Statistical Properties of the Returns of Stock Prices of International Markets

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Download

The Journal of Applied Business Research – September/October 2017 Volume 33, Number 5 The Effect Of Corporate Governance On Unfaithful Disclosure Designation And Unfaithful Disclosure Penalty Points Bo Young Moon, Dankook University, South Korea Soo Yeon Park, Korea University, South Korea ABSTRACT This paper investigates the relation between Unfaithful Disclosure Corporations (“UDC”) and corporate governance using listed firm (KOSPI and KOSDAQ) data in Korea. Prior literature reports that corporate governance has an impact on the level of disclosure and the quality of disclosure provided by companies. However, it is hard to find the studies about corporate governance and UDC at the term of disclosure quality. Compare to some financially advanced countries, Korea established corporate governance in a relatively short period of time; hence concerns have been raised the corporate governance have not played effective role to monitor management. We question how corporate governance affects companies’ unfaithful disclosure by using several corporate governance proxy variables and UDC data which is unique system in Korea. From the empirical tests, we find a negative association between the proportion of outside directors, an indicator of the board’s independence, and UDC designation, among companies listed on both KOSPI and KOSDAQ. On the other hand, there is a significant positive association between the proportion of outside directors and UDCs’ imposed and accumulated penalty points among KOSDAQ-listed companies. This implies that outside director system effectively play a monitoring role however due to different natures of members included in outside directors, the system often fails to control regarding based reasons for penalty points imposition. In addition, we find the percentage of foreign equity ownership showed statistically significant positive association with UDC designation and a significant positive association with the imposed and accumulated penalty points among KOSPI-listed companies. -

Does the Market React Differently to Chaebol Firms?

The Journal of Applied Business Research – September/October 2014 Volume 30, Number 5 Does The Market React Differently To Chaebol Firms? Heejin Park, Hanyang University, South Korea Jinsoo Kim, Hanyang University, South Korea Mihye Ha, Hanyang University, South Korea Sambock Park, Hanyang University, South Korea ABSTRACT Based on a sample of Korean firms listed on the KOSPI and KOSDAQ from 2001 to 2011, we examined whether the affiliation of a firm with a Chaebol group affects the sensitivity of stock prices to earnings surprises. We found that the market response to positive (negative) earnings surprises is more positive (negative) for Chaebol firms than for non-Chaebol firms. In addition, we investigated how intra-group transactions affect the ERCs of Chaebol firms by comparing with those of non-Chaebol firms. Our results show that the intra-group transactions of Chaebol firms are positively related to ERCs under both positive and negative earnings surprises. However, we did not find the same results from the analyses of non-Chaebol firms. Keywords: Chaebol Firms; Earnings Response Coefficient (ERC); Earnings Surprises; KOSPI; KOSDAQ 1. INTRODUCTION he aim of this study is to examine how differently the market reacts to earnings surprises of Chaebol firms compared to those of non-Chaebol firms. Although there is no official definition of Chaebol, T firms are perceived as Chaebol if they consist of a large group and operate in many different industries, maintain substantial business ties with other firms in their group, and are controlled by the largest shareholder as a whole. The definition used to identify Chaebol firms is that of a large business group established by the Korea Fair Trade Commission (KFTC) and a group of companies of which more than 30% of the shares are owned by the group’s controlling shareholders and its affiliated companies. -

