Hang Seng China Enterprises Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Contents the Year 2002 in Review Major Events of Hong Kong

List of Contents The year 2002 in review Major events of Hong Kong securities market 2002 Market highlights Cash market - Main board Cash market - Growth enterprise market (GEM) Derivatives market Clearing statistics Exchange participants The investing community Hong Kong stock market historical events Appendices The Year 2002 in Review The Year The Year 2002 in Review The Hong Kong economy remained weak in 2002 but trade figures began to turn around in the second half of the year. Benefiting from the weakening US dollar and strong demand in the Mainland of China, Hong Kong’s total exports regained double-digit growth over a year earlier in the third quarter of 2002. The seasonally adjusted unemployment rate also fell from its historical peak of 7.8% in July 2002 to 7.2% in December 2002. However, the domestic sector remained sluggish in both investment and consumer spending. The latest economic forecast suggests a 2% growth in real terms of GDP and a 3% decline in the Composite Consumer Price Index for 2002. The trading performance of the Hong Kong securities and futures markets further weakened during the year. Hang Seng Index fell 18.2% from the previous year to end at 9,321.29. The average daily turnover of the Main Board also declined to HK$6,474 million, 19.3% less than that in 2001. The GEM Index ended at 110.4 at end of December 2002, representing a decrease of 44.6% from the previous year. The average daily turnover of the GEM improved slightly to HK$178 million in 2002, an increase of 9.9% from 2001. -

Geely Auto Alert

Deutsche Bank Markets Research Rating Company Date 4 March 2015 Hold Geely Auto Alert Breaking News Asia China Reuters Bloomberg Exchange Ticker Price at 4 Mar 2015 (HKD) 3.31 Automobiles & 0175.HK 175 HK HKG 0175 Price target - 12mth (HKD) 2.95 Components ADR Ticker ISIN 52-week range (HKD) 3.61 - 2.44 GELYY US36847Q1031 HANG SENG INDEX 24,703 Disposal of manual transmission Vincent Ha, CFA Research Analyst business (+852) 2203 6247 To stay focused on core auto manufacturing operation [email protected] Geely announced after today’s market close that the company will sell its manual transmission manufacturing operation to Zhejiang Wanliyang Stock data Transmission (002434.SZ, RMB19.36, Not Rated), an auto part supplier for RMB300m, 1.13x December 2014 NAV. After the completion of the sale, Geely Market cap (HKDm) 29,133 expects to probably realize RMB35m disposal gain, and will procure manual Market cap (USDm) 3,757 transmissions from Wanliyang at least until December 2018. Shares outstanding (m) 8,801.4 Major shareholders Zhejiang Geely According to Geely, the manual transmission business disposal is in line with Hldg (45%) the company’s strategy of streamlining its business to be focused on Free float (%) 57 automobile manufacturing. To recap, Geely also sold its automatic Avg daily value traded 18.8 transmission business back to its parent Zhejiang Geely in FY14 for similar (USDm) reason. Source: Deutsche Bank We do not see a material long-term impact on Geely’s operations or financials Key data from the subject business sale other than for less inter-segmental revenue. -

