Mtr Corporation Limited 香港鐵路有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Contents the Year 2002 in Review Major Events of Hong Kong

List of Contents The year 2002 in review Major events of Hong Kong securities market 2002 Market highlights Cash market - Main board Cash market - Growth enterprise market (GEM) Derivatives market Clearing statistics Exchange participants The investing community Hong Kong stock market historical events Appendices The Year 2002 in Review The Year The Year 2002 in Review The Hong Kong economy remained weak in 2002 but trade figures began to turn around in the second half of the year. Benefiting from the weakening US dollar and strong demand in the Mainland of China, Hong Kong’s total exports regained double-digit growth over a year earlier in the third quarter of 2002. The seasonally adjusted unemployment rate also fell from its historical peak of 7.8% in July 2002 to 7.2% in December 2002. However, the domestic sector remained sluggish in both investment and consumer spending. The latest economic forecast suggests a 2% growth in real terms of GDP and a 3% decline in the Composite Consumer Price Index for 2002. The trading performance of the Hong Kong securities and futures markets further weakened during the year. Hang Seng Index fell 18.2% from the previous year to end at 9,321.29. The average daily turnover of the Main Board also declined to HK$6,474 million, 19.3% less than that in 2001. The GEM Index ended at 110.4 at end of December 2002, representing a decrease of 44.6% from the previous year. The average daily turnover of the GEM improved slightly to HK$178 million in 2002, an increase of 9.9% from 2001. -

The Chief Executive's 2020 Policy Address

The Chief Executive’s 2020 Policy Address Striving Ahead with Renewed Perseverance Contents Paragraph I. Foreword: Striving Ahead 1–3 II. Full Support of the Central Government 4–8 III. Upholding “One Country, Two Systems” 9–29 Staying True to Our Original Aspiration 9–10 Improving the Implementation of “One Country, Two Systems” 11–20 The Chief Executive’s Mission 11–13 Hong Kong National Security Law 14–17 National Flag, National Emblem and National Anthem 18 Oath-taking by Public Officers 19–20 Safeguarding the Rule of Law 21–24 Electoral Arrangements 25 Public Finance 26 Public Sector Reform 27–29 IV. Navigating through the Epidemic 30–35 Staying Vigilant in the Prolonged Fight against the Epidemic 30 Together, We Fight the Virus 31 Support of the Central Government 32 Adopting a Multi-pronged Approach 33–34 Sparing No Effort in Achieving “Zero Infection” 35 Paragraph V. New Impetus to the Economy 36–82 Economic Outlook 36 Development Strategy 37 The Mainland as Our Hinterland 38–40 Consolidating Hong Kong’s Status as an International Financial Centre 41–46 Maintaining Financial Stability and Striving for Development 41–42 Deepening Mutual Access between the Mainland and Hong Kong Financial Markets 43 Promoting Real Estate Investment Trusts in Hong Kong 44 Further Promoting the Development of Private Equity Funds 45 Family Office Business 46 Consolidating Hong Kong’s Status as an International Aviation Hub 47–49 Three-Runway System Development 47 Hong Kong-Zhuhai Airport Co-operation 48 Airport City 49 Developing Hong Kong into -

Rail Merger (1) Connected Transactions (2) Very Substantial Acquisition

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Circular does not constitute, or form part of, an offer or invitation, or solicitation or inducement of an offer, to subscribe for or purchase any of the MTRC Shares or other securities of the Company. If you are in any doubt as to any aspect of this Circular, or as to the action to be taken, you should consult a licensed securities LR 14.63(2)(b) dealer, bank manager, solicitor, professional accountant or other professional adviser. LR 14A.58(3)(b) If you have sold or transferred all your MTRC Shares, you should at once hand this Circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this Circular, makes no representation as to its LR 14.58(1) accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the LR 14A.59(1) whole or any part of the contents of this Circular. App. 1B, 1 LR 13.51A RAIL MERGER (1) CONNECTED TRANSACTIONS (2) VERY SUBSTANTIAL ACQUISITION Joint Financial Advisers to the Company Goldman Sachs (Asia) L.L.C. UBS Investment Bank Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders Merrill Lynch (Asia Pacific) Limited It is important to note that the purpose of distributing this Circular is to provide the Independent Shareholders of the Company with information, amongst other things, on the proposed Rail Merger, so that they may make an informed decision on voting in respect of the EGM Resolution. -

