MTR Corporation (C.I.) Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

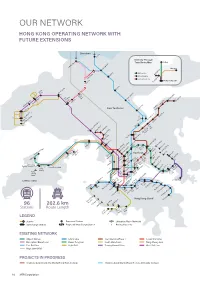

Our Network Hong Kong Operating Network with Future Extensions

OUR NETWORK HONG KONG OPERATING NETWORK WITH FUTURE EXTENSIONS Shenzhen Lo Wu Intercity Through Train Route Map Beijing hau i C Lok Ma Shanghai Sheung Shu g Beijing Line Guangzhou Fanlin Shanghai Line Kwu Tung Guangdong Line n HONG KONG SAR Dongguan San Ti Tai Wo Long Yuen Long t Ping 48 41 47 Ngau a am Tam i Sh i K Mei a On Shan a Tai Po Marke 36 K Sheungd 33 M u u ui Wa W Roa Au Tau Tin Sh 49 Heng On y ui Hung Shui Ki g ng 50 New Territories Tai Sh Universit Han Siu Ho 30 39 n n 27 35 Shek Mu 29 Tuen Mu cecourse* e South Ra o Tan Area 16 F 31 City On Tuen Mun n 28 a n u Sha Ti Sh n Ti 38 Wai Tsuen Wan West 45 Tsuen05 Wa Tai Wo Ha Che Kung 40 Temple Kwai Hing 07 i 37 Tai Wa Hin Keng 06 l Kwai Fong o n 18 Mei Fo k n g Yi Diamond Hil Kowloon Choi Wa Tsin Tong n i King Wong 25 Shun Ti La Lai Chi Ko Lok Fu d Tai Si Choi Cheung Sha Wan Hung Sau Mau Ping ylan n ay e Sham Shui Po ei Kowloon ak u AsiaWorld-Expo B 46 ShekM T oo Po Tat y Disn Resort m Po Lam Na Kip Kai k 24 Kowl y Sunn eong g Hang Ha Prince n Ba Ch o Sungong 01 53 Airport M Mong W Edward ok ok East 20 K K Toi ong 04 To T Ho Kwa Ngau Tau Ko Cable Car n 23 Olympic Yau Mai Man Wan 44 n a Kwun Ti Ngong Ping 360 19 52 42 n Te Ti 26 Tung Chung East am O 21 L Tung Austi Yau Tong Tseung Chung on Whampo Kwan Tung o n Jordan Tiu g Kowl loo Tsima Hung 51 Ken Chung w Sh Hom Leng West Hong Kong Tsui 32 t Tsim Tsui West Ko Eas 34 22 ha Fortress10 Hill Hong r S ay LOHAS Park ition ew 09 Lantau Island ai Ying Pun Kong b S Tama xhi aus North h 17 11 n E C y o y Centre Ba Nort int 12 16 Po 02 Tai -

7Th Status Report About the Implementation Progress of the TAP TSI (2020)

Report 7th TAP TSI Implementation progress report - ERA-REP-152 IMPL-2021 V 1.0 Making the railway system work better for society. Report 7th status report about the implementation progress of the TAP TSI (2020) Drafted by Validated by Approved by Name Stefan JUGELT Jo de BOSSCHERE Pio GUIDO Head of RSYS Position Project Officer Head of Unit Department Date 17/02/2021 Enter a date. Enter a date. Signature Document History Version Date Comments 1st draft for the presentation at the TAP TSI 0.1 08/03/2021 cooperation group 0.2 09/03/2021 Updated chapters 4.2.2.18 – 4.2.2.20 0.3 19/04/2021 Comments from TSGA 1.0 11/05/2020 Final version 120 Rue Marc Lefrancq | BP 20392 | FR-59307 Valenciennes Cedex 1 / 81 Tel. +33 (0)327 09 65 00 | era.europa.eu Any printed copy is uncontrolled. The version in force is available on Agency’s intranet/extranet. Report 7th TAP TSI Implementation progress report - ERA-REP-152 IMPL-2021 V 1.0 Contents Acronyms ............................................................................................................................................................ 4 Reference documents ........................................................................................................................................ 5 Reference legislation .......................................................................................................................................... 5 1 ABSTRACT ........................................................................................................................................... -

