List of Contents the Year 2002 in Review Major Events of Hong Kong

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Geely Auto Alert

Deutsche Bank Markets Research Rating Company Date 4 March 2015 Hold Geely Auto Alert Breaking News Asia China Reuters Bloomberg Exchange Ticker Price at 4 Mar 2015 (HKD) 3.31 Automobiles & 0175.HK 175 HK HKG 0175 Price target - 12mth (HKD) 2.95 Components ADR Ticker ISIN 52-week range (HKD) 3.61 - 2.44 GELYY US36847Q1031 HANG SENG INDEX 24,703 Disposal of manual transmission Vincent Ha, CFA Research Analyst business (+852) 2203 6247 To stay focused on core auto manufacturing operation [email protected] Geely announced after today’s market close that the company will sell its manual transmission manufacturing operation to Zhejiang Wanliyang Stock data Transmission (002434.SZ, RMB19.36, Not Rated), an auto part supplier for RMB300m, 1.13x December 2014 NAV. After the completion of the sale, Geely Market cap (HKDm) 29,133 expects to probably realize RMB35m disposal gain, and will procure manual Market cap (USDm) 3,757 transmissions from Wanliyang at least until December 2018. Shares outstanding (m) 8,801.4 Major shareholders Zhejiang Geely According to Geely, the manual transmission business disposal is in line with Hldg (45%) the company’s strategy of streamlining its business to be focused on Free float (%) 57 automobile manufacturing. To recap, Geely also sold its automatic Avg daily value traded 18.8 transmission business back to its parent Zhejiang Geely in FY14 for similar (USDm) reason. Source: Deutsche Bank We do not see a material long-term impact on Geely’s operations or financials Key data from the subject business sale other than for less inter-segmental revenue. -

Hsi Total Return Index Futures Hscei Total Return Index Futures

HSI TOTAL RETURN INDEX FUTURES HSCEI TOTAL RETURN INDEX FUTURES September 2018 INTRODUCTION In stock investing, the return and risk profile for investors has two components: stock price appreciation and dividend. The conventional stock Index futures such as the Hang Seng Index (HSI) futures and Hang Seng China Enterprises Index (HSCEI) futures are risk management tools based on an index calculated from prices of constituent stocks only. The introduction of total return index (TRI) futures by Hong Kong Exchanges and Clearing Limited (HKEX) aims to meet the trading and risk management needs of investors who adopt a total return strategy. TRI futures are based on an index calculated by assuming the cash dividends of constituent stocks are re-invested into the index’s portfolio according to their respective market capitalisation weightings. The Hong Kong Futures Exchange Limited (HKFE) is offering four TRI futures contracts: • Hang Seng Index (Gross Total Return Index) Futures (HSIGTRI Futures) • Hang Seng Index (Net Total Return Index) Futures (HSINTRI Futures) • Hang Seng China Enterprises Index (Gross Total Return Index) Futures (HSCEIGTRI Futures) • Hang Seng China Enterprises Index (Net Total Return Index) Futures (HSCEINTRI Futures) USAGES OF TRIS Due to the unique nature of indexing, TRIs are widely used by fund managers, actuaries and financial advisers to measure their index-based performances in equity funds and pension funds, as price indexes fail to capture the dividend income of the equity funds over time. TRIs are commonly used as the underlying index of equity total return index swaps traded in the over-the-counter (OTC) market among banks, insurance companies and investment funds, which enable users to realise the economic benefits of ownership of shares – price appreciation and dividend return – without the cost of capital outlay and expense of the consequences of ownership, such as custodian arrangements and regular reconciliations. -

Is There a January Effect in the Greater China Area?

Is There a January Effect in the Greater China Area? by Chung-Wen (Sally) Hsu M.Sc., Civil Engineering, National Central University, Taiwan PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration O Chung-Wen (Sally) Hsu 2005 SIMON FRASER UNIVERSITY Spring 2005 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL Name: Chung-Wen (Sally) Hsu Degree: Master of Business Administration Title of Project: Is There a January Effect in the Greater China Area? Supervisory Committee: Robert Grauer Supervisor Peter Klein Senior Supervisor Date Approved: SIMON FRASER UNIVERSITY PARTIAL COPYRIGHT LICENCE The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection. The author has further agreed that permission for multiple copying of this work for scholarly purposes may be granted by either the author or the Dean of Graduate Studies. It is understood that copying or publication of this work for financial gain shall not be allowed without the author's written permission. -

