2Q 21 Earnings Release IR Presentation LG Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

View Complaint

Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 1 of 19 PageID #: 81 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE DELAWARE DISPLAY GROUP LLC § and INNOVATIVE DISPLAY § TECHNOLOGIES LLC, § § C.A. No. 15-cv-1221-RGA § Plaintiffs, § JURY TRIAL DEMANDED § v. § § LG ELECTRONICS, INC., § LG ELECTRONICS U.S.A., INC., § LG ELECTRONICS MOBILECOMM § U.S.A., INC.,LG DISPLAY CO., LTD., § and LG DISPLAY AMERICA, INC. § § § Defendants. § PLAINTIFFS’ FIRST AMENDED COMPLAINT Delaware Display Group LLC and Innovative Display Technologies LLC (collectively, “Plaintiffs”) by and through their undersigned counsel, file this First Amended Complaint against LG Electronics, Inc.; LG Electronics U.S.A., Inc.; LG Electronics Mobilecomm U.S.A., Inc., LG Display Co., Ltd.; and LG Display America, Inc. (collectively, “LG”) THE PARTIES 1. Delaware Display Group LLC (“DDG”) is a Delaware limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 2. Innovative Display Technologies LLC (“IDT”) is a Texas limited liability company with its principal place of business located at 2400 Dallas Parkway, Suite 200, Plano, Texas 75093. 1 Case 1:15-cv-01221-RGA Document 4 Filed 03/24/16 Page 2 of 19 PageID #: 82 3. Upon information and belief, LG Electronics, Inc. (“LG Electronics”) is a corporation in South Korea located at LG Twin Tower 128, Yeoui-daero, Yeongdeungpo-gu, Seoul, Korea, 150-721, South Korea. Upon information and belief, LG Electronics may be served with process in South Korea pursuant to the Hague Convention on the Service Abroad of Judicial and Extrajudicial Documents in Civil or Commercial Matters. -

Business Year from January 1, 2019 to June 30, 2019 to the Financial

Semi-annual Business Report (The 21st Year) Business year from January 1, 2019 to June 30, 2019 To The Financial Services Commission Korea Stock Exchange August 13, 2019 Type of corporation for submission: Stock-listed Corporation Occurrence of exemption: N/A Company Name: Silicon Works Co., Ltd. Representative Director: Boik Son Address of the Headquarter: 222 Techno 2-ro, Yuseong-gu, Daejeon, Korea (Tel.) 02-3777-1114 (Website) http://www.siliconworks.co.kr Responsible personnel of the report: (Position) CFO (Name) Sung Kwan Choi (Tel.) 02-3774-1114 【Confirmation by CEO】 Confirmation and Signature of CEO Letter of Confirmation We, CEO of the company and a director of reporting, have checked and reviewed this report thoroughly and confirm that all the important matters to be provided have been given without omission, or falsification, and that there is no content inducing critical misunderstanding to the readers of this report. Furthermore, we hereby confirm that the company has established and run its internal accounting management system based on Article 8 of the [Act on External Auditors of Stock Companies]. August 13, 2019 Silicon Work Co., Ltd. CEO Boik Son (Signature) Director of Reporting Sung Kwan Choi (Signature) 2 I. Company Overview 1. Company Overview A. Outline of subsidiaries to be consolidated (Unit: KRW) Company Date of Main Total asset at Basis of controlling Major Address name establishment businesses the end of the relationship subsidiary previous year Find and Control over the 2540 N. 1st Silicon open new investee St, #250 San Works October 15, markets and 298,468,756 (consolidated Jose, CA N/A Inc. -

View Annual Report

As filed with the Securities and Exchange Commission on April 30, 2014 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F (Mark One) REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report For the transition period from to Commission file number 1-32238 LG Display Co., Ltd. (Exact name of Registrant as specified in its charter) LG Display Co., Ltd. (Translation of Registrant’s name into English) The Republic of Korea (Jurisdiction of incorporation or organization) LG Twin Towers, 128 Yeoui-daero, Yeongdeungpo-gu, Seoul 150-721, Republic of Korea (Address of principal executive offices) Suk Heo LG Twin Towers, 128 Yeoui-daero, Yeongdeungpo-gu, Seoul 150-721, Republic of Korea Telephone No.: +82-2-3777-1010 Facsimile No.: +82-2-3777-0797 (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange on which registered American Depositary Shares, each representing one-half New York Stock Exchange of one share of Common Stock Common Stock, par value ₩5,000 per share New York Stock Exchange* * Not for trading, but only in connection with the registration of the American Depositary Shares. -

