UK Smaller Companies PDF Factsheet

Adventurous 31 August 2021 Life Fund SW BlackRock UK Smaller Companies Life Asset Allocation (as at 31/07/2021) This document is provided for the purpose of UK Small Cap Companies 99.8% information only. This factsheet is intended for individuals who are familiar with investment Money Market 0.2% terminology. Please contact your financial adviser if you need an explanation of the terms used. This material should not be relied upon as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim The fund aims for long-term growth by investing in UK smaller companies which the Fund Manager considers to have above average long-term growth prospects. The fund Sector Breakdown (as at 31/07/2021) invests solely through the BlackRock UK Consumer Discretionary 27.7% Smaller Companies Unit Trust. Industrials 25.1% Basic Fund Information Financials 12.2% Fund Launch Date 19/09/2001 Technology 11.3% Fund Size £5.3m Basic Materials 5.1% Sector ABI UK Smaller Other 4.9% Companies Energy 3.8% ISIN GB0030873565 Consumer Staples 3.8% MEX ID SWMUL Health Care 3.7% SEDOL 3087356 Telecommunications 2.5% Manager Name Roland Arnold Regional Breakdown (as at 31/07/2021) Manager Since 26/03/2015 Top Ten Holdings (as at 31/07/2021) WATCHES OF SWITZERLAND 2.9% GROUP PLC IMPAX ASSET MANAGEMENT 2.4% GROUP PLC TREATT PLC 2.2% The composition of asset mix and asset allocation may change at any time and exclude cash CVS GROUP PLC 2.1% unless otherwise stated BREEDON GROUP PLC 2.0% OXFORD INSTRUMENTS PLC 1.8% INTEGRAFIN HOLDINGS PLC 1.8% AUCTION TECHNOLOGY GROUP 1.7% PLC ERGOMED PLC 1.7% LEARNING TECHNOLOGIES GROUP 1.7% PL TOTAL 20.3% Page 1 Past Performance Fund Rating Information 100% Overall Morningstar **** Rating Morningstar Analyst Rating 50% FE fundinfo Crown Rating The FE fundinfo Crown Rating relates to this fund. -

JH Inv Funds Series I OEIC AR 05 2021.Indd

ANNUAL REPORT & ACCOUNTS For the year ended 31 May 2021 Janus Henderson Investment Funds Series I Janus Henderson Investment Funds Series I A Who are Janus Henderson Investors? Global Strength 14% 13% £309.6B 55% 45% 31% 42% Assets under Over 340 More than 2,000 25 Over 4,300 management Investment professionals employees Offi ces worldwide companies met by investment teams in 2020 North America EMEA & LatAm Asia Pacifi c Source: Janus Henderson Investors, Staff and assets under management (AUM) data as at 30 June 2021. AUM data excludes Exchange-Traded Note (ETN) assets. Who we are Janus Henderson Investors (‘Janus Henderson’) is a global asset manager off ering a full suite of actively managed investment products across asset classes. As a company, we believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefi t clients through the connections we make. Connections enable strong relationships based on trust and insight aswell as the fl ow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Our commitment to active management off ers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change. Why Janus Henderson Investors At Janus Henderson, we believe in linking our world-class investment teams and experienced global distribution professionals with our clients around the world. -

