Auction Topco Limited Financial Statements 30 September 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kopi Af Aktivlisten 2021-06-30 Ny.Xlsm

Velliv noterede aktier i alt pr. 30-06-2021 ISIN Udstedelsesland Navn Markedsværdi (i DKK) US0378331005 US APPLE INC 1.677.392.695 US5949181045 US MICROSOFT CORP 1.463.792.732 US0231351067 US AMAZON.COM INC 1.383.643.996 DK0060534915 DK NOVO NORDISK A/S-B 1.195.448.146 US30303M1027 US FACEBOOK INC-CLASS A 1.169.094.867 US02079K3059 US ALPHABET INC-CL A 867.740.769 DK0010274414 DK DANSKE BANK A/S 761.684.457 DK0060079531 DK DSV PANALPINA A/S 629.313.827 US02079K1079 US ALPHABET INC-CL C 589.305.120 US90138F1021 US TWILIO INC - A 514.807.852 US57636Q1040 US MASTERCARD INC - A 490.766.560 US4781601046 US JOHNSON & JOHNSON 478.682.981 US70450Y1038 US PAYPAL HOLDINGS INC 471.592.728 DK0061539921 DK VESTAS WIND SYSTEMS A/S 441.187.698 US79466L3024 US SALESFORCE.COM INC 439.114.061 US01609W1027 US ALIBABA GROUP HOLDING-SP ADR 432.325.255 US8835561023 US THERMO FISHER SCIENTIFIC INC 430.036.612 US22788C1053 US CROWDSTRIKE HOLDINGS INC - A 400.408.622 KYG875721634 HK TENCENT HOLDINGS LTD 397.054.685 KR7005930003 KR SAMSUNG ELECTRONICS CO LTD 389.413.700 DK0060094928 DK ORSTED A/S 378.578.374 ES0109067019 ES AMADEUS IT GROUP SA 375.824.429 US46625H1005 US JPMORGAN CHASE & CO 375.282.618 US67066G1040 US NVIDIA CORP 357.034.119 US17275R1023 US CISCO SYSTEMS INC 348.160.692 DK0010244508 DK AP MOLLER-MAERSK A/S-B 339.783.859 US20030N1019 US COMCAST CORP-CLASS A 337.806.502 NL0010273215 NL ASML HOLDING NV 334.040.559 CH0012032048 CH ROCHE HOLDING AG-GENUSSCHEIN 325.008.200 KYG970081173 HK WUXI BIOLOGICS CAYMAN INC 321.300.236 US4370761029 US HOME DEPOT INC 317.083.124 US58933Y1055 US MERCK & CO. -

Blackrock UK Smaller Companies PDF Factsheet

Adventurous 31 August 2021 Life Fund SW BlackRock UK Smaller Companies Life Asset Allocation (as at 31/07/2021) This document is provided for the purpose of UK Small Cap Companies 99.8% information only. This factsheet is intended for individuals who are familiar with investment Money Market 0.2% terminology. Please contact your financial adviser if you need an explanation of the terms used. This material should not be relied upon as sufficient information to support an investment decision. The portfolio data on this factsheet is updated on a quarterly basis. Fund Aim The fund aims for long-term growth by investing in UK smaller companies which the Fund Manager considers to have above average long-term growth prospects. The fund Sector Breakdown (as at 31/07/2021) invests solely through the BlackRock UK Consumer Discretionary 27.7% Smaller Companies Unit Trust. Industrials 25.1% Basic Fund Information Financials 12.2% Fund Launch Date 19/09/2001 Technology 11.3% Fund Size £5.3m Basic Materials 5.1% Sector ABI UK Smaller Other 4.9% Companies Energy 3.8% ISIN GB0030873565 Consumer Staples 3.8% MEX ID SWMUL Health Care 3.7% SEDOL 3087356 Telecommunications 2.5% Manager Name Roland Arnold Regional Breakdown (as at 31/07/2021) Manager Since 26/03/2015 Top Ten Holdings (as at 31/07/2021) WATCHES OF SWITZERLAND 2.9% GROUP PLC IMPAX ASSET MANAGEMENT 2.4% GROUP PLC TREATT PLC 2.2% The composition of asset mix and asset allocation may change at any time and exclude cash CVS GROUP PLC 2.1% unless otherwise stated BREEDON GROUP PLC 2.0% OXFORD INSTRUMENTS PLC 1.8% INTEGRAFIN HOLDINGS PLC 1.8% AUCTION TECHNOLOGY GROUP 1.7% PLC ERGOMED PLC 1.7% LEARNING TECHNOLOGIES GROUP 1.7% PL TOTAL 20.3% Page 1 Past Performance Fund Rating Information 100% Overall Morningstar **** Rating Morningstar Analyst Rating 50% FE fundinfo Crown Rating The FE fundinfo Crown Rating relates to this fund. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

