Bmv Ohio-ELT-Participant-List.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Working Together to Build Bridges to the Future

DEC. 612, 2019 5 Working together to build bridges to the future SENATOR JOHN HEINZ HISTORY CENTER GETTY IMAGES SPONSORED BY: 2 PITTSBURGH BUSINESS TIMES THE PITTSBURGH REGION AND OUR NEXT 75 Th e next chapter in our region’s history eventy-fi ve years. Th at’s an entire improving quality of place. lifetime. We will only succeed in reaching S When you get to 75 years – so this goal if we join together and involve we’re told – you’re wiser. Your world- as many people as possible. At the Our view broadens. You understand how Next 75 Summit in June and the Allegh- things succeed and how things fail. eny Conference’s 75th Annual Meeting Over the past 75 years of regional earlier this week, packed rooms, buzz- transformation, two generations of lead- ing with the energy and enthusiasm of Jeff Broadhurst and Toni Murphy are ers have shaped the story of our region, everyone present, proved a point: we co-chairs of the Allegheny Conference and a third is taking the reins. have the ability to propel this place for- on Community Development’s Our Next Much of 2019 was devoted to listening ward to achieve its fullest potential. 75 initiative. to emerging leaders – that third genera- Such a future off ers: tion – as well as to the voices of experi- • A Strong Economy that leverages ence. From Butler to Washington … from our human and natural resources with a will give them pause – and give them Greensburg to Pittsburgh … we invit- focus on tech and innovation, a well-cal- cause – to draw inspiration from us, ed leaders from across our region to the ibrated business ecosystem and eff ective much as we do from the leaders who table to gather directly from them more marketing. -

Press Release Third Annual National Speakers

PRESS RELEASE CONTACT: Veronica S. Laurel CHRISTUS Santa Rosa Foundation 210.704.3645 office; 210.722-5325 mobile THIRD ANNUAL NATIONAL SPEAKERS LUNCHEON HONORED TOM FROST AND FEATURED CAPTAIN“SULLY” SULLENBERGER Proceeds from the Luncheon benefit the Friends of CHRISTUS Santa Rosa Foundation SAN ANTONIO – (April, 3, 2013) Today, the Friends of CHRISTUS Santa Rosa Foundation held its Third Annual National Speakers Luncheon to honor Tom C. Frost, Jr. with the Beacon Award for his passionate service to the community, and featured Captain Chesley B. “Sully” Sullenberger, III as the keynote speaker. Proceeds from the event will benefit programs supported by the Foundation. The Friends of CHRISTUS Santa Rosa Foundation supports the health and wellness of adults throughout south and central Texas by raising money for innovative programs and equipment for four general hospitals and regional health and wellness outreach programs in the San Antonio Medical Center, Westover Hills, Alamo Heights and New Braunfels. The National Speakers Luncheon celebrates the contributions of Frost by honoring him with the Friends of CHRISTUS Santa Rosa Beacon Award. Frost is chairman emeritus of Frost Bank and is the fourth generation of his family to oversee the bank founded by his great grandfather, Colonel T.C. Frost in 1868. He has a long history of community service, having served on the Board of Trustees for the San Antonio Medical Foundation, the Texas Research and Technology Foundation and Southwest Research Institute. He has served on executive committees, boards and initiatives for the San Antonio Livestock Exposition, the McNay Art Museum, the Free Trade Alliance and the YMCA, to name just a few. -

3Rd Quarter 2020

List of Section 13F Securities Third Quarter FY 2020 Copyright (c) 2020 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of September 15, 2020, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending September 30, 2020. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by [ Section 13(f)(1) and Rule 13f-1] thereunder. -

Emergency Assistance for Chrysler Financial

PRELIMINARY YPFS DISCUSSION DRAFT| MARCH 2020 Emergency Assistance for Chrysler Financial Alexander Nye1 October 24, 2019 Abstract In 2008, due to the confluence of the financial crisis and years of structural decline, Chrysler was nearing bankruptcy. Chrysler’s related finance company, Chrysler Financial, was in dire straits. On January 2, the U.S. Treasury extended Chrysler a $4 billion bridge loan to give the company time to prepare a viable restructuring plan (See Nye 2019 Bridge Loans). Two weeks later, the Treasury arranged $1.5 billion in low-interest financing for Chrysler Financial to fund the securitization of new consumer car loans. Chrysler Financial drew down the entire $1.5 billion between January 16 and April 9, 2009. Although the loans bore a 5-year term, Chrysler Financial paid off the loans in July after accessing another government program, the Term Asset-Backed Securities Loan Facility. The $1.5 billion facility subjected Chrysler Financial to several management restrictions, most of which related to executive compensation. When Chrysler entered bankruptcy on April 30, GMAC (General Motors’ related auto finance company) took over most of Chrysler Financial’s business. Chrysler Financial continued to do business at a much smaller scale. Treasury expected Chrysler Financial to wind-down its business. In December 2010, TD Bank bought Chrysler Financial from Cerberus for $6.3 billion. Commentators do not have much to say on the impact of its aid for Chrysler Financial, although the $1.5 billion facility coincided with several months of increased sales Key Words: Bailout, Securitization, Chrysler, AIFP, Manufacturing, Auto Finance, Chrysler Financial, TALF, TARP 1 Research Assistant, Yale Program on Financial Stability, Yale School of Management PRELIMINARY YPFS DISCUSSION DRAFT| MARCH 2020 Table of Contents Abstract ............................................................................................................................................................. -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