Hsi Total Return Index Futures Hscei Total Return Index Futures

HSI TOTAL RETURN INDEX FUTURES HSCEI TOTAL RETURN INDEX FUTURES September 2018 INTRODUCTION In stock investing, the return and risk profile for investors has two components: stock price appreciation and dividend. The conventional stock Index futures such as the Hang Seng Index (HSI) futures and Hang Seng China Enterprises Index (HSCEI) futures are risk management tools based on an index calculated from prices of constituent stocks only. The introduction of total return index (TRI) futures by Hong Kong Exchanges and Clearing Limited (HKEX) aims to meet the trading and risk management needs of investors who adopt a total return strategy. TRI futures are based on an index calculated by assuming the cash dividends of constituent stocks are re-invested into the index’s portfolio according to their respective market capitalisation weightings. The Hong Kong Futures Exchange Limited (HKFE) is offering four TRI futures contracts: • Hang Seng Index (Gross Total Return Index) Futures (HSIGTRI Futures) • Hang Seng Index (Net Total Return Index) Futures (HSINTRI Futures) • Hang Seng China Enterprises Index (Gross Total Return Index) Futures (HSCEIGTRI Futures) • Hang Seng China Enterprises Index (Net Total Return Index) Futures (HSCEINTRI Futures) USAGES OF TRIS Due to the unique nature of indexing, TRIs are widely used by fund managers, actuaries and financial advisers to measure their index-based performances in equity funds and pension funds, as price indexes fail to capture the dividend income of the equity funds over time. TRIs are commonly used as the underlying index of equity total return index swaps traded in the over-the-counter (OTC) market among banks, insurance companies and investment funds, which enable users to realise the economic benefits of ownership of shares – price appreciation and dividend return – without the cost of capital outlay and expense of the consequences of ownership, such as custodian arrangements and regular reconciliations. -

Is There a January Effect in the Greater China Area?

Is There a January Effect in the Greater China Area? by Chung-Wen (Sally) Hsu M.Sc., Civil Engineering, National Central University, Taiwan PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION In the Faculty of Business Administration O Chung-Wen (Sally) Hsu 2005 SIMON FRASER UNIVERSITY Spring 2005 All rights reserved. This work may not be reproduced in whole or in part, by photocopy or other means, without permission of the author. APPROVAL Name: Chung-Wen (Sally) Hsu Degree: Master of Business Administration Title of Project: Is There a January Effect in the Greater China Area? Supervisory Committee: Robert Grauer Supervisor Peter Klein Senior Supervisor Date Approved: SIMON FRASER UNIVERSITY PARTIAL COPYRIGHT LICENCE The author, whose copyright is declared on the title page of this work, has granted to Simon Fraser University the right to lend this thesis, project or extended essay to users of the Simon Fraser University Library, and to make partial or single copies only for such users or in response to a request from the library of any other university, or other educational institution, on its own behalf or for one of its users. The author has further granted permission to Simon Fraser University to keep or make a digital copy for use in its circulating collection. The author has further agreed that permission for multiple copying of this work for scholarly purposes may be granted by either the author or the Dean of Graduate Studies. It is understood that copying or publication of this work for financial gain shall not be allowed without the author's written permission. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Changes to Board Composition (2 March 2009)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Stock code: 11) A N N O U N C E M E N T Changes to Board Composition The Board of Directors (the “Board”) of Hang Seng Bank Limited (the “Bank”) has today announced the following changes to the Bank’s Board composition to take effect on the dates mentioned below. Retirement of Mr Raymond Or Ching Fai from the Board of the Bank Mr Raymond Or Ching Fai will retire as Vice-Chairman and Chief Executive of the Bank and from the Board with effect from the conclusion of the Bank’s Annual General Meeting to be held on 6 May 2009 (“2009 AGM”). Mr Or has confirmed that he has no disagreement with the Board and that he is not aware of any matter relating to his retirement that needs to be brought to the attention of the shareholders of the Bank. The Board would like to express its gratitude to Mr Or for his outstanding contributions and strong leadership over the years and wish him all the best following his retirement. Proposed Appointment of Mrs Margaret Leung Ko May Yee as non-executive Director of the Bank with effect from 1 April 2009, and as Vice-Chairman and Chief Executive of the Bank with effect from the conclusion of the Bank’s AGM on 6 May 2009 Mrs Margaret Leung Ko May Yee, currently Group General Manager and Global Co-Head Commercial Banking for the HSBC Group, will be appointed a non-executive Director of the Bank with effect from 1 April 2009 until the conclusion of the 2009 AGM. -