For Additional Information

April 2015 Attached please find the updated Foreign Listed Stock Index Futures and Options Approvals Chart, current as of April 2015. All prior versions are superseded and should be discarded. Please note the following developments since we last distributed the Approvals Chart: (1) The CFTC has approved the following contracts for trading by U.S. Persons: (i) Singapore Exchange Derivatives Trading Limited’s futures contract based on the MSCI Malaysia Index; (ii) Osaka Exchange’s futures contract based on the JPX-Nikkei Index 400; (iii) ICE Futures Europe’s futures contract based on the MSCI World Index; (iv) Eurex’s futures contracts based on the Euro STOXX 50 Variance Index, MSCI Frontier Index and TA-25 Index; (v) Mexican Derivatives Exchange’s mini futures contract based on the IPC Index; (vi) Australian Securities Exchange’s futures contract based on the S&P/ASX VIX Index; and (vii) Moscow Exchange’s futures contract based on the MICEX Index. (2) The SEC has not approved any new foreign equity index options since we last distributed the Approvals Chart. However, the London Stock Exchange has claimed relief under the LIFFE A&M and Class Relief SEC No-Action Letter (Jul. 1, 2013) to offer Eligible Options to Eligible U.S. Institutions. See note 16. For Additional Information The information on the attached Approvals Chart is subject to change at any time. If you have questions or would like confirmation of the status of a specific contract, please contact: James D. Van De Graaff +1.312.902.5227 [email protected] Kenneth M. -

Mr. Alp Eroglu International Organization of Securities Commissions (IOSCO) Calle Oquendo 12 28006 Madrid Spain

1301 Second Avenue tel 206-505-7877 www.russell.com Seattle, WA 98101 fax 206-505-3495 toll-free 800-426-7969 Mr. Alp Eroglu International Organization of Securities Commissions (IOSCO) Calle Oquendo 12 28006 Madrid Spain RE: IOSCO FINANCIAL BENCHMARKS CONSULTATION REPORT Dear Mr. Eroglu: Frank Russell Company (d/b/a “Russell Investments” or “Russell”) fully supports IOSCO’s principles and goals outlined in the Financial Benchmarks Consultation Report (the “Report”), although Russell respectfully suggests several alternative approaches in its response below that Russell believes will better achieve those goals, strengthen markets and protect investors without unduly burdening index providers. Russell is continuously raising the industry standard for index construction and methodology. The Report’s goals accord with Russell’s bedrock principles: • Index providers’ design standards must be objective and sound; • Indices must provide a faithful and unbiased barometer of the market they represent; • Index methodologies should be transparent and readily available free of charge; • Index providers’ operations should be governed by an appropriate governance structure; and • Index providers’ internal controls should promote efficient and sound index operations. These are all principles deeply ingrained in Russell’s heritage, practiced daily and they guide Russell as the premier provider of indices and multi-asset solutions. Russell is a leader in constructing and maintaining securities indices and is the publisher of the Russell Indexes. Russell operates through subsidiaries worldwide and is a subsidiary of The Northwestern Mutual Life Insurance Company. The Russell Indexes are constructed to provide a comprehensive and unbiased barometer of the market segment they represent. All of the Russell Indexes are reconstituted periodically, but not less frequently than annually or more frequently than monthly, to ensure new and growing equities and fixed income securities are reflected in its indices. -

Thomson One Quick Reference Guide

THOMSON ONE QUICK REFERENCE GUIDE Thomson ONE (www.thomsonone.com) provides integrated access to comprehensive market and company information. All of the intelligence you need to power your knowledge gathering and drive smarter decision-making. This Quick Reference Card offers some quick tips on customizing your workspace, setting up alerts, searching and more. LOOKING UP A COMPANY To add a service to your Favorites, open the page, click , and then select Add to Favorites. PUBLIC COMPANIES: To organize your favorites 1. If the company symbol is not known, click the 1. Click , and select Organize Favorites. Search icon. 2. If you want to create and name folders, click 2. Select either Contains or Begins With, then type all or Create Folder, and type in a name. part of the company name. 3. Drag a favorite into any folder, or click up or down 3. (Optional) Click the Home Listing Only check box to arrows to move it to a different place in the list. limit results to a company’s primary (Home) exchange. 4. Click OK. 4. Click Search. 5. Select the company symbol to display content related To set any page as your Home Page to that company. Click , and select Set as Home. PRIVATE COMPANIES: To return to your home page at any time, click . 1. Click the Symbol drop-down, and select Private Co. FLEX MONITOR: MONITORING A 2. Type the private company name (use , if needed), and click Go. COVERAGE LIST 3. Select the private company name to display content Flex Monitor allows you to create and save an unlimited related to that company. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

FTSE Global Equity Index Series Ground Rules Visit Or E-Mail [email protected]