Business Overview About MTR

Business Overview About MTR MTR is regarded as one of the world’s leading railways for safety, reliability, customer service and cost efficiency. In addition to its Hong Kong, China and international railway operations, the MTR Corporation is involved in a wide range of business activities including the development of residential and commercial properties, property leasing and management, advertising, telecommunication services and international consultancy services. Corporate Strategy MTR is pursuing a new Corporate Strategy, “Transforming the Future”, The MTR Story by more deeply embedding sustainability and Environmental, Social and Governance principles into its businesses and operations The MTR Corporation was established in 1975 as the Mass Transit with the aim of creating more value for all the stakeholders. Railway Corporation with a mission to construct and operate, under prudent commercial principles, an urban metro system to help meet The strategic pillars of the new Corporate Strategy are: Hong Kong’s public transport requirements. The sole shareholder was the Hong Kong Government. The platform columns at To Kwa Wan Station on Tuen Ma Line are decorated with artworks entitled, “Earth Song”, which presents a modern interpretation of the aesthetics of the Song Dynasty, The Company was re-established as the MTR Corporation Limited in June 2000 after the Hong Kong Special Administrative Region illustrating the scenery from day to night and the spring and winter seasons using porcelain clay. Government sold 23% of its issued share capital to private investors Hong Kong Core in an Initial Public Offering. MTR Corporation shares were listed on the Stock Exchange of Hong Kong on 5 October 2000. -

Annual Report 2020 Stock Code: 66

Keep Cities Moving Annual Report 2020 Stock code: 66 SUSTAINABLE CARING INNOVATIVE CONTENTS For over four decades, MTR has evolved to become one of the leaders in rail transit, connecting communities in Hong Kong, the Mainland of China and around the world with unsurpassed levels of service reliability, comfort and safety. In our Annual Report 2020, we look back at one of the most challenging years in our history, a time when our Company worked diligently in the midst of an unprecedented global pandemic to continue delivering high operational standards while safeguarding the well-being of our customers and colleagues – striving, as always, to keep cities moving. Despite the adverse circumstances, we were still able to achieve our objective of planning an exciting strategic direction. This report also introduces our Corporate Strategy, “Transforming the Future”, which outlines how innovation, technology and, most importantly, sustainability and robust environmental, social and governance practices will shape the future for MTR. In addition, we invite you Keep Cities to read our Sustainability Report 2020, which covers how relevant Moving and material sustainability issues are managed and integrated into our business strategies. We hope that together, these reports offer valuable insights into the events of the past year and the steps we plan on taking toward helping Hong Kong and other cities we serve realise a promising long-term future. Annual Report Sustainability 2020 Report 2020 Overview Business Review and Analysis 2 Corporate Strategy -

MTR Corporation

MTR Corporation Company Overview November 2020 to December 2020 Forward-looking statements Certain statements contained in this presentation may be viewed as forward-looking statements. Such forward- looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from any future performance, financial condition or results of operations implied by such forward-looking statements. Page 2 COVID-19 update (Recurrent businesses) For 1H2020, the estimated total financial impact of the COVID-19 outbreak on recurrent profit was ~HK$5 billion, mainly due to: • Lower patronage • Rental concession to tenants at station kiosks and shopping malls since February • Lower advertising revenue • Negative financial impact on Mainland China & International businesses Since July 2020 • Domestic Services average weekday patronage declined in July (-33.0% YoY) and August (-38.6% YoY), after the 3rd wave of COVID-19 outbreak. The decline has narrowed in September (-22.8% YoY) and October (-3.4% YoY), due to the gradual recovery and low base in 2019 • Revenue loss during station closures (mainly cross-boundary stations) • Rental concession remains, on case-by-case basis. • Advertising activities remained weak • Mainland China businesses continue to improve, following the re-opening in most cities. • Overseas operations remain negatively affected, given the global outbreak. Page 3 COVID-19 update (Transport operations) • The decline widened again after the 3rd wave of COVID- Overall Patronage (‘000) 19 outbreak, with renewed work-from-home 20% 6,000 5.1% 1.7% 1.8% 2.6% 2.3% 1.3% -1.3% 10% arrangement, tightened social distancing and school 5,000 -5.4% -7.9% 0% -16.0% 4,000 -17.5% (10%) -6.7%-23.8% suspension. -

MTR Corporation (C.I.) Limited

Offering Circular (a company incorporated on 26th April 2000 in Hong Kong with company number 714016) and MTR Corporation (C.I.) Limited (a company with limited liability organised under the laws of the Cayman Islands on 30th October 2000) (Unconditionally and Irrevocably Guaranteed by MTR Corporation Limited) US$7,000,000,000 Debt Issuance Programme On 22nd December 1993, Mass Transit Railway Corporation (“MTRC”) entered into a US$1,000,000,000 Debt Issuance Programme (the “Programme”). The maximum aggregate nominal amount of Notes (as defined below) which may be outstanding under the Programme was increased to US$2,000,000,000 with effect from 1st June 1999, to US$3,000,000,000 with effect from 31st October 2006, to US$4,000,000,000 with effect from 13th March 2013 and to US$5,000,000,000 with effect from 20th October 2017 and to US$7,000,000,000 with effect from 30th October 2020. On 30th June 2000 MTR Corporation Limited (“MTRCL” or “the Company”) replaced MTRC as the issuer of Notes under the Programme. All the assets and liabilities of MTRC vested in MTRCL and MTRCL has adopted all of the accounts of MTRC. MTR Corporation (C.I.) Limited (“MTR Cayman”) became an additional issuer of Notes under the Programme with effect from 9th April 2001 pursuant to an Amending and Restating Programme Agreement dated 9th April 2001 made between MTRCL, MTR Cayman and the Dealers named therein (MTRCL and MTR Cayman together being the “Issuers” and each an “Issuer”). This Offering Circular supersedes any previous prospectus, listing particulars or offering circular describing the Programme. -

