IN FOCUS: COUNTRYSIDE of TUSCANY, ITALY Nana Boussia Associate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fratelli-Wine-Full-October-1.Pdf

SIGNATURE COCKTAILS Luna Don Julio Blanco, Aperol, Passionfruit, Fresh Lime Juice 18 Pear of Brothers Ketel One Citroen, Pear Juice, Agave, Fresh Lemon Juice 16 Sorelle Absolut Ruby Red, Grapefruit Juice, St. Elder, Prosecco, Aperol, Lemon Juice 16 Poker Face Hendricks, St. Elder, Blackberry Puree, Ginger Beer, Fresh Lime Juice 17 Famous Espresso Martini Absolut Vanilla, Bailey’s, Kahlua, Frangelico, Disaronno, Espresso, Raw Sugar & Cocoa Rim 19 Uncle Nino Michter’s Bourbon, Amaro Nonino, Orange Juice, Agave, Cinnamon 17 Fantasma Ghost Tequila, Raspberries, Egg White, Pomegranate Juice, Lemon Juice 16 Tito’s Doli Tito’s infused pineapple nectar, luxardo cherry 17 Ciao Bella (Old Fashioned) Maker’s Mark, Chia Tea Syrup, Vanilla Bitters 17 Fratelli’s Sangria Martell VS, Combier Peach, Cointreau, Apple Pucker, red or white wine 18 BEER DRAFT BOTTLE Night Shift Brewing ‘Santilli’ IPA 9 Stella 9 Allagash Belgian Ale 9 Corona 9 Sam Adams Seasonal 9 Heineken 9 Peroni 9 Downeast Cider 9 Bud Light 8 Coors Light 8 Buckler N.A. 8 WINES BY THE GLASS SPARKLING Gl Btl N.V. Gambino, Prosecco, Veneto, Italy 16 64 N.V. Ruffino, Rose, Veneto, Italy 15 60 N.V. Veuve Clicquot, Brut, Reims, France 29 116 WHITES 2018 Chardonnay, Tormaresca, Puglia, Italy 17 68 2015 Chardonnay, Tom Gore, Sonoma, California 14 56 2016 Chardonnay, Jordan Winery, Russian River Valley, California 21 84 2017 Falanghina, Vesevo, Campania, Italy 15 60 2018 Gavi di Gavi, Beni di Batasiolo, Piemonte, Italy 14 56 2018 Pinot Grigio, Villa Marchese, Friuli, Italy 14 56 2017 Riesling, Kung -

Tuscany & Umbria

ITALY Tuscany & Umbria A Guided Walking Adventure Table of Contents Daily Itinerary ........................................................................... 4 Tour Itinerary Overview .......................................................... 10 Tour Facts at a Glance ........................................................... 12 Traveling To and From Your Tour .......................................... 14 Information & Policies ............................................................ 17 Italy at a Glance ..................................................................... 19 Packing List ........................................................................... 24 800.464.9255 / countrywalkers.com 2 © 2015 Otago, LLC dba Country Walkers Travel Style This small-group Guided Walking Adventure offers an authentic travel experience, one that takes you away from the crowds and deep in to the fabric of local life. On it, you’ll enjoy 24/7 expert guides, premium accommodations, delicious meals, effortless transportation, and local wine or beer with dinner. Rest assured that every trip detail has been anticipated so you’re free to enjoy an adventure that exceeds your expectations. And, with our optional Flight + Tour ComboCombo, Florence PrePre----tourtour Extension and Rome PostPost----TourTour Extension to complement this destination, we take care of all the travel to simplify the journey. Refer to the attached itinerary for more details. Overview A walk in the sweeping hills of Tuscany and Umbria is a journey into Italy’s artistic and agricultural heart. Your path follows history, from Florence—where your tour commences—to Siena—an important art center distinguished by its remarkable cathedral—and on to Assisi to view the art treasures of the Basilica of St. Francis. Deep in Umbria, you view Gubbio’s stunning Palazzo dei Consolo and move on to the mosaics decorating Orvieto’s Gothic cathedral. Your stay in the Roman town of Spello—known for its medieval frescoes— inspires with aesthetic balance and timeless charm. -