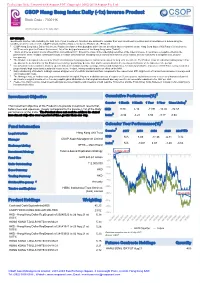

CSOP Hang Seng Index Daily (-1X) Inverse Product

Evaluation Only. Created with Aspose.PDF. Copyright 2002-2019 Aspose Pty Ltd. CSOP Hang Seng Index Daily (-1x) Inverse Product Stock Code : 7300 HK All Information as of 30 July 2021 IMPORTANT: Investments involve risks, including the total loss of your investment. Investors are advised to consider their own investment objectives and circumstances in determining the suitability of an investment in the CSOP Hang Seng Index Daily (-1x) Inverse Product (the “Product”). CSOP Hang Seng Index Daily (-1x) Inverse Product is a futures-based product which invests directly in futures contracts on the Hang Seng Index (“HSI Futures”) listed on the HKFE so as to give the Product the inverse (-1x) of the daily performance of the Hang Seng Index ("Index") This is an inverse product and is different from conventional ETF. Should the value of the underlying securities of the Index increase, it could have a negative effect on the performance of the Product. Unitholders could, in certain circumstances including a bull market, face minimal or no returns, or may even suffer a complete loss, on such investments. The Product is designed to be used for short term trading or hedging purposes, and is not intended for long term investment. The Product is not intended for holding longer than one day as the performance of this Product over a longer period may deviate from and be uncorrelated to the inverse performance of the Index over the period. Investment in futures contracts involves specific risks such as high volatility, leverage, rollover and margin risks. A relatively small price movement in HSI Futures may result in a proportionally high impact and substantial losses to the Product, having a material adverse effect on the NAV. -

Support at 100 Day SMA; Regulatory Concerns Remained on Other Digital Platform Leaders

Investment Daily 13 April 2021 Major Market Indicators Market Overview 12 Apr 9 Apr 8 Apr Mkt. Turn.(mn) 160,700 141,700 281,100 Support at 100 Day SMA; Regulatory Concerns Remained on other Stock Advances 534 637 943 digital platform leaders Stock Declines 1,155 1,025 742 Hang Seng index opened up 93 points. However, due to tightening regulatory concern, HSI 28,453 28,699 29,008 Hang Seng index gradually retreated in the morning and stabilized in the afternoon, closing Change -246 -309 +333 at 28,453, down 245 points. H-shares index fell 102 points to 10,874, and Hang Seng Tech HSI Turn.($bn) 74.51 53.46 194.82 index declined 136 points to 8,169. Market turnover amounted to HK$160.7bn. AAC Tech HSCEI 10,875 10,977 11,109 (2018) issued a positive profit alert at the lunch break, triggering share price up 12.7%. Change -103 -132 +39 China’s regulator fined Rmb18.2bn on Alibaba (9988) due to its monopoly acts, but its HSCEI Turn.($bn) 75.21 54.29 193.04 share price rebounded 6.5% on lower-than-expected penalties. Geely (0175) was reported to involve in a consumption probe, with its share price down 7%, being the worst-performing blue-chip stock. HSI Technical Indicators Ahead of the major US enterprises announce the first quarter result, US stock market traded 10-days MA 28,530 50-days MA 29,204 within narrow range on Monday. The three major US index closed slightly lower with the 250-days MA 26,030 Nasdaq index fell 0.4% which performed the worst. -

