OLED Investor Presentation 2Q 2021 (Updated: May 2021)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

View Complaint

Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 1 of 19 PageID #: 81 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE DELAWARE DISPLAY GROUP LLC § and INNOVATIVE DISPLAY § TECHNOLOGIES LLC, § § C.A. No. 15-cv-1221-RGA § Plaintiffs, § JURY TRIAL DEMANDED § v. § § LG ELECTRONICS, INC., § LG ELECTRONICS U.S.A., INC., § LG ELECTRONICS MOBILECOMM § U.S.A., INC.,LG DISPLAY CO., LTD., § and LG DISPLAY AMERICA, INC. § § § Defendants. § PLAINTIFFS’ FIRST AMENDED COMPLAINT Delaware Display Group LLC and Innovative Display Technologies LLC (collectively, “Plaintiffs”) by and through their undersigned counsel, file this First Amended Complaint against LG Electronics, Inc.; LG Electronics U.S.A., Inc.; LG Electronics Mobilecomm U.S.A., Inc., LG Display Co., Ltd.; and LG Display America, Inc. (collectively, “LG”) THE PARTIES 1. Delaware Display Group LLC (“DDG”) is a Delaware limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 2. Innovative Display Technologies LLC (“IDT”) is a Texas limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 1 Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 2 of 19 PageID #: 82 3. Upon information and belief, LG Electronics, Inc. (“LG Electronics”) is a corporation in South Korea located at LG Twin Tower 128, Yeoui-daero, Yeongdeungpo-gu, Seoul, Korea, 150-721, South Korea. Upon information and belief, LG Electronics may be served with process in South Korea pursuant to the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters. -

LP5520 RGB Backlight LED Driver Datasheet

Product Sample & Technical Tools & Support & Folder Buy Documents Software Community LP5520 SNVS440B –MAY 2007–REVISED MARCH 2016 LP5520 RGB Backlight LED Driver 1 Features 3 Description The LP5520 is an RGB backlight LED driver for small 1• Temperature Compensated LED Intensity and Color format color LCDs. RGB backlights enable better colors on the display and power savings compared • Individual Calibration Coefficients for Each Color with white LED backlights. The device offers a small • Color Accuracy ΔX and ΔY ≤ 0.003 and simple driver solution without need for optical • 12-Bit ADC for Measurement of 2 Sensors feedback. Calibration in display module production can be done in one temperature. The LP5520 • Adjustable Current Outputs for Red, Green, and produces true white light over a wide temperature Blue (RGB) LED range. Three independent LED drivers have accurate • 0.2% Typical LED Output Current Matching programmable current sinks and PWM modulation • PWM Control Inputs for Each Color control. Using internal calibration memory and external temperature sensor, the RGB LED currents • SPI™ and I2C-Compatible Interface are adjusted for perfect white balance independent of • Stand-Alone Mode With One-Wire Control the brightness setting or temperature. The user • Sequential Mode for One Color at a Time programmable calibration memory has intensity vs • Magnetic High Efficiency Boost Converter temperature data for each color. This white balance calibration data can be programmed to the memory • Programmable Output Voltage from 5 V to 20 V on the production line of a backlight module. • Adaptive Output Voltage Control Option The device has a magnetic boost converter that • < 2-µA Typical Shutdown Current creates a supply voltage of up to 20 V LED from the battery voltage. -

An Analysis of Power Consumption in a Smartphone

An Analysis of Power Consumption in a Smartphone Josh Hildebrand Introduction l Mobile devices derive the energy required to operate from batteries that are limited by the size of the device. l The ability to manage energy usage requires a good understanding of where and how the energy is being used. l The advancing functionality of modern smartphones is increasing the pressure on battery lifetime, and increases the need for effective energy management. l Goal is to break down a modern smartphone and measure the power consumption of the devices major subsystems, under a range of usage scenarios. l Results from the breakdown of energy consumption will be validated against two additional mobile devices. l Finally, an analysis of the energy consumption will be performed, and an energy model will be created to allow us to model usage patterns. Methodology / Device Under Test l The approach is to take physical power measurements at the component level on a piece of real hardware. l Three elements to the experimental setup, the device under test, a hardware data acquisition (DAQ) system, and a host computer. l Device under test is the Openmoko Neo Freerunner 2.5G smartphone. Experimental Setup l To measure power to each component, supply voltage and current must be measured. l Current is measured by placing sense resistors on the power supply rails of each component. Resistors were selected such that the voltage drop did not exceed 10mV, less than 1% of the supply voltage. l Voltages were measured using a National Instruments PCI-6229 DAQ. Software l The device was running the Freerunner port of Android 1.5, using the Linux v2.6.29 kernel. -