Hong Kong SAR

Hong Kong SAR 104 Doing Business in Asia Pacific SEPTEMBER 2020 Chapter 1: Introduction 108 Chapter 2: Business environment 110 2.1 Hong Kong’s free economy 110 2.2 Gateway to mainland China 111 2.3 International outlook 112 2.4 Well-established legal and financial infrastructures 112 2.5 Favourable tax regime 113 Chapter 3: Business and corporate structures 114 3.1 Limited company 114 3.2 Unincorporated businesses 116 3.3 Forms of business collaboration 116 Chapter 4: Takeovers (friendly M&A) 117 4.1 Introduction 117 4.2 Hong Kong company law 118 4.3 Other common legal issues 118 4.4 Typical documentation 119 4.5 Due diligence 120 4.6 Sale and purchase agreement 120 Chapter 5: Foreign investment 122 5.1 Overview of Hong Kong’s business and investment environment 122 5.2 Restrictions on foreign investment 123 Chapter 6: Restructuring and insolvency 124 6.1 Legal framework 124 6.2 Liquidation 124 6.3 Restructuring 125 6.4 International insolvency 126 Doing Business in Asia Pacific SEPTEMBER 2020 105 Chapter 7: Employment, industrial relations, and work health and safety 127 7.1 Basic employment rights 127 7.2 Employment contract 128 7.3 Expatriates 129 7.4 Termination 129 7.5 Work health and safety 130 Chapter 8: Taxation 131 8.1 Outline 131 8.2 Profits tax 131 8.3 Salaries tax 133 8.4 Property tax 134 8.5 Stamp duty 134 8.6 Tax disputes 135 8.7 Anti-avoidance 135 Chapter 9: Intellectual property 135 9.1 Trademarks 136 9.2 Copyright 136 9.3 Registered designs 137 9.4 Patents 137 9.5 Confidential information 138 9.6 Private information 138 -

HONG KONG LEGISLATIVE COUNCIL ― 16 May 1984 947

HONG KONG LEGISLATIVE COUNCIL ― 16 May 1984 947 OFFICIAL REPORT OF PROCEEDINGS Wednesday, 16 May 1984 The Council met at half past two o’clock PRESENT HIS EXCELLENCY THE ACTING GOVERNOR (PRESIDENT) THE HONOURABLE THE CHIEF SECRETARY SIR CHARLES PHILIP HADDON-CAVE. K.B.E., C.M.G., J.P. THE HONOURABLE THE FINANCIAL SECRETARY SIR JOHN HENRY BREMRIDGE, K.B.E., J.P. THE HONOURABLE THE ATTORNEY GENERAL MR. MICHAEL DAVID THOMAS, Q.C. THE HONOURABLE DENIS CAMPBELL BRAY. C.M.G., C.V.O., J.P. SECRETARY FOR HOME AFFAIRS DR. THE HONOURABLE HARRY FANG SIN-YANG, C.B.E., J.P. THE HONOURABLE FRANCIS YUAN-HAO TIEN. O.B.E., J.P. THE HONOURABLE ALEX WU SHU-CHIH. C.B.E., J.P. THE HONOURABLE CHEN SHOU-LUM, C.B.E., J.P. THE HONOURABLE LYDIA DUNN, C.B.E., J.P. THE REVD. THE HONOURABLE PATRICK TERENCE McGOVERN. O.B.E., S.J., J.P. THE HONOURABLE PETER C. WONG. O.B.E., J.P. THE HONOURABLE WONG LAM, O.B.E., J.P. DR. THE HONOURABLE THONG KAH-LEONG. C.B.E., J.P. DIRECTOR OF MEDICAL AND HEALTH SERVICES THE HONOURABLE CHARLES YEUNG SIU-CHO. O.B.E., J.P. THE HONOURABLE JOHN MARTIN ROWLANDS, C.B.E., J.P. SECRETARY FOR THE CIVIL SERVICE DR. THE HONOURABLE HO KAM-FAI, O.B.E., J.P. THE HONOURABLE ANDREW SO KWOK-WING, O.B.E., J.P. THE HONOURABLE GERALD PAUL NAZARETH, Q.C., J.P. LAW DRAFTSMAN THE HONOURABLE WONG PO-YAN, O.B.E., J.P. -