Product Brochure Eng Upd V3 Jun07

IMPORTANT RISK WARNINGS/FUND INFORMATION FOR INVESTORS (Capitalised terms used herein but not otherwise defined will have the same meanings as defined in the Explanatory Memorandum of the Hang Seng Investment Series (the “Series”) and the Term Sheet of the Fund) • Hang Seng Ping An Asian Income Fund (“the Fund”) invests primarily in a balanced portfolio consisting of equity and debt securities issued in the debt and securities markets in the Asia Pacific region (excluding Japan). • Hang Seng Investment Management, as the Manager, has delegated its investment management duties in relation to debt securities to the Sub-investment Manager, and will rely on the Sub-investment Manager’s expertise and systems for the Fund’s investments in debt securities only. Any disruption in the communication with or assistance from the Sub-investment Manager or a loss of service of the Sub-investment Manager or any of its key personnel may adversely affect the operations of the Fund. • The asset allocation of the Fund is determined by the Manager and depends on the views of the Manager and the Sub-investment Manager on fundamental economic and market conditions and investment trends across the globe, the dynamic asset allocation may not achieve the desired results under all circumstances and market conditions. The investments of the Fund may be periodically rebalanced and therefore the Fund may incur greater transaction costs than a fund with static allocation strategy. • The Fund is also subject to investment risks, equity market risks, risks associated with investing in fixed income instruments, general risks of investments associated with an emerging market, concentration risk and currency and exchange rate control risk. -

Smart Tips for INWARD Payments to Hang Seng Bank Limited (HASEHKHH)

Smart Tips for INWARD Payments to Hang Seng Bank Limited (HASEHKHH) 1) Provide following general information to your remittance counterpart: Account Holder's Name & Account Number Bank's Name: Hang Seng Bank Limited Bank’s Address: 83 Des Voeux Road Central, Hong Kong SWIFT Code: HASEHKHH Clearing No.: 024 (for local interbank transfer) 2) Our major overseas correspondent bank network for your remittance counterpart’s reference: Currency Correspondent Bank(s) Name SWIFT Code / Fedwire No. Australian Dollar AUD Commonwealth Bank of Australia, Sydney, Australia CTBAAU2S ANZ Bank Ltd, Melbourne, Australia ANZBAU3M Canadian Dollar CAD Canadian Imperial Bank of Commerce, Toronto, Canada CIBCCATT Toronto Dominion Bank, Toronto, Canada TDOMCATTTOR Swiss Franc CHF UBS AG, Zurich, Switzerland UBSWCHZH80A Credit Suisse AG, Zurich, Switzerland CRESCHZZ80A Danish Kroner DKK Danske Bank A/S, Copenhagen, Denmark DABADKKK Euro EUR Unicredit Bank Austria AG, Vienna, Austria BKAUATWW Credit Agricole SA, Paris, France AGRIFRPP Commerzbank AG, Frankfurt, Germany COBADEFF Royal Bank of Scotland N.V, Amsterdam, Holland RBOSNL2A Intesa Sanpaolo SPA, Milan, Italy BCITITMM Banco Santander SA, Madrid, Spain BSCHESMM HSBC Bank PLC, London, UK MIDLGB22 Pound Sterling GBP HSBC Bank PLC, London, UK MIDLGB22 Japanese Yen JPY Bank of Tokyo-Mitsubishi UFJ Ltd, Tokyo, Japan BOTKJPJT Sumitomo Mitsui Banking Corporation, Tokyo, Japan SMBCJPJT Norwegian Kroner NOK DNB NOR Bank ASA, Oslo, Norway DNBANOKK New Zealand Dollar NZD Bank of New Zealand, Wellington, New Zealand BKNZNZ22 Swedish Kroner SEK Svenska Handelsbanken, Stockholm, Sweden HANDSESS Singapore Dollar SGD Hongkong and Shanghai Bkg Corp Ltd, Singapore HSBCSGSG Thai Baht THB Hongkong and Shanghai Bkg Corp Ltd, Bangkok, Thailand HSBCTHBK US Dollar USD Bank of America, San Francisco, USA BOFAUS6S FW 121000358 Bank of New York Mellon, New York, USA IRVTUS3N FW 021000018 Citibank NA, New York, USA CITIUS33 FW 021000089 Deutsche Bank Trust Co Americas, USA BKTRUS33 FW 021001033 HSBC Bank USA, N.A. -