Korean Multinationals Show Solid Recovery After Global Crisis

Korean multinationals show solid recovery after global crisis Report dated November 16, 2010 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before November 16, 2010, 10:00 a.m. Seoul; 1 a.m. GMT, and 9:00 p.m. November 15, 2010, New York. Seoul and New York, November 16, 2010 The Institute of International Affairs of the Graduate School of International Studies (GSIS) at Seoul National University in Seoul, and the Vale Columbia Center on Sustainable International Investment (VCC) at Columbia University in New York, are releasing the first annual report on leading Korean multinationals. The research for this report was conducted in 2010 and covers the period 2007 to 2009. 1 Highlights The Republic of Korea (henceforth ‘Korea’), the 11 th largest economy in the world, has now become one of the leading investors abroad. The number and the size of the corporate giants that dominate the economy have increased over the years, boosting and diversifying their investments around the world. Korea’s multinational enterprises ranked by their foreign assets (see table 1 below) show about USD 93 billion in assets held abroad. 2 Samsung Electronics Co., Ltd. (SEC), a member of a leading Korean conglomerate, ranked 1 st with slightly over USD 18 billion, followed by another top conglomerate member, LG Electronics, with over USD 10 billion dollars. Hyundai Heavy Industries Co., Ltd, and DSME Co., Ltd, had foreign assets of over USD 8 billion each and LG Display had over USD 6 billion. The top five firms together accounted for just over half of the total foreign assets of the top 20 companies. -

Changes and Continued Growth of Foreign Investment

The Top 20 Korean Multinationals: Changes and Continued Growth of Foreign Investment Seoul and New York, March 5, 2015 Graduate School of International Studies at Seoul National University in Seoul, and the Columbia Center on Sustainable Investment (CCSI), a joint center of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their survey of Korean multinationals today. The survey, conducted during 2014, is part of a long-term study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets.1 The research for this report was conducted in 2014 and covers the period from 2011 to 2013.2 Highlights In 2013, the top 20 Korean multinationals, ranked by their foreign assets (See Table 1), jointly held US$68.9 billion assets abroad.3 Most firms were subsidiaries of Korea’s eight leading business groups (or chaebols), including Samsung, POSCO, LG, Hyundai Heavy Industries, Hyundai-Kia Motors, SK, Lotte, and Hyosung Group. Five out of the 20 multinationals were also included in UNCTAD’s “Top 100 non-financial TNCs from developing and transition economies” in 2012.4 The average age of the top 20 firms is about 47 years, which is two times the average age of Korea’s top 1,000 firms (ranked in terms of total assets). There is a high concentration by the top players in the list in terms of foreign assets. Among the top 20 companies, Samsung Electronics, POSCO, and Hyundai Motor Company ranked in the top three in that order. There was a significant difference between first and second place, with the foreign assets of Samsung Electronics more than doubling that of POSCO. -

LG Energy Solution, Ltd. and Subsidiaries Consolidated Statements of Financial Position December 31, 2020

LG Energy Solution, Ltd. and Subsidiaries Consolidated Statements of Financial Position December 31, 2020 (in millions of Korean won) Notes December 31, 2020 Assets Current assets Cash and cash equivalents 3, 5, 6 1,493,145 Trade receivables 3, 5, 7, 30 2,931,150 Other receivables 3, 5, 7, 30 819,075 Other current financial assets 3, 5, 8 23,821 Prepaid income taxes 14,944 Other current assets 13 401,600 Inventories 9 3,043,138 Assets held for sale 34 358,833 Total current assets 9,085,706 Non-current assets Trade receivables 3, 5, 7 26,291 Other receivables 3, 5, 7 81,585 Investments in associates and joint ventures 1, 10, 32 48,350 Deferred tax assets 27 1,356,096 Property, plant and equipment 11 8,683,614 Intangible assets 12 325,786 Investment properties 36 255,086 Other non-current assets 13 79,281 Total non-current assets 10,856,089 Total assets 19,941,795 Liabilities Current liabilities Trade payables 3, 5, 30 2,592,309 Other payables 3, 5, 30 1,768,709 Borrowings 3, 5, 14 1,123,038 Provisions 15 997,209 Income tax payables 27 73,762 Other current liabilities 17 334,058 Liabilities held for sale 34 142 Total current liabilities 6,889,227 Non-current liabilities Other payables 3, 5 5,849 Borrowings 3, 5, 14 5,036,286 Other non-current financial liabilities 3, 5, 8 41,768 Provisions 15 242,635 Net defined benefit liabilities 16 42,786 Deferred tax liabilities 27 27,463 Other non-current liabilities 17 90,376 Total non-current liabilities 5,487,163 Total liabilities 12,376,390 4 LG Energy Solution, Ltd. -