London IPO Activity Skyrockets in Q1 2021

London IPO activity skyrockets in Q1 2021 IPO Eye An overview of the London Stock Exchange listings in Q1 2021 Market overview A busy start to 2021 for the London markets Main Market AIM Twelve floats Raised: Eight admissions Raised: The London Stock Exchange witnessed the best start to a year since 2007 with 20 issuers raising £5.6b in the first quarter of 2021, more than half of the £9.4b £5.2b £441m raised in the whole of 2020. The Main Market saw 12 IPOs which raised a combined £5.2b, whilst the Alternative Largest IPO: Largest IPO: Investment Market (AIM) saw eight admissions in the quarter raising £441m. The Dr Martens plc tinyBuild Inc largest Main Market IPO in the period was Dr Martens plc which raised £1.5b, and the largest AIM admission was tinyBuild Inc which raised £154m. Raised: Raised: The performance during the first three months of 2021 is in stark contrast to the same period in 2020 when there were just three IPOs on the Main Market and two £1.5b £154m on AIM, which raised a combined total of £615m — a value nine times lower than this year’s opening quarter. The UK has maintained both its position as the leading listing location in Europe for fund raising and, on a global basis, remains in third place behind the US and China for funds raised via IPO. The markets also had three cross border IPOs in In addition to the extensive IPO activity, the London markets also continued to the quarter including FixPrice, the retailer from the Russian Federation, that raised offer support to existing issuers with over £9b being raised in further offers and £1.2b through the issue of Global depository receipts (GDRs). -

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda

IPO Masterclass Tuesday, 13 April 2021 Deloitte IPO Masterclass Agenda Welcome London Stock J.P. Morgan Deloitte DWF Q&A Exchange and closing Simon Olsen Marcus Stuttard Barry Meyers Az Ajam-Hassani Chris Stefani Simon Olsen © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 2 Deloitte IPO Masterclass You are in good company Attended Listed Attended Listed 2013 2015 2015 2015 2013 2014 2015 2015 2013 2015 2015 2015 2013 2015 2016 2018 2013 2014 2016 2018 2014 2016 2016 2018 2014 2015 2016 2019 2014 2015 2017 2018 2014 2015 2017 2018 2014 2014 2018 2021 2014 2015 2019 2021 ITF 2015 2016 © 2021 Deloitte LLP. All rights reserved. Deloitte IPO MasterClass – 13 April 2021 3 A pick up in global Equity Capital Markets activity Global IPO activity has been above the three-year average for the past three quarters Quarterly issuance value and volume – globally since 2017 200 1000 180 900 160 800 140 700 120 600 100 500 80 400 Deal value (£bn) value Deal Number of deals of Number 60 300 40 200 20 100 0 0 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Value Volume Follow-On IPO Follow-on IPO Source: Dealogic. All IPOs and Follow-Ons with a deal value greater than or equal to £10m % increase Global stockmarket indices performance since January 2020 from trough 130 83.1% 79.5% • There has been a resurgence in global ECM activity 120 following a period of slight decline from early 2017. -