Mtr Corporation Limited 香港鐵路有限公司

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited (“SEHK”) take no responsibility for the contents of this announcement and the listing documents attached hereto, make no representation as to their accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement and the listing documents attached hereto. This announcement and the listing documents attached hereto are for information purposes only and do not constitute an invitation or offer to acquire, purchase or subscribe for securities. The securities have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state of the United States or other jurisdiction and the securities may not be offered or sold into or within the United States, or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the Securities Act) except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state or local securities laws. This announcement and the listing documents attached hereto have been published for information purposes only as required by the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and do not constitute an offer to sell nor a solicitation of an offer to buy any securities. Neither this announcement nor anything referred to herein (including the listing documents attached hereto) forms the basis for any contract or commitment whatsoever. -

MTR CORPORATION LIMITED 香港鐵路有限公司 (The “Company”) (Incorporated in Hong Kong with Limited Liability) (Stock Code: 66)

PR071/15 13 August 2015 MTR CORPORATION LIMITED 香港鐵路有限公司 (the “Company”) (Incorporated in Hong Kong with limited liability) (Stock code: 66) ANNOUNCEMENT OF UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2015 HIGHLIGHTS Financial - Total revenue increased 3.8% to HK$20,210 million; Revenue excluding Mainland of China and international subsidiaries increased 6.9% to HK$14,029 million - Post-tax underlying profit Recurrent business profit HK$ 4,516 million up 7.9% Property development profit HK$ 2,311 million up HK$2,108 million HK$ 6,827 million up 55.5% - Property development profit comprised mainly profit from LOHAS Park Package 3 (“Hemera”) with all 1,648 residential units sold - Earnings per share on underlying profit was HK$1.17 - Profit after investment property revaluation increased 3.5% to HK$8,189 million - Net assets increased 2.4% to HK$167,355 million; Net debt-to-equity ratio at 9.1% - Interim dividend of HK$0.25 per share declared (with scrip dividend alternative) Hong Kong Railway Network - On-time performance maintained at 99.9% - Patronage from Hong Kong transport operations increased 4.4% to 949.4 million - Sai Ying Pun Station on the Island Line Extension commenced service in March 2015 - HK$3.3 billion contract awarded to replace the signalling system and HK$6 billion contract awarded to replace all of the 93 first-generation 8-car trains operating in the urban areas Hong Kong New Railway Projects - For Express Rail Link, as project manager, the Company had notified Government at the end of June 2015 of a revised estimated target completion timetable of the 3rd quarter 2018 (including programme contingency) together with a revised estimated project cost of HK$85.3 billion (including contingency, based on the revised timetable). -

5.0 Million 867.5 Km 8

WEBSITE MENU About this Report MAINLAND OF CHINA AND CEO Letter INTERNATIONAL BUSINESS Q&A with the Chairman About MTR Corporation Safety Financial and Economic Performance Environment Corporate Governance Staff Community Customers 8 5.0 million Rail Services in Total weekday patronage Supply Chain operation outside of on average outside of 2016 and Beyond Hong Kong Hong Kong Mainland of China and International Business Introduction MTR in the Mainland of China MTR in Europe MTR in Australia View Stories Performance Metrics 867.5 km Operating route length outside of Hong Kong 145 WEBSITE MENU INTRODUCTION About this Report Outside of Hong Kong, we invest selectively in rail-related projects, including In this section of the report, we highlight key aspects of the sustainability property developments, which we believe will generate sustainable returns performance of railway operations managed by our subsidiaries around CEO Letter within clear risk parameters. the world by location, namely, MTR in the Mainland of China, Europe and Q&A with the Chairman Australia. Key performance indicators (KPIs) for these railway operations are Learn more… also available. About MTR Corporation Safety Please refer to our Annual Report 2015. Financial and Economic Performance UK SWEDEN MAINLAND OF CHINA Environment London Crossrail Corporate Governance Stockholm Metro Stockholm Commuter Rail Beijing Line 4 Staff (from December 2016) Beijing Daxing Line MTR Tech (renamed from TBT) Beijing Line 14 Community Beijing Line 16 Customers London Overground MTR Express -

