Technology 6 November 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China Equity Strategy

June 5, 2019 09:40 AM GMT MORGAN STANLEY ASIA LIMITED+ China Equity Strategy | Asia Pacific Jonathan F Garner EQUITY STRATEGIST [email protected] +852 2848-7288 The Rubio "Equitable Act" - Our Laura Wang EQUITY STRATEGIST [email protected] +852 2848-6853 First Thoughts Corey Ng, CFA EQUITY STRATEGIST [email protected] +852 2848-5523 Fran Chen, CFA A new bill sponsored by US Senator Marco Rubio has the EQUITY STRATEGIST potential to cause significant change in the listing domains of [email protected] +852 2848-7135 Chinese firms. After the market close in the US yesterday 4th June the Wall Street Journal published an Op-Ed by US Senator Marco Rubio in which he announced that he intends to sponsor the “Equitable Act” – an acronym for Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges. At this time the text of the bill has not been published and we are seeking additional information about its contents and likelihood of passing. However, our early reaction is that this has the potential to cause significant changes in the domain for listings of Chinese firms going forward with the potential for de- listing of Chinese firms on US exchanges and re-listing elsewhere (most likely Hong Kong). More generally we see this development as part of an increased escalation of tensions between China and the US on multiple fronts which should cap the valuation multiple for China equities, in particular in the offshore index constituents and US-listed parts of the universe. We provide a list of the potentially impacted China / HK names with either primary or secondary listings on Amex, NYSE or Nasdaq. -

Leading Chinese Cross-Border Brands – the Top 50

Leading Chinese cross-border brands The Top 50 kpmg.com/cn © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Contents Foreword: KPMG & Facebook 2 Executive summary 4 Methodology 6 Top 50 Chinese global brands 8 Survey commentary 10 Chinese brands going global – business opportunities for SMEs 32 • Thought leader: Yan Zhu, Head, Institute of Internet Industry, Tsinghua University 34 Going global and ensuring market diversification 36 Customer centricity 44 Thought leaders 58 • Kaitian Zeng, Co-founder, 37 Interactive Entertainment 58 • Yue Leng, General Manager, Tmall Global, Alibaba Group 59 • Scott Thiel, Partner, DLA Piper 60 • Gu He, Vice President, Shenzhen Globalegrow E-Commerce Co., Ltd. 62 • Chibo Tang, Managing Director, Gobi Partners 63 • Ethan Wang, Vice President, NetEase 64 • Scott Kronick, Chief Executive, Public Relations & Influence, Asia, Ogilvy 65 • Alen Wu, Vice President, OPPO Mobile; Head of Business, Overseas Markets 66 • Beehong Hong, General Manager, Brand Management Centre, TRANSSION Holdings 67 Acknowledgements 68 About us 69 Contact us 70 Leading Chinese cross-border brands: The Top 50 1 © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. © 2018 KPMG, a Hong Kong partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Foreword Global trade has long been a hallmark of Chinese business culture. -

2020 Interim Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (incorporated in Hong Kong under the Companies Ordinance with limited liability) (Stock code: 285) 2020 INTERIM RESULTS ANNOUNCEMENT The Board of Directors of the Company (the “Board”) is pleased to announce the unaudited results of the Company and its subsidiaries for the six months period ended 30 June 2020. This announcement, containing the full text of the 2020 Interim Report of the Company, is prepared with reference to the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of interim results. Printed version of the Company’s 2020 Interim Report will be delivered to the Company’s shareholders and is also available for viewing on the websites of Hong Kong Exchanges and Clearing Limited at http://www.hkex.com.hk and of the Company at http://www.byd-electronics.com. By Order of the Board of BYD Electronic (International) Company Limited WANG Nian-qiang Director Hong Kong, 28 August 2020 As at the date of this announcement, the executive Directors of the Company are Mr. WANG Nian- qiang and Mr. JIANG Xiang-rong; the non-executive Directors are Mr. WANG Chuan-fu and Mr. WANG Bo; and the independent non-executive Directors are Mr. -