Britain's Hottalent

Britain’s Hot Talent 2014/15 A handbook of UK venture capital innovation Editors Chris Etheridge Rory McDougall Managing Editor Tom Allchorne For additional information Tom Allchorne Email [email protected] 22 BVCA e: [email protected] w: bvca.co.uk Contents Introduction Foreword 4 Five facts about venture capital in the UK 5 Definitions of industry sectors 6 Company Profiles Chapter 1 Cleantech 7 Chapter 2 Digital & Consumer 17 Chapter 3 Finance & Business Support 47 Chapter 4 Information Technology 69 Chapter 5 Life Sciences 91 Chapter 6 Materials 105 Chapter 7 Media 113 Chapter 8 Medical 123 Chapter 9 Telecoms 145 Index Index by company name 158 Index by investor 163 Index by parliamentary constituency 180 e: [email protected] w: bvca.co.uk BVCA 3 Foreword Welcome to Britain’s Hot Talent 2014/15, the third edition of the BVCA handbook, showcasing a selection of this country’s most dynamic and cutting-edge young companies. Britain has a long and proud history of entrepreneurship and the businesses featured here present a snapshot of some of the exciting and creative work being carried out right now. This edition has profiles of over 100 venture-capital-backed companies from ten distinct sectors of the British economy, all fantastic examples of what can be achieved with ingenuity, hard work and the right support. Venture capital has long been a backer of innovative businesses, and such skills and investment are needed now more than ever before. As the UK recovers from the worst economic recession in over 50 years, it is vital that entrepreneurship is encouraged in all its forms and across all industries, from life sciences to finance, from digital media to online security. -

Ecmi Report Q1 2021

An Acuris Company A unique look at UK ECM activity in the first quarter of 2021. April 2021 ECMi Report Q1 2021 perfectinfo.com Perfect Information ECMi Report Q1 2021 Introduction 2 Welcome to Perfect Information's ECM Insight (“ECMi”) market analysis report for Q1 2021. This report takes a unique look at UK ECM activity and examines the factors that have shaped market behaviour during the period. The information contained within is based solely on UK markets, providing a more in-depth examination than similar reviews focused on Pravin Patil Senior ECM Analyst EMEA. This analysis provides a general overview of market activity during the period before delving into some of the more interesting and noteworthy trends that have developed. In particular, this report looks at IPOs, secondary offerings, sector trends and carries out a thorough investigation of underwriting and banking fees. We have provided our own UK centric league tables for banks, legal advisers, financial advisers, reporting accountants and financial PR firms, as sorted by volume and value. perfectinfo.com Perfect Information ECMi Report Q1 2021 Contents 3 A unique look at UK ECM activity throughout the first quarter of 2021. Edited by Pravin Patil Senior ECM Analyst ECM Insight & Report Methodology 04 Overview 05 ECM Q1 2021 Highlights 06 Top 5 Deals 07 UK ECM Breakdown 08 UK ECM Overview 09 Top 5 IPOs & UK IPO Breakdown 10 Sector Analysis 11 Q1 2020 / Q1 2021 12 Q1 2020 / Q1 2021 AIM 13 Fees 14 Average Commission Breakdown 15 Average Commission 16 Fee Disclosure 17 League Tables 18 Criteria 26 Contacts 27 perfectinfo.com Perfect Information ECMi Report Q1 2021 ECM Insight Report Methodology 4 ECM Insight Report Methodology ECMi delivers fully verified ECM practice information to our This report sources its data from extracted and fully verified end users in minutes. -

Report Publisher

€ FUND MANAGER'S COMMENT 31/08/2021 FRAMLINGTONGBP EQUITIES AXA Framlington UK Growth Fund R GBP Fund manager's report Main changes to the portfolio during August We increased our holding in Rotork which, despite a robust trading statement, fell sharply on the disappointing news that its well-liked CEO was leaving the business. However, the prospects for the business are still robust and it should do well as carbon-intensive industries increasingly look for efficiency savings, and from the burgeoning hydrogen market. We sold our position in TP ICAP as the growth prospects for the business look underwhelming, and we also took some profits in Sanne and Experian following a strong period of outperformance. Factors affecting performance during August August got off to a slow start due to worries that monetary policy would be tightened more quickly than previously anticipated and also as a result of continued pandemic-related concerns. However, it recovered strongly due to a combination of continued strong earnings, takeover activity, and capital inflows as a result of low interest rates and higher than usual savings levels. On the M&A front, an interesting development in August has been companies receiving improved counter offers to their initial bids, with Sanne, Meggitt and Morrisons all benefiting from this. UK GDP rebounded in the second quarter, growing 4.8% from the previous three months, following a 1.6% contraction in the first quarter. The expansion was driven mainly by household consumption and government spending. The second-quarter recovery left GDP 4.4% below pre-pandemic levels. In surprising news, the inflation rate fell to 2.0% year-on-year in July, from June’s recent peak level of 2.5%. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

