Principal Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Changes to Board Composition (2 March 2009)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Stock code: 11) A N N O U N C E M E N T Changes to Board Composition The Board of Directors (the “Board”) of Hang Seng Bank Limited (the “Bank”) has today announced the following changes to the Bank’s Board composition to take effect on the dates mentioned below. Retirement of Mr Raymond Or Ching Fai from the Board of the Bank Mr Raymond Or Ching Fai will retire as Vice-Chairman and Chief Executive of the Bank and from the Board with effect from the conclusion of the Bank’s Annual General Meeting to be held on 6 May 2009 (“2009 AGM”). Mr Or has confirmed that he has no disagreement with the Board and that he is not aware of any matter relating to his retirement that needs to be brought to the attention of the shareholders of the Bank. The Board would like to express its gratitude to Mr Or for his outstanding contributions and strong leadership over the years and wish him all the best following his retirement. Proposed Appointment of Mrs Margaret Leung Ko May Yee as non-executive Director of the Bank with effect from 1 April 2009, and as Vice-Chairman and Chief Executive of the Bank with effect from the conclusion of the Bank’s AGM on 6 May 2009 Mrs Margaret Leung Ko May Yee, currently Group General Manager and Global Co-Head Commercial Banking for the HSBC Group, will be appointed a non-executive Director of the Bank with effect from 1 April 2009 until the conclusion of the 2009 AGM. -

Product Brochure Eng Upd V3 Jun07

IMPORTANT RISK WARNINGS/FUND INFORMATION FOR INVESTORS (Capitalised terms used herein but not otherwise defined will have the same meanings as defined in the Explanatory Memorandum of the Hang Seng Investment Series (the “Series”) and the Term Sheet of the Fund) • Hang Seng Ping An Asian Income Fund (“the Fund”) invests primarily in a balanced portfolio consisting of equity and debt securities issued in the debt and securities markets in the Asia Pacific region (excluding Japan). • Hang Seng Investment Management, as the Manager, has delegated its investment management duties in relation to debt securities to the Sub-investment Manager, and will rely on the Sub-investment Manager’s expertise and systems for the Fund’s investments in debt securities only. Any disruption in the communication with or assistance from the Sub-investment Manager or a loss of service of the Sub-investment Manager or any of its key personnel may adversely affect the operations of the Fund. • The asset allocation of the Fund is determined by the Manager and depends on the views of the Manager and the Sub-investment Manager on fundamental economic and market conditions and investment trends across the globe, the dynamic asset allocation may not achieve the desired results under all circumstances and market conditions. The investments of the Fund may be periodically rebalanced and therefore the Fund may incur greater transaction costs than a fund with static allocation strategy. • The Fund is also subject to investment risks, equity market risks, risks associated with investing in fixed income instruments, general risks of investments associated with an emerging market, concentration risk and currency and exchange rate control risk. -

Smart Tips for INWARD Payments to Hang Seng Bank Limited (HASEHKHH)