Fund Factsheet

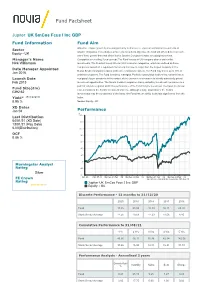

Fund Factsheet Jupiter UK SmCos Fcus I Inc GBP Fund Information Fund Aim Objective: capital growth by investing primarily in shares (i.e. equities) and similar investments of Sector smaller companies. In seeking to achieve its investment objective, the fund will aim to deliver a return, Equity - UK net of fees, greater than that of the Numis Smaller Companies Index excluding Investment Manager's Name Companies over rolling 3 year periods.The Fund invests in UK company shares and similar Nick Williamson investments. The Fund will invest at least 80% in smaller companies, which are defined as those companies quoted on a regulated market and that are no larger than the largest company in the Date Manager Appointed Numis Smaller Companies Index at the time of initial investment. The Fund may invest up to 10% in Jan 2016 unlisted companies. The Fund is actively managed. Portfolio construction is driven by research into a Launch Date company's future prospects in the context of the economic environment to identify attractively priced Feb 2013 investment opportunities. The Numis Smaller Companies Index excluding Investment Companies is a point of reference against which the performance of the Fund may be measured. The Index is a broad Fund Size(£m) representation of the Fund's investment universe. Although a large proportion of the Fund’s £392.62 investments may be components of the Index, the Fund has the ability to deviate significantly from the Yield* (See page2) Index. 0.95 % Sector: Equity - UK XD Dates Jan 04 Performance % 140 Last Distribution -

Look-Through Overzicht Per Eind Maart 2021

Look-through overzicht Pensioenfonds PostNL Per eind maart 2021 Beleggingen niet in Look-through overzicht: Investering % van totaal Aandelen wereldwijd (fonds in transitie, look-through gegevens later beschikbaar) 800,000,000 15.18% Niet genoteerd vastgoed 627,848,789 11.92% Landbouwgrond 25,000,000 0.47% Hypothecaire leningen 2,098,846,692 39.84% Hoogrentend onderhandse leningen 39,888,404 0.76% Renteafdekking 1,348,014,492 25.59% Liquiditeiten 74,080,882 1.41% Valuta-afdekking (56,139,594) -1.07% Belegging ("Ultimate parent") Investering % van totaal Taiwan Semiconductor Manufacturing Co., Ltd. 51,534,489 0.98% Samsung Electronics Co., Ltd. 50,029,405 0.95% Government of Mexico 49,037,200 0.93% Tencent Holdings Ltd. 47,266,866 0.90% Government of Indonesia 46,788,203 0.89% ASML Holding NV 42,324,970 0.80% Siemens AG 35,634,637 0.68% Alibaba Group Holding Ltd. 33,582,024 0.64% Government of Poland 32,060,976 0.61% Government of Malaysia 31,458,852 0.60% Allianz SE 31,136,419 0.59% Prologis, Inc. 30,784,437 0.58% Government of Brazil 30,741,115 0.58% Volkswagen AG 30,130,706 0.57% BNP Paribas S.A. 29,938,207 0.57% Iberdrola SA 29,656,463 0.56% SAP SE 29,547,071 0.56% AstraZeneca PLC 28,643,785 0.54% Novo Nordisk A/S 28,449,747 0.54% Government of South Africa 28,143,553 0.53% Rue la Boetie SAS 27,551,011 0.52% E.ON SE 26,205,806 0.50% Vonovia SE 26,098,490 0.50% Government of China 25,929,691 0.49% Digital Realty Trust, Inc. -