Performance Metrics

PERFORMANCE METRICS CONTENTS Independent Limited Assurance 02 Report in Relation to MTR Corporation Limited’s Sustainability Report 2020 Hong Kong Environmental 06 This section provides consolidated information about our sustainability performance and data management, including Performance definitions for key terms and the basis of calculation for Key Performance Indicators (KPIs). Quantitative data from Macau is not disclosed in this Report as the Corporation is not the sole owner of the data under the O&M service contract with the client in Hong Kong Social Performance 08 Macau. Subject to the disclosure arrangement which will be reviewed from time to time, we may include such data in future reports. Please refer to CoMET Benchmarking Results 2019 to learn how our operations compare with other metros globally. Hong Kong Safety Targets 12 and Performance This section is also available in Traditional Chinese; however for any differences in definition in the translation, the English version will prevail. Mainland of China and 16 DATA MANAGEMENT International Business The following components of our robust data management system ensure the integrity of data disclosed in this Mainland of China and 21 sustainability report: International Business – MTR Nordic • The Audit Committee of the Board of Directors monitors the integrity of all financial information, and the Company has engaged KPMG as its External Auditor. NP360 ESG Performance 26 • Our Human Resources Management system contains all data relating to our staff. • Our centralised sustainability data collection system provides an audit trail and helps to identify errors or data gaps for CoMET Benchmarking Results 2019 27 other quantitative data. Scope of Key Performance 31 • Regular assessments and internal monitoring programmes ensure compliance in accordance with our Corporate Indicators (KPIS) Guideline and Instruction (CGI) on Compliance with Statutes and Regulations. -

Page 1 MTR CORPORATION LIMITED 香港鐵路有限公司 (The “Company”) (Incorporated in Hong Kong with Limited Liability) (

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. MTR CORPORATION LIMITED 香港鐵路有限公司 (the “Company”) (Incorporated in Hong Kong with limited liability) (Stock code: 66) ANNOUNCEMENT OF AUDITED RESULTS FOR THE YEAR ENDED 31 DECEMBER 2015 HIGHLIGHTS Financial - Total revenue increased 3.8% to HK$41,701 million; Revenue excluding Mainland of China and international subsidiaries increased 5.8% to HK$29,129 million - Post-tax underlying profit Recurrent businesses profit HK$ 8,565 million up 6.7% Property development profit HK$ 2,329 million down 34.3% HK$ 10,894 million down 5.9% - Property development profit comprised mainly profit from LOHAS Park Package 3 (“Hemera”) - Earnings per share on underlying profit was HK$1.87 - Profit after investment property revaluation decreased 16.7% to HK$12,994 million - Net assets increased 4.1% to HK$170,171 million; Net debt-to-equity ratio at 11.3%; Return on equity from underlying businesses at 6.5% - Final dividend of HK$0.81 per share (with scrip dividend alternative) recommended by the Board; Total dividend for the year of HK$1.06 per share Hong Kong Railway Network - Patronage of Hong Kong Transport Operations increased 1.8% to 1,938 million with on-time performance maintained at 99.9% -

Network Around the World Total Route Length in Mainland of 145.7Km China Operation Executive Management’S Report

total route length in km overseas 624 operation 7 lines in operation outside of Hong Kong Network around The World total route length in Mainland of 145.7km China operation Executive Management’s Report Mainland and International Businesses and Growth The total number of passengers carried by our railway related subsidiaries and associates outside of Hong Kong was approximately over 1,458 million in 2014, against approximately 1,355 million in 2013. 74 MTR Corporation Our associates outside of Hong Kong, namely Beijing MTR Corporation Limited (“BJMTR”), London Overground Rail Operations Limited (“LOROL”), Tunnelbanan Teknik Stockholm AB and Hangzhou MTR Corporation Limited (“HZMTR”), continued to provide high quality rail and railway related services to their respective communities. The start-up losses at HZMTR stabilised and our overall share of losses from these four associates was HK$101 million in 2014. The total number of passengers carried by our railway related Overview subsidiaries and associates outside of Hong Kong was over 1,458 million in 2014, against approximately 1,355 million in 2013. Railway Businesses in the Mainland of China Beijing Metro Line 4 and the Daxing Line both exceeded their service targets in 2014. The combined ridership on these two lines in 2014 reached 461 million passenger trips, with an average weekday patronage of more than 1.3 million. The two lines have 35 stations and a combined length of 50 km. The last station of Phase 1 of BJL14, Qilizhang Station, an interchange with Beijing Metro Line 9, opened for service on 15 February 2014. BJL14 service performance has been satisfactory, recording 18 million passenger trips and average weekday patronage of over 52,000 in 2014.