View Annual Report

As filed with the Securities and Exchange Commission on April 30, 2014 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 1-32238 LG Display Co., Ltd. (Exact name of Registrant as specified in its charter) LG Display Co., Ltd. (Translation of Registrant’s name into English) The Republic of Korea (Jurisdiction of incorporation or organization) LG Twin Towers, 128 Yeoui-daero, Yeongdeungpo-gu, Seoul 150-721, Republic of Korea (Address of principal executive offices) Suk Heo LG Twin Towers, 128 Yeoui-daero, Yeongdeungpo-gu, Seoul 150-721, Republic of Korea Telephone No.: +82-2-3777-1010 Facsimile No.: +82-2-3777-0797 (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered American Depositary Shares, each representing one-half New York Stock Exchange of one share of Common Stock Common Stock, par value ₩5,000 per share New York Stock Exchange* * Not for trading, but only in connection with the registration of the American Depositary Shares. -

Korean Multinationals Show Solid Recovery After Global Crisis

Korean multinationals show solid recovery after global crisis Report dated November 16, 2010 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before November 16, 2010, 10:00 a.m. Seoul; 1 a.m. GMT, and 9:00 p.m. November 15, 2010, New York. Seoul and New York, November 16, 2010 The Institute of International Affairs of the Graduate School of International Studies (GSIS) at Seoul National University in Seoul, and the Vale Columbia Center on Sustainable International Investment (VCC) at Columbia University in New York, are releasing the first annual report on leading Korean multinationals. The research for this report was conducted in 2010 and covers the period 2007 to 2009. 1 Highlights The Republic of Korea (henceforth ‘Korea’), the 11 th largest economy in the world, has now become one of the leading investors abroad. The number and the size of the corporate giants that dominate the economy have increased over the years, boosting and diversifying their investments around the world. Korea’s multinational enterprises ranked by their foreign assets (see table 1 below) show about USD 93 billion in assets held abroad. 2 Samsung Electronics Co., Ltd. (SEC), a member of a leading Korean conglomerate, ranked 1 st with slightly over USD 18 billion, followed by another top conglomerate member, LG Electronics, with over USD 10 billion dollars. Hyundai Heavy Industries Co., Ltd, and DSME Co., Ltd, had foreign assets of over USD 8 billion each and LG Display had over USD 6 billion. The top five firms together accounted for just over half of the total foreign assets of the top 20 companies. -

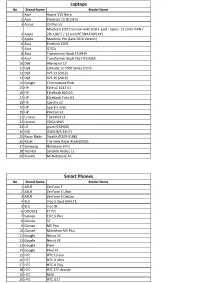

Type-C Compatible Device List 1.Xlsx

Laptops No Brand Name Model Name 1 Acer Aspire V15 Nitro 2 Acer Predator 15 (N15P3) 3 Aorus X3 Plus v5 MacBook (2015 version with USB-C port - Specs: 13.1mm THIN / 4 Apple 2lb. LIGHT / 12-inch RETINA DISPLAY) 5 Apple MacBook Pro (Late 2016 Version) 6 Asus EeeBook E202 7 Asus G752v 8 Asus Transformer Book T100HA 9 Asus Transformer Book Flip (TP200SA) 10 Dell Alienware 17 11 Dell Latitude 12 7000 Series (7275 12 Dell XPS 13 (2016) 13 Dell XPS 15 (2016) 14 Google Chromebook Pixel 15 HP Elite x2 1012 G1 16 HP EliteBook 840 G3 17 HP EliteBook Folio G1 18 HP Spectre x2 19 HP Spectre x360 20 HP Pavilion x2 21 Lenovo ThinkPad 13 22 Lenovo YOGA 900S 23 LG gram (15Z960) 24 MSI GS60 (MS-16H7) 25 Razer Blade Stealth (RZ09-0168) 26 Razer The New Razer Blade(2016) 27 Samsung Notebook 9 Pro 28 Toshiba Satellite Radius 12 29 Xiaomi Mi Notebook Air Smart Phones No Brand Name Model Name 1 ASUS ZenFone 3 2 ASUS ZenFone 3 Ultra 3 ASUS ZenFone 3 Deluxe 4 BLU Vivo 5 Dual SIM LTE 5 BLU Vivo XL 6 DOOGEE F7 Pro 7 Gionee Elife S Plus 8 Gionee S6 9 Gionee M5 Plus 10 Gionee Marathon M5 Plus 11 Google Nexus 5X 12 Google Nexus 6P 13 Google Pixel 14 Google Pixel XL 15 HTC HTC 10 evo 16 HTC HTC U Ultra 17 HTC HTC U Play 18 HTC HTC 10 Lifestyle 19 HTC M10 20 HTC HTC U11 21 Huawei Honor 22 Huawei Honor 8 23 Huawei Honor 9 24 Huawei Honor Magic 25 Huawei Hornor V9 26 Huawei Mate 9 27 Huawei Mate 9 Pro 28 Huawei Mate 9 Porsche Design 29 Huawei Nexus 6P 30 Huawei Nova2 31 Huawei P9 32 Huawei P10 33 Huawei P10 Plus 34 Huawei V8 35 Lenovo ZUK Z1(China) 36 Lenovo Zuk Z2 37 -

