Mercosur and the Creation of the Free Trade Area of the Americas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release INOLEX Introduces Breakthrough Technology with 100

PRESS RELEASE FOR IMMEDIATE RELEASE: INOLEX Introduces Breakthrough Technology with 100% Natural Amino-Acid Based Cationic Ingredients: AminoSensyl™ HC and AminoSensyl™ SC Contact: Lisa Gandolfi, PhD Director of Marketing 215-320-1488 [email protected] March 31, 2019 (Philadelphia, PA USA) — INOLEX is introducing two breakthrough products, AminoSensyl™ HC and AminoSensyl™ SC, to its 100% Natural Amino Lipid Technology Platform. The revolutionary ingredients debut at in-cosmetics Global 2019 Paris, April 2-4, where the company’s team of technical experts and formulators will be providing personalized demos of the technology. Both products are part of INOLEX’s patented AminoSensyl™ range, a portfolio of next generation conditioning ingredients ideal for the natural products marketplace. The amino-acid based, 100% natural, eco-friendly, and high performance systems are based on sustainable green chemistry principles—and offer the benefits of being petrochemical-free; palm-free; quat-free1; readily biodegradable (OECD 301B); non-GMO; and free from animal testing. Each product is optimized for its respective category. AminoSensyl™ HC is a pre-neutralized, natural hair care active system that provides higher performance and ease of formulation in hair conditioning & treatment products. The system contains Brassicyl Valinate Esylate, an amino lipid derived from valine amino acid, which has a non-quat cationic charge for hair substantivity and a better aquatic toxicity profile than traditional conditioning or strengthening cationic surfactants. AminoSensyl™ HC delivers significant strengthening, conditioning, smoothness, and definition in hair applications. AminoSensyl™ SC is a natural formulation system designed for all-natural, luxury skin care products that are gentle to skin and eyes. The patented amino lipid technology enables self-emulsifying formulations that stabilize high oil loads and deliver a soft, velvety aesthetic. -

Inolex Slide Templates

Natural Cosmetic Ingredients Partnering with BioAmber to promote natural silicone alternatives. Inolex‘s History & Evolution • More than 100 years in oleochemistry . • More than 50 years manufacturing esters and polyesters. • Current owners, the Plimpton Family, since early 80s. • Since 2007, globalization & innovation program — goal is to be a global leader in personal care ingredient innovation • First to market and IP driven Several natural silicone replacements market natural cationic hair conditioner firsts natural broad spectrum preservation Our Market: End-users you may of heard of Our Market: End-users that are emerging Ingredient Innovation Philosophy Consumer Values, Demographics, Shifting Wealth Lifestyles (e.g. LOHAS) Consumer Choice • Lifestyle driven Cosmetic Ingredient Selection • Must enhance the lifestyle effect Ingredient • Inolex as a lifestyle chemical company Innovation Inolex’s LOHAS Innovations Silicone Replacements (LexFeel D4/D5) Palm-free Brassica derivatives (ProCondition22) Paraben-free solutions (Spectrastat) Natural Silicone Replacements (LexFeel N-Series) Fully natural & ecological conditioners (Emulsense) Non-endocrine disrupting technologies Increasing level of Increasing LOHAS commitment Complexity LOHAS and All Natural • 100% non-petrochemical inputs • Green chemistry e.g. esterification O O D HO A OH + HO OH Poly (or mono) acid Poly (or mono) alcohol Ester or Polyester + HOH Partnerships for LOHAS Cosmetic Ingredients Partnerships are the ideal way to meet the needs of this market. Biorefineries Oleochemicals -