MTR Corporation

Prospectus MTR Corporation Limited ࠰ಥ᚛༩Ϟࠢʮ̡ (a company incorporated on 26th April 2000 under the Companies Ordinance of Hong Kong with company number 714016) and MTR Corporation (C.I.) Limited (a company organised under the laws of the Cayman Islands on 30th October 2000) (Unconditionally and Irrevocably Guaranteed by MTR Corporation Limited) US$3,000,000,000 Debt Issuance Programme For the issue of Notes with maturities of between one month and 30 years On 22nd December 1993, Mass Transit Railway Corporation (“MTRC”) entered into a US$1,000,000,000 Debt Issuance Programme (the “Programme”). The maximum aggregate nominal amount of Notes (as defined below) which may be outstanding under the Programme was increased to US$2,000,000,000 with effect from 1st June 1999 and to US$3,000,000,000 with effect from 31st October 2006. On 30th June 2000 MTR Corporation Limited (“MTRCL” or “the Company”) replaced MTRC as the issuer of Notes under the Programme. All the assets and liabilities of MTRC vested in MTRCL and MTRCL has adopted all of the accounts of MTRC. MTR Corporation (C.I.) Limited (“MTR Cayman”) became an additional issuer of Notes under the Programme with effect from 9th April 2001 pursuant to an Amending and Restating Programme Agreement dated 9th April 2001 made between MTRCL, MTR Cayman and the Dealers named therein (MTRCL and MTR Cayman together being the “Issuers” and each an “Issuer”). This Prospectus supersedes any previous prospectus, listing particulars or offering circular describing the Programme. Any Notes issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein. -

Octopus Cards Limited

Octopus Cards Limited Final Report on the Independent Assessment under Section 59(2) of the Hong Kong Banking Ordinance 26 November 2010 Enterprise Risk Services Contents Important Notes to Reader ...................................................... 1 1. Introduction .................................................... 2 2. Objective ........................................................ 2 3. Scope of Work .............................................. 2 4. Fieldwork Period ............................................ 3 5. Limitations ..................................................... 3 6. Statement of Responsibilities ........................ 4 7. Findings and Recommendations ................... 4 Appendix I Summary of Octopus Cardholders' Personal Data Shared with Third Parties Appendix II Prior Communications with Privacy Commissioner of Personal Data Acronyms A-card Anonymous Octopus Card AAVS Automatic Add Value Service AC Audit Committee AIA American International Assurance Company Limited AIU American International Underwriters Limited Board Board of Directors CEO Chief Executive Officer CIGNA CIGNA Worldwide Insurance Company Cimigo Cimigo Limited CPP Card Protection Plan Limited CRM Customer Relationship Management DAR Data Access Request DCR Data Correction Request DTT/HK Deloitte Touche Tohmatsu in Hong Kong eDM Electronic Direct Mailing HKID Hong Kong Identity Card HKMA Hong Kong Monetary Authority IAD Internal Audit Department INED Independent Non-executive Director LegCo Legislative Council of the Hong Kong Special -

The Yet-To-Be Effective but Effective Tax: Hong Kong's Buyer's Stamp

The Yet-to-be Effective But Effective Tax: Hong Kong’s Buyer’s Stamp Duty as A Critical Case Study of Legislation by Press Release Jianlin Chen ** When a government announces that an existing law will be amended, and that the amendment, when finally enacted by the legislature, will be made effective from the announcement date, it is natural and inevitable that private entities will conduct their activities on the basis of the amended law immediately upon the announcement date, notwithstanding the announcement’s lack of any formal legal effect. This practice of effecting immediate de facto legal changes is known derisively, but perhaps aptly, as “legislation by press release.” This Article utilizes the recent use of legislation by press release to implement the Buyer’s Stamp Duty in Hong Kong as a case study to critically examine the legality and normative considerations of this increasingly common but under-theorized practice. Legally, this Article argues that the prospective notice provided by the initial announcement ensures the practice’s legality in all but an explicit prohibition of retrospective civil legislation. Normatively, this Article highlights the various criteria of clarity, consistency, necessity and political dynamic that affect the desirability of the practice. On a broader note, the formal retrospectivity inherent in the practice - but which does not disrupt the reliance interests of private entities - provides a useful reexamination of the conventional aversion towards retrospective laws. **Assistant Law Professor (University of Hong Kong), JSD Candidate (University of Chicago), LLM (University of Chicago), LLB (University of Singapore). Admitted to the bar in New York and Singapore. -