Smart Tips for INWARD Payments to Hang Seng Bank Limited (HASEHKHH) 1) Provide following general information to your remittance counterpart: Account Holder's Name & Account Number Bank's Name: Hang Seng Bank Limited Bank’s Address: 83 Des Voeux Road Central, Hong Kong SWIFT Code: HASEHKHH Clearing No.: 024 (for local interbank transfer) 2) Our major overseas correspondent bank network for your remittance counterpart’s reference: Currency Correspondent Bank(s) Name SWIFT Code / Fedwire No. Australian Dollar AUD Commonwealth Bank of Australia, Sydney, Australia CTBAAU2S ANZ Bank Ltd, Melbourne, Australia ANZBAU3M Canadian Dollar CAD Canadian Imperial Bank of Commerce, Toronto, Canada CIBCCATT Toronto Dominion Bank, Toronto, Canada TDOMCATTTOR Swiss Franc CHF UBS AG, Zurich, Switzerland UBSWCHZH80A Credit Suisse AG, Zurich, Switzerland CRESCHZZ80A Danish Kroner DKK Danske Bank A/S, Copenhagen, Denmark DABADKKK Euro EUR Unicredit Bank Austria AG, Vienna, Austria BKAUATWW Credit Agricole SA, Paris, France AGRIFRPP Commerzbank AG, Frankfurt, Germany COBADEFF Royal Bank of Scotland N.V, Amsterdam, Holland RBOSNL2A Intesa Sanpaolo SPA, Milan, Italy BCITITMM Banco Santander SA, Madrid, Spain BSCHESMM HSBC Bank PLC, London, UK MIDLGB22 Pound Sterling GBP HSBC Bank PLC, London, UK MIDLGB22 Japanese Yen JPY Bank of Tokyo-Mitsubishi UFJ Ltd, Tokyo, Japan BOTKJPJT Sumitomo Mitsui Banking Corporation, Tokyo, Japan SMBCJPJT Norwegian Kroner NOK DNB NOR Bank ASA, Oslo, Norway DNBANOKK New Zealand Dollar NZD Bank of New Zealand, Wellington, New Zealand BKNZNZ22 Swedish Kroner SEK Svenska Handelsbanken, Stockholm, Sweden HANDSESS Singapore Dollar SGD Hongkong and Shanghai Bkg Corp Ltd, Singapore HSBCSGSG Thai Baht THB Hongkong and Shanghai Bkg Corp Ltd, Bangkok, Thailand HSBCTHBK US Dollar USD Bank of America, San Francisco, USA BOFAUS6S FW 121000358 Bank of New York Mellon, New York, USA IRVTUS3N FW 021000018 Citibank NA, New York, USA CITIUS33 FW 021000089 Deutsche Bank Trust Co Americas, USA BKTRUS33 FW 021001033 HSBC Bank USA, N.A. -

Hang Seng Bank Branch Location

Hang Seng Bank Bank Branch Address 1. Wong Tai Sin Branch Shop No.121A, Level 1, Wong Tai Sin Plaza 2. MTR Kwai Fong Station (This branch was closed after July 31, 2021) Office 3. Metro City Branch Shop 211, Level 2, Metro City, Phase 1 4. Lok Fu Plaza Branch Shop G202, Lok Fu Plaza 5. Castle Peak Road Branch 339 Castle Peak Road 6. Quarry Bay Branch 989 King's Road 7. Polytechnic University Room VA207, The HK Polytechnic University Branch 8. Shau Kei Wan Branch Shop 6, 1/F, i-UniQ Residence, 295 Shau Kei Wan Road 9. Tai Po Branch 35 Kwong Fuk Road 10. Johnston Road Branch 142 Johnston Road 11. Taikoo Shing Branch Shop G15, G/F, Fu Shan Mansion, 25 Taikoo Shing Road 12. Tam Kung Road Branch 38 Tam Kung Road 13. 141 Prince Edward Road 141 Prince Edward Road Branch 14. Aberdeen Centre Branch 10 Nam Ning Street 15. Fanling Branch 9 Luen Hing Street, Luen Wo Market 16. Sheung Wan Branch Shop 9-10, 1/F, Tung Ning Building, 251 Des Voeux Road Central 17. Tsz Wan Shan Branch 63 Fung Tak Road 18. Tai Wai Branch 33 Tai Wai Road 19. Mei Foo Sun Chuen (Nassau 10 Nassau Street St) Branch Bank Branch Address 20. Mei Foo Sun Chuen (Nassau Shops Nos. N23-N25, G/F, Nos. 1-15, 2-24 Nassau St) Prestige Banking Centre Street, Mei Foo Sun Chuen 21. San Fung Avenue Branch 53 San Fung Avenue 22. San Fung Avenue Prestige 94 San Fung Avenue Banking Centre 23. -