United States Bankruptcy Court Eastern District of Michigan Southern Division

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: ) Chapter 11 ) Collins & Aikman Corporation, et al.1 ) Case No. 05-55927 (SWR) ) (Jointly Administered) ) Debtors. ) Honorable: Steven W. Rhodes ) PROOF OF SERVICE The undersigned, being duly sworn, certifies that he served papers as follows: 1. Document(s) served: A. Order (A) Approving Bidding Procedures, Expense Reimbursement and Overbid Protections in Connection With Sale of Certain of the Assets of Debtors' Interiors Plastics Group, (B) Approving the Form and Manner of Notice, (C) Scheduling and Auction and Sale Hearing and (D) Approving Procedures for Determining Cure Amounts (Docket No. 4532) B. Bidding Procedures for the Sale of Certain of the Assets of Debtors' Interiors Plastics Group (Exhibit D to Docket No. 4408) C. Notice of Sale of Assets of Debtors’ Interiors Plastics Group Free and Clear of Liens, Claims, Encumbrances and Interests (Exhibit E to Docket No. 4408) 1 The Debtors in the jointly administered cases include: Collins & Aikman Corporation; Amco Convertible Fabrics, Inc., Case No. 05-55949; Becker Group, LLC (d/b/a/ Collins & Aikman Premier Mold), Case No. 05-55977; Brut Plastics, Inc., Case No. 05-55957; Collins & Aikman (Gibraltar) Limited, Case No. 05-55989; Collins & Aikman Accessory Mats, Inc. (f/k/a the Akro Corporation), Case No. 05-55952; Collins & Aikman Asset Services, Inc., Case No. 05-55959; Collins & Aikman Automotive (Argentina), Inc. (f/k/a Textron Automotive (Argentina), Inc.), Case No. 05-55965; Collins & Aikman Automotive (Asia), Inc. (f/k/a Textron Automotive (Asia), Inc.), Case No. 05-55991; Collins & Aikman Automotive Exteriors, Inc. -

Preserving the Faith a Cosmetic Formulators Overview John Woodruff John Woodruff: the Personal Stuff

Preserving the faith A cosmetic formulators overview John Woodruff www.creative-developments.co.uk John Woodruff: the personal stuff 1960: joined Smith & Nephew Research 1976: Co-founded Pava, responsible for all technical aspects, from formulation and development to manufacture and filling and originated many well-known brands. October 1988: Established consulting laboratory for formulation of cosmetics and toiletry products. Developed Creativity a unique programme written for formula creation and cosmetic manufacture Two books and many articles published on cosmetic technology. Twice appeared as an expert witness, 3 times Chairman of the European UV & Sun Filters Conference, Twice chaired a technical session at In-Cosmetics 1990 – 1996: Cosmetics Consultant to Manufacturing Chemist 1996 – Present: Regular contributions to Soap, Perfumery and Cosmetics (SPC) Supports the Distance Leaning Course run by the SCS Lectures on product formulation at the Principles and Practice of Cosmetic Science When he is not working he is sailing. 2 The cosmetic product brief • Product type • Claims • Product format • Application • Texture • Colour • Perfume • Packaging • Cost 3 What about the preservative? Preservatives are one of the last things that most chemists think about when formulating a product and one of the first things that are suspected when a problem occurs. They are important ingredients, the value of which is never noticed when functioning properly and which are worthless when not. Preservatives are much maligned and misunderstood within the cosmetics industry. Because of this, they are often over-dosed, under-dosed or improperly formulated even by experienced chemists Cosmetic formulations require a delicate balance of a large number of raw materials. -