Schedule of Investments (Unaudited) Blackrock Advantage Emerging Markets Fund January 31, 2021 (Percentages Shown Are Based on Net Assets)

Schedule of Investments (unaudited) BlackRock Advantage Emerging Markets Fund January 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Security Shares Value Common Stocks China (continued) China Life Insurance Co. Ltd., Class H .................. 221,000 $ 469,352 Argentina — 0.0% China Longyuan Power Group Corp. Ltd., Class H ....... 52,000 76,119 (a) 313 $ 60,096 Globant SA .......................................... China Mengniu Dairy Co. Ltd.(a) ......................... 15,000 89,204 Brazil — 4.9% China Merchants Bank Co. Ltd., Class H ................ 36,000 275,683 Ambev SA ............................................. 236,473 653,052 China Overseas Land & Investment Ltd.................. 66,500 151,059 Ambev SA, ADR ....................................... 94,305 263,111 China Pacific Insurance Group Co. Ltd., Class H......... 22,000 90,613 B2W Cia Digital(a) ...................................... 20,949 315,188 China Railway Group Ltd., Class A ...................... 168,800 138,225 B3 SA - Brasil Bolsa Balcao............................. 33,643 367,703 China Resources Gas Group Ltd. ....................... 30,000 149,433 Banco do Brasil SA..................................... 15,200 94,066 China Resources Land Ltd. ............................. 34,000 134,543 BRF SA(a).............................................. 22,103 85,723 China Resources Pharmaceutical Group Ltd.(b) .......... 119,500 62,753 BRF SA, ADR(a) ........................................ 54,210 213,045 China Vanke Co. Ltd., Class A .......................... 67,300 289,157 Cia de Saneamento de Minas Gerais-COPASA .......... 52,947 150,091 China Vanke Co. Ltd., Class H .......................... 47,600 170,306 Duratex SA ............................................ 19,771 71,801 CITIC Ltd............................................... 239,000 186,055 Embraer SA(a).......................................... 56,573 90,887 Contemporary Amperex Technology Co. Ltd., Class A .... 1,700 92,204 Gerdau SA, ADR ...................................... -

Quarterly Report (The 21St Year) Business Year from January 1, 2019

Quarterly Report (The 21st Year) Business year from January 1, 2019 to September 30, 2019 To the Financial Services Commission Korea Stock Exchange November 13, 2019 Type of corporation for submission: Stock-listed Corporation Occurrence of exemption: N/A Company Name: Silicon Works Co., Ltd. Representative Director: Boik Son Address of the Headquarter: 222 Techno 2-ro, Yuseong-gu, Daejeon, Korea (Tel.) 02-3777-1114 (Website) http://www.siliconworks.co.kr Responsible personnel of the report: (Position) CFO (Name) Sung Kwan Choi (Tel.) 02-3774-1114 【Confirmation by CEO】 Confirmation and Signature of CEO Letter of Confirmation We, CEO of the company and a director of reporting, have checked and reviewed this report thoroughly and confirm that all the important matters to be provided have been given without omission, or falsification, and that there is no content inducing critical misunderstanding to the readers of this report. Furthermore, we hereby confirm that the company has established and run its internal accounting management system based on Article 8 of the [Act on External Auditors of Stock Companies]. Novemebr 13, 2019 Silicon Work Co., Ltd. CEO Boik Son (Signature) Director of Reporting Sung Kwan Choi (Signature) I. Company Overview 1. Company Overview A. Outline of subsidiaries to be consolidated (Unit: KRW) Company Date of Main Total asset at Basis of controlling Major Address name establishment businesses the end of the relationship subsidiary previous year Control over the Find and open Silicon investee 2952 BUNKER new markets Works October 15, 298,468,756 (consolidated HILL LN #101 and support N/A Inc. 2012 SANTA CLARA, financial statements existing (USA) CA 95054 paragraph 5 to 18 of customers K-IFRS No. -

Corporate Sustainable Management and Capital Market: Evidence from Data on Korean Firms

August 2016;1(1):56-66 http://dx.doi.org/10.20522/APJBR.2016.1.1.56 Corporate Sustainable Management and Capital Market: Evidence from Data on Korean Firms Young Sik Kim School of Management, Kyung Hee University Ki Bum Park* Department of music education, Chuncheon National University of Education Abstract This paper analyzes the impact of CSR on the capital market in Korea. Using listed firm data, we found that the creation of a sustainability report that indirectly measures the level of CSR can bring the stock rate of return difference of the capital markets representative market index. First, when a firm that publishes a sustainability report was compared in terms of its market rate of return, it showed a return increase of about 2%. We found that higher returns were gained through the competitive advantage of related business when the firm was actively involved in social responsibility. Second, subdivided by industry, firms belonging to the capital goods industry were found to reach a rate of return higher than that of industry. These firms were noticeable in that they were mainly industries that caused environmental pollution. Third, in an additional analysis, foreign investors were given the sustainability report of financial businesses, which was interpreted as a result of industrial properties. A sustainability report is a comprehensive report on the economic, environmental, and social activities of a firm. Firms must learn that they can gain trust through publishing trustworthy reports while achieving the lasting power of growth from the stakeholders. Keywords Sustainability report, CSR, Capital market, GRI, Stock return 1) 1. -