Changes and Continued Growth of Foreign Investment

The Top 20 Korean Multinationals: Changes and Continued Growth of Foreign Investment Seoul and New York, March 5, 2015 Graduate School of International Studies at Seoul National University in Seoul, and the Columbia Center on Sustainable Investment (CCSI), a joint center of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their survey of Korean multinationals today. The survey, conducted during 2014, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets.1 The research for this report was conducted in 2014 and covers the period from 2011 to 2013.2 Highlights In 2013, the top 20 Korean multinationals, ranked by their foreign assets (See Table 1), jointly held US$68.9 billion assets abroad.3 Most firms were subsidiaries of Korea’s eight leading business groups (or chaebols), including Samsung, POSCO, LG, Hyundai Heavy Industries, Hyundai-Kia Motors, SK, Lotte, and Hyosung Group. Five out of the 20 multinationals were also included in UNCTAD’s “Top 100 non-financial TNCs from developing and transition economies” in 2012.4 The average age of the top 20 firms is about 47 years, which is two times the average age of Korea’s top 1,000 firms (ranked in terms of total assets). There is a high concentration by the top players in the list in terms of foreign assets. Among the top 20 companies, Samsung Electronics, POSCO, and Hyundai Motor Company ranked in the top three in that order. There was a significant difference between first and second place, with the foreign assets of Samsung Electronics more than doubling that of POSCO. -

Statistics of Chinese SEP Cases in 2011-2019

Statistics of Chinese SEP Cases in 2011-2019 ZHAO Qishan, LU Zhe LexField Law Offices From 2011 to December 2019, Chinese courts accepted 160 cases related to SEPs. Most of the cases involve foreign entities and relate to the telecommunication industry. Most of the cases were filed with the courts in Beijing, Guangdong, Shanghai and Jiangsu. Most of the cases are patent infringement disputes, while cases asking the court to determine FRAND terms during license negotiations are also on the rise. This report includes a quantitative analysis from annual distribution, parties involved, geographic distribution of the courts, causes of action, adjudication progress and final outcomes, and also provides a particular summary of the SEP cases accepted in 2018 and 2019.1 From 2011 to 2019, Chinese courts have accepted over one hundred cases involving standard essential patents (“SEPs”) and Chinese judges have accumulated considerable judicial experience in hearing the cases. Aiming to provide a complete overview, this report analyzes information related to these SEP cases from various aspects based on the following methodology: (1) Scope of cases reviewed: The cases covered in the report are those accepted by civil courts in mainland China where the plaintiffs claimed or the defendants argued that the asserted patents were SEPs. Such cases are collectively referred to as "SEP cases" in this report. Cases that were withdrawn or dismissed due to the invalidation of asserted patents are also covered. (2) Time span: The cases included in the report are accepted by Chinese court from 2011 to December 2019. Since 2011, the number of Chinses SEP cases has gradually increased, and types of the cases have also become diversified. -