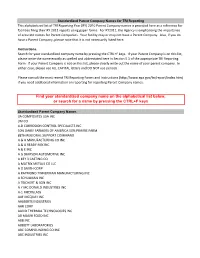

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT -

Focus: Sun Care COS1501 Inolex 02 215X290mm 1/1 a 22.01.15 15:17 Seite 1

COS1501_00_Titel_GB_COS1402_01_Titel_GB 22.01.15 15:16 Seite 1 www.cossma.com E51280 COSMETICS SPRAY TECHNOLOGY MARKETING Product development Global perspectives and new approaches to sun protection and tanning Marketing New study: Beauty salons – where next? Markets An up-to-date look at the Russian cosmetics market Legislation Lines of demarcation: The A to Z in product development VIP of the Month Uli Osterwalder of BASF looks at an easier way of devel - oping attractive solar protection products 1-2/2015 Focus: Sun care www.cossma.com COS1501_Inolex_02_215x290mm_1/1_A 22.01.15 15:17 Seite 1 www.cossma.com Advanced Ingredients for Sun Applications NEW! WetFilmTM - Compatibilizer and water-proofer for wet skin application LexFilm® Sun - Water-proofing agent; solubilizer for UV actives LexFilm® Spray - Water-proofing system for spray application Lexorez® 100 & 200 - Water-proofing film former LexSolvTM A - Superior solubilizer for UVA filters LexFeel® 7 - Light emollient; enhanced skin feel ideas start here www.inolex.com COS1501_03_Edi_GB_COS1409_03_Edi_GB 23.01.15 06:25 Seite 1 www.cossma.com EDITORIAL Lots going go! 15 years ago, with the first issue of the year, you had in your hand the very first. The magazine was in two language versions ... Do you remember? In the last one a half decades there has been a lot happening at COSSMA – and of course in trade magazines in general. Since 2004 you can receive COSSMA as the only trade magazine to offer addi- tional information, on line, about articles in Downloads the magazine itself. In Additional informations at 2007 we published www.health-and-beauty.com/ qr00037 COSSMA in two lan- or scan the QR code now! guages: German and Your access codes for February: User name: cossma2 an international Eng- Password: sun lish edition. -

COSMETAGORA Les Rencontres De La Formulation

COSMETAGORA Les Rencontres de la Formulation ESPACE CHAMPERRET Place de la Porte Champerret Les 10 et 11 janvier 2017 75017 PARIS De 9h30 à 18h00 ème GUIDE VISITEUR ÉDITION Plan du salon 9 Liste des exposants Edito Le Salon Cosmetagora est une idée qui a vu le jour il y a maintenant 9 ans à l’initiative du conseil d’administration de la Société Française de Cosmétologie, devenu le rendez-vous incontournable de notre profession. Pour cette 9ème édition, ce salon se veut toujours plus proche de vos attentes, avec encore plus de services et de professionnalisme. Pour la cinquième année, nous vous accueillons à l’Espace Champerret, un espace idéalement placé et parfaitement configuré pour vous recevoir dans les meilleures conditions. Plus que jamais Cosmetagora reste le lieu propice aux rencontres, aux échanges et aux opportunités commerciales. Nous avons le plaisir d’organiser la quatrième édition du Prix de la Formulation Cosmetagora qui verra les formules les plus innovantes récompensées par un jury d’experts. Nous vous souhaitons un excellent Salon Cosmetagora 2017 en attendant de vous retrouver pour la 10ème édition en 2018. La commission COSMETAGORA Plan du salon et liste des exposants 3 V Sigma .....................................................................60 Grolman ................................................................173ter Active Beauty ........................................................55-56 Helioscience .........................................................120bis Active Concepts ..........................................................95 -

Inolex Chemical Company Communications of Progress 2019

RSPO Annual Inolex Chemical Company Communications of Progress 2019 Particulars About Your Organisation 1.1 Name of your organization Inolex Chemical Company 1.2 What is/are the primary activity(ies) or product(s) of your organization? Grower Processor and/or Trader Consumer Goods Manufacturer Retailer and/or Wholesaler Bank and/or Investor Social and/or Development NGO Environmental and/or Conservation NGO Supply Chain Associate Affiliate 1.3 Membership number 2-0337-12-000-00 1.4 Membership category Palm Oil Processors and/or Traders 1.5 Membership sector Ordinary Particulars Form Page 1/1 RSPO Annual Inolex Chemical Company Communications of Progress 2019 Processor and/or Trader 1. Operational Profile 1.1 Please state your main activity(ies) within the palm oil supply chain. Please select the option(s) that apply to you Refiner of CPO and PKO Trader with physical possession Trader without physical possession Palm kernel crusher Food and non-food ingredients producer Power, energy and biofuel Animal feed producer Producer of oleochemicals Distributor and wholesaler Other Other: Cosmetic ingredient manufacturer 2. Palm Oil and Certified Sustainable Palm Oil Use 2.1 Please include details of all operations using palm oil owned and/or managed by the member and/or all entities that belong to the group. Producer of esters and blends, some using palm derivatives, for cosmetic ingredient applications 2.1.1 In which markets do you sell goods containing palm oil and oil palm products? Applies globally 2.2 Volumes of palm oil and oil palm products -