Site List Fashion, Food & Home

SITE LIST FASHION, FOOD & HOME MARCH 2020 The John Lewis Partnership’s relationships with its suppliers are based on honesty, fairness, courtesy and promptness. In return, the Partnership expects its suppliers to obey the law and to respond the wellbeing of their employees, local communities and the environment. The sites featured in the list below are John Lewis & Partners suppliers’ production sites which represent 100% of John Lewis & Partners’ branded product. Region Number of Sites Africa 23 Americas 14 Arab States 1 Asia Pacific 1195 Europe & Central Asia 526 United Kingdom 548 Total 2307 Active Union or Product No. of Female Male Site Name Address Country Worker Category Workers Worker % Worker % Committee Afa 3 Calzatura Sh.P.K. Velabisht, Beral, Albania Fashion 221 73% 27% Yes Weingut Rabl Weraingraben 10, Langenlois Austria Food 20 25% 75% No Weingut Markus Hurber Cmbh & Cokg Rechersdorf An Der Traisen, Weinriedenweg 13 Austria Food * No Akh Fashions 133-134 Hemayetpur, Savar, Dhaka, Dhaka 1340 Bangladesh Fashion 1222 65% 35% Yes Aman Graphics & Designs Ltd Najim Nagar, Dhaka, Savar Bangladesh Fashion 3804 60% 40% Yes Aman Knittings Ltd Kulashur, Hemayetpur, Dhaka, Savar Bangladesh Fashion 1715 46% 54% Yes Bando Eco Apparels Ld. Plot #188/2, Block G-A, Chanpur, Amin Bazar, Savar, Dhaka, Dhaka, Dhaka Bangladesh Fashion 1200 53% 47% Yes Basic Shirts Ltd Plot # 341, Majukhan, Po: Harbaid, Ps Gazipur Sadar, Gazipur Bangladesh Fashion 2410 70% 30% Yes Direct Sports & Leisurewear (Bd) Limited Plot No. S.A. 07, 08, R.S. 11, 12, 13 Karamtola Pubail Gazipur, Dhaka, Bangladesh Fashion 374 65% 35% No Energypac Fashion Ltd. -

Final Study Report on CEF Automated Translation Value Proposition in the Context of the European LT Market/Ecosystem

Final study report on CEF Automated Translation value proposition in the context of the European LT market/ecosystem FINAL REPORT A study prepared for the European Commission DG Communications Networks, Content & Technology by: Digital Single Market CEF AT value proposition in the context of the European LT market/ecosystem Final Study Report This study was carried out for the European Commission by Luc MEERTENS 2 Khalid CHOUKRI Stefania AGUZZI Andrejs VASILJEVS Internal identification Contract number: 2017/S 108-216374 SMART number: 2016/0103 DISCLAIMER By the European Commission, Directorate-General of Communications Networks, Content & Technology. The information and views set out in this publication are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. ISBN 978-92-76-00783-8 doi: 10.2759/142151 © European Union, 2019. All rights reserved. Certain parts are licensed under conditions to the EU. Reproduction is authorised provided the source is acknowledged. 2 CEF AT value proposition in the context of the European LT market/ecosystem Final Study Report CONTENTS Table of figures ................................................................................................................................................ 7 List of tables .................................................................................................................................................. -