Hang Seng Becomes First Hong Kong Bank to Adopt 'Iam Smart' Verification

12 April 2021 Hang Seng Becomes First Hong Kong Bank to Adopt ‘iAM Smart’ Verification Customers Can Enjoy Convenience of Using ‘iAM Smart’ Identify Authentication at All Branches for Immediate Assistance with Range of Banking Needs And Enquiries Hang Seng Bank has notched up another first in its ongoing drive to provide customer- centric, fintech-enabled services that make banking easier and more convenient. Beginning today (12 April), customers will be able to use the ‘iAM Smart’ mobile app for identity verification purposes at all Hang Seng branches*, giving individuals a convenient digital alternative to providing their physical Hong Kong ID card. The launch of this service today also makes Hang Seng the first bank in Hong Kong to accept the use of ‘iAM Smart’ as a valid form of identification. All digitally equipped frontline staff at Hang Seng branches can now use their tablets to verify the identity of customers who have registered with ‘iAM Smart’. This new capability will save customers’ time by increasing the scope of in-branch banking needs and enquiries that can be dealt with away from the counter. Digital Advocates and General Banking Managers can assist customers with services such as applying for a new ATM card or card replacement, ordering cheque books and requesting copies of bank account statement without needing to ask for their physical Hong Kong ID card. The Bank will continue to expand the range of services that digitally equipped frontline staff can handle for customers. Hang Seng has been making good use of innovative technology to enhance branch services and provide seamless online-offline banking experience for customers. -

Press Release

Hang Seng Indexes Company Launches Hang Seng New Consumption Index and Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index Investable Indexes to Reflect Performances of Stocks in Traditional and Online Consumption Sectors (Hong Kong, 26 July 2021) Hang Seng Indexes Company today launched the Hang Seng New Consumption Index and Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index. With a series of policies put forward by mainland China recently to focus on facilitating Internet+ and e-commerce, China will likely see a new growth in the consumption sector driven by these policies in the coming years. Meanwhile, the two new indexes are designed by Hang Seng Indexes Company to capture the full picture of listed companies in traditional consumption sectors (i.e., consumer discretionary and consumer staples) as well as online consumption sectors such as e-commerce, online/mobile gaming, media streaming and healthcare retail amid the shifting megatrends in consumption patterns in China. The Hang Seng New Consumption Index covers Hong Kong-listed Greater China companies; while the Hang Seng Shanghai-Shenzhen-Hong Kong New Consumption Index is a cross-market index, covering Mainland-listed A shares and Hong Kong-listed shares that are eligible for southbound trading under the Stock Connect Scheme. Daniel Wong, Director & Chief Index Officer at Hang Seng Indexes Company, said: “According to China’s National Bureau of Statistics, online retail sales amounted to RMB11.76 trillion in 2020, representing an increase of 10.9% compared with 20191, indicating that the rise of China’s technology-driven consumption brands and development of e-commerce are catalysing the transformation of China’s consumption model to weigh more on online consumption. -