2019 Raymond James US Bank Conference

NYSE: FCF NYSE: FCF Forward‐looking statements This presentation contains forward‐looking statements about First Commonwealth’s future plans, strategies and financial performance. These statements can be identified by the fact that they do not relate strictly to historical or current facts and often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate" or words of similar meaning, or future or conditional verbs such as "will," "would," "should," "could" or "may." Such statements are based on assumptions and involve risks and uncertainties, many of which are beyond our control. Factors that could cause actual results, performance or achievements to differ from those discussed in the forward‐looking statements include, but are not limited to: › Local, regional, national and international economic conditions and the impact they may have on First Commonwealth and its customers; › volatility and disruption in national and international financial markets; › the effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board; › inflation, interest rate, commodity price, securities market and monetary fluctuations; › the effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities and insurance) with which First Commonwealth must comply; › the soundness of other financial institutions; › political instability; › impairment of First Commonwealth’s goodwill or other intangible assets; › acts -

Fund Holdings March 31, 2021

Fund Holdings March 31, 2021 Our Funds Daily Income Fund (HDIXX) Short-Term Government Securities Fund (HOSGX) Short-Term Bond Fund (HOSBX) Intermediate Bond Fund (HOIBX) Stock Index Fund (HSTIX) Value Fund (HOVLX) Growth Fund (HNASX) International Equity Fund (HISIX) Small-Company Stock Fund (HSCSX) Table of Contents Daily Income Fund......................................................... 1 Short-Term Government Securities Fund .................... 3 Short-Term Bond Fund.................................................. 7 Intermediate Bond Fund ...............................................15 Stock Index Fund............................................................25 S&P 500 Index Master Portfolio.....................................26 Value Fund ......................................................................35 Growth Fund...................................................................37 International Equity Fund .............................................39 Small-Company Stock Fund..........................................42 Portfolio of Investments Daily Income Fund | March 31, 2021 | (Unaudited) U.S. Government & Agency Obligations | 74.0% of portfolio Interest Rate / Yield Maturity Date Face Amount Value Federal Farm Credit Bank .% // $ ,, $ ,, Federal Farm Credit Bank .(a) // ,, ,, Federal Home Loan Bank . // ,, ,, Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal Home Loan Bank . // , , Federal National Mortgage Assoc. // ,, ,, Tunisia Government AID Bonds . -

Usaa Fund Holdings Usaa High Income Fund

USAA FUND HOLDINGS As of September 30, 2020 USAA HIGH INCOME FUND CUSIP TICKER SECURITY NAME SHARES/PAR/CONTRACTS MARKET VALUE 00105DAF2 AES VRN 3/26/2079 5,000,000.00 5,136,700.00 001846AA2 ANGI 3.875% 8/15/28 100,000.00 99,261.00 00206R102 T AT&T, INC. 33,780.00 963,067.80 00287Y109 ABBV ABBVIE INC. 22,300.00 1,953,257.00 00687YAA3 ADIENT GL 4.875% 08/15/26 10,000,000.00 9,524,000.00 00774MAB1 AERCAP IE 3.65% 07/21/27 5,000,000.00 4,575,600.00 00790RAA2 ADVANCED 5.00% 09/30/27 1,000,000.00 1,044,910.00 009089AA1 AIR CANAD 4.125% 11/15/26 5,485,395.25 4,928,079.09 01166VAA7 ALASKA 4.80% 2/15/29 2,000,000.00 2,092,020.00 013092AG6 ALBERTSON 3.5% 03/15/29 1,000,000.00 970,120.00 013093AD1 ALBERTSONS 5.75% 3/15/25 9,596,000.00 9,917,370.04 013817AK7 ARCONIC 5.95% 02/01/37 5,000,000.00 5,359,250.00 013822AC5 ALCOA NED 6.125% 5/15/28 4,000,000.00 4,213,680.00 016900AC6 ALLEGHENY 6.95% 12/15/25 6,456,000.00 6,418,361.52 01741RAH5 ALLEGHENY 5.875% 12/01/27 500,000.00 480,715.00 01879NAA3 ALLIANCE 7.5% 05/01/25 3,000,000.00 2,129,100.00 02154CAF0 ALTICE FI 5.00% 01/15/28 5,000,000.00 4,855,050.00 02156LAA9 ALTICE FR 8.125% 02/01/27 6,000,000.00 6,536,940.00 02156TAA2 ALTICE 6.00% 02/15/28 10,000,000.00 9,518,800.00 031921AA7 AMWINS GR 7.75% 07/01/26 4,000,000.00 4,282,040.00 032359AE1 AMTRUST F 6.125% 08/15/23 9,760,000.00 8,937,817.60 037411BE4 APACHE 4.375% 10/15/28 10,000,000.00 9,131,000.00 03938LAP9 ARCELORMI 7.% 10/15/39 8,000,000.00 10,121,280.00 03966VAA5 ARCONIC 6.125% 02/15/28 1,200,000.00 1,234,896.00 03966VAB3 ARCONIC 6.00% 05/15/2025 -