Pena 2013A Prepublication Ms

Evidence for the Use of Raw Materials for the Manufacture of Black-Gloss Ware and Italian Sigillata at Arezzo and Volterra J. Theodore Peña – University of California, Berkeley Abtract A program of compositional analysis involving the mineralogical (optical miscroscopy, petrographic analysis) and chemical (NAA) characterization of Black-Gloss Ware and Italian Sigillata from the site of Cetamura del Chianti along with tiles made from potting clay from several locations in northern Etruria sheds light on the use of raw materials for the manufacture of these two pottery classes at Volterra and Arezzo. The program achieved no textural or chemical matches between the specimens of Black-Gloss Ware of likely Volterran origin and several specimens of clay from outcrops of the Plio-Plestocene marine clay in the environs of Volterra that were very probably employed for the manufacture of this pottery. This suggests that the manufacture of this pottery involved the levigation of the clay. In contrast, an excellent textural and chemical match was obtained between the specimens of Black-Gloss Ware and Italian Sigillata of likely Arretine origin and specimens of the argille di Quarata lacustrine clay (formation agQ) that outcrops along the Torrente Castro/Canale Maestro della Chiana to the west of Arezzo. This indicates that the manufacture of Black-Gloss Ware and Italian Sigillata at Arezzo did not involve the levigation of the clay employed. The agQ formation is overlain by a bed of peat that is effectively unique in peninsular Italy. Peat has been regularly used as a fuel for pottery manufacture in northern Europe, and it seems likely that the producers of these two pottery classes at Arezzo employed it for this purpose. -

Multiple Sclerosis in the Campania Region (South Italy): Algorithm Validation and 2015–2017 Prevalence

International Journal of Environmental Research and Public Health Article Multiple Sclerosis in the Campania Region (South Italy): Algorithm Validation and 2015–2017 Prevalence Marcello Moccia 1,* , Vincenzo Brescia Morra 1, Roberta Lanzillo 1, Ilaria Loperto 2 , Roberta Giordana 3, Maria Grazia Fumo 4, Martina Petruzzo 1, Nicola Capasso 1, Maria Triassi 2, Maria Pia Sormani 5 and Raffaele Palladino 2,6 1 Multiple Sclerosis Clinical Care and Research Centre, Department of Neuroscience, Reproductive Science and Odontostomatology, Federico II University, Via Sergio Pansini 5, 80131 Naples, Italy; [email protected] (V.B.M.); [email protected] (R.L.); [email protected] (M.P.); [email protected] (N.C.) 2 Department of Public Health, Federico II University, 80131 Naples, Italy; [email protected] (I.L.); [email protected] (M.T.); raff[email protected] (R.P.) 3 Campania Region Healthcare System Commissioner Office, 80131 Naples, Italy; [email protected] 4 Regional Healthcare Society (So.Re.Sa), 80131 Naples, Italy; [email protected] 5 Biostatistics Unit, Department of Health Sciences, University of Genoa, 16121 Genoa, Italy; [email protected] 6 Department of Primary Care and Public Health, Imperial College, London SW7 2AZ, UK * Correspondence: [email protected] or [email protected]; Tel./Fax: +39-081-7462670 Received: 21 April 2020; Accepted: 12 May 2020; Published: 13 May 2020 Abstract: We aim to validate a case-finding algorithm to detect individuals with multiple sclerosis (MS) using routinely collected healthcare data, and to assess the prevalence of MS in the Campania Region (South Italy). To identify individuals with MS living in the Campania Region, we employed an algorithm using different routinely collected healthcare administrative databases (hospital discharges, drug prescriptions, outpatient consultations with payment exemptions), from 1 January 2015 to 31 December 2017. -