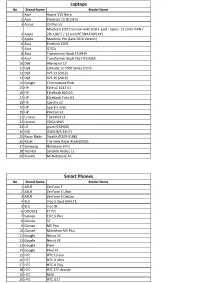

Type-C Compatible Device List 1.Xlsx

Laptops No Brand Name Model Name 1 Acer Aspire V15 Nitro 2 Acer Predator 15 (N15P3) 3 Aorus X3 Plus v5 MacBook (2015 version with USB-C port - Specs: 13.1mm THIN / 4 Apple 2lb. LIGHT / 12-inch RETINA DISPLAY) 5 Apple MacBook Pro (Late 2016 Version) 6 Asus EeeBook E202 7 Asus G752v 8 Asus Transformer Book T100HA 9 Asus Transformer Book Flip (TP200SA) 10 Dell Alienware 17 11 Dell Latitude 12 7000 Series (7275 12 Dell XPS 13 (2016) 13 Dell XPS 15 (2016) 14 Google Chromebook Pixel 15 HP Elite x2 1012 G1 16 HP EliteBook 840 G3 17 HP EliteBook Folio G1 18 HP Spectre x2 19 HP Spectre x360 20 HP Pavilion x2 21 Lenovo ThinkPad 13 22 Lenovo YOGA 900S 23 LG gram (15Z960) 24 MSI GS60 (MS-16H7) 25 Razer Blade Stealth (RZ09-0168) 26 Razer The New Razer Blade(2016) 27 Samsung Notebook 9 Pro 28 Toshiba Satellite Radius 12 29 Xiaomi Mi Notebook Air Smart Phones No Brand Name Model Name 1 ASUS ZenFone 3 2 ASUS ZenFone 3 Ultra 3 ASUS ZenFone 3 Deluxe 4 BLU Vivo 5 Dual SIM LTE 5 BLU Vivo XL 6 DOOGEE F7 Pro 7 Gionee Elife S Plus 8 Gionee S6 9 Gionee M5 Plus 10 Gionee Marathon M5 Plus 11 Google Nexus 5X 12 Google Nexus 6P 13 Google Pixel 14 Google Pixel XL 15 HTC HTC 10 evo 16 HTC HTC U Ultra 17 HTC HTC U Play 18 HTC HTC 10 Lifestyle 19 HTC M10 20 HTC HTC U11 21 Huawei Honor 22 Huawei Honor 8 23 Huawei Honor 9 24 Huawei Honor Magic 25 Huawei Hornor V9 26 Huawei Mate 9 27 Huawei Mate 9 Pro 28 Huawei Mate 9 Porsche Design 29 Huawei Nexus 6P 30 Huawei Nova2 31 Huawei P9 32 Huawei P10 33 Huawei P10 Plus 34 Huawei V8 35 Lenovo ZUK Z1(China) 36 Lenovo Zuk Z2 37 -

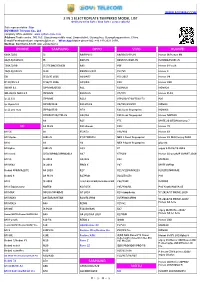

2 in 1 Electroplate Tempered Model List Iphone Samsung

WWW.BOYIMAX.COM 2 IN 1 ELECTROPLATE TEMPERED MODEL LIST Ordinary white light / blue light / aurora colorful Sale representative :Star BOYIMAX® Telecom Co., Ltd company office website: www.i-phonecase.com Address:Trade centra , NO.163, Qiaozhong middle road, Liwan distirct, Guangzhou, Guangdong province, China. E-mail/Facebook/skype: [email protected] ,WhatsApp/Mobile phone NO.:+86 189 2621 0199, WeChat: BOYIMAX-STAR ,QQ: 2233234410 IPHONE SAMSUNG OPPO VIVO HUAWEI 6G(4.7)/6S J2 R9/FIPLUS X9/X9S/V5PLUS Honor 9I/Honor 9N 6G(5.5)/6SPLUS J5 R9PLUS X9SPLUS/X9PLUS P20PRO/P20PLUS 7G(4.7)/8G J7/J7CORE/J7NEO R9S Y66 Honor 9 Youth 7G(5.5)/8PLUS J120 R9SPLUS/F3P Y67/V5 Honor 9 5G J510/J5 2016 A39/A57 Y53 2017 Honor V9 IP 8X/XS 5.8 J710/J7 2016 A59/FIS X20 Honor V10 9G/XR 6.1 J2PRIME/G530 R11 X20PLUS NOVA2S 9PLUS/XS MAX 6.5 J5PRIME R11PLUS V7/Y75 Honor PLAY ip 11 6.1 J7PRIME R11S V7PLUS/Y79/Y75S/Y73 P20 ip 11pro 5.8 J3PRO/J330 R11SPLUS V9/Y85/Z1\Z3X NOVA3 ip 11 pro max J5PRO/J530 A79 X21 back fingerprint NOVA3I J7PRO/J730/J7PLUS A83/A1 X21 front fingerprint Honor NOTE10 A8 R15 Y71 MATE 20 LITE/Maimang 7 MI A8 PLUS R15 dream X21I Honor 7X MI 5X S8 F5/A73 Y83/Y81 Honor 8X MI 5Splus S8PLUS F7/F7YOUTH NEX S front fingerprint Honor 8X MAX/enjoy MAX MI 6 S9 A3 NEX A back fingerprint play 8C MI 6plus S9PLUS A33 X7 enjoy 9 PLUS/Y9 2019 MI note3 J250/J2PRO/J2PRO2018 A37 X7PLUS Honor 10 youth/P SMART 2019 MI 5S J4 2018 A5/A3S X23 MATE20 MI MIX2 J6 2018 FIND X Y97 MATE20PRO Redmi 6PRO/A2LITE A6 2018 R17 V11/V11PRO/X21S P20LITE/NOVA3E Redmi 6 A6 PLUS R17PRO V11I/Z3I/Z3 -