Fund Information

Fund Information HANG SENG INDEX FUND CLASS A (HKD) (MIP) (U42281) Fund Price Type of Morningstar Fund Size Risk Level Investment Tenor Divdend Policy Change vs Previous Investment Return Overall Rating NAV Last Update Trading Day (%) HKD28.94000 0.07% 27-09-2021 (PM) HKD 2,501,252,407.00 4 ≥1 Year(s) Inc (Unit) 3 ★★ 0 Month(s) Product Features - Investment Objective and Strategy The investment objective of the Fund is to match as closely as practicable, before fees and expenses, the total return performance (net of withholding tax) of the Hang Seng Index (the “Index”) through investing primarily in the constituent stocks of the Index. The Manager primarily adopts the full replication strategy by which the assets of the Fund comprise the constituent stocks with reference to their respective weightings in the Index or futures contracts on the Index. Exposure to the Index may also be obtained through other index-tracking strategies or financial derivative instruments (such as futures contracts) from which the return to the Fund will substantially reflect the performance of the Index. The Fund's net derivative exposure may be up to 50% of its Net Asset Value. Fund Portfolio as of 30-06-2021 Asset Allocation Equity Holdings Geographical Allocation Equity Holdings Sector Allocation Stock Bond Cash Other 99.07 0.00 0.93 0.00 Total Number of Equity Holdings 58 Total Number of Bond Holdings 0 Fee Information Performance History Subscription Fee 3.00% Switching Handling Fee 1% *Not applicable to Guaranteed Funds* Management Fee 1.000% p.a. Redemption Fee - Performance Fee - Incentive Fee - Other Fund Information Launch Date 13-07-1998 Fund Type Index Fund and Index Leveraged Fund Fund Category Greater China Equity Investment Market Sector Hong Kong Equity Dealing Freqeuncy/ Dealing Cut-off Time Two Dealing Sessions per Dealing Day / Fund indexed performance (initial value =100%). -

Hang Seng Bank Branch Location

Hang Seng Bank Bank Branch Address 1. Wong Tai Sin Branch Shop No.121A, Level 1, Wong Tai Sin Plaza 2. MTR Kwai Fong Station (This branch was closed after July 31, 2021) Office 3. Metro City Branch Shop 211, Level 2, Metro City, Phase 1 4. Lok Fu Plaza Branch Shop G202, Lok Fu Plaza 5. Castle Peak Road Branch 339 Castle Peak Road 6. Quarry Bay Branch 989 King's Road 7. Polytechnic University Room VA207, The HK Polytechnic University Branch 8. Shau Kei Wan Branch Shop 6, 1/F, i-UniQ Residence, 295 Shau Kei Wan Road 9. Tai Po Branch 35 Kwong Fuk Road 10. Johnston Road Branch 142 Johnston Road 11. Taikoo Shing Branch Shop G15, G/F, Fu Shan Mansion, 25 Taikoo Shing Road 12. Tam Kung Road Branch 38 Tam Kung Road 13. 141 Prince Edward Road 141 Prince Edward Road Branch 14. Aberdeen Centre Branch 10 Nam Ning Street 15. Fanling Branch 9 Luen Hing Street, Luen Wo Market 16. Sheung Wan Branch Shop 9-10, 1/F, Tung Ning Building, 251 Des Voeux Road Central 17. Tsz Wan Shan Branch 63 Fung Tak Road 18. Tai Wai Branch 33 Tai Wai Road 19. Mei Foo Sun Chuen (Nassau 10 Nassau Street St) Branch Bank Branch Address 20. Mei Foo Sun Chuen (Nassau Shops Nos. N23-N25, G/F, Nos. 1-15, 2-24 Nassau St) Prestige Banking Centre Street, Mei Foo Sun Chuen 21. San Fung Avenue Branch 53 San Fung Avenue 22. San Fung Avenue Prestige 94 San Fung Avenue Banking Centre 23.