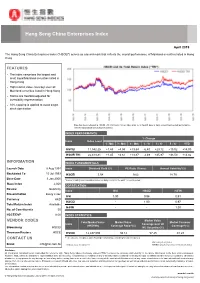

Hang Seng China Enterprises Index

Hang Seng China Enterprises Index April 2019 The Hang Seng China Enterprises Index ("HSCEI") serves as a benchmark that reflects the overall performance of Mainland securities listed in Hong Kong. FEATURES ■ The index comprises the largest and most liquid Mainland securities listed in Hong Kong ■ High market value coverage over all Mainland securities listed in Hong Kong ■ Stocks are freefloat-adjusted for investibility representation ■ 10% capping is applied to avoid single stock domination Data has been rebased at 100.00. All information for an index prior to its launch date is back-tested, back-tested performance reflects hypothetical historical performance. INDEX PERFORMANCE % Change Index Index Level 1 - Mth 3 - Mth 6 - Mth 1 - Yr 3 - Yr 5 - Yr YTD HSCEI 11,542.25 +1.43 +4.59 +13.84 -6.40 +29.12 +18.02 +14.00 HSCEI TRI 22,413.81 +1.45 +4.61 +13.87 -2.49 +45.97 +43.50 +14.02 INFORMATION INDEX FUNDAMENTALS Launch Date 8 Aug 1994 Index Dividend Yield (%) PE Ratio (Times) Annual Volatility*(%) Backdated To 15 Jul 1993 HSCEI 3.54 9.62 18.75 Base Date 3 Jan 2000 *Annual Volatility was calculated based on daily return for the past 12-month period. Base Index 2,000 CORRELATION Review Quarterly Index HSI HSCEI H-FIN Dissemination Every 2 sec HSI 1.00 0.96 0.91 Currency HKD HSCEI - 1.00 0.97 Total Return Index Available H-FIN - - 1.00 No. of Constituents 50 HSCEIDVP 0.00 INDEX STATISTICS VENDOR CODES Market Value Total Market Value Market Value Market Turnover Index Coverage over all (HKD Mn) Coverage Ratio^(%) Coverage^(%) Bloomberg HSCEI ML Securities(%) Thomson Reuters .HSCE HSCEI 12,437,096 36.12 57.25 41.28 CONTACT US ^ The universe comprises Main Board primary listings excluding foreign companies HSI: Hang Seng Index Email [email protected] All data as at 30 Apr 2019 H-FIN: Hang Seng China H-Financials Index Disclaimer All information contained herein is provided for reference only. -

Hang Seng Indexes Announces Index Review Results

16 August 2019 Hang Seng Indexes Announces Index Review Results Hang Seng Indexes Company Limited (“Hang Seng Indexes”) today announced the results of its review of the Hang Seng Family of Indexes for the quarter ended 28 June 2019. All changes will take effect on 9 September 2019 (Monday). 1. Hang Seng Index There is no change to the constituents of the Hang Seng Index. The total number of constituents is fixed at 50. The list of constituents is provided in Appendix 1. 2. Hang Seng China Enterprises Index The following constituent changes will be made to the Hang Seng China Enterprises Index. The total number of constituents is fixed at 50. Inclusion: Code Company 151 Want Want China Holdings Ltd. 175 Geely Automobile Holdings Ltd. 656 Fosun International Ltd. 966 China Taiping Insurance Holdings Co. Ltd. 1918 Sunac China Holdings Ltd. Removal: Code Company 489 Dongfeng Motor Group Co. Ltd. - H Shares 1359 China Cinda Asset Management Co., Ltd. - H Shares 2238 Guangzhou Automobile Group Co., Ltd. - H Shares 2799 China Huarong Asset Management Co., Ltd. - H Shares 6886 Huatai Securities Co., Ltd. - H Shares The list of constituents is provided in Appendix 2. more… Hang Seng Indexes Announces Index Review Results /2 3. Hang Seng Composite LargeCap & MidCap Index The following constituent changes will be made to the Hang Seng Composite LargeCap & MidCap Index. The total number of constituents will decrease from 304 to 301. Inclusion: Code Company 667 China East Education Holdings Ltd. 1579 Yihai International Holding Ltd. 1717 Ausnutria Dairy Corporation Ltd. 1951 Jinxin Fertility Group Ltd. -