Veneto 10/38 Lucciola Organic Pinot Grigio 2018

ITALIAN WHITES SANTI SORTESELE PINOT GRIGIO 2019 – VENETO 10/38 LUCCIOLA ORGANIC PINOT GRIGIO 2018 - ALTO ADIGE 9/34 ITALIAN REDS ABBAZIA DI NOVACELLA PINOT GRIGIO 2017 – VENETO 45 LA SERENA BRUNELLO DI MONTALCINO 2010 - TUSCANY 144 VILLA SPARINA GAVI 2018 — PIEDMONT 34 PAOLO CONTERNO BAROLO 2011 - PIEDMONT 112 SERIO E BATISTA BORGOGNO, CANNUBI BAROLO 2015 - PIEDMONT 78 CHAMPAGNE & SPARKLING CAMPASS BARBERA D’ ALBA 2016 - PIEDMONT 51 NTONIOLO ASTELLE ATTINARA IEDMONT MARTINI & ROSSI ASTI NV – ITALY (187ML) 9 A C G 2013 - P 98 AOLO CAVINO ANGHE EBBIOLO IEDMONT DA LUCA PROSECCO NV – ITALY 9/34 P S L N 2017 - P 49 AOLO CAVINO INO OSSO IEDMONT FERRARI BRUT - ITALY (750ML) 56 P S V R 2018 - P 38 SANTI “SOLANE” VALPOLICELLA CLASSICO SUPERIORE 2015 – VENETO 42 LAURENT PERRIER BRUT CHAMPAGNE NV - FRANCE (187 ML) 21 LE RAGOSE AMARONE DELLA VALPOLICELLA 2008 - VENETO 102 CONUNDRUM BLANC DE BLANC 2016 - CA 53 BERTANI AMARONE CLASSICO DELLA VALPOLICELLA 2009 — VENETO 200 POL ROGER EXTRA CUVÉE DE RÉSERVE NV – FRANCE (375 ML) 55 BADIA A COLTIBUONO ORGANIC CHIANTI CLASSICO 2016 - TUSCANY 49 TAITTINGER BRUT CUVEE PRESTIGE NV - CHAMPAGNE, FRANCE 72 ORMANNI CHIANTI CLASSICO 2016 - TUSCANY 45 VUEVE CLIQUOT ROSE NV - CHAMPAGNE, FRANCE 118 CASTELLO DI AMA CHIANTI CLASSICO SAN LORENZO 2014 - TUSCANY 91 DOMAINE DE CHANDON “BLANC DE NOIRS” NV CARNEROS, CA 42 CASTELLO DI BOSSI GRAN SELEZIONE CHIANTI CLASSICO 2016—TUSCANY 13/49 SAUVIGNON BLANC FATTORIA LE PUPILLE “MORELLINO DI SCANSANO” 2015 - TUSCANY 40 LA COLOMBINA BRUNELLO DI MONTALCINO 2010 - TUSCANY 120 DOMAINE -

Passion for Cycling Tourism

TUSCANY if not HERE, where? PASSION FOR CYCLING TOURISM Tuscany offers you • Unique landscapes and climate • A journey into history and art: from Etruscans to Renaissance down to the present day • An extensive network of cycle paths, unpaved and paved roads with hardly any traffic • Unforgettable cuisine, superb wines and much more ... if not HERE, where? Tuscany is the ideal place for a relaxing cycling holiday: the routes are endless, from the paved roads of Chianti to trails through the forests of the Apennines and the Apuan Alps, from the coast to the historic routes and the eco-paths in nature photo: Enrico Borgogni reserves and through the Val d’Orcia. This guide has been designed to be an excellent travel companion as you ride from one valley, bike trail or cultural site to another, sometimes using the train, all according to the experiences reported by other cyclists. But that’s not all: in the guide you will find tips on where to eat and suggestions for exploring the various areas without overlooking small gems or important sites, with the added benefit of taking advantage of special conditions reserved for the owners of this guide. Therefore, this book is suitable not only for families and those who like easy routes, but can also be helpful to those who want to plan multiple-day excursions with higher levels of difficulty or across uscanyT for longer tours The suggested itineraries are only a part of the rich cycling opportunities that make Tuscany one of the paradises for this kind of activity, and have been selected giving priority to low-traffic roads, white roads or paths always in close contact with nature, trying to reach and show some of our region’s most interesting destinations. -

International Mail Crossing the Italian Peninsula in the Pre-Stamp Period 1815—1852

International Mail crossing the Italian Peninsula in the Pre-Stamp Period 1815—1852 prepared for the Collectors Club of New York, November 14th, 2012 by Thomas Mathà FRPSL This exhibit shows the letter mail, the postal rates, the routes, the conventions and markings of foreign countries trans- iting the Roman States in the period from the Congress of Vienna (1815), when Europe was re-organized after the Napoleonic Wars, to the introduction of the postage stamps in Rome in 1852. Subsequently, the letter mail in the Ro- man States changed and new conventions modified also international relations and the mail system. It is mainly mail from and to the South of Italy, Ionian Islands and Malta that followed the route of Rome. PARIS to NAPLES. January 2, 1833 by Royal Courier via Rome. Personal Letter from Louis Philippe, King of France, to Ferdinand II, King of Both Sicilies A. Introduction C. Foreign Mail carried through Roman States A.1 · Routes & Exchange Offices A.2 · Transit Routes C.1 · Roman-Austrian Postal Convention (1815) A.3 · Exchange and Entry Markings C.2 · special Austrian Lloyd Postal Convention (1839) A.4 · General Guidelines C.3 · Franco-Austrian Postal Convention (1843) C.4 · Sardinian-Austrian Postal Convention (1818) B. Mail exchanged between the Old Italian States C.5 · Franco-Sardinian Postal Convention (1817) B.1 · Roman-Austrian Postal Convention (1815) C.6 · Roman-Neapolitan Postal Convention (1816) B.2 · Roman-Tuscan Postal Convention (1823) C.7 · carried by Forwarding Agents B.3 · Tuscan-Sardinian Postal Convention (1822) Thomas Mathà, born in 1972, is a lawyer and lives in Bozen, Italy. -