What Is Clean Beauty?

Clean Beauty Ebook 2019 Safe and Sustainable Silicones for Clean Beauty Clean Beauty Directory and Formulary • Clean • Safe • Sustainable • Eco-Friendly Replacing • Bio-Based Microplastics Sustainability Drives Consumer Purchases Free Ebook Sponsored By: CT16_ad_template.indd 1 12/10/18 3:46 PM Market Intelligence | C&T ® KEY POINTS • Clean beauty aligns with a variety of tenets: minimal ingredients, consumer safety, social responsibility, transparency, etc. • This free “Clean Beauty E-book” combines these approaches in one resource to provide cosmetic formulators with a tool for any clean beauty path(s) they follow. Decoding Clean Beauty Jeb Gleason-Allured and lean beauty is something everyone is talking about with- Rachel L. Grabenhofer out ever defining it. While the specifics may vary, most Cosmetics & Toiletries retailers, brands and even consumers agree the key pillars include: safety, sustainability, ethics and transparency. In attempt to decode this market phenomenon, consider this quote from Gregg Renfrew, CEO and founder of Beau- tycounter: “[O]ur mission is to get safer products into the hands of everyone … ” CBeautycounter grew 27% between 2017-2018, and in 2018, it was the most searched beauty brand online in the U.S., generating $320 million in sales for the year, per NPD num- Reproduction in English or any other language of all or part of this article is strictly prohibited. © 2019 Allured Business Media. 2 | www.CosmeticsandToiletries.com www.grantinc.com 2019 Clean Beauty E-book Consumers want products that are thoughtfully designed for the least possible negative impact— as they, the shopper, define it. bers. That makes it not only the largest digital-native oils.” Qualifying products feature a Clean at Sephora brand, but also one of the top stand-alone brands sticker. -

2021 Research & Development Tax Credit Report to the Pennsylvania General Assembly

DOP-26 03-21 MARCH 15, 2021 THE RESEARCH & DEVELOPMENT TAX CREDIT REPORT to the PENNSYLVANIA GENERAL ASSEMBLY Tom Wolf, Governor C. Daniel Hassell, Secretary of Revenue PENNSYLVANIA RESEARCH & DEVELOPMENT TAX CREDIT ‐ 2021 REPORT TABLE OF CONTENTS PAGE INTRODUCTION 1 LEGISLATIVE CHANGES 2 TENTATIVE VS. ACTUAL 3 2020 RECIPIENTS 4 UTILIZATION 5 SALES & ASSIGNMENTS 6 STATE COMPARISONS 7 EFFECTIVENESS OF THE PENNSYLVANIA TAX CREDIT PROGRAM 8 ADMINISTRATION AND EVALUATION 10 RECOMMENDATIONS FOR THE PENNSYLVANIA TAX CREDIT PROGRAM 11 APPENDIX 1A PENNSYLVANIA RESEARCH & DEVELOPMENT TAX CREDIT ‐ 2021 REPORT INTRODUCTION AUTHORIZATION Act 7 of 1997 created the Pennsylvania Research & Development (R&D) tax credit. The R&D tax credit provision became Article XVII‐B of the Tax Reform Code of 1971 (TRC). The intent of the R&D tax credit was to encourage taxpayers to increase R&D expenditures within the Commonwealth in order to enhance economic growth. The terms and concepts used in the calculation of the Commonwealth's R&D tax credit are based on the federal government's R&D tax credit definitions for qualified research expenses. Act 7 of 1997 authorized the Department of Revenue (Department) to approve up to $15 million in total tax credits per fiscal year. $3 million of the $15 million was set aside for "small businesses," which are defined as a "for‐profit corporation, limited liability company, partnership or proprietorship with net book value of assets totaling...less than five million dollars ($5,000,000)." APPLICATION Taxpayers must submit an application to the Department by September 15th to apply for the R&D tax credit. -