Quarterly Fiscal Holdings

American Century Investments® Quarterly Portfolio Holdings NT International Small-Mid Cap Fund February 28, 2021 NT International Small-Mid Cap - Schedule of Investments FEBRUARY 28, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) COMMON STOCKS — 99.4% Australia — 5.9% carsales.com Ltd. 197,901 2,839,233 Mineral Resources Ltd. 33,622 983,490 NEXTDC Ltd.(1) 592,629 5,096,282 Nickel Mines Ltd. 3,790,792 4,093,733 NRW Holdings Ltd. 845,057 1,311,176 OZ Minerals Ltd. 372,965 6,440,122 Redbubble Ltd.(1) 626,448 2,457,192 Seven Group Holdings Ltd.(2) 461,872 7,727,321 30,948,549 Belgium — 0.8% D'ieteren SA 47,529 4,009,420 Canada — 9.7% BRP, Inc. 72,333 5,226,324 CAE, Inc. 212,817 5,632,309 Colliers International Group, Inc. (Toronto)(2) 72,668 7,530,611 Descartes Systems Group, Inc. (The)(1) 44,818 2,624,068 Element Fleet Management Corp. 539,690 5,292,575 FirstService Corp. 17,712 2,687,420 Innergex Renewable Energy, Inc. 131,864 2,495,116 Jamieson Wellness, Inc. 57,384 1,560,181 Nuvei Corp.(1) 83,001 4,362,533 Parex Resources, Inc.(1) 310,404 4,961,195 TFI International, Inc. 117,504 8,207,552 50,579,884 China — 0.9% Minth Group Ltd. 1,132,000 4,966,137 Denmark — 2.5% ALK-Abello A/S(1) 14,579 6,132,655 Netcompany Group A/S(1) 5,794 517,466 Pandora A/S 31,437 3,048,023 Royal Unibrew A/S 30,918 3,182,152 12,880,296 Finland — 2.8% Huhtamaki Oyj 56,824 2,555,551 Metso Outotec Oyj 745,927 8,374,240 Musti Group Oyj(1) 122,200 3,938,826 14,868,617 France — 3.0% APERAM SA 117,132 4,902,388 Elis SA(1) 236,096 4,083,108 SOITEC(1) 31,439 6,623,706 15,609,202 Germany — 4.9% Dermapharm Holding SE 60,537 4,285,737 flatexDEGIRO AG(1) 59,710 6,280,375 Hypoport SE(1) 4,400 3,088,479 LPKF Laser & Electronics AG 95,125 2,974,651 ProSiebenSat.1 Media SE(1) 308,262 6,310,982 TeamViewer AG(1) 49,535 2,658,324 25,598,548 Hong Kong — 0.9% Man Wah Holdings Ltd. -

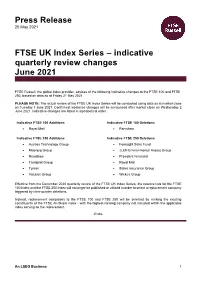

FTSE UK Index Series – Indicative Quarterly Review Changes June 2021

Press Release 25 May 2021 FTSE UK Index Series – indicative quarterly review changes June 2021 FTSE Russell, the global index provider, advises of the following indicative changes to the FTSE 100 and FTSE 250, based on data as at Friday 21 May 2021. PLEASE NOTE: The actual review of the FTSE UK Index Series will be conducted using data as at market close on Tuesday 1 June 2021. Confirmed rebalance changes will be announced after market close on Wednesday 2 June 2021. Indicative changes are listed in alphabetical order. Indicative FTSE 100 Additions Indicative FTSE 100 Deletions • Royal Mail • Renishaw Indicative FTSE 250 Additions Indicative FTSE 250 Deletions • Auction Technology Group • Foresight Solar Fund • Moonpig Group • JLEN Environmental Assets Group • Renishaw • Provident Financial • Trustpilot Group • Royal Mail • Tyman • Sabre Insurance Group • Volution Group • Wickes Group Effective from the December 2020 quarterly review of the FTSE UK Index Series, the reserve lists for the FTSE 100 Index and the FTSE 250 Index will no longer be published or utilised in order to select a replacement company triggered by intra-quarter deletions. Instead, replacement companies to the FTSE 100 and FTSE 250 will be selected by ranking the existing constituents of the FTSE All-Share index - with the highest-ranking company not included within the applicable index serving as the replacement. -Ends- An LSEG Business 1 Press Release For further information: Global Media Oliver Mann / Nandeep Roopray +44 (0)20 7797 1222 [email protected] Notes to editors: About FTSE Russell: FTSE Russell is a global index leader that provides innovative benchmarking, analytics and data solutions for investors worldwide. -