Ground Rules FTSE Global Equity Index Series v10.9 ftserussell.com An LSEG Business September 2021 Contents 1.0 Introduction .................................................................... 3 2.0 Management Responsibilities ....................................... 5 3.0 FTSE Russell Index Policies ......................................... 7 4.0 Country Inclusion Criteria ............................................. 9 5.0 Inclusion Criteria .......................................................... 11 6.0 Eligible Security Screens ............................................ 12 7.0 Periodic Review of Constituents ................................ 16 8.0 Additions Outside of a Review ................................... 21 9.0 Corporate Actions and Events .................................... 24 10.0 Treatment of Dividends ............................................... 26 11.0 Industry Classification Benchmark (ICB)................... 27 12.0 Algorithm and Calculation Method ............................. 28 Appendix A: Eligible Exchanges and Market Segments .... 29 Appendix B: Eligible Classes of Securities ......................... 34 Appendix C: Calculation Schedule ...................................... 39 Appendix D: Country Additions and Deletions ................... 41 Appendix E: Country Classification ..................................... 43 Appendix F: Country Indices ................................................ 44 Appendix G: FTSE Russell China Share Descriptions ....... 45 Appendix H: Further Information ........................................ -

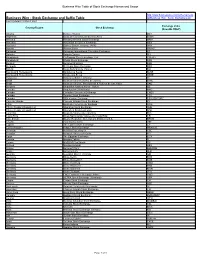

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

List of Asian Stock Exchanges

List of Asian stock exchanges This is a list of Asian stock exchanges. In the Asian region, there are multiple stock exchanges. As per data from World Federation of Exchanges, below are top 10 selected in 2019:[1][2] Tokyo Stock Exchange, Japan Shanghai Stock Exchange, China Hong Kong Stock Exchange, Hong Kong Shenzhen Stock Exchange, China Bombay Stock Exchange, India National Stock Exchange, India Korea Exchange, South Korea Taiwan Exchange, Taiwan Singapore Exchange, Singapore The Stock Exchange of Thailand, Thailand Asia Contents Stock exchanges Central Asian East Asian North Asia South Asian Southeast Asian West Asian See also References External links Stock exchanges Central Asian Operating Economy Exchange Location Founded Listings Link Technology MIC KASE (http Kazakhstan Stock Almaty 1993 127 s://kase.k Exchange z/en/) Kazakhstan Astana AIX (http Nasdaq Nur- International 2018 25 s://www.ai Matching AIXK Sultan Exchange x.kz/) Engine[3] KSE (htt Kyrgyz Stock Bishkek 1994 p://www.ks Kyrgyzstan Exchange (KSE) e.kg/) CASE (http Central Asian s://www.ca Dushanbe 2015 Tajikistan Stock Exchange se.com.tj/e n/) SRCMET State Commodity (https://ww and Raw Material Ashgabat 1994 w.exchang Exchange of Turkmenistan e.gov.tm/?l Turkmenistan ang=en) UZSE (http Tashkent Stock Tashkent 1994 104 s://uzse.u Uzbekistan Exchange z/) East Asian Economy Exchange Location Founded Listings Link Shanghai Stock SSE (http://www.sse.com. Shanghai 1990 Exchange cn) Shenzhen Stock SZSE (http://www.szse.cn/ Shenzhen 1991 2,375 (Jan 2021) Mainland Exchange main/) China Dalian Commodity DCE (http://www.dce.com. Dalian 1993 Exchange cn/DCE/) SEHK (https://web.archive. -