The Problem Faced and the Solution of Xiaomi Company in India

ISSN: 2278-3369 International Journal of Advances in Management and Economics Available online at: www.managementjournal.info RESEARCH ARTICLE The Problem Faced and the Solution of Xiaomi Company in India Li Kai-Sheng International Business School, Jinan University, Qianshan, Zhuhai, Guangdong, China. Abstract This paper mainly talked about the problem faced and the recommend solution of Xiaomi Company in India. The first two parts are introduction and why Xiaomi targeting at the India respectively. The third part is the three problems faced when Xiaomi operate on India, first is low brand awareness can’t attract consumes; second, lack of patent reserves and Standard Essential Patent which result in patent dispute; at last, the quality problems after-sales service problems which will influence the purchase intention and word of mouth. The fourth part analysis the cause of the problem by the SWOT analysis of Xiaomi. The fifth part is the decision criteria and alternative solutions for the problems proposed above. The last part has described the recommend solution, in short, firstly, make good use of original advantage and increase the advertising investment in spokesman and TV show; then, in long run, improve the its ability of research and development; next, increase the number of after-sales service staff and service centers, at the same, the quality of service; finally, train the local employee accept company’s culture, enhance the cross-culture management capability of managers, incentive different staff with different programs. Keywords: Cross-cultural Management, India, Mobile phone, Xiaomi. Introduction Xiaomi was founded in 2010 by serial faces different problem inevitably. -

RELEASE NOTES UFED PHYSICAL ANALYZER, Version 5.0 | March 2016 UFED LOGICAL ANALYZER

NOW SUPPORTING 19,203 DEVICE PROFILES +1,528 APP VERSIONS UFED TOUCH, UFED 4PC, RELEASE NOTES UFED PHYSICAL ANALYZER, Version 5.0 | March 2016 UFED LOGICAL ANALYZER COMMON/KNOWN HIGHLIGHTS System Images IMAGE FILTER ◼ Temporary root (ADB) solution for selected Android Focus on the relevant media files and devices running OS 4.3-5.1.1 – this capability enables file get to the evidence you need fast system and physical extraction methods and decoding from devices running OS 4.3-5.1.1 32-bit with ADB enabled. In addition, this capability enables extraction of apps data for logical extraction. This version EXTRACT DATA FROM BLOCKED APPS adds this capability for 110 devices and many more will First in the Industry – Access blocked application data with file be added in coming releases. system extraction ◼ Enhanced physical extraction while bypassing lock of 27 Samsung Android devices with APQ8084 chipset (Snapdragon 805), including Samsung Galaxy Note 4, Note Edge, and Note 4 Duos. This chipset was previously supported with UFED, but due to operating system EXCLUSIVE: UNIFY MULTIPLE EXTRACTIONS changes, this capability was temporarily unavailable. In the world of devices, operating system changes Merge multiple extractions in single unified report for more frequently, and thus, influence our support abilities. efficient investigations As our ongoing effort to continue to provide our customers with technological breakthroughs, Cellebrite Logical 10K items developed a new method to overcome this barrier. Physical 20K items 22K items ◼ File system and logical extraction and decoding support for iPhone SE Samsung Galaxy S7 and LG G5 devices. File System 15K items ◼ Physical extraction and decoding support for a new family of TomTom devices (including Go 1000 Point Trading, 4CQ01 Go 2505 Mm, 4CT50, 4CR52 Go Live 1015 and 4CS03 Go 2405). -

Technology 6 November 2017

INDUSTRY NOTE China | Technology 6 November 2017 Technology EQUITY RESEARCH China Summit Takeaway: AI, Semi, Smartphone Value Chain Key Takeaway We hosted several experts and 24 A/H corporates at our China Summit and Digital Disruption tour last week. Key takeaways: 1) AI shifting from central cloud to the edge (end devices), driving GPU/FPGA demand in near term, 2) AI leaders in China rolling out own ASICs in the next 2~3 years, 3) China's new role in semi, forging ahead in design and catching up in foundry. In smartphone value chain, maintain AAC as top pick for lens opportunity and Xiaomi strength. CHINA Artificial Intelligence - From cloud to edge computing: The rise of AI on the edge (terminal devices, like surveillance cameras, smartphones) from central cloud, can solve one key weakness of AI: the brains are located thousands of miles away from the applications. The benefits of AI on the edge include: 1) better analysis based on non-compressed raw data, which contains more information, 2) lower requirement on bandwidth, as transmitted data has been pre-processed, 3) faster response. This will keep driving the demands for GPUs and FPGAs in near term. Meanwhile, China's leading AI companies including Hikvision (002415 CH) and Unisound (private, leader in voice recognition) also noted they may develop own ASICs in the next 2~3 years, for better efficiency and low power. While machines getting smarter, we notice increasing concerns on data privacy. Governments are not only implementing Big Data laws and policies, also starts investing AI leaders, like Face ++ (computer vision) in China.