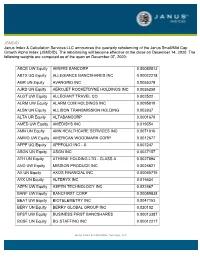

JSMDID Janus Index & Calculation Services LLC Announces The

JSMDID Janus Index & Calculation Services LLC announces the quarterly rebalancing of the Janus Small/Mid Cap Growth Alpha Index (JSMDID). The rebalancing will become effective at the close on December 14, 2020. The following weights are computed as of the open on December 07, 2020: ABCB UW Equity AMERIS BANCORP 0.00080013 ABTX UQ Equity ALLEGIANCE BANCSHARES INC 0.00022218 AGR UN Equity AVANGRID INC 0.0055378 AJRD UN Equity AEROJET ROCKETDYNE HOLDINGS INC 0.0026259 ALGT UW Equity ALLEGIANT TRAVEL CO 0.002522 ALRM UW Equity ALARM.COM HOLDINGS INC 0.0095819 ALSN UN Equity ALLISON TRANSMISSION HOLDING 0.003937 ALTA UR Equity ALTABANCORP 0.0001678 AMED UW Equity AMEDISYS INC 0.019354 AMN UN Equity AMN HEALTHCARE SERVICES INC 0.0071816 AMWD UW Equity AMERICAN WOODMARK CORP 0.0012677 APPF UQ Equity APPFOLIO INC - A 0.007247 ASGN UN Equity ASGN INC 0.0037157 ATH UN Equity ATHENE HOLDING LTD - CLASS A 0.0027894 AVO UW Equity MISSION PRODUCE INC 0.0026621 AX UN Equity AXOS FINANCIAL INC 0.00065715 AYX UN Equity ALTERYX INC 0.015624 AZPN UW Equity ASPEN TECHNOLOGY INC 0.022467 BANF UW Equity BANCFIRST CORP 0.00059838 BEAT UW Equity BIOTELEMETRY INC 0.0047153 BERY UN Equity BERRY GLOBAL GROUP INC 0.020102 BFST UW Equity BUSINESS FIRST BANCSHARES 0.00013387 BGSF UN Equity BG STAFFING INC 0.00012217 Janus Index & Calculation Services, LLC BLBD UQ Equity BLUE BIRD CORP 0.0003894 BLD UN Equity TOPBUILD CORP 0.0043497 BLDR UW Equity BUILDERS FIRSTSOURCE INC 0.0035128 BMCH UW Equity BMC STOCK HOLDINGS INC 0.0026463 BOOT UN Equity BOOT BARN HOLDINGS INC -