MTR Corporation (C.I.) Limited

Offering Circular (a company incorporated on 26th April 2000 in Hong Kong with company number 714016) and MTR Corporation (C.I.) Limited (a company with limited liability organised under the laws of the Cayman Islands on 30th October 2000) (Unconditionally and Irrevocably Guaranteed by MTR Corporation Limited) US$7,000,000,000 Debt Issuance Programme On 22nd December 1993, Mass Transit Railway Corporation (“MTRC”) entered into a US$1,000,000,000 Debt Issuance Programme (the “Programme”). The maximum aggregate nominal amount of Notes (as defined below) which may be outstanding under the Programme was increased to US$2,000,000,000 with effect from 1st June 1999, to US$3,000,000,000 with effect from 31st October 2006, to US$4,000,000,000 with effect from 13th March 2013 and to US$5,000,000,000 with effect from 20th October 2017 and to US$7,000,000,000 with effect from 30th October 2020. On 30th June 2000 MTR Corporation Limited (“MTRCL” or “the Company”) replaced MTRC as the issuer of Notes under the Programme. All the assets and liabilities of MTRC vested in MTRCL and MTRCL has adopted all of the accounts of MTRC. MTR Corporation (C.I.) Limited (“MTR Cayman”) became an additional issuer of Notes under the Programme with effect from 9th April 2001 pursuant to an Amending and Restating Programme Agreement dated 9th April 2001 made between MTRCL, MTR Cayman and the Dealers named therein (MTRCL and MTR Cayman together being the “Issuers” and each an “Issuer”). This Offering Circular supersedes any previous prospectus, listing particulars or offering circular describing the Programme. -

Hong Kong Tax Update Seminar 2020 - 2021

Hong Kong Tax Update Seminar 2020 - 2021 BENEFITS OF ATTENDING/ LEARNING OUTCOMES From 1 January 2020 to 30 November 2020, Commissioner of Inland Revenue issued one New Inland Revenue Departmental Interpretation and Practice Notes (DIPN) No. 61, and revised 15 existing DIPNs. Three new pieces of legislation were enacted to amend the Inland Revenue Ordinance and Stamp duty Ordinance, and one case was recently decided. The objective of this seminar is to provide an understanding of the new tax law and practice. PROGRAM OVERVIEW AND KEY TOPICS ⚫ New principles governing permanent establishment ⚫ Transfer pricing rule after the abolition of section 20 of the Inland Revenue Ordinance ⚫ New deduction rules for research & development expenditure ⚫ Environmental protection installations ⚫ Various concessionary deductions under salaries tax from 2019/20 onward ⚫ Separate personal assessment and other new personal assessment arrangement from 2018/19 onward ⚫ New development of Base Erosion and Profit Shifting (BEPS) ⚫ New stamp duty treatment on transfer of immovable property Speaker Profile Mr Patrick Ho is the author of the book “Hong Kong Taxation and Tax Planning”. He has more than 35 years’ experience in tax practice, university teaching and in-house teaching in all the Big 4. Who Should Attend Students of professional accounting bodies, commercial accountants, officers of human resource department, tax professionals and auditors. Language Fee: HK$560 Cantonese (Handout in English) (Four hours in total, Part A & Part B) Date Time Venue Speaker/ Organisation Part A : 14 Apr 2021 (Wed) Hong Kong School of Mr. Patrick Ho, LL.B, LL.M., MBA, MCS, PCLL, 19:00 –21:00 Part B : 16 Apr 2021 (Fri) Commerce FCPA Barrister-at-law (ONE REGISTRATION FORM FOR ONE PERSON ONLY) Cheques should be made payable to: “Hong Kong School of Commerce” Full Name: HKID: Gender M / F Telephone No: Email: Cheque No.: Bank: Please tick the appropriate box if receipt is required. -