The Chief Executive's 2020 Policy Address

The Chief Executive’s 2020 Policy Address Striving Ahead with Renewed Perseverance Contents Paragraph I. Foreword: Striving Ahead 1–3 II. Full Support of the Central Government 4–8 III. Upholding “One Country, Two Systems” 9–29 Staying True to Our Original Aspiration 9–10 Improving the Implementation of “One Country, Two Systems” 11–20 The Chief Executive’s Mission 11–13 Hong Kong National Security Law 14–17 National Flag, National Emblem and National Anthem 18 Oath-taking by Public Officers 19–20 Safeguarding the Rule of Law 21–24 Electoral Arrangements 25 Public Finance 26 Public Sector Reform 27–29 IV. Navigating through the Epidemic 30–35 Staying Vigilant in the Prolonged Fight against the Epidemic 30 Together, We Fight the Virus 31 Support of the Central Government 32 Adopting a Multi-pronged Approach 33–34 Sparing No Effort in Achieving “Zero Infection” 35 Paragraph V. New Impetus to the Economy 36–82 Economic Outlook 36 Development Strategy 37 The Mainland as Our Hinterland 38–40 Consolidating Hong Kong’s Status as an International Financial Centre 41–46 Maintaining Financial Stability and Striving for Development 41–42 Deepening Mutual Access between the Mainland and Hong Kong Financial Markets 43 Promoting Real Estate Investment Trusts in Hong Kong 44 Further Promoting the Development of Private Equity Funds 45 Family Office Business 46 Consolidating Hong Kong’s Status as an International Aviation Hub 47–49 Three-Runway System Development 47 Hong Kong-Zhuhai Airport Co-operation 48 Airport City 49 Developing Hong Kong into -

Hong Kong SAR

Hong Kong SAR 104 Doing Business in Asia Pacific SEPTEMBER 2020 Chapter 1: Introduction 108 Chapter 2: Business environment 110 2.1 Hong Kong’s free economy 110 2.2 Gateway to mainland China 111 2.3 International outlook 112 2.4 Well-established legal and financial infrastructures 112 2.5 Favourable tax regime 113 Chapter 3: Business and corporate structures 114 3.1 Limited company 114 3.2 Unincorporated businesses 116 3.3 Forms of business collaboration 116 Chapter 4: Takeovers (friendly M&A) 117 4.1 Introduction 117 4.2 Hong Kong company law 118 4.3 Other common legal issues 118 4.4 Typical documentation 119 4.5 Due diligence 120 4.6 Sale and purchase agreement 120 Chapter 5: Foreign investment 122 5.1 Overview of Hong Kong’s business and investment environment 122 5.2 Restrictions on foreign investment 123 Chapter 6: Restructuring and insolvency 124 6.1 Legal framework 124 6.2 Liquidation 124 6.3 Restructuring 125 6.4 International insolvency 126 Doing Business in Asia Pacific SEPTEMBER 2020 105 Chapter 7: Employment, industrial relations, and work health and safety 127 7.1 Basic employment rights 127 7.2 Employment contract 128 7.3 Expatriates 129 7.4 Termination 129 7.5 Work health and safety 130 Chapter 8: Taxation 131 8.1 Outline 131 8.2 Profits tax 131 8.3 Salaries tax 133 8.4 Property tax 134 8.5 Stamp duty 134 8.6 Tax disputes 135 8.7 Anti-avoidance 135 Chapter 9: Intellectual property 135 9.1 Trademarks 136 9.2 Copyright 136 9.3 Registered designs 137 9.4 Patents 137 9.5 Confidential information 138 9.6 Private information 138 -

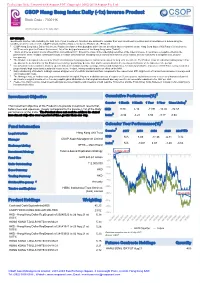

CSOP Hang Seng Index Daily (-1X) Inverse Product

Evaluation Only. Created with Aspose.PDF. Copyright 2002-2019 Aspose Pty Ltd. CSOP Hang Seng Index Daily (-1x) Inverse Product Stock Code : 7300 HK All Information as of 30 July 2021 IMPORTANT: Investments involve risks, including the total loss of your investment. Investors are advised to consider their own investment objectives and circumstances in determining the suitability of an investment in the CSOP Hang Seng Index Daily (-1x) Inverse Product (the “Product”). CSOP Hang Seng Index Daily (-1x) Inverse Product is a futures-based product which invests directly in futures contracts on the Hang Seng Index (“HSI Futures”) listed on the HKFE so as to give the Product the inverse (-1x) of the daily performance of the Hang Seng Index ("Index") This is an inverse product and is different from conventional ETF. Should the value of the underlying securities of the Index increase, it could have a negative effect on the performance of the Product. Unitholders could, in certain circumstances including a bull market, face minimal or no returns, or may even suffer a complete loss, on such investments. The Product is designed to be used for short term trading or hedging purposes, and is not intended for long term investment. The Product is not intended for holding longer than one day as the performance of this Product over a longer period may deviate from and be uncorrelated to the inverse performance of the Index over the period. Investment in futures contracts involves specific risks such as high volatility, leverage, rollover and margin risks. A relatively small price movement in HSI Futures may result in a proportionally high impact and substantial losses to the Product, having a material adverse effect on the NAV. -