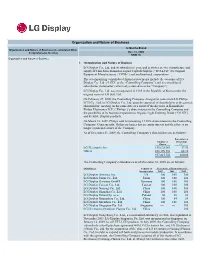

Organization and Nature of Business LG Display Co., Ltd. and Its

Organization and Nature of Business 12 Months Ended Organization and Nature of Business (Accumulated Other Comprehensive Income) Dec. 31, 2009 KRW (?) Organization and Nature of Business 1. Organization and Nature of Business LG Display Co., Ltd. and its subsidiaries’ principal activities are the manufacture and supply of Thin Film Transistor Liquid Crystal Displays (“TFT-LCD”) to Original Equipment Manufacturers (“OEMs”) and multinational corporations. The accompanying consolidated financial statements include the accounts of LG Display Co., Ltd. (“LGD” or the “Controlling Company”) and its consolidated subsidiaries (hereinafter collectively referred to as the “Company”). LG Display Co., Ltd. was incorporated in 1985 in the Republic of Korea under the original name of LG Soft, Ltd. On February 29, 2008, the Controlling Company changed its name from LG.Philips LCD Co., Ltd. to LG Display Co., Ltd. upon the approval of shareholders at the general shareholders’ meeting on the same date as a result of the decrease in Koninklijke Philips Electronics N.V. (“Philips”)’s share interest in the Controlling Company and the possibility of its business expansion to Organic Light Emitting Diode (“OLED”) and Flexible Display products. On March 16, 2009, Philips sold its remaining 13.20% share interest in the Controlling Company. Consequently, Philips no longer has an equity interest and therefore is no longer a principal owner of the Company. As of December 31, 2009, the Controlling Company’s shareholders are as follows: Percentage of Number of Ownership Shares (%) LG Electronics Inc. 135,625,000 37.90 Others 222,190,700 62.10 357,815,700 100.00 The Controlling Company’s subsidiaries as of December 31, 2009 are as follows: Subsidiaries Country of Percentage of Ownership (%) Incorporation 2007 2008 2009 LG Display America, Inc. -

Korea Companies in US with Products

Multinational Corporations to Be Given Rights Beyond the Rights of U.S. Companies Under the Korea Free Trade Agreement Source: Uniworld & Public Citizen Rep. Last District Company Address Rep. First Name Name Party State Product Description 4600 Postmark Dr., # NB 216, Anchorage, AK AK-00 KOREAN AIR 99502-1038 Donald Young R AK International passenger and cargo air transport. HYUNDAI MOTOR MANUFACTURING AL-02 ALABAMA, LLC 700 Hyundai Blvd., Montgomery, AL 36105-9622 Bobby Bright D AL Mfr., sales and service of automobiles. Mfr. automobile parts specializing in internationally competitive state-of-the-art chassis AL-03 MANDO AMERICA CORPORATION 4201 North Park Dr., Opelika, AL 36801-9667 Michael Rogers R AL components and systems. 2312 Center Hill Dr., Ste. A, Opelika, AL 36801- Mfr. quartz countertop surfaces and interior AL-03 HANWHA L&C ALABAMA, LLC 7279 Michael Rogers R AL building materials. Mfr. tires, steel products, electronics, AL-05 HYOSUNG USA, INC. 500 19th Ave. SE, Decatur, AL 35601-3424 Parker Griffith R AL fabrics/yarns, and musical instruments. 201 James Record Rd., Huntsville, AL 35824- Technology services; consumer electronics, home AL-05 LG ELECTRONICS ALABAMA INC. (LGEAI) 1513 Parker Griffith R AL appliances and mobile communications. AL-05 EKO PEROXIDE LLC 1455 Redhat Rd., Decatur, AL 35601-7588 Parker Griffith R AL Mfr. chemicals and petrochemicals. AZ-02 LG SOLID SURFACE LLC 8009 W. Olive Ave., Peoria, AZ 85345-7109 Trent Franks R AZ Mfr. chemicals. 1702 E. Highland Ave., Ste. 400, Phoenix, AZ Manufacturing and sales of electronically AZ-04 SNTECH INC. USA 85016-4630 Edward Pastor D AZ commutated motors (ECM).