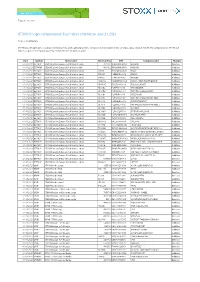

STOXX Changes Composition of Size Indices Effective on June 21, 2021

Zug, June 01, 2021 STOXX Changes composition of Size Indices effective on June 21, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Size Indices as part of the regular quarterly review effective on June 21, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 01.06.2021 EETMLP STOXX Eastern Europe Total Market Large 401112 TRAAKBNK91N6 AKBANK Deletion 01.06.2021 EETMMP STOXX Eastern Europe Total Market Mid 401112 TRAAKBNK91N6 AKBANK Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small UC003 HRKRASRA0008 KRAS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW027 PLERBUD00012 ERBUD Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small EW037 PLACTIN00018 ACTION Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small HR401D HRARNTRA0004 ARENA HOSPITALITY GROUP Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small GR801G GRS326003019 CRETE PLASTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL00BL PLINTKS00013 CFI HOLDING Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10OZ PLCPTRT00014 CAPTOR THERAPEUTICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10Q1 PLCRPJR00019 CREEPY JAR Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10P0 PLCPTRT00030 CAPTOR THERAPEUTICS CERT Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10S3 PLPRBLG00010 PURE BIOLOGICS Addition 01.06.2021 EETMSP STOXX Eastern Europe Total Market Small PL10T4 PLZSTAL00012 PGF POLSKA GRUPA FOTOWLT. -

London IPO Activity Skyrockets in Q1 2021

London IPO activity skyrockets in Q1 2021 IPO Eye An overview of the London Stock Exchange listings in Q1 2021 Market overview A busy start to 2021 for the London markets Main Market AIM Twelve floats Raised: Eight admissions Raised: The London Stock Exchange witnessed the best start to a year since 2007 with 20 issuers raising £5.6b in the first quarter of 2021, more than half of the £9.4b £5.2b £441m raised in the whole of 2020. The Main Market saw 12 IPOs which raised a combined £5.2b, whilst the Alternative Largest IPO: Largest IPO: Investment Market (AIM) saw eight admissions in the quarter raising £441m. The Dr Martens plc tinyBuild Inc largest Main Market IPO in the period was Dr Martens plc which raised £1.5b, and the largest AIM admission was tinyBuild Inc which raised £154m. Raised: Raised: The performance during the first three months of 2021 is in stark contrast to the same period in 2020 when there were just three IPOs on the Main Market and two £1.5b £154m on AIM, which raised a combined total of £615m — a value nine times lower than this year’s opening quarter. The UK has maintained both its position as the leading listing location in Europe for fund raising and, on a global basis, remains in third place behind the US and China for funds raised via IPO. The markets also had three cross border IPOs in In addition to the extensive IPO activity, the London markets also continued to the quarter including FixPrice, the retailer from the Russian Federation, that raised offer support to existing issuers with over £9b being raised in further offers and £1.2b through the issue of Global depository receipts (GDRs). -