Octopus Cards Limited (“OCL”) Operates the Core Business of Octopus Cards in Hong Kong As an Electronic Payment System

Report Published under Section 48(2) of the Personal Data (Privacy) Ordinance (Cap. 486) Report Number: R10-9866 Date issued: 18 th October 2010 The Collection and Use of Personal Data of Members under the Octopus Rewards Programme run by Octopus Rewards Limited This report in respect of investigations carried out by the Commissioner pursuant to section 38(b) of the Personal Data (Privacy) Ordinance, Cap 486 (“the Ordinance”) against Octopus Rewards Limited and its holding company, Octopus Holdings Limited is published in the exercise of the power conferred on the Commissioner by Part VII of the Ordinance. Section 48(2) of the Ordinance provides that “the Commissioner may, after completing an investigation and if he is of the opinion that it is in the public interest to do so, publish a report – (a) setting out - (i) the result of the investigation; (ii) any recommendations arising from the investigation that the Commissioner thinks fit to make relating to the promotion of compliance with the provisions of this Ordinance, in particular the data protection principles, by the class of data users to which the relevant data user belongs; and (iii) such other comments arising from the investigation as he thinks fit to make; and (b) in such manner as he thinks fit.” ALLAN CHIANG Privacy Commissioner for Personal Data Table of Contents CHAPTER ONE INTRODUCTION .................................................................................... 5 BACKGROUND .................................................................................................. -

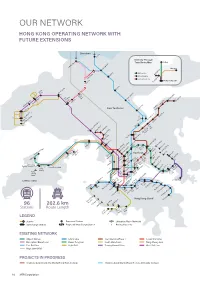

Our Network Hong Kong Operating Network with Future Extensions

OUR NETWORK HONG KONG OPERATING NETWORK WITH FUTURE EXTENSIONS Shenzhen Lo Wu Intercity Through Train Route Map Beijing hau i C Lok Ma Shanghai Sheung Shu g Beijing Line Guangzhou Fanlin Shanghai Line Kwu Tung Guangdong Line n HONG KONG SAR Dongguan San Ti Tai Wo Long Yuen Long t Ping 48 41 47 Ngau a am Tam i Sh i K Mei a On Shan a Tai Po Marke 36 K Sheungd 33 M u u ui Wa W Roa Au Tau Tin Sh 49 Heng On y ui Hung Shui Ki g ng 50 New Territories Tai Sh Universit Han Siu Ho 30 39 n n 27 35 Shek Mu 29 Tuen Mu cecourse* e South Ra o Tan Area 16 F 31 City On Tuen Mun n 28 a n u Sha Ti Sh n Ti 38 Wai Tsuen Wan West 45 Tsuen05 Wa Tai Wo Ha Che Kung 40 Temple Kwai Hing 07 i 37 Tai Wa Hin Keng 06 l Kwai Fong o n 18 Mei Fo k n g Yi Diamond Hil Kowloon Choi Wa Tsin Tong n i King Wong 25 Shun Ti La Lai Chi Ko Lok Fu d Tai Si Choi Cheung Sha Wan Hung Sau Mau Ping ylan n ay e Sham Shui Po ei Kowloon ak u AsiaWorld-Expo B 46 ShekM T oo Po Tat y Disn Resort m Po Lam Na Kip Kai k 24 Kowl y Sunn eong g Hang Ha Prince n Ba Ch o Sungong 01 53 Airport M Mong W Edward ok ok East 20 K K Toi ong 04 To T Ho Kwa Ngau Tau Ko Cable Car n 23 Olympic Yau Mai Man Wan 44 n a Kwun Ti Ngong Ping 360 19 52 42 n Te Ti 26 Tung Chung East am O 21 L Tung Austi Yau Tong Tseung Chung on Whampo Kwan Tung o n Jordan Tiu g Kowl loo Tsima Hung 51 Ken Chung w Sh Hom Leng West Hong Kong Tsui 32 t Tsim Tsui West Ko Eas 34 22 ha Fortress10 Hill Hong r S ay LOHAS Park ition ew 09 Lantau Island ai Ying Pun Kong b S Tama xhi aus North h 17 11 n E C y o y Centre Ba Nort int 12 16 Po 02 Tai