View the 2016 Exhibitor Guide

Midwest Chapter of the Society of Cosmetic Chemists Donald E. Stephens Convention Center Teamworks 2016 Schedule of Events Wednesday, April 6, 2016 7:30 AM-11:00 AM Trade Show Set Up 8:30 AM—6:00 PM 8:00 AM to close Registration Begins (Badge Pick Up) 8:30 AM – Noon Technical Symposium Noon – 6 PM Teamworks Tradeshow Open Exhibitor 4:00 PM Vendor Prize Drawings Guide 5:00 PM Refreshment Hour 6:00 PM Teamworks Closed The premier industrial trade show for the personal and home care industries in mid-America. Teamworks 2016 Teamworks 2016 Society of Cosmetic Chemists Thank You to our Sponsors Dedicated to the advancement of cosmetic science, the Society of Cosmetic Chemists strives to increase and disseminate scientific information through meetings and publications. By promoting research in cosmetic science and industry, and by setting high ethical, professional and educational standards, we reach our goal of improving the qualifica- tions of cosmetic scientists. Our mission is to further the interests and recognition of cosmetic scientists while maintaining the confidence of the public in the cosmetic and toiletries industry. Comprised of over 4,000 members, the Society of Cosmetic Chemists was founded in 1945 to promote high standards of practice in the cosmetic sciences. We serve as a focus and provide the proper forums for the exchange of ideas and new developments in cosmetic research and technology. Since 1948 Chapters have been the lifeblood of the Society of Cosmetic Chemists. SCC has 18 Chapters throughout the United States and Canada which conduct monthly meetings, educational seminars, suppliers' days and publish monthly newsletters. -

Cosmetic & Personal Care Ingredients R&D Technical Service Manager

CASE STUDY: MARKET NICHE Cosmetic & Personal Care Ingredients POSITIONS NICHE R&D JOB TITLE Technical Service Manager CLIENT Inolex 850-983-4777 | www.ropella.co m COMPANY Inolex Lexolube POSITION Jr. Tech Services Manager LOCATION Philadelphia, PA For more information contact: Robbie Ropella President, Executive Search Ropella 850-983-4883 [email protected] ROPELLATM GROWING GREAT COMPANIES 8100 Opportunity Drive, Milton, Florida 32583 850-983-4777 | www.ropella.com Inolex 2 Jr. Tech Services Manager Company Information Inolex Inolex Chemical Company is a family-owned supplier of specialty chemicals for the lubricant, personal care, and cosmetics industries. Inolex’s headquarters is located in Philadelphia, PA. More Information: www.inolex.com At this Philadelphia site, fatty acids have been produced since the 1800s, when D.B. Martin Oil and Fats began operations there. Wilson and Company, a major meat packer, acquired the business for the first half of the century. In the 1970s, American Can acquired the company as part of a diversification strategy providing an entry for American Can into the chemical business. American Can changed the name to Inolex (Innovation Technology Excellence) in 1974. The present ownership dates back to 1981 when the Plimpton family acquired the business and incorporated under the name Inolex Chemical Company. In recent years, the product line of Inolex has expanded and adapted to better fit customers’ needs. Additional applications and performance- oriented products have been added to the Inolex product line, which now consists of products for the lubricant and personal care industries. Though their origins are over 100 years old, Inolex remains on the cutting-edge of the markets they serve.