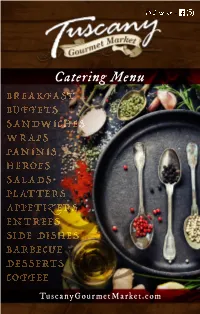

Catering Menu

Catering Menu TuscanyGourmetMarket.com Bring our best to your table. At Tuscany Gourmet Market, we think of you more like family- to us you're not just another customer. We’re here to prepare you and your guests a delicious meal- so, sit back and relax while we do what we do best. Restaurant quality food, mixed with the love & care of your Grandmother’s homecooking. We’ve got just about everything from soup to nuts. That’s because we want you to enjoy an impressive, seamless meal. If choosing your menu seems overwhelming, we’re happy to make suggestions that everyone will love. Planning an Event? Consider us your one-stop-shop for an unforget- table experience. We've got you covered from wait staff to full service Event Coordinating. BREAKFAST Continental Breakfast Assorted Bakery-Fresh Bagels, Assorted Danish, & Muffins. (w/ Gourmet Cream Cheese platter, Butter, & Fruit Preserves.) Fresh Fruit Salad Fresh-Brewed Coffee & Tea, chilled Tropicana Orange Juice. Includes all heavy-duty plasticware. Minimum 10 people Hot Breakfast Buffet Choice of Fresh Scrambled Eggs or Western-Style Egg Fritatta. Includes Belgian Waffles, Home Fries, Bacon, Sausage, Assorted Bakery-Fresh Bagels, Assorted Danish, Muffins (w/ Gourmet Cream Cheese platter, Butter, & Fruit Preserves.) Fresh Fruit Salad Fresh-Brewed Coffee & Tea, chilled Tropicana Orange Juice. Includes all condiments & paper goods. Minimum 10 people Yogurt Parfait French Vanilla Yogurt topped w/ crunchy Granola & Fresh seasonal Berries 3 lbs. - Serves 5 - 10 people 5 lbs. - Serves 10-15 people Visit Us Online @: TuscanyGourmetMarket.com 1 Cold Buffet A la Carte Elegantly arranged platters consist of: • Italian-seasoned Roast Beef • Boar’s Head Ovengold® Turkey Breast • Boar’s Head Deluxe Boiled Ham • Italian Genoa Salami • Sharp Provolone cheese • Imported Swiss cheese • Land O’Lakes American cheese (Garnished with roasted peppers, red onions & beefsteak tomatoes.) Includes: Fresh-baked Hard Rolls, Rye bread, White bread, Whole Wheat bread, Mayonnaise, Mustard, Italian dressing, + Pickle & Olive tray. -

Discover Enchanting Sicily… 12 Days a Land of Contrasts

DISCOVER ENCHANTING SICILY… 12 DAYS A LAND OF CONTRASTS SMALL GROUP TOUR DISCOVER THE MAGIC OF SICILY: A LAND OF CONTRASTS A wonderful journey to discover the beauty of Sicily travelling from west to east, through the magical interior of this paradise island. Travel to Sicily with its idyllic climate, its archaeology treasures, dramatic vistas and hearty cuisine that embodies all things Sicilian. Extravagant scenic beauty, a multicultural crossroads with a history that dates back to 3,000 years, an exuberant and richly layered culture and a tradition of food and wine that is celebrated the world over…all converge here in sunny Sicily!. On this small group journey, you’ll delve into one of the most fascinating and coveted regions in Italy. Stare face to face with some of the world’s best Byzantine mosaics in the cathedral of Monreale – a literal Bible in gold. Sit in Taormina’s Greek theatre looking out at still-smouldering Mt. Etna and you can’t help but feel Goosebumps. Marvel at the rich archaeological ruins of Siracusa dating to the 5Th century BC. Explore the brilliant Roman floor mosaics in the Villa del Casale. Enjoy an Italia evening Opera in Taormina and more. The Greek influence is particularly strong in the south of Italy – we’ll see better preserved temples here than in Greece itself! Sicily has some of Italy’s best beaches and on this tour we make sure that you’ll have time to enjoy them. The cuisine of Sicily varies from one province to the next as do the wines. -

The North-South Divide in Italy: Reality Or Perception?