HONG KONG LEGISLATIVE COUNCIL ― 16 May 1984 947

HONG KONG LEGISLATIVE COUNCIL ― 16 May 1984 947 OFFICIAL REPORT OF PROCEEDINGS Wednesday, 16 May 1984 The Council met at half past two o’clock PRESENT HIS EXCELLENCY THE ACTING GOVERNOR (PRESIDENT) THE HONOURABLE THE CHIEF SECRETARY SIR CHARLES PHILIP HADDON-CAVE. K.B.E., C.M.G., J.P. THE HONOURABLE THE FINANCIAL SECRETARY SIR JOHN HENRY BREMRIDGE, K.B.E., J.P. THE HONOURABLE THE ATTORNEY GENERAL MR. MICHAEL DAVID THOMAS, Q.C. THE HONOURABLE DENIS CAMPBELL BRAY. C.M.G., C.V.O., J.P. SECRETARY FOR HOME AFFAIRS DR. THE HONOURABLE HARRY FANG SIN-YANG, C.B.E., J.P. THE HONOURABLE FRANCIS YUAN-HAO TIEN. O.B.E., J.P. THE HONOURABLE ALEX WU SHU-CHIH. C.B.E., J.P. THE HONOURABLE CHEN SHOU-LUM, C.B.E., J.P. THE HONOURABLE LYDIA DUNN, C.B.E., J.P. THE REVD. THE HONOURABLE PATRICK TERENCE McGOVERN. O.B.E., S.J., J.P. THE HONOURABLE PETER C. WONG. O.B.E., J.P. THE HONOURABLE WONG LAM, O.B.E., J.P. DR. THE HONOURABLE THONG KAH-LEONG. C.B.E., J.P. DIRECTOR OF MEDICAL AND HEALTH SERVICES THE HONOURABLE CHARLES YEUNG SIU-CHO. O.B.E., J.P. THE HONOURABLE JOHN MARTIN ROWLANDS, C.B.E., J.P. SECRETARY FOR THE CIVIL SERVICE DR. THE HONOURABLE HO KAM-FAI, O.B.E., J.P. THE HONOURABLE ANDREW SO KWOK-WING, O.B.E., J.P. THE HONOURABLE GERALD PAUL NAZARETH, Q.C., J.P. LAW DRAFTSMAN THE HONOURABLE WONG PO-YAN, O.B.E., J.P. -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

HKEX Fact Book 2016 Contents of HKEX Fact Book 2016

HKEX Fact Book 2016 Contents of HKEX Fact Book 2016 ● Market Performance in 2016 ● Major events of the Hong Kong securities and derivatives market 2016 ● Market highlights ● Securities market – Main Board – market indices – listing statistics – market capitalisation – trading statistics and analysis – short selling – listed companies – equity warrants – derivative warrants – callable bull/bear contracts – debt securities – unit trusts and mutual funds – trading only stock – RMB securities products – Shanghai-Hong Kong Stock Connect – Shenzhen-Hong Kong Stock Connect – historical section – world stock markets ● Securities market – Growth Enterprise Market (GEM) – market indices – listing statistics – market capitalisation – trading statistics and analysis – listed companies – warrants ● Derivatives market – equity index products – interest rate products – equity products – commodity products – currency products – historical section ● LME commodities market ● Clearing statistics ● Exchange participants ● Clearing participants/members ● Hong Kong securities and derivatives markets historical events ● Appendices MARKET PERFORMANCE IN 2016 Market Performance in 2016 2015 2016 Change (%) Stock Market No. of listed companies 1,866 1,973 5.73 Main Board 1,644 1,713 4.20 GEM 222 260 17.12 No. of listed securities 9,015 8,591 (4.70) Main Board 8,792 8,330 (5.25) GEM 223 261 17.04 No. of new listed companies (1) 138 126 (8.70) Main Board 104 81 (22.12) Transfer of listing from GEM 14 6 (57.14) GEM 34 45 32.35 Total market capitalisation (HK$mil) -