Statistics of Chinese SEP Cases in 2011-2019

Statistics of Chinese SEP Cases in 2011-2019 ZHAO Qishan, LU Zhe LexField Law Offices From 2011 to December 2019, Chinese courts accepted 160 cases related to SEPs. Most of the cases involve foreign entities and relate to the telecommunication industry. Most of the cases were filed with the courts in Beijing, Guangdong, Shanghai and Jiangsu. Most of the cases are patent infringement disputes, while cases asking the court to determine FRAND terms during license negotiations are also on the rise. This report includes a quantitative analysis from annual distribution, parties involved, geographic distribution of the courts, causes of action, adjudication progress and final outcomes, and also provides a particular summary of the SEP cases accepted in 2018 and 2019.1 From 2011 to 2019, Chinese courts have accepted over one hundred cases involving standard essential patents (“SEPs”) and Chinese judges have accumulated considerable judicial experience in hearing the cases. Aiming to provide a complete overview, this report analyzes information related to these SEP cases from various aspects based on the following methodology: (1) Scope of cases reviewed: The cases covered in the report are those accepted by civil courts in mainland China where the plaintiffs claimed or the defendants argued that the asserted patents were SEPs. Such cases are collectively referred to as "SEP cases" in this report. Cases that were withdrawn or dismissed due to the invalidation of asserted patents are also covered. (2) Time span: The cases included in the report are accepted by Chinese court from 2011 to December 2019. Since 2011, the number of Chinses SEP cases has gradually increased, and types of the cases have also become diversified. -

Ew 01357AR-25032021.Pdf

Contents Annual Report 2020 Contents Contents CORPORATE INFORMATION 2 2020 HIGHLIGHTS 4 KEY FINANCIAL DATA OF CONTINUING OPERATIONS 5 KEY OPERATIONAL DATA OF CONTINUING OPERATIONS 6 CHAIRMAN’S STATEMENT 7 MANAGEMENT DISCUSSION AND ANALYSIS 10 DIRECTORS AND SENIOR MANAGEMENT 21 REPORT OF THE DIRECTORS 28 CORPORATE GOVERNANCE REPORT 61 ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT 78 INDEPENDENT AUDITOR’S REPORT 109 CONSOLIDATED INCOME STATEMENT 115 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 116 CONSOLIDATED BALANCE SHEET 117 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 119 CONSOLIDATED STATEMENT OF CASH FLOWS 121 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 123 FIVE YEAR FINANCIAL SUMMARY 216 DEFINITIONS 217 1 Corporate Information MEITU, INC. Corporate Information BOARD OF DIRECTORS AUDITOR PricewaterhouseCoopers Executive Directors Certified Public Accountants Mr. CAI Wensheng (Chairman of the Board) Registered Public Interest Entity Auditor Mr. WU Zeyuan (also known as: Mr. WU Xinhong) REGISTERED OFFICE Non-Executive Directors The offices of Conyers Trust Company (Cayman) Limited Dr. GUO Yihong Cricket Square, Hutchins Drive Dr. LEE Kai-fu PO Box 2681 Mr. CHEN Jiarong Grand Cayman, KY1-1111 Cayman Islands Independent Non-Executive Directors Mr. ZHOU Hao HEADQUARTERS Mr. LAI Xiaoling 1-3/F, Block 2 Mr. ZHANG Ming (also known as: Mr. WEN Chu) Building No. 6, Wanghai Road Ms. KUI Yingchun Siming District Xiamen, Fujian AUDIT COMMITTEE PRC Mr. ZHOU Hao (Chairman) Dr. GUO Yihong PRINCIPAL PLACE OF BUSINESS Mr. LAI Xiaoling IN HONG KONG Room 8106B, Level 81 REMUNERATION COMMITTEE International Commerce Centre Mr. LAI Xiaoling (Chairman) 1 Austin Road West Dr. LEE Kai-fu Kowloon Mr. ZHANG Ming (also known as: Mr. -