Information Transmission Between NASDAQ and Asian Secondary

Information Transmission between NASDAQ and Asian Second Board Markets Bong-Soo Lee∗, Oliver Meng Rui!, and Steven Shuye Wang! Abstract In Asia, NASDAQ's success has helped prompt Singapore (SESDAQ), Japan (JASDAQ), Taiwan (TAISDAQ) and South Korea (KOSDAQ) to set up or formalize their own second board markets in the 1980s and early 1990s. In 1999, Malaysia (MESDAQ) and Hong Kong (GEM) also set up their second board markets. Given the growing importance of these second board markets, we examine whether there is any evidence of spillovers from NASDAQ returns and volatilities to Asian second board market returns and volatilities and whether the cross-country spillovers are strong relative to domestic spillovers from the corresponding main board markets. For this purpose, we employ EGARCH models, dynamic causality tests, and VAR-based forecast error decompositions using daily data of a recent sample period that includes the Asian financial crisis of 1997 and up to April 20, 2001. We find that, first, there is strong evidence of lagged returns and volatility spillovers from the NASDAQ market to the Asian second board markets when we exclude contemporaneous main board market returns. Second, there is strong evidence of contemporaneous and lagged returns and volatility spillovers from the local main board markets to the corresponding second board markets. However, even in the presence of contemporaneous main board market returns, there remain substantial spillovers from the lagged NASDAQ returns and volatilities to Asian second board market returns and volatilities. These findings are not sensitive to whether we use U.S. dollar-based data or local currency-based data. -

SBI Holdings, Inc. Financial Results for the Six-Month Period Ended Sept

Strategic Business Innovator SBI Holdings, Inc. Financial Results for the Six-Month Period Ended Sept. 30, 2011 (Fiscal Year Ending March 31, 2012) October 26, 2011 The items in this document are provided as information related to the business strategy of the SBI Group companies and not as an invitation to invest in the stock or securities issued by each company. None of the Group companies guarantees the completeness of this document in terms of information and future business strategy. The content of this document is subject to revision or cancellation without warning. Note: Fiscal Year (“FY”) ends March 31 of the following year 1 1. Overall Summary of 1H FY2011 2. Measures to Realize Continuous Growth in Anticipation of a More Difficult Business Environment 2 1. Overall Summary of 1H FY2011 (1) The operating environment is ever more challenging due to the Great East Japan Earthquake, delay in the US economic recovery, European debt crisis and slowdown in emerging economies. But the SBI Group achieved a growth in ordinary and net income in the 1H of FY2011 (2) The Group promoted cost reduction and reorganization on a group-wide basis in anticipation of the worsening business environment 3 (1) The operating environment is ever more challenging due to the Great East Japan Earthquake, delay in the US economic recovery, European debt crisis and slowdown in emerging economies. But the SBI Group achieved a growth in ordinary and net income in the 1H of FY2011 4 Business Environment Worsening Owing to the Great East Japan Earthquake and the Continuance of the Debt Crisis of the Euro Zone Stock prices fell around the world, even in emerging countries Rates of decline from the highest prices since the Lehman Shock (Sept. -

Comparative Analysis of Indian Stock Market with International Markets

Comparative Analysis of Indian Stock Market with International Markets Debjiban Mukherjee T. A. Pai Management Institute, Manipal, India Abstract The stock market is witnessing heightened activities and is increasingly gaining importance. In the current context of globalization and the subsequent integration of the global markets this paper captures the trends, similarities and patterns in the activities and movements of the Indian Stock Market in comparison to its international counterparts. This study covers New York Stock Exchange (NYSE), Hong Kong Stock exchange (HSE), Tokyo Stock exchange (TSE), Russian Stock exchange (RSE), Korean Stock exchange (KSE) from various socio- politico-economic backgrounds. Both the Bombay Stock exchange (BSE) and the National Stock Exchange of Indian Limited (NSE) have been used in the study as a part of Indian Stock Market. The time period has been divided into various eras to test the correlation between the various exchanges to prove that the Indian markets have become more integrated with its global counterparts and its reaction are in tandem with that are seen globally. Keywords: Stock Market, Comparative Analysis, Statistical analysis, Efficiency Test. 39 ©Great Lakes Herald – April 2007 Volume 1, Issue 1 by Great Lakes Institute of Management, Chennai 1. Introduction The Indian stock exchanges hold a place of prominence not only in Asia but also at the global stage. The Bombay Stock Exchange (BSE) is one of the oldest exchanges across the world, while the National Stock Exchange (NSE) is among the best in terms of sophistication and advancement of technology. The Indian stock market scene really picked up after the opening up of the economy in the early nineties.