CORE Metadata, citation and similar papers at core.ac.uk EUROPEAN SPATIAL RESEARCH AND POLICY Volume 25 2018 Number 1 http://dx.doi.org/10.18778/1231-1952.25.1.03 Dario MUSOLINO∗ THE NORTH-SOUTH DIVIDE IN ITALY: REALITY OR PERCEPTION? Abstract. Although the literature about the objective socio-economic characteristics of the Italian North- South divide is wide and exhaustive, the question of how it is perceived is much less investigated and studied. Moreover, the consistency between the reality and the perception of the North-South divide is completely unexplored. The paper presents and discusses some relevant analyses on this issue, using the findings of a research study on the stated locational preferences of entrepreneurs in Italy. Its ultimate aim, therefore, is to suggest a new approach to the analysis of the macro-regional development gaps. What emerges from these analyses is that the perception of the North-South divide is not consistent with its objective economic characteristics. One of these inconsistencies concerns the width of the ‘per- ception gap’, which is bigger than the ‘reality gap’. Another inconsistency concerns how entrepreneurs perceive in their mental maps regions and provinces in Northern and Southern Italy. The impression is that Italian entrepreneurs have a stereotyped, much too negative, image of Southern Italy, almost a ‘wall in the head’, as also can be observed in the German case (with respect to the East-West divide). Keywords: North-South divide, stated locational preferences, perception, image. 1. INTRODUCTION The North-South divide1 is probably the most known and most persistent charac- teristic of the Italian economic geography. -

Reggio Emilia: Results of the Intercultural Cities Index Date: February 2015 a Comparison Between 70 Cities1

Reggio Emilia: Results of the Intercultural Cities Index Date: February 2015 A comparison between 70 cities1 Introduction The Intercultural Cities programme is a joint initiative between the Council of Europe and the European Commission. It seeks to explore the potential of an intercultural approach to integration in communities with culturally diverse populations. The cities participating in the programme are reviewing their governance, policies, discourse and practices from an intercultural point of view. In the past, this review has taken the form of narrative reports and city profiles – a form which is rich in content and detail. However, it is relatively weak as a tool to monitor and communicate progress. The new Intercultural City Index has been designed as a new benchmarking tool for the cities taking part in the pilot phase of the programme as well as future participants. As of today 70 cities have undergone their intercultural policies analysis using the Intercultural City Index: Amadora (Portugal), Arezzo (Italy), Barcelona (Spain), Beja (Portugal), Bergen (Norway), Bilbao (Spain), Botkyrka (Sweden), Campi Bisenzio (Italy), Cartagena (Spain), Casalecchio di Rena (Italy), Castellón (Spain), Castelvetro (Italy), Coimbra (Portugal), Constanta (Romania), Copenhagen (Denmark), Donostia-San Sebastian2 (Spain), Dortmund (Germany), Dublin (Ireland), Duisburg (Germany), Erlangen (Germany), Forli (Italy), Fucecchio (Italy), Fuenlabrada (Spain), Geneva (Switzerland), Genoa (Italy), Getxo (Spain), Haifa (Israel), Hamburg (Germany), Izhevsk -

Meredith Abroad in Italy Summer 2018 Child Development: Italian Style

MEREDITH ABROAD IN ITALY SUMMER 2018 CHILD DEVELOPMENT: ITALIAN STYLE Student Voices WHY STUDY ABROAD? “The ability to study child development in a different country and have hands-on experience with the children opened my To gain independence, confidence, cross-cultural eyes. You don't realize that the general way we interact with understanding, and valuable travel skills children in the U.S. is not the only way that is effective. As a child development major, seeing the cultural differences To make real connections to what you between America and Italy in regards to children has helped study in the classroom me be more open to different approaches. I'm very grateful for my experience in Sansepolcro!" - Kendall Fletcher To become a citizen of the world Course CD/PSY 940: Child Development: Italian Style, 4 credits To acquire skills that employers and Fulfills PSY 310 and other Gen. Ed. Requirements graduate schools find desirable Contact Faculty Director: Dr. Gwynn Morris, [email protected] To have fun Faculty: Dr. Paul Winterhoff, [email protected] Program Highlights How to Apply Visit www.meredith.edu/studyabroad under “Application Process.” Applications will be accepted on rolling admission Dates until February 15, 2018. July 5 - July 27, 2018 Program Cost Locations $4,600 (see reverse for budget) Sansepolcro is a medieval walled city in the heart of Tuscany, where Meredith students have studied abroad for over 25 Scholarships and Financial Aid years. You will live in the beautiful and historic Palazzo Additional study abroad funding is available. Visit Alberti, Meredith College’s home in Italy.