BXE Liquidity Provider Program Registered Securities

BXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-10-05: 3INl - 3i Infrastructure PLC Citadel Securities (Europe) Limited (Program Three) 888l - 888 Holdings PLC Jane Street Financial Limited (Program Three) A2Am - A2A SpA Virtu Financial Ireland Ltd (Program Two) AAFl - Airtel Africa PLC Jane Street Financial Limited (Program Three) AAKs - AAK AB HRTEU Limited (Program Two) AALBa - Aalberts NV Virtu Financial Ireland Ltd (Program Two) AALl - Anglo American PLC BNP Paribas Arbitrage SNC (Program One and Three) Citadel Securities (Europe) Limited (Program Three) Jane Street Financial Limited (Program Three) Societe Generale London Branch (Program Three) Tower Research Capital Europe Limited (Program Two) Virtu Financial Ireland Ltd (Program Two) ABBNz - ABB Ltd BNP Paribas Arbitrage SNC (Program One and Three) Citadel Securities (Europe) Limited (Program Three) Jane Street Financial Limited (Program Three) Societe Generale London Branch (Program Three) Virtu Financial Ireland Ltd (Program Two) ABBs - ABB Ltd BNP Paribas Arbitrage SNC (Program One and Three) Virtu Financial Ireland Ltd (Program Two) ABDNl - Abrdn Plc BNP Paribas Arbitrage SNC (Program One and Three) Citadel Securities (Europe) Limited (Program Three) Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. -

FTSE All-Share

2 FTSE Russell Publications 19 August 2021 FTSE All-Share Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.47 UNITED AstraZeneca 4.77 UNITED Biffa 0.03 UNITED KINGDOM KINGDOM KINGDOM 3i Infrastructure 0.07 UNITED Auction Technology Group 0.02 UNITED Big Yellow Group 0.09 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.03 UNITED Augmentum Fintech 0.01 UNITED Biotech Growth Trust 0.02 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.04 UNITED Aurora Investment Trust 0.01 UNITED Blackrock Frontiers Investment Trust 0.01 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Asia Income Fund 0.02 UNITED Auto Trader Group 0.25 UNITED BlackRock Greater Euro Inv Tst 0.02 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Diversified Income And Growth 0.01 UNITED Avast 0.11 UNITED BlackRock Latin American Inv Tst 0.01 UNITED Trust KINGDOM KINGDOM KINGDOM Aberdeen New Dawn Inv Tst 0.02 UNITED Aveva Group 0.18 UNITED Blackrock North American Income Trust 0.01 UNITED KINGDOM KINGDOM KINGDOM Aberdeen New India Investment Trust 0.01 UNITED Avi Global Trust 0.04 UNITED BlackRock Smaller Companies Tst 0.04 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Standard Asia Focus 0.02 UNITED Avi Japan Opportunity Trust 0.01 UNITED Blackrock Throgmorton Trust 0.04 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Standard Equity Income Trust 0.01 UNITED Aviva 0.67 UNITED BlackRock World Mining Trust 0.05 UNITED KINGDOM KINGDOM KINGDOM Aberdeen Standard European Logistics 0.01 -

Xtrackers** Société D’Investissement À Capital Variable R.C.S

Xtrackers** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2021 to 30 June 2021 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers** accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. ** This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2021 28 Statement of Investments as at 30 June 2021 48 Xtrackers MSCI WORLD SWAP UCITS ETF* 48 Xtrackers MSCI EUROPE UCITS ETF 53 Xtrackers MSCI JAPAN UCITS ETF 64 Xtrackers MSCI USA SWAP UCITS ETF* 70 Xtrackers EURO STOXX 50 UCITS ETF 74 Xtrackers DAX UCITS ETF 76 Xtrackers FTSE MIB UCITS ETF 77 Xtrackers SWITZERLAND UCITS ETF 79 Xtrackers FTSE 100 INCOME UCITS ETF 80 Xtrackers FTSE 250 UCITS ETF 83 Xtrackers MSCI UK ESG UCITS ETF 90 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 94 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 99 Xtrackers MSCI EM LATIN AMERICA ESG SWAP UCITS ETF*(1) 103 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA ESG SWAP UCITS ETF*(2) 104 Xtrackers MSCI TAIWAN UCITS ETF 105 Xtrackers MSCI BRAZIL UCITS ETF 107 Xtrackers NIFTY 50 SWAP UCITS ETF* 109 Xtrackers MSCI KOREA UCITS ETF 111 Xtrackers FTSE CHINA 50 UCITS ETF 114 Xtrackers EURO STOXX QUALITY DIVIDEND UCITS ETF 116 Xtrackers STOXX GLOBAL SELECT DIVIDEND