The Yet-To-Be Effective but Effective Tax: Hong Kong's Buyer's Stamp

The Yet-to-be Effective But Effective Tax: Hong Kong’s Buyer’s Stamp Duty as A Critical Case Study of Legislation by Press Release Jianlin Chen ** When a government announces that an existing law will be amended, and that the amendment, when finally enacted by the legislature, will be made effective from the announcement date, it is natural and inevitable that private entities will conduct their activities on the basis of the amended law immediately upon the announcement date, notwithstanding the announcement’s lack of any formal legal effect. This practice of effecting immediate de facto legal changes is known derisively, but perhaps aptly, as “legislation by press release.” This Article utilizes the recent use of legislation by press release to implement the Buyer’s Stamp Duty in Hong Kong as a case study to critically examine the legality and normative considerations of this increasingly common but under-theorized practice. Legally, this Article argues that the prospective notice provided by the initial announcement ensures the practice’s legality in all but an explicit prohibition of retrospective civil legislation. Normatively, this Article highlights the various criteria of clarity, consistency, necessity and political dynamic that affect the desirability of the practice. On a broader note, the formal retrospectivity inherent in the practice - but which does not disrupt the reliance interests of private entities - provides a useful reexamination of the conventional aversion towards retrospective laws. **Assistant Law Professor (University of Hong Kong), JSD Candidate (University of Chicago), LLM (University of Chicago), LLB (University of Singapore). Admitted to the bar in New York and Singapore. -

Hong Kong Tax Update Seminar 2020 - 2021

Hong Kong Tax Update Seminar 2020 - 2021 BENEFITS OF ATTENDING/ LEARNING OUTCOMES From 1 January 2020 to 30 November 2020, Commissioner of Inland Revenue issued one New Inland Revenue Departmental Interpretation and Practice Notes (DIPN) No. 61, and revised 15 existing DIPNs. Three new pieces of legislation were enacted to amend the Inland Revenue Ordinance and Stamp duty Ordinance, and one case was recently decided. The objective of this seminar is to provide an understanding of the new tax law and practice. PROGRAM OVERVIEW AND KEY TOPICS ⚫ New principles governing permanent establishment ⚫ Transfer pricing rule after the abolition of section 20 of the Inland Revenue Ordinance ⚫ New deduction rules for research & development expenditure ⚫ Environmental protection installations ⚫ Various concessionary deductions under salaries tax from 2019/20 onward ⚫ Separate personal assessment and other new personal assessment arrangement from 2018/19 onward ⚫ New development of Base Erosion and Profit Shifting (BEPS) ⚫ New stamp duty treatment on transfer of immovable property Speaker Profile Mr Patrick Ho is the author of the book “Hong Kong Taxation and Tax Planning”. He has more than 35 years’ experience in tax practice, university teaching and in-house teaching in all the Big 4. Who Should Attend Students of professional accounting bodies, commercial accountants, officers of human resource department, tax professionals and auditors. Language Fee: HK$560 Cantonese (Handout in English) (Four hours in total, Part A & Part B) Date Time Venue Speaker/ Organisation Part A : 14 Apr 2021 (Wed) Hong Kong School of Mr. Patrick Ho, LL.B, LL.M., MBA, MCS, PCLL, 19:00 –21:00 Part B : 16 Apr 2021 (Fri) Commerce FCPA Barrister-at-law (ONE REGISTRATION FORM FOR ONE PERSON ONLY) Cheques should be made payable to: “Hong Kong School of Commerce” Full Name: HKID: Gender M / F Telephone No: Email: Cheque No.: Bank: Please tick the appropriate box if receipt is required. -

Tax Analysis Hong Kong Tax

Tax Issue H57/2014 – 25 March 2014 Tax Analysis Hong Kong Tax Hong Kong’s new Companies Ordinance creates opportunities for tax-free Hong Kong SAR amalgamations Davy Yun Tax Partner Hong Kong’s new Companies Ordinance (Cap. 622) (New CO), which Tel: +852 2852 6538 became effective on 3 March 2014, includes a broad range of measures Email: [email protected] designed to enhance corporate governance, ensure better regulation, facilitate business and modernize the law itself. Among the measures to Karen Chow facilitate business reorganizations, the New CO introduces a new concept Tax Director of amalgamation under court-free procedures that should allow intra-group Tel: +852 2852 5609 mergers to be carried out in a simpler and less costly manner, as compared Email: [email protected] to the traditional court-sanctioned procedures. However, there is some uncertainty about the Hong Kong (and foreign) tax treatment of court-free amalgamations. Despite requests for clarification of the tax consequences of the new amalgamation procedure and/or interpretive guidelines, Hong Kong’s Inland Revenue Department (IRD) has not indicated that it plans to issue guidance or practice notes. The potential tax exposure of a court-free amalgamation could be an important factor and cost when a taxpayer is assessing whether to proceed with such an amalgamation or to pursue other alternatives, such as a normal transfer of a business and assets. In the absence of clarifying guidance or amendments to the Inland Revenue Ordinance (IRO), potential tax risks and exposures could actually undermine the stated purpose of the New CO.