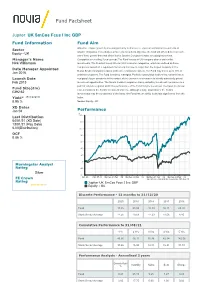

Fund Factsheet

Fund Factsheet Jupiter UK SmCos Fcus I Inc GBP Fund Information Fund Aim Objective: capital growth by investing primarily in shares (i.e. equities) and similar investments of Sector smaller companies. In seeking to achieve its investment objective, the fund will aim to deliver a return, Equity - UK net of fees, greater than that of the Numis Smaller Companies Index excluding Investment Manager's Name Companies over rolling 3 year periods.The Fund invests in UK company shares and similar Nick Williamson investments. The Fund will invest at least 80% in smaller companies, which are defined as those companies quoted on a regulated market and that are no larger than the largest company in the Date Manager Appointed Numis Smaller Companies Index at the time of initial investment. The Fund may invest up to 10% in Jan 2016 unlisted companies. The Fund is actively managed. Portfolio construction is driven by research into a Launch Date company's future prospects in the context of the economic environment to identify attractively priced Feb 2013 investment opportunities. The Numis Smaller Companies Index excluding Investment Companies is a point of reference against which the performance of the Fund may be measured. The Index is a broad Fund Size(£m) representation of the Fund's investment universe. Although a large proportion of the Fund’s £392.62 investments may be components of the Index, the Fund has the ability to deviate significantly from the Yield* (See page2) Index. 0.95 % Sector: Equity - UK XD Dates Jan 04 Performance % 140 Last Distribution -

Moments That Matter, Every Day. Moonpig Group Plc Prospectus: February 2021 Prospectus: February 2021

Moments that matter, every day. Moonpig Group plc Prospectus: February 2021 February plc Prospectus: Moonpig Group Prospectus: February 2021 Moonpig Group plc 10 Back Hill London EC1R 5EN This document comprises a prospectus (the “Prospectus”) relating to Moonpig Group plc (the “Company”) prepared in accordance with the prospectus regulation rules (the “Prospectus Regulation Rules”) of the Financial Conduct Authority (the “FCA”) made under Section 73A of the Financial Services and Markets Act 2000 (as amended) (the “FSMA”). This document has been approved as a prospectus by the FCA as competent authority under the UK version of Regulation (EU) 2017/1129 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA”) (the “UK Prospectus Regulation”). The FCA only approves this document as meeting the standards of completeness, comprehensibility and consistency imposed by the UK Prospectus Regulation in respect of a prospectus. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this document. Investors should make their own assessment as to the suitability of investing in the securities. The Prospectus will be made available to the public in accordance with Rule 3.2 of the Prospectus Regulation Rules. Capitalised terms used in this document which are not otherwise defined have the meanings given to them in the section headed “Glossary”. Application will be made to the FCA for all of the ordinary shares of GBP 0.10 each in the capital of the Company (the “Ordinary Shares”) to be admitted to the premium listing segment of the Official List maintained by the FCA (the “Official List”) and to the London Stock Exchange plc (the “London Stock Exchange”) for all such Ordinary Shares to be admitted to trading on the London Stock Exchange’s main market for listed securities (the “Main Market”) (together, “Admission”). -

Auction Topco Limited Financial Statements 30 September 2020

Company Registered No: 12400807 (England and Wales) AUCTION TOPCO LIMITED ANNUAL REPORT AND FINANICAL STATEMENTS FOR THE PERIOD FROM 13 JANUARY 2020 TO 30 SEPTEMBER 2020 AUCTION TOPCO LIMITED COMPANY INFORMATION Directors T E Hargreaves J Savant Company Secretary M Edwards Registered number 12400807 Registered office The Harlequin Building 6th Floor 65 Southwark Street London SE1 0HR Registered auditor Deloitte LLP London United Kingdom AUCTION TOPCO LIMITED Contents Page STRATEGIC REPORT .............................................................................................................................................. 1 DIRECTORS’ REPORT ............................................................................................................................................ 6 STATEMENT OF DIRECTORS’ RESPONSIBILITIES ............................................................................................. 9 INDEPENDENT AUDITOR’S REPORT .................................................................................................................. 10 CONSOLIDATED INCOME STATEMENT .............................................................................................................. 14 CONSOLIDATED AND COMPANY STATEMENT OF FINANCIAL POSITION ..................................................... 15 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY ................................................................................. 16 COMPANY STATEMENT OF CHANGES IN EQUITY ..........................................................................................