Hang Seng Bank Announces 2003/04 Hang Seng Scholars

28 July 2003 HANG SENG BANK ANNOUNCES 2003/04 HANG SENG SCHOLARS Hang Seng Bank has awarded scholarships to four outstanding students in Hong Kong and mainland China to study abroad, taking the total number of students benefiting from the Hang Seng Bank Overseas Scholarship Scheme to 32 since its launch in 1996. The Bank has allocated about HK$32 million in the past seven years to overseas, Hong Kong and mainland China scholarship schemes. Over 550 students have benefited. At a reception held today, Mr Vincent Cheng, the Bank's Vice-Chairman and Chief Executive, presented this year's overseas scholarships under the Hong Kong programme to Mr Vincent Yu of Li Po Chun United World College; Miss Celine Leung of Tsuen Wan Government Secondary School and Mr Daniel Tang of La Salle College. The three Hang Seng Scholars will undertake undergraduate studies in economics at Princeton University, molecular biology at Princeton University and law at King’s College London respectively this September. The fourth scholarship recipient, Mr Yang Ming of Tsinghua University will pursue post-graduate studies in public administration in international development at Harvard University under the mainland China programme of the Overseas Scholarship Scheme. Mr Cheng said: "As a good corporate citizen, Hang Seng treats education as a top priority in its social responsibility programmes. We believe educational excellence is a critical component for building up the economic success of Hong Kong and the Mainland, and enhancing the quality of life in the community. We are pleased to play a role in nurturing young people for the betterment of the community.” Also attending the reception was Prof Joseph J Y Sung, Associate Dean (Clinical) of the Faculty of Medicine of The Chinese University of Hong Kong, who shared his thoughts on ‘Serving the Society’ with the Bank’s scholarship recipients. -

Annual Report 2019 Annual Report 2019

HANG SENG BANK LIMITED HANG SENG BANK ANNUAL REPORT 2019 ANNUAL REPORT 2019 REPORT ANNUAL 83 Des Voeux Road Central, Hong Kong www.hangseng.com Our day-to-day lives are moving faster. From smart cities initiatives to AI in our mobile phones, the ways in which we interact with the world around us are evolving every day. Hang Seng’s goal is to make it easy for our customers to manage their finances. We create smart solutions that allow us to deliver fast, simple and convenient banking services for a diverse range of financial needs. Using human-centric design and technology, we enable customers to manage their finances on their own terms – anywhere, anytime. Smart living… through intelligent banking. Founded in 1933, Hang Seng is one of Hong Kong’s largest listed companies. Our market capitalisation as at 31 December 2019 was HK$307.8 billion. We serve over half the adult residents of Hong Kong – more than 3.5 million people – through about 290 service outlets. We also maintain branches in Macau and Singapore and a representative office in Taipei. Established in May 2007, wholly owned subsidiary Hang Seng Bank (China) Limited is headquartered in Pudong, Shanghai, and operates a mainland China network with outlets in the Pearl River Delta, the Yangtze River Delta, the Bohai Rim Region and midwest China. Hang Seng is a principal member of the HSBC Group, one of the world’s largest banking and financial services organisations. RATINGS Moody’s Standard & Poor’s Long-term Bank Deposit Long-term Issuer Credit (local/foreign currency) (local and -

2007 Annual Report

CONTENTS 1 Corporate Profile 2 Results in Brief 3 Five-year Financial Summary 4 Major Milestones 6 Recognition 8 Chairman's Statement 10 Chief Executive's Report 15 Corporate Responsibility 19 Corporate Governance and Other Information 32 Management Discussion and Analysis - Business in Hong Kong - Business on the Mainland - Financial Review 54 Biographical Details of Directors 59 Biographical Details of Senior Management 61 Report of the Directors 69 2007 Financial Statements 182 Independent Auditor's Report 183 Supplementary Notes to the Financial Statements (unaudited) 193 Analysis of Shareholders 194 Subsidiaries 195 Corporate Information and Calendar CORPORATE PROFILE Established in 1933, Hang Seng Bank is a world-class financial institution and one of Hong Kong’s largest listed companies in terms of market capitalisation (HK$307.6 billion as at 31 December 2007). In Hong Kong, we serve over one-third of the population through around 150 branches and automated banking centres. We also maintain a branch in Shenzhen for foreign currency wholesale business, branches in Macau and Singapore, and representative offices in Xiamen and Taipei. Established on 28 May 2007, wholly owned subsidiary Hang Seng Bank (China) Limited operates a mainland China network of 23 outlets in Beijing, Shanghai, Guangzhou, Dongguan, Shenzhen, Fuzhou, Nanjing, Hangzhou and Ningbo. Hang Seng is a principal member of the HSBC Group, one of the world’s largest banking and financial services organisations. 1 RESULTS IN BRIEF 2007 2006 Change For the year HK$m HK$m