Meitu, Inc. 美图公司 (Incorporated in the Cayman Islands with Limited Liability and Carrying on Business in Hong Kong As “美圖之家”) (Stock Code: 1357)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Meitu, Inc. 美图公司 (Incorporated in the Cayman Islands with limited liability and carrying on business in Hong Kong as “美圖之家”) (Stock Code: 1357) INSIDE INFORMATION AND PROFIT WARNING This announcement is made by Meitu, Inc. (the “Company”, together with its subsidiaries and Xiamen Meitu Networks Technology Co., Ltd. and its subsidiaries, collectively the “Group”, “we” or “us”) pursuant to Rule 13.09(2)(a) of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and the Inside Information Provisions (as defined under the Listing Rules) under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). INSIDE INFORMATION REGARDING THE GROUP'S SMART HARDWARE BUSINESS The board (the “Board”) of directors (the “Directors”) of the Company is pleased to announce that on November 19, 2018, the Company and Xiaomi Corporation (a company incorporated in the Cayman Islands with limited liability and listed on the Main Board of The Stock Exchange of Hong Kong Limited with stock code: 1810) (“Xiaomi”) entered into a strategic cooperation framework agreement (the “Strategic Cooperation Agreement”). While the Group remains committed to grow the Meitu branded smartphones and other smart hardware business, the Board has determined that it is in the Group's interests to operate this business by way of cooperating with a partner with the scale and reach of Xiaomi. -

The Problem Faced and the Solution of Xiaomi Company in India

ISSN: 2278-3369 International Journal of Advances in Management and Economics Available online at: www.managementjournal.info RESEARCH ARTICLE The Problem Faced and the Solution of Xiaomi Company in India Li Kai-Sheng International Business School, Jinan University, Qianshan, Zhuhai, Guangdong, China. Abstract This paper mainly talked about the problem faced and the recommend solution of Xiaomi Company in India. The first two parts are introduction and why Xiaomi targeting at the India respectively. The third part is the three problems faced when Xiaomi operate on India, first is low brand awareness can’t attract consumes; second, lack of patent reserves and Standard Essential Patent which result in patent dispute; at last, the quality problems after-sales service problems which will influence the purchase intention and word of mouth. The fourth part analysis the cause of the problem by the SWOT analysis of Xiaomi. The fifth part is the decision criteria and alternative solutions for the problems proposed above. The last part has described the recommend solution, in short, firstly, make good use of original advantage and increase the advertising investment in spokesman and TV show; then, in long run, improve the its ability of research and development; next, increase the number of after-sales service staff and service centers, at the same, the quality of service; finally, train the local employee accept company’s culture, enhance the cross-culture management capability of managers, incentive different staff with different programs. Keywords: Cross-cultural Management, India, Mobile phone, Xiaomi. Introduction Xiaomi was founded in 2010 by serial faces different problem inevitably. -

RELEASE NOTES UFED PHYSICAL ANALYZER, Version 5.0 | March 2016 UFED LOGICAL ANALYZER

NOW SUPPORTING 19,203 DEVICE PROFILES +1,528 APP VERSIONS UFED TOUCH, UFED 4PC, RELEASE NOTES UFED PHYSICAL ANALYZER, Version 5.0 | March 2016 UFED LOGICAL ANALYZER COMMON/KNOWN HIGHLIGHTS System Images IMAGE FILTER ◼ Temporary root (ADB) solution for selected Android Focus on the relevant media files and devices running OS 4.3-5.1.1 – this capability enables file get to the evidence you need fast system and physical extraction methods and decoding from devices running OS 4.3-5.1.1 32-bit with ADB enabled. In addition, this capability enables extraction of apps data for logical extraction. This version EXTRACT DATA FROM BLOCKED APPS adds this capability for 110 devices and many more will First in the Industry – Access blocked application data with file be added in coming releases. system extraction ◼ Enhanced physical extraction while bypassing lock of 27 Samsung Android devices with APQ8084 chipset (Snapdragon 805), including Samsung Galaxy Note 4, Note Edge, and Note 4 Duos. This chipset was previously supported with UFED, but due to operating system EXCLUSIVE: UNIFY MULTIPLE EXTRACTIONS changes, this capability was temporarily unavailable. In the world of devices, operating system changes Merge multiple extractions in single unified report for more frequently, and thus, influence our support abilities. efficient investigations As our ongoing effort to continue to provide our customers with technological breakthroughs, Cellebrite Logical 10K items developed a new method to overcome this barrier. Physical 20K items 22K items ◼ File system and logical extraction and decoding support for iPhone SE Samsung Galaxy S7 and LG G5 devices. File System 15K items ◼ Physical extraction and decoding support for a new family of TomTom devices (including Go 1000 Point Trading, 4CQ01 Go 2505 Mm, 4CT50, 4CR52 Go Live 1015 and 4CS03 Go 2405).