Autozone OFFERING MEMORANDUM San Antonio, Texas

AutoZone OFFERING MEMORANDUM San Antonio, Texas Cassidyu Andrew Bogardus Christopher Sheldon Douglas Longyear Ed Colson, Jr. 415-677-0421 415-677-0441 415-677-0458 858-546-5423 [email protected] [email protected] [email protected] [email protected] Lic #00913825 Lic #01806345 Lic #00829911 TX Lic #635820 Disclaimer The information contained in this marketing brochure (“Materials”) is proprietary The information contained in the Materials has been obtained by Agent from sources and confidential. It is intended to be reviewed only by the person or entity receiving believed to be reliable; however, no representation or warranty is made regarding the the Materials from Cassidy Turley Northern California (“Agent”). The Materials are accuracy or completeness of the Materials. Agent makes no representation or warranty intended to be used for the sole purpose of preliminary evaluation of the subject regarding the Property, including but not limited to income, expenses, or financial property/properties (“Property”) for potential purchase. performance (past, present, or future); size, square footage, condition, or quality of the land and improvements; presence or absence of contaminating substances The Materials have been prepared to provide unverified summary financial, property, (PCB’s, asbestos, mold, etc.); compliance with laws and regulations (local, state, and and market information to a prospective purchaser to enable it to establish a preliminary federal); or, financial condition or business prospects of any tenant (tenants’ intentions level of interest in potential purchase of the Property. The Materials are not to be regarding continued occupancy, payment of rent, etc). A prospective purchaser must considered fact. -

Court File No. CV-19-614593-00CL

Court File No. CV-19-614593-00CL ONTARIO SUPERIOR COURT OF JUSTICE (COMMERCIAL LIST) B E T W E E N: CORNER FLAG LLC Applicant – and – ERWIN HYMER GROUP NORTH AMERICA, INC. Respondent APPLICATION UNDER section 243 of the Bankruptcy and Insolvency Act, R.S.C. 1985, c. B-3, as amended, and under section 101 of the Courts of Justice Act, R.S.O. 1990, c. C.43 MOTION RECORD OF ALVAREZ & MARSAL CANADA INC., IN ITS CAPACITY AS COURT-APPOINTED RECEIVER AND MANAGER OF ERWIN HYMER GROUP NORTH AMERICA, INC. (Motion for Approval of Sales Process) March 20, 2019 OSLER, HOSKIN & HARCOURT LLP 100 King Street West 1 First Canadian Place Suite 6200, P.O. Box 50 Toronto, ON M5X 1B8 Tracy C. Sandler (LSO# 32443N) Tel: 416.862.5890 Jeremy Dacks (LSO# 41851R) Tel: 416.862.4923 Fax: 416.862.6666 Counsel for the Receiver – 2 – TO: THE SERVICE LIST AND TO: THE SUPPLEMENTAL SERVICE LIST Court File No. CV-19-614593-00CL ONTARIO SUPERIOR COURT OF JUSTICE COMMERCIAL LIST BETWEEN: CORNER FLAG LLC Applicant – and – ERWIN HYMER GROUP NORTH AMERICA, INC. Respondents SERVICE LIST (as at March 20, 2019) PARTY CONTACT BLAKE, CASSELS & GRAYDON LLP Pamela L.J. Huff Commerce Court West Tel: 416.863.2958 199 Bay Street, Suite 4600 Email: [email protected] Toronto, ON M5L 1A9 Linc Rogers Tel: 416.863.4168 Fax: 416.863.2653 Email: [email protected] Counsel to the Applicant Aryo Shalviri Tel: 416.863.2962 Email: [email protected] Vanja Ginic Tel: 416.863.3278 Email: [email protected] Caitlin McIntyre Tel: 416.863.4174 Email: [email protected] [2] ALVAREZ & MARSAL CANADA INC. -

Fully Nnn Medical Office Building Investment

FULLY NNN MEDICAL OFFICE BUILDING INVESTMENT 16088 SAN PEDRO, SAN ANTONIO, TEXAS 78232 Teresa L. Corbin, CCIM Jim Lundblad Office: 210.366.2222 Office: 210.366.2222 Mobile: 210.241.4686 Mobile: 210.602.5401 9311 San Pedro, Suite 850 [email protected] [email protected] San Antonio, Texas 78216 endurasa.com THE PROPERTY FULLY NNN MEDICAL OFFICE BUILDING INVESTMENT 16088 SAN PEDRO, SAN ANTONIO, TEXAS 78232 This investment property offering is an opportunity for an investor to acquire an income producing medical office building on Highway 281, a major north/south commercial and commuter corridor within San Antonio. Nearby businesses include restaurants, hotels, retail, banks, self storage, assisted living facility, office parks and office buildings. The building was built in 1986 and renovated in 2012. It has excellent visibility and frontage along Hwy 281. There is an abundance of parking, (free surface parking). The 28,255 square foot medical building is 100% leased to one of San Antonio’s largest healthcare systems. The Property is nestled among many well established subdivisions. This well established area and has an estimated 2020 population of 243,817 within a five mile radius. During the last 10 years, the population grew by 16.4% within this radius and is projected to grow another 6.4% by the year 2025. The estimated households for 2020 is at 97,190 with a projected growth of 5.9% by the year 2025, totaling 102,910 households. This area is also home to 12,190 businesses within the five mile radius and has an estimated 118,329 employees.